444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan dietary supplements market represents one of Asia-Pacific’s most sophisticated and mature nutritional product sectors, characterized by exceptional consumer awareness and stringent regulatory standards. Japanese consumers demonstrate remarkable dedication to health maintenance and preventive wellness, driving consistent demand for high-quality dietary supplements across diverse demographic segments. The market encompasses traditional herbal formulations, modern vitamin complexes, protein supplements, and specialized functional foods designed to address specific health concerns.

Market dynamics indicate robust growth potential, with the sector expanding at a steady CAGR of 6.2% driven by aging population demographics and increasing health consciousness among younger generations. Premium positioning characterizes the Japanese market, where consumers prioritize quality, safety, and efficacy over price considerations. The regulatory environment, governed by Japan’s Ministry of Health, Labour and Welfare, ensures exceptional product standards while creating barriers for international market entry.

Consumer preferences lean heavily toward scientifically-backed formulations, with approximately 78% of Japanese consumers researching supplement ingredients before purchase decisions. The market demonstrates strong seasonal variations, with immune support supplements experiencing 45% higher demand during winter months, while beauty and anti-aging products maintain consistent year-round consumption patterns.

The Japan dietary supplements market refers to the comprehensive ecosystem of nutritional products, functional foods, and health-enhancing formulations specifically designed to supplement regular dietary intake and support overall wellness objectives. This market encompasses vitamins, minerals, herbal extracts, amino acids, probiotics, and specialized compounds marketed to Japanese consumers through various retail channels including pharmacies, convenience stores, online platforms, and specialized health food retailers.

Regulatory classification in Japan distinguishes between Foods with Health Claims (FHC), Foods for Specified Health Uses (FOSHU), and general dietary supplements, each category subject to different approval processes and marketing restrictions. The market includes both domestic manufacturers leveraging traditional Japanese ingredients like green tea extract, shiitake mushrooms, and fermented foods, alongside international brands adapting formulations to meet local preferences and regulatory requirements.

Consumer understanding of dietary supplements in Japan extends beyond basic nutrition to encompass concepts of preventive healthcare, beauty enhancement, cognitive support, and longevity promotion, reflecting the country’s holistic approach to wellness and health maintenance throughout the aging process.

Strategic positioning within the Japan dietary supplements market reveals a highly sophisticated consumer base driving demand for premium, scientifically-validated nutritional products. The market demonstrates exceptional resilience and growth potential, supported by demographic trends including rapid population aging and increasing health awareness among millennials and Generation Z consumers.

Key market drivers include the world’s most aged society structure, with 29.1% of the population over 65 years, creating sustained demand for age-related health supplements. Additionally, rising healthcare costs motivate preventive health approaches, while busy urban lifestyles drive convenience-focused supplement consumption. The market benefits from strong e-commerce adoption, with online sales representing 34% of total supplement purchases.

Competitive landscape features a mix of established Japanese pharmaceutical companies, specialized supplement manufacturers, and international brands. Domestic players maintain advantages through deep consumer insights and regulatory expertise, while foreign companies contribute innovation and global best practices. The market structure supports both mass-market and premium positioning strategies.

Future projections indicate continued expansion driven by personalized nutrition trends, technological integration, and expanding applications in sports nutrition, cognitive health, and beauty supplementation. Regulatory evolution toward more flexible health claims and digital marketing approaches will likely accelerate market development.

Consumer behavior analysis reveals distinctive purchasing patterns that differentiate the Japanese market from other global regions. The following insights characterize current market dynamics:

Distribution channel evolution shows increasing importance of online platforms, while traditional pharmacy and drugstore channels maintain significant market share. Convenience store distribution represents a unique characteristic of the Japanese market, providing accessible supplement access in urban areas.

Demographic transformation serves as the primary catalyst driving Japan’s dietary supplements market expansion. The country’s super-aged society status creates unprecedented demand for health maintenance and age-related wellness products. Healthcare cost pressures motivate consumers to invest in preventive health measures, viewing supplements as cost-effective alternatives to medical treatments.

