444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan Property & Casualty Insurance Market represents one of the most sophisticated and mature insurance sectors in the Asia-Pacific region, characterized by robust regulatory frameworks, technological innovation, and comprehensive coverage solutions. Japan’s property and casualty insurance landscape encompasses a diverse range of products including automobile insurance, fire insurance, marine insurance, and various specialty lines that serve both individual consumers and corporate clients across the archipelago.

Market dynamics in Japan’s property and casualty insurance sector are significantly influenced by the country’s unique geographical challenges, including frequent natural disasters such as earthquakes, typhoons, and tsunamis. This environmental reality has shaped the industry’s approach to risk assessment, product development, and claims management, resulting in some of the world’s most advanced catastrophe modeling and risk mitigation strategies.

Digital transformation continues to reshape the Japanese property and casualty insurance market, with insurers investing heavily in artificial intelligence, machine learning, and data analytics to enhance underwriting processes, improve customer experience, and streamline operations. The market demonstrates strong growth potential, with industry analysts projecting a compound annual growth rate of 3.2% over the next five years, driven by increasing awareness of insurance needs and evolving risk landscapes.

Regulatory evolution under Japan’s Financial Services Agency has created a more competitive environment, encouraging innovation while maintaining strict consumer protection standards. The market’s maturity is reflected in its high penetration rates, with automobile insurance achieving 74% market penetration and property insurance maintaining steady growth across residential and commercial segments.

The Japan Property & Casualty Insurance Market refers to the comprehensive ecosystem of insurance products and services designed to protect individuals, businesses, and organizations against financial losses arising from property damage, liability claims, and various casualty risks within Japan’s domestic market. This market encompasses traditional insurance lines including automobile, fire, marine, and liability insurance, as well as emerging specialty products tailored to address contemporary risk exposures.

Property insurance components within this market provide coverage for physical assets including residential homes, commercial buildings, industrial facilities, and personal belongings against perils such as fire, natural disasters, theft, and vandalism. Casualty insurance elements focus on liability protection, covering legal obligations that may arise from bodily injury or property damage caused to third parties, along with various forms of accident and health-related coverage.

Market participants include domestic insurance companies, foreign insurers operating through subsidiaries or branches, mutual insurance organizations, and cooperative insurance entities. The sector operates under strict regulatory oversight, ensuring financial stability, consumer protection, and fair market practices while fostering innovation and competition among market players.

Japan’s property and casualty insurance market stands as a pillar of the country’s financial services sector, demonstrating remarkable resilience and adaptability in the face of evolving risk landscapes and technological disruption. The market’s strength lies in its comprehensive product offerings, sophisticated risk management capabilities, and deep market penetration across key insurance lines.

Key market characteristics include a highly competitive landscape dominated by major domestic insurers, supported by a robust regulatory framework that balances innovation with consumer protection. The sector has successfully navigated numerous challenges including natural disasters, demographic shifts, and technological transformation, emerging stronger and more sophisticated with each evolution.

Growth drivers encompass increasing natural disaster awareness, expanding commercial activities, rising vehicle ownership, and growing recognition of liability risks in an increasingly litigious society. Digital adoption rates have accelerated significantly, with online insurance sales growing by 28% annually as consumers embrace digital channels for policy purchase and claims processing.

Market consolidation trends continue to shape the competitive landscape, with strategic mergers and acquisitions creating larger, more efficient organizations capable of investing in technology and expanding product portfolios. The sector’s commitment to innovation is evident in the development of parametric insurance products, usage-based insurance models, and AI-driven underwriting processes that enhance accuracy and efficiency.

Strategic market insights reveal several critical trends shaping Japan’s property and casualty insurance landscape. The market demonstrates exceptional sophistication in catastrophe risk modeling and management, positioning Japanese insurers as global leaders in natural disaster insurance expertise.

Market maturity indicators include sophisticated product differentiation, advanced distribution networks, and comprehensive customer service capabilities that set global benchmarks for insurance market development. The sector’s resilience is demonstrated through its ability to maintain stability and growth despite facing some of the world’s most challenging natural disaster exposures.

