444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan fresh fruits market represents one of the most sophisticated and quality-driven agricultural sectors in Asia, characterized by premium positioning, exceptional quality standards, and innovative cultivation techniques. Japanese consumers demonstrate strong preferences for domestically produced fruits, with local varieties commanding premium prices due to their superior taste, appearance, and cultural significance. The market exhibits remarkable resilience and growth potential, driven by increasing health consciousness, aging population demographics, and evolving consumption patterns.

Market dynamics in Japan’s fresh fruits sector reflect unique characteristics including seasonal gift-giving traditions, meticulous quality grading systems, and strong consumer willingness to pay premium prices for exceptional produce. The sector benefits from advanced agricultural technologies, controlled environment cultivation, and sophisticated distribution networks that ensure optimal freshness and quality delivery. Growth trends indicate expanding opportunities in organic segments, functional fruits, and export-oriented premium varieties, with the market experiencing steady expansion at approximately 3.2% CAGR over recent years.

Regional distribution shows concentrated production in key agricultural prefectures including Aomori, Yamanashi, and Okayama, each specializing in specific fruit varieties that have gained national and international recognition. The market structure encompasses traditional wholesale systems, direct-to-consumer channels, and emerging e-commerce platforms that cater to diverse consumer preferences and purchasing behaviors.

The Japan fresh fruits market refers to the comprehensive ecosystem encompassing cultivation, distribution, and retail of fresh fruit products within Japan’s domestic market, including both locally produced and imported varieties. This market represents a sophisticated agricultural sector that prioritizes quality, seasonality, and cultural significance over volume-based production models typical in other regions.

Fresh fruits in the Japanese context extend beyond basic nutrition to encompass cultural traditions, gift-giving practices, and premium lifestyle choices. The market includes diverse categories such as apples, citrus fruits, grapes, strawberries, melons, and exotic varieties, each with distinct quality grades, seasonal availability, and consumer positioning strategies that reflect Japan’s unique agricultural heritage and consumer preferences.

Japan’s fresh fruits market demonstrates exceptional stability and growth potential, driven by strong domestic demand, premium quality positioning, and innovative agricultural practices. The sector benefits from favorable demographic trends including increased health awareness among aging populations and growing interest in functional foods with enhanced nutritional profiles. Market participants range from traditional agricultural cooperatives to modern agribusiness enterprises, all focused on maintaining Japan’s reputation for producing world-class fruit varieties.

Key growth drivers include technological advancement in cultivation methods, expanding export opportunities for premium Japanese fruit varieties, and increasing consumer preference for locally sourced, sustainably produced fresh fruits. The market shows particular strength in premium segments, where Japanese consumers demonstrate willingness to pay significantly higher prices for superior quality, with premium fruit categories experiencing growth rates of approximately 5.8% annually.

Strategic developments focus on enhancing production efficiency, developing new varieties with extended shelf life, and expanding direct marketing channels that connect producers with consumers. The integration of digital technologies in agriculture and supply chain management continues to drive operational improvements and market expansion opportunities.

Consumer behavior analysis reveals distinct purchasing patterns that differentiate Japan’s fresh fruits market from global counterparts. Japanese consumers prioritize visual appeal, seasonal appropriateness, and origin authenticity, with domestic varieties commanding premium positioning despite higher production costs compared to imported alternatives.

Health and wellness trends serve as primary market drivers, with Japanese consumers increasingly recognizing fresh fruits as essential components of healthy lifestyle choices. The growing awareness of antioxidants, vitamins, and functional compounds in fresh fruits supports sustained demand growth, particularly among health-conscious demographics and aging populations seeking nutritional benefits.

Premium quality positioning continues driving market expansion, as Japanese agricultural practices focus on producing exceptional fruit varieties that command premium prices both domestically and internationally. The emphasis on perfect appearance, optimal taste profiles, and consistent quality standards creates competitive advantages that support market growth and profitability.

Technological advancement in agricultural practices enables improved production efficiency, extended growing seasons, and enhanced fruit quality characteristics. Innovations in controlled environment agriculture, precision farming techniques, and post-harvest handling contribute to market growth by ensuring consistent supply and superior product quality.

