444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Japan’s Property and Casualty Insurance Market has been a crucial component of the nation’s insurance landscape. Property and casualty insurance refers to coverage that protects against property damage and liability for bodily injury or damage to others. It plays a significant role in safeguarding individuals, businesses, and assets from unforeseen risks, accidents, and natural disasters.

Meaning

Property and casualty insurance, also known as P&C insurance, is a type of coverage that protects against financial losses resulting from damage to one’s property or liability for causing harm to others. It encompasses various policies such as homeowners’ insurance, automobile insurance, and commercial liability insurance. The primary purpose of this insurance is to provide a safety net to policyholders, allowing them to recover financially after unexpected events.

Executive Summary

The Japan Property and Casualty Insurance Market have shown resilience and steady growth over the years. With a diverse range of insurance products and strong risk management strategies, the market has attracted both individual and corporate customers. This executive summary highlights the key aspects of the market, including its drivers, restraints, opportunities, and future outlook.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Japan Property and Casualty Insurance Market have experienced substantial growth due to rising awareness about risk management and the need for financial protection. The market has witnessed increasing adoption of insurance policies among individuals and businesses alike. Additionally, the integration of advanced technologies, such as AI and big data analytics, has improved underwriting processes and customer service.

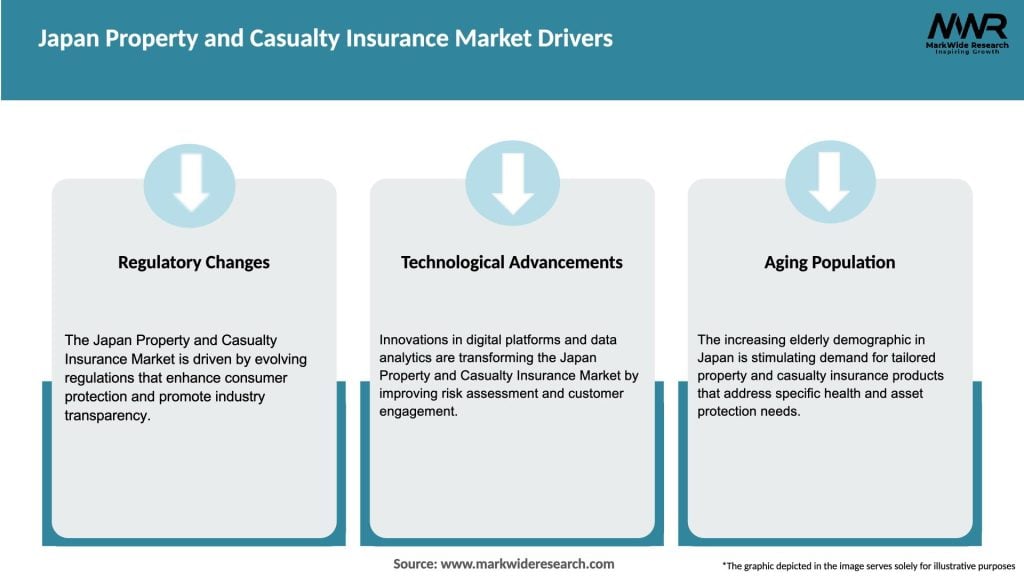

Market Drivers

Several factors have contributed to the growth of the Japan Property and Casualty Insurance Market. One of the primary drivers is the country’s vulnerability to natural disasters, such as earthquakes, typhoons, and floods. This necessitates property insurance for homeowners and businesses seeking protection against potential damage.

Another crucial driver is the growing awareness among consumers regarding the importance of safeguarding their assets and liabilities. Moreover, the rising number of vehicles on the road has boosted demand for automobile insurance, further propelling the market’s growth.

Market Restraints

Despite its growth, the market faces some challenges. One significant restraint is the intense competition among insurance providers. This competition exerts pressure on premium rates and profitability. Additionally, the market is susceptible to economic fluctuations, which can impact consumers’ purchasing power and, subsequently, the demand for insurance products.

Market Opportunities

The Japan Property and Casualty Insurance Market present several opportunities for growth and expansion. As the population becomes more conscious of insurance coverage, there is room for market players to tap into the underserved segments. Customized insurance products targeting specific demographics or niche markets can be developed to cater to the evolving needs of customers.

Furthermore, the adoption of digital platforms and online distribution channels offers an opportunity to enhance customer engagement and reach a broader audience.

Market Dynamics

The Japan Property and Casualty Insurance Market is characterized by dynamic forces that shape its growth trajectory. The interplay of market drivers, restraints, and opportunities determines the overall performance of the market. External factors such as regulatory changes, technological advancements, and economic conditions also influence market dynamics.

Regional Analysis

Japan’s diverse geographical landscape and varying levels of urbanization influence the demand for property and casualty insurance across different regions. Urban areas with higher population densities and more valuable properties often have a greater demand for insurance coverage, while rural regions might have different insurance needs. Understanding these regional variations is crucial for insurers to tailor their offerings effectively.

