444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Japan’s digital transformation market represents one of the most dynamic and rapidly evolving technology landscapes in Asia-Pacific, driven by the nation’s commitment to modernizing its traditional industries and embracing innovative digital solutions. The market encompasses a comprehensive range of technologies including cloud computing, artificial intelligence, Internet of Things (IoT), big data analytics, and robotic process automation, all aimed at revolutionizing how Japanese businesses operate and compete globally.

Market dynamics indicate robust growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 12.3% as organizations across various industries accelerate their digital adoption strategies. This transformation is particularly pronounced in manufacturing, healthcare, financial services, and retail sectors, where traditional Japanese companies are leveraging advanced technologies to enhance operational efficiency and customer experiences.

Government initiatives play a crucial role in driving market expansion, with Japan’s Society 5.0 vision and Digital Transformation Strategy creating favorable conditions for technology adoption. The integration of digital solutions has become essential for Japanese enterprises seeking to maintain competitive advantages in an increasingly connected global economy, with cloud adoption rates reaching 68% among large enterprises.

The Japan digital transformation market refers to the comprehensive ecosystem of technologies, services, and solutions designed to fundamentally change how Japanese organizations operate, deliver value to customers, and compete in the digital economy through the strategic adoption of advanced digital technologies.

Digital transformation in the Japanese context encompasses the integration of cutting-edge technologies into all aspects of business operations, fundamentally altering organizational processes, culture, and customer interactions. This transformation extends beyond simple technology adoption to include comprehensive business model innovation, data-driven decision making, and the creation of new digital revenue streams.

Key components of Japan’s digital transformation landscape include cloud migration services, artificial intelligence implementation, IoT connectivity solutions, cybersecurity frameworks, and digital workplace technologies. These elements work synergistically to enable Japanese companies to modernize legacy systems, improve operational efficiency, and develop innovative products and services that meet evolving market demands.

Japan’s digital transformation market stands at the forefront of technological innovation in Asia, characterized by strong government support, substantial corporate investment, and a growing ecosystem of technology providers and system integrators. The market demonstrates exceptional resilience and adaptability, with organizations across diverse sectors embracing digital solutions to address demographic challenges, enhance productivity, and maintain global competitiveness.

Market penetration varies significantly across different industry verticals, with manufacturing and financial services leading adoption rates at 75% and 72% respectively. The healthcare and retail sectors are experiencing rapid catch-up growth, driven by pandemic-induced acceleration of digital initiatives and changing consumer expectations for seamless digital experiences.

Technology adoption patterns reveal a strong preference for hybrid cloud solutions, AI-powered automation, and IoT-enabled smart manufacturing systems. Japanese enterprises are increasingly prioritizing cybersecurity investments, with security-related spending accounting for 18% of total digital transformation budgets. The market outlook remains highly positive, supported by continued government digitalization policies and increasing recognition of digital transformation as a business imperative rather than a technology upgrade.

Strategic insights from Japan’s digital transformation landscape reveal several critical trends shaping market evolution and competitive dynamics:

Government policy support serves as a primary catalyst for Japan’s digital transformation acceleration, with comprehensive national strategies including Society 5.0 and the Digital Government Action Plan creating favorable regulatory environments and substantial public sector investment in digital infrastructure. These initiatives provide clear direction and financial incentives for private sector digital adoption.

Demographic pressures significantly influence market growth, as Japan’s aging population and declining workforce necessitate automation and digital solutions to maintain productivity levels. Companies are increasingly turning to AI-powered systems, robotic process automation, and smart manufacturing technologies to address labor shortages and enhance operational efficiency across various industries.

Global competitiveness requirements drive Japanese enterprises to embrace digital transformation as essential for maintaining market leadership in international markets. The need to compete with digitally native companies from other regions compels traditional Japanese businesses to modernize their operations, customer engagement strategies, and product development processes through advanced technology adoption.

Pandemic-induced acceleration has fundamentally altered business priorities, with remote work capabilities, digital customer interfaces, and supply chain resilience becoming critical success factors. This shift has accelerated digital transformation timelines and increased executive commitment to comprehensive technology modernization initiatives across all business sectors.

