444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan electric wheelchair market represents a dynamic and rapidly evolving sector within the country’s healthcare and mobility assistance industry. Japan’s unique demographic profile, characterized by one of the world’s most rapidly aging populations, has created substantial demand for advanced mobility solutions. The market encompasses various types of electric wheelchairs, from basic power chairs to sophisticated smart mobility devices equipped with cutting-edge technology.

Market dynamics in Japan are particularly influenced by the country’s aging society, with over 28% of the population aged 65 and above. This demographic shift has intensified the need for reliable, comfortable, and technologically advanced electric wheelchairs. The market is experiencing robust growth driven by increasing healthcare awareness, government support initiatives, and continuous technological innovations in mobility assistance devices.

Japanese manufacturers and international companies are actively competing in this space, offering products that range from lightweight portable models to heavy-duty outdoor electric wheelchairs. The market is characterized by strong emphasis on quality, durability, and user-friendly features that cater to the specific needs of Japanese consumers. Innovation in battery technology, smart connectivity features, and ergonomic design continues to drive market expansion and product differentiation.

The Japan electric wheelchair market refers to the comprehensive ecosystem of powered mobility devices designed to assist individuals with mobility impairments or limitations in navigating their daily activities independently. These electrically powered wheelchairs utilize rechargeable batteries and electric motors to provide propulsion, eliminating the need for manual operation and reducing physical strain on users.

Electric wheelchairs in the Japanese market encompass a wide range of products, including rear-wheel drive, mid-wheel drive, and front-wheel drive configurations. The market includes both indoor and outdoor models, with varying weight capacities, speed capabilities, and technological features. Modern electric wheelchairs often incorporate advanced features such as programmable controls, smartphone connectivity, GPS navigation, and intelligent obstacle detection systems.

Market participants include manufacturers, distributors, healthcare providers, insurance companies, and end-users. The ecosystem also involves regulatory bodies that ensure safety standards, quality certifications, and accessibility compliance. The market serves diverse user groups, including elderly individuals, people with disabilities, rehabilitation patients, and those recovering from injuries or surgeries.

Japan’s electric wheelchair market stands as a testament to the country’s commitment to supporting its aging population and individuals with mobility challenges. The market demonstrates consistent growth patterns driven by demographic trends, technological advancements, and supportive government policies. Key market characteristics include high-quality product standards, innovative design approaches, and strong integration with healthcare systems.

Market growth is primarily fueled by Japan’s super-aged society status, where approximately 35% of wheelchair users are over 75 years old. The market benefits from comprehensive insurance coverage systems, including Japan’s Long-Term Care Insurance program, which provides financial support for mobility aids. This supportive framework has enabled broader market penetration and accessibility for users across different economic segments.

Technological innovation remains a cornerstone of market development, with Japanese and international manufacturers investing heavily in research and development. Smart features, improved battery life, enhanced safety systems, and connectivity options are becoming standard offerings. The market is also witnessing increased focus on lightweight designs, foldable models, and environmentally sustainable manufacturing processes.

Strategic insights reveal several critical factors shaping the Japan electric wheelchair market landscape:

Primary market drivers propelling the Japan electric wheelchair market include several interconnected demographic, technological, and socioeconomic factors. The most significant driver remains Japan’s rapidly aging population, which continues to expand the potential user base for electric mobility solutions.

Demographic transformation represents the fundamental growth engine, with Japan experiencing one of the world’s fastest aging rates. The increasing prevalence of age-related mobility issues, including arthritis, osteoporosis, and general physical decline, creates sustained demand for electric wheelchairs. Additionally, the growing awareness of maintaining independence and quality of life among elderly individuals drives market adoption.

Government initiatives and supportive policies significantly contribute to market growth. Japan’s Long-Term Care Insurance system provides substantial financial assistance for mobility aids, making electric wheelchairs more accessible to a broader population. Government programs promoting active aging and independent living further stimulate market demand.

Technological advancements continue to attract new users and encourage upgrades among existing wheelchair users. Innovations in battery technology, smart features, and user-friendly controls make electric wheelchairs more appealing and practical for daily use. The integration of digital health monitoring and connectivity features adds value beyond basic mobility assistance.

Market constraints affecting the Japan electric wheelchair market include several challenges that may limit growth potential or create barriers to adoption. Understanding these restraints is crucial for market participants to develop effective strategies and solutions.

High initial costs represent a significant barrier for many potential users, despite insurance coverage. Premium electric wheelchairs with advanced features can be expensive, and insurance may not cover the full cost of high-end models. This financial constraint particularly affects middle-income users who may not qualify for maximum insurance benefits but find premium products financially challenging.

