444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan surveillance analog camera market represents a significant segment within the country’s comprehensive security infrastructure ecosystem. Despite the global shift toward digital surveillance technologies, analog cameras maintain a substantial presence in Japan’s security landscape, driven by cost-effectiveness, reliability, and compatibility with existing infrastructure. The market demonstrates steady growth patterns with a projected compound annual growth rate of 4.2% CAGR through the forecast period, reflecting sustained demand across various sectors including retail, manufacturing, transportation, and residential applications.

Market dynamics in Japan are influenced by the country’s unique security requirements, technological preferences, and regulatory framework. The analog camera segment continues to serve critical roles in surveillance applications where high-definition imaging is not the primary requirement, but consistent monitoring and cost-efficient deployment are prioritized. Industrial applications particularly favor analog systems for their proven reliability and lower maintenance requirements compared to more complex digital alternatives.

Regional distribution shows concentrated demand in major metropolitan areas including Tokyo, Osaka, and Nagoya, where commercial and industrial facilities require extensive surveillance coverage. The market benefits from Japan’s advanced manufacturing capabilities and strong domestic production base, with local manufacturers maintaining approximately 58% market share in the analog camera segment. This domestic strength provides competitive advantages in terms of customization, technical support, and rapid deployment capabilities.

The Japan surveillance analog camera market refers to the commercial ecosystem encompassing the manufacturing, distribution, installation, and maintenance of analog-based video surveillance systems specifically within the Japanese market. These systems utilize traditional analog signal transmission methods to capture, transmit, and record video footage for security monitoring purposes across diverse applications ranging from small retail establishments to large industrial complexes.

Analog surveillance cameras in this context represent devices that convert optical images into electrical signals using charge-coupled device (CCD) or complementary metal-oxide-semiconductor (CMOS) sensors, transmitting video data through coaxial cables to recording and monitoring equipment. Unlike digital IP cameras, these systems rely on established analog video standards and require dedicated video management infrastructure for operation and storage.

Market scope encompasses various camera types including dome cameras, bullet cameras, box cameras, and specialized variants designed for specific environmental conditions or security applications. The definition extends to include supporting infrastructure such as digital video recorders (DVRs), monitors, cabling systems, and installation services that enable comprehensive analog surveillance solutions tailored to Japanese market requirements and regulatory standards.

Strategic analysis of the Japan surveillance analog camera market reveals a mature yet resilient segment that continues to serve essential security functions despite technological evolution toward digital alternatives. The market maintains stability through established customer relationships, proven technology reliability, and cost-effective deployment models that appeal to budget-conscious organizations and applications where basic surveillance capabilities suffice.

Key growth drivers include the replacement cycle of aging analog systems, integration requirements with existing infrastructure, and specific applications where analog technology provides optimal cost-performance ratios. The market benefits from Japan’s strong manufacturing base, with domestic producers leveraging advanced production techniques to maintain competitive positioning against international alternatives while serving local market preferences.

Market segmentation analysis indicates that commercial applications account for approximately 42% of total demand, followed by industrial applications at 28%, residential installations at 18%, and government/public sector deployments representing the remaining 12%. This distribution reflects the diverse application landscape and the continued relevance of analog technology across multiple security scenarios in the Japanese market environment.

Competitive landscape features a mix of established Japanese manufacturers, international technology providers, and specialized system integrators who collectively serve the market’s diverse requirements. The industry demonstrates consolidation trends as companies seek to optimize operations and expand service capabilities while maintaining the technical expertise necessary for analog system deployment and maintenance.

Primary market insights reveal several critical factors shaping the Japan surveillance analog camera landscape:

Economic factors serve as primary drivers for the Japan surveillance analog camera market, with cost-effectiveness remaining a compelling advantage for organizations seeking basic surveillance capabilities without premium pricing associated with advanced digital systems. The lower total cost of ownership, including reduced infrastructure requirements and simplified maintenance procedures, appeals to budget-conscious buyers across various sectors.

Infrastructure considerations drive market demand as many facilities possess existing coaxial cable installations that support analog camera deployment without requiring comprehensive rewiring projects. This compatibility advantage reduces implementation costs and deployment timeframes, making analog solutions attractive for retrofit applications and system expansions where infrastructure investment must be minimized.

