444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan indoor LED lighting market represents a dynamic and rapidly evolving sector within the country’s broader lighting industry. Japan’s commitment to energy efficiency and technological innovation has positioned the nation as a leader in LED adoption across residential, commercial, and industrial applications. The market demonstrates robust growth potential driven by government initiatives promoting energy-efficient lighting solutions and increasing consumer awareness of environmental sustainability.

Market dynamics indicate that Japan’s indoor LED lighting sector is experiencing significant transformation, with traditional incandescent and fluorescent lighting systems being systematically replaced by advanced LED technologies. The market benefits from strong domestic manufacturing capabilities and a tech-savvy consumer base that readily adopts innovative lighting solutions. Growth rates of approximately 8.5% CAGR reflect the market’s expansion trajectory, supported by favorable regulatory frameworks and declining LED component costs.

Regional distribution shows concentrated demand in major metropolitan areas including Tokyo, Osaka, and Nagoya, where commercial and residential construction activities drive substantial lighting requirements. The market encompasses diverse applications ranging from smart home integration to large-scale commercial installations, reflecting Japan’s comprehensive approach to LED technology adoption across multiple sectors.

The Japan indoor LED lighting market refers to the comprehensive ecosystem of light-emitting diode technologies designed for interior illumination applications within Japanese residential, commercial, and industrial environments. This market encompasses the manufacturing, distribution, and installation of LED lighting systems specifically engineered for indoor use, including ceiling fixtures, wall-mounted units, track lighting, and specialized task lighting solutions.

LED technology in this context represents semiconductor-based lighting devices that convert electrical energy directly into light through electroluminescence, offering superior energy efficiency compared to traditional lighting technologies. The Japanese market emphasizes high-quality standards and innovative features such as dimming capabilities, color temperature adjustment, and smart connectivity options that align with the country’s technological advancement priorities.

Market scope includes various LED product categories such as downlights, panel lights, strip lights, and decorative fixtures, all designed to meet Japan’s stringent safety and performance standards while addressing diverse consumer preferences and application requirements across different indoor environments.

Japan’s indoor LED lighting market demonstrates exceptional growth momentum driven by the convergence of environmental consciousness, technological innovation, and supportive government policies. The market has achieved remarkable penetration rates of approximately 72% adoption in commercial applications and 58% in residential sectors, reflecting the country’s progressive transition toward energy-efficient lighting solutions.

Key market drivers include Japan’s commitment to carbon neutrality by 2050, which has accelerated LED adoption across all sectors. The market benefits from strong domestic manufacturing capabilities led by major Japanese companies and supported by continuous technological innovations in LED efficiency and smart lighting integration. Consumer preferences increasingly favor LED solutions that offer both energy savings and enhanced functionality.

Competitive landscape features a mix of established Japanese manufacturers and international players, creating a dynamic environment that fosters innovation and competitive pricing. The market’s future trajectory appears highly positive, with emerging trends in IoT integration and human-centric lighting expected to drive continued expansion and technological advancement throughout the forecast period.

Strategic market insights reveal several critical factors shaping Japan’s indoor LED lighting landscape:

Government initiatives serve as primary catalysts for Japan’s indoor LED lighting market expansion. The country’s comprehensive energy efficiency policies, including the Top Runner Program and building energy codes, mandate improved lighting performance standards that favor LED technology adoption. Regulatory support includes subsidies for LED retrofits and tax incentives for energy-efficient building upgrades.

Environmental consciousness among Japanese consumers and businesses drives substantial demand for sustainable lighting solutions. The nation’s commitment to reducing greenhouse gas emissions creates strong market pull for LED technologies that offer significant energy savings compared to conventional lighting systems. Corporate sustainability initiatives increasingly prioritize LED adoption as part of comprehensive environmental strategies.

Technological advancement in LED manufacturing and smart lighting integration creates compelling value propositions for end users. Japanese manufacturers continue developing innovative LED solutions with enhanced features such as tunable white light, circadian rhythm support, and seamless IoT connectivity. Cost reduction trends in LED components make these technologies increasingly accessible across diverse market segments.

Urbanization patterns and construction activity in major Japanese cities generate substantial demand for modern lighting solutions. New commercial developments and residential projects increasingly specify LED lighting as standard equipment, while renovation projects drive retrofit market growth. Infrastructure modernization programs further accelerate LED adoption in public and commercial buildings.

