444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan spinal surgery device market represents a critical segment of the country’s advanced medical technology landscape, driven by an aging population and increasing prevalence of spinal disorders. Japan’s healthcare system has embraced innovative spinal surgery technologies, positioning the nation as a leader in minimally invasive surgical procedures and advanced implant technologies. The market encompasses a comprehensive range of devices including spinal fusion systems, spinal decompression devices, vertebral compression fracture treatment systems, and motion preservation devices.

Market dynamics indicate robust growth potential, with the sector experiencing a 6.8% CAGR driven by technological advancements and demographic shifts. Japanese medical institutions are increasingly adopting next-generation spinal surgery devices that offer improved patient outcomes and reduced recovery times. The integration of robotics, artificial intelligence, and advanced imaging technologies has revolutionized spinal surgery practices across the country.

Healthcare infrastructure in Japan supports widespread adoption of sophisticated spinal surgery devices, with major medical centers investing heavily in state-of-the-art surgical equipment. The market benefits from strong government support for medical innovation and a well-established regulatory framework that ensures device safety and efficacy while facilitating market access for innovative technologies.

The Japan spinal surgery device market refers to the comprehensive ecosystem of medical devices, instruments, and implants specifically designed for the diagnosis, treatment, and management of spinal disorders within Japan’s healthcare system. This market encompasses surgical instruments, spinal implants, biologics, and advanced technology platforms used in various spinal procedures ranging from minimally invasive interventions to complex reconstructive surgeries.

Spinal surgery devices include fusion systems that permanently connect vertebrae, decompression tools that relieve pressure on neural structures, and motion preservation technologies that maintain spinal flexibility. The market also covers specialized instruments for specific procedures such as vertebroplasty, kyphoplasty, and artificial disc replacement, along with supporting technologies like surgical navigation systems and intraoperative monitoring equipment.

Market scope extends beyond traditional surgical implants to include emerging technologies such as 3D-printed custom implants, bioactive materials, and smart implants with integrated sensors. The definition encompasses both domestic manufacturing capabilities and imported technologies that serve Japan’s sophisticated healthcare market, reflecting the country’s commitment to providing world-class spinal care to its population.

Japan’s spinal surgery device market demonstrates exceptional growth momentum, driven by demographic trends and technological innovation. The market benefits from Japan’s rapidly aging population, with 28% of citizens over 65 years old, creating substantial demand for spinal intervention procedures. Healthcare expenditure allocation toward advanced medical technologies continues to increase, supporting market expansion and technology adoption.

Key market segments include thoracolumbar fusion devices, cervical fusion systems, and non-fusion technologies, each experiencing distinct growth patterns. The minimally invasive surgery segment has gained significant traction, with 42% adoption rate among leading medical centers. Robotic-assisted surgery represents an emerging high-growth segment, with increasing installations across major hospitals.

Competitive landscape features a mix of global medical device manufacturers and specialized Japanese companies, creating a dynamic market environment. Innovation focus areas include patient-specific implants, biocompatible materials, and integrated surgical platforms that combine multiple technologies. Market consolidation trends indicate strategic partnerships between device manufacturers and healthcare providers to enhance market penetration and clinical outcomes.

Market intelligence reveals several critical insights shaping the Japan spinal surgery device landscape:

Demographic transformation serves as the primary driver for Japan’s spinal surgery device market, with the country experiencing the world’s most rapid population aging. Life expectancy increases combined with declining birth rates have created a substantial patient population requiring spinal interventions. The prevalence of age-related spinal conditions such as spinal stenosis, degenerative disc disease, and vertebral compression fractures continues to rise, directly correlating with device market demand.

Technological advancement represents another significant growth driver, with innovations in materials science, surgical techniques, and device design improving patient outcomes and expanding treatment options. 3D printing technology enables patient-specific implant manufacturing, while advanced biomaterials enhance osseointegration and reduce complications. Robotic surgery platforms and AI-assisted surgical planning tools are transforming surgical precision and efficiency.

