444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan lithium niobate modulator market is advancing quickly as optical communications upgrade to higher baud rates, coherent transmission, and integrated photonics. Lithium niobate (LiNbO3)—valued for its large electro-optic coefficient, low half-wave voltage, and temperature stability—remains the gold standard for external modulators used in metro, long-haul, and data-center interconnects. In Japan, demand is propelled by 400G/800G rollouts, 5G/FTTx densification, emerging 1.6T trials, and growth in quantum photonics and microwave photonics. Carriers and hyperscalers are prioritizing devices with low insertion loss, very high linearity, and compact footprints, while equipment vendors pivot to pluggable coherent optics. Market momentum points to a sustained expansion at an estimated 7.9% CAGR across the latter 2020s as LiNbO3 evolves from discrete bench-top devices toward wafer-scale, thin-film platforms compatible with hybrid integration.

Performance advantages—including low chirp, high extinction ratio, and proven reliability—keep LiNbO3 central even as silicon photonics and indium phosphide advance. Thin-film lithium niobate (TFLN) foundry processes are improving yield and enabling tighter RF/optical confinement, trimming drive voltages by 20–30% versus conventional bulk devices. Japan’s well-developed component supply chain, robust telecom standards, and R&D ecosystem support steady commercialization of next-gen modulators aligned to domestic and export opportunities.

The Japan lithium niobate modulator market refers to the ecosystem of companies, technologies, and applications in Japan focused on designing, fabricating, packaging, and integrating lithium niobate electro-optic modulators used to encode information onto light for fiber-optic transmission. It spans bulk and thin-film LiNbO3, analog and digital formats, and applications from coherent communications to microwave photonics, lidar, sensing, and quantum systems.

In practice, lithium niobate modulators convert electrical drive signals into controlled changes in optical phase or amplitude, enabling high-speed data modulation with low distortion. Japanese network operators, data centers, test & measurement vendors, and research labs rely on these devices for stable, high-rate, low-noise optical links.

Japan’s market is transitioning from legacy bulk LiNbO3 devices to compact, lower-Vπ thin-film designs suitable for co-packaging with drivers and coherent DSPs. Domestic demand is amplified by metro core upgrades and data-center spine/leaf refresh cycles: 400G ZR/ZR+ has achieved > 40% penetration in new coherent deployments, while early 800G adoption is ramping in trials. Suppliers are differentiating on insertion loss reductions of ~0.5–1.0 dB, improved linearity for analog photonics, and better thermal management for field stability. According to MarkWide Research, Japan’s ecosystem benefits from cross-fertilization between telecom photonics, precision RF, and materials science—accelerating time-to-market for TFLN modulators and paving a path toward integrated electro-optic engines.

Key strategic vectors include wafer-scale manufacturing, hybrid integration with Si/SiN, and packaging innovations that cut total power by 10–15% at the line card. With component miniaturization and improved yield, the addressable scope expands into microwave photonics (optical true-time delay, radar) and quantum (entangled photon sources, frequency conversion), reinforcing medium-term growth.

Market dynamics reflect a platform transition and vertical co-design. System OEMs require modulators that sustain > 90 Gbaud with low drive voltage and stable extinction across temperature ranges; suppliers respond with TFLN ridge waveguides, traveling-wave electrodes, and improved mode converters. Power budgets are shrinking at the line card: new packages paired with efficient drivers yield end-to-end power reductions of 10–15%, a decisive advantage in dense data-center racks. Japan’s focus on quality and long-term reliability sustains LiNbO3 adoption in coherent links while opening adjacent opportunities in sensing and lab instrumentation.

Ecosystem collaboration is intensifying. Co-optimization among modulator vendors, driver IC designers, and DSP teams improves signal integrity, allowing higher symbol rates with lower penalties. As MarkWide Research notes, the winners will blend materials leadership with packaging and RF engineering, enabling repeatable, scalable modulators that integrate seamlessly into pluggable form factors and PIC-centric architectures.

This assessment integrates primary interviews with Japanese optical component vendors, system OEMs, and carriers, plus secondary analysis of technical literature and standards activity. Forecasts employ bottom-up unit modeling tied to coherent port deployments and a top-down alignment to transport/datacom capex scenarios. MarkWide Research applies data triangulation and sensitivity testing across yield, ASP, and bandwidth adoption curves to bound outcomes for TFLN and bulk LiNbO3 trajectories.

Within Japan, demand clusters around high-density network corridors and R&D hubs:

| Segmentation Details | Description |

|---|---|

| By Platform | Bulk LiNbO3 Modulators; Thin-Film LiNbO3 (TFLN) Modulators |

| By Modulation Type | Phase Modulators; Intensity (MZM) Modulators; I/Q Coherent Modulators |

| By Application | Coherent Communications (400G/800G/1.6T); Analog/Microwave Photonics; Sensing/Lidar; Quantum/Nonlinear Optics; Test & Measurement |

| By Package | Benchtop/Module; Pigtailed Device; Co-packaged with Driver; Pluggable-Module Integrated |

| By End User | Network Operators; Data Centers/Cloud; Equipment OEMs; Research & Defense; Instrumentation Vendors |

Strengths:

Weaknesses:

Opportunities:

Threats:

The Japan lithium niobate modulator market is set for healthy growth at ~7.9% CAGR as coherent optics proliferate and TFLN matures into a high-volume platform. By 2030, thin-film variants could exceed 50% of new design-ins, supported by hybrid PIC strategies and line-card power budgets that reward low-Vπ architectures. MarkWide Research anticipates broader adoption in analog photonics with annual growth near 8.2%, while quantum/nonlinear pilots transition to early commercial supply chains. Export momentum should remain strong as Japan leverages quality leadership and packaging excellence.