Infrastructure limitations in certain areas of Japan pose challenges for electric wheelchair users. While major cities have excellent accessibility features, rural areas and older buildings may lack adequate ramps, elevators, and accessible pathways. These infrastructure gaps can limit the practical utility of electric wheelchairs in some environments.

Technical complexity and maintenance requirements may deter some potential users, particularly elderly individuals who may be less comfortable with technology. The need for regular charging, software updates, and technical troubleshooting can create usability barriers. Additionally, the weight and size of some electric wheelchairs may limit portability and storage options.

Regulatory compliance requirements and safety standards, while necessary, can increase development costs and time-to-market for new products. Manufacturers must navigate complex certification processes and ongoing compliance requirements, which may limit innovation speed or increase product costs.

Emerging opportunities in the Japan electric wheelchair market present significant potential for growth and innovation. These opportunities arise from evolving user needs, technological possibilities, and changing market dynamics that create new avenues for development and expansion.

Smart technology integration offers substantial opportunities for product differentiation and value creation. The development of AI-powered navigation systems, health monitoring capabilities, and seamless connectivity with smart home systems can transform electric wheelchairs from simple mobility aids into comprehensive lifestyle solutions. Integration with telemedicine platforms and remote health monitoring systems represents particularly promising opportunities.

Customization and personalization present growing opportunities as users increasingly seek products tailored to their specific needs and preferences. Modular designs, adjustable features, and personalized control systems can create competitive advantages and justify premium pricing. The development of specialized models for different user groups, such as active seniors or individuals with specific medical conditions, offers market segmentation opportunities.

Rental and subscription models represent innovative business opportunities that can address cost barriers and provide flexible solutions for users with temporary or changing needs. These models can expand market reach and create recurring revenue streams while making electric wheelchairs more accessible to cost-conscious consumers.

Export potential to other aging societies in Asia and beyond offers opportunities for Japanese manufacturers to leverage their expertise and reputation for quality. The growing global demand for mobility solutions creates international expansion possibilities for established Japanese brands.

Market dynamics in the Japan electric wheelchair sector reflect a complex interplay of demographic trends, technological evolution, regulatory frameworks, and competitive forces. These dynamics create a constantly evolving landscape that requires continuous adaptation from market participants.

Supply chain dynamics have become increasingly important, particularly following global disruptions that highlighted the importance of resilient manufacturing and distribution networks. Japanese companies are focusing on localizing key components and developing robust supplier relationships to ensure consistent product availability and quality control.

Competitive dynamics feature both domestic Japanese manufacturers and international brands competing for market share. Japanese companies leverage their understanding of local preferences and quality standards, while international players bring global expertise and potentially lower-cost solutions. This competition drives continuous innovation and improvement in product offerings.

User behavior dynamics show evolving expectations and preferences among electric wheelchair users. Modern users increasingly expect technology integration, aesthetic appeal, and lifestyle compatibility in addition to basic mobility functionality. The growing influence of younger family members in purchase decisions also affects product development priorities.

Regulatory dynamics continue to evolve as authorities balance safety requirements with innovation encouragement. New standards for smart features, connectivity, and data privacy are emerging, requiring manufacturers to adapt their development processes and compliance strategies.

Research approach for analyzing the Japan electric wheelchair market employs comprehensive methodologies combining primary and secondary research techniques to ensure accurate and reliable market insights. The methodology encompasses multiple data collection and analysis approaches to provide a holistic view of market conditions and trends.

Primary research involves direct engagement with key market stakeholders, including manufacturers, distributors, healthcare providers, insurance companies, and end-users. In-depth interviews with industry executives provide insights into strategic directions, challenges, and opportunities. User surveys and focus groups offer valuable perspectives on product preferences, satisfaction levels, and unmet needs.

Secondary research encompasses analysis of industry reports, government statistics, healthcare data, demographic studies, and regulatory documents. This research provides context for market sizing, trend analysis, and competitive landscape assessment. Academic research and clinical studies contribute to understanding of user needs and product effectiveness.

Data validation processes ensure accuracy and reliability through triangulation of multiple sources, expert review, and statistical analysis. Market data is cross-referenced with demographic trends, healthcare statistics, and economic indicators to verify consistency and identify potential discrepancies. MarkWide Research employs rigorous validation protocols to ensure data integrity and analytical accuracy.

