444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan data center physical security market represents a critical component of the nation’s digital infrastructure landscape, experiencing unprecedented growth driven by increasing cybersecurity threats and regulatory compliance requirements. Japan’s data center industry has witnessed remarkable expansion as organizations prioritize comprehensive security measures to protect their digital assets and maintain operational continuity. The market encompasses various physical security solutions including access control systems, surveillance technologies, environmental monitoring, and perimeter security measures specifically designed for data center facilities.

Market dynamics indicate robust growth patterns with the sector expanding at a compound annual growth rate of 8.2% through the forecast period. This growth trajectory reflects Japan’s commitment to strengthening its digital infrastructure while addressing evolving security challenges. Enterprise adoption of advanced physical security solutions has accelerated significantly, with organizations recognizing the critical importance of protecting their data center investments against both physical and environmental threats.

Regional factors contributing to market expansion include Japan’s position as a technology leader in Asia-Pacific, increasing cloud adoption rates, and stringent regulatory frameworks governing data protection. The market benefits from strong government support for digital transformation initiatives and substantial investments in modernizing critical infrastructure. Technology integration trends show increasing convergence between physical and logical security systems, creating comprehensive protection frameworks for modern data center operations.

The Japan data center physical security market refers to the comprehensive ecosystem of hardware, software, and service solutions designed to protect data center facilities from physical threats, unauthorized access, and environmental hazards. This market encompasses all security measures that safeguard the physical infrastructure housing critical IT equipment, servers, and networking components essential for digital operations across various industries.

Physical security solutions in this context include access control systems utilizing biometric authentication, smart card readers, and multi-factor authentication protocols. The market also covers video surveillance systems with advanced analytics capabilities, intrusion detection systems, environmental monitoring solutions, fire suppression systems, and perimeter security measures. Integration capabilities allow these various components to work cohesively, providing comprehensive protection against diverse threat vectors.

Market scope extends beyond traditional security measures to include intelligent monitoring systems that can predict and prevent potential security breaches before they occur. Modern solutions incorporate artificial intelligence and machine learning algorithms to enhance threat detection accuracy and reduce false alarms, making them increasingly valuable for data center operators seeking optimal security efficiency.

Japan’s data center physical security market demonstrates exceptional growth potential driven by increasing digitalization across industries and heightened awareness of security vulnerabilities. The market landscape features diverse solution categories ranging from basic access control to sophisticated AI-powered surveillance systems, catering to varying organizational requirements and security mandates.

Key market drivers include rising cyber threats targeting physical infrastructure, stringent regulatory compliance requirements, and growing adoption of cloud computing services requiring robust data center protection. Organizations are increasingly investing in comprehensive security frameworks that integrate multiple protection layers, with 65% of enterprises implementing multi-layered security approaches to address evolving threat landscapes.

Technology advancement remains a crucial factor shaping market evolution, with innovations in biometric authentication, video analytics, and environmental monitoring creating new opportunities for enhanced security effectiveness. The market benefits from strong collaboration between technology providers and data center operators, fostering development of customized solutions that address specific operational requirements and regulatory compliance needs.

Competitive dynamics feature both international technology leaders and domestic solution providers, creating a diverse ecosystem that promotes innovation and competitive pricing. Market participants are focusing on developing integrated platforms that combine multiple security functions while maintaining user-friendly interfaces and simplified management capabilities.

Strategic market analysis reveals several critical insights shaping the Japan data center physical security landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Primary market drivers propelling growth in Japan’s data center physical security market stem from multiple converging factors that create compelling demand for advanced security solutions. These drivers reflect both technological advancement and evolving threat landscapes that require sophisticated protection measures.

Digital transformation initiatives across Japanese enterprises are generating substantial demand for secure data center infrastructure capable of supporting mission-critical applications and sensitive data processing. Organizations are recognizing that physical security forms the foundation of comprehensive cybersecurity strategies, with 72% of IT decision-makers identifying physical security as a critical component of their overall security posture.

Regulatory compliance requirements continue strengthening, with Japanese authorities implementing stricter data protection standards that mandate comprehensive physical security measures for data center operations. These regulations require detailed documentation, audit trails, and multi-layered protection systems that drive adoption of sophisticated security solutions.

