444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan smart home market represents a rapidly evolving landscape characterized by technological innovation, demographic shifts, and changing consumer preferences. Japan’s unique position as a technology-forward nation with an aging population creates distinctive opportunities for smart home solutions that emphasize convenience, security, and energy efficiency. The market demonstrates robust growth potential driven by increasing urbanization, rising disposable income, and government initiatives promoting digital transformation.

Market dynamics in Japan reflect a growing consumer acceptance of connected devices and Internet of Things (IoT) technologies. The integration of artificial intelligence, machine learning, and advanced sensor technologies has transformed traditional homes into intelligent living spaces. Japanese consumers increasingly prioritize solutions that offer enhanced comfort, improved energy management, and comprehensive security features.

Growth projections indicate the market is expanding at a compound annual growth rate of 12.5%, reflecting strong demand across multiple product categories. The convergence of 5G technology deployment, government smart city initiatives, and increasing environmental consciousness drives market expansion. Urban households represent approximately 78% of smart home adoption, with metropolitan areas leading technology integration trends.

The Japan smart home market refers to the comprehensive ecosystem of connected devices, systems, and services that enable automated control and monitoring of residential environments through digital technologies. This market encompasses intelligent lighting systems, climate control solutions, security devices, entertainment systems, and energy management platforms that can be remotely controlled and programmed for optimal performance.

Smart home technology in Japan integrates various components including sensors, actuators, communication protocols, and cloud-based platforms to create seamless user experiences. The market includes both hardware components such as smart thermostats, connected appliances, and security cameras, as well as software solutions including mobile applications, voice assistants, and artificial intelligence algorithms that enable predictive automation.

Japanese smart homes emphasize harmony between technology and traditional living concepts, incorporating elements of minimalism and efficiency that align with cultural preferences. The market definition extends beyond individual devices to include comprehensive home automation ecosystems that learn user preferences and adapt to daily routines.

Japan’s smart home market demonstrates exceptional growth momentum driven by technological advancement, demographic trends, and evolving consumer expectations. The market benefits from Japan’s position as a global technology leader, with domestic companies developing innovative solutions tailored to local preferences and international standards.

Key market drivers include the rapid aging of Japan’s population, which creates demand for assistive technologies and remote monitoring solutions. Additionally, increasing energy costs and environmental awareness drive adoption of smart energy management systems. The market shows strong penetration in urban areas, with smart device adoption rates reaching 45% among tech-savvy consumers.

Competitive landscape features both established Japanese electronics manufacturers and emerging technology startups, creating a dynamic environment for innovation. Major players focus on developing integrated platforms that combine multiple smart home functions while maintaining user-friendly interfaces. The market also benefits from strategic partnerships between technology providers and construction companies, facilitating smart home integration in new residential developments.

Future outlook remains highly positive, with market expansion expected to accelerate through increased 5G network deployment and government digitalization initiatives. Consumer awareness campaigns and demonstration projects in smart cities contribute to growing market acceptance and adoption rates.

Strategic insights reveal several critical factors shaping Japan’s smart home market evolution. The following key insights provide comprehensive understanding of market dynamics:

Demographic transformation serves as a primary market driver, with Japan’s rapidly aging population creating substantial demand for smart home technologies that support independent living. The increasing number of elderly residents living alone drives adoption of health monitoring systems, emergency response technologies, and automated assistance features that enhance safety and convenience.

Government initiatives promoting digital transformation and smart city development provide significant market momentum. National policies supporting IoT deployment, 5G network expansion, and energy efficiency improvements create favorable conditions for smart home technology adoption. Government subsidies and incentive programs further encourage consumer investment in smart home solutions.

Energy management concerns drive market growth as consumers seek solutions to reduce utility costs and environmental impact. Smart thermostats, automated lighting systems, and intelligent appliance management help households optimize energy consumption. The integration of renewable energy sources and battery storage systems creates additional opportunities for smart home energy management platforms.