Lifestyle factors significantly influence market growth, particularly among urban populations experiencing high stress levels, irregular eating patterns, and limited time for meal preparation. The prevalence of single-person households, representing 38% of all Japanese households, drives demand for convenient nutritional solutions that supplement potentially inadequate dietary intake.

Health consciousness evolution among younger demographics creates new market segments focused on fitness, beauty, and cognitive enhancement. Social media influence and celebrity endorsements amplify awareness of supplement benefits, particularly for beauty and anti-aging applications. The integration of traditional Japanese wellness concepts with modern nutritional science appeals to consumers seeking culturally relevant health solutions.

Technological advancement in supplement formulation and delivery systems enhances product efficacy and consumer appeal. Innovations in personalized nutrition, including genetic testing and customized supplement recommendations, align with Japanese preferences for precision and optimization in health management approaches.

Regulatory complexity presents significant challenges for market participants, particularly international companies seeking to enter the Japanese market. The stringent approval processes for health claims and functional food classifications create lengthy product development cycles and substantial compliance costs. Marketing restrictions limit promotional activities and health benefit communications, constraining brand building and consumer education efforts.

Cultural skepticism toward certain supplement categories, particularly synthetic vitamins and unfamiliar ingredients, limits market expansion opportunities. Traditional Japanese dietary philosophy emphasizing whole foods and balanced nutrition creates resistance to supplement dependency among certain consumer segments. Medical professional attitudes toward supplements vary, with some healthcare providers expressing caution about supplement interactions and unproven benefits.

Economic pressures including stagnant wages and increased living costs impact discretionary spending on premium supplements. The market’s premium positioning, while supporting profitability, limits accessibility for price-sensitive consumers. Competition from functional foods and fortified beverages provides alternative nutritional solutions that may substitute for traditional supplement consumption.

Supply chain vulnerabilities exposed during global disruptions highlight dependencies on international ingredient sourcing and manufacturing. Quality control requirements and traceability standards increase operational complexity and costs for market participants.

Personalized nutrition represents the most significant growth opportunity, leveraging Japan’s advanced technology infrastructure and consumer acceptance of data-driven health solutions. Genetic testing integration with supplement recommendations appeals to Japanese preferences for precision and customization. The development of AI-powered nutrition platforms could revolutionize supplement selection and dosage optimization.

Sports and fitness nutrition presents expanding opportunities as Japan prepares for increased international sporting events and growing fitness culture adoption. The integration of supplements with wearable technology and fitness tracking creates new product categories and consumption occasions. Professional athlete endorsements and sports performance applications enhance supplement credibility and appeal.

Beauty and anti-aging supplements offer substantial growth potential, particularly among female consumers seeking holistic approaches to skin health and appearance enhancement. The convergence of cosmetics and nutrition, known as “nutricosmetics,” aligns with Japanese beauty culture and innovation leadership. Collagen supplements and beauty-focused formulations demonstrate strong market acceptance and growth potential.

Cognitive health and brain function supplements address growing concerns about mental acuity and age-related cognitive decline. The market opportunity extends beyond elderly consumers to include students, professionals, and anyone seeking cognitive enhancement. Stress management and mood support supplements align with increasing awareness of mental health importance in overall wellness.

Supply and demand equilibrium in the Japan dietary supplements market reflects sophisticated consumer expectations and premium product positioning. Demand patterns show consistent growth across multiple categories, with particularly strong performance in immune support, beauty enhancement, and age-related health maintenance segments. Seasonal fluctuations create predictable demand cycles that manufacturers and retailers can optimize for inventory management and marketing campaigns.

Pricing dynamics support premium positioning strategies, with consumers demonstrating willingness to pay higher prices for quality assurance, scientific validation, and brand reputation. The market structure allows for multiple price tiers, from accessible mass-market products to ultra-premium specialized formulations. Value perception extends beyond price to encompass convenience, efficacy, and safety considerations.

Innovation cycles drive market evolution through new ingredient discoveries, improved delivery systems, and enhanced formulation technologies. Research and development investments by leading companies focus on bioavailability enhancement, targeted delivery, and combination therapies that address multiple health concerns simultaneously. The integration of traditional Japanese ingredients with modern nutritional science creates unique market positioning opportunities.

