444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan dangerous goods logistics market represents a critical segment of the nation’s supply chain infrastructure, encompassing the specialized transportation, storage, and handling of hazardous materials across various industries. Japan’s advanced industrial economy generates substantial demand for dangerous goods logistics services, driven by sectors including chemicals, pharmaceuticals, automotive, electronics, and energy. The market demonstrates steady growth patterns with increasing regulatory compliance requirements and technological advancement driving expansion.

Market dynamics in Japan reflect the country’s commitment to safety standards and environmental protection, with stringent regulations governing the movement of hazardous materials. The logistics infrastructure supports diverse dangerous goods categories including flammable liquids, corrosive substances, toxic materials, radioactive substances, and explosive materials. Growth rates indicate sustained expansion at approximately 4.2% CAGR over the forecast period, supported by industrial modernization and increased safety awareness.

Regional distribution shows concentration in major industrial hubs including Tokyo, Osaka, Nagoya, and Yokohama, where manufacturing activities generate significant dangerous goods transportation requirements. The market benefits from Japan’s strategic geographic position as a major trading nation, facilitating both domestic distribution and international trade of hazardous materials through sophisticated port and airport facilities.

The Japan dangerous goods logistics market refers to the specialized sector encompassing the transportation, warehousing, handling, and distribution of hazardous materials within Japan’s borders, adhering to strict regulatory frameworks and safety protocols established by national and international authorities.

Dangerous goods logistics involves comprehensive services including classification, packaging, labeling, documentation, transportation planning, emergency response, and regulatory compliance management. The market serves industries requiring specialized handling capabilities for materials classified under various hazard categories according to international standards such as the UN Model Regulations and Japan’s domestic regulations.

Service providers in this market offer integrated solutions combining transportation expertise, specialized equipment, trained personnel, and technology systems designed to ensure safe and compliant movement of hazardous materials. The sector encompasses multiple transportation modes including road, rail, sea, and air transport, each requiring specific safety protocols and equipment configurations.

Japan’s dangerous goods logistics market exhibits robust fundamentals driven by the country’s advanced manufacturing base and stringent safety regulations. The market demonstrates consistent growth momentum supported by increasing industrial activity, technological innovation, and enhanced regulatory compliance requirements across various sectors.

Key market drivers include expanding chemical and pharmaceutical industries, growing automotive production, increasing electronics manufacturing, and rising energy sector activities. The market benefits from Japan’s technological leadership in developing advanced logistics solutions, including IoT-enabled tracking systems, automated handling equipment, and sophisticated safety monitoring technologies.

Competitive landscape features both domestic logistics specialists and international service providers offering comprehensive dangerous goods handling capabilities. Market participants focus on service differentiation through advanced technology adoption, specialized equipment investments, and enhanced safety protocols to meet evolving customer requirements and regulatory standards.

Future prospects indicate continued market expansion driven by industrial growth, regulatory evolution, and technological advancement. The market shows increasing adoption rates of approximately 38% for digital tracking solutions and growing demand for specialized storage and handling facilities equipped with advanced safety systems.

Strategic insights reveal several critical factors shaping the Japan dangerous goods logistics market landscape:

Industrial expansion serves as a primary driver for Japan’s dangerous goods logistics market, with manufacturing sectors requiring specialized transportation and storage solutions for hazardous materials. The chemical industry growth particularly contributes to increased demand for dangerous goods logistics services, driven by expanding production capacities and new product development initiatives.

Regulatory enhancement continues driving market growth as authorities implement stricter safety standards and compliance requirements. Companies invest in advanced logistics capabilities to meet evolving regulatory frameworks, creating opportunities for specialized service providers offering comprehensive compliance management solutions.

Technological advancement accelerates market development through innovative solutions improving safety, efficiency, and transparency in dangerous goods handling. Digital transformation initiatives enable real-time monitoring, predictive maintenance, and enhanced emergency response capabilities, attracting customers seeking advanced logistics solutions.

Supply chain optimization drives demand for integrated dangerous goods logistics services as companies focus on reducing costs while maintaining safety standards. The trend toward outsourcing specialized logistics functions creates growth opportunities for service providers offering comprehensive dangerous goods handling capabilities.

