444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan electric vehicle charging station market represents a pivotal component of the nation’s ambitious transition toward sustainable transportation infrastructure. As Japan continues to strengthen its commitment to carbon neutrality by 2050, the electric vehicle charging ecosystem has emerged as a critical enabler of widespread EV adoption across the archipelago. The market encompasses various charging technologies, from standard AC charging points to ultra-rapid DC fast charging stations, strategically positioned throughout urban centers, highways, and residential areas.

Market dynamics indicate robust expansion driven by government initiatives, automotive industry investments, and evolving consumer preferences. The charging infrastructure landscape is experiencing unprecedented growth, with installation rates accelerating at approximately 15.2% annually as municipalities and private enterprises collaborate to establish comprehensive charging networks. This growth trajectory reflects Japan’s strategic positioning as a leader in clean energy technology and sustainable mobility solutions.

Regional distribution shows concentrated development in metropolitan areas, with Tokyo, Osaka, and Nagoya leading infrastructure deployment. However, rural and suburban regions are increasingly becoming focal points for charging station expansion, ensuring nationwide accessibility and supporting Japan’s goal of achieving 35% electric vehicle market share by 2030.

The Japan electric vehicle charging station market refers to the comprehensive ecosystem of infrastructure, technology, and services designed to provide electrical energy to battery electric vehicles and plug-in hybrid electric vehicles throughout Japan. This market encompasses the manufacturing, installation, operation, and maintenance of various charging solutions, ranging from residential Level 1 chargers to commercial ultra-fast charging networks capable of delivering power at rates exceeding 150 kW.

Infrastructure components include charging hardware, software management systems, payment processing platforms, grid integration technologies, and supporting electrical infrastructure. The market also encompasses service providers, equipment manufacturers, energy companies, and technology developers who collectively create a seamless charging experience for Japanese EV owners and visitors.

Strategic positioning of Japan’s electric vehicle charging infrastructure reflects the nation’s commitment to technological innovation and environmental sustainability. The market demonstrates remarkable resilience and growth potential, supported by comprehensive government policies, substantial private sector investments, and increasing consumer acceptance of electric mobility solutions.

Key market characteristics include diversified charging technologies, strategic geographic distribution, and integration with renewable energy sources. The charging network expansion is particularly notable in commercial and public sectors, where businesses recognize the competitive advantage of providing EV charging amenities to customers and employees.

Investment trends show significant capital allocation toward fast-charging infrastructure, with deployment rates increasing by approximately 22.8% in high-traffic corridors and commercial districts. This investment pattern reflects market maturity and the transition from basic charging availability to comprehensive, user-friendly charging experiences.

Market intelligence reveals several critical insights shaping the Japan electric vehicle charging station landscape:

Government initiatives serve as the primary catalyst for charging infrastructure expansion, with national and local authorities implementing comprehensive policies to accelerate EV adoption. The Japanese government’s Green Growth Strategy includes substantial funding for charging infrastructure development, creating favorable conditions for market participants and encouraging private sector investment.

Automotive industry transformation represents another significant driver, as major Japanese automakers including Toyota, Nissan, and Honda commit to electric vehicle production increases. These manufacturers are actively partnering with charging infrastructure providers to ensure adequate charging availability for their expanding EV portfolios, creating synergistic market growth.

Environmental consciousness among Japanese consumers continues to strengthen, with surveys indicating that 68% of potential car buyers consider environmental impact as a primary purchase criterion. This shift in consumer preferences is driving demand for accessible, reliable charging infrastructure that supports sustainable transportation choices.

Technological advancements in battery technology and charging efficiency are reducing charging times and improving user convenience, making electric vehicles more attractive to mainstream consumers. These improvements are directly correlating with increased charging station utilization rates and supporting business case development for charging infrastructure investments.

High infrastructure costs present significant challenges for charging station deployment, particularly in rural areas where utilization rates may be lower initially. The substantial capital requirements for fast-charging installations, including electrical infrastructure upgrades and grid connection costs, can create barriers for smaller market participants and limit expansion in economically challenging locations.

Grid capacity limitations in certain regions pose technical constraints on charging infrastructure development. Older electrical distribution systems may require extensive upgrades to support high-power charging installations, creating additional costs and complexity for infrastructure deployment projects.

Land availability and zoning restrictions in densely populated urban areas can limit optimal charging station placement. Competition for prime real estate locations, combined with regulatory approval processes, can extend project timelines and increase development costs.

