444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan data center power market represents a critical infrastructure segment experiencing unprecedented growth driven by digital transformation initiatives and increasing cloud adoption across enterprises. Japan’s data center power infrastructure has evolved significantly as organizations prioritize reliable, efficient power solutions to support their expanding digital operations. The market encompasses various power components including uninterruptible power supplies (UPS), power distribution units (PDUs), generators, and advanced power management systems designed specifically for data center environments.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate (CAGR) of 8.2% as businesses accelerate their digital initiatives. The increasing demand for cloud services, artificial intelligence applications, and edge computing solutions has created substantial opportunities for power infrastructure providers. Japanese enterprises are investing heavily in modernizing their data center facilities to meet growing computational demands while maintaining operational efficiency and environmental sustainability.

Regional distribution shows concentrated growth in major metropolitan areas, with Tokyo accounting for approximately 45% of market activity, followed by Osaka and other industrial centers. The market benefits from Japan’s advanced technological infrastructure and strong government support for digital transformation initiatives across various industry sectors.

The Japan data center power market refers to the comprehensive ecosystem of electrical infrastructure, power management systems, and energy solutions specifically designed to support data center operations across Japan. This market encompasses all power-related components and services required to maintain continuous, reliable electricity supply to data centers, including primary power systems, backup power solutions, power distribution equipment, and energy management technologies.

Data center power infrastructure includes critical components such as uninterruptible power supplies that provide seamless power continuity during outages, sophisticated power distribution units that manage electricity flow throughout facilities, emergency generators for extended backup power, and intelligent monitoring systems that optimize energy consumption. The market also covers power conditioning equipment, surge protection devices, and advanced cooling systems that ensure optimal operating conditions for sensitive computing equipment.

Furthermore, this market encompasses emerging technologies like renewable energy integration, energy storage solutions, and smart grid connectivity that enable data centers to operate more sustainably while maintaining the highest levels of reliability and performance required for modern digital operations.

Japan’s data center power market demonstrates exceptional growth potential as organizations across multiple sectors embrace digital transformation and cloud-first strategies. The market benefits from strong technological foundations, supportive regulatory frameworks, and increasing enterprise investments in modern data center infrastructure. Key growth drivers include the rapid adoption of artificial intelligence applications, expanding cloud services demand, and the proliferation of edge computing solutions requiring distributed power infrastructure.

Market segmentation reveals diverse opportunities across various power solution categories, with UPS systems representing the largest segment due to their critical role in ensuring uninterrupted operations. Power distribution units and backup generators also demonstrate significant growth potential as organizations prioritize comprehensive power redundancy strategies. Enterprise adoption rates show approximately 72% of large organizations planning substantial data center power infrastructure investments over the next three years.

Competitive dynamics feature both established international providers and innovative domestic companies developing specialized solutions for Japanese market requirements. The market landscape emphasizes energy efficiency, reliability, and integration capabilities as key differentiating factors driving vendor selection decisions.

Strategic market analysis reveals several critical insights shaping the Japan data center power market landscape:

Digital transformation initiatives represent the primary catalyst driving Japan’s data center power market expansion. Organizations across industries are modernizing their IT infrastructure to support cloud computing, artificial intelligence, and advanced analytics applications requiring substantial computational resources. This digital evolution necessitates robust, reliable power infrastructure capable of supporting increased server densities and continuous operations.

Cloud services adoption continues accelerating as businesses recognize the operational and economic benefits of cloud-based solutions. The shift toward cloud-first strategies drives demand for scalable data center facilities equipped with advanced power management systems. Enterprise cloud adoption rates have reached approximately 68% among large organizations, creating sustained demand for supporting power infrastructure.

Edge computing proliferation creates new market opportunities as organizations deploy distributed computing resources closer to end users. Edge data centers require specialized power solutions optimized for smaller footprints while maintaining enterprise-grade reliability and efficiency standards. Government initiatives supporting digital infrastructure development provide additional market stimulus through favorable policies and investment incentives.

Artificial intelligence applications demand substantial computational power, driving requirements for high-density server deployments and corresponding power infrastructure upgrades. The growing adoption of AI across various sectors creates sustained demand for advanced power solutions capable of supporting intensive processing workloads.

High capital investment requirements present significant barriers for organizations considering data center power infrastructure upgrades. Advanced power systems, backup generators, and comprehensive monitoring solutions require substantial upfront investments that may challenge budget constraints, particularly for smaller organizations with limited capital resources.