High operational costs present significant challenges for dangerous goods logistics providers, requiring substantial investments in specialized equipment, trained personnel, insurance coverage, and compliance systems. These cost pressures can limit market entry for smaller players and impact pricing strategies across the industry.

Regulatory complexity creates operational challenges as companies navigate multiple regulatory frameworks governing different types of dangerous goods and transportation modes. The compliance burden requires continuous investment in training, documentation, and system updates to maintain regulatory adherence.

Infrastructure limitations in certain regions may constrain market growth, particularly for specialized dangerous goods storage and handling facilities. Capacity constraints at ports, airports, and rail terminals can create bottlenecks affecting service delivery and market expansion opportunities.

Skilled labor shortage challenges the industry as specialized dangerous goods handling requires extensive training and certification. The aging workforce in Japan’s logistics sector compounds this challenge, requiring significant investment in recruitment and training programs to maintain service capabilities.

Technology integration presents substantial opportunities for market expansion through advanced solutions including IoT sensors, blockchain tracking, artificial intelligence, and automated handling systems. These technological innovations enable enhanced safety monitoring, improved efficiency, and better regulatory compliance management.

Service diversification offers growth potential as logistics providers expand into specialized segments including pharmaceutical cold chain, lithium battery transport, and renewable energy components handling. Niche market development allows companies to differentiate services and capture premium pricing opportunities.

International trade growth creates opportunities for dangerous goods logistics providers supporting Japan’s export and import activities. The expansion of cross-border e-commerce and global supply chain integration drives demand for specialized international dangerous goods transportation services.

Sustainability initiatives open new market segments as companies seek environmentally responsible dangerous goods logistics solutions. Green logistics programs including electric vehicle adoption, carbon footprint reduction, and sustainable packaging solutions attract environmentally conscious customers and support regulatory compliance.

Supply-demand dynamics in Japan’s dangerous goods logistics market reflect the balance between industrial production requirements and specialized service capacity. Demand patterns show seasonal variations aligned with manufacturing cycles, particularly in chemical and automotive sectors, requiring flexible capacity management strategies.

Competitive dynamics feature both consolidation trends among major players and niche specialization by smaller providers. Market competition drives innovation in service offerings, technology adoption, and pricing strategies as companies seek to differentiate their dangerous goods logistics capabilities.

Regulatory dynamics continue evolving with authorities implementing enhanced safety standards and environmental protection measures. These regulatory changes create both challenges and opportunities as companies adapt operations while potentially gaining competitive advantages through superior compliance capabilities.

Technology dynamics accelerate market transformation through digital solutions improving operational efficiency and safety performance. Innovation adoption varies across market segments, with larger companies typically leading in technology implementation while smaller providers focus on specialized service niches.

Comprehensive research approach combines multiple data collection methods to ensure accurate market analysis and insights. Primary research includes interviews with industry executives, logistics managers, regulatory officials, and technology providers to gather firsthand market intelligence and validate market trends.

Secondary research encompasses analysis of industry reports, regulatory documents, company financial statements, trade publications, and government statistics. Data triangulation ensures accuracy by cross-referencing information from multiple sources and validating findings through expert consultations.

Market modeling employs quantitative analysis techniques including trend analysis, correlation studies, and forecasting models to project market development patterns. Statistical analysis validates market size estimates, growth projections, and segment performance indicators through rigorous analytical frameworks.

Quality assurance processes include peer review, expert validation, and continuous monitoring of market developments to ensure research accuracy and relevance. MarkWide Research methodology emphasizes transparency and reliability in market analysis through systematic data collection and validation procedures.

Tokyo metropolitan area dominates Japan’s dangerous goods logistics market, accounting for approximately 35% of national demand due to concentrated industrial activity, major port facilities, and extensive transportation infrastructure. The region benefits from advanced logistics capabilities and proximity to key manufacturing centers.

Osaka-Kansai region represents the second-largest market segment with 22% market share, driven by chemical industry concentration, pharmaceutical manufacturing, and major international gateway functions. The region’s industrial diversity creates demand across multiple dangerous goods categories.

Nagoya region captures significant market share through automotive industry concentration and advanced manufacturing activities. The area’s transportation infrastructure including ports, airports, and rail connections supports efficient dangerous goods distribution networks serving central Japan.