Standardization challenges persist despite industry progress, with some legacy charging systems creating compatibility issues for certain vehicle models. These technical inconsistencies can create user confusion and limit the universal accessibility that consumers expect from charging infrastructure.

Rural market expansion presents substantial growth opportunities as government initiatives focus on ensuring nationwide charging coverage. Rural and suburban areas offer lower land costs and reduced installation complexity, while serving growing populations of EV adopters seeking convenient charging solutions outside major metropolitan areas.

Commercial integration opportunities are expanding rapidly as retail businesses, hotels, restaurants, and entertainment venues recognize charging stations as customer amenities that can increase dwell time and spending. According to MarkWide Research analysis, businesses with charging facilities report 18% higher customer satisfaction scores compared to those without charging amenities.

Workplace charging represents a significant untapped market segment, with corporate sustainability initiatives driving demand for employee charging benefits. Companies are increasingly viewing workplace charging as an employee retention tool and a demonstration of environmental commitment.

Tourism infrastructure development offers opportunities to serve international visitors and domestic tourists, particularly in scenic and cultural destinations where EV tourism is growing. Charging stations at tourist attractions, national parks, and cultural sites can support sustainable tourism initiatives while generating revenue.

Supply chain evolution is reshaping the charging infrastructure market, with domestic manufacturing capabilities strengthening to support growing demand. Japanese companies are investing in local production facilities for charging equipment, reducing dependence on imports and improving supply chain resilience.

Partnership ecosystems are becoming increasingly important, with energy companies, technology providers, automotive manufacturers, and real estate developers forming strategic alliances to accelerate infrastructure deployment. These collaborations are creating integrated solutions that address multiple market needs simultaneously.

Regulatory frameworks continue evolving to support market growth while ensuring safety and interoperability standards. Recent policy updates have streamlined permitting processes and established clearer guidelines for charging infrastructure installation, reducing regulatory uncertainty for market participants.

Consumer behavior patterns show increasing acceptance of electric vehicles, with charging convenience ranking as the second most important factor in EV purchase decisions. This consumer priority is driving market participants to focus on user experience improvements and charging network reliability.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry stakeholders, including charging infrastructure providers, automotive manufacturers, energy companies, and government officials responsible for EV policy development.

Secondary research incorporates analysis of government publications, industry reports, company financial statements, and regulatory filings to provide comprehensive market understanding. Data validation processes ensure accuracy and reliability of market intelligence.

Market modeling utilizes advanced analytical techniques to project market trends and identify growth opportunities. Statistical analysis of historical data, combined with forward-looking scenario planning, provides robust market forecasts and strategic insights.

Field research includes site visits to charging installations, user experience assessments, and technology evaluations to provide practical insights into market conditions and operational challenges.

Tokyo Metropolitan Area dominates the charging infrastructure landscape, accounting for approximately 32% of total installations nationwide. The region benefits from high population density, strong government support, and concentrated automotive industry presence. Urban charging solutions, including destination charging at shopping centers and office buildings, are particularly well-developed.

Kansai Region including Osaka, Kyoto, and Kobe represents the second-largest market segment, with robust infrastructure development supporting both urban and intercity travel. The region’s focus on sustainable tourism is driving charging station installations at cultural sites and tourist destinations.

Chubu Region centered around Nagoya benefits from strong automotive industry presence and manufacturing activity. The region shows particular strength in workplace charging installations and industrial facility charging infrastructure.

Rural prefectures are experiencing accelerated growth, with government initiatives ensuring equitable access to charging infrastructure. These regions offer opportunities for innovative charging solutions, including solar-powered installations and community-based charging networks.

Market leadership is distributed among several key players, each contributing unique strengths to the charging infrastructure ecosystem:

By Charging Type:

By Application:

By Power Output:

Public charging infrastructure demonstrates the strongest growth trajectory, with installations increasing at approximately 19.5% annually as municipalities prioritize accessible charging solutions. Public charging stations are becoming increasingly sophisticated, incorporating smart payment systems, real-time availability monitoring, and integration with mobile applications for enhanced user experience.

Residential charging solutions show steady growth as homeowners invest in convenient charging capabilities. The segment benefits from government incentives and decreasing equipment costs, making home charging installations increasingly attractive for EV owners seeking overnight charging convenience.

Commercial charging represents the fastest-expanding category, with businesses recognizing charging stations as competitive differentiators and customer service enhancements. Retail locations, hotels, and restaurants are leading commercial charging adoption, viewing infrastructure investment as marketing and customer retention strategies.

