444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan dairy market represents one of Asia’s most sophisticated and technologically advanced dairy sectors, characterized by premium quality products and innovative processing techniques. Japan’s dairy industry has evolved significantly over the past decades, transforming from traditional farming practices to highly mechanized operations that prioritize food safety, nutritional value, and consumer preferences. The market encompasses a comprehensive range of products including fluid milk, cheese, yogurt, butter, and specialized dairy ingredients that cater to diverse consumer segments.

Market dynamics in Japan reflect the country’s unique demographic challenges and evolving consumption patterns. With an aging population and declining birth rates, the dairy sector has adapted by focusing on functional foods, premium products, and health-oriented offerings. The industry demonstrates remarkable resilience through continuous innovation in product development, sustainable farming practices, and advanced cold chain logistics that ensure product quality from farm to consumer.

Growth trajectories indicate steady expansion driven by increasing health consciousness, rising demand for protein-rich foods, and growing popularity of Western-style dairy products. The market benefits from strong domestic production capabilities, advanced processing technologies, and robust distribution networks that serve both urban and rural populations effectively. Consumer preferences increasingly favor organic, low-fat, and fortified dairy products, creating opportunities for premium positioning and value-added offerings.

The Japan dairy market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and consumption of milk and milk-derived products within Japan’s domestic economy. This market includes traditional dairy products such as fluid milk, cheese, yogurt, and butter, as well as specialized items like functional dairy beverages, probiotic products, and dairy-based ingredients used in food manufacturing and culinary applications.

Market scope extends beyond basic dairy commodities to include value-added products that incorporate advanced nutritional science, flavor innovation, and packaging technologies. The Japanese dairy sector is characterized by its emphasis on quality assurance, traceability, and adherence to stringent food safety standards that exceed international requirements. Industry participants range from large-scale commercial dairy farms and processing facilities to artisanal producers specializing in premium and organic products.

Consumer segments within this market include households, food service establishments, educational institutions, healthcare facilities, and industrial food manufacturers. The market’s definition encompasses both domestic production and selective imports of specialized dairy products that complement local offerings, creating a diverse and competitive landscape that serves Japan’s sophisticated consumer base.

Japan’s dairy market demonstrates remarkable stability and innovation despite facing demographic headwinds and changing consumer behaviors. The industry has successfully navigated challenges through strategic focus on premium products, technological advancement, and sustainable practices that align with environmental consciousness. Market leaders have invested heavily in automation, quality control systems, and research and development to maintain competitive advantages in an increasingly sophisticated marketplace.

Key performance indicators reveal strong consumer loyalty to established brands, growing demand for functional dairy products, and increasing acceptance of plant-based alternatives that complement traditional offerings. The market exhibits resilience through diversification strategies that include expansion into health and wellness segments, development of age-specific products, and integration of digital technologies in marketing and distribution channels.

Strategic positioning within the broader food and beverage sector emphasizes Japan’s role as a regional innovation hub for dairy technology and product development. The industry’s commitment to sustainability, animal welfare, and environmental stewardship creates long-term value propositions that resonate with environmentally conscious consumers. Future growth prospects remain positive despite demographic challenges, supported by export opportunities and continued innovation in product categories.

Consumer behavior analysis reveals significant shifts toward health-conscious purchasing decisions, with increasing preference for products that offer functional benefits beyond basic nutrition. Japanese consumers demonstrate willingness to pay premium prices for dairy products that provide specific health advantages, such as immune system support, digestive health, and bone strength enhancement.

Health consciousness trends serve as the primary catalyst driving Japan’s dairy market expansion, with consumers increasingly recognizing dairy products as essential components of balanced nutrition. The aging population’s focus on maintaining bone health, muscle mass, and overall wellness creates sustained demand for calcium-rich and protein-enhanced dairy offerings. Nutritional awareness campaigns by health organizations and government agencies reinforce the importance of dairy consumption across all age groups.

