444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan hotel booking market represents a dynamic and rapidly evolving sector within the country’s hospitality industry, characterized by technological innovation, changing consumer preferences, and strategic digital transformation initiatives. Digital booking platforms have fundamentally reshaped how travelers discover, compare, and reserve accommodations across Japan’s diverse hospitality landscape. The market encompasses traditional hotels, ryokans, business hotels, capsule hotels, and emerging accommodation formats that cater to both domestic and international travelers.

Market dynamics indicate substantial growth driven by increasing smartphone penetration, with mobile bookings accounting for approximately 68% of all hotel reservations in Japan. The integration of artificial intelligence, machine learning algorithms, and personalized recommendation systems has enhanced user experience while optimizing pricing strategies for accommodation providers. Online travel agencies and direct booking platforms compete intensively for market share, implementing sophisticated loyalty programs and exclusive partnership arrangements.

Consumer behavior patterns reveal significant shifts toward last-minute bookings, with same-day reservations increasing by 34% over recent periods. The market benefits from Japan’s robust tourism infrastructure, cultural attractions, and business travel requirements that sustain consistent demand across multiple accommodation categories. Technology adoption rates among Japanese consumers continue accelerating, supporting the expansion of digital booking channels and mobile-first reservation platforms.

The Japan hotel booking market refers to the comprehensive ecosystem of digital platforms, technologies, and services that facilitate the discovery, comparison, reservation, and management of hotel accommodations throughout Japan. This market encompasses online travel agencies, hotel direct booking websites, mobile applications, metasearch engines, and emerging booking technologies that connect travelers with accommodation providers across the country’s hospitality sector.

Digital transformation within this market involves sophisticated booking engines, dynamic pricing algorithms, customer relationship management systems, and integrated payment processing solutions. The market includes both business-to-consumer platforms serving individual travelers and business-to-business solutions supporting corporate travel management, group bookings, and hospitality industry partnerships.

Strategic market positioning reveals the Japan hotel booking market as a technologically advanced sector experiencing robust digital adoption and innovative service delivery models. The market demonstrates resilience through diversified accommodation offerings, ranging from luxury international hotel chains to traditional Japanese ryokans and modern capsule hotel concepts. Mobile-first strategies dominate platform development, with companies investing heavily in user experience optimization and personalized recommendation engines.

Competitive landscape dynamics showcase intense rivalry between global online travel agencies and domestic booking platforms, each implementing unique value propositions and customer acquisition strategies. The market benefits from Japan’s position as a leading international tourism destination, supporting sustained demand for accommodation booking services. Technology integration rates continue expanding, with artificial intelligence adoption increasing by 42% among major booking platforms.

Market evolution trends indicate growing emphasis on sustainable tourism practices, contactless booking experiences, and integrated travel service offerings that combine accommodation with transportation, dining, and activity reservations. The sector demonstrates strong recovery momentum following global travel disruptions, with domestic tourism serving as a crucial foundation for market stability and growth.

Consumer preference analysis reveals several critical insights shaping the Japan hotel booking market landscape:

Technological advancement serves as the primary catalyst driving Japan hotel booking market expansion, with sophisticated booking platforms leveraging artificial intelligence, machine learning, and big data analytics to enhance user experiences and optimize pricing strategies. Smartphone penetration rates exceeding national averages support mobile-first booking behaviors, while high-speed internet infrastructure enables seamless reservation processes across urban and rural destinations.

Tourism industry growth provides fundamental market support through increasing domestic and international travel demand. Japan’s cultural attractions, business travel requirements, and seasonal tourism patterns create consistent accommodation booking needs across diverse traveler segments. Government tourism promotion initiatives and infrastructure investments further stimulate market activity through enhanced destination accessibility and visitor experience improvements.

Consumer behavior evolution toward digital-first travel planning drives platform adoption and feature development. Travelers increasingly prefer online research, comparison shopping, and digital booking processes over traditional reservation methods. Generational preferences favor technology-enabled travel experiences, supporting continued market digitization and innovation investments by booking platform operators.

Intense competition among booking platforms creates margin pressure and customer acquisition challenges, with companies investing heavily in marketing and promotional activities to maintain market share. Commission structure dynamics between platforms and accommodation providers generate ongoing negotiations and potential conflicts over revenue distribution models.