Primary market drivers propelling growth in Japan’s property and casualty insurance sector stem from a combination of environmental, economic, technological, and social factors that create sustained demand for comprehensive insurance coverage across multiple market segments.

Natural disaster frequency remains the most significant driver, with Japan’s exposure to earthquakes, typhoons, floods, and volcanic activity creating consistent demand for property insurance coverage. Climate change impacts are intensifying weather-related risks, leading to increased awareness and uptake of comprehensive property protection among both residential and commercial customers.

Economic development continues to drive market expansion through increased commercial activities, infrastructure development, and rising asset values that require adequate insurance protection. Urbanization trends concentrate higher-value properties in metropolitan areas, creating opportunities for specialized coverage products and enhanced risk management services.

Technological advancement serves as both a market driver and enabler, with innovations in risk assessment, policy administration, and claims processing improving service delivery while reducing operational costs. Digital transformation initiatives are expanding market reach and enabling new product development that addresses emerging risk categories.

Regulatory support through progressive policy frameworks encourages market development while maintaining consumer confidence through robust oversight and protection mechanisms. Demographic shifts including an aging population and changing lifestyle patterns create new insurance needs and opportunities for product innovation tailored to evolving customer requirements.

Market restraints affecting Japan’s property and casualty insurance sector include structural challenges, regulatory constraints, and economic factors that may limit growth potential or create operational difficulties for market participants.

Demographic challenges pose significant long-term constraints, with Japan’s declining birth rate and aging population potentially reducing the customer base for certain insurance products while increasing claims costs in others. Economic stagnation periods can limit consumer spending on discretionary insurance products and reduce commercial insurance demand from businesses facing financial pressures.

Regulatory complexity while providing consumer protection, can also create barriers to innovation and market entry for new participants. Compliance costs associated with maintaining regulatory standards may disproportionately impact smaller insurers and limit their ability to compete effectively with larger market players.

Natural disaster exposure while driving demand also creates significant capital requirements and potential volatility in financial results. Catastrophe risk concentration in Japan requires substantial reinsurance arrangements and capital reserves that may constrain profitability and growth investments.

Technology implementation costs can be substantial, particularly for traditional insurers seeking to modernize legacy systems and processes. Cybersecurity risks associated with digital transformation create new operational challenges and potential liability exposures that require ongoing investment and attention.

Market saturation in certain product lines may limit growth opportunities, requiring insurers to focus on product innovation and market expansion strategies to maintain competitive positions and revenue growth.

Emerging opportunities in Japan’s property and casualty insurance market reflect evolving risk landscapes, technological capabilities, and changing customer expectations that create potential for significant market expansion and innovation.

Digital insurance platforms present substantial opportunities for market expansion through improved customer accessibility, streamlined processes, and enhanced service delivery. Insurtech partnerships enable traditional insurers to leverage innovative technologies and business models while maintaining their market expertise and customer relationships.

Parametric insurance products offer opportunities to address coverage gaps in traditional policies, particularly for natural disaster risks where rapid claims settlement is crucial. Usage-based insurance models create opportunities for more accurate risk pricing and enhanced customer engagement through telematics and IoT technologies.

ESG-focused products align with growing environmental and social consciousness, creating opportunities for green building insurance, renewable energy coverage, and sustainability-linked insurance solutions. Cyber insurance expansion addresses the growing digital risk exposure faced by businesses and individuals in an increasingly connected society.

Regional expansion opportunities exist for Japanese insurers to leverage their natural disaster expertise and technological capabilities in other Asia-Pacific markets facing similar risk exposures. Corporate risk management services present opportunities to expand beyond traditional insurance into comprehensive risk consulting and mitigation services.

Demographic-specific products tailored to Japan’s aging population and changing household structures create opportunities for specialized coverage and service offerings that address unique customer needs and preferences.

Market dynamics in Japan’s property and casualty insurance sector reflect the complex interplay of competitive forces, regulatory influences, technological disruption, and evolving customer expectations that shape industry evolution and strategic decision-making.

Competitive intensity continues to drive innovation and efficiency improvements as insurers seek to differentiate their offerings and maintain market share in mature product segments. Price competition in commodity lines such as automobile insurance is balanced by value-added services and enhanced customer experience initiatives.