Fleet charging is emerging as a specialized segment, with logistics companies, delivery services, and corporate fleets requiring dedicated charging solutions. This category demands higher utilization rates and specialized management systems to support operational efficiency.

Energy companies benefit from new revenue streams and grid modernization opportunities through charging infrastructure development. The integration of charging stations with smart grid technologies creates opportunities for demand response programs and energy storage applications, enhancing overall grid efficiency and reliability.

Automotive manufacturers gain competitive advantages by ensuring adequate charging infrastructure availability for their electric vehicle customers. Strategic partnerships with charging providers enable automakers to offer comprehensive mobility solutions and reduce customer concerns about charging accessibility.

Real estate developers can increase property values and attract tenants by incorporating charging infrastructure into residential and commercial developments. Charging amenities are becoming standard expectations for modern buildings, particularly in urban markets.

Government entities achieve environmental policy objectives while stimulating economic development through charging infrastructure investments. Public charging networks support tourism, reduce urban air pollution, and demonstrate commitment to sustainable development goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart charging integration is transforming the charging experience through intelligent load management, dynamic pricing, and grid optimization capabilities. These technologies enable charging stations to communicate with electrical grids, vehicles, and users to optimize charging schedules and reduce energy costs.

Renewable energy integration is becoming standard practice, with solar-powered charging stations and battery storage systems providing sustainable charging solutions. This trend supports Japan’s renewable energy goals while reducing operational costs for charging infrastructure operators.

Mobile application integration is enhancing user experience through real-time charging station availability, reservation systems, and seamless payment processing. Advanced applications provide route planning with charging stops, energy cost calculations, and charging history tracking.

Ultra-fast charging deployment is accelerating to meet consumer expectations for rapid charging experiences comparable to traditional fuel stops. These installations require significant electrical infrastructure but provide competitive advantages for high-traffic locations.

Strategic partnerships between automotive manufacturers and charging infrastructure providers are creating integrated mobility ecosystems. Recent collaborations include joint ventures for charging network development and technology sharing agreements for advanced charging solutions.

Government funding initiatives have allocated substantial resources for charging infrastructure expansion, with particular focus on rural areas and highway corridors. These programs provide financial incentives for private sector participation and accelerate deployment timelines.

Technology standardization efforts are progressing through industry collaboration and regulatory guidance. Recent developments include universal payment systems, standardized charging protocols, and interoperability requirements for public charging stations.

International expansion by Japanese charging infrastructure companies is creating global market opportunities while bringing international expertise to the domestic market. These cross-border activities are enhancing technology transfer and competitive positioning.

Infrastructure planning should prioritize strategic location selection based on traffic patterns, demographic analysis, and future development plans. MWR recommends focusing on high-utilization locations that can support sustainable business models while serving diverse user needs.

Technology investment should emphasize future-ready solutions that can adapt to evolving charging standards and user expectations. Companies should consider modular designs that allow for capacity upgrades and technology refresh without complete infrastructure replacement.

Partnership development represents a critical success factor, with collaboration enabling resource sharing, risk mitigation, and market access acceleration. Strategic alliances should focus on complementary capabilities and shared market objectives.

User experience optimization should remain a primary focus, with charging infrastructure designed to provide convenient, reliable, and intuitive experiences. Investment in customer service, maintenance programs, and technology updates will differentiate successful market participants.

Market expansion is projected to continue at robust rates, with charging infrastructure deployment accelerating to support growing EV adoption. The market is expected to achieve comprehensive geographic coverage by 2028, with charging stations accessible within reasonable distances throughout Japan.

Technology evolution will drive next-generation charging solutions, including wireless charging, vehicle-to-grid integration, and artificial intelligence-powered charging optimization. These innovations will enhance user convenience while providing grid stability benefits and new revenue opportunities.

Business model innovation will create diverse revenue streams beyond basic charging services, including energy storage, grid services, advertising, and mobility-as-a-service integration. According to MarkWide Research projections, ancillary services could represent 25% of charging infrastructure revenue by 2030.

International integration will strengthen through standardization efforts and cross-border collaboration, supporting Japan’s position as a global leader in sustainable transportation infrastructure. This international connectivity will benefit both domestic users and international visitors.

The Japan electric vehicle charging station market represents a dynamic and rapidly evolving sector that is fundamental to the nation’s sustainable transportation future. With strong government support, technological innovation, and increasing consumer acceptance, the market demonstrates exceptional growth potential and strategic importance for Japan’s environmental and economic objectives.