Cultural resistance to change represents a significant challenge in Japan’s digital transformation journey, as traditional business practices and hierarchical organizational structures can impede rapid technology adoption. Many established companies struggle with change management processes required for successful digital transformation implementation, particularly in conservative industries with deeply rooted operational traditions.

Skills shortage in digital technologies creates substantial barriers to transformation initiatives, with limited availability of qualified professionals in areas such as cloud architecture, data science, cybersecurity, and AI development. This talent gap forces organizations to invest heavily in training programs or compete intensively for scarce technical expertise, potentially slowing implementation timelines.

Legacy system complexity poses technical challenges for many Japanese enterprises operating sophisticated but outdated IT infrastructure. The integration of modern digital solutions with existing systems requires careful planning, substantial investment, and extended implementation periods, creating hesitation among decision-makers concerned about operational disruption.

Cybersecurity concerns increasingly influence digital transformation strategies, as organizations must balance innovation objectives with security requirements. The growing threat landscape and regulatory compliance obligations necessitate comprehensive security frameworks that can add complexity and cost to transformation initiatives.

Smart city initiatives present substantial growth opportunities as Japanese municipalities invest in IoT infrastructure, intelligent transportation systems, and digital governance platforms. These projects create demand for integrated technology solutions spanning multiple domains including energy management, traffic optimization, and citizen services digitalization.

Industry 4.0 implementation offers significant potential in Japan’s manufacturing sector, where companies are investing in smart factory technologies, predictive maintenance systems, and supply chain digitalization. The integration of AI, IoT, and advanced analytics in manufacturing processes creates opportunities for technology providers specializing in industrial automation and data management solutions.

Healthcare digitalization represents a rapidly expanding market segment, driven by aging population demographics and the need for efficient healthcare delivery systems. Opportunities include telemedicine platforms, electronic health records, AI-powered diagnostic tools, and remote patient monitoring solutions that can improve care quality while reducing costs.

Financial services innovation continues to drive digital transformation investments, with opportunities in digital banking platforms, blockchain applications, regulatory technology solutions, and AI-powered risk management systems. The sector’s embrace of fintech innovations creates demand for comprehensive digital infrastructure and customer experience enhancement technologies.

Competitive dynamics in Japan’s digital transformation market reflect a complex ecosystem involving global technology giants, domestic system integrators, and specialized solution providers. Market consolidation trends are evident as larger players acquire niche specialists to expand service capabilities and geographic coverage, while partnerships between international vendors and local integrators facilitate market penetration.

Technology evolution patterns demonstrate rapid advancement in AI capabilities, edge computing solutions, and 5G-enabled applications. These technological developments create new possibilities for digital transformation initiatives while requiring continuous adaptation of implementation strategies and solution architectures. The pace of innovation necessitates agile approaches to technology adoption and vendor selection processes.

Customer behavior shifts significantly influence market dynamics, with Japanese consumers and businesses demonstrating increased comfort with digital interfaces and automated services. This behavioral change, accelerated by pandemic experiences, creates opportunities for more comprehensive digital transformation initiatives that previously faced user acceptance challenges.

Investment patterns reveal growing confidence in digital transformation returns, with organizations allocating larger portions of IT budgets to modernization initiatives. MarkWide Research analysis indicates that digital transformation spending efficiency has improved by 23% over the past two years, encouraging continued investment in advanced technology solutions.

Primary research methodologies employed in analyzing Japan’s digital transformation market include comprehensive surveys of enterprise decision-makers, in-depth interviews with technology executives, and detailed case studies of successful transformation initiatives. These primary sources provide direct insights into market trends, challenges, and opportunities from the perspective of actual market participants.

Secondary research approaches encompass analysis of government policy documents, industry reports, financial statements of key market players, and technology adoption statistics from various authoritative sources. This secondary research provides context for primary findings and enables comprehensive market sizing and trend analysis across different industry segments.

Data validation processes ensure research accuracy through triangulation of multiple information sources, expert review panels, and statistical verification of quantitative findings. The methodology includes regular updates to reflect rapidly changing market conditions and emerging technology trends that influence digital transformation strategies.