Technological advancement in dairy farming and processing enables producers to enhance product quality, extend shelf life, and develop innovative formulations that meet specific consumer needs. Advanced pasteurization techniques, precision fermentation processes, and smart packaging technologies contribute to improved product safety and consumer convenience. Automation systems reduce production costs while maintaining consistent quality standards that Japanese consumers expect.

Government support initiatives promote domestic dairy production through subsidies, research funding, and infrastructure development programs. Policy frameworks encourage sustainable farming practices, animal welfare improvements, and technological modernization that strengthen the industry’s competitive position. Educational programs in schools and communities promote dairy consumption as part of healthy lifestyle choices, creating long-term market stability.

Urbanization patterns and changing lifestyle preferences drive demand for convenient, ready-to-consume dairy products that fit busy schedules. The growth of modern retail channels, including convenience stores and online platforms, improves product accessibility and creates new distribution opportunities. Cultural integration of Western dietary habits continues to expand the market for cheese, yogurt, and other dairy products traditionally less common in Japanese cuisine.

Demographic challenges pose significant constraints on Japan’s dairy market growth, with declining birth rates and an aging population reducing the traditional consumer base for many dairy products. The shrinking workforce in rural areas affects dairy farming operations, leading to consolidation and potential supply chain disruptions. Population decline in certain regions creates distribution inefficiencies and increases per-unit logistics costs.

Import competition from lower-cost international suppliers pressures domestic producers, particularly in commodity dairy categories where price sensitivity is high. Trade agreements and tariff reductions expose Japanese dairy farmers to increased competition from countries with larger-scale operations and lower production costs. Cost pressures from feed, energy, and labor expenses challenge profitability margins for domestic producers.

Lactose intolerance prevalence among the Japanese population limits market expansion potential, as a significant percentage of adults experience digestive discomfort from dairy consumption. This biological constraint requires specialized product development and limits the addressable market size for traditional dairy products. Dietary preferences shifting toward plant-based alternatives create additional competitive pressure on conventional dairy offerings.

Environmental concerns regarding dairy farming’s carbon footprint and land use efficiency generate regulatory pressures and consumer skepticism. Strict environmental regulations increase compliance costs and may limit expansion opportunities for dairy operations. Climate change impacts on feed crop production and water availability create long-term sustainability challenges for the industry.

Functional food development presents substantial opportunities for dairy companies to create value-added products that address specific health concerns prevalent in Japanese society. The integration of probiotics, prebiotics, and bioactive compounds into dairy products can command premium pricing while meeting consumer wellness objectives. Personalized nutrition trends create opportunities for customized dairy products tailored to individual health profiles and dietary requirements.

Export market expansion offers growth potential as Japanese dairy products gain recognition for their quality and safety standards in international markets. Premium positioning of Japanese dairy brands in affluent Asian markets can generate significant revenue streams and reduce dependence on domestic consumption. Tourism recovery post-pandemic creates opportunities to showcase Japanese dairy products to international visitors, potentially building export demand.

Technology partnerships with food tech companies enable the development of innovative dairy alternatives and hybrid products that combine traditional dairy with plant-based ingredients. Collaboration with biotechnology firms can lead to breakthrough products with enhanced nutritional profiles and extended shelf life. Digital transformation opportunities include direct-to-consumer sales platforms, subscription services, and smart packaging that enhances consumer engagement.

Sustainability initiatives can differentiate Japanese dairy products in environmentally conscious market segments, creating competitive advantages through carbon-neutral production methods and circular economy practices. Organic certification and regenerative farming practices appeal to premium market segments willing to pay higher prices for environmentally responsible products.

Supply chain evolution in Japan’s dairy market reflects ongoing consolidation among producers, processors, and distributors seeking operational efficiencies and cost optimization. Large-scale dairy cooperatives increasingly dominate milk collection and processing, while smaller artisanal producers focus on niche markets and premium products. Vertical integration strategies enable companies to control quality throughout the production chain and capture additional value margins.

Consumer purchasing patterns demonstrate increasing sophistication, with shoppers actively comparing nutritional labels, ingredient lists, and sustainability credentials when making dairy product selections. The rise of health-conscious millennials and Gen Z consumers drives demand for transparency in production methods and ingredient sourcing. Brand loyalty remains strong in established categories but shows flexibility in emerging product segments.

