444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan power transistor market represents a cornerstone of the nation’s advanced semiconductor industry, driving innovation across automotive, industrial, and consumer electronics sectors. Power transistors serve as critical components in power management systems, enabling efficient energy conversion and control in diverse applications ranging from electric vehicles to renewable energy systems. Japan’s technological leadership in semiconductor manufacturing positions the country as a global hub for high-performance power transistor development and production.

Market dynamics indicate robust growth driven by increasing demand for energy-efficient solutions and the rapid adoption of electric vehicles. The automotive sector’s transformation toward electrification has created unprecedented opportunities for power transistor manufacturers, with silicon carbide (SiC) and gallium nitride (GaN) technologies gaining significant traction. Japanese companies continue to invest heavily in next-generation power semiconductor technologies, maintaining their competitive edge in the global marketplace.

Regional leadership in power transistor technology stems from Japan’s established semiconductor ecosystem, featuring world-class manufacturing capabilities and extensive research and development infrastructure. The market benefits from strong government support for semiconductor innovation and strategic partnerships between industry leaders and academic institutions. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 8.2% through the forecast period, driven by increasing adoption of wide-bandgap semiconductors and growing demand for power-efficient solutions.

The Japan power transistor market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and application of power semiconductor devices within Japan’s domestic and export markets. Power transistors are semiconductor devices that control and amplify electrical power, serving as fundamental building blocks in power conversion systems, motor drives, and energy management applications across multiple industries.

These devices operate by switching or regulating electrical current flow, enabling efficient power conversion from AC to DC, voltage regulation, and power amplification in electronic systems. The market encompasses various transistor technologies including metal-oxide-semiconductor field-effect transistors (MOSFETs), insulated-gate bipolar transistors (IGBTs), and emerging wide-bandgap semiconductors such as silicon carbide and gallium nitride devices.

Market scope includes both discrete power transistors and integrated power modules, serving applications in automotive electronics, industrial automation, renewable energy systems, consumer electronics, and telecommunications infrastructure. The Japanese market’s significance extends beyond domestic consumption, as leading manufacturers export advanced power transistor technologies globally, contributing to Japan’s position as a semiconductor technology leader.

Japan’s power transistor market demonstrates exceptional growth potential, driven by the nation’s leadership in automotive electrification and industrial automation technologies. The market’s evolution reflects broader trends toward energy efficiency and sustainable technology adoption, with wide-bandgap semiconductors representing the fastest-growing segment. Automotive applications account for approximately 42% of market demand, followed by industrial and consumer electronics sectors.

Key market drivers include Japan’s ambitious carbon neutrality goals, accelerating electric vehicle adoption, and increasing demand for energy-efficient industrial equipment. The government’s strategic semiconductor initiatives and substantial R&D investments continue to strengthen Japan’s competitive position in advanced power transistor technologies. Manufacturing excellence and technological innovation remain core strengths, enabling Japanese companies to command premium market positions globally.

Competitive landscape features established industry leaders alongside emerging technology specialists, creating a dynamic ecosystem that fosters continuous innovation. The market’s resilience stems from diversified application portfolios and strong domestic demand across multiple sectors. Future growth prospects appear robust, supported by expanding electric vehicle infrastructure, renewable energy deployment, and ongoing digital transformation initiatives across Japanese industries.

Strategic insights reveal several critical factors shaping the Japan power transistor market’s trajectory and competitive dynamics:

Electric vehicle proliferation stands as the primary catalyst driving Japan’s power transistor market expansion. The automotive industry’s transition toward electrification creates substantial demand for high-efficiency power semiconductors capable of handling increased voltage and current requirements. Government incentives and regulatory mandates supporting EV adoption further accelerate market growth, with power transistor content per vehicle increasing significantly compared to traditional internal combustion engines.

Industrial automation advancement represents another crucial growth driver, as Japanese manufacturers increasingly adopt smart factory technologies and energy-efficient production systems. Power transistors enable precise motor control, variable frequency drives, and advanced power management systems essential for Industry 4.0 implementations. The push for manufacturing efficiency and reduced energy consumption drives continuous demand for higher-performance power semiconductor solutions.

Renewable energy deployment creates expanding opportunities for power transistor applications in solar inverters, wind power systems, and energy storage solutions. Japan’s commitment to carbon neutrality by 2050 necessitates massive renewable energy infrastructure development, requiring sophisticated power conversion systems. Grid modernization initiatives and smart grid implementations further increase demand for advanced power management technologies.