Regional distribution within Japan reveals distinct patterns of electric wheelchair adoption and market characteristics across different prefectures and urban-rural divisions. Tokyo and surrounding metropolitan areas represent the largest market concentration, accounting for approximately 42% of total market demand due to high population density and advanced healthcare infrastructure.

Urban markets including Tokyo, Osaka, and Nagoya demonstrate higher adoption rates of advanced electric wheelchairs with smart features and compact designs suitable for city living. These areas benefit from excellent public transportation accessibility, comprehensive healthcare systems, and higher disposable incomes that support premium product adoption.

Rural regions show different market characteristics, with preference for robust, outdoor-capable electric wheelchairs that can handle varied terrain and longer distances between destinations. Rural markets often face challenges with service availability and infrastructure limitations, but government initiatives are working to address these gaps.

Regional preferences vary based on local conditions, with northern prefectures showing demand for cold-weather capable models and southern regions preferring lightweight, heat-resistant designs. Coastal areas may require additional corrosion resistance features, while mountainous regions need enhanced climbing capabilities and battery life.

Market competition in Japan’s electric wheelchair sector features a diverse mix of domestic and international players, each bringing unique strengths and market approaches. The competitive landscape is characterized by innovation focus, quality emphasis, and strong customer service orientation.

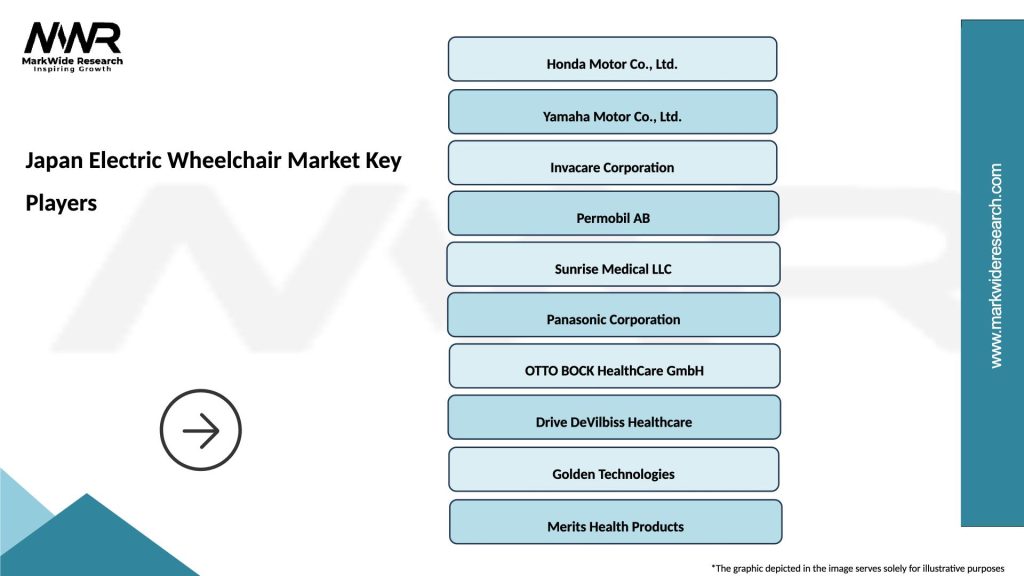

Leading market participants include:

Competitive strategies vary among market participants, with some focusing on premium technology integration while others emphasize cost-effectiveness and accessibility. Japanese companies typically leverage their reputation for quality and reliability, while international players may compete on innovation or pricing advantages.

Market segmentation in Japan’s electric wheelchair market encompasses multiple dimensions that help identify distinct user groups, product categories, and market opportunities. Understanding these segments enables targeted product development and marketing strategies.

By Product Type:

By Application:

By End User:

Product category analysis reveals distinct trends and preferences within different segments of the Japan electric wheelchair market. Each category serves specific user needs and demonstrates unique growth patterns and technological developments.

Premium Category: High-end electric wheelchairs with advanced features command approximately 38% of market value despite representing a smaller volume share. These products incorporate smart technology, superior comfort features, and extensive customization options. Premium models often include GPS navigation, smartphone connectivity, advanced suspension systems, and intelligent obstacle detection.

Standard Category: Mid-range electric wheelchairs represent the largest volume segment, offering balanced functionality and affordability. These products provide reliable mobility solutions with essential features while maintaining reasonable pricing. Standard models typically include basic programmable controls, adequate battery life, and standard safety features.

Portable Category: Lightweight, foldable electric wheelchairs are experiencing rapid growth due to increasing demand for travel-friendly solutions. These models prioritize portability and convenience, often featuring quick-fold mechanisms and airline-compatible designs. The portable segment appeals particularly to active users who require mobility assistance while maintaining lifestyle flexibility.