Technical complexity associated with modern power management systems creates implementation challenges requiring specialized expertise and extensive planning. Organizations must navigate complex integration requirements, compatibility considerations, and ongoing maintenance demands that may strain internal technical resources and capabilities.

Regulatory compliance requirements add complexity and cost to power infrastructure projects as organizations must ensure adherence to evolving energy efficiency standards, environmental regulations, and safety requirements. Compliance obligations may extend project timelines and increase implementation costs.

Space constraints in urban areas limit data center expansion opportunities, particularly in high-demand metropolitan regions where real estate costs and availability present ongoing challenges. Limited physical space restricts power infrastructure deployment options and may require innovative, compact solution approaches.

Skilled workforce shortages in specialized technical areas create challenges for organizations implementing and maintaining advanced power systems. The shortage of qualified technicians and engineers with data center power expertise may impact project timelines and operational effectiveness.

Renewable energy integration presents substantial opportunities as organizations prioritize environmental sustainability and seek to reduce operational costs through clean energy adoption. Data center operators increasingly demand power solutions capable of seamlessly integrating solar, wind, and other renewable energy sources while maintaining operational reliability.

Energy storage technologies offer significant market potential as battery systems become more cost-effective and capable of supporting extended backup power requirements. Advanced energy storage solutions enable organizations to optimize energy consumption patterns, reduce peak demand charges, and enhance overall power system resilience.

Smart grid connectivity creates opportunities for data centers to participate in demand response programs and optimize energy consumption based on grid conditions and pricing signals. Intelligent power management systems can automatically adjust consumption patterns to maximize cost savings while maintaining operational requirements.

Edge computing expansion drives demand for distributed power solutions optimized for smaller facilities and remote locations. The proliferation of edge data centers creates new market segments requiring specialized power equipment designed for diverse deployment environments and operational conditions.

Artificial intelligence applications in power management offer opportunities for predictive maintenance, automated optimization, and enhanced operational efficiency. AI-powered systems can analyze consumption patterns, predict equipment failures, and optimize power distribution to maximize system performance and reliability.

Supply chain dynamics significantly influence the Japan data center power market as global component availability and pricing fluctuations impact project timelines and costs. Manufacturers are adapting their supply strategies to ensure consistent product availability while managing cost pressures from raw material price volatility and transportation challenges.

Technological innovation drives continuous market evolution as vendors develop more efficient, reliable, and intelligent power solutions. Advanced features such as predictive analytics, remote monitoring capabilities, and automated optimization functions are becoming standard expectations rather than premium features, influencing competitive positioning strategies.

Customer expectations continue evolving toward comprehensive, integrated solutions that combine power infrastructure with advanced management and monitoring capabilities. Organizations increasingly prefer vendors capable of providing end-to-end solutions rather than individual components, driving consolidation and partnership strategies within the market.

Regulatory environment shapes market development through energy efficiency standards, environmental requirements, and safety regulations that influence technology selection and implementation approaches. Compliance rates with new energy efficiency standards have reached approximately 78% among major data center operators, demonstrating industry commitment to regulatory adherence.

Economic factors including energy costs, capital availability, and operational budget pressures influence purchasing decisions and technology adoption patterns. Organizations balance initial investment costs against long-term operational savings when evaluating power infrastructure options.

Comprehensive market research methodology combines primary and secondary research approaches to provide accurate, actionable insights into the Japan data center power market. Primary research includes extensive interviews with industry executives, technology vendors, end-user organizations, and market experts to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market context and validate primary research findings. Data triangulation techniques ensure research accuracy and reliability by cross-referencing multiple information sources and analytical approaches.

Market sizing methodologies utilize bottom-up and top-down approaches to establish comprehensive market scope and growth projections. Bottom-up analysis examines individual market segments and customer categories, while top-down analysis considers broader economic and industry factors influencing overall market development.

Quantitative analysis incorporates statistical modeling techniques to identify market trends, growth patterns, and correlation relationships between various market factors. Advanced analytics help establish reliable growth projections and identify key market drivers and restraints.

Qualitative research provides deeper insights into market dynamics, competitive positioning, and strategic considerations through expert interviews and industry observation. This approach captures nuanced market understanding that complements quantitative findings and enhances overall research quality.

Tokyo metropolitan area dominates Japan’s data center power market, accounting for approximately 45% of total market activity due to its concentration of major enterprises, financial institutions, and technology companies. The region benefits from advanced infrastructure, skilled workforce availability, and proximity to key business centers driving sustained demand for data center services and supporting power infrastructure.

