444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan logistics market represents one of Asia’s most sophisticated and technologically advanced supply chain ecosystems, characterized by exceptional efficiency standards and innovative automation solutions. Japan’s logistics sector has evolved into a critical infrastructure supporting the nation’s manufacturing excellence, e-commerce expansion, and international trade relationships. The market demonstrates remarkable resilience and adaptability, incorporating cutting-edge technologies such as artificial intelligence, robotics, and Internet of Things (IoT) solutions to maintain competitive advantages in global supply chains.

Market dynamics indicate robust growth driven by increasing e-commerce penetration, which has reached approximately 8.1% of total retail sales, and the ongoing digital transformation of traditional logistics operations. The sector benefits from Japan’s strategic geographic position as a gateway to Asian markets, advanced port infrastructure, and sophisticated rail networks that facilitate seamless domestic and international cargo movements.

Technological integration remains a defining characteristic of Japan’s logistics landscape, with companies investing heavily in warehouse automation, predictive analytics, and sustainable transportation solutions. The market’s emphasis on precision, quality control, and customer satisfaction has established benchmarks that influence global logistics standards and practices.

The Japan logistics market refers to the comprehensive ecosystem of transportation, warehousing, distribution, and supply chain management services that facilitate the movement of goods throughout Japan and support the nation’s international trade activities. This market encompasses various segments including freight transportation, third-party logistics services, warehouse operations, and last-mile delivery solutions that collectively enable efficient commerce and manufacturing operations.

Logistics services in Japan are characterized by exceptional attention to detail, punctuality, and service quality that reflect broader cultural values of precision and customer satisfaction. The market includes traditional logistics providers, technology-enabled startups, and integrated supply chain solutions that serve diverse industries from automotive manufacturing to consumer electronics and retail.

Supply chain integration within Japan’s logistics market emphasizes seamless connectivity between manufacturers, distributors, retailers, and end consumers through sophisticated information systems and coordinated transportation networks. This integration supports Japan’s position as a global manufacturing hub and facilitates efficient domestic distribution of both locally produced and imported goods.

Japan’s logistics market demonstrates exceptional sophistication and technological advancement, positioning the nation as a leader in supply chain innovation and operational excellence. The market benefits from comprehensive infrastructure development, including world-class port facilities, extensive rail networks, and advanced highway systems that support efficient cargo movement across the archipelago.

E-commerce growth has emerged as a primary market driver, with online retail adoption accelerating significantly and creating new demands for last-mile delivery services and urban logistics solutions. The sector has responded with innovative delivery methods, including drone technology trials, autonomous vehicle development, and micro-fulfillment center deployment in urban areas.

Sustainability initiatives are increasingly important, with logistics companies implementing green transportation solutions, energy-efficient warehouse operations, and carbon footprint reduction programs. These efforts align with Japan’s broader environmental commitments and corporate social responsibility expectations that influence business operations across all sectors.

Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to enhance service capabilities, expand geographic coverage, and integrate advanced technologies. This consolidation supports improved operational efficiency and enables smaller logistics providers to access sophisticated technology platforms and expanded service networks.

Technology adoption represents a fundamental transformation driver within Japan’s logistics market, with companies implementing advanced solutions to address labor shortages and enhance operational efficiency. Key insights reveal strategic priorities and market developments:

E-commerce expansion continues to drive significant growth in Japan’s logistics market, with online shopping behavior changes creating sustained demand for efficient last-mile delivery services and flexible fulfillment solutions. The shift toward digital commerce has accelerated following global events, establishing new consumer expectations for delivery speed, convenience, and service quality.

Manufacturing excellence requirements support continued logistics market development, as Japan’s automotive, electronics, and precision machinery industries demand sophisticated supply chain solutions. These industries require just-in-time delivery capabilities, quality assurance protocols, and integrated logistics services that maintain production efficiency and product quality standards.