Urbanization trends contribute to market expansion as city dwellers seek convenient solutions for managing smaller living spaces efficiently. Smart home technologies enable optimal space utilization and automated control of multiple systems within compact urban residences. The growing number of dual-income households increases demand for remote monitoring and control capabilities.

Technological advancement in artificial intelligence, machine learning, and sensor technologies enables more sophisticated and user-friendly smart home solutions. Improved voice recognition, predictive automation, and seamless device integration enhance user experiences and drive market acceptance.

High implementation costs present significant barriers to market adoption, particularly for comprehensive smart home systems. Initial investment requirements for quality devices, professional installation, and system integration can be substantial, limiting adoption among price-sensitive consumers. The cost of ongoing maintenance and system upgrades adds to total ownership expenses.

Technical complexity challenges some consumers, particularly older demographics who may struggle with device setup, configuration, and ongoing management. The need for reliable internet connectivity and technical troubleshooting capabilities can deter potential adopters. Compatibility issues between different brands and protocols create additional complexity barriers.

Privacy and security concerns limit market growth as consumers worry about data collection, storage, and potential misuse by technology providers. High-profile security breaches and privacy violations in other markets create skepticism about smart home technology safety. Regulatory uncertainty regarding data protection and consumer rights adds to market hesitation.

Cultural resistance to technology adoption exists among certain demographic segments, particularly older consumers who prefer traditional home management approaches. Conservative attitudes toward new technology and concerns about over-dependence on automated systems can slow market penetration in some segments.

Infrastructure limitations in rural areas restrict market expansion, as reliable high-speed internet connectivity is essential for smart home functionality. Limited technical support availability in remote regions further constrains adoption opportunities outside major metropolitan areas.

Aging population services represent substantial market opportunities as Japan’s demographic shift creates demand for specialized smart home solutions. Technologies supporting independent living, health monitoring, and emergency response systems offer significant growth potential. The development of intuitive interfaces designed for elderly users can capture this expanding market segment.

Energy management solutions present growing opportunities as consumers seek to reduce utility costs and environmental impact. Integration with renewable energy systems, smart grid technologies, and battery storage creates new market segments. Government incentives for energy-efficient homes further enhance these opportunities.

New construction integration offers substantial growth potential as builders and developers incorporate smart home technologies into new residential projects. Partnerships between technology providers and construction companies can facilitate large-scale smart home deployment. Pre-installed smart home systems in new developments reduce consumer barriers to adoption.

Subscription service models create recurring revenue opportunities through ongoing monitoring, maintenance, and feature updates. Cloud-based services, remote support, and continuous system optimization provide value-added services that enhance customer relationships and market sustainability.

Rural market expansion presents untapped opportunities as internet infrastructure improvements enable smart home adoption in previously underserved areas. Tailored solutions addressing rural-specific needs such as agricultural monitoring and remote property management can drive market growth.

Supply chain dynamics in Japan’s smart home market reflect complex interactions between global component suppliers, domestic manufacturers, and local system integrators. The market benefits from Japan’s strong electronics manufacturing base and established supply chain relationships, though global semiconductor shortages and trade tensions create periodic challenges.

Consumer behavior patterns show increasing acceptance of smart home technologies, with adoption rates accelerating among younger demographics and tech-savvy households. Purchase decision factors prioritize reliability, ease of use, and integration capabilities over price considerations. Consumer education and demonstration programs significantly influence adoption decisions.

Competitive dynamics feature intense rivalry between established electronics manufacturers and emerging technology companies. Market leaders focus on developing comprehensive platforms while smaller players target niche applications and specialized solutions. Strategic partnerships and ecosystem development play crucial roles in competitive positioning.

Regulatory environment continues evolving as government agencies develop standards for smart home device security, data protection, and interoperability. Industry self-regulation initiatives complement government oversight, creating frameworks for responsible market development. Compliance requirements influence product development and market entry strategies.

Technology evolution drives continuous market transformation through advances in artificial intelligence, 5G connectivity, and edge computing. These developments enable more sophisticated automation, faster response times, and enhanced user experiences that drive market growth and differentiation opportunities.

