444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan rechargeable battery market represents one of the most technologically advanced and rapidly evolving sectors in the global energy storage industry. Japan’s position as a pioneer in battery technology development has established the nation as a critical hub for innovation in lithium-ion, nickel-metal hydride, and emerging solid-state battery technologies. The market encompasses diverse applications ranging from consumer electronics and electric vehicles to grid-scale energy storage systems and industrial equipment.

Market dynamics in Japan are driven by the country’s commitment to carbon neutrality by 2050, aggressive electrification initiatives, and substantial investments in renewable energy infrastructure. The domestic market benefits from the presence of leading battery manufacturers including Panasonic, Sony, and Murata Manufacturing, which have established Japan as a global technology leader. Current market trends indicate a robust growth trajectory of 8.2% CAGR through the forecast period, driven primarily by electric vehicle adoption and energy storage system deployment.

Technological advancement remains a cornerstone of Japan’s rechargeable battery market, with significant research and development investments focused on next-generation battery chemistries. The market demonstrates strong integration across automotive, electronics, and energy sectors, with electric vehicle applications representing approximately 42% of total market demand. Japan’s strategic focus on battery recycling and circular economy principles further strengthens its market position while addressing sustainability concerns.

The Japan rechargeable battery market refers to the comprehensive ecosystem of secondary battery technologies, manufacturing capabilities, and applications within Japan’s domestic and export-oriented economy. This market encompasses the development, production, distribution, and utilization of rechargeable energy storage solutions across multiple industry verticals including automotive, consumer electronics, industrial equipment, and stationary energy storage systems.

Rechargeable batteries in the Japanese context represent advanced electrochemical energy storage devices capable of multiple charge-discharge cycles while maintaining performance characteristics. The market includes various battery chemistries such as lithium-ion, nickel-metal hydride, lithium-polymer, and emerging solid-state technologies. Japan’s market definition extends beyond traditional manufacturing to encompass battery management systems, charging infrastructure, recycling technologies, and integrated energy solutions.

Market scope includes both domestic consumption and international trade, with Japan serving as a major exporter of high-quality battery technologies and components. The definition encompasses the entire value chain from raw material processing and cell manufacturing to system integration and end-of-life management, reflecting Japan’s comprehensive approach to battery technology development and commercialization.

Japan’s rechargeable battery market stands at the forefront of global energy storage innovation, driven by technological excellence, strategic government initiatives, and strong industrial partnerships. The market demonstrates exceptional growth potential with expanding applications across electric mobility, renewable energy integration, and consumer electronics sectors. Key market drivers include Japan’s carbon neutrality commitments, electric vehicle adoption acceleration, and increasing demand for grid-scale energy storage solutions.

Market leadership is characterized by the presence of world-class manufacturers who have established Japan as a technology benchmark for battery performance, safety, and reliability. The domestic market benefits from strong research and development capabilities, with battery technology patents representing approximately 28% of global innovations. Strategic partnerships between automotive manufacturers, battery producers, and technology companies create a robust ecosystem supporting market expansion.

Competitive advantages include advanced manufacturing processes, superior quality control systems, and integrated supply chain management. The market demonstrates resilience through diversified application portfolios and strong export capabilities. Future growth prospects remain positive, supported by government incentives, technological breakthroughs in solid-state batteries, and expanding international market opportunities.

Strategic market insights reveal several critical factors shaping Japan’s rechargeable battery landscape:

Electric vehicle adoption serves as the primary catalyst driving Japan’s rechargeable battery market expansion. Government initiatives promoting electric mobility, including purchase incentives and charging infrastructure development, create substantial demand for high-performance automotive batteries. The transition from internal combustion engines to electric powertrains requires advanced battery technologies capable of delivering extended range, fast charging capabilities, and long-term reliability.

Renewable energy integration represents another significant market driver as Japan seeks to achieve carbon neutrality goals. The increasing deployment of solar and wind power generation systems necessitates large-scale energy storage solutions to manage grid stability and power quality. Battery energy storage systems enable effective integration of intermittent renewable sources while providing grid services such as frequency regulation and peak shaving capabilities.

Technological innovation continues to drive market growth through the development of next-generation battery technologies. Japanese companies invest heavily in solid-state battery research, promising improved energy density, enhanced safety characteristics, and extended operational lifespans. These technological advances create new market opportunities while strengthening Japan’s competitive position in global battery markets.