Heavy-Duty Category: Robust electric wheelchairs designed for larger users or challenging environments represent a specialized but important market segment. These models feature enhanced weight capacity, reinforced construction, and powerful motors suitable for outdoor use and rough terrain navigation.

Industry participants and stakeholders in the Japan electric wheelchair market enjoy numerous advantages and opportunities that contribute to business success and market growth. These benefits span across manufacturers, distributors, healthcare providers, and service organizations.

For Manufacturers:

For Healthcare Providers:

For Distributors and Retailers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends in the Japan electric wheelchair market reflect evolving user expectations, technological capabilities, and market dynamics. These trends shape product development priorities and business strategies across the industry.

Smart Technology Integration represents the most significant trend, with manufacturers incorporating IoT connectivity, smartphone apps, and AI-powered features. Modern electric wheelchairs increasingly offer GPS navigation, health monitoring, remote diagnostics, and integration with smart home systems. This trend is driven by younger family members’ influence on purchase decisions and growing comfort with technology among elderly users.

Lightweight and Portable Designs are gaining popularity as users seek mobility solutions that don’t restrict their lifestyle choices. Foldable electric wheelchairs that can be transported in cars or taken on public transportation are experiencing strong demand growth. This trend reflects the active aging philosophy and desire for continued independence.

Customization and Personalization trends show users increasingly seeking products tailored to their specific needs, preferences, and physical requirements. Modular designs, adjustable features, and personalized control systems are becoming standard offerings. Color customization and aesthetic options are also gaining importance.

Sustainability Focus is emerging as manufacturers adopt eco-friendly materials, energy-efficient technologies, and sustainable manufacturing processes. Battery recycling programs and environmentally conscious design approaches are becoming competitive differentiators.

Service Integration trends show growing emphasis on comprehensive support services, including user training, maintenance programs, and technical support. Subscription-based service models and comprehensive care packages are gaining traction.

Recent industry developments in the Japan electric wheelchair market demonstrate the dynamic nature of this sector and the continuous evolution of products, services, and business models. These developments reflect both technological advancement and changing market needs.

Product Innovation continues to drive industry development, with manufacturers introducing advanced features such as voice control, gesture recognition, and predictive maintenance capabilities. Recent launches include electric wheelchairs with integrated health monitoring systems that can track vital signs and alert healthcare providers to potential issues.

Partnership Developments between wheelchair manufacturers and technology companies are creating new product capabilities and market opportunities. Collaborations with smartphone manufacturers, healthcare technology companies, and AI developers are resulting in more sophisticated and user-friendly products.

Regulatory Updates have introduced new safety standards and technical requirements that are shaping product development priorities. Recent regulations addressing cybersecurity for connected devices and data privacy protection are influencing smart wheelchair development approaches.

Market Expansion initiatives by international companies entering the Japanese market are intensifying competition and driving innovation. These new entrants bring global expertise and potentially disruptive technologies that challenge established market dynamics.

Service Innovation developments include new rental programs, subscription services, and comprehensive care packages that address cost barriers and provide flexible solutions for users with varying needs. These service innovations are expanding market accessibility and creating new revenue models.

Strategic recommendations for market participants in the Japan electric wheelchair sector focus on leveraging demographic trends, technological opportunities, and evolving user expectations to achieve sustainable growth and competitive advantage.

For Manufacturers: Focus on developing smart, connected products that integrate seamlessly with users’ digital lifestyles while maintaining the reliability and quality standards expected in the Japanese market. Invest in user experience design to ensure technology features enhance rather than complicate wheelchair operation. Consider modular product architectures that enable customization without excessive manufacturing complexity.

For Market Entrants: Understand the unique characteristics of Japanese consumer preferences, including emphasis on quality, reliability, and after-sales service. Develop partnerships with local distributors and healthcare providers to build market presence and credibility. Consider starting with specialized market segments where differentiation is possible before expanding to mainstream markets.

For Healthcare Providers: Evaluate opportunities to integrate electric wheelchair services into comprehensive care programs. Consider developing expertise in wheelchair assessment, fitting, and training to provide value-added services. Explore partnerships with manufacturers for institutional purchasing programs and service agreements.

For Investors: MarkWide Research analysis suggests focusing on companies with strong technology capabilities, established market presence, and comprehensive service offerings. Consider the long-term demographic trends and government support policies that provide favorable market conditions for sustained growth.