Other regional markets including Yokohama, Kobe, and Fukuoka contribute to national market development through specialized industrial activities and regional distribution requirements. These markets show steady growth patterns aligned with local economic development and infrastructure improvements.

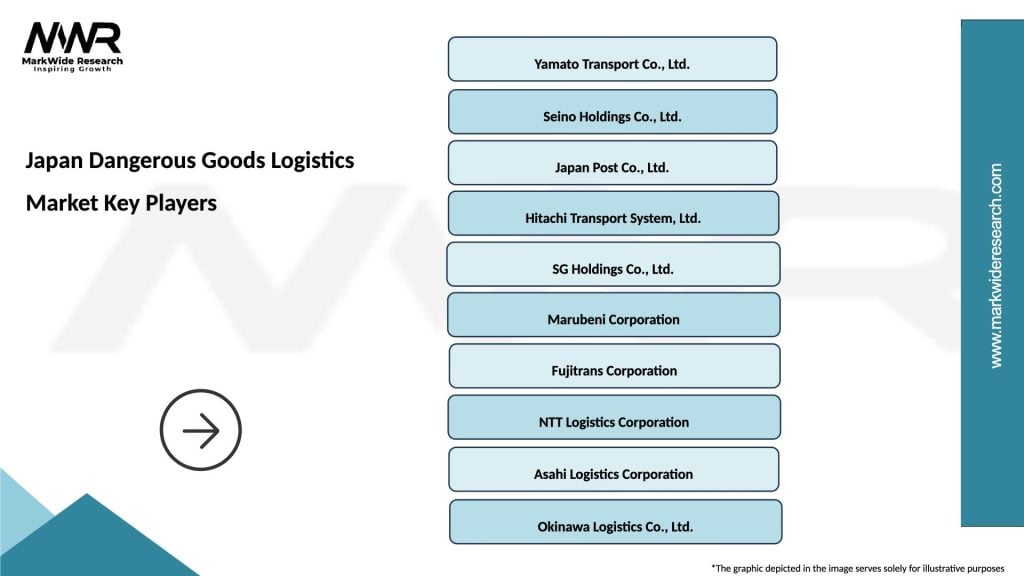

Market leadership features established logistics companies with specialized dangerous goods handling capabilities and extensive service networks:

Competitive strategies focus on technology investment, safety performance improvement, regulatory compliance excellence, and service specialization to differentiate market positioning and capture growth opportunities.

By Dangerous Goods Class:

By Transportation Mode:

By End-User Industry:

Flammable liquids category dominates market demand due to extensive use across chemical, automotive, and manufacturing industries. This segment requires specialized tank vehicles, fire suppression systems, and trained personnel certified in flammable materials handling protocols.

Corrosive substances category shows steady growth driven by chemical industry expansion and infrastructure development projects. Handling requirements include specialized containers, protective equipment, and emergency response capabilities for potential spill situations.

Toxic substances category experiences increasing demand from pharmaceutical and specialty chemical sectors. This segment requires enhanced safety protocols, specialized ventilation systems, and comprehensive emergency response planning to ensure personnel and environmental protection.

Lithium battery category within Class 9 dangerous goods shows rapid growth driven by electric vehicle adoption and consumer electronics demand. Specialized handling requirements include fire-resistant packaging, temperature monitoring, and specific transportation protocols to prevent thermal runaway incidents.

Logistics service providers benefit from stable demand patterns and premium pricing opportunities in dangerous goods transportation. Specialized expertise creates competitive advantages and barriers to entry, enabling sustainable business models and long-term customer relationships.

Manufacturing companies gain access to professional dangerous goods handling services, reducing operational risks and regulatory compliance burdens. Outsourcing benefits include cost optimization, enhanced safety performance, and access to specialized equipment and expertise.

Technology vendors find growth opportunities in developing innovative solutions for dangerous goods tracking, monitoring, and safety management. Market demand for digital solutions creates revenue streams and partnership opportunities with logistics providers.