Healthcare infrastructure investment by both public and private sectors supports market growth through facility upgrades and equipment procurement. Government healthcare policies emphasize quality improvement and cost-effectiveness, driving adoption of advanced technologies that demonstrate superior clinical outcomes. Insurance coverage expansion for innovative procedures has reduced financial barriers for patients seeking spinal surgery interventions.

Clinical evidence generation through extensive research programs has validated the effectiveness of modern spinal surgery devices, increasing surgeon confidence and adoption rates. Patient awareness of treatment options has grown significantly, leading to earlier intervention and increased procedure volumes. The shift toward outpatient and same-day discharge procedures has made spinal surgery more accessible and cost-effective.

Economic pressures within Japan’s healthcare system create significant constraints on market growth, as cost containment measures limit spending on expensive medical devices. Budget constraints at hospital levels often delay equipment purchases and technology upgrades, particularly for smaller healthcare facilities. The emphasis on cost-effectiveness requires manufacturers to demonstrate clear economic benefits alongside clinical advantages.

Regulatory complexity continues to challenge market participants, despite recent improvements in approval processes. Clinical trial requirements for device approval can be extensive and time-consuming, particularly for innovative technologies without established precedents. Post-market surveillance obligations and quality system requirements impose ongoing compliance costs that may limit smaller manufacturer participation.

Surgeon training requirements for advanced technologies create adoption barriers, as healthcare institutions must invest in comprehensive education programs. Learning curves associated with new surgical techniques and technologies can temporarily reduce surgical efficiency and increase procedure times. The limited number of specialized spine surgeons in certain regions constrains market penetration for sophisticated devices.

Competition from alternative treatments such as conservative management, physical therapy, and non-surgical interventions may reduce demand for surgical devices. Patient preference for less invasive treatments when possible can limit the addressable market for certain device categories. Reimbursement limitations for newer technologies may restrict access and adoption rates among cost-conscious healthcare providers.

Emerging technologies present substantial opportunities for market expansion, particularly in areas such as bioactive implants, smart devices with integrated sensors, and personalized medicine approaches. Artificial intelligence integration in surgical planning and navigation systems offers potential for improved outcomes and operational efficiency. The development of biodegradable implants and tissue engineering solutions represents a significant growth frontier.

Market expansion into underserved segments such as pediatric spinal surgery and complex revision procedures offers growth potential for specialized device manufacturers. Outpatient surgery trends create opportunities for devices specifically designed for minimally invasive procedures that enable same-day discharge. The growing demand for motion preservation technologies presents alternatives to traditional fusion procedures.

Strategic partnerships between device manufacturers and healthcare providers can create value-based care models that align incentives and improve patient outcomes. Digital health integration through connected devices and remote monitoring capabilities offers opportunities to enhance post-operative care and long-term patient management. Telemedicine applications for pre-operative planning and post-operative follow-up expand market reach.

Export opportunities exist for Japanese manufacturers to leverage domestic innovation and quality reputation in international markets. Technology licensing and joint development agreements with global partners can accelerate innovation and market access. The development of training and education services alongside device sales creates additional revenue streams and strengthens customer relationships.

Supply chain dynamics in Japan’s spinal surgery device market reflect a complex interplay between global manufacturers, domestic suppliers, and healthcare providers. Manufacturing capabilities within Japan focus on high-precision components and specialized materials, while many finished devices are imported from established global manufacturers. The market demonstrates resilience through diversified supply sources and strategic inventory management.

Pricing dynamics are influenced by government healthcare policies, competitive pressures, and value-based purchasing initiatives. Reimbursement frameworks play a crucial role in market access, with recent reforms emphasizing clinical outcomes and cost-effectiveness. Price competition has intensified as patents expire on established technologies, creating opportunities for generic alternatives and biosimilar products.

Innovation cycles in the market are accelerating, with shorter product lifecycles and rapid technology evolution. Research collaboration between manufacturers, academic institutions, and healthcare providers drives continuous improvement in device design and functionality. The integration of digital technologies and data analytics is transforming traditional device paradigms toward smart, connected solutions.