Regulatory complexity surrounding consumer protection, data privacy, and hospitality industry standards requires continuous compliance investments and operational adjustments. Traditional booking preferences among certain consumer segments, particularly older demographics, limit complete market digitization and require hybrid service delivery approaches.

Economic sensitivity affects discretionary travel spending during uncertain periods, impacting booking volumes and average transaction values. Seasonal demand fluctuations create revenue volatility challenges for booking platforms, requiring sophisticated demand forecasting and capacity management strategies to maintain profitability across varying market conditions.

Artificial intelligence integration presents significant opportunities for enhanced personalization, dynamic pricing optimization, and predictive analytics capabilities that improve both user experience and platform efficiency. Voice search technology and conversational interfaces offer new booking channels and customer interaction methods that align with evolving consumer preferences for hands-free digital experiences.

Sustainable tourism initiatives create opportunities for platforms to differentiate through eco-friendly accommodation promotion, carbon footprint tracking, and responsible travel recommendations. Corporate travel digitization represents substantial growth potential as businesses increasingly adopt digital booking solutions for employee travel management and expense optimization.

Regional expansion opportunities exist through enhanced coverage of rural destinations, traditional accommodations, and unique lodging experiences that appeal to experience-seeking travelers. Partnership development with transportation providers, activity operators, and dining establishments enables comprehensive travel service offerings that increase customer value and platform revenue potential.

Competitive intensity shapes market dynamics through continuous innovation cycles, aggressive customer acquisition strategies, and technological advancement races among major platform operators. Global online travel agencies compete directly with domestic booking platforms, creating dynamic pricing environments and feature development pressures that benefit consumers through improved services and competitive rates.

Technology evolution cycles drive platform modernization requirements, with companies investing in mobile optimization, artificial intelligence capabilities, and user experience enhancements to maintain competitive positioning. Consumer expectation escalation demands continuous service improvement and feature expansion, creating ongoing development costs and innovation pressures across the market.

Supply chain relationships between booking platforms and accommodation providers influence market dynamics through commission negotiations, exclusive partnership arrangements, and inventory management agreements. Seasonal demand patterns create cyclical market conditions that require sophisticated revenue management and capacity planning strategies to optimize performance across varying booking volumes.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Japan hotel booking market landscape. Primary research activities include structured interviews with industry executives, booking platform operators, accommodation providers, and consumer focus groups representing diverse traveler segments and demographic categories.

Secondary research components encompass analysis of industry reports, government tourism statistics, company financial disclosures, and technology adoption surveys. Data triangulation methods validate findings across multiple sources, ensuring research accuracy and reliability for strategic decision-making purposes.

Quantitative analysis techniques include statistical modeling, trend analysis, and market sizing calculations based on verified data sources and industry benchmarks. Qualitative research elements provide contextual insights into consumer behavior patterns, competitive strategies, and market development trends that complement numerical findings with strategic perspective and industry expertise.

Tokyo metropolitan area dominates the Japan hotel booking market, accounting for approximately 35% of total booking volume due to its concentration of business travelers, international tourists, and diverse accommodation options. The region benefits from extensive transportation infrastructure, major international airports, and high smartphone penetration rates that support digital booking adoption.

Osaka and Kansai region represents the second-largest market segment, driven by cultural tourism, business travel, and proximity to traditional attractions. Regional booking patterns show strong preference for mobile platforms and last-minute reservations, particularly among domestic travelers exploring nearby destinations.

Rural and regional destinations demonstrate growing booking activity as travelers seek authentic experiences and less crowded alternatives to major urban centers. Regional market share for rural accommodations has increased by 23% over recent periods, supported by government tourism promotion initiatives and improved digital infrastructure. Hokkaido and Okinawa show seasonal booking concentration with high international visitor engagement, while traditional hot spring destinations maintain steady domestic demand throughout the year.