Demographic changes influence logistics market dynamics, with an aging population creating opportunities for specialized delivery services, healthcare logistics, and senior-focused convenience solutions. Labor shortage challenges simultaneously drive automation adoption and technology integration across logistics operations, creating market opportunities for innovative service providers.

Infrastructure investment continues to enhance logistics capabilities, with ongoing port modernization, rail network improvements, and highway system upgrades supporting increased cargo capacity and transportation efficiency. These investments strengthen Japan’s position as a regional logistics hub and facilitate international trade growth.

Sustainability regulations and corporate environmental commitments drive adoption of green logistics solutions, creating market demand for electric vehicles, renewable energy systems, and carbon-neutral transportation options. These environmental considerations increasingly influence logistics provider selection and service design decisions.

Labor shortage challenges represent a significant constraint for Japan’s logistics market, with an aging workforce and declining birth rates creating persistent staffing difficulties across transportation, warehousing, and delivery operations. This demographic challenge requires substantial investment in automation and technology solutions to maintain service levels and operational efficiency.

High operational costs associated with Japan’s advanced infrastructure and quality standards can limit market accessibility for smaller logistics providers and create pricing pressures across the industry. These costs include expensive urban real estate, sophisticated technology requirements, and comprehensive regulatory compliance obligations that impact profitability.

Geographic constraints inherent to Japan’s island geography create logistical complexities and transportation costs that affect supply chain efficiency. Limited land availability in urban areas restricts warehouse expansion opportunities and increases facility costs, particularly in major metropolitan regions where logistics demand is highest.

Regulatory complexity across transportation, environmental, and safety standards requires substantial compliance investments and operational adjustments that can slow market entry and innovation adoption. These regulatory requirements, while ensuring high service quality, create barriers for international logistics providers and technology implementation.

Natural disaster risks including earthquakes, typhoons, and tsunamis create ongoing operational challenges and require comprehensive risk management strategies that increase operational complexity and insurance costs throughout the logistics sector.

Technology integration presents substantial opportunities for logistics market expansion, with artificial intelligence, machine learning, and IoT solutions enabling new service capabilities and operational efficiencies. These technologies support predictive maintenance, demand forecasting, and automated decision-making that enhance service quality while reducing operational costs.

Cross-border e-commerce growth creates opportunities for specialized international logistics services, customs clearance solutions, and integrated supply chain management that support Japanese businesses expanding globally and international companies entering Japan’s market. This trend benefits from Japan’s strategic location and advanced logistics infrastructure.

Sustainable logistics development offers opportunities for companies providing green transportation solutions, renewable energy systems, and carbon footprint reduction services. Growing environmental awareness and regulatory requirements create market demand for innovative sustainability solutions across the logistics sector.

Healthcare logistics expansion opportunities emerge from Japan’s aging population and advanced healthcare system requirements, creating demand for specialized pharmaceutical distribution, medical device logistics, and temperature-controlled transportation services. These specialized services command premium pricing and require sophisticated operational capabilities.

Smart city initiatives across Japan create opportunities for integrated urban logistics solutions, including autonomous delivery systems, traffic optimization technologies, and coordinated distribution networks that reduce congestion and environmental impact while improving service efficiency.

Competitive intensity within Japan’s logistics market drives continuous innovation and service improvement, with established providers competing against technology-enabled startups and international logistics companies. This competition benefits customers through improved service options, competitive pricing, and accelerated technology adoption across the industry.

Customer expectations continue evolving toward greater convenience, transparency, and sustainability, requiring logistics providers to invest in advanced tracking systems, flexible delivery options, and environmental responsibility programs. These expectations influence service design and operational priorities throughout the supply chain.

Technology disruption creates both opportunities and challenges, with emerging solutions like autonomous vehicles, drone delivery, and blockchain technology promising operational improvements while requiring substantial investment and regulatory adaptation. Companies must balance innovation adoption with operational stability and customer service consistency.