Initial investment costs remain a significant barrier for some market segments, particularly in residential applications where consumers may hesitate to replace functioning traditional lighting systems. While LED prices have declined substantially, the upfront cost differential compared to conventional lighting can delay adoption decisions, especially among price-sensitive consumer segments.

Technical complexity associated with advanced LED systems, particularly smart lighting solutions, can create implementation challenges for some users. Integration requirements with existing electrical systems and the need for specialized installation expertise may limit adoption in certain applications. Compatibility issues with legacy dimming systems and control infrastructure can complicate retrofit projects.

Market saturation in certain segments, particularly high-end commercial applications, may limit future growth opportunities. As LED adoption reaches maturity in some sectors, market growth increasingly depends on replacement cycles and technological upgrades rather than new installations. Competition intensity among manufacturers can pressure profit margins and limit investment in innovation.

Supply chain dependencies on semiconductor components and rare earth materials used in LED manufacturing can create vulnerability to global supply disruptions. Quality concerns regarding lower-cost LED products from some manufacturers may impact consumer confidence and slow adoption in quality-conscious market segments.

Smart lighting integration presents substantial growth opportunities as Japan advances toward comprehensive IoT adoption in buildings and homes. The convergence of LED technology with sensors, wireless connectivity, and artificial intelligence creates new market segments focused on intelligent lighting systems that optimize energy usage and enhance user experience. Human-centric lighting applications offer particular promise in healthcare, education, and workplace environments.

Retrofit market expansion provides significant opportunities as Japan’s existing building stock undergoes modernization. Millions of commercial and residential properties still utilize traditional lighting systems, creating a substantial addressable market for LED conversion projects. Government incentive programs supporting energy efficiency upgrades can accelerate retrofit adoption rates.

Emerging applications in specialized sectors such as horticulture, healthcare, and industrial processes offer new growth avenues for LED technology. Horticultural lighting for indoor farming and plant factories represents a rapidly expanding niche market, while medical and therapeutic lighting applications leverage LED’s controllability for specialized treatments.

Export opportunities for Japanese LED manufacturers continue expanding as global demand for high-quality, efficient lighting solutions grows. Japan’s reputation for technological excellence and quality manufacturing creates competitive advantages in international markets, particularly in Asia-Pacific regions with growing infrastructure development needs.

Supply chain evolution in Japan’s LED lighting market reflects the industry’s maturation and optimization. Domestic manufacturers have developed sophisticated supply networks that balance cost efficiency with quality control, while international component sourcing provides access to advanced semiconductor technologies. Manufacturing consolidation among LED producers has improved economies of scale and production efficiency.

Demand patterns show increasing sophistication as customers seek LED solutions with enhanced functionality beyond basic illumination. Commercial customers prioritize energy management capabilities and integration with building automation systems, while residential consumers increasingly value smart home compatibility and aesthetic design. Seasonal variations in demand align with construction cycles and renovation periods.

Price dynamics continue favoring LED adoption as manufacturing costs decline and competition intensifies. The market has achieved price parity with traditional lighting in many applications, while total cost of ownership calculations strongly favor LED solutions due to energy savings and extended lifespan. Value proposition enhancement through smart features and improved performance maintains healthy profit margins for manufacturers.

Innovation cycles in LED technology drive continuous market evolution, with manufacturers regularly introducing products with improved efficiency, enhanced features, and better integration capabilities. MarkWide Research analysis indicates that technological advancement remains a key differentiator in the competitive landscape, with successful companies investing heavily in R&D and product development.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Japan’s indoor LED lighting market. Primary research includes extensive interviews with industry executives, distributors, installers, and end users across various market segments to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and trade association data to establish market context and validate primary findings. Quantitative analysis utilizes statistical modeling and forecasting techniques to project market trends and growth trajectories based on historical data and identified market drivers.

Market segmentation analysis examines demand patterns across different applications, technologies, and customer segments to identify growth opportunities and competitive dynamics. Regional analysis considers geographic variations in market development, regulatory environments, and customer preferences throughout Japan’s diverse market landscape.