Competitive Landscape

Leading Companies in Japan Property and Casualty Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

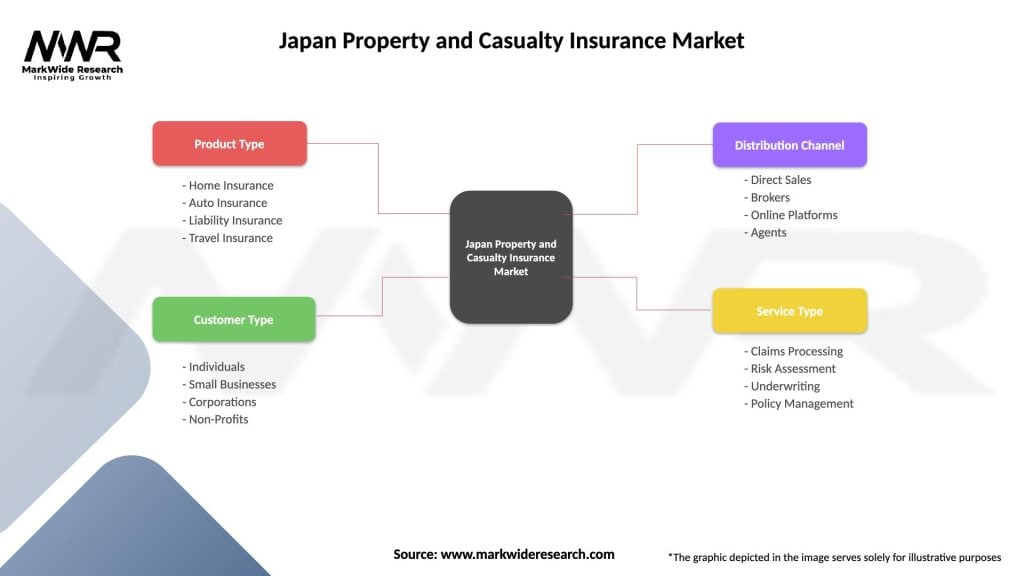

Segmentation

The market can be segmented based on various parameters such as insurance type (homeowners’ insurance, automobile insurance, liability insurance, etc.), distribution channel (direct sales, agents/brokers, online platforms), and end-user (individuals, commercial entities, government bodies).

Each segment has its unique characteristics, customer preferences, and challenges, requiring insurers to tailor their strategies accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a notable impact on the Japan Property and Casualty Insurance Market. The economic slowdown and lockdown measures resulted in reduced vehicle usage, affecting automobile insurance premiums. However, the pandemic also highlighted the importance of insurance, leading to increased interest in coverage related to health, business interruption, and cyber risks.

Key Industry Developments

Analyst Suggestions

To thrive in the competitive market, insurers should focus on:

Future Outlook

The Japan Property and Casualty Insurance Market are expected to continue growing steadily in the coming years. The rise in insurance awareness, coupled with technological advancements, will drive market expansion. Insurers must stay agile and adapt to evolving customer needs and preferences to remain competitive.

Conclusion

The Japan Property and Casualty Insurance Market plays a pivotal role in safeguarding individuals and businesses from unforeseen risks and financial losses. With a diverse range of insurance products and the adoption of advanced technologies, the market has demonstrated resilience and steady growth. The future looks promising as insurers continue to innovate, leverage digital solutions, and cater to the evolving demands of customers. The industry’s commitment to providing reliable protection will undoubtedly contribute to the nation’s overall financial stability and growth.

What is Property and Casualty Insurance?

Property and Casualty Insurance refers to a type of insurance that provides coverage for property loss and liability for damages to others. This includes various policies such as homeowners, auto, and commercial insurance, which protect individuals and businesses from financial losses due to unforeseen events.

What are the key players in the Japan Property and Casualty Insurance Market?

Key players in the Japan Property and Casualty Insurance Market include Tokio Marine Holdings, Sompo Holdings, and Mitsui Sumitomo Insurance. These companies offer a range of insurance products and services tailored to meet the needs of consumers and businesses, among others.

What are the growth factors driving the Japan Property and Casualty Insurance Market?

The Japan Property and Casualty Insurance Market is driven by factors such as increasing natural disasters, rising awareness of insurance products, and the growth of the real estate sector. Additionally, advancements in technology are enhancing customer engagement and service delivery.

What challenges does the Japan Property and Casualty Insurance Market face?

Challenges in the Japan Property and Casualty Insurance Market include intense competition among insurers, regulatory changes, and the impact of low-interest rates on profitability. These factors can affect the sustainability and growth of insurance companies in the market.

What opportunities exist in the Japan Property and Casualty Insurance Market?

Opportunities in the Japan Property and Casualty Insurance Market include the potential for digital transformation, the introduction of innovative insurance products, and the growing demand for personalized insurance solutions. These trends can help insurers better meet customer needs and expand their market reach.

What trends are shaping the Japan Property and Casualty Insurance Market?

Trends shaping the Japan Property and Casualty Insurance Market include the increasing use of artificial intelligence for claims processing, the rise of insurtech companies, and a focus on sustainability in insurance practices. These trends are influencing how insurers operate and engage with customers.

Japan Property and Casualty Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Home Insurance, Auto Insurance, Liability Insurance, Travel Insurance |

| Customer Type | Individuals, Small Businesses, Corporations, Non-Profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Service Type | Claims Processing, Risk Assessment, Underwriting, Policy Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Japan Property and Casualty Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at