Supply chain resilience has become a critical focus following global disruptions, with companies developing diversified supplier networks, flexible logistics capabilities, and risk management strategies. This resilience focus influences logistics provider selection and service design across industries.

Regulatory evolution continues shaping market dynamics, with new environmental standards, safety requirements, and technology regulations influencing operational practices and investment priorities. Logistics providers must adapt to changing regulatory landscapes while maintaining service quality and cost competitiveness.

Comprehensive market analysis for Japan’s logistics sector employs multiple research methodologies to ensure accurate and actionable insights for industry stakeholders. The research approach combines quantitative data analysis with qualitative industry expertise to provide a complete market perspective.

Primary research includes structured interviews with logistics executives, supply chain managers, and industry experts across various market segments. These interviews provide insights into operational challenges, technology adoption trends, and strategic priorities that shape market development. Survey data from logistics service users offers customer perspective on service quality, pricing expectations, and emerging requirements.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial disclosures to establish market trends and competitive dynamics. This research includes examination of regulatory developments, infrastructure investments, and technology adoption patterns that influence market evolution.

Market modeling techniques incorporate economic indicators, demographic trends, and industry-specific factors to project market development scenarios and identify growth opportunities. These models consider various factors including e-commerce growth, manufacturing output, and international trade volumes that drive logistics demand.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review, and industry feedback. This validation approach confirms research findings and enhances the reliability of market insights and projections provided to stakeholders.

Tokyo metropolitan area dominates Japan’s logistics market, accounting for approximately 35% of total logistics activity due to its concentration of corporate headquarters, major ports, and consumer population. The region benefits from sophisticated infrastructure including Haneda and Narita airports, Tokyo Port facilities, and extensive rail networks that support both domestic and international logistics operations.

Osaka-Kansai region represents the second-largest logistics hub, capturing roughly 20% market share through its strategic location, manufacturing base, and Kansai International Airport connectivity. The region serves as a critical distribution point for western Japan and supports significant manufacturing logistics for automotive and electronics industries.

Nagoya region maintains approximately 15% market share as a major manufacturing and logistics center, particularly supporting Japan’s automotive industry concentration. The region benefits from Chubu Centrair International Airport, Port of Nagoya facilities, and strategic highway connections that facilitate efficient cargo movement.

Northern regions including Sendai and Sapporo collectively represent about 12% of logistics activity, with growth driven by agricultural exports, tourism, and regional manufacturing. These areas benefit from specialized cold chain logistics capabilities and seasonal cargo handling expertise.

Southern regions encompassing Kyushu and surrounding areas account for approximately 10% market share, with logistics activity supported by semiconductor manufacturing, agricultural production, and proximity to Asian markets. The remaining 8% market share is distributed across other regional centers and rural logistics networks.

Market leadership in Japan’s logistics sector is characterized by a mix of established domestic providers, international logistics companies, and technology-enabled service providers that compete across various market segments and service categories.

Competitive strategies focus on technology differentiation, service quality enhancement, and operational efficiency improvements that create sustainable competitive advantages in Japan’s demanding logistics market.

By Service Type: Japan’s logistics market encompasses diverse service categories that address specific customer requirements and industry needs across transportation, warehousing, and value-added services.

By End-User Industry: Market segmentation reflects diverse industry requirements and specialized logistics needs across Japan’s economy.

Express delivery services demonstrate the strongest growth momentum, driven by e-commerce expansion and consumer demand for faster delivery options. This category benefits from urbanization trends, changing shopping behaviors, and technology integration that enables efficient last-mile delivery solutions. Companies in this segment invest heavily in sorting automation, route optimization, and alternative delivery methods.

Third-party logistics services show robust expansion as companies increasingly outsource supply chain management to specialized providers. This trend reflects corporate focus on core business activities, cost optimization, and access to advanced logistics technologies. 3PL providers offer comprehensive solutions including inventory management, order processing, and integrated transportation services.