Consumer electronics innovation continues driving market growth through increasing power efficiency requirements and miniaturization trends. 5G infrastructure deployment and IoT device proliferation create new application opportunities for power transistors in telecommunications and edge computing systems. The growing emphasis on energy efficiency across all electronic devices supports sustained market expansion.

High development costs associated with next-generation power transistor technologies present significant barriers for market participants, particularly smaller companies seeking to compete with established industry leaders. Wide-bandgap semiconductor development requires substantial capital investments in specialized manufacturing equipment and advanced materials, limiting market entry opportunities and constraining innovation pace among resource-constrained organizations.

Technical complexity in power transistor design and manufacturing creates challenges for companies attempting to develop competitive products. Advanced packaging technologies and thermal management requirements demand specialized expertise and sophisticated manufacturing capabilities, potentially limiting market participation to well-established players with extensive technical resources and manufacturing experience.

Supply chain vulnerabilities in critical raw materials and specialized components pose ongoing risks to market stability and growth. Geopolitical tensions and trade restrictions may impact access to essential materials or manufacturing equipment, potentially disrupting production schedules and increasing costs. The semiconductor industry’s global nature makes it susceptible to various external factors beyond individual companies’ control.

Intense competition from international manufacturers, particularly those offering lower-cost alternatives, pressures Japanese companies to maintain technological leadership while managing cost competitiveness. Price erosion in commodity power transistor segments may impact profitability and limit resources available for advanced technology development. Market maturity in certain application segments also constrains growth opportunities.

Wide-bandgap semiconductor adoption presents exceptional growth opportunities as industries seek higher efficiency and performance solutions. Silicon carbide and gallium nitride technologies offer superior characteristics compared to traditional silicon devices, enabling new application possibilities and premium pricing opportunities. Japanese manufacturers’ technological leadership in these materials positions them advantageously for market expansion.

Electric vehicle infrastructure development creates substantial opportunities beyond automotive applications, including charging station equipment, grid integration systems, and energy storage solutions. Fast-charging technology advancement requires high-performance power transistors capable of handling increased power levels and switching frequencies, representing a high-growth market segment with significant value potential.

Industrial IoT integration opens new markets for intelligent power management systems incorporating advanced sensing and communication capabilities. Smart manufacturing initiatives require sophisticated power control solutions that can adapt to changing operational conditions and optimize energy consumption in real-time. This convergence of power electronics and digital technologies creates differentiation opportunities.

Renewable energy expansion globally provides export opportunities for Japanese power transistor manufacturers, particularly in high-efficiency solar inverters and wind power systems. Energy storage systems represent another growing application area requiring advanced power conversion technologies. Japan’s expertise in power electronics positions domestic companies to capture significant market share in these expanding segments.

Technological evolution drives continuous market transformation as manufacturers develop increasingly sophisticated power transistor solutions. The transition from silicon-based devices to wide-bandgap semiconductors represents a fundamental shift enabling higher efficiency, reduced size, and improved performance across applications. This technological progression creates both opportunities for innovation leaders and challenges for companies relying on legacy technologies.

Customer requirements increasingly emphasize energy efficiency, reliability, and integration capabilities, pushing manufacturers to develop comprehensive solutions rather than standalone components. System-level optimization becomes critical as customers seek to maximize overall performance while minimizing total cost of ownership. This trend favors companies capable of providing complete power management solutions and application expertise.

Competitive intensity varies significantly across market segments, with commodity applications experiencing price pressure while advanced technology segments command premium pricing. Differentiation strategies focus on technological innovation, application-specific optimization, and comprehensive customer support. Companies must balance investment in breakthrough technologies with maintaining competitiveness in established market segments.

Market consolidation trends reflect the industry’s capital-intensive nature and need for scale to support advanced technology development. Strategic partnerships and acquisitions enable companies to access complementary technologies, expand market reach, and share development costs. According to MarkWide Research analysis, consolidation activity is expected to accelerate as companies seek to strengthen competitive positions in key growth segments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Japan’s power transistor market dynamics. Primary research includes extensive interviews with industry executives, technology leaders, and key stakeholders across the value chain, providing firsthand insights into market trends, competitive dynamics, and future growth prospects.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to validate primary findings and identify emerging trends. Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth trajectories and segment performance across different time horizons.

Industry expert consultations provide specialized insights into technical developments, application trends, and competitive positioning within specific market segments. Supply chain analysis examines raw material availability, manufacturing capacity, and distribution channels to assess market supply-demand dynamics and identify potential constraints or opportunities.

Market validation processes include cross-referencing multiple data sources, conducting sensitivity analyses, and peer review by industry specialists to ensure research accuracy and reliability. Continuous monitoring of market developments enables real-time updates to research findings and maintains relevance of insights for strategic decision-making purposes.

