444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan life and non-life insurance market represents one of the most mature and sophisticated insurance ecosystems globally, characterized by robust regulatory frameworks and innovative product offerings. Japan’s insurance sector has evolved significantly over the past decades, adapting to demographic shifts, technological advancements, and changing consumer preferences. The market demonstrates remarkable resilience with life insurance penetration rates reaching approximately 8.2% of GDP, positioning Japan among the world’s leading insurance markets.

Market dynamics in Japan’s insurance sector reflect the country’s unique demographic profile, with an aging population driving demand for comprehensive life insurance products and healthcare coverage. The non-life insurance segment continues to expand, supported by increasing awareness of natural disaster risks and mandatory automobile insurance requirements. Digital transformation initiatives are reshaping traditional insurance operations, with companies investing heavily in artificial intelligence, blockchain technology, and customer-centric digital platforms.

Regulatory environment plays a crucial role in shaping market development, with the Financial Services Agency implementing progressive policies to enhance consumer protection and promote market competition. The sector experiences steady growth with annual premium growth rates averaging 2.8% across combined life and non-life segments, driven by product innovation and expanding distribution channels.

The Japan life and non-life insurance market refers to the comprehensive ecosystem of insurance products and services offered within Japan’s domestic market, encompassing both life insurance coverage for mortality and longevity risks, and non-life insurance protection against property, casualty, and liability exposures. This market includes traditional life insurance policies, annuities, health insurance products, automobile insurance, property insurance, marine insurance, and specialized commercial coverage lines.

Life insurance components within this market include whole life policies, term life insurance, endowment policies, individual and group annuities, medical insurance, and long-term care coverage. Non-life insurance segments encompass automobile insurance, fire and property insurance, marine and cargo insurance, personal accident coverage, liability insurance, and emerging cyber insurance products. The market operates through diverse distribution channels including traditional agents, banks, post offices, online platforms, and direct sales operations.

Market participants include domestic insurance companies, foreign insurers, mutual insurance organizations, and cooperative insurance entities, all operating under comprehensive regulatory oversight to ensure financial stability and consumer protection throughout Japan’s insurance landscape.

Japan’s insurance market maintains its position as a global leader in insurance penetration and premium volume, driven by sophisticated consumer demand and comprehensive product portfolios. The market benefits from strong regulatory frameworks, technological innovation, and evolving distribution strategies that address changing demographic and economic conditions. Life insurance dominance continues with approximately 75% of total premium volume, while non-life insurance segments demonstrate steady growth across multiple product lines.

Key market characteristics include high consumer awareness of insurance benefits, extensive product customization capabilities, and robust financial strength among leading insurers. The sector adapts continuously to Japan’s aging society through innovative product development, enhanced digital services, and strategic partnerships with healthcare providers and financial institutions.

Growth drivers encompass increasing longevity risks, natural disaster preparedness, regulatory modernization, and digital transformation initiatives. The market faces challenges from low interest rate environments, intense competition, and evolving consumer preferences toward more flexible and affordable insurance solutions. Future prospects remain positive with anticipated growth in health insurance, cyber coverage, and technology-enabled insurance services.

Strategic market insights reveal several critical trends shaping Japan’s insurance landscape:

Demographic shifts serve as the primary driver for Japan’s insurance market expansion, with an aging population requiring comprehensive life insurance and healthcare coverage solutions. The country’s life expectancy rates among the world’s highest create sustained demand for longevity insurance products and retirement planning services. Urbanization trends and changing family structures drive demand for individual insurance policies rather than traditional family-based coverage approaches.

Natural disaster risks significantly influence non-life insurance demand, with Japan’s exposure to earthquakes, typhoons, and flooding creating consistent need for comprehensive property and casualty coverage. Climate change impacts intensify these risks, leading to increased insurance penetration and more sophisticated risk assessment methodologies. Government initiatives promoting disaster preparedness further stimulate insurance adoption across residential and commercial segments.