Threat landscape evolution presents increasingly sophisticated challenges that traditional security measures cannot adequately address. Modern threats include coordinated physical and cyber attacks, insider threats, and environmental hazards that require integrated security approaches combining multiple protection layers and intelligent monitoring capabilities.

Business continuity concerns are driving organizations to invest in robust physical security infrastructure that ensures uninterrupted operations even during security incidents or natural disasters. The growing dependence on digital services makes data center availability critical for business success, creating strong demand for comprehensive protection solutions.

Market growth challenges in Japan’s data center physical security sector include several factors that may limit adoption rates or slow market expansion. Understanding these restraints is essential for market participants developing strategies to address potential obstacles and maximize growth opportunities.

High implementation costs represent a significant barrier for smaller organizations considering comprehensive physical security upgrades. Advanced security systems require substantial capital investments in hardware, software, and professional services, which may exceed budget constraints for some data center operators. Integration complexity can further increase total implementation costs, particularly for organizations with legacy infrastructure.

Technical complexity challenges arise from the sophisticated nature of modern security systems that require specialized expertise for proper implementation and ongoing management. Organizations may lack internal resources with necessary skills to deploy and maintain advanced security solutions effectively, creating dependency on external service providers and increasing operational costs.

Integration difficulties with existing infrastructure can complicate security system deployments, particularly in older data center facilities that may not have been designed to accommodate modern security technologies. Retrofitting existing facilities with comprehensive security systems may require significant modifications to physical infrastructure, increasing project complexity and costs.

Vendor selection complexity presents challenges for organizations evaluating multiple solution options with varying capabilities, compatibility requirements, and pricing structures. The diverse vendor landscape can make it difficult to identify optimal solutions that meet specific requirements while providing long-term value and scalability.

Emerging opportunities in Japan’s data center physical security market present significant potential for growth and innovation. These opportunities reflect evolving market needs and technological capabilities that create new avenues for solution development and market expansion.

Artificial intelligence integration offers substantial opportunities for enhancing security system effectiveness through advanced analytics, predictive threat detection, and automated response capabilities. AI-powered solutions can significantly improve security efficiency while reducing false alarms and operational overhead, making them attractive for organizations seeking optimal security performance.

Edge computing expansion creates new market segments requiring distributed security solutions that can protect smaller, remote data center facilities while maintaining centralized management capabilities. This trend opens opportunities for scalable security platforms that can adapt to diverse deployment scenarios and varying security requirements.

Sustainability initiatives are driving demand for energy-efficient security solutions that minimize environmental impact while maintaining comprehensive protection capabilities. Organizations are increasingly prioritizing green technology solutions that align with corporate sustainability goals and regulatory environmental requirements.

Service-based delivery models present opportunities for solution providers to offer security-as-a-service options that reduce upfront costs and provide ongoing support and maintenance. These models can make advanced security solutions accessible to smaller organizations while creating recurring revenue streams for providers.

International expansion opportunities exist for Japanese solution providers to leverage their technological expertise and market experience in other Asia-Pacific markets experiencing similar digital transformation trends and security requirements.

Market dynamics in Japan’s data center physical security sector reflect complex interactions between technological innovation, regulatory requirements, competitive pressures, and evolving customer needs. These dynamics create a constantly shifting landscape that requires continuous adaptation and strategic planning from market participants.

Technology evolution continues driving market transformation through introduction of advanced capabilities such as biometric authentication, intelligent video analytics, and integrated threat detection systems. Innovation cycles are accelerating as solution providers compete to deliver more sophisticated and user-friendly security platforms that address emerging threats and operational requirements.

Competitive intensity is increasing as both established security vendors and emerging technology companies compete for market share in Japan’s growing data center security market. This competition is fostering rapid innovation and competitive pricing while creating challenges for vendors seeking to differentiate their offerings in an increasingly crowded marketplace.

Customer expectations are evolving toward comprehensive, integrated solutions that provide seamless security management across multiple protection layers. Organizations are demanding solutions that combine ease of use with advanced capabilities, creating pressure on vendors to develop intuitive interfaces and simplified management tools without compromising security effectiveness.