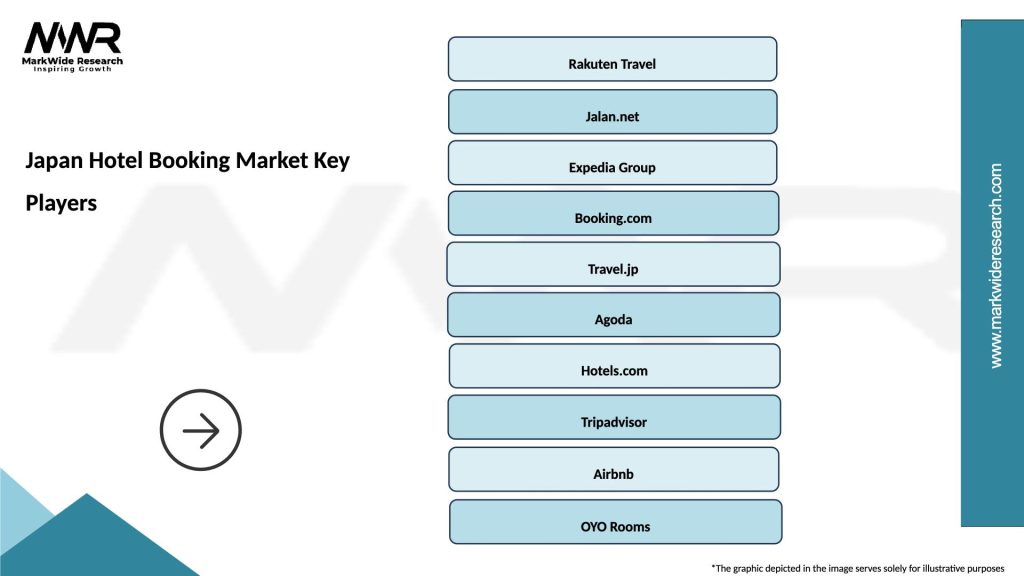

Market leadership involves both international and domestic players competing across multiple service categories and customer segments:

Competitive strategies focus on mobile optimization, personalized recommendations, loyalty program development, and exclusive partnership arrangements with accommodation providers. Technology investment priorities include artificial intelligence implementation, user experience enhancement, and payment processing optimization to maintain competitive advantages in the dynamic market environment.

By Platform Type:

By Traveler Type:

By Accommodation Type:

Luxury accommodation bookings demonstrate strong growth in personalized service expectations and exclusive experience offerings. Premium travelers increasingly utilize mobile platforms for last-minute upgrades and special amenity requests, with luxury booking conversion rates improving by 31% through enhanced mobile experiences and concierge service integration.

Budget accommodation segments show high price sensitivity and comparison shopping behaviors, with travelers utilizing multiple platforms to identify optimal value propositions. Capsule hotels and hostels experience growing international interest, particularly among younger travelers seeking authentic Japanese experiences at accessible price points.

Business travel categories emphasize efficiency, location convenience, and corporate rate programs. Business hotel bookings demonstrate strong mobile adoption with same-day booking rates reaching 45% among corporate travelers requiring flexible accommodation arrangements. Extended stay options gain popularity as remote work trends influence accommodation preferences and booking duration patterns.

Accommodation providers benefit from expanded market reach, sophisticated revenue management tools, and access to diverse customer segments through digital booking platforms. Direct booking capabilities enable hotels to reduce commission costs while building stronger customer relationships and loyalty program engagement.

Travelers gain advantages through comprehensive accommodation comparison, transparent pricing, user review access, and convenient mobile booking experiences. Personalized recommendations and loyalty program benefits enhance travel value while streamlined booking processes reduce planning time and complexity.

Technology providers capitalize on growing demand for booking platform development, payment processing solutions, and customer relationship management systems. Data analytics opportunities enable insights into consumer behavior patterns, market trends, and optimization strategies that benefit multiple industry stakeholders.

Tourism industry stakeholders benefit from increased visitor accessibility, enhanced destination marketing capabilities, and improved traveler experience coordination. Economic impact extends to local communities through increased tourism revenue and employment opportunities generated by enhanced accommodation booking accessibility.

Strengths:

Weaknesses:

Opportunities:

Threats:

Mobile-first optimization continues driving platform development priorities, with companies investing heavily in smartphone user experience enhancement and location-based service integration. Voice search capabilities and conversational booking interfaces represent emerging trends that align with consumer preferences for hands-free digital interactions and natural language processing.