Tokyo metropolitan area dominates Japan’s power transistor market, hosting major semiconductor companies, research institutions, and technology development centers. The region’s concentration of automotive manufacturers and electronics companies creates substantial local demand while fostering innovation through industry collaboration. Market share in the Tokyo region represents approximately 38% of national demand, reflecting its role as Japan’s economic and technological hub.

Osaka-Kyoto corridor serves as another critical market region, featuring significant industrial manufacturing and automotive production facilities. The area’s industrial automation focus drives demand for power transistors in factory automation and process control applications. Regional market dynamics benefit from proximity to major ports and transportation infrastructure, facilitating both domestic distribution and export activities.

Central Japan region, including Nagoya and surrounding prefectures, represents a major automotive manufacturing hub requiring substantial power transistor volumes for electric vehicle production. Toyota and other automotive leaders’ presence creates concentrated demand for advanced power semiconductor solutions. The region accounts for approximately 28% of automotive-related power transistor consumption nationally.

Northern regions including Tohoku demonstrate growing importance in semiconductor manufacturing, with several major facilities expanding production capacity. Government incentives for regional development and disaster recovery support semiconductor industry growth in these areas. Southern regions including Kyushu maintain significance in consumer electronics manufacturing, supporting steady demand for power transistors in various applications.

Market leadership in Japan’s power transistor sector reflects a combination of technological innovation, manufacturing excellence, and strategic market positioning. The competitive environment features both established semiconductor giants and specialized power device manufacturers competing across different market segments and application areas.

Competitive strategies emphasize technological differentiation, application-specific solutions, and comprehensive customer support. Companies invest heavily in R&D capabilities to maintain technology leadership while building strategic partnerships to expand market reach and access complementary technologies.

Technology-based segmentation reveals distinct market dynamics across different power transistor categories:

By Technology:

By Application:

By Voltage Rating:

Automotive segment analysis reveals rapid transformation driven by electrification trends and advanced driver assistance system deployment. Electric vehicle powertrains require sophisticated power management systems utilizing high-efficiency transistors for motor control, battery management, and charging systems. The segment’s growth rate of 12.5% annually reflects accelerating EV adoption and increasing electronic content per vehicle.

Industrial applications demonstrate steady growth supported by automation initiatives and energy efficiency requirements. Variable frequency drives represent the largest sub-segment, enabling precise motor control and energy savings in manufacturing processes. Power supply systems for industrial equipment increasingly adopt advanced power transistors to meet efficiency regulations and reduce operational costs.

Consumer electronics category shows mature market characteristics with emphasis on miniaturization and cost optimization. Smartphone chargers and laptop adapters drive volume demand while premium applications focus on fast-charging capabilities and compact designs. Home appliances increasingly incorporate intelligent power management systems requiring sophisticated control solutions.

Renewable energy segment exhibits exceptional growth potential as Japan expands solar and wind power capacity. Solar inverters require high-efficiency power conversion systems where advanced transistor technologies provide significant performance advantages. Energy storage systems represent an emerging application area with substantial growth prospects as grid modernization accelerates.

Manufacturers benefit from Japan’s advanced semiconductor ecosystem, accessing world-class research facilities, skilled workforce, and sophisticated supply chain infrastructure. Technology development advantages include collaboration opportunities with leading universities and research institutions, enabling accelerated innovation cycles and breakthrough technology development. Market access to Japan’s demanding customer base provides valuable feedback for product optimization and quality improvement.

Automotive companies gain access to cutting-edge power transistor technologies essential for electric vehicle development and advanced driver assistance systems. Performance advantages from Japanese power semiconductors include higher efficiency, improved reliability, and compact form factors enabling innovative vehicle designs. Supply chain reliability ensures consistent component availability for high-volume production requirements.

Industrial equipment manufacturers benefit from comprehensive power management solutions that enhance system performance and energy efficiency. Technical support from Japanese suppliers includes application engineering assistance and customization capabilities for specific requirements. Quality assurance standards ensure long-term reliability in demanding industrial environments.

Technology investors find attractive opportunities in Japan’s power transistor market through exposure to high-growth segments and innovative technologies. Market stability provided by diverse application portfolios and strong domestic demand reduces investment risks. Export potential enables participation in global market growth while benefiting from Japanese technology leadership.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wide-bandgap semiconductor adoption represents the most significant trend reshaping Japan’s power transistor market. Silicon carbide and gallium nitride technologies offer superior performance characteristics including higher efficiency, faster switching speeds, and improved thermal management compared to traditional silicon devices. This technological shift enables new application possibilities while commanding premium pricing for manufacturers with advanced capabilities.

