444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan telecom towers market represents a critical infrastructure backbone supporting the nation’s advanced telecommunications ecosystem. Japan’s telecom tower infrastructure has evolved significantly to accommodate the growing demands of 5G networks, IoT connectivity, and digital transformation initiatives across various industries. The market encompasses a diverse range of tower types including lattice towers, monopole structures, guyed towers, and stealth installations designed to blend seamlessly with urban environments.

Market dynamics indicate robust growth driven by the accelerated deployment of 5G networks, with major telecommunications operators investing heavily in tower densification strategies. The market is experiencing a compound annual growth rate (CAGR) of approximately 6.2%, reflecting the substantial infrastructure investments required to support next-generation wireless technologies. Urban areas particularly Tokyo, Osaka, and Nagoya are witnessing intensive tower deployment activities to ensure comprehensive 5G coverage and enhanced network capacity.

Infrastructure modernization initiatives are reshaping the competitive landscape, with traditional tower companies expanding their portfolios to include small cells, distributed antenna systems, and edge computing facilities. The market benefits from Japan’s commitment to maintaining technological leadership in telecommunications, supported by favorable regulatory frameworks and substantial private sector investments in network infrastructure development.

The Japan telecom towers market refers to the comprehensive ecosystem of telecommunications infrastructure comprising physical tower structures, supporting equipment, and related services that enable wireless communication networks across Japan. This market encompasses the design, construction, installation, maintenance, and operation of various tower types that support cellular networks, broadcasting services, and emerging wireless technologies including 5G, IoT, and private network solutions.

Telecom towers serve as critical infrastructure platforms that house antennas, transmitters, receivers, and other essential equipment required for wireless signal transmission and reception. The market includes traditional macro towers, small cell installations, rooftop solutions, and innovative stealth designs that address Japan’s unique urban density challenges and aesthetic considerations. Market participants range from tower construction companies and infrastructure providers to telecommunications operators and specialized maintenance service organizations.

Japan’s telecom towers market is experiencing unprecedented growth momentum driven by the nationwide 5G rollout and increasing demand for high-capacity wireless networks. The market demonstrates strong fundamentals with consistent investment flows from major telecommunications operators and infrastructure companies seeking to capitalize on Japan’s digital transformation initiatives.

Key market drivers include the government’s Society 5.0 vision, which emphasizes advanced connectivity infrastructure, and the growing adoption of IoT applications across manufacturing, healthcare, and smart city initiatives. The market is characterized by technological innovation with approximately 78% of new tower installations incorporating advanced features such as edge computing capabilities and multi-operator sharing arrangements.

Strategic partnerships between tower companies and telecommunications operators are becoming increasingly common, with shared infrastructure models gaining traction to optimize deployment costs and accelerate network expansion timelines. The market outlook remains highly positive, supported by continued government backing for digital infrastructure development and robust private sector investment commitments.

Market intelligence reveals several critical insights shaping the Japan telecom towers landscape:

Primary market drivers propelling the Japan telecom towers market include the accelerated deployment of 5G networks across urban and rural areas. Telecommunications operators are investing heavily in network densification to meet the stringent latency and capacity requirements of 5G applications, creating substantial demand for new tower installations and existing infrastructure upgrades.

Digital transformation initiatives across various industries are generating increased demand for reliable, high-capacity wireless connectivity. The growing adoption of IoT devices, with penetration rates reaching approximately 42% in industrial applications, is driving requirements for enhanced network coverage and capacity. Smart city projects in major metropolitan areas are creating additional demand for specialized tower infrastructure supporting traffic management, environmental monitoring, and public safety systems.

Government support through the Society 5.0 initiative and related digital infrastructure programs is providing significant momentum for market growth. Regulatory frameworks promoting infrastructure sharing and streamlined approval processes are reducing deployment barriers and encouraging private sector investment in tower infrastructure development.

Market constraints include the high capital requirements associated with tower construction and deployment, particularly for 5G-ready infrastructure that demands advanced technical specifications and enhanced site preparation. Land acquisition challenges in densely populated urban areas create significant barriers to new tower installations, often requiring innovative solutions such as rooftop deployments and stealth installations.