Artificial intelligence personalization advances through sophisticated recommendation engines, dynamic pricing algorithms, and predictive analytics that anticipate traveler preferences and optimize booking suggestions. Machine learning applications enhance fraud detection, customer service automation, and demand forecasting accuracy across platform operations.

Sustainable tourism integration emerges as platforms incorporate eco-friendly accommodation certification, carbon footprint tracking, and responsible travel recommendations. Contactless service preferences accelerate adoption of digital check-in processes, mobile key systems, and touchless payment solutions that enhance safety and convenience for travelers.

Integrated travel services expand beyond accommodation booking to include transportation, dining, and activity reservations within comprehensive travel planning platforms. Subscription-based models and membership programs offer exclusive benefits and simplified booking experiences for frequent travelers seeking premium service levels.

Strategic partnerships between booking platforms and accommodation providers continue evolving through exclusive rate agreements, inventory management integration, and co-marketing initiatives. Technology acquisitions enable platform operators to enhance capabilities in artificial intelligence, mobile optimization, and customer relationship management systems.

Regulatory compliance initiatives address data privacy requirements, consumer protection standards, and hospitality industry regulations through enhanced security measures and transparent booking policies. MarkWide Research analysis indicates that compliance investment rates have increased by 38% among major platform operators responding to evolving regulatory environments.

Innovation investments focus on emerging technologies including virtual reality accommodation previews, augmented reality location services, and blockchain-based loyalty programs. Customer experience enhancements through chatbot integration, multilingual support, and personalized communication systems improve user satisfaction and booking conversion rates.

Market consolidation activities involve strategic mergers and acquisitions that reshape competitive dynamics and create integrated service offerings. International expansion strategies enable domestic platforms to access global markets while international operators enhance local market penetration through cultural adaptation and partnership development.

Platform optimization strategies should prioritize mobile user experience enhancement, artificial intelligence integration, and personalized recommendation system development to maintain competitive positioning in the evolving market landscape. Investment priorities include customer acquisition cost optimization, loyalty program development, and technology infrastructure modernization.

Market expansion opportunities exist through rural destination coverage enhancement, traditional accommodation type promotion, and sustainable tourism initiative integration. Partnership development with local tourism boards, transportation providers, and activity operators can create comprehensive travel service offerings that increase customer value and platform differentiation.

Technology advancement focus should emphasize voice search capabilities, contactless service integration, and predictive analytics implementation to align with evolving consumer preferences and market trends. Data analytics investments enable improved demand forecasting, pricing optimization, and customer behavior understanding that support strategic decision-making and operational efficiency.

Competitive strategy recommendations include direct booking channel development, exclusive partnership arrangement negotiation, and customer retention program enhancement. Market positioning should leverage unique value propositions such as local expertise, cultural accommodation specialization, or technology innovation leadership to differentiate from competitors and attract target customer segments.

Market evolution projections indicate continued digital transformation acceleration with mobile booking penetration expected to reach 78% within the forecast period. Artificial intelligence adoption will expand across platform operations, enabling sophisticated personalization, dynamic pricing, and predictive analytics capabilities that enhance both user experience and operational efficiency.

Consumer behavior trends suggest growing preference for integrated travel services, sustainable accommodation options, and contactless booking experiences. Technology integration will advance through voice search capabilities, augmented reality features, and blockchain-based loyalty programs that create differentiated platform offerings and enhanced customer value propositions.

Competitive landscape development anticipates continued consolidation activities, strategic partnership formation, and innovation investment acceleration among major market participants. MWR projections indicate that platform technology investment rates will increase by 45% as companies compete for market share through enhanced capabilities and superior user experiences.

Market growth drivers include tourism industry recovery, business travel digitization, and emerging accommodation format popularity that support sustained booking platform demand. Regional expansion opportunities and international market penetration will create additional growth avenues for established platform operators seeking market share expansion and revenue diversification.

The Japan hotel booking market represents a dynamic and technologically advanced sector characterized by intense competition, continuous innovation, and evolving consumer preferences that drive platform development and service enhancement. Mobile-first strategies dominate market development as smartphone adoption and digital booking behaviors reshape how travelers discover, compare, and reserve accommodations across Japan’s diverse hospitality landscape.

