444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The parametric insurance market in Japan is a burgeoning segment of the insurance industry, offering innovative risk transfer solutions that provide coverage based on predefined triggers rather than indemnifying actual losses. Parametric insurance products in Japan address various perils, including natural disasters, weather-related events, and other specific risks, providing policyholders with rapid payouts to facilitate recovery and resilience. As Japan faces frequent and severe natural disasters, such as earthquakes, typhoons, and floods, parametric insurance plays a crucial role in enhancing financial protection and promoting disaster risk management strategies.

Meaning

Parametric insurance, also known as index-based insurance, is a type of risk transfer mechanism that pays out predetermined amounts based on measurable parameters, such as seismic activity, wind speed, rainfall levels, or temperature deviations. Unlike traditional insurance, which indemnifies actual losses, parametric insurance triggers payouts automatically when predefined conditions are met, providing rapid and transparent compensation to policyholders. This innovative approach offers advantages such as faster claims processing, reduced administrative costs, and enhanced financial resilience, particularly in regions prone to catastrophic events like Japan.

Executive Summary

The parametric insurance market in Japan has experienced significant growth in recent years, driven by the country’s vulnerability to natural disasters and the increasing recognition of parametric solutions as effective risk management tools. With frequent earthquakes, typhoons, and other perils threatening lives, property, and economic stability, parametric insurance offers policyholders timely financial protection and facilitates rapid recovery in the aftermath of disasters. As insurers and reinsurers continue to develop innovative parametric products tailored to Japan’s specific risks, the market is poised for further expansion and adoption across various sectors.

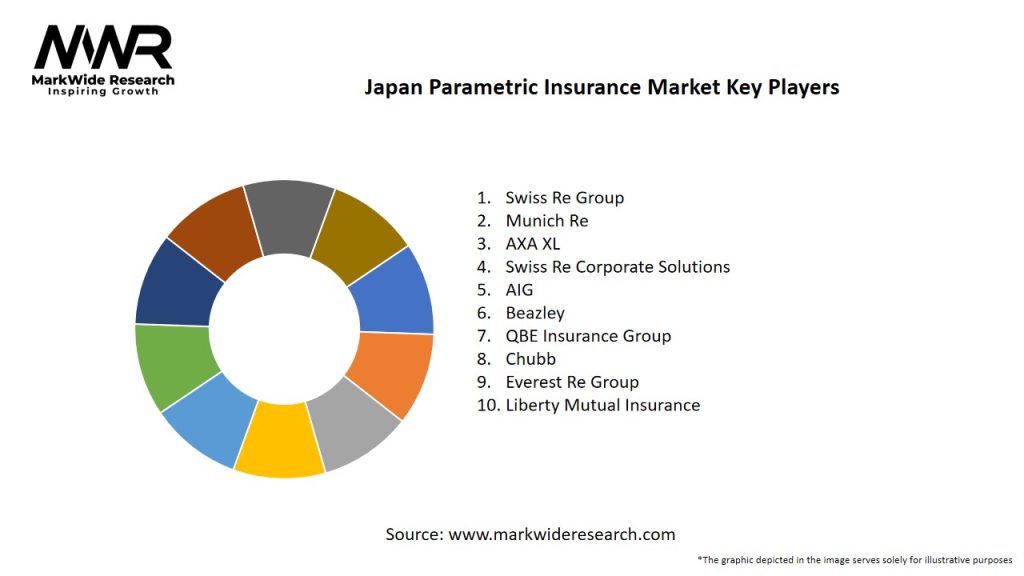

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The parametric insurance market in Japan operates in a dynamic environment shaped by various factors, including regulatory developments, technological advancements, climate change impacts, and socioeconomic trends. These dynamics influence market trends, consumer preferences, insurer strategies, and industry collaborations, driving innovation, growth, and resilience in the insurance sector.

Regional Analysis

The parametric insurance market in Japan exhibits regional variations in risk exposure, hazard vulnerability, and insurance penetration, reflecting geographic diversity, urbanization patterns, and economic disparities across prefectures and regions. Urban centers, coastal areas, and seismic zones are particularly exposed to natural disaster risks, driving demand for parametric insurance solutions tailored to local hazards and vulnerabilities.

Competitive Landscape

Leading Companies in Japan Parametric Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