Technology adoption is reshaping traditional business models, with artificial intelligence implementation improving underwriting accuracy by 15-20% while reducing processing times and operational costs. Digital distribution channels are expanding market reach and enabling more efficient customer acquisition and service delivery.

Risk landscape evolution requires continuous adaptation of products and pricing models to address emerging threats including cyber risks, climate change impacts, and new liability exposures. Regulatory adaptation supports market innovation while maintaining consumer protection standards through progressive policy frameworks and oversight mechanisms.

Customer behavior changes driven by digital adoption and evolving expectations are influencing product design, distribution strategies, and service delivery approaches. Data analytics capabilities enable more sophisticated risk assessment and personalized product offerings that enhance customer satisfaction and retention.

Capital market conditions affect investment returns and influence pricing strategies, while reinsurance market dynamics impact capacity and cost structures for catastrophe-exposed risks. Industry consolidation trends create opportunities for scale economies and enhanced competitive positioning through strategic mergers and acquisitions.

Comprehensive research methodology employed in analyzing Japan’s property and casualty insurance market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy, reliability, and actionable insights for market participants and stakeholders.

Primary research components include structured interviews with industry executives, regulatory officials, and market experts to gather firsthand insights on market trends, competitive dynamics, and future outlook. Survey methodologies capture quantitative data on market preferences, adoption rates, and customer satisfaction metrics across different demographic and geographic segments.

Secondary research analysis encompasses comprehensive review of regulatory filings, financial reports, industry publications, and academic research to establish market baselines and identify emerging trends. Data triangulation processes ensure consistency and accuracy across multiple information sources and analytical approaches.

Quantitative analysis techniques include statistical modeling, trend analysis, and comparative benchmarking to identify patterns and relationships within market data. Qualitative assessment methods provide context and interpretation for quantitative findings through expert analysis and industry knowledge application.

Market segmentation analysis examines performance across product lines, distribution channels, customer segments, and geographic regions to identify growth opportunities and competitive positioning. Competitive intelligence gathering provides insights into market participant strategies, capabilities, and performance metrics.

Validation processes include peer review, expert consultation, and cross-referencing with authoritative industry sources to ensure research quality and reliability. Continuous monitoring systems track market developments and update analysis to reflect current conditions and emerging trends.

Regional market analysis reveals significant variations in insurance penetration, product preferences, and growth patterns across Japan’s diverse geographic regions, reflecting local economic conditions, risk exposures, and demographic characteristics that influence market development.

Tokyo Metropolitan Area dominates the market with approximately 35% of total premium volume, driven by high population density, elevated property values, and concentrated commercial activities. Urban market characteristics include sophisticated customer requirements, premium product demand, and advanced distribution infrastructure supporting comprehensive insurance solutions.

Osaka and Kansai Region represents the second-largest market concentration, accounting for 18% of national premiums, with strong industrial and commercial insurance demand supporting regional economic activities. Regional risk profiles include earthquake exposure and industrial hazards that drive specific insurance product development and pricing considerations.

Central Japan regions including Nagoya and surrounding prefectures contribute 15% of market volume, with manufacturing industries creating substantial commercial insurance demand and specialized risk management requirements. Industrial insurance concentration in these areas supports product innovation and risk engineering services.

Northern regions including Hokkaido demonstrate unique risk characteristics related to severe weather conditions and agricultural activities, creating opportunities for specialized coverage products. Rural market dynamics emphasize traditional distribution channels and community-based insurance relationships.

Southern regions including Kyushu face elevated typhoon and volcanic risks that influence product design and pricing strategies. Regional adaptation strategies reflect local risk exposures and customer preferences while maintaining national product standards and service quality.

Competitive landscape analysis reveals a concentrated market structure dominated by major domestic insurers, supported by foreign participants and specialized providers that contribute to market diversity and innovation across Japan’s property and casualty insurance sector.

Market concentration among the top four insurers accounts for approximately 68% of total market premiums, indicating significant scale advantages and competitive positioning. Competitive strategies focus on digital transformation, customer experience enhancement, product innovation, and operational efficiency improvements to maintain market leadership and profitability.