Pricing dynamics reflect the balance between premium positioning and value consciousness, with successful products offering clear value propositions that justify higher prices through superior quality, convenience, or health benefits. Promotional strategies increasingly focus on education and experience rather than price competition, emphasizing product benefits and usage occasions.

Regulatory environment continues to evolve with stricter food safety standards, environmental regulations, and labeling requirements that shape product development and marketing strategies. Innovation cycles accelerate as companies invest in research and development to maintain competitive differentiation and meet changing consumer preferences.

Primary research approaches employed in analyzing Japan’s dairy market include comprehensive consumer surveys, in-depth interviews with industry stakeholders, and focus group discussions with target demographic segments. Data collection methods encompass both quantitative and qualitative techniques to ensure comprehensive market understanding and accurate trend identification.

Secondary research sources include government statistical databases, industry association reports, trade publications, and academic research studies that provide historical context and comparative analysis. Market intelligence gathering involves monitoring retail channels, analyzing competitor activities, and tracking regulatory developments that impact market dynamics.

Analytical frameworks utilize statistical modeling, trend analysis, and scenario planning to project future market conditions and identify growth opportunities. Validation processes ensure data accuracy through cross-referencing multiple sources and expert consultation to confirm findings and recommendations.

Sampling methodologies represent diverse consumer segments, geographic regions, and industry participants to provide balanced perspectives on market conditions and future prospects. Research limitations are acknowledged and addressed through transparent methodology disclosure and confidence interval reporting where applicable.

Hokkaido region dominates Japan’s dairy production landscape, accounting for approximately 55% of national milk production due to favorable climate conditions, extensive grasslands, and established dairy farming infrastructure. The region’s dairy farms benefit from economies of scale, advanced breeding programs, and proximity to major processing facilities. Premium positioning of Hokkaido dairy products leverages the region’s reputation for quality and purity in consumer marketing.

Kanto region represents the largest consumption market, driven by Tokyo’s metropolitan area and surrounding prefectures with high population density and purchasing power. The region’s sophisticated retail infrastructure and diverse consumer base create opportunities for premium and specialty dairy products. Distribution efficiency in urban areas enables rapid product turnover and fresh product availability.

Kansai region demonstrates strong demand for traditional and innovative dairy products, with Osaka and surrounding areas serving as important consumption centers. The region’s food culture embraces both Japanese and Western dairy applications, creating diverse market opportunities. Regional preferences influence product development and marketing strategies tailored to local tastes and consumption patterns.

Rural regions throughout Japan face challenges from population decline and aging demographics, but maintain importance as production centers and niche markets for artisanal dairy products. Local specialties and farm-direct sales channels provide alternative revenue streams for smaller dairy operations. Tourism integration creates opportunities to showcase regional dairy products and build brand awareness.

Market leadership in Japan’s dairy sector is characterized by a mix of large cooperatives, multinational corporations, and specialized regional producers that compete across different product categories and market segments. The competitive environment emphasizes quality, innovation, and brand reputation rather than price competition alone.

Product category segmentation reveals distinct market dynamics across different dairy product types, with fluid milk maintaining the largest volume share while value-added products demonstrate higher growth rates and profit margins. Consumer segmentation analysis identifies key demographic and psychographic groups that drive purchasing decisions and brand preferences.

By Product Type:

By Distribution Channel:

Fluid milk category maintains market stability through product innovation focusing on functional benefits, extended shelf life, and convenient packaging formats. Consumer preferences increasingly favor low-fat and calcium-enriched varieties, while organic milk commands premium pricing despite limited supply. The category benefits from strong consumption habits and government nutrition recommendations supporting daily milk intake.

Yogurt segment demonstrates the highest growth potential within Japan’s dairy market, driven by probiotic health benefits and diverse flavor innovations. Greek yogurt and high-protein varieties gain market share among health-conscious consumers, while traditional Japanese-style yogurt maintains loyal customer base. Drinking yogurt products appeal to on-the-go consumption patterns and functional health positioning.