Competitive intensity varies across market segments, with established categories experiencing mature competition while emerging segments offer greater differentiation opportunities. Market consolidation trends among smaller players contrast with continued innovation and market entry by specialized companies focusing on niche applications and premium positioning.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Japan dietary supplements market. Primary research includes consumer surveys, industry expert interviews, and retail channel assessments conducted across major metropolitan areas and regional markets. The methodology incorporates both quantitative and qualitative research approaches to capture market dynamics and consumer behavior patterns.

Secondary research encompasses analysis of government publications, industry association reports, company financial statements, and regulatory documentation. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability. The research framework includes historical trend analysis, current market assessment, and forward-looking projections based on identified drivers and market dynamics.

Consumer behavior studies utilize focus groups, online surveys, and purchase behavior tracking to understand decision-making processes, brand preferences, and consumption patterns. Retail channel analysis includes mystery shopping, inventory assessments, and pricing studies across pharmacy chains, convenience stores, online platforms, and specialty health retailers.

Expert consultation with industry professionals, regulatory specialists, and healthcare practitioners provides insights into market trends, regulatory developments, and future growth opportunities. The methodology ensures comprehensive coverage of market segments, geographic regions, and consumer demographics to deliver actionable market intelligence.

Tokyo metropolitan area dominates the Japan dietary supplements market, representing approximately 35% of total consumption due to high population density, elevated income levels, and advanced retail infrastructure. Urban consumers in Tokyo demonstrate strong preference for premium products, convenience packaging, and innovative formulations. The region serves as a testing ground for new product launches and market trends that subsequently spread to other areas.

Osaka and Kansai region accounts for 18% of market share, characterized by price-conscious consumers who balance quality requirements with value considerations. The region shows strong adoption of traditional Japanese ingredients and herbal supplements, reflecting cultural preferences for natural health solutions. Distribution networks in Kansai emphasize pharmacy and drugstore channels over convenience store sales.

Regional markets including Nagoya, Sendai, and Fukuoka demonstrate distinct consumption patterns influenced by local demographics and cultural factors. Rural areas show increasing supplement adoption, particularly among aging populations seeking health maintenance solutions. Online distribution plays a crucial role in serving regional markets with limited retail infrastructure.

Northern regions including Hokkaido exhibit seasonal consumption patterns with higher demand for immune support and vitamin D supplements during winter months. Southern regions show consistent year-round consumption with emphasis on beauty and anti-aging supplements. Regional preferences for local ingredients and traditional formulations create opportunities for specialized product development.