Innovation leadership among major participants drives industry-wide advancement in technology adoption, risk assessment capabilities, and service delivery standards that benefit the entire market ecosystem.

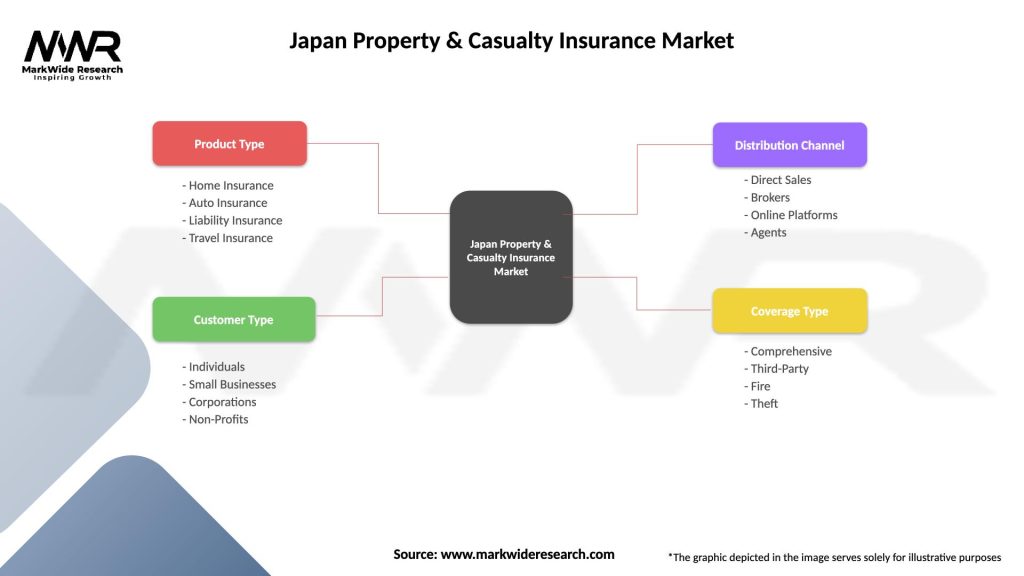

Market segmentation analysis provides detailed insights into the diverse components of Japan’s property and casualty insurance market, revealing performance patterns, growth opportunities, and competitive dynamics across multiple classification dimensions.

By Product Type:

By Distribution Channel:

By Customer Segment:

Category-specific analysis reveals distinct performance characteristics, growth drivers, and competitive dynamics within major product segments of Japan’s property and casualty insurance market, providing actionable insights for strategic decision-making.

Automobile Insurance Category demonstrates mature market characteristics with intense price competition and regulatory oversight. Telematics adoption is transforming risk assessment and pricing models, with usage-based insurance penetration reaching 12% among new policies. Electric vehicle insurance represents an emerging opportunity as EV adoption accelerates across Japan.

Property Insurance Category shows resilient growth driven by natural disaster awareness and property value appreciation. Earthquake insurance attachment rates continue improving, supported by government initiatives and insurer education programs. Smart home technology integration is enabling new risk mitigation approaches and pricing innovations.

Commercial Insurance Category reflects economic activity levels and business confidence, with cyber insurance demand growing 45% annually as digital transformation accelerates. Supply chain insurance gains importance as businesses recognize interconnected risk exposures and business interruption vulnerabilities.

Specialty Lines Category includes marine, aviation, and professional liability insurance serving specific industry needs. Marine insurance benefits from Japan’s substantial shipping activities and international trade relationships. Professional liability coverage expands as service industries grow and litigation risks increase.

Personal Accident Category adapts to demographic changes and lifestyle evolution, with products tailored to aging population needs and changing work patterns. Travel insurance demonstrates volatility based on international travel patterns and health concerns.

Industry participants in Japan’s property and casualty insurance market enjoy numerous strategic advantages and benefits that support sustainable growth, competitive positioning, and stakeholder value creation across the insurance ecosystem.

Insurance Companies benefit from market stability, sophisticated regulatory frameworks, and advanced risk management infrastructure that support profitable operations and strategic expansion. Technology investments enable operational efficiency improvements and enhanced customer experience delivery that strengthen competitive positioning.