Market segmentation analysis utilizes both quantitative and qualitative research techniques to identify distinct customer segments, technology adoption patterns, and competitive positioning within the Japanese digital transformation landscape. This segmentation approach enables precise targeting of market opportunities and accurate forecasting of future growth trends.

Tokyo metropolitan area dominates Japan’s digital transformation market, accounting for approximately 45% of total market activity due to the concentration of large enterprises, government agencies, and technology companies. The region serves as the primary hub for digital innovation, with numerous pilot projects and advanced technology implementations serving as models for nationwide adoption.

Osaka and Kansai region represents the second-largest market segment, driven by strong manufacturing presence and growing startup ecosystem. The region’s focus on industrial automation and smart manufacturing creates substantial demand for IoT solutions, AI-powered analytics, and advanced robotics integration. Regional government initiatives support digital transformation through various incentive programs and infrastructure investments.

Nagoya and central Japan demonstrate significant growth potential, particularly in automotive and aerospace industries where digital transformation is essential for maintaining global competitiveness. The region’s industrial heritage combined with modern technology adoption creates unique opportunities for specialized digital solutions tailored to manufacturing excellence.

Regional distribution patterns show increasing technology adoption in smaller cities and rural areas, supported by government digitalization initiatives and improved connectivity infrastructure. This geographic expansion of digital transformation activities creates opportunities for solution providers to extend their market reach beyond traditional metropolitan centers.

Major international players maintain strong positions in Japan’s digital transformation market through comprehensive solution portfolios and local partnerships:

Domestic system integrators play crucial roles in market development through local expertise and customer relationships:

By Technology:

By Industry Vertical:

By Organization Size:

Cloud computing solutions demonstrate the highest adoption rates across all organization sizes, with hybrid cloud deployments preferred by 78% of enterprises seeking to balance security requirements with operational flexibility. Multi-cloud strategies are becoming increasingly common as organizations avoid vendor lock-in while optimizing performance and cost efficiency.

Artificial intelligence implementations show strong growth in manufacturing and financial services sectors, where AI applications deliver measurable productivity improvements and enhanced decision-making capabilities. Machine learning algorithms are particularly valuable for predictive maintenance, fraud detection, and customer behavior analysis applications.

IoT connectivity solutions experience rapid expansion in smart manufacturing and smart city initiatives, where sensor networks and connected devices enable real-time monitoring and automated response systems. The integration of 5G connectivity enhances IoT capabilities and creates new possibilities for advanced applications.

Cybersecurity investments continue to grow as organizations recognize the critical importance of protecting digital assets and maintaining customer trust. Zero-trust security architectures and advanced threat detection systems are becoming standard components of comprehensive digital transformation strategies.

Enterprise customers benefit from digital transformation through enhanced operational efficiency, improved customer experiences, and new revenue generation opportunities. Organizations report average productivity improvements of 35% following comprehensive digital transformation initiatives, along with reduced operational costs and enhanced competitive positioning in their respective markets.

Technology vendors gain access to a sophisticated market with strong demand for innovative solutions and willingness to invest in advanced technologies. The Japanese market’s emphasis on quality and long-term relationships creates opportunities for vendors to develop deep customer partnerships and expand their solution portfolios through customer feedback and collaboration.

System integrators benefit from increased demand for implementation services, change management support, and ongoing maintenance of complex digital transformation initiatives. The market’s complexity and customization requirements create substantial opportunities for specialized consulting and integration services.

Government stakeholders achieve policy objectives related to economic modernization, productivity enhancement, and global competitiveness through successful digital transformation initiatives. These outcomes support broader national goals including Society 5.0 implementation and sustainable economic growth in an increasingly digital global economy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid work transformation continues to drive demand for digital workplace solutions, collaboration platforms, and cloud-based productivity tools. Organizations are investing in comprehensive remote work capabilities that maintain productivity while supporting flexible work arrangements, creating sustained demand for digital infrastructure and management tools.

