444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan plastic caps and closures market represents a dynamic and essential segment of the country’s packaging industry, serving diverse sectors from beverages and pharmaceuticals to personal care and household products. Market dynamics in Japan reflect the nation’s commitment to innovation, sustainability, and consumer convenience, driving continuous evolution in closure technologies and materials. The market demonstrates robust growth potential with an estimated compound annual growth rate of 4.2% CAGR over the forecast period, supported by increasing demand for packaged goods and advanced closure solutions.

Japanese manufacturers have established themselves as leaders in precision engineering and quality control, producing caps and closures that meet stringent international standards. The market encompasses various closure types including screw caps, snap-on caps, dispensing closures, and specialty closures designed for specific applications. Consumer preferences increasingly favor convenience features such as easy-open mechanisms, tamper-evident designs, and resealable options, driving innovation across the industry.

Sustainability initiatives have become a cornerstone of market development, with manufacturers investing heavily in recyclable materials and eco-friendly production processes. The integration of advanced technologies such as injection molding, compression molding, and multi-layer barrier technologies has enhanced product performance while reducing environmental impact. Regional market penetration shows approximately 68% concentration in major metropolitan areas, reflecting the distribution of manufacturing facilities and consumer markets.

The Japan plastic caps and closures market refers to the comprehensive ecosystem of manufacturing, distribution, and application of plastic-based sealing solutions designed to protect, preserve, and provide convenient access to packaged products across multiple industries. These closure systems serve as critical components in maintaining product integrity, extending shelf life, and ensuring consumer safety while facilitating ease of use and brand differentiation.

Plastic caps and closures encompass a wide range of products including threaded caps, snap-fit closures, flip-top dispensers, pump dispensers, child-resistant closures, and tamper-evident seals. The market includes various plastic materials such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and specialized barrier materials designed to meet specific performance requirements. Manufacturing processes involve sophisticated molding techniques, quality control systems, and customization capabilities to serve diverse packaging applications.

Strategic market analysis reveals that Japan’s plastic caps and closures market operates within a highly competitive and innovation-driven environment, characterized by strong domestic manufacturing capabilities and increasing export opportunities. The market benefits from Japan’s advanced manufacturing infrastructure, technological expertise, and commitment to quality excellence, positioning it as a significant player in the global packaging industry.

Key growth drivers include expanding beverage consumption, pharmaceutical packaging requirements, and personal care product demand, with the beverage segment accounting for approximately 42% market share. The market demonstrates resilience through diversified application areas and continuous product innovation, supported by substantial research and development investments from leading manufacturers.

Competitive landscape features both established Japanese companies and international players, creating a dynamic environment that fosters innovation and quality improvements. Market participants focus on developing sustainable solutions, advanced functionality, and cost-effective production methods to maintain competitive advantages. Future prospects indicate continued growth driven by urbanization, changing consumer lifestyles, and increasing demand for convenient packaging solutions.

Market intelligence reveals several critical insights that shape the Japan plastic caps and closures landscape:

Primary market drivers propelling growth in Japan’s plastic caps and closures market stem from multiple interconnected factors that reflect broader economic and social trends. The expanding beverage industry, particularly in ready-to-drink categories, creates substantial demand for innovative closure solutions that maintain product freshness and provide consumer convenience.

Demographic shifts including an aging population and increasing urbanization influence packaging preferences, with consumers favoring easy-open and ergonomic closure designs. The pharmaceutical sector’s growth, driven by healthcare needs and regulatory requirements, demands specialized closures with child-resistant features and tamper-evident properties. E-commerce expansion has increased the need for secure, damage-resistant closures that can withstand shipping and handling stresses.

Sustainability consciousness among consumers and corporations drives demand for recyclable and environmentally friendly closure solutions. Government initiatives promoting circular economy principles encourage manufacturers to develop innovative materials and production processes. Technological advancements in manufacturing equipment and quality control systems enable production of more sophisticated and reliable closure products, supporting market expansion across diverse applications.

