444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan DRAM market represents a cornerstone of the global semiconductor industry, showcasing remarkable technological advancement and manufacturing excellence. As one of the world’s leading memory chip producers, Japan has established itself as a critical hub for Dynamic Random Access Memory development and production. The market demonstrates consistent growth patterns, with industry analysts projecting a compound annual growth rate of 6.2% through the forecast period.

Japanese DRAM manufacturers have maintained their competitive edge through continuous innovation in memory architecture and process technology. The market encompasses various applications ranging from consumer electronics to enterprise computing solutions, with mobile devices accounting for approximately 45% of total DRAM consumption in the region. Manufacturing capabilities in Japan are characterized by advanced fabrication facilities and cutting-edge research and development initiatives that drive technological breakthroughs.

Market dynamics reflect the increasing demand for high-performance memory solutions across multiple sectors. The automotive industry’s digital transformation has emerged as a significant growth driver, with automotive DRAM applications experiencing rapid expansion. Additionally, the proliferation of artificial intelligence and machine learning applications has created substantial demand for specialized memory configurations optimized for data-intensive workloads.

The Japan DRAM market refers to the comprehensive ecosystem of Dynamic Random Access Memory design, manufacturing, and distribution activities within Japan’s semiconductor industry. DRAM technology serves as volatile memory storage that provides temporary data access for computing devices, enabling rapid information processing and system performance optimization.

Dynamic Random Access Memory represents a fundamental component in modern electronic systems, characterized by its ability to store data temporarily while power is supplied to the device. The Japanese market encompasses both domestic consumption and export-oriented production, with leading manufacturers such as Micron Technology Japan, Samsung Semiconductor Japan, and various domestic players contributing to the market landscape.

Market significance extends beyond traditional computing applications, encompassing emerging technologies such as Internet of Things devices, autonomous vehicles, and next-generation gaming consoles. The Japanese approach to DRAM development emphasizes quality, reliability, and technological innovation, positioning the market as a global benchmark for memory technology advancement.

Japan’s DRAM market demonstrates robust growth momentum driven by technological innovation and expanding application domains. The market benefits from strong domestic demand coupled with significant export opportunities, particularly in high-performance computing and mobile device segments. Key market drivers include the digital transformation of traditional industries, increasing data center requirements, and the growing adoption of artificial intelligence technologies.

Competitive landscape features both international corporations with Japanese operations and domestic technology companies specializing in memory solutions. The market structure reflects a balance between volume production capabilities and specialized high-performance memory products. Manufacturing efficiency improvements have contributed to cost optimization while maintaining quality standards that define Japanese semiconductor production.

Strategic initiatives focus on next-generation memory technologies, including DDR5 and emerging memory architectures that promise enhanced performance and energy efficiency. The market’s evolution aligns with global trends toward increased memory bandwidth requirements and reduced power consumption, positioning Japanese manufacturers at the forefront of industry innovation.

Market analysis reveals several critical insights that shape the Japan DRAM landscape. MarkWide Research indicates that technological advancement remains the primary differentiator among market participants, with companies investing heavily in research and development activities.

Primary market drivers propelling Japan’s DRAM industry growth encompass technological advancement, application expansion, and evolving consumer demands. The increasing complexity of electronic devices requires higher memory capacity and improved performance characteristics, creating sustained demand for advanced DRAM solutions.

Digital transformation initiatives across various industries generate substantial memory requirements, particularly in data processing and storage applications. The automotive sector’s evolution toward connected and autonomous vehicles represents a significant growth opportunity, with automotive DRAM demand expected to increase by approximately 35% annually over the next five years.

Artificial intelligence and machine learning applications drive demand for specialized memory configurations optimized for parallel processing and high-bandwidth data access. The proliferation of edge computing devices creates additional market opportunities, as these systems require efficient memory solutions that balance performance with power consumption constraints.

Gaming industry growth contributes significantly to market expansion, with next-generation gaming consoles and high-performance gaming PCs requiring advanced memory technologies. The mobile device market continues to evolve, with smartphones and tablets demanding higher memory capacities to support increasingly sophisticated applications and multimedia content.

Market challenges facing Japan’s DRAM industry include intense global competition, cyclical demand patterns, and significant capital investment requirements. The semiconductor industry’s inherent volatility creates planning difficulties for manufacturers and affects long-term investment decisions.