Regulatory authorities benefit from improved industry safety performance and compliance rates through professional dangerous goods logistics services. Enhanced oversight capabilities through digital tracking and reporting systems support regulatory enforcement and public safety objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across Japan’s dangerous goods logistics market with companies implementing IoT sensors, blockchain tracking, and AI-powered analytics. Technology adoption rates show increasing implementation of digital solutions for enhanced safety monitoring and regulatory compliance management.

Sustainability initiatives gain momentum as logistics providers invest in electric vehicles, alternative fuels, and carbon footprint reduction programs. Environmental consciousness drives demand for green dangerous goods logistics solutions aligned with corporate sustainability objectives.

Service integration trends show companies expanding beyond basic transportation to offer comprehensive dangerous goods management including consulting, training, and emergency response services. Value-added services create differentiation opportunities and strengthen customer relationships.

Automation advancement includes deployment of automated handling systems, robotic packaging solutions, and autonomous vehicle technologies for dangerous goods transportation. Automation benefits include improved safety performance, reduced human error, and enhanced operational efficiency.

Regulatory updates include enhanced safety standards for lithium battery transportation and revised classification criteria for certain chemical substances. MarkWide Research analysis indicates these regulatory changes drive investment in specialized handling equipment and training programs across the industry.

Technology partnerships between logistics companies and technology vendors accelerate innovation in dangerous goods tracking and monitoring solutions. Collaborative initiatives focus on developing integrated platforms combining transportation management, safety monitoring, and regulatory compliance capabilities.

Infrastructure investments include expansion of specialized dangerous goods storage facilities and enhancement of transportation equipment fleets. Capacity expansion projects support growing market demand and improve service capabilities across different dangerous goods categories.

International cooperation initiatives enhance cross-border dangerous goods transportation capabilities through harmonized regulations and improved information sharing systems. Global integration supports Japan’s role in international trade and supply chain networks.

Technology investment recommendations emphasize prioritizing digital solutions that enhance safety monitoring, improve operational efficiency, and strengthen regulatory compliance capabilities. Strategic technology adoption should focus on scalable platforms supporting multiple dangerous goods categories and transportation modes.

Service differentiation strategies should emphasize specialized expertise, advanced safety performance, and comprehensive compliance management to justify premium pricing and build competitive advantages. Market positioning through safety excellence and regulatory expertise creates sustainable competitive moats.

Partnership development with technology vendors, equipment manufacturers, and international logistics providers can enhance service capabilities and market reach. Strategic alliances enable access to specialized expertise and resources while sharing investment costs and risks.

Workforce development initiatives should prioritize recruitment, training, and retention programs addressing skilled labor shortages in dangerous goods handling. Human capital investment ensures service quality and safety performance while supporting long-term market growth.

Market growth prospects indicate continued expansion driven by industrial development, regulatory evolution, and technology advancement. Growth projections suggest sustained development at approximately 4.2% CAGR over the forecast period, supported by increasing demand across multiple end-user industries.

Technology evolution will transform dangerous goods logistics through advanced automation, artificial intelligence, and IoT integration. Digital transformation trends indicate accelerating adoption rates of smart logistics solutions improving safety, efficiency, and transparency in dangerous goods handling.

Regulatory development will continue enhancing safety standards and environmental protection requirements, creating both challenges and opportunities for market participants. Compliance excellence will become increasingly important for competitive differentiation and market access.

Market consolidation trends may accelerate as companies seek scale advantages and comprehensive service capabilities. Strategic partnerships and acquisitions will likely reshape the competitive landscape while maintaining focus on safety performance and regulatory compliance.

Japan’s dangerous goods logistics market demonstrates robust fundamentals supported by advanced industrial economy, stringent safety regulations, and sophisticated infrastructure capabilities. The market exhibits steady growth momentum driven by expanding manufacturing sectors, technological innovation, and increasing regulatory compliance requirements.

Key success factors include specialized expertise, advanced technology adoption, comprehensive safety protocols, and superior regulatory compliance capabilities. Market participants focusing on these areas position themselves for sustainable competitive advantages and long-term growth opportunities in this specialized logistics segment.

Future market development will be shaped by digital transformation, sustainability initiatives, regulatory evolution, and changing customer requirements. Companies investing in technology advancement, workforce development, and service innovation will be best positioned to capitalize on emerging opportunities while maintaining safety excellence and regulatory compliance standards that define success in Japan’s dangerous goods logistics market.