Cultural significance and traditional practices surrounding fruit consumption, including seasonal celebrations and gift-giving customs, provide stable demand foundations that support market resilience. These cultural elements create unique market dynamics that differentiate Japan from other fresh fruit markets globally.

High production costs represent significant market constraints, as Japanese agricultural practices emphasize quality over efficiency, resulting in higher per-unit production expenses compared to international competitors. Labor-intensive cultivation methods, premium input costs, and stringent quality control processes contribute to elevated operational expenses that limit market accessibility for price-sensitive consumer segments.

Aging agricultural workforce poses long-term challenges for market sustainability, as younger generations show limited interest in traditional farming practices. The demographic shift in agricultural communities creates potential supply constraints and increases reliance on technology solutions to maintain production levels.

Climate change impacts introduce uncertainty in production planning and quality consistency, with extreme weather events and shifting seasonal patterns affecting traditional cultivation cycles. These environmental factors require adaptive strategies and increased investment in climate-resilient production methods.

Import competition from lower-cost international suppliers creates pricing pressure, particularly in commodity fruit categories where quality differentiation is less pronounced. The challenge of maintaining market share against competitively priced imports requires continuous innovation and value proposition enhancement.

Export market expansion presents substantial growth opportunities, as international recognition of Japanese fruit quality creates demand in premium markets across Asia, North America, and Europe. The development of export-focused varieties and supply chain infrastructure supports market diversification and revenue growth potential.

Organic and sustainable production segments offer significant expansion opportunities, driven by increasing consumer awareness of environmental impacts and health benefits associated with organic farming practices. The premium positioning of organic fruits aligns well with Japanese consumer preferences for quality and authenticity.

Direct-to-consumer channels create opportunities for producers to capture higher margins while building stronger customer relationships. E-commerce platforms, farm-direct sales, and subscription services enable market participants to bypass traditional distribution channels and enhance profitability.

Functional fruit development represents emerging opportunities in creating varieties with enhanced nutritional profiles, extended shelf life, or specific health benefits. Innovation in breeding programs and biotechnology applications supports the development of differentiated products that command premium positioning.

Supply chain evolution continues reshaping market dynamics, with traditional wholesale systems adapting to accommodate direct marketing channels, e-commerce platforms, and consumer preference for traceability. The integration of digital technologies in supply chain management enhances efficiency while maintaining quality standards throughout distribution networks.

Consumer preference shifts toward convenience, health benefits, and sustainability influence product development and marketing strategies across the fresh fruits sector. Market participants respond by developing new packaging solutions, extending shelf life through improved handling techniques, and emphasizing environmental responsibility in production practices.

Seasonal demand fluctuations create dynamic pricing patterns and inventory management challenges, with peak seasons generating 60% higher average prices compared to off-season periods. These cyclical patterns require sophisticated planning and storage capabilities to optimize market positioning and profitability.

Technology integration accelerates across all market segments, from precision agriculture in production to artificial intelligence in quality grading and distribution optimization. These technological advances enhance operational efficiency while supporting quality consistency and market competitiveness.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Japan’s fresh fruits market dynamics. The research approach combines quantitative data collection with qualitative analysis to provide holistic understanding of market trends, consumer behaviors, and industry developments.

Primary research activities include structured interviews with key market participants, including producers, distributors, retailers, and consumers across different demographic segments. Survey methodologies capture consumer preferences, purchasing behaviors, and satisfaction levels to understand market demand patterns and growth opportunities.

Secondary research sources encompass government agricultural statistics, industry association reports, trade publications, and academic studies focusing on Japanese agriculture and consumer trends. This comprehensive data collection ensures robust analytical foundations for market insights and projections.

Data validation processes involve cross-referencing multiple sources, conducting expert interviews, and applying statistical analysis techniques to ensure accuracy and reliability of market findings. The methodology emphasizes current market conditions while identifying emerging trends that influence future market development.

Hokkaido region represents a significant production center for fresh fruits, particularly known for premium melons, apples, and berries that benefit from the region’s favorable climate conditions and advanced agricultural practices. The region contributes approximately 18% of national fruit production while commanding premium prices for its high-quality varieties.