Market challenges facing the Japan plastic caps and closures industry include several constraining factors that impact growth potential and operational efficiency. Rising raw material costs, particularly for petroleum-based plastics, create pressure on profit margins and pricing strategies. Environmental regulations and plastic waste concerns lead to increased compliance costs and the need for alternative materials that may have higher production expenses.

Competition from alternative packaging solutions such as pouches, cans with integrated openings, and glass containers with metal closures presents ongoing challenges. The complexity of developing closures for specialized applications requires significant research and development investments, which may strain resources for smaller manufacturers. Supply chain disruptions and raw material availability issues can impact production schedules and customer relationships.

Consumer price sensitivity in certain market segments limits the adoption of premium closure solutions, despite their superior functionality. Regulatory changes and evolving safety standards require continuous adaptation and investment in new technologies and processes. Market saturation in traditional applications necessitates innovation and expansion into new segments to maintain growth trajectories.

Emerging opportunities in Japan’s plastic caps and closures market present significant potential for growth and innovation across multiple dimensions. The development of smart closures incorporating RFID technology, temperature indicators, and freshness sensors opens new possibilities for premium packaging applications. Sustainable material innovations including bio-based plastics and advanced recycling technologies create competitive advantages and meet evolving consumer expectations.

Export market expansion leverages Japan’s reputation for quality and precision manufacturing, particularly in Southeast Asian and North American markets. The growing craft beverage industry and artisanal food products create demand for unique, customizable closure solutions that enhance brand differentiation. Healthcare sector growth driven by an aging population increases demand for specialized pharmaceutical and nutraceutical packaging solutions.

Digital transformation opportunities include implementing Industry 4.0 technologies for improved manufacturing efficiency and quality control. Collaboration with packaging machinery manufacturers can lead to integrated solutions that optimize filling and capping processes. Circular economy initiatives present opportunities for developing closed-loop recycling systems and take-back programs that create additional revenue streams while supporting sustainability goals.

Market dynamics in Japan’s plastic caps and closures sector reflect a complex interplay of technological innovation, consumer behavior changes, and regulatory influences. The industry demonstrates remarkable adaptability to shifting market conditions, with manufacturers continuously evolving their product portfolios and production capabilities to meet emerging demands. Competitive pressures drive ongoing improvements in quality, functionality, and cost-effectiveness.

Innovation cycles in the market typically span 18-24 months, with companies investing approximately 8-12% of revenue in research and development activities. The integration of sustainable practices has become a key differentiator, with leading manufacturers achieving 35-40% reduction in carbon footprint through process optimization and material innovations. Customer collaboration has intensified, with closure manufacturers working closely with brand owners to develop customized solutions that enhance product performance and consumer experience.

Supply chain dynamics have evolved to emphasize flexibility and resilience, with companies diversifying supplier bases and implementing just-in-time production strategies. The market demonstrates strong responsiveness to seasonal demand variations, particularly in beverage applications where summer months can see 25-30% higher volume requirements. Technology adoption rates continue to accelerate, with automation and digitalization improving production efficiency and quality consistency across the industry.

Comprehensive research methodology employed in analyzing Japan’s plastic caps and closures market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of findings. Primary research involves extensive interviews with industry executives, manufacturing specialists, and key stakeholders across the value chain, providing firsthand insights into market trends and challenges.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and validate primary findings. Quantitative analysis includes statistical modeling of market trends, growth projections, and segment performance using historical data and forward-looking indicators. Market surveys conducted among end-users and packaging professionals provide consumer preference insights and demand forecasting data.

Data triangulation methods ensure consistency and accuracy across multiple information sources, while expert validation confirms the relevance and applicability of research findings. The methodology incorporates both top-down and bottom-up approaches to market sizing and segmentation analysis. Quality assurance protocols include peer review processes and cross-verification of key data points to maintain research integrity and reliability.

Regional market distribution across Japan reveals distinct patterns of concentration and growth potential, with the Greater Tokyo Area accounting for approximately 38% of total market demand. The Kansai region, centered around Osaka and Kyoto, represents another significant market cluster with 22% market share, driven by strong manufacturing and consumer goods industries. Industrial concentration in these metropolitan areas reflects the proximity to major packaging and consumer goods companies.