Competitive intelligence gathering includes monitoring manufacturer strategies, product launches, pricing trends, and market positioning to understand competitive dynamics and industry evolution. Technology assessment evaluates emerging LED technologies and their potential market impact through expert interviews and technical literature review.

Greater Tokyo Area dominates Japan’s indoor LED lighting market, accounting for approximately 42% of national consumption due to its concentration of commercial buildings, residential developments, and industrial facilities. The region benefits from early LED adoption, sophisticated distribution networks, and strong presence of major lighting manufacturers and system integrators.

Kansai Region including Osaka and Kyoto represents the second-largest market segment with 22% market share, driven by substantial commercial and industrial activity. The region’s manufacturing base and logistics infrastructure support robust LED lighting demand across diverse applications, while cultural preservation requirements in historic areas create specialized lighting needs.

Chubu Region centered around Nagoya contributes 18% of market demand, supported by automotive manufacturing, aerospace industries, and growing commercial development. The region’s industrial focus drives demand for specialized LED lighting solutions in manufacturing facilities and warehouses, while residential growth supports consumer market expansion.

Regional distribution patterns reflect Japan’s urban concentration, with major metropolitan areas accounting for 75% of total LED lighting consumption. Rural areas show growing adoption rates as LED technology becomes more accessible and government programs support energy efficiency improvements in smaller communities. Infrastructure development in secondary cities creates emerging opportunities for LED lighting market expansion.

Market leadership in Japan’s indoor LED lighting sector features a combination of established domestic manufacturers and international players, creating a dynamic competitive environment that drives innovation and market development.

Competitive strategies focus on technological differentiation, quality leadership, and comprehensive solution offerings that address diverse customer needs across multiple market segments.

By Application:

By Product Type:

By Technology:

Residential segment demonstrates strong growth momentum with increasing consumer awareness of LED benefits and declining product costs. Smart home integration drives premium segment growth as consumers seek lighting systems compatible with voice assistants and mobile applications. Retrofit applications dominate residential demand as homeowners replace traditional lighting systems during renovation projects.

Commercial applications represent the largest market segment, driven by office building construction and renovation activities. Energy management requirements in commercial buildings favor LED solutions that integrate with building automation systems and provide detailed usage monitoring. Retail applications emphasize LED lighting’s ability to enhance product presentation while reducing operating costs.

Industrial segment focuses on high-performance LED solutions that withstand demanding operating conditions while providing superior illumination quality. Manufacturing facilities increasingly adopt LED lighting for improved worker safety and productivity, while warehouses benefit from LED’s instant-on capability and excellent light distribution characteristics.

Institutional applications prioritize LED lighting’s reliability and energy efficiency for budget-conscious organizations. Healthcare facilities utilize specialized LED solutions that support patient care and staff productivity, while educational institutions benefit from LED’s maintenance advantages and improved learning environments.

Manufacturers benefit from Japan’s sophisticated LED lighting market through opportunities for premium product positioning and technological innovation. The market’s emphasis on quality and performance allows manufacturers to command higher margins while investing in advanced R&D capabilities. Export potential from Japan’s reputation for quality manufacturing creates additional revenue opportunities in international markets.

Distributors and retailers gain from LED lighting’s growing market acceptance and expanding product categories. The technology’s long lifespan creates opportunities for service-based business models and ongoing customer relationships. Installation specialists benefit from increasing demand for professional LED system design and implementation services.

End users across all segments realize significant benefits from LED adoption including reduced energy costs, lower maintenance requirements, and improved lighting quality. Commercial customers achieve operational cost savings and enhanced building performance, while residential users enjoy improved home environments and reduced electricity bills.

Government stakeholders benefit from LED adoption’s contribution to national energy efficiency goals and carbon emission reduction targets. Environmental benefits support Japan’s sustainability commitments while reduced energy demand helps ensure grid stability and energy security.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart lighting integration represents the most significant trend shaping Japan’s indoor LED lighting market. IoT connectivity enables LED fixtures to communicate with building management systems, mobile applications, and voice assistants, creating comprehensive lighting ecosystems that optimize energy usage and enhance user experience. This trend drives premium segment growth and creates new revenue opportunities for manufacturers.