Osaka region represents the second-largest market segment with approximately 22% market share, supported by significant manufacturing activity, logistics operations, and growing technology sector presence. The area’s strategic location and industrial base create substantial demand for data center facilities and corresponding power solutions.

Nagoya and surrounding areas demonstrate strong growth potential driven by automotive industry digitization, manufacturing automation, and expanding logistics operations. The region’s industrial focus creates unique requirements for specialized power solutions supporting manufacturing-related data center applications.

Regional distribution strategies vary based on local market characteristics, regulatory requirements, and customer preferences. Vendors adapt their approaches to address regional differences in infrastructure requirements, energy costs, and operational considerations.

Government initiatives at regional levels provide additional market stimulus through digital infrastructure development programs, smart city projects, and technology innovation incentives that support data center expansion and modernization efforts.

Market leadership features a combination of established international technology providers and innovative domestic companies developing specialized solutions for Japanese market requirements. The competitive environment emphasizes technological innovation, service quality, and local market understanding as key differentiating factors.

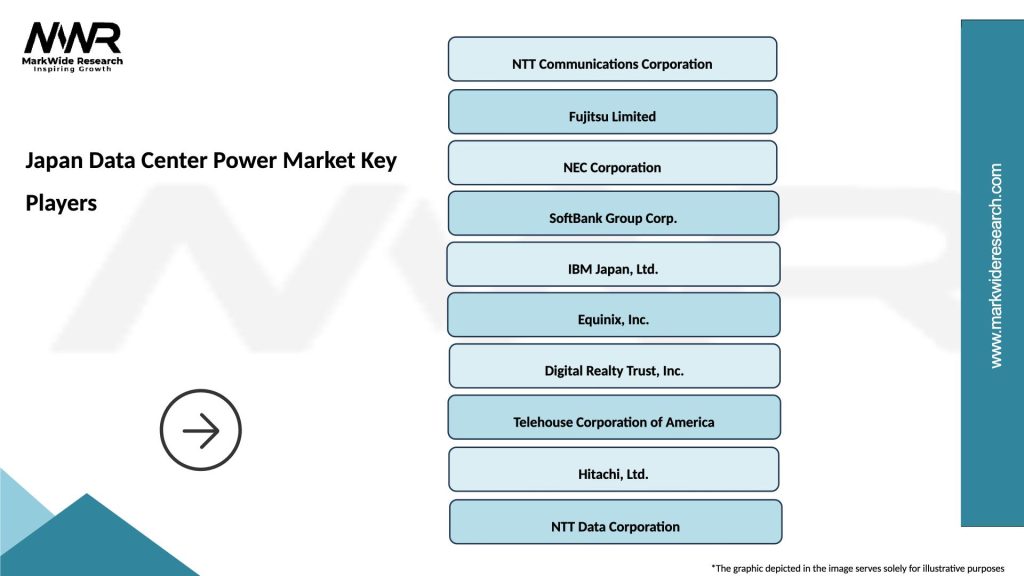

Major market participants include:

Competitive strategies focus on technological innovation, comprehensive service offerings, and strategic partnerships to address evolving customer requirements and market opportunities.

By Component Type:

By Power Rating:

By End-User Industry:

UPS Systems Category represents the largest market segment due to critical role in ensuring uninterrupted data center operations. Modern UPS solutions incorporate advanced features including intelligent battery management, predictive maintenance capabilities, and seamless integration with facility management systems. Technology adoption rates show approximately 85% of data centers implementing next-generation UPS systems with enhanced efficiency and monitoring capabilities.

Power Distribution Units demonstrate strong growth driven by increasing server densities and requirements for granular power monitoring and control. Intelligent PDUs provide real-time consumption data, remote management capabilities, and automated load balancing functions that optimize energy utilization across data center facilities.

Generator Systems benefit from growing emphasis on comprehensive backup power strategies and disaster recovery preparedness. Modern generators incorporate advanced control systems, remote monitoring capabilities, and fuel management features that ensure reliable emergency power during extended outages.

Power Monitoring Solutions represent the fastest-growing category as organizations prioritize energy efficiency and operational optimization. Advanced monitoring systems utilize artificial intelligence and machine learning to analyze consumption patterns, predict maintenance requirements, and optimize power distribution strategies.

Emerging Technologies including energy storage systems and renewable energy integration solutions create new market opportunities as organizations seek sustainable, cost-effective power alternatives while maintaining operational reliability requirements.