What is Dangerous Goods Logistics?

Dangerous Goods Logistics refers to the specialized transportation and handling of hazardous materials that pose risks to health, safety, and the environment. This includes chemicals, explosives, and radioactive materials, which require strict compliance with safety regulations and protocols.

What are the key players in the Japan Dangerous Goods Logistics Market?

Key players in the Japan Dangerous Goods Logistics Market include Nippon Express, Yamato Transport, and Kintetsu World Express, among others. These companies provide comprehensive logistics solutions tailored to the unique requirements of transporting hazardous materials.

What are the main challenges in the Japan Dangerous Goods Logistics Market?

The Japan Dangerous Goods Logistics Market faces challenges such as stringent regulatory compliance, the need for specialized training for personnel, and the complexities of packaging and labeling hazardous materials. These factors can complicate logistics operations and increase costs.

What opportunities exist in the Japan Dangerous Goods Logistics Market?

Opportunities in the Japan Dangerous Goods Logistics Market include the growing demand for e-commerce, which requires efficient handling of hazardous materials, and advancements in technology that improve tracking and safety measures. Additionally, increased awareness of environmental sustainability can drive innovation in logistics practices.

What trends are shaping the Japan Dangerous Goods Logistics Market?

Trends in the Japan Dangerous Goods Logistics Market include the adoption of digital technologies for better supply chain visibility and the implementation of green logistics practices. Companies are increasingly focusing on reducing their carbon footprint while ensuring compliance with safety regulations.

What segments are included in the Japan Dangerous Goods Logistics Market?

The Japan Dangerous Goods Logistics Market includes segments such as chemicals, pharmaceuticals, and industrial goods. Each segment has specific requirements for transportation, storage, and handling to ensure safety and compliance with regulations.

Japan Dangerous Goods Logistics Market

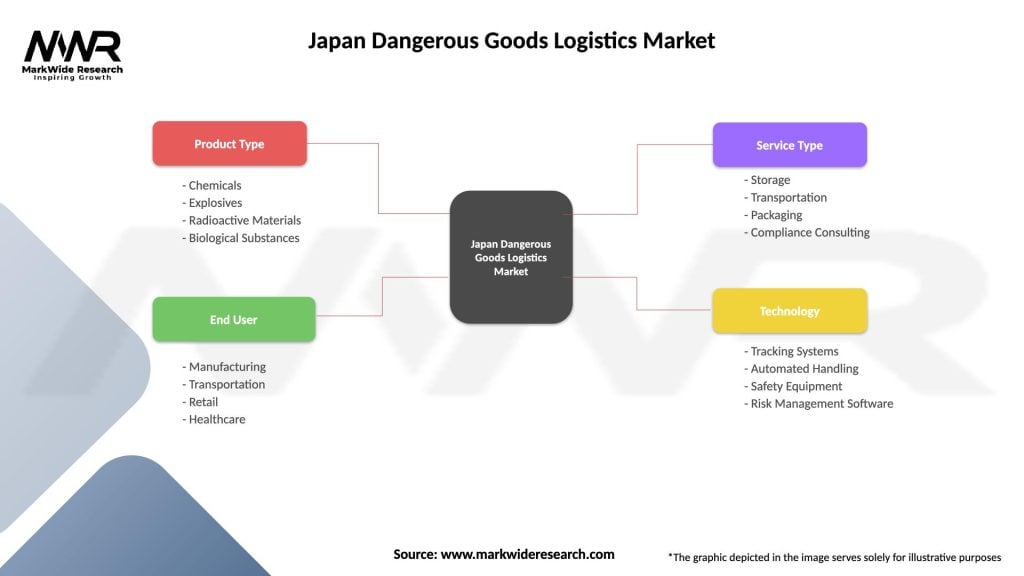

| Segmentation Details | Description |

|---|---|

| Product Type | Chemicals, Explosives, Radioactive Materials, Biological Substances |

| End User | Manufacturing, Transportation, Retail, Healthcare |

| Service Type | Storage, Transportation, Packaging, Compliance Consulting |

| Technology | Tracking Systems, Automated Handling, Safety Equipment, Risk Management Software |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Dangerous Goods Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at