Technological advancement drives market growth through improved customer experiences, streamlined operations, and innovative product offerings. Digital health monitoring technologies enable personalized insurance products and wellness programs that attract health-conscious consumers. Regulatory support for innovation creates favorable conditions for new product development and market entry strategies.

Economic stability and high disposable income levels support sustained insurance premium growth, while financial literacy improvements increase consumer understanding of insurance benefits and long-term financial planning importance.

Low interest rate environment presents significant challenges for life insurance companies, reducing investment returns and pressuring product profitability margins. Prolonged monetary easing policies limit insurers’ ability to generate attractive returns on traditional guaranteed products, forcing product redesign and pricing adjustments that may reduce consumer appeal.

Intense market competition constrains premium growth and profit margins, particularly in mature product segments where differentiation becomes increasingly difficult. Price competition among insurers, especially in automobile insurance, reduces profitability and limits resources available for innovation and expansion initiatives.

Regulatory compliance costs continue rising as authorities implement more stringent capital requirements and consumer protection measures. Solvency regulations require substantial capital allocation that could otherwise support growth initiatives or product development activities.

Changing consumer preferences toward more flexible and affordable insurance options challenge traditional product structures and distribution models. Younger demographics show reduced interest in traditional whole life insurance products, preferring term insurance and investment-linked alternatives. Digital-native consumers demand seamless online experiences that require significant technology investments from traditional insurers.

Economic uncertainties and potential recession risks may reduce consumer spending on discretionary insurance products, while deflationary pressures limit premium growth potential across various insurance segments.

Digital transformation opportunities present substantial growth potential through enhanced customer engagement, operational efficiency improvements, and innovative product development capabilities. Artificial intelligence applications enable personalized insurance offerings, automated underwriting processes, and predictive risk assessment models that improve both customer satisfaction and profitability.

Health insurance expansion offers significant growth prospects as consumers increasingly prioritize healthcare coverage and wellness programs. Preventive healthcare integration with insurance products creates opportunities for risk reduction and customer loyalty enhancement. Telemedicine adoption accelerated by recent global events opens new avenues for health insurance product innovation and service delivery.

Cyber insurance demand grows rapidly as businesses and individuals recognize increasing cybersecurity risks and data protection requirements. Digital economy expansion creates new insurance needs for online businesses, digital assets, and technology-related liabilities that traditional insurance products cannot adequately address.

Sustainable insurance products align with growing environmental consciousness and ESG investment trends. Green insurance initiatives support renewable energy projects and environmentally responsible business practices while creating new revenue streams for forward-thinking insurers.

Regional expansion opportunities exist through strategic partnerships and technology sharing with emerging Asian markets. Cross-border collaboration enables Japanese insurers to leverage their expertise and technological capabilities in rapidly growing regional insurance markets.

Supply-side dynamics in Japan’s insurance market reflect intense competition among established domestic insurers and growing presence of foreign companies seeking market share. Market consolidation trends continue as smaller insurers merge or form strategic alliances to achieve economies of scale and enhance competitive positioning. Product innovation cycles accelerate as companies invest in research and development to differentiate their offerings and capture emerging market segments.

Demand-side factors demonstrate evolving consumer preferences toward more transparent, flexible, and digitally accessible insurance products. Customer expectations increasingly focus on seamless digital experiences, personalized coverage options, and value-added services beyond traditional insurance protection. Generational differences in insurance purchasing behavior require tailored marketing strategies and product designs.

Regulatory dynamics continue evolving with authorities balancing market liberalization objectives against consumer protection and financial stability concerns. Solvency II implementation influences capital allocation strategies and risk management practices across the industry. Data protection regulations impact customer data utilization and digital service development initiatives.

Technological disruption reshapes traditional insurance value chains through automation, artificial intelligence, and blockchain applications. InsurTech partnerships enable established insurers to access innovative technologies and business models while maintaining regulatory compliance and customer trust.

Comprehensive research approach combines quantitative analysis of market data with qualitative insights from industry stakeholders, regulatory authorities, and consumer surveys. Primary research activities include structured interviews with insurance company executives, distribution channel partners, and regulatory officials to gather firsthand market intelligence and strategic perspectives.