Human-centric lighting emerges as a key differentiator, with LED systems designed to support circadian rhythms and enhance human well-being. Tunable white technology allows automatic adjustment of color temperature throughout the day, supporting productivity in offices and comfort in residential applications. Healthcare and educational facilities increasingly specify human-centric lighting for improved outcomes.

Sustainability focus intensifies as organizations seek lighting solutions that support environmental goals and corporate responsibility initiatives. Circular economy principles influence product design with emphasis on recyclability and component reuse. Energy efficiency improvements continue with LED products achieving higher lumens per watt ratios and extended operational lifespans.

Aesthetic integration becomes increasingly important as LED technology enables new design possibilities. Architectural lighting applications blend functionality with visual appeal, while residential products emphasize style and customization options. Miniaturization trends allow LED integration into furniture and architectural elements previously unsuitable for lighting applications.

Technology advancement continues driving industry evolution with manufacturers introducing LED products featuring improved efficiency ratings exceeding 200 lumens per watt in laboratory conditions. Quantum dot technology integration enhances color quality and enables more precise color reproduction for specialty applications requiring superior light quality.

Strategic partnerships between LED manufacturers and technology companies accelerate smart lighting development. Collaboration initiatives focus on integrating artificial intelligence, machine learning, and advanced sensors into lighting systems to create autonomous lighting environments that adapt to user needs and environmental conditions.

Manufacturing innovation includes development of new production techniques that reduce costs while improving product quality. Automation advances in LED assembly and testing processes enhance manufacturing efficiency and consistency, supporting market expansion through improved cost competitiveness.

Regulatory developments continue supporting LED adoption through updated energy efficiency standards and building codes that favor high-performance lighting technologies. MWR analysis indicates that government initiatives will remain crucial drivers of market growth throughout the forecast period.

Market participants should prioritize smart lighting technology development to capitalize on growing demand for connected lighting solutions. Investment in IoT capabilities and software development will become increasingly important for maintaining competitive advantage as the market evolves toward intelligent lighting ecosystems.

Manufacturers should focus on developing comprehensive solution offerings that combine hardware, software, and services to address customer needs holistically. Service-based business models including lighting-as-a-service and performance contracting can create recurring revenue streams and strengthen customer relationships.

Distribution strategies should emphasize digital channels and direct customer engagement to improve margins and market responsiveness. E-commerce capabilities become essential for reaching residential customers and smaller commercial accounts efficiently while providing comprehensive product information and support.

International expansion opportunities should be pursued strategically, leveraging Japan’s reputation for quality and innovation in growing markets throughout Asia-Pacific. Technology transfer and joint venture arrangements can facilitate market entry while managing investment risks and regulatory complexities.

Long-term prospects for Japan’s indoor LED lighting market remain highly positive, supported by continued technological advancement and expanding application areas. Market evolution will increasingly focus on intelligent lighting systems that provide value beyond basic illumination through data collection, space optimization, and user experience enhancement.

Growth projections indicate sustained expansion at approximately 7.2% CAGR through the forecast period, driven by smart lighting adoption, retrofit market development, and emerging applications in specialized sectors. MarkWide Research projects that smart lighting will represent over 45% of new installations by the end of the forecast period.

Technology trends will continue driving market evolution with advances in LED efficiency, smart connectivity, and integration capabilities. Artificial intelligence and machine learning integration will enable predictive lighting systems that anticipate user needs and optimize performance automatically.

Market consolidation may accelerate as companies seek scale advantages and comprehensive technology portfolios. Innovation investment will remain critical for success as the market becomes increasingly sophisticated and competitive, requiring continuous product development and technological advancement.

Japan’s indoor LED lighting market represents a mature yet dynamic sector characterized by technological leadership, sophisticated customer demands, and strong growth potential. The market’s evolution from basic LED adoption to intelligent lighting ecosystems reflects Japan’s commitment to innovation and energy efficiency while creating substantial opportunities for industry participants.

Key success factors include technological differentiation, quality leadership, and comprehensive solution offerings that address diverse customer needs across residential, commercial, and industrial segments. The market’s emphasis on smart lighting integration and human-centric design creates premium positioning opportunities for manufacturers willing to invest in advanced capabilities.