Reliability requirements in critical applications favor analog technology due to its proven stability and reduced dependency on network infrastructure. Industries such as manufacturing, transportation, and utilities value the consistent performance characteristics of analog systems, particularly in environments where network connectivity may be unreliable or where system simplicity is prioritized over advanced features.

Replacement cycles for aging analog systems generate ongoing market demand as organizations upgrade existing installations while maintaining analog technology platforms. This replacement activity supports market stability and provides opportunities for manufacturers to introduce enhanced analog camera models with improved performance characteristics while preserving compatibility with existing infrastructure.

Regulatory compliance requirements in certain applications support analog camera adoption where specific standards or certification requirements favor established analog technology over newer digital alternatives. Government facilities, critical infrastructure, and regulated industries may specify analog systems to meet particular security or operational requirements.

Technological limitations represent significant restraints for the Japan surveillance analog camera market, as these systems cannot match the image quality, resolution, and advanced features offered by modern digital IP camera solutions. The inherent resolution constraints of analog technology limit its applicability in scenarios requiring detailed image capture or advanced analytics capabilities.

Digital migration trends create ongoing pressure on analog market demand as organizations increasingly recognize the benefits of IP-based surveillance systems, including higher resolution imaging, network integration capabilities, and advanced software features. This technological shift reduces the addressable market for analog solutions and limits long-term growth potential.

Limited scalability constraints affect analog system expansion capabilities, as these installations require dedicated cabling infrastructure and centralized recording equipment that may become cost-prohibitive for large-scale deployments. The point-to-point connectivity requirements of analog systems create infrastructure complexity that digital alternatives can avoid through network-based architectures.

Feature limitations restrict analog camera applications in scenarios requiring advanced functionality such as video analytics, remote access capabilities, or integration with modern security management platforms. These technological constraints limit market opportunities in applications where sophisticated surveillance features are essential requirements.

Maintenance challenges emerge as analog systems age and replacement components become increasingly difficult to source. The declining supplier base for analog camera components creates potential support issues that may accelerate migration to digital alternatives, particularly for organizations concerned about long-term system sustainability.

Hybrid system integration presents significant opportunities for analog camera manufacturers to develop solutions that bridge analog and digital technologies, enabling organizations to leverage existing analog infrastructure while incorporating modern digital capabilities. These hybrid approaches can extend the useful life of analog investments while providing migration paths to fully digital systems.

Specialized applications offer growth opportunities in niche markets where analog technology characteristics provide specific advantages over digital alternatives. Industrial environments with electromagnetic interference, outdoor installations requiring extreme weather resistance, or applications with specific power consumption constraints may favor analog solutions designed for these specialized requirements.

Cost-sensitive segments represent expansion opportunities as economic pressures drive demand for affordable surveillance solutions across small businesses, residential applications, and developing market segments. Manufacturers can capitalize on these opportunities by developing cost-optimized analog camera models that deliver essential surveillance capabilities at competitive price points.

Retrofit markets provide opportunities for analog camera suppliers to serve organizations upgrading aging surveillance systems while maintaining existing infrastructure investments. These applications require compatible analog solutions that offer improved performance characteristics while preserving connectivity with established cabling and recording systems.

Export potential exists for Japanese analog camera manufacturers to serve international markets where cost-effective surveillance solutions remain in high demand. Leveraging Japan’s reputation for quality manufacturing, companies can expand beyond domestic markets to serve global customers seeking reliable analog surveillance technology.

Supply chain dynamics in the Japan surveillance analog camera market reflect the mature nature of the technology, with established manufacturing processes and component sourcing relationships that provide stability but limited growth potential. Manufacturers benefit from optimized production costs and reliable component availability, though innovation opportunities are constrained by the fundamental limitations of analog technology.

Competitive dynamics feature intense price competition as manufacturers seek to maintain market share in a declining technology segment. This competitive pressure drives efficiency improvements and cost optimization initiatives while limiting profit margins and investment in analog technology development. Companies increasingly focus on service differentiation and specialized applications to maintain competitive positioning.