Regulatory influence continues shaping market development through implementation of new data protection standards and security requirements that mandate specific security measures and documentation procedures. These regulatory changes create both opportunities and challenges for solution providers adapting their offerings to meet compliance requirements.

Comprehensive research methodology employed for analyzing Japan’s data center physical security market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. The methodology combines primary research, secondary analysis, and expert validation to provide thorough market understanding.

Primary research activities include extensive interviews with industry executives, technology vendors, data center operators, and security professionals across Japan’s major metropolitan areas. These interviews provide firsthand insights into market trends, challenges, and opportunities while validating secondary research findings through direct industry feedback.

Secondary research analysis encompasses comprehensive review of industry reports, government publications, regulatory documents, and company financial statements to establish market baseline data and identify key trends. This analysis includes evaluation of technology patents, product announcements, and strategic partnerships that influence market development.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market growth patterns and identify emerging opportunities. These models incorporate multiple variables including economic indicators, technology adoption rates, and regulatory changes to provide accurate market projections.

Expert validation processes ensure research accuracy through review by industry specialists and academic researchers with extensive experience in data center security and Japanese technology markets. This validation helps confirm findings and identify potential research gaps or biases that could affect analysis quality.

Regional market distribution across Japan reveals distinct patterns reflecting economic concentration, industrial development, and technology adoption rates in different geographic areas. Understanding these regional dynamics is essential for developing effective market strategies and identifying optimal expansion opportunities.

Tokyo metropolitan area dominates the market with approximately 45% market share, driven by high concentration of financial institutions, technology companies, and government organizations requiring sophisticated data center security solutions. The region benefits from advanced infrastructure, skilled workforce availability, and proximity to major technology vendors and service providers.

Osaka and Kansai region represents the second-largest market segment with 22% market share, supported by strong manufacturing presence and growing technology sector adoption of cloud computing and digital transformation initiatives. The region’s strategic location and transportation infrastructure make it attractive for data center development and security solution deployment.

Nagoya and central Japan account for 15% market share, with growth driven primarily by automotive industry digitalization and manufacturing sector modernization. The region’s industrial focus creates specific security requirements related to protecting intellectual property and maintaining operational continuity in manufacturing environments.

Northern and southern regions collectively represent 18% market share, with growth opportunities emerging from government digitalization initiatives and regional economic development programs. These areas present opportunities for cost-effective security solutions that can serve smaller data center facilities and distributed computing infrastructure.

Competitive landscape in Japan’s data center physical security market features diverse participants ranging from global technology leaders to specialized local solution providers. This competitive environment fosters innovation while creating challenges for market differentiation and customer acquisition.

Market leaders include established international vendors with comprehensive security portfolios and strong local presence in Japan. These companies leverage their global expertise and resources to deliver sophisticated solutions while adapting to local market requirements and regulatory standards.

Emerging competitors include innovative technology startups and specialized solution providers focusing on niche market segments such as AI-powered analytics, environmental monitoring, and cloud-based security management platforms.