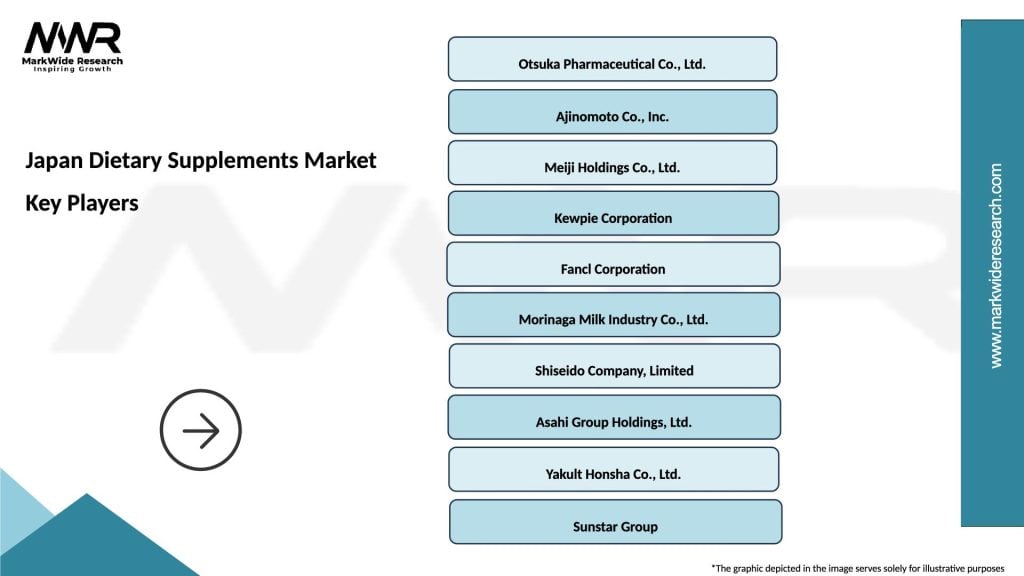

Market leadership in the Japan dietary supplements sector reflects a diverse competitive environment combining established pharmaceutical companies, specialized supplement manufacturers, and international brands. The competitive landscape demonstrates clear segmentation between mass-market and premium positioning strategies.

Competitive strategies emphasize product differentiation through scientific research, premium ingredients, and targeted marketing approaches. Brand building relies heavily on consumer education, healthcare professional endorsements, and long-term relationship development. Market participants invest significantly in regulatory compliance and quality assurance to maintain consumer trust and market access.

Innovation competition drives continuous product development in formulation technology, delivery systems, and ingredient sourcing. Companies leverage partnerships with research institutions and international suppliers to enhance product efficacy and market differentiation.

Product category segmentation reveals diverse market opportunities across multiple supplement types and applications. The Japan dietary supplements market demonstrates sophisticated segmentation reflecting varied consumer needs and preferences:

By Product Type:

By Consumer Demographics:

By Distribution Channel:

Vitamins and minerals represent the foundational category of Japan’s dietary supplements market, maintaining steady demand across all consumer segments. Vitamin D supplementation shows particularly strong growth due to limited sun exposure in urban environments and increasing awareness of deficiency risks. Multivitamin formulations tailored to specific age groups and gender needs demonstrate consistent market performance.

Beauty and anti-aging supplements constitute the fastest-growing category, with collagen supplements leading market expansion. Japanese consumers demonstrate exceptional willingness to invest in beauty-focused nutrition, viewing supplements as essential components of comprehensive skincare routines. Hyaluronic acid, ceramides, and antioxidant complexes show strong market acceptance and premium pricing power.

Immune support supplements experience significant seasonal demand variations, with winter months driving 60% higher consumption compared to summer periods. Vitamin C, zinc, and traditional herbal formulations including echinacea and elderberry maintain strong market positions. The category benefits from increased health awareness following global health concerns.

Digestive health and probiotics represent a sophisticated market segment with Japanese consumers demonstrating advanced understanding of gut health importance. Multi-strain probiotic formulations and prebiotic combinations show strong growth potential. Traditional fermented food ingredients integrated into supplement formulations appeal to cultural preferences while delivering modern health benefits.

Sports and performance nutrition shows emerging growth potential, particularly among younger consumers and fitness enthusiasts. Protein supplements, amino acid formulations, and energy enhancement products demonstrate increasing market acceptance as fitness culture expands in Japan.

Manufacturers and suppliers benefit from Japan’s premium market positioning, which supports higher profit margins and brand value development. The sophisticated consumer base appreciates quality differentiation and scientific validation, allowing companies to command premium pricing for innovative formulations. Regulatory clarity provides predictable operating environment for long-term business planning and investment decisions.

Retailers and distributors enjoy consistent demand growth and customer loyalty in the dietary supplements category. High-margin products contribute significantly to overall profitability while driving customer traffic and repeat purchases. The market’s stability and growth trajectory provide reliable revenue streams for retail partners across multiple channel formats.

Healthcare professionals benefit from increased patient engagement in preventive health measures and wellness optimization. Supplement integration with traditional healthcare approaches creates opportunities for comprehensive patient care and improved health outcomes. Professional recommendations carry significant weight with Japanese consumers, enhancing healthcare provider influence and patient relationships.

Consumers gain access to high-quality, scientifically-validated nutritional products that support health maintenance and wellness goals. Product innovation continuously improves efficacy, convenience, and safety profiles. The competitive market environment ensures diverse product options and competitive pricing within premium positioning strategies.