Customer dynamics show a bifurcated market where some organizations continue to value analog technology benefits while others migrate to digital alternatives. This division creates distinct customer segments with different requirements, purchasing behaviors, and technology preferences that manufacturers must address through targeted product and service strategies.

Technology dynamics demonstrate the ongoing evolution of analog camera capabilities within the constraints of the underlying technology platform. Manufacturers continue to improve image sensors, signal processing, and environmental resistance while maintaining compatibility with existing analog infrastructure, though these improvements face inherent technological limitations.

Regulatory dynamics influence market development through standards and compliance requirements that may favor or restrict analog technology adoption in specific applications. Changes in security regulations, building codes, or industry standards can significantly impact market demand and application opportunities for analog surveillance systems.

Primary research methodology for analyzing the Japan surveillance analog camera market incorporates comprehensive data collection from industry stakeholders including manufacturers, distributors, system integrators, and end-users across diverse application segments. This approach ensures accurate representation of market conditions, competitive dynamics, and customer requirements that shape market development.

Data collection techniques include structured interviews with industry executives, technical specialists, and procurement decision-makers to gather insights on market trends, technology preferences, and purchasing criteria. Survey methodologies capture quantitative data on market size, growth rates, and segmentation patterns while qualitative research explores underlying market drivers and constraints.

Secondary research sources encompass industry publications, government statistics, trade association reports, and corporate financial disclosures that provide context for primary research findings. This secondary data validates primary research conclusions and ensures comprehensive coverage of market factors that influence analog camera demand in Japan.

Market modeling approaches utilize statistical analysis techniques to project market trends, estimate segment sizes, and forecast growth patterns based on historical data and identified market drivers. These models incorporate economic indicators, technology adoption rates, and competitive dynamics to generate reliable market projections.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review panels, and iterative analysis refinement. This validation approach confirms research conclusions and provides confidence in market insights and projections presented in the analysis.

Tokyo metropolitan area dominates the Japan surveillance analog camera market, accounting for approximately 35% of national demand due to the concentration of commercial facilities, corporate headquarters, and government installations requiring surveillance coverage. The region’s dense urban environment and established infrastructure support extensive analog camera deployments across diverse applications from retail security to transportation monitoring.

Osaka region represents the second-largest market segment with 22% market share, driven by significant industrial activity, port facilities, and commercial developments that require comprehensive surveillance systems. The area’s manufacturing base creates demand for analog cameras in industrial applications where cost-effectiveness and reliability are prioritized over advanced digital features.

Nagoya corridor accounts for 15% of market demand, supported by automotive manufacturing facilities, logistics centers, and transportation infrastructure that utilize analog surveillance systems for security monitoring. The region’s industrial focus creates opportunities for specialized analog camera applications designed for manufacturing environments and supply chain security.

Northern regions including Sendai and Sapporo contribute 12% of market volume, with demand driven by government facilities, educational institutions, and seasonal tourism infrastructure requiring reliable surveillance coverage. These areas often favor analog systems due to harsh weather conditions that may challenge more complex digital alternatives.

Southern regions encompassing Fukuoka, Hiroshima, and surrounding areas represent 16% of total market demand, supported by port facilities, industrial complexes, and commercial developments. The remaining regional markets collectively account for the balance of national demand, reflecting the distributed nature of surveillance requirements across Japan’s diverse economic landscape.

Market leadership in the Japan surveillance analog camera sector features a combination of established domestic manufacturers and international technology providers who compete across different market segments and application areas:

Competitive strategies focus on differentiation through specialized applications, service excellence, and cost optimization as companies navigate the mature analog camera market while preparing for eventual technology transitions.

By Technology Type:

By Camera Type:

By Application:

Commercial applications represent the largest category within the Japan surveillance analog camera market, driven by retail establishments, office buildings, and commercial facilities that require cost-effective surveillance solutions. These applications typically prioritize reliability and ease of installation over advanced features, making analog cameras well-suited for basic security monitoring requirements. The commercial segment benefits from established installation practices and service networks that support analog technology deployment.