Tohoku region dominates apple production, with Aomori Prefecture alone accounting for substantial national market share through varieties like Fuji and Tsugaru apples. The region’s expertise in apple cultivation and post-harvest handling creates competitive advantages in both domestic and export markets.

Kanto region serves as the primary consumption center, with Tokyo metropolitan area representing the largest market for fresh fruits consumption. The region’s sophisticated distribution networks and high-income demographics support premium fruit market segments and innovative retail concepts.

Kansai region combines significant production capabilities with substantial consumption demand, particularly for citrus fruits and grapes. The region’s traditional agricultural practices and modern technology integration create unique market positioning opportunities.

Kyushu region specializes in citrus production and early-season fruits that benefit from favorable climate conditions. The region’s strategic location supports both domestic distribution and export activities, with 22% market share in citrus fruit production nationally.

Market structure in Japan’s fresh fruits sector encompasses diverse participants ranging from individual farmers to large agricultural cooperatives and commercial enterprises. The competitive environment emphasizes quality differentiation, brand recognition, and supply chain efficiency rather than price competition alone.

Competitive strategies focus on quality enhancement, brand building, and supply chain optimization to maintain market position and profitability. Market leaders invest heavily in research and development, sustainable production practices, and consumer education to differentiate their offerings.

By Product Type:

By Distribution Channel:

By Consumer Segment:

Apple category maintains market leadership through consistent quality, diverse variety offerings, and strong consumer loyalty. Japanese apple varieties like Fuji have gained international recognition, supporting both domestic consumption and export opportunities. The segment benefits from advanced storage technologies that extend availability throughout the year.

Citrus segment demonstrates seasonal strength with varieties like mikan (mandarin oranges) playing important cultural roles during winter months. The category shows innovation in developing seedless varieties and extending harvest seasons through greenhouse cultivation techniques.

Strawberry category represents premium positioning with varieties developed specifically for Japanese taste preferences and appearance standards. The segment shows growth in year-round production capabilities and export potential, with premium varieties achieving 85% higher prices than standard offerings.

Melon segment exemplifies ultra-premium positioning with individual fruits commanding exceptional prices in gift markets. The category demonstrates the extreme quality focus of Japanese fruit production, with perfect specimens achieving luxury status comparable to fine jewelry or art pieces.

Grape category shows expansion in table grape varieties with emphasis on large berry size, exceptional sweetness, and attractive appearance. The segment benefits from controlled environment production that ensures consistent quality and extended harvest periods.

Producers benefit from premium pricing opportunities that reward quality focus and innovative cultivation techniques. The market’s emphasis on domestic production provides competitive advantages for local farmers who can demonstrate superior quality and freshness compared to imported alternatives.

Distributors gain from stable demand patterns and consumer willingness to pay premium prices for quality assurance and reliable supply. The sophisticated distribution networks in Japan create opportunities for value-added services and customer relationship development.

Retailers experience enhanced margins through premium fruit categories that attract quality-conscious consumers. The gift market segment provides particularly attractive opportunities during seasonal peaks, with gift sales generating 45% higher margins than regular retail sales.

Consumers receive exceptional quality products that meet stringent standards for taste, appearance, and safety. The market’s focus on quality ensures consistent satisfaction and supports healthy lifestyle choices through access to nutritious, fresh fruit options.

Technology providers find opportunities in supporting agricultural innovation, supply chain optimization, and quality assurance systems that enable market participants to maintain competitive advantages and operational efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus emerges as a dominant trend, with consumers increasingly interested in environmentally responsible production methods and packaging solutions. Market participants respond by adopting organic farming practices, reducing chemical inputs, and implementing sustainable packaging alternatives that appeal to environmentally conscious consumers.

Direct-to-consumer sales gain momentum through e-commerce platforms and farm-direct marketing channels that enable producers to capture higher margins while building stronger customer relationships. This trend accelerates due to COVID-19 impacts and changing consumer shopping behaviors.

Functional fruit development represents growing interest in varieties with enhanced nutritional profiles, extended shelf life, or specific health benefits. MarkWide Research indicates that functional fruit segments experience growth rates of approximately 8.5% annually as health-conscious consumers seek products with proven wellness benefits.