Market consolidation trends indicate strategic acquisitions and partnerships as companies seek to expand product portfolios and market reach. Vertical integration strategies are emerging as manufacturers seek greater control over supply chains and customer relationships. The market dynamics favor companies that can demonstrate clear clinical benefits, cost-effectiveness, and comprehensive support services.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with key stakeholders including spine surgeons, hospital administrators, device manufacturers, and regulatory officials. Survey methodologies capture quantitative data on market trends, adoption patterns, and future projections from representative samples across Japan’s healthcare system.

Secondary research incorporates analysis of published clinical studies, regulatory filings, company financial reports, and industry publications. Market intelligence gathering includes monitoring of patent filings, clinical trial registrations, and regulatory approvals to identify emerging trends and competitive developments. Database analysis of hospital procurement records and surgical procedure volumes provides quantitative market insights.

Expert validation processes ensure research findings align with industry reality through consultation with leading spine surgeons, medical device executives, and healthcare policy experts. Cross-verification of data sources and triangulation of findings enhance research reliability and accuracy. Continuous monitoring of market developments ensures research remains current and relevant.

Analytical frameworks include market sizing methodologies, competitive analysis models, and trend projection techniques specifically adapted for the Japanese healthcare market context. Statistical analysis employs advanced modeling techniques to project future market scenarios and identify key growth drivers. Quality assurance processes ensure research meets international standards for market intelligence and strategic analysis.

Tokyo metropolitan area dominates Japan’s spinal surgery device market, accounting for 35% of total demand due to concentration of major medical centers and research institutions. Greater Tokyo region benefits from advanced healthcare infrastructure, high patient volumes, and early adoption of innovative technologies. The area serves as a key market entry point for international manufacturers and a hub for clinical research activities.

Osaka and Kansai region represents the second-largest market segment, with 22% market share driven by major university hospitals and specialized spine centers. Regional medical clusters in Kansai have developed expertise in specific spinal surgery subspecialties, creating demand for specialized devices and instruments. The region’s manufacturing capabilities support both domestic production and export activities.

Nagoya and Chubu region accounts for 18% of market activity, with strong presence of medical device manufacturing and research facilities. Industrial collaboration between automotive and medical device sectors has fostered innovation in precision manufacturing and materials science. The region demonstrates particular strength in minimally invasive surgery adoption and robotic surgery implementation.

Northern regions including Sendai and Sapporo show growing market potential, with 12% combined market share and increasing investment in healthcare infrastructure. Rural healthcare initiatives are expanding access to advanced spinal surgery services through telemedicine and mobile surgical units. Southern regions including Kyushu demonstrate 13% market presence with focus on aging population healthcare needs and medical tourism development.

Market leadership in Japan’s spinal surgery device sector is characterized by intense competition among established global manufacturers and emerging innovative companies. The competitive environment emphasizes technological differentiation, clinical evidence generation, and comprehensive customer support services.

Competitive strategies emphasize clinical differentiation, comprehensive training programs, and value-based partnerships with healthcare providers. Innovation focus areas include patient-specific implants, smart technologies, and integrated surgical platforms that improve efficiency and outcomes.