Secondary research methodology encompasses analysis of financial statements, regulatory filings, industry reports, and academic studies to establish market trends and competitive dynamics. Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert verification procedures.

Market segmentation analysis utilizes statistical modeling techniques to identify growth patterns, customer preferences, and competitive positioning across different insurance product categories and distribution channels. Trend analysis incorporates historical data patterns with forward-looking indicators to project market development scenarios.

Stakeholder consultation includes engagement with consumer advocacy groups, industry associations, and technology providers to understand market dynamics from multiple perspectives. Regional analysis examines prefecture-level variations in insurance penetration, regulatory implementation, and consumer behavior patterns to provide comprehensive market understanding.

Tokyo metropolitan area dominates Japan’s insurance market with approximately 35% of total premium volume, driven by high population density, elevated income levels, and concentration of corporate headquarters requiring comprehensive commercial insurance coverage. Greater Tokyo region demonstrates the highest penetration rates for sophisticated insurance products including variable life insurance, investment-linked policies, and specialized commercial coverage lines.

Osaka and Kansai region represents the second-largest insurance market, accounting for roughly 18% of national premium volume. Industrial concentration in this region drives demand for commercial property insurance, marine coverage, and liability protection for manufacturing and trading companies. Consumer preferences in Kansai show strong affinity for traditional life insurance products and family-oriented coverage plans.

Regional prefectures collectively contribute 47% of total market volume, with notable variations in product preferences and distribution channel effectiveness. Rural areas maintain higher reliance on traditional agent networks and mutual insurance cooperatives, while suburban regions increasingly adopt digital insurance services and direct sales channels.

Northern prefectures including Hokkaido demonstrate elevated demand for property insurance due to harsh weather conditions and natural disaster risks. Southern regions show increased interest in health insurance and long-term care coverage, reflecting demographic trends and lifestyle factors. Coastal areas maintain strong marine insurance markets supporting fishing and shipping industries.

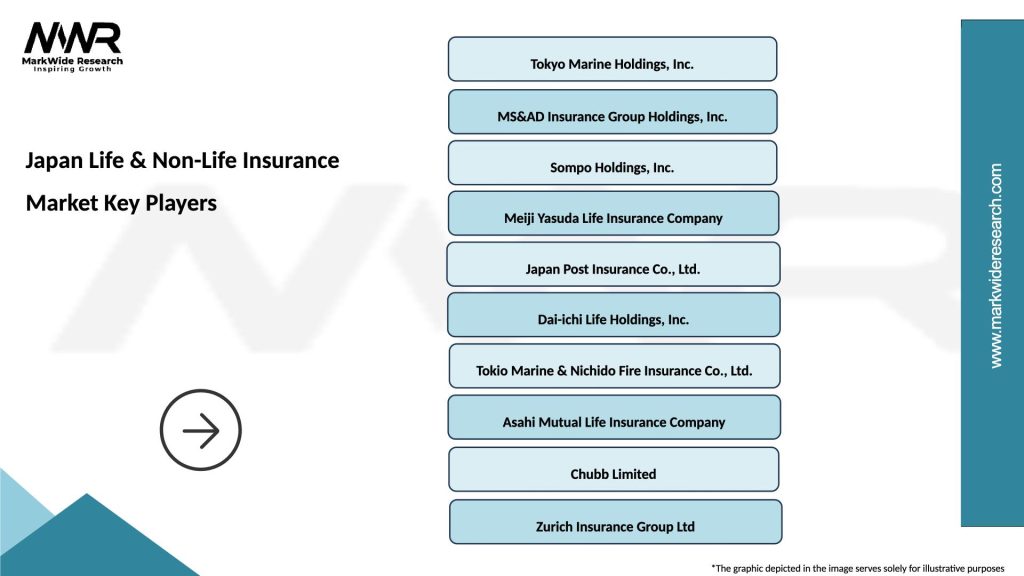

Market leadership remains concentrated among established domestic insurers with strong brand recognition and extensive distribution networks:

Competitive strategies emphasize digital transformation, customer experience enhancement, and product innovation to maintain market position. Foreign insurers continue expanding their presence through strategic partnerships, acquisitions, and specialized product offerings targeting underserved market segments.