Data Center Operators benefit from enhanced operational reliability, reduced energy costs, and improved facility management capabilities through advanced power infrastructure investments. Modern power systems provide comprehensive monitoring, predictive maintenance, and automated optimization features that minimize downtime risks while maximizing operational efficiency.

Enterprise Customers gain improved service reliability, enhanced disaster recovery capabilities, and reduced operational risks through robust data center power infrastructure. Reliable power systems ensure continuous availability of critical business applications and services, supporting digital transformation initiatives and operational continuity requirements.

Technology Vendors access expanding market opportunities driven by digital transformation trends, cloud adoption, and increasing demand for advanced power management solutions. The market provides platforms for innovation, technology development, and strategic partnerships that drive long-term growth and competitive positioning.

System Integrators benefit from growing demand for comprehensive power infrastructure projects requiring specialized expertise in design, implementation, and ongoing support services. Complex power system requirements create opportunities for value-added services and long-term customer relationships.

Government Stakeholders achieve digital infrastructure development objectives, economic growth targets, and environmental sustainability goals through supportive policies and market development initiatives that encourage private sector investment in advanced power technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend with organizations increasingly prioritizing environmental responsibility in their power infrastructure decisions. Data centers are implementing renewable energy sources, energy storage systems, and advanced efficiency technologies to reduce carbon footprints while maintaining operational performance standards.

Artificial Intelligence Adoption transforms power management approaches through predictive analytics, automated optimization, and intelligent maintenance scheduling. AI-powered systems analyze consumption patterns, predict equipment failures, and optimize power distribution to maximize efficiency and reliability while reducing operational costs.

Edge Computing Proliferation creates new requirements for distributed power solutions optimized for smaller facilities and remote locations. Edge data centers require specialized power equipment designed for diverse deployment environments while maintaining enterprise-grade reliability and efficiency standards.

Modular Infrastructure Design gains popularity as organizations seek flexible, scalable power solutions that can adapt to changing requirements and support phased expansion strategies. Modular approaches enable faster deployment, reduced complexity, and improved cost-effectiveness compared to traditional infrastructure approaches.

Advanced Monitoring Integration becomes standard practice as organizations demand comprehensive visibility into power system performance, energy consumption, and operational efficiency. Real-time monitoring capabilities enable proactive maintenance, optimization opportunities, and enhanced decision-making support.

Hybrid Cloud Support drives requirements for flexible power infrastructure capable of supporting diverse deployment models and varying capacity requirements. Organizations implementing hybrid cloud strategies require adaptable power solutions that can scale dynamically based on changing workload demands.

Technology Innovation continues advancing with manufacturers developing more efficient, intelligent, and sustainable power solutions for data center applications. Recent developments include next-generation UPS systems with improved efficiency ratings, advanced battery technologies offering extended life cycles, and intelligent power distribution units with enhanced monitoring capabilities.

Strategic Partnerships between power solution providers and data center operators create comprehensive service offerings that combine equipment supply with ongoing support, maintenance, and optimization services. These partnerships enable more effective technology deployment and long-term operational success.

Regulatory Updates including revised energy efficiency standards and environmental requirements influence technology selection and implementation strategies across the market. New regulations drive adoption of more efficient power solutions and sustainable operational practices.

Market Consolidation activities through mergers and acquisitions reshape competitive dynamics as companies seek to expand capabilities, access new markets, and achieve operational synergies. Consolidation trends create larger, more comprehensive solution providers capable of addressing complex customer requirements.

Investment Expansion in research and development activities drives continuous innovation in power management technologies, energy storage solutions, and renewable energy integration capabilities. Increased R&D spending supports development of next-generation solutions addressing evolving market requirements.

MarkWide Research analysis suggests that organizations should prioritize comprehensive power infrastructure planning that considers both current requirements and future growth projections. Successful implementations require thorough assessment of capacity needs, efficiency objectives, and integration requirements to ensure optimal solution selection and deployment strategies.

Investment strategies should emphasize solutions offering strong return on investment through energy efficiency improvements, operational cost reductions, and enhanced reliability benefits. Organizations should evaluate total cost of ownership including initial capital costs, ongoing operational expenses, and maintenance requirements when making technology selection decisions.

Technology adoption approaches should focus on proven solutions with strong vendor support, comprehensive service offerings, and clear upgrade paths for future enhancement. Organizations should prioritize vendors with demonstrated expertise in data center power applications and strong local market presence.