Market participants who focus on user experience, strategic partnerships, and technology innovation will be best positioned to capitalize on emerging opportunities. The transition from basic charging availability to comprehensive, intelligent charging ecosystems creates substantial value creation potential for forward-thinking companies and investors.

Long-term success in this market will depend on continued collaboration between government, industry, and technology providers to create seamless, accessible, and sustainable charging infrastructure that supports Japan’s vision of a carbon-neutral society. The foundation for this transformation is already in place, with accelerating deployment rates and improving technology creating positive momentum for continued market expansion.

What is Electric Vehicle Charging Station?

Electric Vehicle Charging Stations are facilities that provide electric energy for the recharging of electric vehicles. They are essential for the growth of electric mobility, enabling users to charge their vehicles conveniently in various locations.

What are the key players in the Japan Electric Vehicle Charging Station Market?

Key players in the Japan Electric Vehicle Charging Station Market include companies like Nissan, Toyota, and ChargePoint, which are actively involved in the development and deployment of charging infrastructure, among others.

What are the main drivers of the Japan Electric Vehicle Charging Station Market?

The main drivers of the Japan Electric Vehicle Charging Station Market include the increasing adoption of electric vehicles, government incentives for EV infrastructure, and the growing demand for sustainable transportation solutions.

What challenges does the Japan Electric Vehicle Charging Station Market face?

Challenges in the Japan Electric Vehicle Charging Station Market include the high initial investment costs for infrastructure development, limited charging station availability in rural areas, and the need for standardization in charging technologies.

What opportunities exist in the Japan Electric Vehicle Charging Station Market?

Opportunities in the Japan Electric Vehicle Charging Station Market include advancements in fast-charging technologies, the potential for integrating renewable energy sources, and the expansion of charging networks to support growing EV adoption.

What trends are shaping the Japan Electric Vehicle Charging Station Market?

Trends shaping the Japan Electric Vehicle Charging Station Market include the rise of smart charging solutions, increased collaboration between automakers and charging network providers, and the integration of charging stations with urban planning initiatives.

Japan Electric Vehicle Charging Station Market

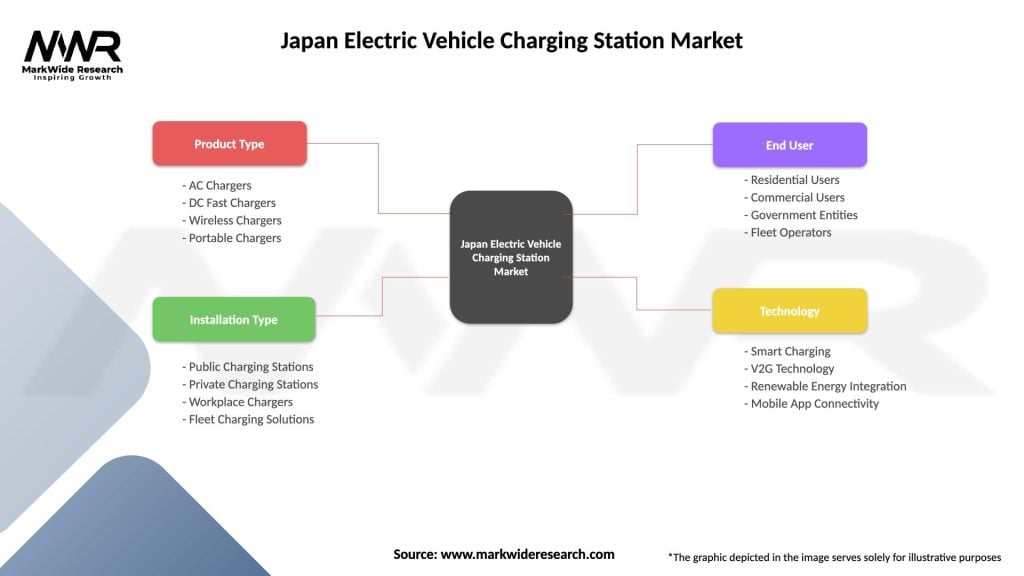

| Segmentation Details | Description |

|---|---|

| Product Type | AC Chargers, DC Fast Chargers, Wireless Chargers, Portable Chargers |

| Installation Type | Public Charging Stations, Private Charging Stations, Workplace Chargers, Fleet Charging Solutions |

| End User | Residential Users, Commercial Users, Government Entities, Fleet Operators |

| Technology | Smart Charging, V2G Technology, Renewable Energy Integration, Mobile App Connectivity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Electric Vehicle Charging Station Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at