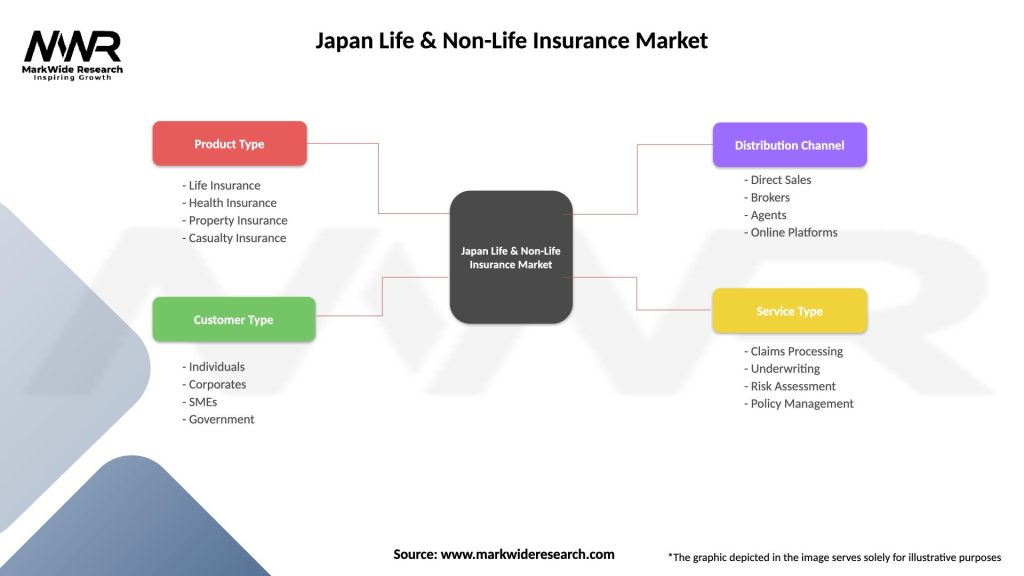

By Product Type:

By Distribution Channel:

By Customer Segment:

Life Insurance Category maintains market dominance with traditional whole life products remaining popular among Japanese consumers seeking long-term financial security and savings accumulation. Product evolution toward more flexible and transparent offerings responds to changing consumer preferences and regulatory requirements. Variable life insurance gains traction among younger demographics seeking investment-linked benefits and portfolio diversification.

Health Insurance Segment experiences robust growth driven by aging population demographics and increasing healthcare costs. Medical expense coverage becomes essential for middle-aged consumers, while long-term care insurance addresses specific needs of elderly populations. Wellness programs integrated with health insurance policies promote preventive care and risk reduction strategies.

Property Insurance Category benefits from heightened awareness of natural disaster risks and mandatory coverage requirements. Earthquake insurance penetration increases following recent seismic events, while flood coverage gains importance due to climate change impacts. Smart home technology integration enables usage-based pricing and risk mitigation services.

Automobile Insurance Market faces challenges from declining vehicle ownership among younger demographics but benefits from mandatory insurance requirements and comprehensive coverage options. Telematics-based insurance emerges as growth driver through personalized pricing and safety monitoring capabilities.

Insurance Companies benefit from market stability, regulatory clarity, and sophisticated consumer demand that supports premium pricing and product innovation initiatives. Diversification opportunities across life and non-life segments provide risk mitigation and revenue optimization potential. Technology adoption enables operational efficiency improvements and enhanced customer engagement capabilities.

Consumers gain access to comprehensive insurance protection, competitive pricing, and innovative product features that address evolving risk management needs. Digital services improve convenience and accessibility while regulatory oversight ensures consumer protection and fair treatment standards.