Edge computing adoption accelerates as organizations seek to process data closer to its source, reducing latency and improving real-time decision-making capabilities. This trend is particularly pronounced in manufacturing, healthcare, and smart city applications where immediate data processing is critical for operational effectiveness.

Sustainability integration becomes increasingly important in digital transformation strategies, with organizations seeking technology solutions that support environmental goals and regulatory compliance. Green IT initiatives and energy-efficient digital solutions are becoming standard requirements in technology procurement processes.

Customer experience focus drives investment in digital customer interfaces, personalization technologies, and omnichannel service platforms. MWR research indicates that customer-centric digital transformation initiatives achieve 42% higher satisfaction scores compared to internally-focused technology implementations.

Strategic partnerships between global technology providers and Japanese system integrators continue to reshape the competitive landscape, enabling international vendors to leverage local expertise while domestic companies access advanced technology capabilities. These collaborations facilitate market penetration and accelerate solution development for specific Japanese market requirements.

Government digitalization initiatives expand beyond initial pilot projects to comprehensive nationwide implementations, creating substantial market opportunities for technology providers specializing in public sector solutions. The Digital Agency’s establishment demonstrates government commitment to systematic digital transformation across all administrative functions.

Industry-specific solutions gain prominence as technology vendors develop specialized offerings tailored to unique requirements of Japanese business sectors. These vertical solutions address specific regulatory, cultural, and operational needs that generic platforms cannot adequately support, creating competitive advantages for specialized providers.

Investment in research and development increases significantly as both domestic and international companies establish innovation centers in Japan to develop next-generation digital transformation technologies. These R&D investments focus on AI advancement, quantum computing applications, and advanced robotics integration.

Technology vendors should prioritize development of Japan-specific solutions that address unique cultural, regulatory, and operational requirements of Japanese enterprises. Success in this market requires deep understanding of local business practices and willingness to customize solutions for specific industry verticals and organizational structures.

Enterprise customers should adopt phased digital transformation approaches that balance innovation objectives with risk management requirements. Successful implementations typically begin with pilot projects that demonstrate value before scaling to comprehensive organizational transformation initiatives.

System integrators should invest in specialized skills development and certification programs to address the growing demand for digital transformation expertise. The market rewards providers who can demonstrate deep technical capabilities combined with strong project management and change management competencies.

Government stakeholders should continue supporting digital transformation through policy frameworks, infrastructure investments, and skills development programs. Public-private partnerships can accelerate market development while ensuring that digital transformation benefits extend throughout Japanese society and economy.

Market evolution over the next five years will be characterized by increased sophistication of digital transformation initiatives, with organizations moving beyond basic digitalization to comprehensive business model innovation and ecosystem integration. The focus will shift from technology implementation to value realization and competitive advantage creation through digital capabilities.

Technology advancement will continue driving market growth, with emerging technologies such as quantum computing, advanced AI, and next-generation connectivity creating new possibilities for digital transformation applications. These technological developments will enable more sophisticated solutions and expand the scope of digital transformation initiatives across all industry sectors.

Market maturation will lead to increased standardization of digital transformation practices and the emergence of industry-specific best practices and reference architectures. This maturation will reduce implementation risks and accelerate adoption timelines while maintaining the customization capabilities that Japanese enterprises require.

Growth projections indicate sustained market expansion driven by continued government support, increasing enterprise digital maturity, and growing recognition of digital transformation as essential for long-term competitiveness. MarkWide Research forecasts suggest the market will maintain robust growth momentum with expanding opportunities across all major industry verticals and geographic regions throughout Japan.

Japan’s digital transformation market represents a dynamic and rapidly evolving landscape characterized by strong government support, substantial corporate investment, and growing technological sophistication across all industry sectors. The market demonstrates exceptional resilience and adaptability, with organizations successfully navigating complex transformation challenges while achieving measurable business value through strategic technology adoption.

Key success factors for market participants include deep understanding of Japanese business culture, comprehensive solution portfolios addressing specific industry requirements, and strong local partnerships that facilitate market penetration and customer relationship development. The market rewards providers who can demonstrate both technical excellence and cultural sensitivity in their approach to digital transformation initiatives.