Cheese market continues expanding as Western dietary habits integrate into Japanese cuisine, with processed cheese leading volume sales while artisanal varieties drive value growth. Domestic production increases to meet growing demand, though premium imported cheeses maintain strong market presence. Food service applications drive significant cheese consumption through pizza, pasta, and fusion cuisine popularity.

Specialty dairy products including butter, cream, and dairy-based desserts serve niche markets with premium positioning and artisanal appeal. Seasonal variations in demand create opportunities for limited-edition products and gift packaging. Industrial applications for dairy ingredients support food manufacturing and bakery sectors with consistent demand patterns.

Dairy farmers benefit from stable demand patterns, government support programs, and opportunities to participate in premium market segments through quality differentiation and sustainable farming practices. Cooperative membership provides access to processing facilities, marketing support, and risk sharing that enhances individual farm viability and profitability.

Processing companies gain advantages through economies of scale, technological innovation, and brand development that create competitive moats in the marketplace. Product diversification strategies reduce market risk and enable companies to capture value across multiple consumer segments and distribution channels.

Retailers and distributors benefit from dairy products’ high turnover rates, consistent consumer demand, and opportunities to offer private label alternatives that improve profit margins. Category management expertise in dairy sections drives store traffic and basket size increases through complementary product placement.

Consumers enjoy access to high-quality, safe dairy products with diverse nutritional profiles and convenient packaging formats that support healthy lifestyle choices. Product innovation provides solutions for specific dietary needs, health concerns, and taste preferences that enhance quality of life and nutritional well-being.

Government stakeholders achieve public health objectives through dairy industry support that ensures adequate nutrition for citizens while maintaining food security and rural economic stability. Export development creates opportunities for international trade balance improvement and cultural exchange through food diplomacy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness positioning dominates product development strategies as consumers increasingly seek dairy products that provide functional benefits beyond basic nutrition. Probiotic integration in various dairy categories creates opportunities for premium positioning and health claim marketing that resonates with health-conscious consumers.

Sustainability initiatives gain momentum as environmental consciousness influences purchasing decisions and corporate responsibility expectations. Carbon footprint reduction programs, renewable energy adoption, and waste minimization strategies become competitive differentiators in the marketplace. Circular economy principles guide packaging innovation and resource utilization optimization.

Premiumization trends drive market value growth as consumers demonstrate willingness to pay higher prices for superior quality, unique flavors, and artisanal production methods. Craft dairy products and small-batch offerings appeal to consumers seeking authentic and distinctive taste experiences. Limited edition products create excitement and urgency in purchasing decisions.

Digital transformation accelerates across the dairy value chain, from smart farming technologies to e-commerce platforms and mobile applications that enhance consumer engagement. Traceability systems provide transparency in product origins and production methods that build consumer trust and brand loyalty. Personalization technologies enable customized product recommendations and targeted marketing communications.

Convenience innovation addresses busy lifestyle needs through portable packaging, extended shelf life, and ready-to-consume formats that fit modern consumption patterns. Single-serving packages reduce waste and provide portion control benefits that appeal to health-conscious consumers. Multi-functional products combine nutrition, convenience, and taste in innovative formats.

Technological advancement in dairy processing includes implementation of artificial intelligence for quality control, blockchain systems for supply chain transparency, and precision fermentation techniques for enhanced product consistency. Automation investments reduce labor dependency while improving operational efficiency and product safety standards.

Strategic partnerships between dairy companies and technology firms accelerate innovation in product development, packaging solutions, and distribution optimization. Collaboration initiatives with research institutions advance nutritional science applications and sustainable production methods that benefit the entire industry.

Regulatory developments include updated food safety standards, environmental compliance requirements, and labeling regulations that shape product development and marketing strategies. Government support programs provide funding for modernization projects, sustainability initiatives, and export promotion activities that strengthen industry competitiveness.

Market consolidation continues as smaller dairy operations merge with larger entities to achieve economies of scale and operational efficiencies. Vertical integration strategies enable companies to control quality throughout the supply chain while capturing additional value margins.