Distribution Partners including agents, banks, and brokers benefit from diverse product portfolios, competitive commission structures, and technology support systems. Training programs and marketing support enhance sales effectiveness and customer satisfaction levels.

Regulatory Authorities achieve policy objectives through market stability, consumer protection, and financial system resilience. Innovation frameworks balance market development with prudential oversight requirements.

Economic Stakeholders benefit from insurance sector contributions to capital formation, employment generation, and financial system stability. Investment activities by insurance companies support infrastructure development and economic growth initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Customer Experience emerges as the dominant trend, with insurers investing heavily in mobile applications, online platforms, and artificial intelligence-powered customer service capabilities. Omnichannel integration provides seamless customer journeys across traditional and digital touchpoints, while personalization engines deliver customized product recommendations and pricing options.

Parametric Insurance Innovation gains momentum as insurers develop products that provide automatic payouts based on predetermined triggers rather than traditional claims assessment processes. Weather-based coverage for agricultural risks and earthquake parametric products demonstrate practical applications of this innovative approach.

ESG Integration becomes increasingly important as insurers incorporate environmental, social, and governance factors into underwriting decisions, investment strategies, and product development initiatives. Sustainable insurance products support renewable energy projects and environmentally responsible business practices.

Wellness and Prevention Focus transforms health insurance offerings through integrated wellness programs, preventive care incentives, and health monitoring technologies. Wearable device integration enables real-time health tracking and personalized risk assessment capabilities.

Collaborative Ecosystems develop as insurers partner with technology companies, healthcare providers, and financial institutions to create comprehensive customer solutions beyond traditional insurance coverage.

Regulatory modernization initiatives continue reshaping the industry landscape with authorities implementing progressive policies to enhance market competition and consumer choice. Solvency regulations evolve to better reflect risk profiles while maintaining financial stability requirements. Data protection frameworks establish clear guidelines for customer information utilization and privacy protection.

Technology partnerships accelerate as traditional insurers collaborate with InsurTech companies to access innovative solutions and digital capabilities. Artificial intelligence deployment expands across underwriting, claims processing, and customer service functions. Blockchain applications emerge for policy administration and claims settlement automation.

Product innovation cycles shorten as companies respond rapidly to changing market conditions and consumer preferences. Micro-insurance products target specific risks and demographics, while usage-based insurance models gain acceptance across multiple product lines.

Market consolidation activities include strategic mergers, acquisitions, and partnership agreements aimed at achieving operational synergies and market expansion objectives. International expansion strategies focus on Asian markets with growth potential and demographic similarities to Japan.

Sustainability initiatives encompass carbon-neutral operations, responsible investment practices, and climate risk assessment integration into business operations and product development processes.

MarkWide Research recommends that insurance companies prioritize digital transformation investments to enhance customer engagement and operational efficiency. Technology adoption should focus on artificial intelligence applications for underwriting automation, customer service enhancement, and predictive analytics capabilities that improve risk assessment accuracy and customer satisfaction levels.

Product development strategies should emphasize flexibility, transparency, and customer-centric design principles that address evolving consumer preferences and demographic trends. Health insurance expansion presents significant growth opportunities through comprehensive coverage options, wellness program integration, and preventive care incentives that reduce long-term claims costs.

Distribution channel optimization requires balanced investment in traditional agent networks and digital platforms to serve diverse customer segments effectively. Omnichannel strategies should provide seamless customer experiences while maintaining cost efficiency and regulatory compliance standards.

Risk management enhancement becomes critical as climate change and cyber threats create new exposure categories requiring sophisticated assessment and mitigation strategies. Parametric insurance development offers innovative solutions for emerging risks while reducing claims processing complexity and customer uncertainty.

Strategic partnerships with technology providers, healthcare organizations, and financial institutions enable comprehensive customer solutions and market expansion opportunities beyond traditional insurance boundaries.