Cold chain logistics experiences steady growth driven by food safety requirements, pharmaceutical distribution needs, and consumer demand for fresh products. This specialized segment requires significant infrastructure investment, regulatory compliance, and technical expertise that create barriers to entry and support premium pricing.

International logistics services benefit from Japan’s export economy and cross-border e-commerce growth, with companies providing customs clearance, freight forwarding, and integrated supply chain solutions. This category requires expertise in international regulations, documentation, and coordination across multiple transportation modes.

Warehouse automation represents a rapidly growing category as companies address labor shortages and efficiency requirements through robotic systems, automated storage solutions, and intelligent inventory management technologies. This segment attracts significant investment and drives operational transformation across the logistics industry.

Operational efficiency improvements through advanced logistics services enable companies to reduce costs, improve customer satisfaction, and focus resources on core business activities. These benefits include optimized inventory levels, faster order fulfillment, and enhanced supply chain visibility that support competitive advantages.

Market access expansion through professional logistics services allows businesses to reach new customer segments, geographic markets, and distribution channels. Logistics providers offer expertise in regulatory compliance, local market knowledge, and established distribution networks that facilitate business growth and market penetration.

Technology advancement access through logistics partnerships enables companies to leverage sophisticated systems and capabilities without substantial internal investment. These technologies include warehouse management systems, transportation optimization, and real-time tracking that enhance operational performance and customer service.

Risk mitigation through diversified logistics networks and professional risk management reduces supply chain vulnerabilities and operational disruptions. Logistics providers offer backup capabilities, alternative transportation routes, and comprehensive insurance coverage that protect business continuity.

Sustainability achievement through green logistics solutions helps companies meet environmental commitments and regulatory requirements while reducing operational costs. These solutions include fuel-efficient transportation, renewable energy systems, and waste reduction programs that support corporate social responsibility objectives.

Customer satisfaction enhancement through reliable, flexible logistics services improves brand reputation and customer loyalty. Professional logistics providers offer consistent service quality, transparent communication, and responsive customer support that strengthen business relationships and market position.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration continues transforming Japan’s logistics landscape, with companies implementing robotic systems, artificial intelligence, and machine learning solutions to address labor shortages and enhance operational efficiency. This trend includes warehouse automation, autonomous vehicles, and predictive analytics that optimize supply chain performance.

Sustainability integration becomes increasingly important as companies adopt green logistics practices, alternative fuel vehicles, and carbon footprint reduction programs. This trend reflects environmental regulations, corporate social responsibility commitments, and customer expectations for sustainable business practices.

Last-mile innovation drives development of new delivery methods including drone technology, autonomous delivery vehicles, and micro-fulfillment centers that improve urban logistics efficiency. These innovations address congestion challenges, reduce delivery costs, and enhance customer convenience in metropolitan areas.

Digital transformation encompasses comprehensive technology adoption across logistics operations, including cloud-based management systems, IoT sensors, and blockchain technology that improve visibility, security, and operational coordination throughout supply chains.

Customer-centric services evolution includes flexible delivery options, real-time tracking, and personalized logistics solutions that meet changing consumer expectations and business requirements. This trend drives service differentiation and competitive positioning in Japan’s demanding market environment.

Supply chain resilience development focuses on diversified networks, risk management strategies, and flexible operational capabilities that maintain service continuity during disruptions. This trend influences logistics provider selection and service design across industries.

Technology partnerships between logistics companies and technology providers accelerate innovation adoption and capability development across the industry. These collaborations focus on automation solutions, data analytics, and integrated platforms that enhance operational performance and customer service capabilities.

Infrastructure investments by government and private sector continue expanding logistics capabilities, including port modernization, rail network improvements, and smart logistics facility development. These investments support increased cargo capacity, operational efficiency, and international competitiveness.

Regulatory updates address environmental standards, safety requirements, and technology adoption guidelines that influence operational practices and investment priorities. Recent developments include drone delivery regulations, autonomous vehicle testing frameworks, and carbon emission standards for transportation.