Comprehensive research approach combines multiple data collection and analysis methodologies to provide accurate market insights and projections. The research methodology incorporates both quantitative and qualitative research techniques to ensure thorough market understanding and reliable forecasting.

Primary research activities include extensive surveys of smart home users, potential adopters, and industry stakeholders across Japan’s major metropolitan areas. In-depth interviews with technology providers, retailers, and installation professionals provide detailed insights into market dynamics and competitive positioning. Focus groups with different demographic segments reveal consumer preferences and adoption barriers.

Secondary research sources encompass government statistics, industry reports, company financial statements, and technology trend analyses. Patent filings, product launches, and strategic partnership announcements provide insights into innovation trends and competitive developments. Academic research and technology forecasting studies contribute to long-term market projections.

Data validation processes ensure research accuracy through cross-referencing multiple sources and expert verification. Statistical analysis techniques identify trends and correlations while accounting for seasonal variations and external factors. MarkWide Research analytical frameworks provide structured approaches to market segmentation and competitive analysis.

Market modeling techniques incorporate demographic trends, economic indicators, and technology adoption curves to generate reliable growth projections. Scenario analysis considers various market development paths and potential disruption factors that could influence future market evolution.

Tokyo Metropolitan Area dominates Japan’s smart home market, accounting for approximately 35% of total market activity. The region’s high population density, elevated income levels, and technology-forward culture drive strong adoption rates across all smart home categories. Premium product segments perform particularly well in Tokyo, with consumers willing to invest in comprehensive automation systems.

Osaka and Kansai Region represents the second-largest market segment, contributing roughly 22% of national smart home adoption. The region shows strong growth in energy management solutions and security systems, driven by industrial development and urban expansion. Cost-conscious consumers in this region favor practical smart home solutions with clear return on investment.

Nagoya and Central Japan demonstrate growing market potential, with adoption rates increasing rapidly among manufacturing industry workers and technology professionals. The region’s automotive industry concentration drives interest in connected home technologies that integrate with smart transportation systems.

Northern regions including Sendai and Sapporo show specialized demand for smart home solutions addressing climate control and energy efficiency needs. Harsh winter conditions create opportunities for intelligent heating systems and automated snow management technologies.

Rural and suburban areas represent emerging market opportunities as internet infrastructure improvements enable smart home adoption. These regions show particular interest in security systems, agricultural monitoring technologies, and remote property management solutions.

Market leadership in Japan’s smart home sector features a diverse mix of established electronics manufacturers, technology startups, and international companies. The competitive environment emphasizes innovation, quality, and comprehensive solution offerings.

Competitive strategies focus on ecosystem development, strategic partnerships, and localized product offerings that address specific Japanese market needs. Companies emphasize reliability, user experience, and integration capabilities to differentiate their offerings in the competitive marketplace.

By Product Category:

By Technology:

By End User:

Security and Access Control represents the most mature smart home category in Japan, driven by urbanization and safety concerns. Smart door locks show particularly strong adoption rates, with biometric authentication features gaining popularity among Japanese consumers who value both security and convenience. Integrated security systems that combine multiple sensors and cameras demonstrate growing market penetration.

Energy Management Solutions experience rapid growth as Japanese households seek to reduce utility costs and environmental impact. Smart thermostats and automated lighting systems show strong return on investment, driving consumer adoption. Integration with solar power systems and battery storage creates comprehensive energy optimization platforms that appeal to environmentally conscious consumers.

Entertainment and Media Systems benefit from Japan’s strong consumer electronics culture and high-quality content preferences. Smart TVs, audio systems, and streaming devices integrate seamlessly with home automation platforms. Voice-controlled entertainment systems gain traction as Japanese language processing capabilities improve.

Kitchen and Appliance Automation reflects Japanese preferences for efficiency and quality in food preparation. Smart refrigerators with inventory management and recipe suggestions appeal to busy urban households. Automated cooking appliances and kitchen monitoring systems support the growing trend toward convenient meal preparation.

Health and Wellness Monitoring emerges as a significant category driven by aging population needs and health consciousness. Air quality sensors, sleep monitoring systems, and emergency response technologies provide peace of mind for families with elderly members.