System integration trends drive demand for comprehensive power management solutions rather than discrete components. Intelligent power modules incorporating sensing, control, and communication capabilities provide enhanced functionality and simplified system design. Customers increasingly prefer suppliers capable of delivering complete solutions with application-specific optimization and technical support.

Miniaturization requirements across all application segments push manufacturers to develop more compact and efficient power transistor solutions. Advanced packaging technologies enable higher power density while maintaining thermal performance and reliability standards. This trend particularly impacts consumer electronics and automotive applications where space constraints are critical design considerations.

Sustainability focus influences product development priorities and customer selection criteria across all market segments. Energy efficiency improvements of 15-20% achievable with advanced power transistors support corporate sustainability goals and regulatory compliance. Environmental considerations extend to manufacturing processes, materials selection, and end-of-life recycling capabilities, according to MWR sustainability analysis.

Strategic partnerships between Japanese power transistor manufacturers and automotive companies accelerate electric vehicle technology development and market adoption. Joint development programs focus on next-generation power modules optimized for specific vehicle platforms and performance requirements. These collaborations enable faster time-to-market for innovative solutions while sharing development costs and risks.

Manufacturing capacity expansion initiatives reflect growing market confidence and demand projections across key application segments. Facility investments focus on advanced production technologies capable of handling wide-bandgap semiconductors and sophisticated packaging requirements. Several major manufacturers announced significant capacity additions to support anticipated growth in automotive and industrial applications.

Technology breakthrough announcements demonstrate continued innovation leadership in advanced power semiconductor technologies. Research achievements include improved device performance, enhanced reliability, and cost reduction initiatives that expand market accessibility. Patent filings and technology licensing agreements indicate active intellectual property development and commercialization efforts.

Regulatory developments supporting electric vehicle adoption and energy efficiency standards create favorable market conditions for advanced power transistor technologies. Government incentives and mandates accelerate customer adoption while providing market visibility for long-term planning. International trade agreements and technology cooperation frameworks facilitate global market expansion opportunities.

Technology investment priorities should focus on wide-bandgap semiconductor capabilities and advanced packaging technologies to maintain competitive advantages in high-growth market segments. Silicon carbide expertise represents a critical differentiator for automotive and industrial applications, while gallium nitride capabilities enable participation in emerging high-frequency applications and consumer electronics segments.

Market diversification strategies can reduce dependence on automotive sector cyclicality while capturing growth opportunities in renewable energy and industrial automation segments. Application-specific solutions development enables premium pricing and stronger customer relationships compared to commodity product approaches. Geographic expansion into high-growth international markets leverages Japanese technology leadership.

Partnership development with system integrators and equipment manufacturers provides access to new applications and customer relationships while sharing development costs and market risks. Collaborative innovation programs with research institutions accelerate breakthrough technology development and maintain competitive positioning. Supply chain optimization ensures reliable component availability while managing cost pressures.

Customer engagement strategies should emphasize technical support capabilities and application expertise rather than competing solely on price. Solution-oriented approaches that address specific customer challenges create stronger value propositions and sustainable competitive advantages. Long-term partnerships with key customers provide market stability and development direction for future products.

Long-term growth prospects for Japan’s power transistor market appear exceptionally positive, driven by fundamental trends toward electrification, automation, and energy efficiency across multiple industries. Electric vehicle proliferation will continue driving substantial demand growth, with power transistor content per vehicle expected to increase significantly as performance requirements advance and costs decline.

Technology evolution toward wide-bandgap semiconductors will accelerate as manufacturing costs decrease and performance advantages become more compelling across broader application ranges. Market penetration of silicon carbide devices is projected to reach 35% of high-power applications within the next five years, while gallium nitride adoption expands in consumer electronics and telecommunications segments.

Industrial automation advancement will create sustained demand for intelligent power management systems incorporating advanced sensing and control capabilities. Industry 4.0 implementations require sophisticated power electronics that can adapt to changing operational conditions and optimize energy consumption in real-time, representing significant growth opportunities for innovative manufacturers.

Global market expansion opportunities will enable Japanese power transistor manufacturers to leverage their technology leadership and quality advantages in international markets. Export growth potential appears particularly strong in automotive and renewable energy applications where Japanese expertise provides clear competitive advantages. MarkWide Research projects sustained market expansion supported by these fundamental growth drivers and Japan’s continued innovation leadership.