Policyholders receive comprehensive protection against diverse risks through innovative products and superior service delivery standards. Claims processing efficiency and customer service excellence provide peace of mind and financial security when coverage is needed most.

Distribution Partners including agents, brokers, and digital platforms benefit from robust product portfolios, competitive commission structures, and ongoing support programs that enable business growth and customer satisfaction. Technology platforms streamline operations and enhance productivity across distribution networks.

Reinsurance Partners gain access to sophisticated risk data, advanced modeling capabilities, and stable market conditions that support profitable reinsurance relationships. Catastrophe risk expertise developed in Japan provides valuable insights for global reinsurance operations.

Technology Providers find opportunities to develop and deploy innovative solutions addressing insurance industry needs. Insurtech collaboration creates mutual benefits through technology advancement and market access facilitation.

Regulatory Authorities benefit from industry cooperation, transparent reporting, and proactive compliance that supports effective oversight and consumer protection objectives. Market stability and innovation balance creates positive regulatory outcomes.

Economic Stakeholders including businesses and individuals benefit from risk transfer mechanisms that support economic activity, investment confidence, and financial stability across Japan’s economy.

Comprehensive SWOT analysis provides strategic insights into the internal strengths and weaknesses, along with external opportunities and threats that shape Japan’s property and casualty insurance market dynamics and future development potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Japan’s property and casualty insurance landscape reflect technological advancement, changing risk profiles, evolving customer expectations, and regulatory developments that influence strategic planning and operational approaches across the industry.

Digital-First Customer Experience dominates market evolution as insurers invest heavily in mobile applications, online platforms, and automated service delivery. Customer portal adoption has increased significantly, with digital policy management usage growing 42% as consumers embrace self-service capabilities and real-time access to policy information.

Artificial Intelligence Integration transforms underwriting, claims processing, and customer service operations through machine learning algorithms and predictive analytics. AI-powered chatbots handle routine customer inquiries while advanced algorithms improve risk assessment accuracy and processing speed.

Parametric Insurance Development addresses coverage gaps and provides rapid claims settlement for natural disaster risks. Earthquake parametric products offer immediate payouts based on seismic intensity measurements, complementing traditional indemnity coverage with faster financial relief.

Sustainability Focus influences product development, investment strategies, and operational practices as insurers align with environmental and social governance principles. Green building insurance and renewable energy coverage reflect growing environmental consciousness and regulatory support for sustainable development.

Cyber Risk Management becomes increasingly critical as digital transformation expands attack surfaces and potential liability exposures. Cyber insurance demand continues accelerating across all business segments as organizations recognize the financial impact of data breaches and system disruptions.

Usage-Based Insurance Models leverage telematics and IoT technologies to enable more accurate risk pricing and enhanced customer engagement. Pay-as-you-drive automobile insurance and similar models provide cost savings for low-risk customers while improving overall portfolio profitability.

Recent industry developments highlight the dynamic nature of Japan’s property and casualty insurance market, with significant strategic initiatives, regulatory changes, and technological advancements shaping competitive dynamics and market evolution.

Regulatory Modernization initiatives by Japan’s Financial Services Agency have streamlined approval processes for new products and digital services while maintaining consumer protection standards. Sandbox programs enable insurtech experimentation and innovation testing within controlled regulatory environments.

Strategic Partnerships between traditional insurers and technology companies accelerate digital transformation and innovation development. Collaboration agreements focus on artificial intelligence, blockchain applications, and IoT integration to enhance operational efficiency and customer experience.

Market Consolidation continues through strategic mergers and acquisitions that create scale economies and enhanced competitive positioning. Integration processes focus on technology harmonization, distribution network optimization, and product portfolio rationalization.

International Expansion by major Japanese insurers leverages domestic expertise and capital strength to pursue growth opportunities in emerging Asian markets. Cross-border investments focus on natural disaster expertise transfer and technology platform deployment.

Product Innovation initiatives include development of climate-resilient coverage solutions, cyber insurance enhancements, and demographic-specific products addressing aging population needs. Research and development investments support continuous product evolution and market adaptation.