Consumer electronics evolution drives demand for compact, high-capacity rechargeable batteries. The proliferation of smartphones, tablets, wearable devices, and IoT applications requires batteries with superior energy density and reliability. Japan’s expertise in miniaturization and precision manufacturing positions the country advantageously in serving these demanding applications.

Raw material dependencies present significant challenges for Japan’s rechargeable battery market, as the country relies heavily on imported lithium, cobalt, and nickel. Price volatility and supply chain disruptions in critical materials can impact production costs and market competitiveness. Geopolitical tensions and trade restrictions may further complicate raw material procurement strategies.

Manufacturing cost pressures intensify as global competition increases and price-sensitive markets demand more affordable battery solutions. Japanese manufacturers face challenges in maintaining premium pricing while competing with lower-cost producers in other regions. High labor costs and stringent quality standards contribute to elevated production expenses that may limit market share in price-competitive segments.

Regulatory complexity creates operational challenges as battery safety, transportation, and environmental regulations become increasingly stringent. Compliance requirements for international markets vary significantly, necessitating substantial investments in testing, certification, and quality assurance processes. Evolving regulations regarding battery recycling and end-of-life management add additional compliance burdens.

Technology transition risks emerge as the industry shifts toward new battery chemistries and form factors. Investments in existing lithium-ion production capacity may face obsolescence as solid-state and other advanced technologies mature. The timing and pace of technology transitions create uncertainty for capacity planning and capital allocation decisions.

Solid-state battery commercialization presents exceptional growth opportunities for Japanese manufacturers who lead global research and development efforts. These next-generation batteries offer superior energy density, enhanced safety characteristics, and extended operational lifespans compared to conventional lithium-ion technologies. Early commercialization success could establish Japan as the dominant supplier for premium battery applications.

Grid-scale energy storage expansion creates substantial market opportunities as utilities and grid operators seek solutions for renewable energy integration. Japan’s expertise in large-format battery systems and grid integration technologies positions the country advantageously for domestic and international energy storage projects. According to MarkWide Research analysis, grid storage applications demonstrate potential growth rates exceeding 15% annually.

International market expansion offers significant revenue growth potential as global demand for high-quality battery technologies increases. Japanese manufacturers can leverage their reputation for reliability and performance to capture market share in emerging economies and developed markets seeking premium battery solutions. Export opportunities span automotive, industrial, and consumer electronics applications.

Circular economy initiatives create new business models around battery recycling, refurbishment, and second-life applications. Japanese companies can develop comprehensive lifecycle management services that extract maximum value from battery investments while addressing environmental sustainability concerns. These services generate recurring revenue streams while supporting circular economy principles.

Supply chain evolution significantly influences Japan’s rechargeable battery market dynamics as companies seek to reduce dependencies on imported raw materials. Domestic processing capabilities for lithium, cobalt, and nickel are expanding through strategic investments and partnerships. Battery recycling technologies enable recovery of valuable materials from end-of-life batteries, creating closed-loop supply chains that enhance resource security.

Competitive landscape dynamics reflect intense innovation competition among Japanese manufacturers and international rivals. Companies differentiate through technological advancement, manufacturing excellence, and integrated solutions capabilities. Strategic partnerships between battery manufacturers, automotive companies, and technology firms create collaborative ecosystems that accelerate innovation and market development.

Demand pattern shifts emerge as applications evolve and new use cases develop. Electric vehicle batteries require different performance characteristics than consumer electronics applications, driving specialized product development. Energy storage systems demand long-duration, high-cycle-life batteries optimized for grid applications. These diverse requirements create market segmentation opportunities for specialized battery solutions.

Investment flows toward battery technology development and manufacturing capacity expansion reflect strong market confidence. Government incentives, private equity investments, and corporate research budgets support continued innovation and scaling efforts. International partnerships facilitate technology transfer and market access while distributing development risks across multiple stakeholders.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, technology experts, and market participants across the battery value chain. Secondary research encompasses analysis of company financial reports, government publications, patent databases, and industry association data.

Data collection processes utilize both quantitative and qualitative research approaches to capture market dynamics and trends. Quantitative analysis includes market sizing, growth rate calculations, and statistical modeling of market drivers and restraints. Qualitative research provides insights into strategic decision-making processes, technology development priorities, and competitive positioning strategies.

Market validation occurs through triangulation of multiple data sources and expert verification of key findings. Industry consultations with leading manufacturers, research institutions, and government agencies ensure accuracy of market assessments. Cross-referencing of data from multiple sources identifies inconsistencies and validates market projections.