Japan’s power transistor market stands at the forefront of global semiconductor innovation, driven by the nation’s technological leadership and strong domestic demand across automotive, industrial, and consumer electronics sectors. The market’s transformation toward wide-bandgap semiconductors and intelligent power management systems creates exceptional opportunities for companies with advanced capabilities and strategic vision.

Growth momentum remains robust, supported by electric vehicle adoption, industrial automation advancement, and renewable energy deployment. Japanese manufacturers’ competitive advantages in technology development, manufacturing excellence, and customer relationships position them favorably for sustained market expansion and global leadership. The convergence of electrification trends and digitalization initiatives ensures continued demand for sophisticated power transistor solutions.

Strategic success in this dynamic market requires continued investment in breakthrough technologies, application-specific solutions, and comprehensive customer support capabilities. Companies that effectively balance innovation leadership with operational excellence while building strategic partnerships will capture the most significant growth opportunities in Japan’s evolving power transistor market landscape.

What is Power Transistor?

Power transistors are semiconductor devices used to amplify or switch electronic signals and electrical power. They are essential components in various applications, including power supplies, motor drives, and audio amplifiers.

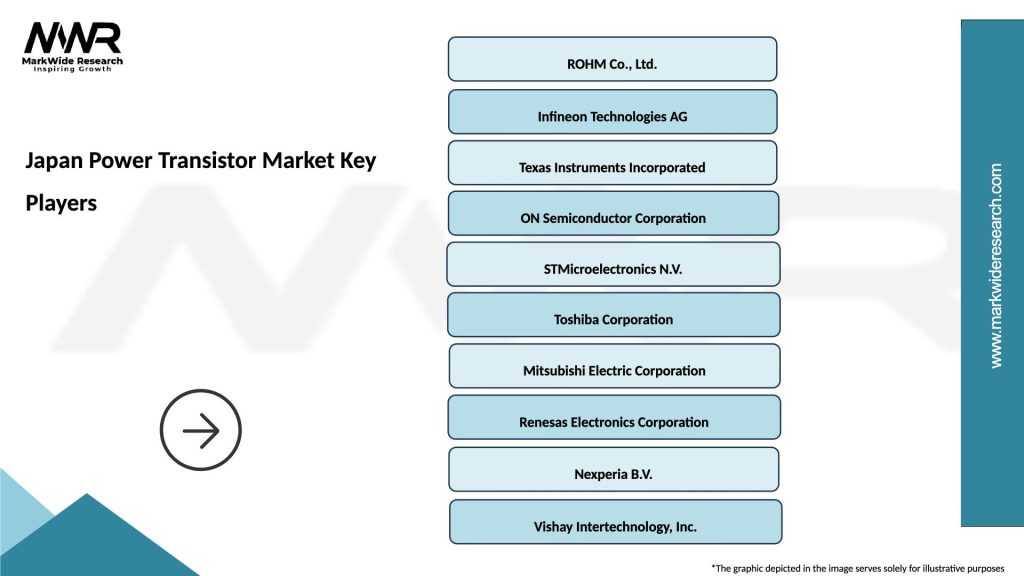

What are the key players in the Japan Power Transistor Market?

Key players in the Japan Power Transistor Market include Mitsubishi Electric, Toshiba Corporation, and Renesas Electronics, among others. These companies are known for their innovative technologies and extensive product portfolios in power transistors.

What are the growth factors driving the Japan Power Transistor Market?

The Japan Power Transistor Market is driven by the increasing demand for energy-efficient devices, the growth of renewable energy sources, and advancements in electric vehicles. These factors are leading to a higher adoption of power transistors in various sectors.

What challenges does the Japan Power Transistor Market face?

The Japan Power Transistor Market faces challenges such as the high cost of advanced semiconductor materials and the rapid pace of technological change. Additionally, competition from alternative technologies can impact market growth.

What opportunities exist in the Japan Power Transistor Market?

Opportunities in the Japan Power Transistor Market include the rising demand for electric vehicles and the expansion of smart grid technologies. These trends are expected to create new applications and increase the need for efficient power transistors.

What trends are shaping the Japan Power Transistor Market?

Trends in the Japan Power Transistor Market include the shift towards wide bandgap semiconductors, which offer better performance and efficiency. Additionally, the integration of power transistors in IoT devices is becoming increasingly prevalent.

Japan Power Transistor Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bipolar Junction Transistor, Field Effect Transistor, IGBT, MOSFET |

| Technology | Silicon, Gallium Nitride, Silicon Carbide, Organic |

| End User | Consumer Electronics, Automotive, Industrial Equipment, Telecommunications |

| Application | Power Supply, Motor Control, Signal Amplification, RF Transmission |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Power Transistor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at