Future prospects for the Japan electric wheelchair market appear highly favorable, driven by demographic certainties, technological advancement opportunities, and supportive policy environments. The market is positioned for sustained growth with expanding opportunities for innovation and service development.

Demographic projections indicate continued aging of Japan’s population, with the elderly population expected to reach 38% by 2065. This demographic trend ensures sustained demand growth for electric wheelchairs and related mobility solutions. The increasing prevalence of age-related mobility issues will continue to expand the potential user base.

Technology evolution will likely transform electric wheelchairs from basic mobility aids into comprehensive health and lifestyle management platforms. Integration with telemedicine, smart home systems, and health monitoring technologies will create new value propositions and market opportunities. Artificial intelligence and machine learning capabilities will enable predictive maintenance, personalized assistance, and enhanced safety features.

Market expansion opportunities include development of specialized products for specific user groups, expansion of service-based business models, and potential export opportunities to other aging societies. The growing emphasis on active aging and independent living will drive demand for more sophisticated and lifestyle-compatible mobility solutions.

Innovation directions will likely focus on improving user experience, enhancing connectivity, and developing sustainable technologies. Battery technology improvements, weight reduction, and enhanced durability will continue to be important development priorities. Integration with emerging technologies such as autonomous navigation and voice assistants will create new product categories and market segments.

The Japan electric wheelchair market represents a compelling growth opportunity driven by demographic certainties, technological innovation potential, and supportive policy frameworks. The market’s foundation on Japan’s rapidly aging population provides sustained demand growth prospects, while continuous technological advancement creates opportunities for product differentiation and value creation.

Market participants who successfully balance technological innovation with user-friendly design, quality standards with cost-effectiveness, and product excellence with comprehensive service support are positioned to capture significant market opportunities. The emphasis on smart features, customization, and integrated health monitoring reflects evolving user expectations and creates pathways for premium positioning.

Strategic success in this market requires understanding the unique characteristics of Japanese consumers, including their emphasis on quality, reliability, and comprehensive support services. Companies that can navigate the complex regulatory environment while delivering innovative solutions that genuinely improve users’ quality of life will find substantial opportunities for growth and market leadership.

Looking forward, the Japan electric wheelchair market is expected to continue its growth trajectory, supported by demographic trends, technological advancement, and evolving healthcare approaches that emphasize independence and quality of life. The market’s evolution toward smart, connected, and personalized mobility solutions positions it at the forefront of the global assistive technology industry, making it an attractive sector for continued investment and innovation.

What is Electric Wheelchair?

Electric wheelchairs are mobility devices powered by electric motors, designed to assist individuals with limited mobility. They are commonly used by elderly individuals, people with disabilities, and those recovering from surgery.

What are the key players in the Japan Electric Wheelchair Market?

Key players in the Japan Electric Wheelchair Market include Panasonic Corporation, Invacare Corporation, and Sunrise Medical, among others. These companies are known for their innovative designs and advanced technology in electric wheelchair manufacturing.

What are the growth factors driving the Japan Electric Wheelchair Market?

The growth of the Japan Electric Wheelchair Market is driven by an aging population, increasing awareness of mobility solutions, and advancements in technology. Additionally, the rise in healthcare expenditure and demand for personalized mobility aids contribute to market expansion.

What challenges does the Japan Electric Wheelchair Market face?

The Japan Electric Wheelchair Market faces challenges such as high costs of advanced models, limited accessibility in certain areas, and regulatory hurdles. These factors can hinder adoption rates among potential users.

What opportunities exist in the Japan Electric Wheelchair Market?

Opportunities in the Japan Electric Wheelchair Market include the development of smart wheelchairs with integrated technology, expansion into rural areas, and increasing partnerships with healthcare providers. These trends can enhance user experience and accessibility.

What trends are shaping the Japan Electric Wheelchair Market?

Trends in the Japan Electric Wheelchair Market include the integration of IoT technology for enhanced user control, lightweight materials for improved portability, and customizable designs to meet individual needs. These innovations are making electric wheelchairs more user-friendly.

Japan Electric Wheelchair Market

| Segmentation Details | Description |

|---|---|

| Product Type | Standard Wheelchairs, Folding Wheelchairs, Powered Wheelchairs, Sports Wheelchairs |

| Technology | Electric Drive, Smart Control, Joystick Operation, Voice Command |

| End User | Individuals, Healthcare Facilities, Rehabilitation Centers, Senior Living Communities |

| Distribution Channel | Online Retail, Medical Supply Stores, Direct Sales, Specialty Shops |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Electric Wheelchair Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at