Risk management strategies should include comprehensive backup power planning, redundancy considerations, and disaster recovery capabilities to ensure business continuity during power-related incidents. Effective risk management requires regular testing, maintenance, and performance monitoring to maintain optimal system reliability.

Sustainability planning should integrate renewable energy sources, energy storage technologies, and efficiency optimization measures to achieve environmental objectives while maintaining operational performance standards. Sustainable approaches can provide long-term cost benefits and regulatory compliance advantages.

Market growth prospects remain strong as digital transformation initiatives continue accelerating across Japanese enterprises and government organizations. The increasing adoption of cloud services, artificial intelligence applications, and edge computing solutions will sustain demand for advanced power infrastructure throughout the forecast period.

Technology evolution will focus on enhanced efficiency, intelligent automation, and sustainable operation capabilities. Future power systems will incorporate advanced analytics, predictive maintenance, and autonomous optimization features that minimize human intervention while maximizing performance and reliability.

Sustainability integration will become increasingly important as organizations seek to achieve carbon neutrality goals and comply with evolving environmental regulations. Renewable energy adoption rates in data center operations are projected to reach approximately 60% by 2028, driving demand for compatible power infrastructure solutions.

Edge computing expansion will create new market segments requiring specialized power solutions optimized for distributed deployment environments. The proliferation of edge data centers will drive innovation in compact, efficient power systems designed for diverse operational conditions.

Market maturation will lead to increased standardization, improved interoperability, and enhanced service offerings as the industry develops best practices and proven implementation methodologies. MWR projections indicate sustained growth momentum with the market maintaining robust expansion rates throughout the next decade.

Japan’s data center power market presents exceptional opportunities for growth and innovation as organizations across multiple sectors embrace digital transformation and modernize their IT infrastructure. The market benefits from strong technological foundations, supportive government policies, and increasing enterprise recognition of the critical importance of reliable, efficient power infrastructure in supporting modern business operations.

Key success factors for market participants include technological innovation, comprehensive service offerings, and deep understanding of local market requirements and customer preferences. Organizations that can effectively combine advanced power solutions with strong support services and sustainable operational approaches will be best positioned to capitalize on expanding market opportunities.

Future market development will be shaped by continued digital transformation, sustainability requirements, and evolving technology capabilities that enable more intelligent, efficient, and reliable power infrastructure solutions. The integration of artificial intelligence, renewable energy, and advanced monitoring capabilities will define next-generation power systems and create new competitive advantages for innovative solution providers.

Strategic positioning requires balancing immediate market opportunities with long-term technology trends and customer requirements. Successful market participants will invest in research and development, strategic partnerships, and comprehensive service capabilities that support sustained growth and competitive differentiation in this dynamic, rapidly evolving market environment.

What is Data Center Power?

Data Center Power refers to the electrical energy required to operate data centers, which house computer systems and associated components. This includes power for servers, cooling systems, and other infrastructure necessary for data processing and storage.

What are the key players in the Japan Data Center Power Market?

Key players in the Japan Data Center Power Market include NTT Communications, KDDI Corporation, and SoftBank Corp., among others. These companies are involved in providing power solutions and infrastructure for data centers across the country.

What are the growth factors driving the Japan Data Center Power Market?

The growth of the Japan Data Center Power Market is driven by the increasing demand for cloud computing services, the rise of big data analytics, and the expansion of IoT applications. These factors necessitate more robust and efficient power solutions for data centers.

What challenges does the Japan Data Center Power Market face?

The Japan Data Center Power Market faces challenges such as high energy costs, regulatory compliance regarding energy efficiency, and the need for sustainable power sources. These factors can impact operational costs and the overall feasibility of data center operations.

What opportunities exist in the Japan Data Center Power Market?

Opportunities in the Japan Data Center Power Market include the adoption of renewable energy sources, advancements in energy-efficient technologies, and the potential for innovative cooling solutions. These developments can enhance sustainability and reduce operational costs for data centers.

What trends are shaping the Japan Data Center Power Market?

Trends shaping the Japan Data Center Power Market include the increasing focus on energy efficiency, the integration of artificial intelligence for power management, and the shift towards modular data center designs. These trends aim to optimize power usage and improve overall operational efficiency.

Japan Data Center Power Market

| Segmentation Details | Description |

|---|---|

| Type | UPS, Generator, Cooling System, Power Distribution Unit |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Technology | Li-ion Batteries, Flywheel Energy Storage, Diesel Generators, Renewable Energy Sources |

| Capacity | Below 1 MW, 1-5 MW, 5-10 MW, Above 10 MW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Data Center Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at