Manufacturing costs represent a substantial constraint, particularly as advanced process technologies require expensive fabrication equipment and specialized facilities. The need for continuous technology upgrades to maintain competitiveness places financial pressure on market participants, especially smaller companies with limited resources.

Supply chain complexities pose ongoing challenges, particularly regarding raw material availability and logistics coordination. Global semiconductor shortages have highlighted vulnerabilities in supply chain management, prompting companies to reassess their sourcing strategies and inventory management approaches.

Regulatory considerations increasingly influence market operations, with environmental regulations affecting manufacturing processes and trade policies impacting export opportunities. The need to comply with various international standards and certification requirements adds complexity and cost to market participation.

Emerging opportunities in Japan’s DRAM market span multiple technology domains and application areas. The development of 5G networks creates substantial demand for high-performance memory solutions capable of supporting increased data throughput and reduced latency requirements.

Internet of Things expansion presents significant growth potential, with billions of connected devices requiring efficient memory solutions. The market opportunity extends to specialized DRAM products optimized for low-power applications and extended operational lifespans typical of IoT deployments.

Data center modernization drives demand for server-grade DRAM products with enhanced reliability and performance characteristics. Cloud computing growth creates sustained demand for memory solutions that support virtualization and distributed computing architectures.

Emerging memory technologies offer opportunities for market differentiation and premium positioning. Companies investing in next-generation memory architectures, including persistent memory and neuromorphic computing solutions, may capture significant market share in developing application segments.

Market dynamics in Japan’s DRAM industry reflect the interplay between technological innovation, competitive pressures, and evolving customer requirements. The cyclical nature of semiconductor demand creates periodic fluctuations in pricing and production volumes, requiring adaptive business strategies.

Competitive intensity drives continuous improvement in manufacturing efficiency and product performance. Companies must balance cost optimization with quality maintenance while investing in future technology development. The market rewards innovation and technological leadership, creating incentives for substantial research and development investments.

Customer relationships play crucial roles in market success, with long-term partnerships enabling better demand forecasting and product customization opportunities. The trend toward closer collaboration between memory manufacturers and system integrators facilitates optimized solutions for specific applications.

Technology convergence influences market evolution, with traditional boundaries between different memory types becoming less distinct. The integration of DRAM with other semiconductor technologies creates opportunities for system-level optimization and enhanced performance delivery.

Research approach for analyzing Japan’s DRAM market employs comprehensive data collection and analysis methodologies. Primary research includes interviews with industry executives, technology experts, and market participants to gather insights into current trends and future developments.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and technology publications. This approach provides historical context and quantitative data supporting market trend identification and growth projections.

Market segmentation analysis examines various dimensions including technology types, application areas, and customer segments. This detailed segmentation enables precise market sizing and growth opportunity identification across different market components.

Competitive analysis evaluates market participants based on technology capabilities, market positioning, financial performance, and strategic initiatives. This assessment provides insights into competitive dynamics and market structure evolution.

Regional distribution within Japan’s DRAM market reflects the concentration of manufacturing facilities and technology development centers. The Kansai region accounts for approximately 40% of domestic production capacity, benefiting from established semiconductor clusters and supporting infrastructure.

Tokyo metropolitan area serves as the primary hub for research and development activities, hosting major technology companies and research institutions. The region’s concentration of talent and resources facilitates innovation and technology transfer between organizations.

Kyushu region has emerged as a significant manufacturing center, with several major semiconductor facilities contributing to national production capacity. The region benefits from government support for semiconductor industry development and strategic location advantages for Asian market access.

Export markets represent substantial opportunities for Japanese DRAM manufacturers, with Asia-Pacific markets accounting for approximately 55% of export volumes. North American and European markets provide additional growth opportunities, particularly for high-performance and specialized memory products.

Competitive environment in Japan’s DRAM market features both global semiconductor giants and specialized domestic companies. Market leadership positions are determined by technology capabilities, manufacturing scale, and customer relationships.

Market competition centers on technological innovation, manufacturing efficiency, and customer service excellence. Companies differentiate through specialized product offerings, advanced process technologies, and comprehensive support services.

Market segmentation analysis reveals diverse application areas and technology categories within Japan’s DRAM market. By Technology: DDR4 currently dominates with approximately 60% market share, while DDR5 adoption accelerates across high-performance applications.

By Application:

By Density: High-density DRAM products experience strongest growth, driven by applications requiring substantial memory capacity within space-constrained environments.