Industrial monitoring applications demonstrate strong demand for analog cameras due to harsh environmental conditions, electromagnetic interference concerns, and reliability requirements that favor proven analog technology. Manufacturing facilities, chemical plants, and heavy industry installations often specify analog systems for their robustness and simplified maintenance procedures. This category shows particular strength in specialized applications where digital alternatives may face operational challenges.

Residential security represents a growing category as homeowners seek affordable surveillance solutions that provide basic monitoring capabilities without complex installation requirements. Analog cameras appeal to residential customers due to lower costs, simplified operation, and compatibility with existing cable television infrastructure in some installations. This segment benefits from DIY installation trends and consumer preference for straightforward security solutions.

Transportation infrastructure maintains steady demand for analog cameras in railway systems, bus terminals, and transportation facilities where proven reliability and standardized interfaces are prioritized. These applications often require specialized environmental ratings and integration with existing transportation management systems, creating opportunities for customized analog solutions designed for specific transportation requirements.

Government and public sector applications continue to specify analog cameras for certain installations where regulatory requirements, budget constraints, or compatibility with existing systems favor analog technology. Educational institutions, government buildings, and public facilities represent stable demand sources for analog surveillance systems designed to meet specific public sector requirements and procurement standards.

Manufacturers benefit from established production processes, mature supply chains, and predictable component costs that enable efficient manufacturing operations and stable profit margins. The analog camera market provides opportunities for companies to leverage existing manufacturing capabilities while serving cost-sensitive customer segments that prioritize value over advanced features.

Distributors gain advantages from simplified product portfolios, established customer relationships, and straightforward technical support requirements that reduce operational complexity compared to rapidly evolving digital alternatives. The analog market offers stable revenue streams and predictable inventory management for distribution partners serving diverse customer segments.

System integrators benefit from standardized installation procedures, proven integration techniques, and simplified troubleshooting processes that improve project efficiency and reduce technical risks. Analog systems enable integrators to serve price-sensitive customers while maintaining profitability through streamlined deployment processes and reduced technical complexity.

End-users receive value through lower total cost of ownership, simplified operation, and reliable performance characteristics that meet basic surveillance requirements without unnecessary complexity. Organizations benefit from reduced training requirements, straightforward maintenance procedures, and compatibility with existing infrastructure that minimizes deployment costs and operational disruption.

Service providers gain from predictable maintenance requirements, established repair procedures, and stable technology platforms that enable efficient service delivery and customer support. The mature nature of analog technology creates opportunities for specialized service companies to develop expertise in analog system maintenance and optimization.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology convergence trends show increasing development of hybrid solutions that combine analog camera hardware with digital processing capabilities, enabling organizations to leverage existing analog infrastructure while accessing some benefits of digital technology. These hybrid approaches represent a bridge between traditional analog systems and fully digital alternatives, extending the useful life of analog investments.

Cost optimization trends drive continued innovation in analog camera manufacturing, with companies developing more efficient production processes and component sourcing strategies to maintain competitive pricing. Manufacturers focus on value engineering and design optimization to deliver essential surveillance capabilities at increasingly competitive price points while maintaining acceptable quality standards.

Application specialization trends emerge as manufacturers identify niche markets where analog technology characteristics provide specific advantages over digital alternatives. These specialized applications include harsh industrial environments, electromagnetic interference-prone locations, and installations with specific power consumption or reliability requirements that favor analog solutions.

Service evolution trends show companies expanding beyond hardware sales to provide comprehensive surveillance solutions including installation, maintenance, and system optimization services. This service-oriented approach helps differentiate analog camera providers and creates additional revenue streams in a mature technology market with limited hardware growth potential.

Integration trends focus on developing analog camera systems that can interface with modern security management platforms and digital recording systems, enabling organizations to maintain analog cameras while upgrading other system components. These integration capabilities help preserve analog camera investments during broader security system modernization initiatives.

Product innovation developments continue within the constraints of analog technology, with manufacturers introducing enhanced image sensors, improved low-light performance, and better environmental resistance. These incremental improvements help maintain analog camera competitiveness in applications where basic surveillance capabilities are sufficient and cost considerations are paramount.

Manufacturing optimization developments focus on production efficiency improvements and cost reduction initiatives that enable competitive pricing in price-sensitive market segments. Companies invest in automated manufacturing processes and supply chain optimization to maintain profitability while serving cost-conscious customers who prioritize value over advanced features.