Central Japan, including the Chubu region, demonstrates robust growth in automotive and industrial applications, contributing 18% of market volume. The region’s strong manufacturing base creates demand for specialized closure solutions in lubricants, chemicals, and industrial products. Northern regions including Tohoku show emerging opportunities in agricultural and food processing applications, supported by local production initiatives.

Southern regions of Kyushu and Shikoku present growth potential in beverage and personal care applications, with increasing urbanization and consumer spending driving demand. Regional preferences vary significantly, with urban areas favoring convenience-oriented closures while rural regions prioritize durability and cost-effectiveness. Distribution networks have adapted to serve diverse regional requirements while maintaining efficient logistics and inventory management systems.

Competitive environment in Japan’s plastic caps and closures market features a diverse mix of established domestic manufacturers and international players, creating a dynamic marketplace that fosters innovation and quality improvements. Leading companies have established strong market positions through technological expertise, customer relationships, and comprehensive product portfolios.

Market competition intensifies through continuous product innovation, quality improvements, and customer service excellence. Companies invest heavily in research and development to maintain competitive advantages and respond to evolving market requirements.

Market segmentation analysis reveals distinct categories based on material type, closure type, application, and end-use industry, each demonstrating unique growth patterns and requirements. Material-based segmentation shows polypropylene (PP) commanding the largest share due to its versatility and cost-effectiveness, followed by polyethylene (PE) and specialty materials.

By Material Type:

By Closure Type:

Beverage applications represent the largest category within Japan’s plastic caps and closures market, driven by strong consumption of bottled water, soft drinks, and ready-to-drink beverages. This segment emphasizes convenience features, tamper-evidence, and brand differentiation through custom designs and colors. Innovation focus includes sports caps, flip-top designs, and easy-grip features that enhance consumer experience.

Pharmaceutical and healthcare applications demand the highest quality standards and regulatory compliance, with child-resistant and senior-friendly designs becoming increasingly important. This category shows consistent growth driven by Japan’s aging population and expanding healthcare needs. Specialized features include tamper-evident seals, dosage control mechanisms, and moisture barrier properties.

Personal care and cosmetics applications focus on aesthetic appeal, functionality, and premium feel, with dispensing closures and pump systems gaining popularity. The category benefits from innovation in airless packaging and precision dispensing technologies. Food and condiment applications emphasize freshness preservation, easy dispensing, and resealability, with growing demand for portion control and convenience features.

Industry participants in Japan’s plastic caps and closures market enjoy numerous strategic advantages that enhance their competitive position and growth potential. Manufacturers benefit from Japan’s advanced industrial infrastructure, skilled workforce, and technological capabilities that enable production of high-quality, precision-engineered closure solutions. Quality reputation associated with Japanese manufacturing provides significant advantages in both domestic and international markets.

Supply chain benefits include access to reliable raw material suppliers, efficient logistics networks, and proximity to major consumer goods manufacturers. The market’s emphasis on innovation and continuous improvement creates opportunities for technology leadership and premium pricing strategies. Regulatory environment provides clear guidelines and standards that facilitate compliance and market access.

Stakeholder advantages extend to brand owners who benefit from innovative closure solutions that enhance product differentiation and consumer satisfaction. Retailers gain from improved product presentation and reduced handling issues, while consumers enjoy enhanced convenience and product protection. Environmental benefits from sustainable closure solutions support corporate responsibility goals and regulatory compliance across the value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping Japan’s plastic caps and closures market, with manufacturers investing heavily in recyclable materials, bio-based alternatives, and circular economy initiatives. Companies are developing innovative solutions that maintain performance while reducing environmental impact, including lightweight designs and mono-material constructions that facilitate recycling.

Smart packaging integration emerges as a key differentiator, with closures incorporating NFC chips, QR codes, and sensor technologies that provide product information, authentication, and freshness monitoring. This trend particularly gains traction in premium beverage and pharmaceutical applications where brand protection and consumer engagement are priorities. Customization demand continues to grow, with brands seeking unique closure designs that enhance shelf appeal and functional benefits.