Technology Infrastructure upgrades enable cloud computing adoption, data analytics enhancement, and cybersecurity strengthening across industry participants. Digital platform investments support omnichannel customer experience delivery and operational automation.

Strategic recommendations from MarkWide Research analysis provide actionable insights for market participants seeking to optimize performance, enhance competitive positioning, and capitalize on emerging opportunities within Japan’s property and casualty insurance market.

Digital Transformation Acceleration should remain a top priority for all market participants, with focus on customer experience enhancement, operational efficiency improvement, and new product development capabilities. Technology investment strategies should emphasize scalable platforms that support future growth and adaptation requirements.

Risk Management Innovation presents opportunities for competitive differentiation through advanced modeling capabilities, predictive analytics, and proactive risk mitigation services. Data analytics investments should focus on improving underwriting accuracy and customer insights while supporting regulatory compliance requirements.

Customer Segmentation Refinement enables more targeted product development and marketing strategies that address specific demographic and geographic market characteristics. Personalization capabilities should leverage data analytics to deliver customized coverage solutions and pricing models.

Partnership Strategy Development should explore collaboration opportunities with insurtech companies, technology providers, and distribution partners to accelerate innovation and market expansion. Strategic alliances can provide access to new capabilities and customer segments while sharing development costs and risks.

Regulatory Engagement should maintain proactive communication with regulatory authorities to support favorable policy development and ensure compliance with evolving requirements. Industry advocacy can influence regulatory outcomes while demonstrating commitment to consumer protection and market stability.

International Expansion Consideration should evaluate opportunities to leverage Japanese expertise in natural disaster insurance and technology capabilities in other Asia-Pacific markets facing similar risk exposures and development needs.

Future market outlook for Japan’s property and casualty insurance sector indicates continued evolution driven by technological advancement, changing risk landscapes, demographic transitions, and regulatory modernization that will reshape industry dynamics over the coming decade.

Growth trajectory projections suggest sustained market expansion supported by increasing risk awareness, product innovation, and digital adoption. Premium growth rates are expected to maintain steady progression, with annual growth averaging 3.5% over the next five years as market participants adapt to evolving customer needs and risk exposures.

Technology integration will accelerate across all market segments, with artificial intelligence, machine learning, and blockchain technologies becoming standard components of insurance operations. Digital native customers will drive demand for seamless online experiences and innovative product features that traditional approaches cannot deliver.

Climate change adaptation will require continuous evolution of natural disaster coverage and risk assessment methodologies. Parametric insurance adoption is projected to increase significantly as customers seek faster claims settlement and more predictable coverage outcomes for catastrophic events.

Demographic influence will create both challenges and opportunities as Japan’s aging population requires specialized products while potentially reducing demand in other segments. Product innovation will focus on addressing unique needs of different age groups and lifestyle patterns.

Regulatory evolution will continue supporting market innovation while maintaining consumer protection standards. International harmonization efforts may influence domestic regulations and create opportunities for cross-border expansion and collaboration.

Competitive landscape transformation will likely include further consolidation among traditional players while new entrants bring innovative approaches and technologies. Market share redistribution may favor organizations that successfully balance innovation with operational excellence and customer satisfaction.

Japan’s property and casualty insurance market represents a sophisticated and resilient sector that continues to evolve in response to changing risk landscapes, technological advancement, and customer expectations. The market’s strength lies in its comprehensive regulatory framework, advanced risk management capabilities, and commitment to innovation that positions it as a global leader in insurance market development.

Market fundamentals remain strong despite demographic challenges and natural disaster exposures, with industry participants demonstrating remarkable adaptability and strategic vision. Digital transformation initiatives are reshaping traditional business models while maintaining the personal relationships and service quality that characterize Japanese insurance culture.

Future success in this market will depend on organizations’ ability to balance innovation with stability, leverage technology while preserving customer trust, and adapt to changing demographics while maintaining profitability. Strategic positioning should emphasize customer-centric approaches, operational excellence, and continuous adaptation to evolving market conditions.