Regulatory complexities surrounding environmental impact assessments and local zoning restrictions can extend project timelines and increase development costs. Community resistance to tower installations, particularly in residential areas, creates additional challenges for site acquisition and permitting processes. The need for specialized technical expertise in 5G infrastructure deployment has created skill shortages that may constrain market growth rates.

Economic uncertainties and potential changes in telecommunications spending patterns could impact investment levels in tower infrastructure. The high maintenance requirements and operational costs associated with advanced tower systems may limit adoption among smaller telecommunications operators and private network providers.

Significant opportunities exist in the development of innovative tower sharing models that enable multiple operators to utilize common infrastructure, reducing deployment costs and accelerating network expansion timelines. Edge computing integration presents substantial growth potential, with tower sites serving as strategic locations for distributed computing resources supporting low-latency applications.

Rural connectivity initiatives supported by government programs create opportunities for tower deployment in underserved areas, with potential for innovative financing models and public-private partnerships. The growing demand for private 5G networks in industrial and enterprise sectors represents a substantial market opportunity, with specialized tower solutions required to support dedicated network deployments.

International expansion opportunities exist for Japanese tower companies to leverage their advanced technical expertise and innovative solutions in regional markets. The development of smart tower platforms incorporating renewable energy systems, environmental monitoring capabilities, and advanced analytics presents opportunities for value-added services and recurring revenue streams.

Market dynamics are characterized by intense competition among established tower infrastructure providers and emerging technology companies seeking to capitalize on 5G deployment opportunities. Consolidation trends are evident as larger companies acquire specialized capabilities and expand their geographic coverage through strategic partnerships and acquisitions.

Technology evolution is driving continuous innovation in tower design and functionality, with manufacturers developing solutions that address Japan’s unique requirements including seismic resistance, space optimization, and aesthetic integration. MarkWide Research analysis indicates that approximately 65% of tower deployments now incorporate advanced monitoring and management systems to optimize performance and reduce operational costs.

Customer demands are evolving toward comprehensive infrastructure solutions that combine traditional tower services with value-added capabilities such as edge computing, IoT platform integration, and managed services. The market is experiencing increased collaboration between tower companies and technology providers to deliver integrated solutions that address complex connectivity requirements across various industry verticals.

Research methodology employed comprehensive primary and secondary research approaches to analyze the Japan telecom towers market landscape. Primary research included structured interviews with key industry stakeholders including tower infrastructure providers, telecommunications operators, equipment manufacturers, and regulatory officials to gather insights on market trends, challenges, and growth opportunities.

Secondary research encompassed analysis of industry reports, government publications, company financial statements, and regulatory filings to establish market baseline data and validate primary research findings. Data triangulation techniques were employed to ensure accuracy and reliability of market insights and projections.

Market modeling utilized advanced analytical frameworks to assess market size, growth trajectories, and competitive dynamics across different tower types, applications, and geographic regions. The research methodology incorporated both quantitative analysis of market metrics and qualitative assessment of industry trends and strategic developments.

Regional market distribution reveals significant concentration in major metropolitan areas, with the Greater Tokyo Area accounting for approximately 38% of total tower installations. Urban centers including Osaka, Nagoya, and Fukuoka demonstrate high tower density requirements driven by population concentration and intensive business activity requiring advanced connectivity infrastructure.

Rural regions present distinct market characteristics with emphasis on coverage extension and connectivity improvement initiatives supported by government programs. Hokkaido and Kyushu regions are experiencing increased tower deployment activity as part of national connectivity enhancement programs targeting underserved communities and supporting regional economic development objectives.

Coastal areas require specialized tower solutions addressing environmental challenges including salt corrosion resistance and enhanced structural stability for extreme weather conditions. The regional analysis indicates growing demand for disaster-resilient infrastructure particularly in areas prone to natural disasters, driving adoption of advanced tower designs and backup systems.

