444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Ready-to-Drink (RTD) coffee market in Japan has been experiencing remarkable growth in recent years. As a nation known for its rich tea culture, the surge in popularity of RTD coffee might come as a surprise to some. However, a combination of changing consumer preferences, convenience, and a diverse range of innovative products has fueled the market’s expansion.

Meaning

Ready-to-Drink (RTD) Coffee is a popular beverage category that has gained immense popularity in recent years, especially in Japan. As the name suggests, RTD coffee refers to pre-packaged coffee beverages that are ready to consume without the need for any additional preparation. These beverages are typically available in various flavors and are served cold or at room temperature. RTD coffee offers convenience to consumers who are always on the go and prefer a quick caffeine fix without the hassle of brewing coffee.

Executive Summary

The Japan Ready-to-Drink (RTD) Coffee Market has experienced substantial growth in recent times. The rising demand for convenient and ready-to-consume beverages, especially among busy urban populations, has been a key driver for this market’s expansion. Additionally, the increasing adoption of coffee culture and the desire for new and innovative flavors have further fueled the market’s growth. In this report, we will provide a comprehensive analysis of the key market insights, drivers, restraints, opportunities, and the overall market dynamics. Moreover, we will assess the impact of Covid-19 on the market, the competitive landscape, and provide future outlook and analyst suggestions to industry participants and stakeholders.

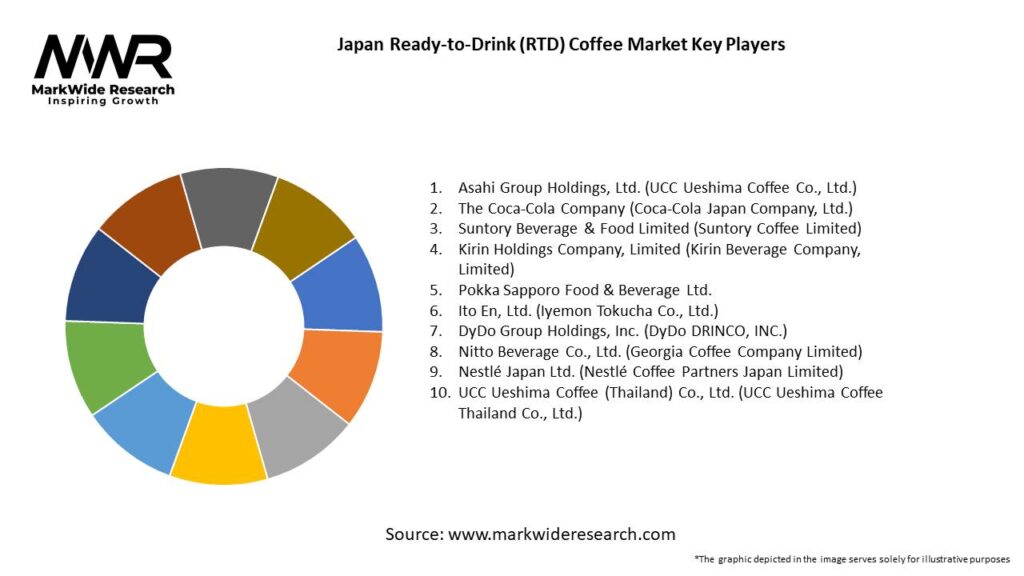

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

Regional Analysis

Japan is one of the largest and most developed markets for RTD coffee in the Asia-Pacific region. The country’s strong coffee culture, combined with the high demand for convenience beverages, has contributed to the steady growth of the RTD coffee market. Japan is known for its unique coffee offerings, such as canned coffee and bottled coffee drinks, which are widely available in vending machines, convenience stores, and supermarkets. The market is also influenced by consumer trends towards healthier options, premiumization, and sustainability. Additionally, Japan’s strong distribution network and robust retail infrastructure make it an attractive market for both domestic and international RTD coffee brands.

Competitive Landscape

Leading Companies in Japan Ready-to-Drink (RTD) Coffee Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Type

By Flavor

By Distribution Channel

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on consumer behavior, with many turning to RTD coffee as a convenient, ready-to-consume option during lockdowns and restrictions. The shift to online shopping has also boosted e-commerce sales for RTD coffee brands. While the pandemic has led to increased demand for convenient products, it has also highlighted the need for health-conscious offerings, as consumers seek healthier beverages during uncertain times.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Japan RTD Coffee Market is expected to continue its upward trajectory, driven by growing consumer demand for convenience, premium options, and innovative flavors. As the market evolves, brands will need to focus on innovation, sustainability, and health-conscious offerings to stay competitive. The future outlook section will offer insights into the projected growth and potential opportunities in the Japan RTD Coffee Market over the coming years.

Conclusion

In conclusion, the Japan Ready-to-Drink (RTD) Coffee Market is witnessing robust growth, driven by changing consumer lifestyles, growing coffee culture, and product innovation. While the market faces competition from alternative beverages and health concerns, opportunities lie in offering health-conscious variants and expanding e-commerce channels. The market’s future looks promising, and industry participants can benefit from staying agile, embracing innovation, and keeping an eye on consumer trends. By taking strategic steps, businesses can make the most of the market’s potential and build a sustainable future in the Japan RTD Coffee industry.

What is Ready-to-Drink (RTD) Coffee?

Ready-to-Drink (RTD) Coffee refers to pre-packaged coffee beverages that are ready for consumption without the need for brewing. These products are often available in various flavors and formats, catering to the growing demand for convenient coffee options among consumers.

What are the key players in the Japan Ready-to-Drink (RTD) Coffee Market?

Key players in the Japan Ready-to-Drink (RTD) Coffee Market include major companies such as Suntory Beverage & Food Limited, Asahi Group Holdings, and UCC Ueshima Coffee Co., among others.

What are the growth factors driving the Japan Ready-to-Drink (RTD) Coffee Market?

The Japan Ready-to-Drink (RTD) Coffee Market is driven by factors such as the increasing demand for convenient beverage options, the rise in coffee consumption among younger demographics, and innovative product offerings that cater to diverse consumer preferences.

What challenges does the Japan Ready-to-Drink (RTD) Coffee Market face?

Challenges in the Japan Ready-to-Drink (RTD) Coffee Market include intense competition among brands, fluctuating raw material prices, and changing consumer preferences towards healthier beverage options.

What opportunities exist in the Japan Ready-to-Drink (RTD) Coffee Market?

Opportunities in the Japan Ready-to-Drink (RTD) Coffee Market include the potential for product diversification, the introduction of organic and low-calorie options, and expanding distribution channels to reach a broader audience.

What trends are shaping the Japan Ready-to-Drink (RTD) Coffee Market?

Trends in the Japan Ready-to-Drink (RTD) Coffee Market include the growing popularity of cold brew coffee, the incorporation of functional ingredients like protein and vitamins, and the rise of eco-friendly packaging solutions.

Japan Ready-to-Drink (RTD) Coffee Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cold Brew, Espresso, Milk Coffee, Black Coffee |

| Packaging Type | Cans, Bottles, Tetra Packs, Pouches |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Cafés |

| Customer Type | Students, Professionals, Health-Conscious Consumers, Tourists |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Japan Ready-to-Drink (RTD) Coffee Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at