Convenience enhancement drives innovation in closure functionality, with one-handed operation, portion control, and ergonomic designs becoming standard expectations. The trend toward premium packaging experiences influences closure development, with tactile feedback, smooth operation, and aesthetic appeal becoming increasingly important. Digital manufacturing adoption accelerates, with companies implementing IoT sensors, predictive maintenance, and real-time quality monitoring systems to improve efficiency and consistency.

Recent industry developments highlight the dynamic nature of Japan’s plastic caps and closures market, with significant investments in sustainable technologies and manufacturing capabilities. Major manufacturers have announced substantial commitments to carbon neutrality and circular economy principles, driving innovation in materials and processes. Strategic partnerships between closure manufacturers and brand owners have intensified, focusing on co-development of specialized solutions.

Technology advancement includes the introduction of advanced injection molding systems that improve precision and reduce waste, while new barrier coating technologies enhance product protection without compromising recyclability. Several companies have expanded their research and development facilities to accelerate innovation in sustainable materials and smart packaging solutions. Market consolidation activities have strengthened competitive positions and expanded technological capabilities.

Regulatory developments include updated food contact regulations and enhanced recycling requirements that influence material selection and design approaches. Industry associations have launched collaborative initiatives to develop standardized sustainability metrics and best practices. Export initiatives supported by government trade promotion programs have opened new international market opportunities for Japanese manufacturers.

Strategic recommendations for market participants emphasize the importance of balancing innovation with cost management while building sustainable competitive advantages. MarkWide Research analysis suggests that companies should prioritize investment in sustainable materials and technologies that align with evolving regulatory requirements and consumer preferences. Developing strong partnerships with raw material suppliers and technology providers can enhance innovation capabilities and supply chain resilience.

Market expansion strategies should focus on high-growth segments such as pharmaceuticals, premium beverages, and personal care applications where quality and innovation command premium pricing. Companies should consider strategic acquisitions or partnerships to access new technologies and market segments. Digital transformation investments in manufacturing systems and customer engagement platforms can improve operational efficiency and market responsiveness.

Sustainability initiatives should be integrated into core business strategies rather than treated as separate programs, with clear metrics and targets for environmental impact reduction. Export market development requires careful selection of target regions and applications where Japanese quality advantages are most valued. Innovation focus should balance breakthrough technologies with incremental improvements that deliver immediate customer value and competitive differentiation.

Future market prospects for Japan’s plastic caps and closures industry appear promising, supported by continued innovation, sustainability initiatives, and expanding application areas. The market is expected to maintain steady growth with projected CAGR of 4.2% over the next five years, driven by demographic trends, technological advancement, and increasing export opportunities. Sustainable packaging requirements will continue to shape product development and market dynamics.

Technology evolution will accelerate the adoption of smart packaging features, advanced materials, and digital manufacturing systems that enhance both product performance and operational efficiency. The integration of artificial intelligence and machine learning in production processes will improve quality control and predictive maintenance capabilities. Market diversification into new applications and geographic regions will provide growth opportunities beyond traditional segments.

Regulatory landscape evolution will continue to influence material selection and design approaches, with increasing emphasis on recyclability and environmental impact reduction. Consumer preferences for convenience, sustainability, and premium experiences will drive ongoing innovation in closure functionality and aesthetics. MWR projections indicate that companies successfully adapting to these trends while maintaining quality excellence will achieve superior market performance and sustainable competitive advantages in the evolving marketplace.

Japan’s plastic caps and closures market demonstrates remarkable resilience and adaptability in responding to evolving consumer needs, regulatory requirements, and sustainability challenges. The industry’s commitment to quality, innovation, and environmental responsibility positions it well for continued growth and international expansion. Market dynamics reflect a mature yet evolving landscape where technological advancement and sustainable practices drive competitive differentiation.