Market consolidation developments show ongoing industry restructuring as companies adapt to declining analog camera demand and increased competition from digital alternatives. Mergers, acquisitions, and strategic partnerships help companies optimize operations, expand service capabilities, and maintain market position in a challenging competitive environment.

Service expansion developments demonstrate companies broadening their offerings beyond hardware sales to include comprehensive surveillance solutions, system integration services, and ongoing maintenance support. This service-oriented approach helps differentiate analog camera providers and creates sustainable revenue streams in a mature technology market.

International expansion developments show Japanese manufacturers exploring export opportunities in markets where cost-effective surveillance solutions remain in high demand. These expansion initiatives leverage Japan’s reputation for quality manufacturing while serving global customers seeking reliable analog surveillance technology at competitive prices.

Strategic positioning recommendations suggest that analog camera manufacturers should focus on specialized applications and niche markets where analog technology characteristics provide specific advantages over digital alternatives. Companies should identify and develop expertise in these specialized segments rather than competing directly with digital solutions in mainstream surveillance applications.

Product development recommendations emphasize the importance of hybrid solutions that bridge analog and digital technologies, enabling customers to leverage existing analog infrastructure while accessing some benefits of digital capabilities. MarkWide Research analysis indicates that hybrid approaches can extend market relevance and provide migration paths for customers transitioning to digital systems.

Market expansion recommendations encourage companies to explore international opportunities where cost-effective surveillance solutions remain in demand, particularly in developing markets with budget constraints and existing analog infrastructure. Export strategies can help offset declining domestic demand while leveraging Japanese manufacturing quality reputation.

Service enhancement recommendations suggest that companies should expand beyond hardware sales to provide comprehensive surveillance solutions including installation, maintenance, and system optimization services. This service-oriented approach creates additional revenue streams and helps differentiate analog camera providers in a competitive market environment.

Partnership development recommendations advocate for strategic alliances with system integrators, security service providers, and technology companies that can help expand market reach and provide complementary capabilities. These partnerships can help analog camera manufacturers access new customer segments and application opportunities while sharing market development costs.

Market trajectory projections indicate that the Japan surveillance analog camera market will experience gradual decline over the long term as digital technologies continue to gain adoption across surveillance applications. However, the market is expected to maintain stability in the near term, with projected growth of 4.2% CAGR through specialized applications and replacement demand for existing analog installations.

Technology evolution outlook suggests that analog cameras will increasingly focus on niche applications where specific technology characteristics provide advantages over digital alternatives. These specialized markets may include harsh industrial environments, cost-sensitive applications, and installations with particular reliability or compatibility requirements that favor analog solutions.

Competitive landscape evolution anticipates continued consolidation as companies adapt to market maturity and declining growth prospects. Successful companies will likely focus on operational efficiency, specialized applications, and service differentiation to maintain profitability in an increasingly challenging competitive environment.

Customer segment development expects continued bifurcation between organizations that maintain analog systems for cost and compatibility reasons and those that migrate to digital alternatives for advanced capabilities. This division will create distinct market segments with different requirements and purchasing behaviors that manufacturers must address through targeted strategies.

Innovation opportunities remain limited by the fundamental constraints of analog technology, though incremental improvements in image quality, environmental resistance, and system integration capabilities may provide competitive advantages. MWR projections suggest that hybrid solutions combining analog hardware with digital processing will represent the most promising innovation direction for maintaining market relevance.

The Japan surveillance analog camera market represents a mature technology segment that continues to serve important security functions despite the broader industry transition toward digital alternatives. While facing long-term challenges from technological evolution and changing customer preferences, the market maintains near-term stability through specialized applications, cost-sensitive segments, and replacement demand for existing analog installations.

Market sustainability depends on manufacturers’ ability to identify and serve niche applications where analog technology characteristics provide specific advantages over digital alternatives. Success in this environment requires focus on operational efficiency, specialized expertise, and service differentiation rather than competing directly with digital solutions in mainstream surveillance applications.