Analytical frameworks incorporate Porter’s Five Forces analysis, SWOT assessment, and value chain analysis to provide comprehensive market understanding. Scenario modeling evaluates potential market outcomes under different assumptions regarding technology adoption, regulatory changes, and economic conditions. These analytical approaches support robust market forecasting and strategic planning.

Tokyo metropolitan area serves as the primary hub for Japan’s rechargeable battery market, hosting major manufacturers, research institutions, and technology companies. The region benefits from concentrated industrial infrastructure, skilled workforce availability, and proximity to key customers in automotive and electronics sectors. Regional market share represents approximately 35% of total domestic production capacity.

Kansai region demonstrates strong market presence through established manufacturing facilities and research centers operated by leading battery companies. The area’s industrial heritage and logistics infrastructure support efficient production and distribution operations. Partnerships between universities and industry create innovation clusters that drive technology development and commercialization efforts.

Chubu region plays a critical role in automotive battery production, leveraging proximity to major automotive manufacturers and suppliers. The region’s manufacturing expertise and supply chain integration capabilities support high-volume battery production for electric vehicle applications. Strategic location advantages facilitate efficient distribution to domestic and international markets.

Northern regions including Tohoku and Hokkaido contribute to market development through renewable energy projects and energy storage system deployments. These areas demonstrate growing demand for grid-scale battery systems supporting wind and solar power integration. Regional energy storage projects create testing grounds for advanced battery technologies and grid integration solutions.

Market leadership in Japan’s rechargeable battery sector is characterized by several world-class manufacturers who have established global reputations for innovation and quality:

Competitive strategies focus on technological differentiation, manufacturing excellence, and strategic partnerships. Companies invest heavily in research and development to maintain technology leadership while expanding production capacity to serve growing markets. Vertical integration strategies enable better quality control and cost management across the value chain.

By Battery Type:

By Application:

By End-User:

Automotive battery segment demonstrates the strongest growth momentum, driven by accelerating electric vehicle adoption and government electrification policies. Japanese automotive manufacturers increasingly specify domestic battery suppliers to ensure quality, reliability, and supply chain security. Advanced battery management systems and thermal management technologies differentiate Japanese automotive batteries in global markets.

Consumer electronics category remains a stable market segment with steady demand from smartphone, tablet, and laptop manufacturers. Japanese battery suppliers focus on high-energy-density solutions that enable thinner device designs and extended operating times. Miniaturization expertise and precision manufacturing capabilities provide competitive advantages in this demanding segment.

Energy storage systems represent the fastest-growing category as utilities and commercial customers deploy battery systems for grid services and renewable energy integration. Large-format battery systems require different design approaches and safety considerations compared to automotive and consumer applications. Japanese manufacturers leverage their systems integration expertise to deliver turnkey energy storage solutions.

Industrial applications encompass diverse use cases including power tools, medical devices, and backup power systems. These applications often require specialized battery designs optimized for specific performance requirements such as high discharge rates, extended cycle life, or extreme temperature operation. Customization capabilities enable Japanese manufacturers to serve niche markets with premium pricing.

Manufacturers benefit from Japan’s advanced technology ecosystem, skilled workforce, and strong intellectual property protection. Access to cutting-edge research institutions and collaborative development programs accelerates innovation cycles and reduces development costs. Government incentives and tax benefits support research and development investments while encouraging domestic production capacity expansion.

Automotive companies gain access to high-quality battery technologies that enable competitive electric vehicle offerings. Long-term supply partnerships with Japanese battery manufacturers provide supply chain stability and technology roadmap alignment. Joint development programs facilitate customized battery solutions optimized for specific vehicle platforms and performance requirements.

Technology companies benefit from miniaturization expertise and precision manufacturing capabilities that enable advanced consumer electronics designs. Japanese battery suppliers offer comprehensive technical support and rapid prototyping services that accelerate product development cycles. Quality assurance systems ensure reliable battery performance in demanding consumer applications.

Utilities and energy companies access proven energy storage technologies that support grid modernization and renewable energy integration initiatives. Japanese battery systems demonstrate superior reliability and longevity characteristics that reduce total cost of ownership. Comprehensive service and maintenance programs ensure optimal system performance throughout operational lifespans.

Strengths:

Weaknesses:

Opportunities:

Threats:

Solid-state battery development represents the most significant technological trend shaping Japan’s rechargeable battery market. Leading manufacturers invest substantial resources in commercializing solid-state technologies that promise superior energy density, enhanced safety, and extended operational lifespans. These next-generation batteries could revolutionize electric vehicle performance while creating new market opportunities across multiple applications.