Strategic market positioning requires sophisticated technology integration, personalized user experiences, and comprehensive service offerings that address the complex needs of business travelers, leisure tourists, and international visitors. Competitive advantages emerge through artificial intelligence implementation, exclusive partnership development, and customer loyalty program optimization that create sustainable differentiation in the crowded marketplace.

Future market success depends on platform operators’ ability to adapt to changing consumer expectations, integrate emerging technologies, and develop innovative service delivery models that enhance travel planning convenience and booking experience quality. The Japan hotel booking market continues evolving as a critical component of the country’s tourism infrastructure, supporting economic growth and visitor experience enhancement through digital innovation and strategic industry collaboration.

What is Japan Hotel Booking?

Japan Hotel Booking refers to the process of reserving accommodations in hotels across Japan, encompassing various platforms and services that facilitate this process for travelers.

What are the key players in the Japan Hotel Booking Market?

Key players in the Japan Hotel Booking Market include Booking.com, Expedia, and Rakuten Travel, which offer a range of options for consumers looking to book hotels in Japan, among others.

What are the main drivers of growth in the Japan Hotel Booking Market?

The main drivers of growth in the Japan Hotel Booking Market include the increasing number of international tourists, the rise of online booking platforms, and the growing demand for unique travel experiences.

What challenges does the Japan Hotel Booking Market face?

Challenges in the Japan Hotel Booking Market include intense competition among online travel agencies, fluctuating travel regulations, and the impact of seasonal demand on hotel occupancy rates.

What opportunities exist in the Japan Hotel Booking Market?

Opportunities in the Japan Hotel Booking Market include the expansion of mobile booking applications, the integration of AI for personalized travel recommendations, and the potential for growth in domestic tourism.

What trends are shaping the Japan Hotel Booking Market?

Trends shaping the Japan Hotel Booking Market include the increasing popularity of eco-friendly accommodations, the use of virtual reality for hotel previews, and the rise of subscription-based travel services.

Japan Hotel Booking Market

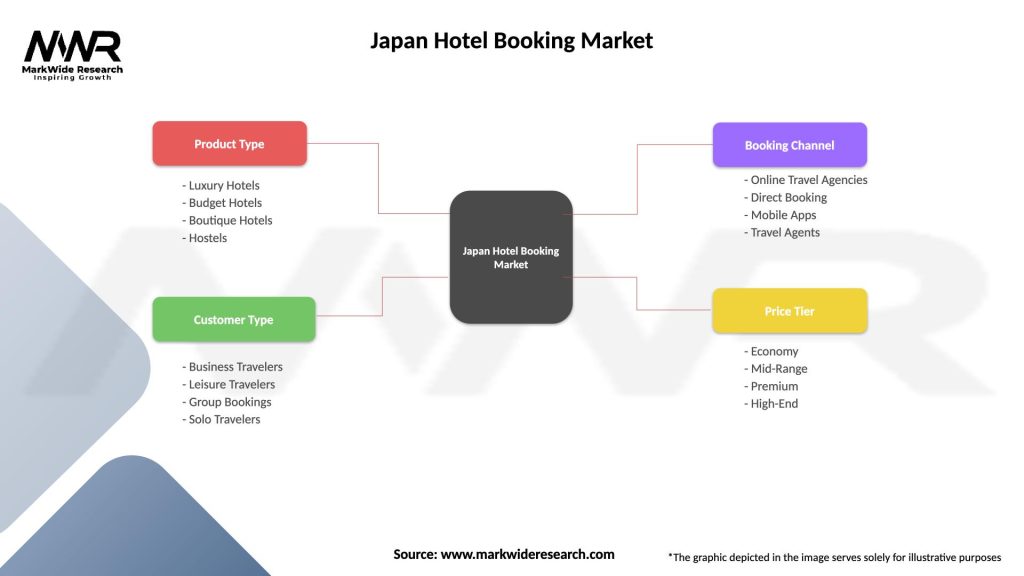

| Segmentation Details | Description |

|---|---|

| Product Type | Luxury Hotels, Budget Hotels, Boutique Hotels, Hostels |

| Customer Type | Business Travelers, Leisure Travelers, Group Bookings, Solo Travelers |

| Booking Channel | Online Travel Agencies, Direct Booking, Mobile Apps, Travel Agents |

| Price Tier | Economy, Mid-Range, Premium, High-End |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Hotel Booking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at