Strategic opportunities abound for companies that can successfully balance innovation with cost management while building strong customer relationships and sustainable business practices. The market’s future success will depend on continued investment in research and development, strategic partnerships, and adaptation to changing consumer preferences and regulatory requirements. Industry participants who embrace digital transformation, sustainability initiatives, and market diversification strategies are best positioned to capitalize on emerging opportunities and achieve long-term success in this dynamic and essential packaging market segment.

What is Plastic Caps And Closures?

Plastic caps and closures are devices used to seal containers, ensuring the contents remain secure and uncontaminated. They are commonly used in various industries, including food and beverage, pharmaceuticals, and personal care products.

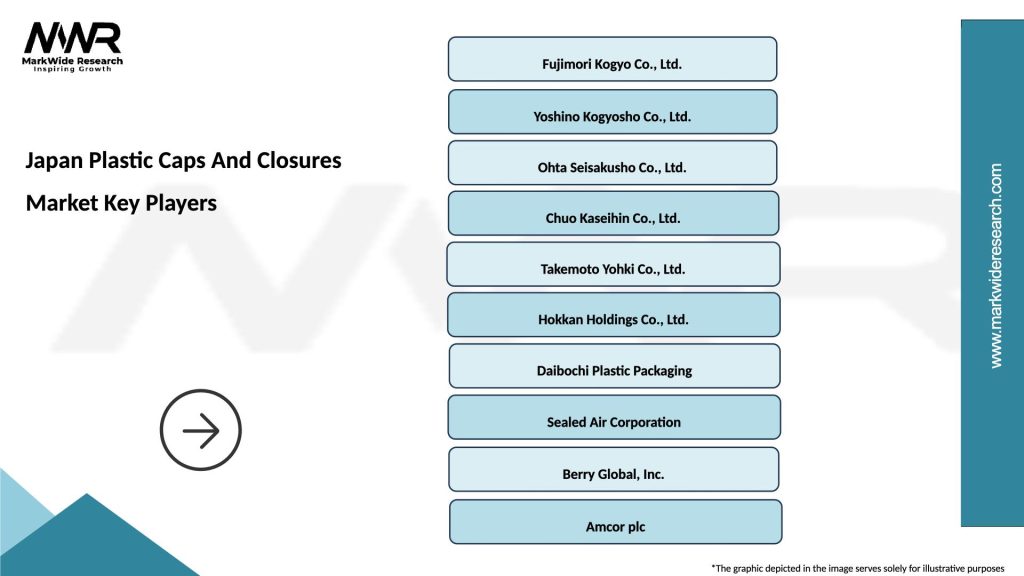

What are the key players in the Japan Plastic Caps And Closures Market?

Key players in the Japan Plastic Caps And Closures Market include Toyo Seikan Group Holdings, Nihon Plast, and A&R Packaging, among others. These companies are known for their innovative designs and commitment to quality in the production of plastic closures.

What are the growth factors driving the Japan Plastic Caps And Closures Market?

The growth of the Japan Plastic Caps And Closures Market is driven by the increasing demand for convenience packaging in the food and beverage sector, the rise in e-commerce, and the growing focus on sustainable packaging solutions.

What challenges does the Japan Plastic Caps And Closures Market face?

The Japan Plastic Caps And Closures Market faces challenges such as stringent regulations regarding plastic use, competition from alternative materials, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the Japan Plastic Caps And Closures Market?

Opportunities in the Japan Plastic Caps And Closures Market include the development of biodegradable and recyclable closure options, expansion into emerging markets, and the integration of smart packaging technologies.

What trends are shaping the Japan Plastic Caps And Closures Market?

Trends in the Japan Plastic Caps And Closures Market include the increasing adoption of lightweight materials, the rise of custom-designed closures for branding purposes, and a growing emphasis on sustainability and eco-friendly practices.

Japan Plastic Caps And Closures Market

| Segmentation Details | Description |

|---|---|

| Product Type | Flip Top Caps, Screw Caps, Dispensing Caps, Snap-On Caps |

| Material | Polyethylene, Polypropylene, PVC, PET |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household Products |

| Closure Type | Child-Resistant, Tamper-Evident, Standard, Specialty |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Plastic Caps And Closures Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at