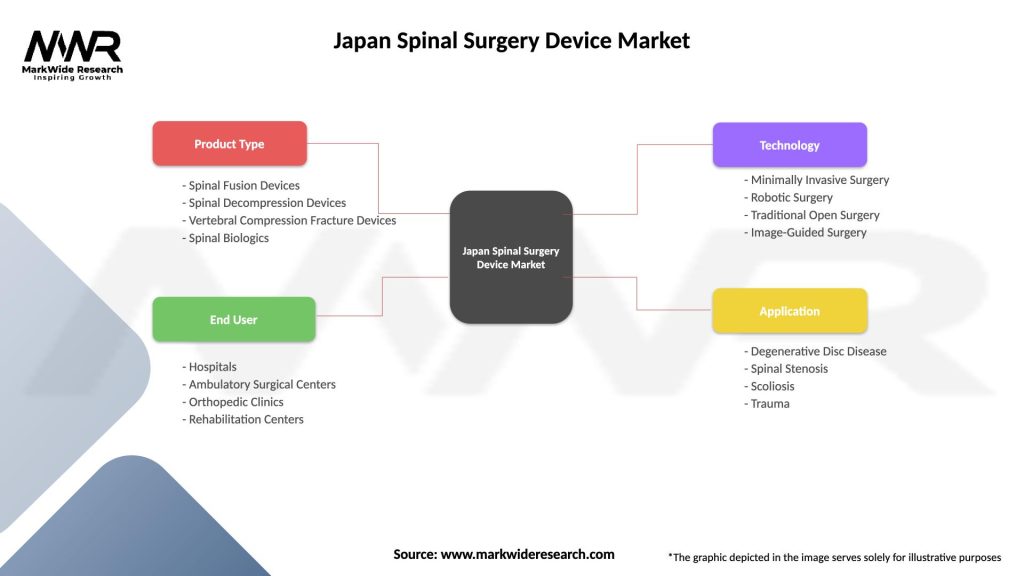

Product segmentation of Japan’s spinal surgery device market reveals distinct categories with varying growth patterns and market dynamics:

By Product Type:

By Surgical Approach:

By Application:

Thoracolumbar fusion devices represent the largest market category, driven by high prevalence of lower back conditions and established surgical techniques. Market maturity in this segment has led to price competition and focus on incremental innovations such as improved materials and surface treatments. Pedicle screw systems dominate this category, with increasing adoption of minimally invasive insertion techniques.

Cervical spine devices show strong growth potential due to increasing diagnosis of neck-related disorders and improved surgical techniques. Artificial cervical discs are gaining acceptance as alternatives to fusion procedures, offering motion preservation benefits. Anterior cervical plates and interbody fusion devices continue to evolve with enhanced designs and materials.

Minimally invasive surgery instruments represent the fastest-growing category, with annual growth rates exceeding traditional open surgery tools. Endoscopic spine surgery equipment is experiencing particular growth as surgeons adopt less invasive approaches. Navigation and imaging systems are increasingly integrated with surgical instruments to improve precision and safety.

Biologics and bone graft substitutes form a specialized high-value category with significant growth potential. Synthetic bone graft materials are gaining preference over traditional autograft procedures due to reduced morbidity and improved outcomes. Growth factors and stem cell therapies represent emerging subcategories with substantial future potential.

Healthcare providers benefit from advanced spinal surgery devices through improved patient outcomes, reduced complications, and enhanced surgical efficiency. Minimally invasive technologies enable shorter hospital stays and faster patient recovery, improving bed utilization and operational efficiency. Advanced navigation systems reduce surgical time and improve precision, leading to better clinical results and reduced revision rates.

Surgeons gain access to innovative tools that enhance their surgical capabilities and expand treatment options for complex spinal conditions. Training programs provided by manufacturers improve surgical skills and confidence with new technologies. Clinical evidence generated through device use supports professional development and research activities.

Patients experience significant benefits including reduced surgical trauma, faster recovery times, and improved long-term outcomes. Motion preservation technologies offer alternatives to fusion procedures that maintain spinal flexibility. Personalized implants and patient-specific surgical planning improve treatment effectiveness and satisfaction.

Device manufacturers benefit from Japan’s sophisticated healthcare market that values innovation and quality. Regulatory environment supports innovation while ensuring safety and efficacy. Clinical collaboration opportunities with leading medical centers facilitate product development and validation. Market access to Japan often serves as a gateway to broader Asian markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Minimally invasive surgery adoption continues to accelerate across Japan’s healthcare system, with hospitals investing in specialized equipment and training programs. Surgeon preference for MIS techniques is driving demand for innovative instruments and implants designed specifically for smaller incisions and reduced tissue trauma. Patient demand for less invasive procedures with faster recovery times is influencing surgical approach selection.