Research institutions benefit from industry collaboration opportunities and funding for nutritional research. Clinical studies and product development partnerships advance scientific understanding while supporting commercial applications. The market’s emphasis on evidence-based products creates demand for rigorous research and validation studies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization revolution transforms the Japan dietary supplements market through customized formulations based on individual health profiles, genetic testing, and lifestyle factors. AI-powered recommendations and data analytics enable precise supplement selection and dosage optimization. Companies invest in technology platforms that deliver personalized nutrition solutions aligned with Japanese preferences for precision and optimization.

Clean label movement drives demand for supplements with minimal, recognizable ingredients and transparent sourcing. Organic certification, non-GMO labeling, and sustainable packaging become increasingly important purchase factors. Consumers scrutinize ingredient lists and manufacturing processes, favoring brands that provide complete transparency and traceability.

Functional convergence blurs traditional boundaries between supplements, cosmetics, and functional foods. Beauty supplements integrate skincare benefits with nutritional support, while functional beverages deliver supplement benefits in convenient, enjoyable formats. This trend creates new product categories and consumption occasions.

Digital health integration connects supplements with wearable devices, health apps, and telemedicine platforms. Biomarker tracking and health monitoring provide objective measures of supplement efficacy and optimization opportunities. The integration appeals to tech-savvy Japanese consumers who appreciate data-driven health management approaches.

Sustainability focus influences packaging choices, ingredient sourcing, and manufacturing processes. Environmental consciousness among younger consumers drives demand for eco-friendly supplement options. Companies adopt sustainable practices throughout the supply chain to align with evolving consumer values and regulatory expectations.

Regulatory evolution continues shaping the Japan dietary supplements market through updated health claim guidelines and streamlined approval processes. Recent policy changes enable more flexible marketing communications while maintaining safety standards. The government’s focus on preventive healthcare supports supplement industry growth and innovation.

Technology partnerships between supplement companies and digital health platforms create integrated wellness solutions. Major collaborations include partnerships with fitness apps, genetic testing companies, and telemedicine providers. These alliances expand market reach and enhance consumer engagement through comprehensive health management platforms.

Manufacturing innovations improve product efficacy through advanced delivery systems, enhanced bioavailability, and targeted release mechanisms. Nanotechnology applications and microencapsulation techniques represent significant technological advances. Companies invest in research and development to differentiate products through superior formulation technologies.

Market consolidation activities include strategic acquisitions, joint ventures, and licensing agreements that strengthen competitive positions. International expansion efforts by Japanese companies and foreign market entry by global brands reshape competitive dynamics. These developments create opportunities for market share growth and geographic expansion.

Sustainability initiatives encompass packaging innovations, carbon footprint reduction, and ethical sourcing programs. Industry-wide commitments to environmental responsibility reflect consumer expectations and regulatory trends. Companies implement comprehensive sustainability strategies to maintain market competitiveness and brand reputation.

Market entry strategies for new participants should emphasize quality differentiation, regulatory compliance, and consumer education. MarkWide Research analysis indicates that successful market entry requires substantial investment in brand building and distribution partnerships. Companies should prioritize pharmacy channel relationships and online platform development to establish market presence effectively.

Product development focus should align with demographic trends and emerging health concerns. Aging population needs create opportunities for cognitive health, bone health, and cardiovascular support supplements. Beauty and anti-aging formulations represent high-growth potential, particularly for companies with cosmetic industry expertise or partnerships.

Distribution strategy optimization requires multi-channel approaches that leverage Japan’s unique retail landscape. Convenience store partnerships provide accessible consumer touchpoints, while online platforms enable direct consumer relationships and personalized marketing. Companies should invest in omnichannel capabilities that integrate physical and digital customer experiences.

Innovation priorities should emphasize personalization, convenience, and scientific validation. Technology integration opportunities include AI-powered recommendations, biomarker tracking, and customized formulations. Companies should collaborate with research institutions and technology partners to develop differentiated products and services.

Regulatory compliance remains critical for market success and requires ongoing investment in quality systems and regulatory expertise. Companies should establish strong relationships with regulatory consultants and maintain proactive compliance monitoring to navigate evolving requirements effectively.