Technology Manufacturers benefit from Japan’s sophisticated consumer market that values quality and innovation. The market provides opportunities for premium product positioning and comprehensive solution development. Strong domestic demand supports research and development investments while providing a platform for international expansion.

Service Providers gain access to recurring revenue opportunities through subscription-based monitoring, maintenance, and support services. The market’s emphasis on reliability creates demand for professional installation and ongoing technical support, supporting service industry growth.

Construction and Real Estate Companies can differentiate their offerings through smart home integration, appealing to tech-savvy buyers and renters. Smart home features increasingly influence property values and rental rates, providing competitive advantages for early adopters.

Utility Companies benefit from smart home energy management systems that optimize grid efficiency and reduce peak demand. Partnerships with smart home providers create new service opportunities and customer engagement channels.

Consumers experience enhanced convenience, security, and energy efficiency through smart home adoption. Long-term cost savings from energy optimization and increased property values provide financial benefits beyond immediate convenience improvements.

Government and Society benefit from reduced energy consumption, improved emergency response capabilities, and enhanced quality of life for aging populations. Smart home technologies support broader digitalization and sustainability objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents a dominant trend as smart home systems become more predictive and autonomous. Machine learning algorithms enable systems to learn user preferences and optimize performance automatically. Voice recognition and natural language processing improvements enhance user interaction capabilities, making smart homes more intuitive and responsive.

Ecosystem Convergence drives market development as consumers prefer unified platforms over standalone devices. Major technology companies develop comprehensive smart home ecosystems that integrate multiple functions through single control interfaces. Cross-platform compatibility and open standards gain importance as consumers seek flexibility in device selection.

Sustainability Focus influences product development and consumer preferences, with energy efficiency becoming a primary consideration. Smart home systems increasingly incorporate renewable energy integration, energy storage management, and carbon footprint tracking. Environmental consciousness drives adoption of solutions that demonstrate measurable sustainability benefits.

Health and Wellness Integration emerges as smart homes expand beyond convenience and security to support occupant health. Air quality monitoring, sleep optimization, and wellness tracking become standard features. The COVID-19 pandemic accelerates interest in home health monitoring and contactless control systems.

Edge Computing Adoption reduces reliance on cloud connectivity while improving response times and privacy protection. Local processing capabilities enable smart homes to function independently during internet outages while reducing data transmission requirements.

Strategic partnerships between technology companies and construction firms accelerate smart home integration in new residential developments. Major builders incorporate smart home systems as standard features, driving market growth and consumer acceptance. These partnerships create comprehensive solutions that address both technology and installation challenges.

Government smart city initiatives provide testing grounds for advanced smart home technologies while demonstrating practical applications. Pilot projects in cities like Tokyo and Osaka showcase integration between smart homes and urban infrastructure, creating models for broader deployment.

5G network deployment enables more sophisticated smart home applications with faster response times and greater device connectivity. Telecommunications companies partner with smart home providers to develop applications that leverage advanced network capabilities.

Regulatory framework development addresses privacy, security, and interoperability concerns while providing industry guidance. New standards for device certification and data protection create consumer confidence while establishing clear compliance requirements for manufacturers.

International expansion by Japanese smart home companies brings domestic innovations to global markets while attracting foreign investment in Japan’s smart home sector. Cross-border partnerships facilitate technology transfer and market development.

Market participants should prioritize user experience design and simplified installation processes to address complexity barriers that limit adoption among certain demographic segments. MWR analysis indicates that companies focusing on intuitive interfaces and professional installation services achieve higher customer satisfaction and retention rates.

Technology providers should develop comprehensive platforms that integrate multiple smart home functions while maintaining compatibility with existing devices. Ecosystem approaches that support gradual adoption and expansion provide competitive advantages over standalone product strategies.

Pricing strategies should consider Japan’s diverse economic segments, with entry-level products targeting price-sensitive consumers while premium offerings serve affluent early adopters. Subscription service models can reduce initial investment barriers while providing ongoing revenue streams.