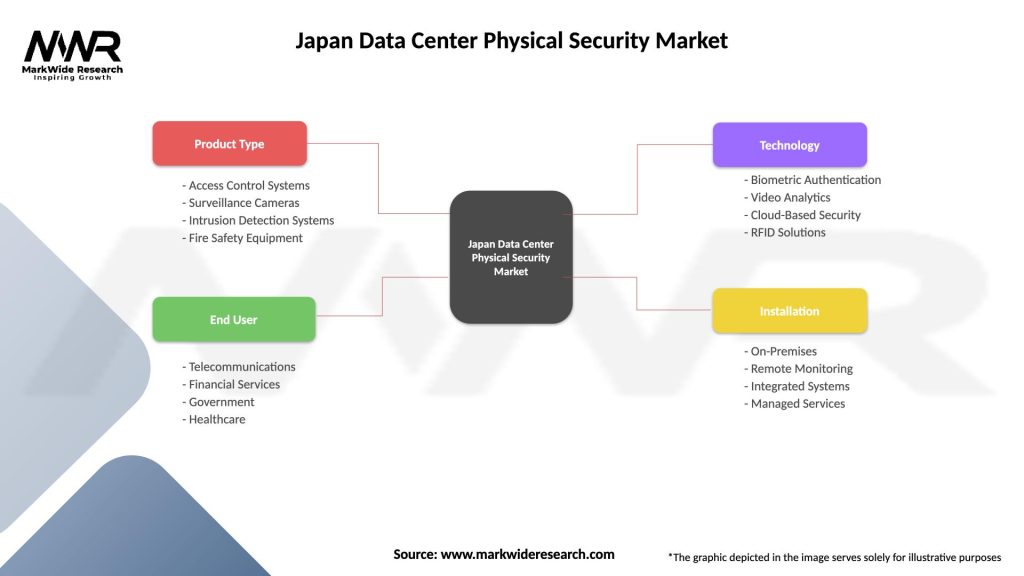

Market segmentation analysis reveals distinct categories based on solution type, deployment model, end-user industry, and facility size. Understanding these segments is crucial for identifying target markets and developing focused solution strategies.

By Solution Type:

By Deployment Model:

By End-User Industry:

Access control systems represent the largest market segment, driven by fundamental security requirements for restricting unauthorized facility access. This category benefits from technological advancement in biometric authentication and multi-factor verification systems that provide enhanced security while improving user experience. Market adoption of advanced access control solutions is accelerating with 78% of data centers implementing multi-layered access verification protocols.

Video surveillance solutions demonstrate strong growth potential through integration of artificial intelligence and advanced analytics capabilities. Modern surveillance systems provide real-time threat detection, behavioral analysis, and automated alert generation that significantly enhance security effectiveness. The segment benefits from declining hardware costs and improving software capabilities that make sophisticated surveillance accessible to organizations of all sizes.

Environmental monitoring systems are gaining importance as organizations recognize the critical role of environmental factors in data center security and operational continuity. These systems protect against fire, flooding, temperature extremes, and other environmental hazards that could compromise data center operations. Integration capabilities with building management systems create comprehensive environmental protection frameworks.

Integrated security platforms represent the fastest-growing segment as organizations seek comprehensive solutions that combine multiple security functions with centralized management capabilities. These platforms reduce complexity while improving security effectiveness through coordinated threat detection and response across multiple protection layers.

Industry participants in Japan’s data center physical security market realize significant benefits through strategic positioning and solution development that addresses evolving market needs. These benefits create value for vendors, customers, and the broader digital infrastructure ecosystem.

For Solution Providers:

For Data Center Operators:

For End-User Organizations:

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming Japan’s data center physical security market. AI-powered solutions are revolutionizing threat detection accuracy, reducing false alarms, and enabling predictive security capabilities that anticipate potential incidents before they occur. Market adoption of AI-enhanced security systems is accelerating with 58% of organizations planning to implement intelligent analytics within the next two years.

Cloud-native security platforms are gaining traction as organizations seek scalable, flexible solutions that can adapt to changing infrastructure requirements. These platforms offer centralized management capabilities, automatic updates, and integration with cloud-based data center services, making them attractive for organizations pursuing digital transformation initiatives.

Zero-trust security models are influencing physical security system design, with organizations implementing comprehensive verification protocols that assume no inherent trust in any system component. This approach requires continuous authentication and authorization for all access requests, creating demand for sophisticated identity management and access control solutions.

Sustainability focus is driving development of energy-efficient security solutions that minimize environmental impact while maintaining comprehensive protection capabilities. Organizations are prioritizing green technology solutions that align with corporate sustainability goals and regulatory environmental requirements.

Remote management capabilities have become essential following increased emphasis on distributed operations and remote workforce management. Security solutions must provide comprehensive monitoring and control capabilities that enable effective management from any location while maintaining security integrity.

Recent industry developments highlight the dynamic nature of Japan’s data center physical security market and demonstrate ongoing innovation in solution capabilities and deployment models. These developments reflect market maturation and evolving customer requirements.

Technology partnerships between security vendors and cloud service providers are creating integrated solutions that combine physical and logical security capabilities. These partnerships enable development of comprehensive protection frameworks that address both traditional security threats and emerging cloud-based vulnerabilities.

Regulatory updates have strengthened data protection requirements and security standards for data center operations, creating new compliance obligations that drive adoption of advanced security solutions. MarkWide Research analysis indicates these regulatory changes are accelerating market growth through mandatory security upgrades and enhanced documentation requirements.