Long-term growth prospects for the Japan dietary supplements market remain highly favorable, supported by demographic trends, technological advancement, and evolving consumer preferences. Market expansion is projected to continue at a steady pace of 6-8% annually over the next five years, driven by aging population needs and increasing health consciousness across all age groups.

Technological transformation will reshape market dynamics through personalized nutrition platforms, AI-powered recommendations, and integrated health monitoring systems. Digital health convergence creates opportunities for supplement companies to expand beyond traditional product sales into comprehensive wellness services. The integration of supplements with wearable technology and health apps will enhance consumer engagement and product efficacy measurement.

Category evolution will see continued growth in beauty supplements, cognitive health products, and personalized formulations. Emerging segments including sports nutrition, stress management, and environmental health protection show significant growth potential. The market will likely see increased convergence between supplements, functional foods, and cosmetic products.

Competitive landscape changes will include increased international competition, technology-driven market entry, and consolidation among smaller players. MWR projections suggest that companies with strong digital capabilities, personalization technologies, and premium positioning will capture disproportionate market share growth.

Regulatory development will likely support market growth through streamlined approval processes and expanded health claim allowances, while maintaining Japan’s high safety and quality standards. The government’s focus on preventive healthcare and healthy aging will create favorable policy environment for supplement industry expansion.

The Japan dietary supplements market represents a sophisticated, premium-positioned sector with exceptional growth potential driven by demographic transformation, technological innovation, and evolving consumer health consciousness. Market fundamentals remain strong, supported by the world’s most aged society, high disposable income levels, and advanced healthcare awareness among consumers.

Strategic opportunities abound for companies that can navigate regulatory requirements, invest in quality differentiation, and develop innovative products aligned with Japanese consumer preferences. The market’s emphasis on scientific validation, premium positioning, and consumer education creates sustainable competitive advantages for well-positioned participants.

Future success will depend on embracing personalization trends, leveraging digital technologies, and maintaining unwavering commitment to quality and safety standards. Companies that can integrate traditional Japanese wellness concepts with modern nutritional science while delivering convenient, effective solutions will capture the greatest market opportunities in this dynamic and rewarding sector.

What is Dietary Supplements?

Dietary supplements are products intended to supplement the diet, containing vitamins, minerals, herbs, amino acids, and other substances. They are available in various forms, including tablets, capsules, powders, and liquids, and are used to enhance overall health and well-being.

What are the key players in the Japan Dietary Supplements Market?

Key players in the Japan Dietary Supplements Market include companies like Otsuka Pharmaceutical Co., Ltd., Fancl Corporation, and Suntory Holdings Limited. These companies are known for their diverse product offerings and strong market presence, among others.

What are the growth factors driving the Japan Dietary Supplements Market?

The Japan Dietary Supplements Market is driven by increasing health consciousness among consumers, a growing aging population, and rising demand for preventive healthcare solutions. Additionally, the trend towards natural and organic supplements is contributing to market growth.

What challenges does the Japan Dietary Supplements Market face?

The Japan Dietary Supplements Market faces challenges such as stringent regulations on product safety and efficacy, competition from pharmaceutical products, and consumer skepticism regarding supplement claims. These factors can hinder market expansion.

What opportunities exist in the Japan Dietary Supplements Market?

Opportunities in the Japan Dietary Supplements Market include the development of innovative products targeting specific health concerns, such as immunity and digestive health. Additionally, the rise of e-commerce platforms presents new avenues for reaching consumers.

What trends are shaping the Japan Dietary Supplements Market?

Trends in the Japan Dietary Supplements Market include a shift towards personalized nutrition, increased use of technology in product formulation, and a growing preference for plant-based supplements. These trends reflect changing consumer preferences and advancements in nutritional science.

Japan Dietary Supplements Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamins, Minerals, Herbal Supplements, Protein Powders |

| Form | Tablets, Capsules, Powders, Liquids |

| End User | Adults, Seniors, Athletes, Children |

| Distribution Channel | Online Retail, Pharmacies, Supermarkets, Health Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Dietary Supplements Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at