Partnership development with construction companies, retailers, and service providers creates distribution channels and reduces market entry barriers. Strategic alliances enable companies to leverage existing customer relationships and technical expertise.

Consumer education initiatives should address privacy concerns and demonstrate practical benefits through hands-on demonstrations and trial programs. Building trust through transparent data practices and security certifications supports market acceptance and growth.

Long-term market prospects remain highly positive as demographic trends, technological advancement, and government support create favorable conditions for sustained growth. The market is expected to maintain robust expansion with projected growth rates exceeding 15% annually through the next decade.

Technology evolution will drive market transformation through advances in artificial intelligence, 5G connectivity, and edge computing capabilities. These developments enable more sophisticated automation, improved user experiences, and enhanced integration with smart city infrastructure.

Demographic shifts toward an aging population create substantial long-term opportunities for smart home technologies that support independent living and health monitoring. The growing number of single-person households also drives demand for security and convenience solutions.

Market maturation will likely result in industry consolidation as successful companies expand their market presence while smaller players focus on specialized niches. Platform-based approaches will dominate as consumers prefer comprehensive solutions over fragmented device collections.

International integration will increase as Japanese smart home technologies gain global recognition while international companies establish stronger presence in Japan. Cross-border partnerships and technology sharing will accelerate innovation and market development.

Japan’s smart home market represents a dynamic and rapidly expanding sector driven by unique demographic trends, technological innovation, and evolving consumer preferences. The market benefits from Japan’s position as a global technology leader, sophisticated consumer base, and supportive government policies that promote digital transformation and smart city development.

Market fundamentals remain strong despite challenges related to implementation costs and technical complexity. The aging population creates substantial opportunities for assistive technologies while urbanization drives demand for convenience and security solutions. Energy efficiency concerns and environmental consciousness further support market growth across multiple product categories.

Competitive dynamics feature both established domestic manufacturers and emerging technology companies, creating an innovative environment that benefits consumers through improved products and competitive pricing. Strategic partnerships between technology providers and construction companies facilitate market expansion while addressing installation and integration challenges.

Future prospects indicate continued robust growth as 5G deployment, artificial intelligence advancement, and ecosystem integration create new opportunities for market development. The Japan smart home market is well-positioned to maintain its growth trajectory while serving as a model for smart home adoption in other developed markets facing similar demographic and technological trends.

What is Smart Home?

Smart Home refers to a residential setup where various devices and appliances are interconnected and can be controlled remotely, often enhancing convenience, security, and energy efficiency. This includes smart lighting, thermostats, security systems, and home entertainment systems.

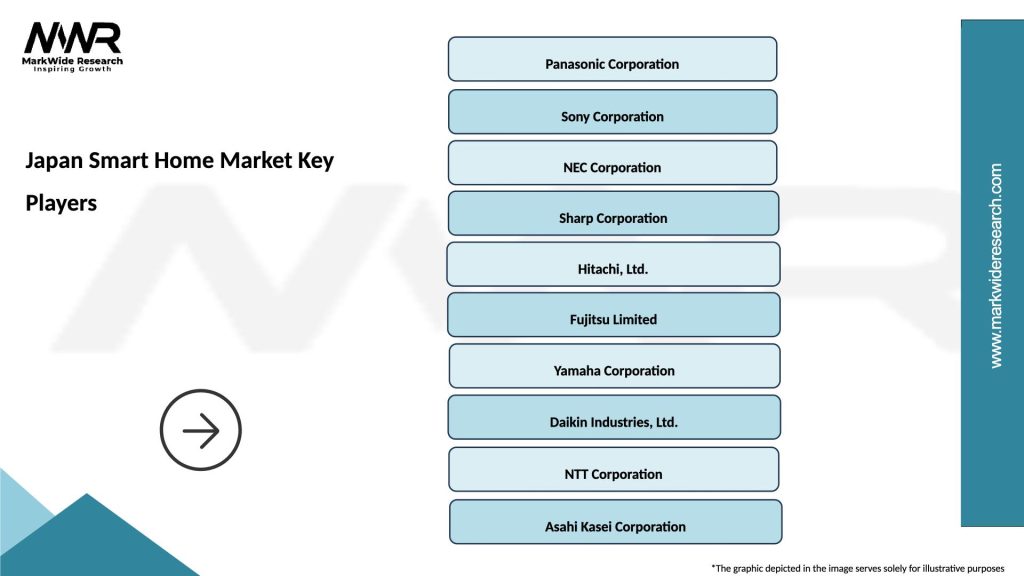

What are the key players in the Japan Smart Home Market?