Future opportunities remain substantial across all market segments, driven by continued digitalization needs, emerging technology capabilities, and evolving customer expectations for digital experiences. The combination of government policy support, corporate investment commitment, and technological advancement creates a favorable environment for sustained market growth and innovation throughout the coming decade.

What is Digital Transformation?

Digital Transformation refers to the integration of digital technology into all areas of a business, fundamentally changing how it operates and delivers value to customers. It encompasses various aspects such as process automation, data analytics, and customer engagement strategies.

What are the key players in the Japan Digital Transformation Market?

Key players in the Japan Digital Transformation Market include Fujitsu, NTT Data, and Hitachi, which provide a range of services from cloud computing to AI solutions. These companies are pivotal in driving innovation and helping businesses adapt to digital changes, among others.

What are the main drivers of the Japan Digital Transformation Market?

The main drivers of the Japan Digital Transformation Market include the increasing demand for operational efficiency, the need for enhanced customer experiences, and the growing adoption of cloud technologies. Additionally, the push for data-driven decision-making is significantly influencing market growth.

What challenges does the Japan Digital Transformation Market face?

Challenges in the Japan Digital Transformation Market include resistance to change within organizations, a shortage of skilled workforce, and concerns over data security and privacy. These factors can hinder the pace of digital adoption and transformation efforts.

What opportunities exist in the Japan Digital Transformation Market?

Opportunities in the Japan Digital Transformation Market include the expansion of IoT applications, the rise of AI and machine learning technologies, and the increasing focus on sustainability through digital solutions. These trends present significant avenues for growth and innovation.

What trends are shaping the Japan Digital Transformation Market?

Trends shaping the Japan Digital Transformation Market include the growing emphasis on remote work solutions, the integration of advanced analytics into business processes, and the rise of customer-centric digital services. These trends are redefining how businesses operate and engage with their customers.

Japan Digital Transformation Market

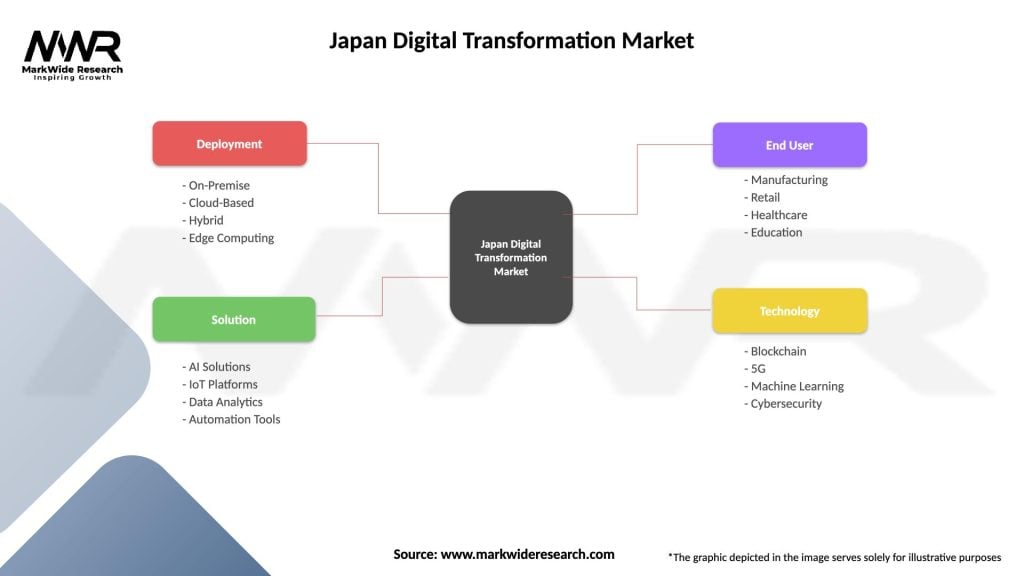

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, Edge Computing |

| Solution | AI Solutions, IoT Platforms, Data Analytics, Automation Tools |

| End User | Manufacturing, Retail, Healthcare, Education |

| Technology | Blockchain, 5G, Machine Learning, Cybersecurity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Digital Transformation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at