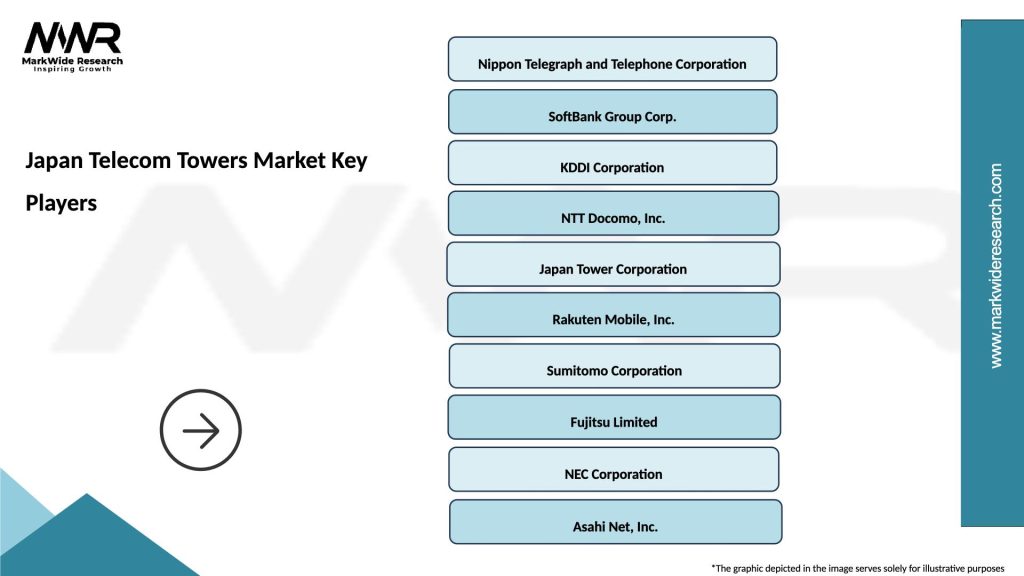

Market leadership is distributed among several key players offering comprehensive tower infrastructure solutions:

Competitive strategies focus on technology differentiation, cost optimization, and comprehensive service offerings that address evolving customer requirements in the 5G era.

Market segmentation analysis reveals distinct categories based on tower type, application, and deployment model:

By Tower Type:

By Application:

Macro tower installations continue to dominate the market with approximately 72% market share, driven by requirements for extensive coverage and high-capacity backbone infrastructure. Small cell deployments are experiencing rapid growth, particularly in dense urban areas where network densification is essential for 5G performance optimization.

Rooftop installations represent a growing segment as operators seek cost-effective deployment options in space-constrained urban environments. MWR data indicates that rooftop solutions account for approximately 28% of new urban deployments, offering advantages in terms of reduced site acquisition costs and faster deployment timelines.

Shared infrastructure models are gaining traction with multiple operators utilizing common tower facilities to optimize deployment costs and accelerate network expansion. Private network towers represent an emerging category driven by industrial digitalization and enterprise requirements for dedicated connectivity solutions.

Telecommunications operators benefit from reduced infrastructure costs through tower sharing arrangements and access to advanced deployment solutions that accelerate network rollout timelines. Enhanced network performance and coverage quality improve customer satisfaction and support premium service offerings in competitive markets.

Tower infrastructure providers gain opportunities for recurring revenue streams through long-term lease agreements and value-added services including maintenance, monitoring, and optimization. Equipment manufacturers benefit from increased demand for advanced tower components and systems supporting 5G and IoT applications.

End-user benefits include improved connectivity quality, reduced latency, and access to advanced services enabled by robust tower infrastructure. Economic stakeholders benefit from job creation in construction, maintenance, and technology sectors, supporting regional economic development and innovation ecosystem growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the Japan telecom towers market include the accelerated adoption of intelligent tower platforms incorporating AI-driven optimization and predictive maintenance capabilities. Sustainability initiatives are driving demand for energy-efficient tower designs and renewable energy integration, with approximately 45% of new installations incorporating solar power systems.

Network slicing capabilities are becoming increasingly important as operators seek to provide differentiated services across various industry verticals. Open RAN architecture adoption is influencing tower infrastructure requirements, creating demand for more flexible and interoperable solutions that support multi-vendor equipment deployments.

Automation trends are transforming tower operations with remote monitoring, automated fault detection, and predictive maintenance systems reducing operational costs and improving service reliability. The integration of digital twin technology is enabling advanced tower modeling and optimization capabilities.

Recent industry developments include major telecommunications operators announcing substantial 5G infrastructure investment programs with dedicated tower deployment initiatives. Strategic partnerships between tower companies and technology providers are creating integrated solutions that combine infrastructure with advanced analytics and management platforms.

