444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Japan Payments Market is at the forefront of the global financial landscape, spearheading innovations in digital transactions, mobile payments, and contactless technologies. In this comprehensive market overview, we delve into the pivotal role of payment solutions, offering insights into their impact on commerce, financial inclusion, and economic growth. This report includes an executive summary and key market insights, analysis of the drivers and restraints shaping the market, exploration of emerging opportunities, and scrutiny of the dynamic forces at play. Moreover, we provide a regional analysis, competitive landscape, segmentation, and category-wise insights. Financial institutions, fintech companies, merchants, consumers, and stakeholders will discover key benefits, a SWOT analysis, recent trends, the impact of technological advancements, notable industry developments, analyst suggestions, and a future outlook, ultimately concluding with a thought-provoking summary of the market’s potential.

Meaning

The Japan Payments Market encompasses a diverse array of payment methods and technologies, driving financial transactions and shaping the future of commerce. This market overview delves into the significance of payment solutions in Japan, fostering financial inclusion, enhancing consumer convenience, and powering economic growth.

Executive Summary

The Japan Payments Market is experiencing significant growth, driven by the increasing adoption of digital payment methods and a cashless society vision. This executive summary provides a concise overview of the market’s key highlights, offering a snapshot of its current status and future potential. Financial institutions, fintech companies, merchants, and consumers play pivotal roles in shaping the market’s future and driving Japan’s financial transformation.

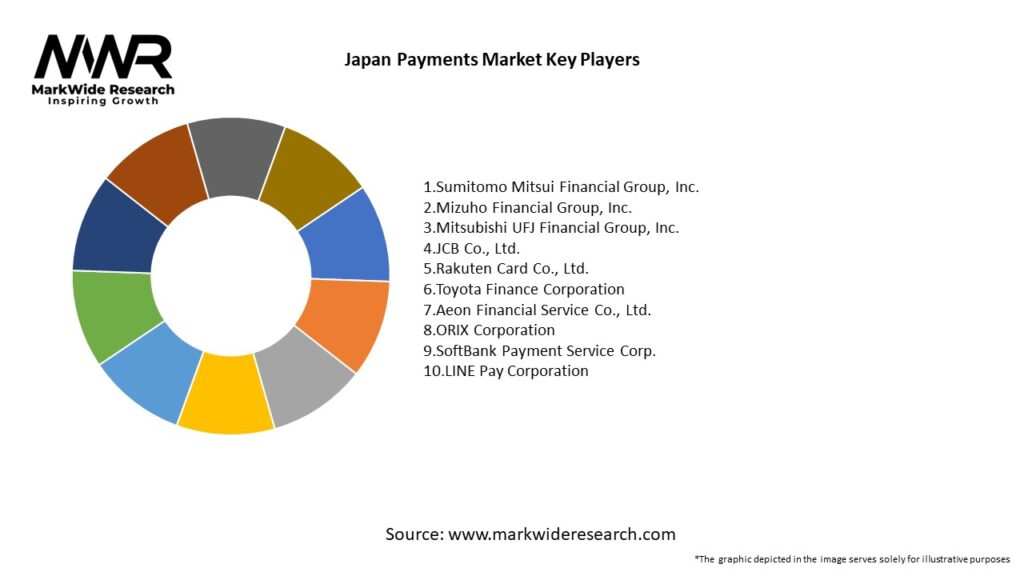

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the Japan Payments Market:

Market Restraints

Despite the promising growth, the Japan Payments Market faces some challenges:

Market Opportunities

The Japan Payments Market offers several opportunities for growth:

Market Dynamics

The dynamics of the Japan Payments Market are shaped by several key factors:

Regional Analysis

The Japan Payments Market is influenced by regional trends and developments, with key growth areas being:

Competitive Landscape

Leading Companies in the Japan Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Japan Payments Market can be segmented as follows:

Category-wise Insights

Each category of payment solutions offers distinct features that cater to different consumer needs:

Key Benefits for Industry Participants and Stakeholders

The Japan Payments Market provides significant advantages for stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends influencing the Japan Payments Market include:

Covid-19 Impact

The Covid-19 pandemic has accelerated the shift to cashless payments, as consumers and businesses seek safer, contactless transaction methods. This has led to a significant rise in the use of mobile wallets, QR code payments, and online payment solutions, driving further digital payment adoption in Japan.

Key Industry Developments

Recent developments in the Japan Payments Market include:

Analyst Suggestions

Analysts recommend the following for stakeholders in the Japan Payments Market:

Future Outlook

The future of the Japan Payments Market is promising, with a multitude of growth opportunities and financial transformation goals on the horizon. This section provides a forward-looking perspective on market trends, technological advancements, and emerging applications. Financial institutions, fintech companies, merchants, and stakeholders can use this outlook to chart their course for future success in transforming Japan’s financial landscape.

Conclusion

In conclusion, the Japan Payments Market is at the forefront of financial transformation, driving innovations in digital transactions, mobile payments, and contactless technologies. As financial institutions, fintech companies, merchants, and stakeholders navigate the market’s dynamic landscape, they must remain adaptable and committed to payment innovation, security, and financial inclusion. The market’s potential is vast, and those who embrace technological advancements, address regulatory challenges, and foster collaboration among industry players will undoubtedly shape the future of financial transactions in Japan. With a commitment to financial inclusion, technological excellence, and economic growth, the Japan Payments Market is poised for continued expansion and a significant impact on the global financial landscape.

What is Japan Payments?

Japan Payments refers to the various methods and systems used for conducting financial transactions in Japan, including credit cards, mobile payments, and bank transfers.

What are the key players in the Japan Payments Market?

Key players in the Japan Payments Market include companies like Rakuten, PayPay, and LINE Pay, which offer diverse payment solutions and services, among others.

What are the main drivers of growth in the Japan Payments Market?

The main drivers of growth in the Japan Payments Market include the increasing adoption of digital wallets, the rise of e-commerce, and the demand for contactless payment solutions.

What challenges does the Japan Payments Market face?

Challenges in the Japan Payments Market include regulatory compliance, cybersecurity threats, and the need for interoperability among different payment systems.

What opportunities exist in the Japan Payments Market?

Opportunities in the Japan Payments Market include the expansion of fintech innovations, the growth of cross-border payments, and the increasing acceptance of cryptocurrencies.

What trends are shaping the Japan Payments Market?

Trends shaping the Japan Payments Market include the rise of biometric authentication, the integration of AI in fraud detection, and the growing popularity of subscription-based payment models.

Japan Payments Market

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Debit Card, Mobile Payment, Bank Transfer |

| Customer Type | Retail Consumers, Small Businesses, Corporates, E-commerce Platforms |

| Transaction Type | Online Transactions, In-store Purchases, Recurring Payments, Peer-to-Peer Transfers |

| Service Type | Payment Processing, Fraud Detection, Currency Exchange, Digital Wallets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Japan Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at