Key players in the Japan Smart Home Market include Panasonic, Sony, and Sharp, which offer a range of smart home products such as smart appliances and home automation systems, among others.

What are the growth factors driving the Japan Smart Home Market?

The Japan Smart Home Market is driven by increasing consumer demand for convenience and energy efficiency, advancements in IoT technology, and a growing focus on home security solutions. Additionally, the rise in smart device adoption among consumers contributes to market growth.

What challenges does the Japan Smart Home Market face?

Challenges in the Japan Smart Home Market include concerns over data privacy and security, high initial costs of smart home systems, and the complexity of integrating various devices. These factors can hinder widespread adoption among consumers.

What future opportunities exist in the Japan Smart Home Market?

Future opportunities in the Japan Smart Home Market include the expansion of smart home ecosystems, increased integration with renewable energy sources, and the development of AI-driven home automation solutions. These trends can enhance user experience and drive further adoption.

What trends are shaping the Japan Smart Home Market?

Trends in the Japan Smart Home Market include the growing popularity of voice-activated devices, the integration of smart home technology with health monitoring systems, and the rise of energy-efficient smart appliances. These innovations are transforming how consumers interact with their homes.

Japan Smart Home Market

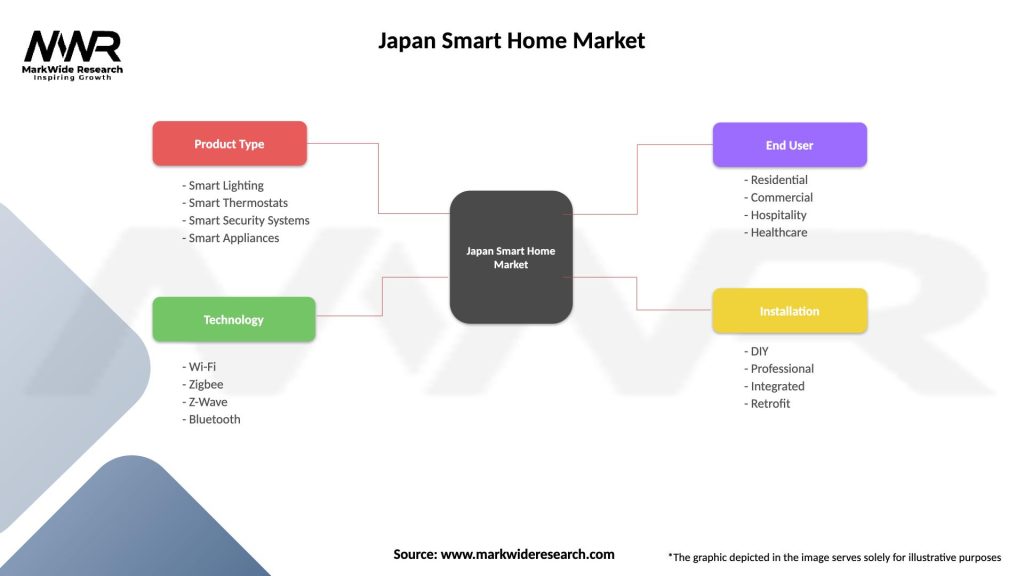

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Lighting, Smart Thermostats, Smart Security Systems, Smart Appliances |

| Technology | Wi-Fi, Zigbee, Z-Wave, Bluetooth |

| End User | Residential, Commercial, Hospitality, Healthcare |

| Installation | DIY, Professional, Integrated, Retrofit |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Smart Home Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at