Future market development will be driven by continued innovation in LED technology, expanding IoT integration, and growing awareness of lighting’s impact on human well-being and environmental sustainability. Companies that successfully navigate these trends while maintaining Japan’s traditional emphasis on quality and reliability will be well-positioned for sustained success in this evolving market landscape.

What is Indoor LED Lighting?

Indoor LED lighting refers to the use of light-emitting diodes (LEDs) for illumination within indoor spaces. This technology is known for its energy efficiency, long lifespan, and versatility in various applications such as residential, commercial, and industrial settings.

What are the key players in the Japan Indoor LED Lighting Market?

Key players in the Japan Indoor LED Lighting Market include Panasonic Corporation, Toshiba Lighting & Technology Corporation, and Nichia Corporation, among others. These companies are known for their innovative lighting solutions and significant market presence.

What are the growth factors driving the Japan Indoor LED Lighting Market?

The growth of the Japan Indoor LED Lighting Market is driven by increasing energy efficiency regulations, rising demand for smart lighting solutions, and the growing trend of sustainable building practices. Additionally, advancements in LED technology are enhancing product performance and adoption.

What challenges does the Japan Indoor LED Lighting Market face?

Challenges in the Japan Indoor LED Lighting Market include high initial costs of LED installations and competition from traditional lighting technologies. Furthermore, consumer awareness and acceptance of LED products can vary, impacting market penetration.

What opportunities exist in the Japan Indoor LED Lighting Market?

Opportunities in the Japan Indoor LED Lighting Market include the expansion of smart home technologies and the increasing integration of IoT in lighting systems. Additionally, the growing focus on energy-efficient solutions presents avenues for innovation and market growth.

What trends are shaping the Japan Indoor LED Lighting Market?

Trends in the Japan Indoor LED Lighting Market include the rise of human-centric lighting, which focuses on enhancing well-being through light quality, and the adoption of tunable white lighting systems. Moreover, the shift towards connected lighting solutions is gaining traction among consumers.

Japan Indoor LED Lighting Market

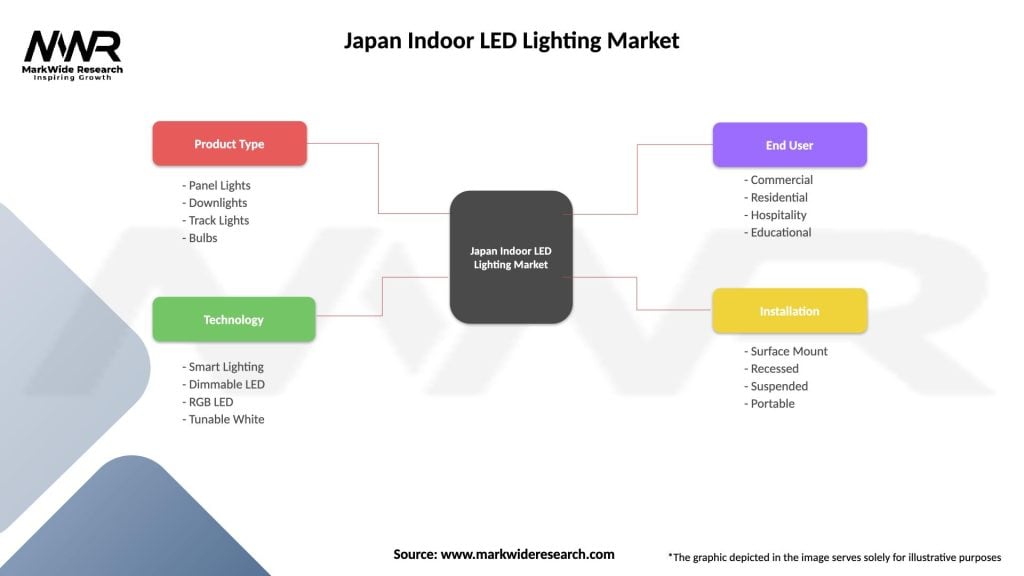

| Segmentation Details | Description |

|---|---|

| Product Type | Panel Lights, Downlights, Track Lights, Bulbs |

| Technology | Smart Lighting, Dimmable LED, RGB LED, Tunable White |

| End User | Commercial, Residential, Hospitality, Educational |

| Installation | Surface Mount, Recessed, Suspended, Portable |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Indoor LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at