Robotic surgery integration represents a transformative trend, with major medical centers implementing robotic platforms for spinal procedures. Precision enhancement through robotic assistance is improving surgical outcomes and reducing complications. Training programs for robotic surgery are expanding, with manufacturers providing comprehensive education and certification programs.

Personalized medicine approaches are gaining traction through patient-specific implants and customized surgical planning. 3D printing technology enables creation of implants tailored to individual patient anatomy and pathology. Advanced imaging and modeling software support pre-operative planning and surgical simulation for complex cases.

Digital health integration is transforming post-operative care through connected devices and remote monitoring capabilities. Smart implants with integrated sensors provide real-time data on healing progress and implant performance. Telemedicine applications enable remote consultation and follow-up care, particularly valuable for rural patients.

Sustainability initiatives are influencing device design and manufacturing processes, with emphasis on environmentally friendly materials and packaging. Circular economy principles are being applied to device lifecycle management and waste reduction. Corporate responsibility programs are becoming important factors in purchasing decisions for healthcare institutions.

Regulatory advancements have streamlined device approval processes, with Japan’s PMDA implementing digital submission systems and expedited review pathways for innovative technologies. International harmonization efforts have aligned Japanese standards with global requirements, facilitating market access for international manufacturers. Post-market surveillance systems have been enhanced to ensure ongoing device safety and effectiveness monitoring.

Technology partnerships between medical device companies and technology firms are accelerating innovation in areas such as artificial intelligence, machine learning, and advanced materials. Strategic alliances with healthcare providers are creating integrated solutions that combine devices, services, and outcome guarantees. Research collaborations with academic institutions are advancing fundamental understanding of spinal biomechanics and healing processes.

Manufacturing innovations include adoption of advanced production techniques such as additive manufacturing, precision machining, and automated assembly systems. Quality improvements through implementation of Industry 4.0 technologies and real-time monitoring systems ensure consistent product quality. Supply chain optimization initiatives have enhanced resilience and reduced costs through strategic sourcing and inventory management.

Clinical evidence generation has intensified through large-scale registry studies and real-world evidence collection programs. Outcome measurement standardization efforts are improving comparability of clinical results across different devices and procedures. Health economics research is demonstrating the cost-effectiveness of advanced spinal surgery technologies, supporting reimbursement decisions.

MarkWide Research analysis indicates that market participants should prioritize investment in minimally invasive technologies and robotic surgery platforms to capture emerging growth opportunities. Strategic focus on surgeon education and training programs will be critical for successful technology adoption and market penetration. Partnership development with leading medical centers can accelerate clinical validation and market acceptance of innovative devices.

Product development strategies should emphasize patient-specific solutions and personalized medicine approaches to differentiate from commodity products. Digital integration capabilities including connectivity, data analytics, and remote monitoring will become essential features for next-generation devices. Value-based contracting models should be developed to align manufacturer incentives with patient outcomes and healthcare cost management.

Market expansion opportunities exist in underserved segments such as outpatient surgery centers and rural healthcare facilities. Technology licensing and joint development agreements can accelerate innovation while sharing development costs and risks. International expansion strategies should leverage Japan’s reputation for quality and innovation to access global markets.

Regulatory strategy should focus on early engagement with authorities and proactive compliance with evolving requirements. Clinical evidence generation should emphasize real-world outcomes and health economic benefits to support market access and reimbursement. Sustainability initiatives should be integrated into product development and manufacturing processes to meet evolving stakeholder expectations.

Long-term market prospects for Japan’s spinal surgery device sector remain highly positive, driven by demographic trends and continuous technological advancement. Market growth is projected to maintain a 7.2% CAGR over the next five years, supported by increasing surgical volumes and technology adoption. Innovation acceleration in areas such as biologics, smart implants, and personalized medicine will create new market segments and opportunities.

Technology evolution will focus on integration of artificial intelligence, machine learning, and advanced materials to improve surgical outcomes and patient experience. Robotic surgery adoption is expected to reach 25% penetration in major medical centers within the next decade. Minimally invasive procedures will continue to gain market share, potentially reaching 60% of total procedures by 2030.

