444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Japan Real Time Payment Market is witnessing significant growth and transformation in recent years. Real-time payment systems have revolutionized the way financial transactions are conducted, offering swift and secure fund transfers around the clock. These systems enable individuals and businesses to make instant payments, thereby eliminating the need for traditional bank transfers that often take several days to process.

Meaning

Real-time payments refer to electronic transactions that allow immediate transfer of funds from the payer to the recipient. Unlike conventional payment methods that involve delays due to batch processing, real-time payment systems facilitate instant settlement, offering a seamless and efficient experience to users. These systems operate 24/7, 365 days a year, enhancing the convenience and speed of financial transactions.

Executive Summary

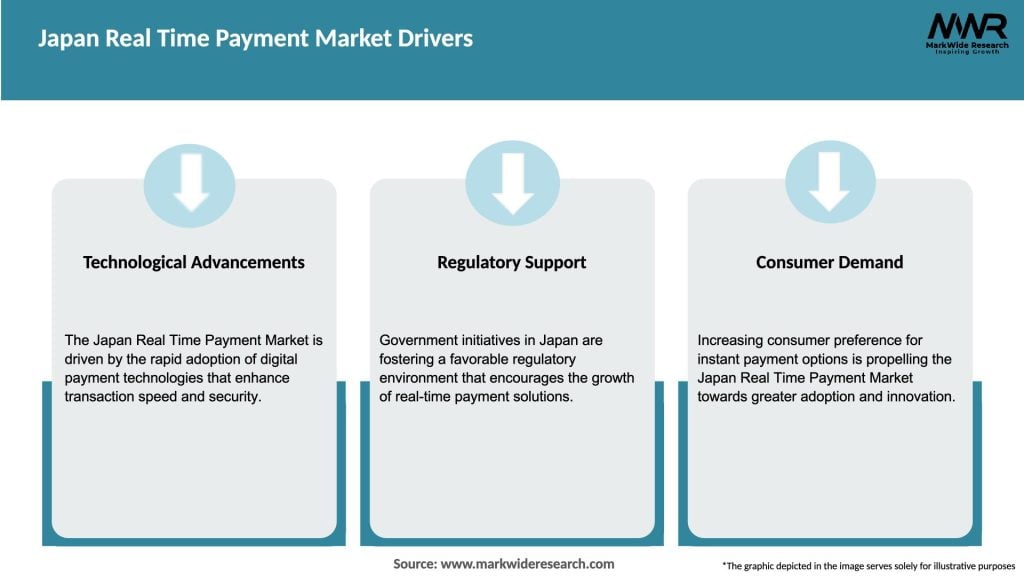

The Japan Real Time Payment Market is experiencing robust growth, driven by increasing consumer demand for quick and hassle-free payment solutions. With technological advancements and growing smartphone penetration, real-time payment adoption has surged in Japan. The market’s rapid expansion has attracted various players, including financial institutions, payment service providers, and FinTech startups, contributing to a highly competitive landscape.

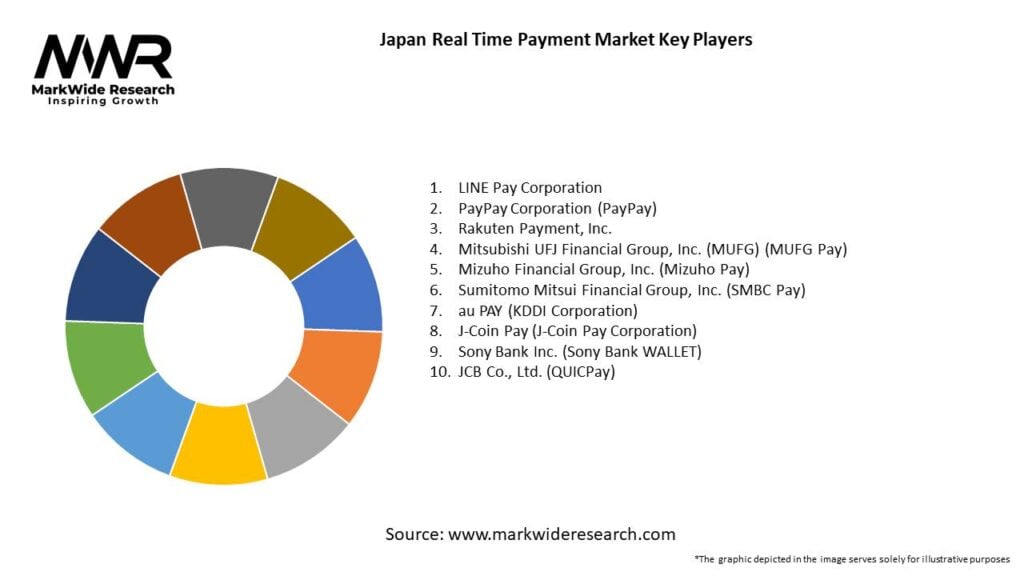

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Japan Real Time Payment Market is characterized by intense competition and rapid technological advancements. The market is witnessing collaborations and partnerships between financial institutions, payment service providers, and technology companies to offer innovative and seamless payment solutions. Consumer preferences and behaviors are continually evolving, driving the need for adaptable and user-friendly payment systems.

Additionally, the COVID-19 pandemic has accelerated the adoption of digital payment methods as people turned to contactless options to reduce physical interactions. This shift in consumer behavior has further boosted the demand for real-time payment solutions.

Regional Analysis

The Japan Real Time Payment Market’s growth is not evenly distributed across regions. Major urban centers with higher smartphone penetration and access to reliable internet connectivity have seen faster adoption compared to rural areas. However, efforts are being made to improve digital infrastructure in rural regions to promote inclusive growth.