Market consolidation through mergers, acquisitions, and strategic partnerships creates larger, more capable logistics providers with enhanced service offerings and geographic coverage. This consolidation trend enables improved operational efficiency and technology investment capabilities.

International expansion by Japanese logistics companies supports global supply chain development and cross-border trade facilitation. These expansion efforts include overseas facility development, partnership agreements, and service capability enhancement in key international markets.

Sustainability initiatives across the industry include electric vehicle adoption, renewable energy implementation, and waste reduction programs that address environmental commitments and regulatory requirements. These initiatives demonstrate industry leadership in sustainable business practices.

Technology investment should remain a priority for logistics companies seeking competitive advantages and operational efficiency improvements. MarkWide Research analysis indicates that companies implementing comprehensive automation and digital solutions achieve significant productivity gains while addressing labor shortage challenges effectively.

Sustainability integration requires strategic planning and systematic implementation across operations, with companies developing comprehensive environmental programs that address regulatory requirements and customer expectations. Early adoption of green logistics solutions creates competitive advantages and supports long-term market positioning.

Customer experience enhancement through service innovation and technology adoption enables differentiation in Japan’s competitive logistics market. Companies should focus on flexibility, transparency, and convenience that meet evolving customer expectations and support business growth.

Partnership strategies can accelerate capability development and market expansion while sharing investment costs and risks. Strategic alliances with technology providers, international logistics companies, and industry specialists create opportunities for enhanced service offerings and operational improvements.

Risk management development should address natural disaster preparedness, supply chain disruptions, and operational continuity requirements. Comprehensive risk strategies including diversified networks, backup capabilities, and insurance coverage protect business operations and customer service.

Market expansion opportunities in specialized segments such as healthcare logistics, cross-border e-commerce, and sustainable transportation offer growth potential and premium pricing opportunities for companies with appropriate capabilities and expertise.

Growth trajectory for Japan’s logistics market remains positive, supported by e-commerce expansion, technology adoption, and infrastructure development that create sustained demand for advanced logistics services. MWR projections indicate continued market expansion driven by digital transformation and evolving customer requirements.

Technology evolution will continue reshaping logistics operations, with artificial intelligence, autonomous systems, and advanced analytics becoming standard capabilities across the industry. These technologies promise substantial efficiency improvements and new service possibilities that enhance competitive positioning.

Sustainability requirements will increasingly influence logistics operations, with environmental regulations and corporate commitments driving adoption of green transportation, renewable energy, and carbon-neutral logistics solutions. Companies preparing for these requirements will achieve competitive advantages and regulatory compliance.

Market consolidation trends are expected to continue, creating larger, more capable logistics providers with enhanced technology capabilities and geographic coverage. This consolidation supports improved operational efficiency and enables substantial technology investments that benefit the entire industry.

International integration will expand as Japan’s logistics companies develop global capabilities and international providers enhance their Japanese operations. This integration supports cross-border trade growth and creates opportunities for specialized international logistics services.

Customer expectations will continue evolving toward greater convenience, sustainability, and transparency, requiring ongoing service innovation and operational adaptation. Companies that anticipate and respond to these expectations will maintain competitive advantages and market leadership positions.

Japan’s logistics market represents a sophisticated and dynamic sector characterized by technological excellence, operational efficiency, and continuous innovation that supports the nation’s economic competitiveness and international trade relationships. The market demonstrates remarkable adaptability in addressing challenges such as labor shortages, environmental requirements, and evolving customer expectations through strategic technology adoption and service innovation.

Future success in Japan’s logistics market will depend on companies’ ability to integrate advanced technologies, develop sustainable operations, and maintain service excellence while adapting to changing market conditions and customer requirements. The sector’s emphasis on quality, reliability, and innovation creates opportunities for companies that can deliver superior value and operational performance.