Technology integration accelerates across production, processing, and distribution activities, with artificial intelligence, IoT sensors, and automation systems enhancing efficiency and quality consistency. These technological advances support market competitiveness while addressing labor shortage challenges.

Premium gift market expansion continues growing, particularly in luxury fruit categories where presentation, packaging, and exclusivity create exceptional value propositions for special occasions and corporate gifting applications.

Variety development programs focus on creating new fruit cultivars with improved characteristics including enhanced flavor profiles, extended shelf life, and resistance to environmental stresses. These breeding initiatives support long-term market competitiveness and consumer satisfaction.

Export infrastructure expansion includes development of specialized packaging, cold chain logistics, and quality certification systems that enable Japanese fruit producers to access international premium markets effectively. These investments support market diversification and revenue growth opportunities.

Sustainable production initiatives encompass adoption of organic farming methods, integrated pest management systems, and renewable energy applications in agricultural operations. These developments respond to consumer preferences while supporting environmental responsibility goals.

Digital transformation projects integrate advanced technologies including precision agriculture systems, automated quality grading equipment, and supply chain optimization platforms that enhance operational efficiency and market responsiveness.

Collaborative marketing programs bring together producers, distributors, and retailers to promote Japanese fruit quality and cultural significance in both domestic and international markets, strengthening brand recognition and market positioning.

Investment priorities should focus on technology adoption that addresses labor shortage challenges while maintaining quality standards essential for market competitiveness. Automation systems in cultivation, harvesting, and post-harvest handling offer opportunities to improve efficiency without compromising the quality focus that differentiates Japanese fruits.

Market diversification strategies should emphasize export development for premium fruit varieties that can command exceptional prices in international markets. Building brand recognition and distribution partnerships in target export markets creates sustainable growth opportunities beyond domestic demand limitations.

Sustainability integration becomes increasingly important for long-term market viability, with organic production methods and environmental responsibility supporting consumer preferences and regulatory requirements. Early adoption of sustainable practices creates competitive advantages and premium positioning opportunities.

Direct marketing channel development offers opportunities to capture higher margins while building stronger customer relationships. E-commerce platforms, subscription services, and farm-direct sales enable producers to differentiate their offerings and reduce dependence on traditional distribution channels.

Collaborative approaches among industry participants can address common challenges including labor shortages, technology adoption costs, and export market development. Cooperative initiatives enable smaller producers to access resources and capabilities that support market competitiveness.

Market growth prospects remain positive, supported by stable domestic demand, expanding export opportunities, and continued consumer preference for premium quality fruits. MWR analysis projects sustained growth momentum with particular strength in organic segments and direct-to-consumer channels that align with evolving consumer preferences.

Technology integration will accelerate across all market segments, with artificial intelligence, robotics, and precision agriculture systems becoming standard tools for maintaining competitiveness. These technological advances support quality consistency while addressing labor shortage challenges that threaten long-term sustainability.

Export market expansion represents significant growth potential, with Japanese fruit varieties gaining international recognition for exceptional quality and unique characteristics. Development of export-focused infrastructure and marketing programs will support market diversification and revenue growth opportunities.

Sustainability trends will influence production methods, packaging choices, and consumer preferences, with organic and environmentally responsible practices becoming increasingly important for market success. Early adopters of sustainable approaches will benefit from premium positioning and consumer loyalty.

Consumer behavior evolution toward health consciousness, convenience, and authenticity will drive product development and marketing strategies. The market will continue emphasizing quality over quantity, with premium segments showing the strongest growth potential at projected rates of 6.2% annually over the next five years.

Japan’s fresh fruits market demonstrates exceptional resilience and growth potential, built upon foundations of quality excellence, cultural significance, and consumer loyalty that differentiate it from global counterparts. The market’s emphasis on premium positioning, technological innovation, and sustainable practices creates competitive advantages that support long-term viability and profitability for industry participants.

Strategic opportunities in export development, organic production, and direct marketing channels offer pathways for market expansion and margin enhancement. The integration of advanced technologies addresses operational challenges while maintaining the quality standards essential for market success. Future growth will be driven by continued consumer preference for premium quality, expanding health consciousness, and international recognition of Japanese fruit excellence, positioning the market for sustained development and prosperity in the years ahead.