Mobile DRAM segment represents the largest application category, benefiting from continuous smartphone evolution and increasing memory requirements. Low-power DDR technologies dominate this segment, with manufacturers focusing on energy efficiency and compact form factors.

Server DRAM category demonstrates strong growth driven by data center expansion and cloud computing adoption. This segment demands high-reliability products with enhanced error correction capabilities and optimized performance characteristics for server workloads.

Automotive DRAM applications show exceptional growth potential as vehicles incorporate more electronic systems. Automotive-grade memory requires specialized qualification processes and extended temperature operation capabilities, creating opportunities for premium pricing.

Gaming and graphics applications drive demand for high-bandwidth memory solutions optimized for parallel processing workloads. This category benefits from continuous performance improvements in gaming hardware and professional graphics applications.

Industry participants in Japan’s DRAM market benefit from several strategic advantages. Technology leadership positions enable premium pricing and preferred customer relationships, particularly in applications requiring high-performance memory solutions.

Manufacturing excellence provides cost advantages and quality differentiation compared to competitors. Japanese companies leverage advanced process technologies and quality management systems to deliver superior products with enhanced reliability characteristics.

Market access benefits include established relationships with major electronics manufacturers and system integrators. These partnerships facilitate product development collaboration and provide insights into future market requirements.

Innovation ecosystem advantages stem from Japan’s strong research and development infrastructure, including universities, research institutions, and technology companies. This environment supports continuous innovation and technology advancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Japan’s DRAM industry include the transition toward higher-performance memory architectures and increased integration with system-level solutions. DDR5 adoption accelerates across various applications, with penetration rates expected to reach 25% by 2025.

Artificial intelligence integration drives demand for specialized memory configurations optimized for machine learning workloads. This trend creates opportunities for differentiated products with enhanced parallel processing capabilities and optimized data access patterns.

Sustainability initiatives increasingly influence product development and manufacturing processes. Companies focus on energy-efficient memory solutions and environmentally responsible manufacturing practices to meet customer requirements and regulatory standards.

Edge computing growth creates demand for memory solutions that balance performance with power efficiency. This trend supports market expansion in IoT applications and distributed computing architectures.

Recent industry developments highlight the dynamic nature of Japan’s DRAM market. MWR analysis indicates that major manufacturers have announced significant capacity expansion plans to meet growing demand across multiple application segments.

Technology partnerships between Japanese companies and international research institutions accelerate innovation in next-generation memory technologies. These collaborations focus on developing memory solutions for emerging applications such as neuromorphic computing and quantum systems.

Manufacturing investments in advanced fabrication facilities demonstrate industry commitment to maintaining technological leadership. Companies are implementing cutting-edge process technologies to improve manufacturing efficiency and product performance.

Market consolidation activities reshape competitive dynamics, with strategic acquisitions and partnerships creating stronger market positions for participating companies. These developments enable better resource utilization and technology sharing among market participants.

Strategic recommendations for Japan DRAM market participants emphasize the importance of technology differentiation and application-specific product development. Companies should focus on high-value market segments where Japanese quality and innovation advantages provide competitive benefits.

Investment priorities should target next-generation memory technologies and manufacturing process improvements. Research and development spending remains critical for maintaining technological leadership and capturing emerging market opportunities.

Partnership strategies can enhance market access and technology development capabilities. Collaborations with system integrators, technology companies, and research institutions provide valuable insights into future market requirements and application trends.

Market expansion efforts should focus on high-growth application areas such as automotive electronics, artificial intelligence, and edge computing. These segments offer opportunities for premium pricing and long-term customer relationships.

Future market prospects for Japan’s DRAM industry appear positive, supported by continued technology advancement and expanding application domains. The market is expected to maintain steady growth momentum, with compound annual growth rates projected at approximately 6.8% through 2030.

Technology evolution toward advanced memory architectures will create new market opportunities and enable performance improvements across various applications. The transition to DDR5 and beyond will drive product refresh cycles and support market expansion.

Application diversification reduces market dependence on traditional computing segments while creating opportunities in emerging technology areas. The automotive and industrial sectors represent particularly promising growth areas for specialized DRAM products.

Competitive positioning will increasingly depend on innovation capabilities and customer relationship strength. Companies that successfully balance technology leadership with cost competitiveness will capture the largest market opportunities in the evolving landscape.

Japan’s DRAM market represents a dynamic and technologically advanced segment of the global semiconductor industry. The market benefits from strong domestic capabilities in research, development, and manufacturing, positioning Japanese companies as leaders in high-performance memory solutions.