Investment activity in security technology startups and innovative solution providers has increased significantly, with venture capital and corporate investors recognizing the growth potential in advanced data center security solutions. This investment is fostering innovation and accelerating development of next-generation security capabilities.

International expansion by Japanese security solution providers is increasing as companies leverage their domestic market success to pursue opportunities in other Asia-Pacific markets with similar digital transformation trends and security requirements.

Standardization initiatives are progressing through industry collaboration efforts aimed at establishing common security frameworks and interoperability standards that simplify solution integration and reduce deployment complexity.

Strategic recommendations for market participants focus on positioning for long-term success in Japan’s evolving data center physical security landscape. These suggestions address key success factors and potential challenges that could impact market performance.

Investment in AI capabilities should be a priority for solution providers seeking to differentiate their offerings and address growing demand for intelligent security systems. Organizations should focus on developing practical AI applications that provide measurable security improvements while maintaining user-friendly interfaces and simplified management capabilities.

Partnership strategies can help companies expand their market reach and solution capabilities through collaboration with complementary technology providers, system integrators, and service organizations. Strategic partnerships enable access to new customer segments while reducing development costs and time-to-market for innovative solutions.

Service model development presents opportunities for creating recurring revenue streams while making advanced security solutions accessible to organizations with limited capital budgets. Companies should consider developing security-as-a-service offerings that provide ongoing value through continuous monitoring, maintenance, and capability updates.

Market education initiatives can help accelerate adoption by increasing awareness of advanced security capabilities and demonstrating return on investment for comprehensive protection frameworks. Educational programs should focus on practical benefits and real-world case studies that illustrate security solution value.

Regulatory compliance focus is essential for ensuring solutions meet evolving data protection and security requirements. Companies should maintain close monitoring of regulatory developments and proactively adapt their offerings to address new compliance obligations.

Future market prospects for Japan’s data center physical security market remain highly positive, with multiple growth drivers supporting sustained expansion through the forecast period. The market is expected to benefit from continued digitalization, evolving threat landscapes, and technological advancement that create new opportunities for innovative security solutions.

Technology evolution will continue driving market transformation through introduction of advanced capabilities such as quantum-resistant encryption, autonomous threat response systems, and integrated IoT security platforms. These innovations will create new market segments while enhancing the effectiveness of existing security solutions. MWR projections indicate that AI-powered security solutions will achieve 85% market penetration within the next five years.

Market expansion is expected to accelerate as edge computing adoption increases and organizations deploy distributed data center infrastructure requiring comprehensive security coverage. This trend will create opportunities for scalable security platforms that can protect diverse facility types while maintaining centralized management capabilities.

Integration trends will continue toward comprehensive security ecosystems that combine physical protection with cybersecurity capabilities, creating unified threat detection and response platforms. Organizations will increasingly demand solutions that provide holistic security coverage across all infrastructure components and threat vectors.

Sustainability requirements will influence solution development priorities, with organizations seeking energy-efficient security technologies that minimize environmental impact while maintaining comprehensive protection capabilities. This focus will drive innovation in low-power security devices and renewable energy integration for security systems.

Service delivery models will evolve toward more flexible, consumption-based offerings that align security costs with actual usage and value delivered. These models will make advanced security capabilities accessible to organizations of all sizes while creating predictable revenue streams for solution providers.

Japan’s data center physical security market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing digitalization, regulatory requirements, and technological advancement. The market benefits from strong fundamentals including robust demand, technological innovation, and supportive regulatory frameworks that create favorable conditions for sustained expansion.

Key success factors for market participants include investment in advanced technologies, development of integrated solution platforms, and focus on customer-centric service delivery models that address evolving security requirements. Organizations that can effectively combine technological innovation with practical implementation capabilities will be best positioned to capitalize on market opportunities.

Market challenges including high implementation costs, technical complexity, and evolving threat landscapes require strategic approaches that balance security effectiveness with operational efficiency and cost optimization. Solution providers must continue innovating while maintaining focus on user experience and simplified management capabilities.

Future growth prospects remain strong with multiple drivers supporting continued market expansion including AI integration, edge computing adoption, and sustainability initiatives. The Japan data center physical security market is well-positioned to benefit from these trends while contributing to the nation’s broader digital infrastructure development and security enhancement objectives.