Strategic opportunities exist for companies that can develop hybrid solutions bridging analog and digital technologies, serve specialized market segments with unique requirements, and expand into international markets where cost-effective surveillance solutions remain in demand. The key to success lies in recognizing the market’s constraints while maximizing opportunities within those limitations.

Future viability of the Japan surveillance analog camera market will depend on the industry’s ability to adapt to changing customer needs while maintaining the cost and reliability advantages that have sustained analog technology adoption. Companies that can successfully navigate this transition while serving specialized customer requirements will be best positioned for continued success in this evolving market landscape.

What is Surveillance Analog Camera?

Surveillance Analog Camera refers to traditional video cameras that transmit analog signals for monitoring and recording purposes. These cameras are commonly used in security systems across various sectors, including retail, transportation, and public safety.

What are the key players in the Japan Surveillance Analog Camera Market?

Key players in the Japan Surveillance Analog Camera Market include Panasonic Corporation, Sony Corporation, and Canon Inc., among others. These companies are known for their innovative products and extensive distribution networks.

What are the growth factors driving the Japan Surveillance Analog Camera Market?

The growth of the Japan Surveillance Analog Camera Market is driven by increasing security concerns, the expansion of smart city initiatives, and the rising demand for surveillance in various sectors such as retail and transportation.

What challenges does the Japan Surveillance Analog Camera Market face?

Challenges in the Japan Surveillance Analog Camera Market include the rapid advancement of digital technologies, which may render analog systems less competitive, and concerns regarding privacy and data protection.

What opportunities exist in the Japan Surveillance Analog Camera Market?

Opportunities in the Japan Surveillance Analog Camera Market include the integration of advanced features such as remote monitoring and cloud storage, as well as the potential for growth in emerging markets and sectors like healthcare.

What trends are shaping the Japan Surveillance Analog Camera Market?

Trends in the Japan Surveillance Analog Camera Market include the shift towards hybrid systems that combine analog and digital technologies, increased focus on high-definition video quality, and the adoption of smart analytics for enhanced security monitoring.

Japan Surveillance Analog Camera Market

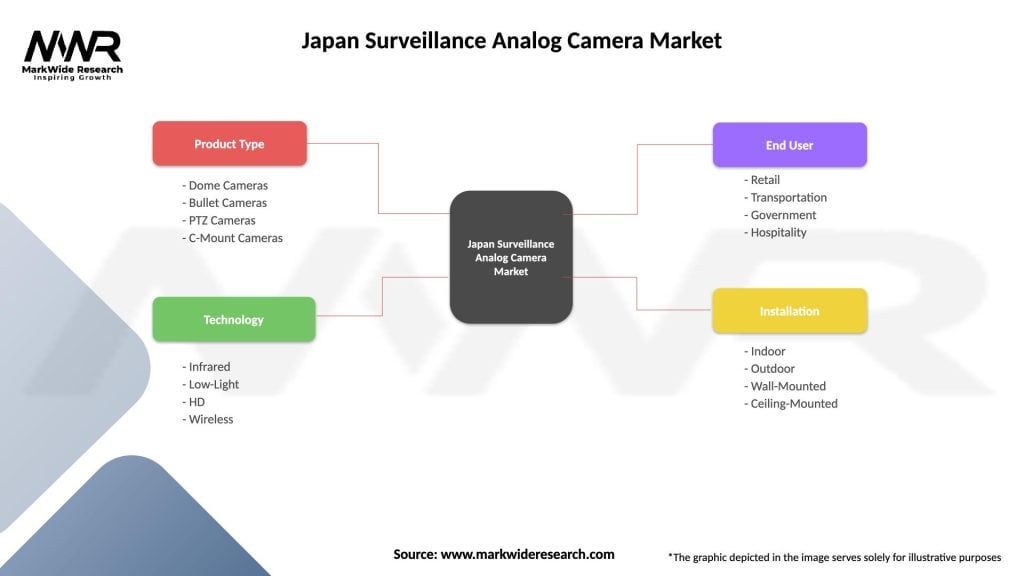

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, C-Mount Cameras |

| Technology | Infrared, Low-Light, HD, Wireless |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Wall-Mounted, Ceiling-Mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Surveillance Analog Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at