Sustainability initiatives drive increasing focus on battery recycling, circular economy principles, and responsible sourcing practices. Japanese companies develop comprehensive lifecycle management approaches that maximize resource utilization while minimizing environmental impact. Battery recycling rates in Japan currently achieve approximately 78% material recovery efficiency, leading global sustainability efforts.

Digital integration transforms battery systems through advanced monitoring, predictive maintenance, and optimization technologies. Internet of Things connectivity enables real-time performance tracking and remote diagnostics that improve system reliability and reduce maintenance costs. Artificial intelligence applications optimize charging patterns and extend battery lifespans through intelligent management algorithms.

Modular system designs enable flexible deployment and scalability across diverse applications. Standardized battery modules facilitate easier installation, maintenance, and replacement while reducing system costs. Modular approaches support rapid scaling of energy storage deployments and enable efficient manufacturing processes.

Strategic partnerships between Japanese battery manufacturers and international automotive companies accelerate global market expansion. Recent collaborations focus on joint development of next-generation battery technologies and establishment of overseas production facilities. These partnerships combine Japanese technological expertise with international market access and manufacturing scale.

Government policy initiatives including the Green Innovation Fund provide substantial financial support for battery technology development and commercialization. Policy frameworks promote domestic battery production while encouraging international competitiveness through research and development incentives. Regulatory support for electric vehicle adoption creates stable demand for automotive battery applications.

Manufacturing capacity expansions reflect strong market confidence and growing demand across multiple application segments. Major battery manufacturers announce significant investments in new production facilities and technology upgrades. MWR data indicates that planned capacity additions could increase domestic production capability by 65% over the next five years.

Technology breakthrough announcements in solid-state batteries, fast-charging technologies, and advanced materials demonstrate continued innovation leadership. Japanese research institutions and companies regularly publish significant advances that maintain the country’s technological edge. Patent filings in battery technologies continue to grow, reflecting sustained innovation investment.

Investment priorities should focus on solid-state battery commercialization and advanced manufacturing technologies that maintain Japan’s competitive advantages. Companies should accelerate development timelines for next-generation batteries while ensuring production scalability and cost competitiveness. Strategic partnerships with international customers can provide market access and volume commitments supporting investment returns.

Supply chain diversification strategies should reduce dependencies on imported raw materials through domestic processing capabilities and alternative sourcing arrangements. Battery recycling investments can create closed-loop material flows while generating additional revenue streams. Strategic stockpiling of critical materials may provide supply security during market disruptions.

Market expansion approaches should leverage Japan’s reputation for quality and reliability to capture premium market segments internationally. Export strategies should focus on applications where performance and reliability command premium pricing. Joint ventures and licensing agreements can accelerate international market penetration while sharing development risks.

Technology development should maintain focus on breakthrough innovations that create sustainable competitive advantages. Solid-state batteries, advanced materials, and intelligent battery management systems represent priority areas for continued investment. Collaboration with research institutions and international partners can accelerate innovation while distributing development costs.

Market growth prospects remain exceptionally positive as multiple application segments demonstrate strong expansion potential. Electric vehicle adoption acceleration, renewable energy integration requirements, and consumer electronics evolution create sustained demand for advanced battery technologies. Japan’s technological leadership position supports continued market share growth in premium applications.

Technology evolution toward solid-state batteries and advanced chemistries will likely accelerate over the forecast period. Japanese manufacturers are positioned to lead this transition through substantial research investments and early commercialization efforts. MarkWide Research projects that solid-state battery adoption rates could reach 25% of premium applications within the next decade.

International expansion opportunities will continue growing as global demand for high-quality battery technologies increases. Japanese manufacturers can leverage their technological expertise and quality reputation to capture market share in emerging economies and developed markets. Export growth potential remains substantial across automotive, industrial, and energy storage applications.

Sustainability initiatives will become increasingly important as circular economy principles gain prominence. Battery recycling technologies, second-life applications, and responsible sourcing practices will differentiate market leaders. Companies that successfully integrate sustainability into their business models will capture additional value while meeting stakeholder expectations.

Japan’s rechargeable battery market stands at a pivotal moment of exceptional growth opportunity and technological transformation. The market’s foundation of technological excellence, manufacturing expertise, and strategic partnerships positions Japan advantageously for continued leadership in global battery markets. Strong government support, robust research and development capabilities, and integrated industry ecosystems create sustainable competitive advantages.