Long-term growth prospects for Japan’s insurance market remain positive despite demographic challenges, supported by product innovation, digital transformation, and expanding coverage needs across emerging risk categories. Market evolution toward more personalized, technology-enabled insurance solutions will continue reshaping traditional business models and customer relationships.

Demographic transitions will drive sustained demand for health insurance, long-term care coverage, and retirement planning products, while creating opportunities for innovative service delivery models. Technology integration will enable more accurate risk assessment, streamlined operations, and enhanced customer experiences across all insurance segments.

Regulatory environment is expected to remain supportive of innovation while maintaining strong consumer protection and financial stability oversight. Market liberalization initiatives may create additional competitive pressures but also expand opportunities for differentiation and specialization strategies.

Climate change adaptation will necessitate continuous evolution of property and casualty insurance products, with increased emphasis on risk mitigation, parametric coverage options, and sustainable business practices. Cyber insurance growth will accelerate as digital transformation increases exposure to technology-related risks across all economic sectors.

International expansion opportunities will enable Japanese insurers to leverage their expertise and technological capabilities in rapidly growing Asian markets, while domestic market consolidation may create larger, more efficient industry participants capable of competing globally. MWR analysis projects continued market growth with annual expansion rates of approximately 3.2% over the next five years, driven by innovation adoption and evolving customer needs.

Japan’s life and non-life insurance market demonstrates remarkable resilience and adaptability in addressing evolving demographic, technological, and economic challenges. The sector’s strength lies in its mature regulatory framework, sophisticated consumer base, and commitment to innovation that positions it for sustained growth despite structural headwinds. Digital transformation initiatives and product innovation continue reshaping traditional insurance paradigms while maintaining the industry’s fundamental role in risk management and financial protection.

Future success will depend on insurers’ ability to balance traditional strengths with emerging opportunities in health insurance, cyber coverage, and technology-enabled services. Strategic adaptation to demographic changes, regulatory evolution, and competitive pressures will determine market leadership positions in the coming decades. The industry’s commitment to customer-centric solutions, operational excellence, and sustainable business practices ensures continued relevance and growth potential in Japan’s evolving economic landscape.

What is Life & Non-Life Insurance?

Life & Non-Life Insurance refers to the two main categories of insurance products. Life insurance provides financial protection to beneficiaries upon the policyholder’s death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

What are the key players in the Japan Life & Non-Life Insurance Market?

Key players in the Japan Life & Non-Life Insurance Market include companies like Nippon Life Insurance, Tokio Marine Holdings, and Dai-ichi Life Holdings, among others. These companies offer a range of products catering to both individual and corporate clients.

What are the growth factors driving the Japan Life & Non-Life Insurance Market?

The Japan Life & Non-Life Insurance Market is driven by factors such as an aging population, increasing awareness of insurance products, and the rising demand for health and life coverage. Additionally, advancements in technology are enhancing customer engagement and service delivery.

What challenges does the Japan Life & Non-Life Insurance Market face?

Challenges in the Japan Life & Non-Life Insurance Market include intense competition among insurers, regulatory changes, and the need to adapt to evolving consumer preferences. Additionally, low interest rates can impact profitability for life insurance products.

What opportunities exist in the Japan Life & Non-Life Insurance Market?

Opportunities in the Japan Life & Non-Life Insurance Market include the potential for product innovation, such as personalized insurance solutions and digital platforms. There is also a growing market for insurance products targeting younger demographics and small businesses.

What trends are shaping the Japan Life & Non-Life Insurance Market?

Trends in the Japan Life & Non-Life Insurance Market include the increasing use of artificial intelligence for underwriting and claims processing, as well as a shift towards more sustainable and socially responsible insurance practices. Additionally, the integration of digital technologies is transforming customer interactions.

Japan Life & Non-Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Life Insurance, Health Insurance, Property Insurance, Casualty Insurance |

| Customer Type | Individuals, Corporates, SMEs, Government |

| Distribution Channel | Direct Sales, Brokers, Agents, Online Platforms |

| Service Type | Claims Processing, Underwriting, Risk Assessment, Policy Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Life & Non-Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at