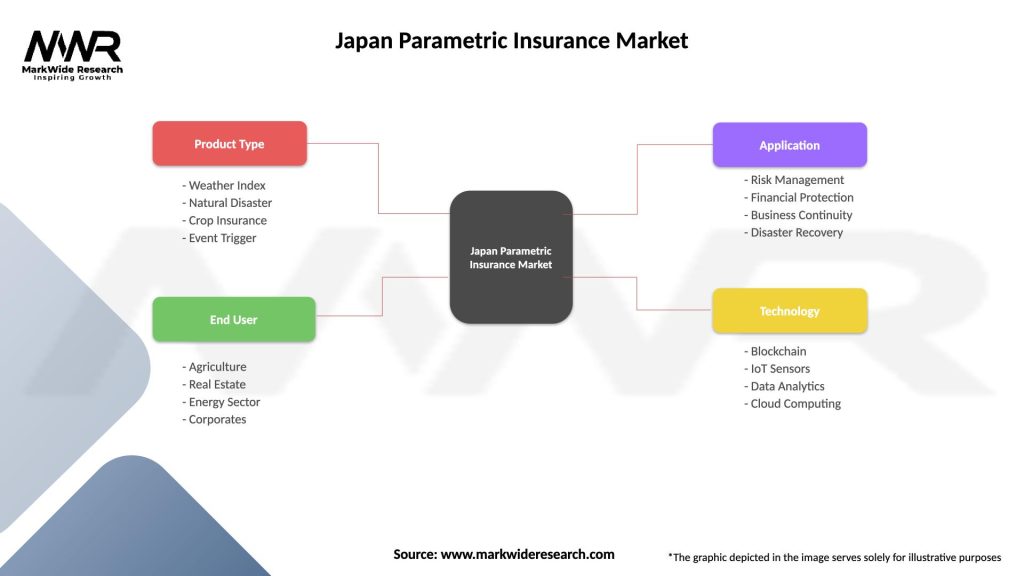

Segmentation

The parametric insurance market in Japan can be segmented based on various factors, including peril type, industry sector, policy coverage, trigger parameters, and geographic scope. Segmentation allows insurers to tailor products, pricing, and distribution strategies to specific customer segments, enhancing market relevance, and competitiveness in the insurance industry.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The parametric insurance market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the parametric insurance market in Japan:

Understanding these factors through a SWOT analysis helps insurers, reinsurers, and policymakers identify strategic priorities, capitalize on growth opportunities, address challenges, and navigate the dynamic landscape of the parametric insurance market in Japan.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had implications for the parametric insurance market in Japan, affecting risk perceptions, insurance demand, and market dynamics:

Key Industry Developments

Analyst Suggestions

Future Outlook

The parametric insurance market in Japan is poised for continued growth and innovation, driven by increasing awareness of natural disaster risks, technological advancements, regulatory support, and changing market dynamics. As insurers develop new products, expand market reach, and enhance risk management capabilities, parametric insurance will play an increasingly vital role in promoting resilience, sustainability, and financial protection for individuals, businesses, and communities across Japan.

Conclusion

The parametric insurance market in Japan represents a dynamic and evolving segment of the insurance industry, offering innovative risk transfer solutions for natural disasters, climate risks, and other perils. With frequent and severe events threatening lives, property, and economic stability, parametric insurance provides rapid, transparent payouts to support disaster response, recovery, and resilience efforts. As insurers, reinsurers, and policymakers collaborate to address market challenges, promote innovation, and enhance consumer education, parametric insurance will continue to contribute to Japan’s disaster risk management strategies, economic resilience, and sustainable development goals in the years ahead.

What is Parametric Insurance?

Parametric insurance is a type of insurance that provides coverage based on predefined parameters or triggers, such as weather events or natural disasters, rather than traditional loss assessments. This approach allows for quicker payouts and can be particularly useful in sectors like agriculture and disaster recovery.

What are the key players in the Japan Parametric Insurance Market?

Key players in the Japan Parametric Insurance Market include Tokio Marine Holdings, Sompo Japan Insurance, and Mitsui Sumitomo Insurance, among others. These companies are actively developing innovative parametric products to meet the needs of various industries.

What are the growth factors driving the Japan Parametric Insurance Market?

The growth of the Japan Parametric Insurance Market is driven by increasing awareness of climate risks, the need for rapid disaster response, and advancements in technology that facilitate data collection and analysis. Additionally, businesses are seeking more flexible insurance solutions to manage their risks effectively.

What challenges does the Japan Parametric Insurance Market face?

The Japan Parametric Insurance Market faces challenges such as regulatory hurdles, the complexity of designing effective parametric products, and the need for accurate data to set triggers. These factors can hinder market growth and adoption among potential users.

What opportunities exist in the Japan Parametric Insurance Market?

Opportunities in the Japan Parametric Insurance Market include the expansion of coverage options for small and medium-sized enterprises, the integration of technology for better risk assessment, and the potential for partnerships with government agencies for disaster management. These factors can enhance the market’s appeal and accessibility.

What trends are shaping the Japan Parametric Insurance Market?

Trends shaping the Japan Parametric Insurance Market include the increasing use of satellite data for risk assessment, the rise of climate-related insurance products, and a growing focus on sustainability in insurance offerings. These trends reflect a shift towards more innovative and responsive insurance solutions.

Japan Parametric Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Weather Index, Natural Disaster, Crop Insurance, Event Trigger |

| End User | Agriculture, Real Estate, Energy Sector, Corporates |

| Application | Risk Management, Financial Protection, Business Continuity, Disaster Recovery |

| Technology | Blockchain, IoT Sensors, Data Analytics, Cloud Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Japan Parametric Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at