Market consolidation trends are likely to continue as companies seek scale advantages and comprehensive product portfolios. Vertical integration strategies may emerge as manufacturers seek greater control over value chains and customer relationships. New entrants from technology sectors may disrupt traditional market dynamics through innovative approaches and business models.

Regulatory environment will continue to evolve toward outcome-based assessments and real-world evidence requirements. Reimbursement frameworks will increasingly emphasize value-based care and cost-effectiveness demonstrations. International harmonization efforts will facilitate global market access and reduce regulatory complexity for innovative technologies.

Japan’s spinal surgery device market represents a dynamic and rapidly evolving sector with substantial growth potential driven by demographic trends, technological innovation, and healthcare system advancement. The market benefits from Japan’s sophisticated healthcare infrastructure, aging population demographics, and commitment to medical innovation, creating favorable conditions for sustained expansion and technology adoption.

Key success factors for market participants include focus on minimally invasive technologies, investment in surgeon education and training, and development of value-based partnerships with healthcare providers. Innovation priorities should emphasize personalized medicine approaches, digital integration capabilities, and outcome-focused solutions that demonstrate clear clinical and economic benefits.

Market challenges including cost containment pressures, regulatory complexity, and intense competition require strategic responses through differentiation, efficiency improvements, and comprehensive market access strategies. Future opportunities in emerging technologies, underserved segments, and international expansion offer significant potential for growth-oriented companies.

Strategic positioning for long-term success requires balancing innovation investment with operational efficiency, while maintaining focus on patient outcomes and healthcare value creation. The Japan spinal surgery device market will continue to serve as a critical testing ground for advanced medical technologies and a gateway to broader Asian market opportunities, making it an essential focus area for global medical device companies seeking sustainable growth and market leadership.

What is Spinal Surgery Device?

Spinal Surgery Devices are specialized instruments and implants used in surgical procedures to treat spinal disorders, including herniated discs, spinal stenosis, and deformities. These devices include screws, rods, and interbody cages designed to stabilize the spine and promote healing.

What are the key players in the Japan Spinal Surgery Device Market?

Key players in the Japan Spinal Surgery Device Market include Medtronic, DePuy Synthes, and Stryker, which are known for their innovative spinal products and technologies. These companies focus on developing advanced surgical solutions to enhance patient outcomes, among others.

What are the growth factors driving the Japan Spinal Surgery Device Market?

The Japan Spinal Surgery Device Market is driven by an aging population, increasing prevalence of spinal disorders, and advancements in surgical techniques. Additionally, the rising demand for minimally invasive surgeries is contributing to market growth.

What challenges does the Japan Spinal Surgery Device Market face?

Challenges in the Japan Spinal Surgery Device Market include high costs associated with advanced surgical devices and the need for skilled surgeons to perform complex procedures. Regulatory hurdles and competition from alternative treatments also pose challenges.

What opportunities exist in the Japan Spinal Surgery Device Market?

Opportunities in the Japan Spinal Surgery Device Market include the development of innovative technologies such as robotic-assisted surgery and smart implants. There is also potential for growth in outpatient surgical centers and telemedicine solutions for pre- and post-operative care.

What trends are shaping the Japan Spinal Surgery Device Market?

Trends in the Japan Spinal Surgery Device Market include the increasing adoption of minimally invasive surgical techniques and the integration of digital technologies in surgical planning. Additionally, there is a growing focus on patient-specific solutions and personalized medicine.

Japan Spinal Surgery Device Market

| Segmentation Details | Description |

|---|---|

| Product Type | Spinal Fusion Devices, Spinal Decompression Devices, Vertebral Compression Fracture Devices, Spinal Biologics |

| End User | Hospitals, Ambulatory Surgical Centers, Orthopedic Clinics, Rehabilitation Centers |

| Technology | Minimally Invasive Surgery, Robotic Surgery, Traditional Open Surgery, Image-Guided Surgery |

| Application | Degenerative Disc Disease, Spinal Stenosis, Scoliosis, Trauma |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Spinal Surgery Device Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at