What is Data Center Physical Security?

Data Center Physical Security refers to the measures and protocols implemented to protect data centers from physical threats such as unauthorized access, natural disasters, and vandalism. This includes surveillance systems, access controls, and environmental monitoring.

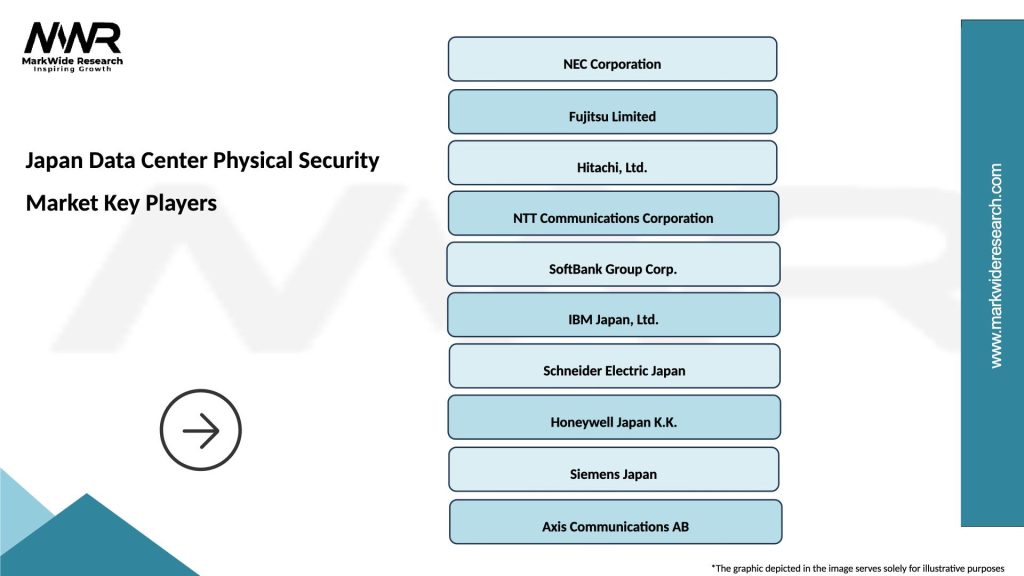

What are the key players in the Japan Data Center Physical Security Market?

Key players in the Japan Data Center Physical Security Market include NEC Corporation, Fujitsu Limited, and Hitachi, Ltd. These companies provide a range of security solutions tailored for data centers, including surveillance systems and access control technologies, among others.

What are the main drivers of the Japan Data Center Physical Security Market?

The main drivers of the Japan Data Center Physical Security Market include the increasing need for data protection due to rising cyber threats, the growth of cloud computing, and the expansion of data center facilities. Additionally, regulatory compliance requirements are pushing organizations to enhance their physical security measures.

What challenges does the Japan Data Center Physical Security Market face?

Challenges in the Japan Data Center Physical Security Market include the high costs associated with implementing advanced security technologies and the complexity of integrating various security systems. Additionally, the rapid evolution of security threats requires continuous updates and training.

What opportunities exist in the Japan Data Center Physical Security Market?

Opportunities in the Japan Data Center Physical Security Market include the adoption of AI and machine learning for enhanced surveillance and threat detection, as well as the growing demand for integrated security solutions. The increasing focus on sustainability also presents avenues for developing eco-friendly security technologies.

What trends are shaping the Japan Data Center Physical Security Market?

Trends shaping the Japan Data Center Physical Security Market include the rise of biometric access controls, the integration of IoT devices for real-time monitoring, and the shift towards cloud-based security solutions. These innovations are aimed at improving efficiency and response times in security management.

Japan Data Center Physical Security Market

| Segmentation Details | Description |

|---|---|

| Product Type | Access Control Systems, Surveillance Cameras, Intrusion Detection Systems, Fire Safety Equipment |

| End User | Telecommunications, Financial Services, Government, Healthcare |

| Technology | Biometric Authentication, Video Analytics, Cloud-Based Security, RFID Solutions |

| Installation | On-Premises, Remote Monitoring, Integrated Systems, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Data Center Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at