Competitive Landscape

Leading Companies in Japan Real Time Payment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

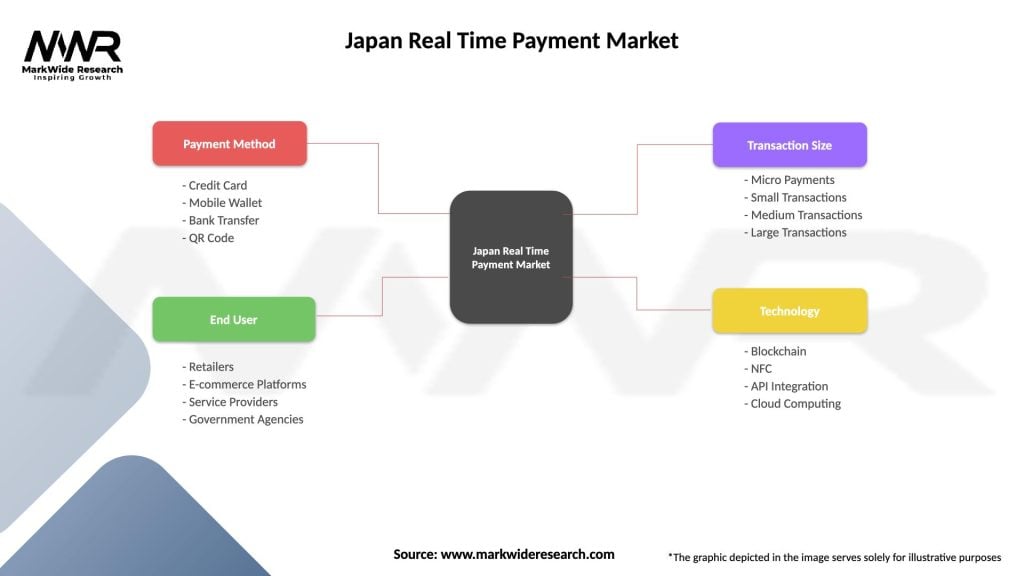

Segmentation

The market can be segmented based on the types of real-time payment systems, such as mobile banking, digital wallets, and instant bank transfers. Additionally, segmentation can be done based on end-users, including individuals, businesses, and government entities.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the shift towards digital payments, including real-time payment systems. Concerns about physical contact and the need for contactless transactions have led to a surge in the adoption of digital payment methods in Japan. This trend is expected to continue even after the pandemic, as consumers have become more accustomed to the convenience of real-time payments.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Japan Real Time Payment Market looks promising, with continued growth expected in the coming years. The market is likely to witness increased collaboration between financial institutions, payment service providers, and technology companies to innovate and offer more sophisticated payment solutions.

As the demand for quick and secure payment options continues to rise, real-time payment systems will become an essential part of Japan’s financial landscape. The market will also see a surge in mobile banking and digital wallet usage, with more users embracing the convenience of digital payments.

Furthermore, the integration of advanced technologies such as biometric authentication, artificial intelligence, and IoT is expected to further enhance the user experience and security of real-time payment systems. These advancements will likely attract more users and businesses to adopt these innovative payment solutions.

Conclusion

The Japan Real Time Payment Market is undergoing a significant transformation, driven by the increasing demand for fast, secure, and convenient payment options. Real-time payment systems have emerged as a game-changer in the financial sector, providing users with the ability to conduct transactions instantaneously.

The market’s growth is further fueled by factors such as increased smartphone penetration, government support for cashless payments, and the booming e-commerce industry. However, challenges related to infrastructure and regulatory compliance remain, requiring concerted efforts from industry participants and policymakers.

To capitalize on the opportunities presented by this evolving market, stakeholders must prioritize security, consumer education, and the adoption of emerging technologies. By doing so, they can create a robust and inclusive real-time payment ecosystem that meets the needs of consumers and businesses alike.

What is Real Time Payment?

Real Time Payment refers to a payment system that allows for the immediate transfer of funds between bank accounts, enabling transactions to be completed in real-time. This system enhances the efficiency of financial transactions, particularly in sectors like retail and e-commerce.

What are the key players in the Japan Real Time Payment Market?

Key players in the Japan Real Time Payment Market include companies like PayPay, LINE Pay, and Rakuten Pay, which are leading the way in digital payment solutions. These companies are innovating to enhance user experience and expand their service offerings, among others.

What are the growth factors driving the Japan Real Time Payment Market?

The Japan Real Time Payment Market is driven by factors such as the increasing adoption of smartphones, the rise of e-commerce, and consumer demand for faster payment solutions. Additionally, government initiatives to promote cashless transactions are also contributing to market growth.

What challenges does the Japan Real Time Payment Market face?

Challenges in the Japan Real Time Payment Market include concerns over cybersecurity, the need for regulatory compliance, and competition from traditional banking systems. These factors can hinder the widespread adoption of real-time payment solutions.

What opportunities exist in the Japan Real Time Payment Market?

Opportunities in the Japan Real Time Payment Market include the potential for partnerships between fintech companies and traditional banks, as well as the expansion of services to underserved demographics. Innovations in blockchain technology may also create new avenues for growth.

What trends are shaping the Japan Real Time Payment Market?

Trends in the Japan Real Time Payment Market include the increasing integration of AI and machine learning for fraud detection, the rise of QR code payments, and the growing popularity of mobile wallets. These trends are transforming how consumers and businesses engage in financial transactions.

Japan Real Time Payment Market

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Mobile Wallet, Bank Transfer, QR Code |

| End User | Retailers, E-commerce Platforms, Service Providers, Government Agencies |

| Transaction Size | Micro Payments, Small Transactions, Medium Transactions, Large Transactions |

| Technology | Blockchain, NFC, API Integration, Cloud Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Japan Real Time Payment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at