In conclusion, Japan’s lithium niobate modulator landscape is evolving from proven bulk devices to agile, wafer-scale TFLN platforms that meet the speed, power, and integration demands of modern optical networks. Rooted in materials science strength and packaging rigor, Japanese suppliers are well positioned to deliver the low-loss, low-Vπ, high-reliability modulators that coherent optics, microwave photonics, and quantum applications require. With ecosystem collaboration, manufacturing scale-up, and disciplined co-design across drivers and DSPs, the market is set to expand domestically and internationally—cementing LiNbO3 as a cornerstone of high-performance electro-optic modulation for the decade ahead.

What is Lithium Niobate Modulator?

Lithium Niobate Modulator refers to a device that utilizes lithium niobate crystals to modulate light signals in optical communication systems. These modulators are essential for high-speed data transmission and are widely used in telecommunications and photonics applications.

What are the key players in the Japan Lithium Niobate Modulator Market?

Key players in the Japan Lithium Niobate Modulator Market include companies such as Fujitsu, NTT Electronics, and Sumitomo Electric Industries, which are known for their advancements in optical technologies and modulators, among others.

What are the growth factors driving the Japan Lithium Niobate Modulator Market?

The Japan Lithium Niobate Modulator Market is driven by the increasing demand for high-speed internet and the expansion of data centers. Additionally, advancements in telecommunications infrastructure and the rise of 5G technology are significant contributors to market growth.

What challenges does the Japan Lithium Niobate Modulator Market face?

Challenges in the Japan Lithium Niobate Modulator Market include the high manufacturing costs associated with lithium niobate materials and competition from alternative modulation technologies. These factors can hinder market expansion and innovation.

What opportunities exist in the Japan Lithium Niobate Modulator Market?

Opportunities in the Japan Lithium Niobate Modulator Market include the growing adoption of optical communication systems in various industries and the potential for innovations in modulator designs. The increasing focus on renewable energy sources also presents new applications for these devices.

What trends are shaping the Japan Lithium Niobate Modulator Market?

Trends in the Japan Lithium Niobate Modulator Market include the development of integrated photonic circuits and the miniaturization of modulator devices. Additionally, there is a growing emphasis on enhancing the performance and efficiency of modulators for next-generation communication systems.

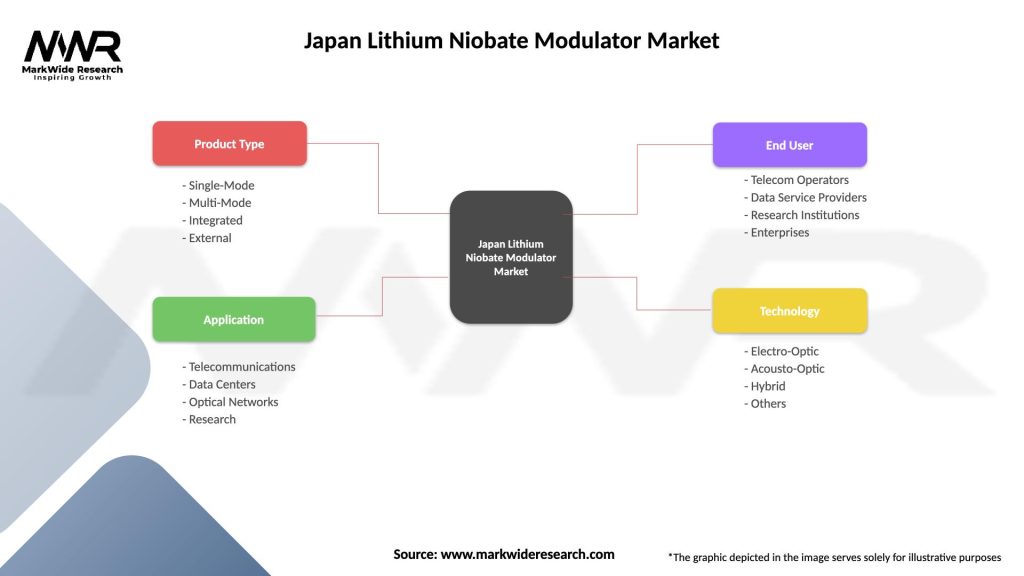

Japan Lithium Niobate Modulator Market

| Segmentation Details | Description |

|---|---|

| Product Type | Single-Mode, Multi-Mode, Integrated, External |

| Application | Telecommunications, Data Centers, Optical Networks, Research |

| End User | Telecom Operators, Data Service Providers, Research Institutions, Enterprises |

| Technology | Electro-Optic, Acousto-Optic, Hybrid, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Japan Lithium Niobate Modulator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at