What is Fresh Fruits?

Fresh fruits refer to the edible, juicy products of flowering plants that are consumed raw or used in various culinary applications. They are characterized by their high nutritional value and are often categorized into segments such as tropical fruits, berries, and stone fruits.

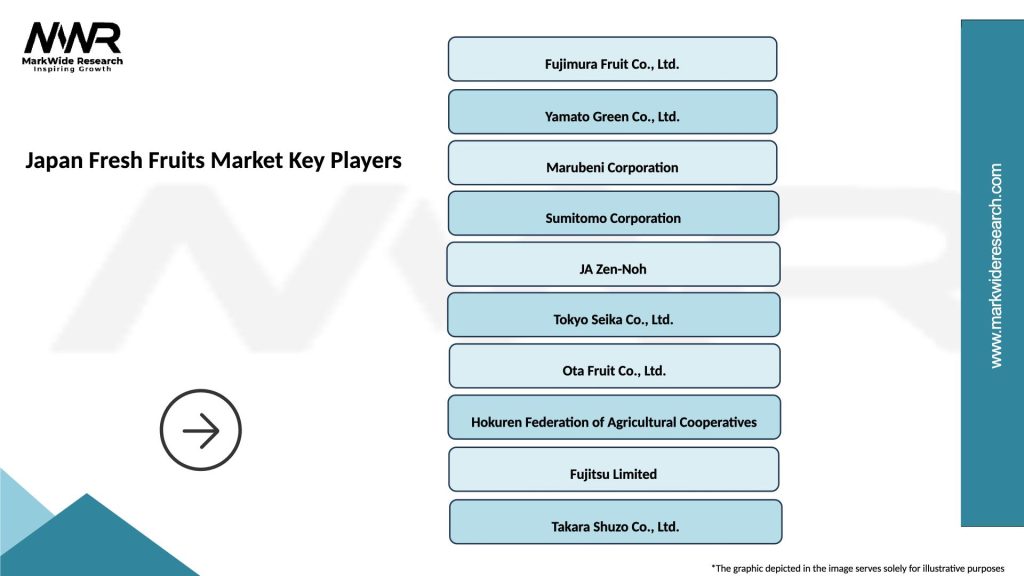

What are the key players in the Japan Fresh Fruits Market?

Key players in the Japan Fresh Fruits Market include companies like JA Group, Marubeni Corporation, and Sumitomo Corporation, which are involved in the distribution and marketing of fresh fruits. These companies play a significant role in ensuring the supply chain and quality of fruits available to consumers, among others.

What are the growth factors driving the Japan Fresh Fruits Market?

The Japan Fresh Fruits Market is driven by factors such as increasing health consciousness among consumers, a growing demand for organic produce, and the rising popularity of fruit-based snacks. Additionally, the trend towards home cooking has also contributed to the market’s growth.

What challenges does the Japan Fresh Fruits Market face?

The Japan Fresh Fruits Market faces challenges such as fluctuating weather conditions affecting crop yields, competition from imported fruits, and changing consumer preferences. These factors can impact the availability and pricing of fresh fruits in the market.

What opportunities exist in the Japan Fresh Fruits Market?

Opportunities in the Japan Fresh Fruits Market include the potential for expanding organic fruit offerings, increasing online sales channels, and the introduction of innovative fruit products. These trends can help companies tap into new consumer segments and enhance market reach.

What trends are shaping the Japan Fresh Fruits Market?

Trends shaping the Japan Fresh Fruits Market include the rise of sustainable farming practices, the popularity of exotic fruits, and the growing interest in functional foods. These trends reflect changing consumer preferences towards healthier and more diverse fruit options.

Japan Fresh Fruits Market

| Segmentation Details | Description |

|---|---|

| Product Type | Apples, Oranges, Bananas, Grapes |

| Distribution Channel | Supermarkets, Online Retail, Farmers’ Markets, Wholesalers |

| Customer Type | Households, Restaurants, Cafés, Juice Bars |

| Packaging Type | Bulk, Retail Packs, Eco-friendly, Plastic Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Fresh Fruits Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at