Strategic positioning requires comprehensive understanding of market dynamics, customer needs, and technological capabilities that enable competitive advantages and sustainable growth. Companies that successfully navigate Japan’s complex logistics environment while embracing innovation and sustainability will achieve long-term success and market leadership in this critical economic sector.

What is Logistics?

Logistics refers to the detailed organization and implementation of complex operations involving the movement of goods, services, and information. In the context of Japan, it encompasses various activities such as transportation, warehousing, inventory management, and supply chain coordination.

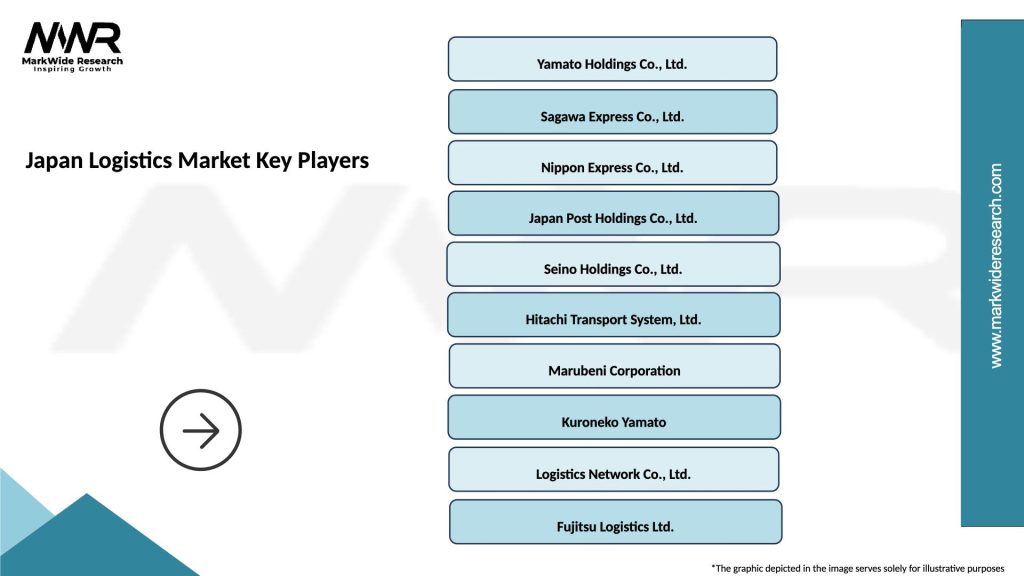

What are the key players in the Japan Logistics Market?

The Japan Logistics Market features several prominent companies, including Nippon Express, Yamato Holdings, and Sagawa Express, which provide a range of logistics services from freight forwarding to last-mile delivery, among others.

What are the main drivers of growth in the Japan Logistics Market?

Key drivers of growth in the Japan Logistics Market include the rise of e-commerce, increasing demand for efficient supply chain solutions, and advancements in technology such as automation and data analytics, which enhance operational efficiency.

What challenges does the Japan Logistics Market face?

The Japan Logistics Market faces challenges such as labor shortages, rising transportation costs, and regulatory compliance issues, which can impact service delivery and operational efficiency.

What opportunities exist in the Japan Logistics Market?

Opportunities in the Japan Logistics Market include the expansion of e-commerce logistics, the adoption of green logistics practices, and the integration of innovative technologies like IoT and AI to optimize supply chain processes.

What trends are shaping the Japan Logistics Market?

Trends shaping the Japan Logistics Market include the increasing focus on sustainability, the growth of omnichannel logistics strategies, and the use of advanced technologies such as robotics and blockchain to enhance transparency and efficiency.

Japan Logistics Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Freight Forwarding, Last-Mile Delivery |

| End User | E-commerce, Manufacturing, Retail, Automotive |

| Technology | IoT, Automation, Blockchain, AI |

| Distribution Channel | Direct, Third-Party Logistics, Online, Offline |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at