Regulatory developments include streamlined approval processes for tower installations and enhanced infrastructure sharing guidelines designed to accelerate deployment timelines. Technology innovations in tower design and construction are addressing Japan’s unique requirements including seismic resistance and space optimization.

Market consolidation activities include strategic acquisitions and joint ventures aimed at expanding geographic coverage and technical capabilities. International collaborations are bringing advanced tower technologies and deployment methodologies to the Japanese market.

Industry analysts recommend that market participants focus on developing comprehensive infrastructure solutions that address the full spectrum of 5G deployment requirements. Investment priorities should emphasize technology differentiation, operational efficiency, and customer service excellence to maintain competitive advantage in the evolving market landscape.

Strategic recommendations include pursuing collaborative partnerships with telecommunications operators to develop customized solutions that address specific network requirements and deployment challenges. MarkWide Research suggests that companies should prioritize sustainability initiatives and environmental compliance to align with evolving regulatory requirements and customer expectations.

Market positioning strategies should emphasize technical expertise, reliability, and comprehensive service offerings that support long-term customer relationships. Innovation investments in emerging technologies such as edge computing, AI-driven optimization, and advanced materials will be critical for maintaining market leadership positions.

Market projections indicate continued robust growth driven by 5G network expansion, IoT adoption, and digital transformation initiatives across various industry sectors. The market is expected to maintain a strong growth trajectory of approximately 6.8% CAGR over the next five years, supported by sustained investment in telecommunications infrastructure and emerging technology applications.

Technology evolution will continue to drive innovation in tower design and functionality, with increasing integration of smart systems, renewable energy, and edge computing capabilities. Market maturation is expected to lead to greater emphasis on operational efficiency, service quality, and value-added offerings beyond basic infrastructure provision.

Long-term outlook remains highly positive, supported by Japan’s commitment to maintaining technological leadership in telecommunications and the ongoing digital transformation of the economy. The market will benefit from continued government support, robust private sector investment, and growing demand for advanced connectivity solutions across consumer and enterprise segments.

Japan’s telecom towers market represents a dynamic and rapidly evolving sector characterized by strong growth fundamentals, technological innovation, and substantial investment opportunities. The market benefits from robust demand drivers including 5G deployment, digital transformation initiatives, and government support for advanced telecommunications infrastructure development.

Market participants are well-positioned to capitalize on emerging opportunities through strategic investments in technology differentiation, operational excellence, and comprehensive service offerings. The competitive landscape continues to evolve with new entrants, strategic partnerships, and innovative business models reshaping traditional market dynamics.

Future success in the Japan telecom towers market will depend on the ability to adapt to changing technology requirements, address evolving customer needs, and maintain competitive advantage through continuous innovation and operational efficiency. The market outlook remains highly favorable, supported by sustained demand growth and ongoing digital infrastructure modernization initiatives across the Japanese economy.

What is Telecom Towers?

Telecom towers are structures that support antennas and other equipment for telecommunications, enabling wireless communication for mobile networks, broadcasting, and data transmission.

What are the key players in the Japan Telecom Towers Market?

Key players in the Japan Telecom Towers Market include NTT Docomo, SoftBank Group, and KDDI Corporation, among others.

What are the growth factors driving the Japan Telecom Towers Market?

The Japan Telecom Towers Market is driven by the increasing demand for mobile data services, the expansion of 5G networks, and the rise in IoT applications requiring robust connectivity.

What challenges does the Japan Telecom Towers Market face?

Challenges in the Japan Telecom Towers Market include regulatory hurdles, high infrastructure costs, and competition from alternative communication technologies.

What opportunities exist in the Japan Telecom Towers Market?

Opportunities in the Japan Telecom Towers Market include the potential for expanding rural connectivity, advancements in tower sharing technologies, and the integration of renewable energy solutions.

What trends are shaping the Japan Telecom Towers Market?

Trends in the Japan Telecom Towers Market include the increasing adoption of small cell technology, the shift towards green tower solutions, and the growing focus on enhancing network security.

Japan Telecom Towers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Monopole, Lattice, Stealth, Guyed |

| Technology | 5G, 4G LTE, Microwave, Fiber Optic |

| End User | Telecom Operators, Government, Enterprises, ISPs |

| Installation | Urban, Rural, Suburban, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Telecom Towers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at