Investment opportunities exist across multiple dimensions including technology enhancement, product innovation, distribution expansion, and international growth initiatives. Market participants that successfully navigate these opportunities while managing inherent risks will be well-positioned for sustained success in Japan’s dynamic property and casualty insurance landscape.

What is Japan Property & Casualty Insurance?

Japan Property & Casualty Insurance refers to the insurance products that protect individuals and businesses from financial losses due to property damage, liability, and other risks. This includes coverage for homes, vehicles, and commercial properties.

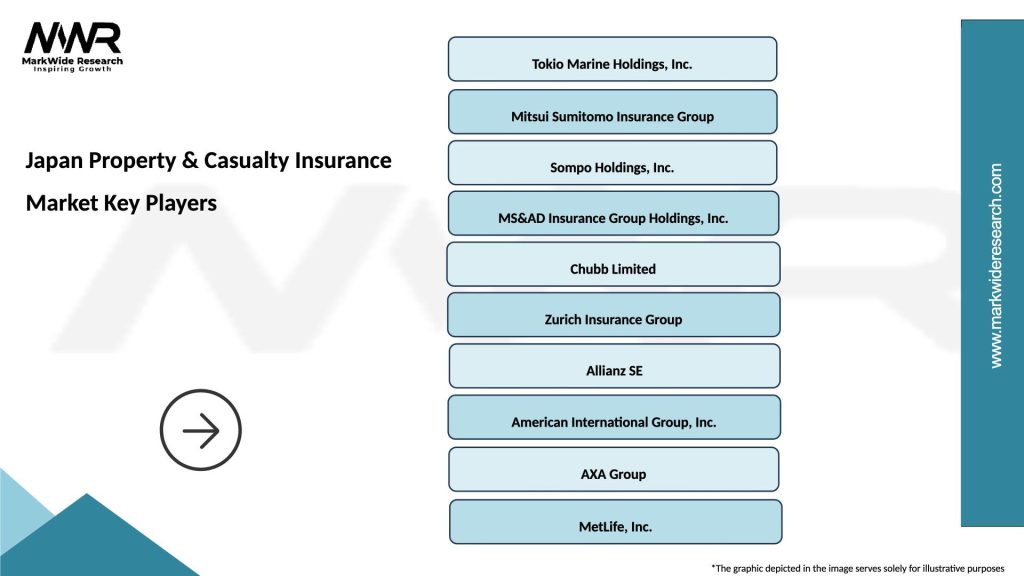

What are the key players in the Japan Property & Casualty Insurance Market?

Key players in the Japan Property & Casualty Insurance Market include Tokio Marine Holdings, Sompo Holdings, and Mitsui Sumitomo Insurance. These companies offer a range of insurance products and services tailored to meet the needs of various customers, among others.

What are the growth factors driving the Japan Property & Casualty Insurance Market?

The growth of the Japan Property & Casualty Insurance Market is driven by increasing urbanization, a rise in natural disasters, and growing awareness of the importance of insurance coverage. Additionally, advancements in technology are enabling better risk assessment and customer service.

What challenges does the Japan Property & Casualty Insurance Market face?

The Japan Property & Casualty Insurance Market faces challenges such as intense competition among insurers, regulatory changes, and the impact of climate change on risk assessment. These factors can affect profitability and operational efficiency.

What opportunities exist in the Japan Property & Casualty Insurance Market?

Opportunities in the Japan Property & Casualty Insurance Market include the development of innovative insurance products, the integration of digital technologies for customer engagement, and the expansion of coverage options for emerging risks. Insurers can also explore partnerships with tech companies to enhance service delivery.

What trends are shaping the Japan Property & Casualty Insurance Market?

Trends shaping the Japan Property & Casualty Insurance Market include the increasing use of artificial intelligence for underwriting and claims processing, a focus on sustainability in insurance practices, and the growing demand for personalized insurance solutions. These trends are influencing how insurers operate and engage with customers.

Japan Property & Casualty Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Home Insurance, Auto Insurance, Liability Insurance, Travel Insurance |

| Customer Type | Individuals, Small Businesses, Corporations, Non-Profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Coverage Type | Comprehensive, Third-Party, Fire, Theft |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Property & Casualty Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at