Growth opportunities span multiple application areas, from traditional computing to emerging technologies such as artificial intelligence and autonomous vehicles. The market’s evolution toward higher-performance memory architectures and specialized applications creates substantial potential for companies that can successfully navigate technological transitions and customer requirements.

Strategic success in this market requires continuous innovation, manufacturing excellence, and strong customer relationships. Companies that leverage Japan’s technological strengths while addressing cost competitiveness challenges will be best positioned to capture future growth opportunities in the expanding global memory market.

What is DRAM?

DRAM, or Dynamic Random Access Memory, is a type of volatile memory used in computers and other devices to store data temporarily. It is essential for the performance of applications that require fast data access, such as gaming, video editing, and server operations.

What are the key players in the Japan DRAM Market?

The Japan DRAM Market features several prominent companies, including Samsung Electronics, SK Hynix, and Micron Technology, which are known for their advanced memory solutions. These companies compete on technology innovation and production efficiency, among others.

What are the growth factors driving the Japan DRAM Market?

The Japan DRAM Market is driven by the increasing demand for high-performance computing, the growth of artificial intelligence applications, and the expansion of the gaming industry. Additionally, the rise in data centers and cloud computing services contributes to market growth.

What challenges does the Japan DRAM Market face?

The Japan DRAM Market faces challenges such as fluctuating raw material prices and intense competition among manufacturers. Additionally, the rapid pace of technological advancements requires continuous investment in research and development.

What opportunities exist in the Japan DRAM Market?

The Japan DRAM Market presents opportunities in emerging technologies like autonomous vehicles and the Internet of Things (IoT). As these sectors grow, the demand for advanced memory solutions is expected to increase significantly.

What trends are shaping the Japan DRAM Market?

Current trends in the Japan DRAM Market include the shift towards higher capacity memory modules and the development of energy-efficient DRAM technologies. Additionally, the integration of AI in memory management is becoming increasingly prevalent.

Japan DRAM Market

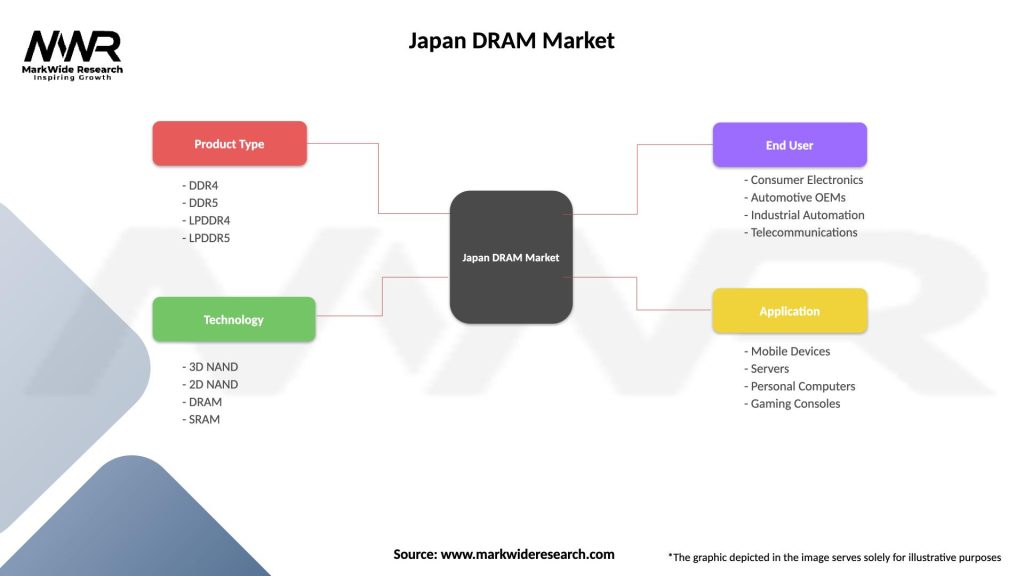

| Segmentation Details | Description |

|---|---|

| Product Type | DDR4, DDR5, LPDDR4, LPDDR5 |

| Technology | 3D NAND, 2D NAND, DRAM, SRAM |

| End User | Consumer Electronics, Automotive OEMs, Industrial Automation, Telecommunications |

| Application | Mobile Devices, Servers, Personal Computers, Gaming Consoles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan DRAM Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at