Future success will depend on successful commercialization of next-generation technologies, particularly solid-state batteries, while maintaining cost competitiveness and manufacturing scale. International expansion strategies, supply chain diversification, and sustainability initiatives will determine long-term market positioning. The convergence of electric vehicle adoption, renewable energy integration, and digital transformation creates unprecedented growth opportunities for Japanese battery manufacturers.

Strategic execution of technology development, market expansion, and operational excellence initiatives will enable Japan to maintain its leadership position while capturing emerging market opportunities. The rechargeable battery market represents a critical component of Japan’s economic future, supporting the transition to sustainable energy systems and advanced mobility solutions. Continued investment in innovation, manufacturing capabilities, and international partnerships will ensure Japan’s rechargeable battery market remains at the forefront of global energy storage evolution.

What is Rechargeable Battery?

Rechargeable batteries are energy storage devices that can be charged and discharged multiple times. They are commonly used in various applications, including consumer electronics, electric vehicles, and renewable energy systems.

What are the key players in the Japan Rechargeable Battery Market?

Key players in the Japan Rechargeable Battery Market include Panasonic, Sony, and Toshiba, which are known for their innovations in battery technology and production capabilities, among others.

What are the main drivers of the Japan Rechargeable Battery Market?

The main drivers of the Japan Rechargeable Battery Market include the increasing demand for electric vehicles, the growth of renewable energy storage solutions, and advancements in battery technology that enhance performance and efficiency.

What challenges does the Japan Rechargeable Battery Market face?

The Japan Rechargeable Battery Market faces challenges such as the high cost of raw materials, competition from alternative energy storage technologies, and environmental concerns related to battery disposal and recycling.

What opportunities exist in the Japan Rechargeable Battery Market?

Opportunities in the Japan Rechargeable Battery Market include the expansion of electric vehicle infrastructure, increasing investments in renewable energy projects, and the development of next-generation battery technologies that offer higher energy densities.

What trends are shaping the Japan Rechargeable Battery Market?

Trends shaping the Japan Rechargeable Battery Market include the rise of solid-state batteries, the integration of smart technologies in battery management systems, and a growing focus on sustainability and recycling initiatives within the industry.

Japan Rechargeable Battery Market

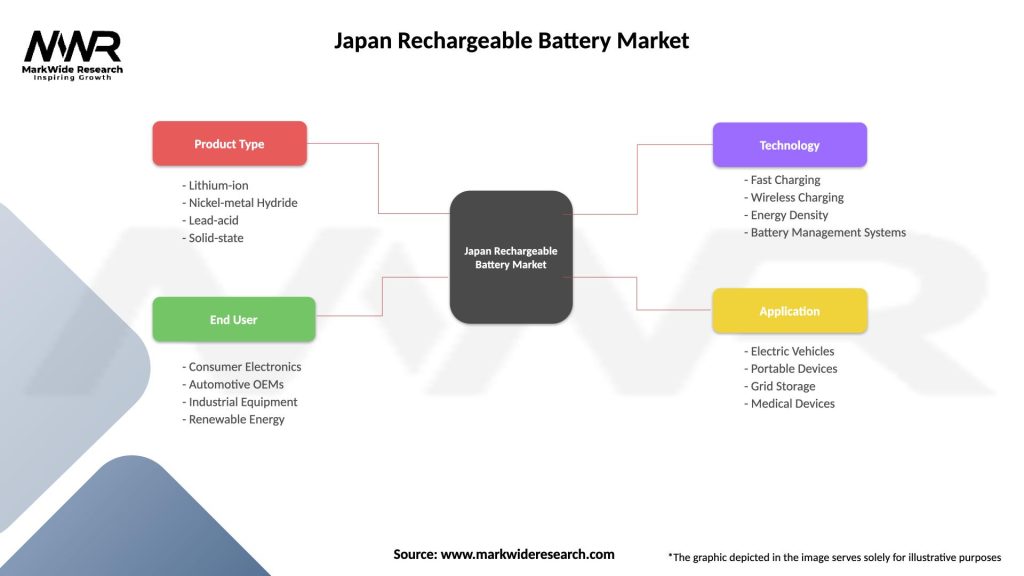

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Lead-acid, Solid-state |

| End User | Consumer Electronics, Automotive OEMs, Industrial Equipment, Renewable Energy |

| Technology | Fast Charging, Wireless Charging, Energy Density, Battery Management Systems |

| Application | Electric Vehicles, Portable Devices, Grid Storage, Medical Devices |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Rechargeable Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at