International expansion efforts by Japanese dairy companies focus on premium market segments in Asia-Pacific regions where quality and safety standards command premium pricing. Export infrastructure development supports market entry strategies and brand building activities in target international markets.

Product innovation focus should prioritize functional dairy products that address specific health concerns prevalent in Japanese society, particularly bone health, digestive wellness, and immune system support. MarkWide Research analysis indicates that consumers demonstrate strong willingness to pay premium prices for products with proven health benefits and scientific backing.

Sustainability integration represents a critical success factor for long-term market positioning, with companies advised to implement comprehensive environmental programs that reduce carbon footprint and enhance resource efficiency. Consumer communication about sustainability efforts should emphasize tangible benefits and measurable outcomes that resonate with environmentally conscious buyers.

Digital transformation acceleration is essential for maintaining competitive relevance, with recommended investments in e-commerce capabilities, data analytics, and customer relationship management systems. Direct-to-consumer channels offer opportunities for higher margins and deeper customer insights that inform product development and marketing strategies.

Export market development should focus on premium positioning and quality differentiation in affluent Asian markets where Japanese products command respect and premium pricing. Brand building investments in target export markets require long-term commitment and cultural sensitivity to achieve sustainable market penetration.

Partnership strategies with food technology companies, research institutions, and international distributors can accelerate innovation and market expansion while sharing risks and resources. Collaborative approaches enable smaller companies to access capabilities and markets that would be difficult to develop independently.

Market evolution over the next decade will be shaped by demographic transitions, technological advancement, and changing consumer preferences that favor health, convenience, and sustainability. Growth opportunities exist in functional dairy products, premium segments, and export markets despite domestic demographic challenges.

Innovation trajectories will focus on personalized nutrition, sustainable production methods, and digital integration that enhances consumer experience and operational efficiency. MWR projections indicate continued market stability with selective growth in high-value segments and international expansion opportunities.

Competitive dynamics will intensify as companies compete for market share in premium segments while managing cost pressures and regulatory requirements. Consolidation trends may accelerate as smaller operations seek scale advantages through mergers and partnerships.

Consumer behavior will continue evolving toward health-conscious choices, sustainable products, and convenient formats that align with busy lifestyles and aging demographics. Technology adoption will enable more sophisticated marketing approaches and supply chain optimization that improves profitability and customer satisfaction.

Regulatory environment will likely become more stringent regarding environmental impact, animal welfare, and food safety standards, requiring ongoing investment in compliance and operational improvements. Government support for domestic dairy industry development and export promotion will remain important for maintaining competitiveness in global markets.

Japan’s dairy market demonstrates remarkable resilience and adaptability in the face of demographic challenges and evolving consumer preferences. The industry’s commitment to quality, innovation, and sustainability positions it well for continued success despite structural headwinds from population decline and aging demographics. Strategic focus on premium products, functional benefits, and export opportunities creates pathways for growth and profitability.

Market participants who embrace technological innovation, sustainability initiatives, and consumer-centric product development will be best positioned to thrive in the evolving competitive landscape. The industry’s strong foundation of quality standards, brand loyalty, and distribution infrastructure provides competitive advantages that can be leveraged for long-term success. Collaboration between industry stakeholders, government agencies, and research institutions will be essential for addressing challenges and capitalizing on emerging opportunities.

Future success in Japan’s dairy market will depend on the ability to balance traditional strengths with innovative approaches that meet changing consumer needs and market conditions. Companies that invest in research and development, sustainability programs, and digital capabilities while maintaining focus on quality and safety will create sustainable competitive advantages. The Japan dairy market remains an attractive sector for investment and growth, offering opportunities for both domestic and international players who understand its unique characteristics and consumer preferences.

What is Dairy?

Dairy refers to products made from the milk of mammals, primarily cows, goats, and sheep. In the context of the Japan Dairy Market, it includes a variety of products such as milk, cheese, yogurt, and butter, which are integral to Japanese cuisine and culture.

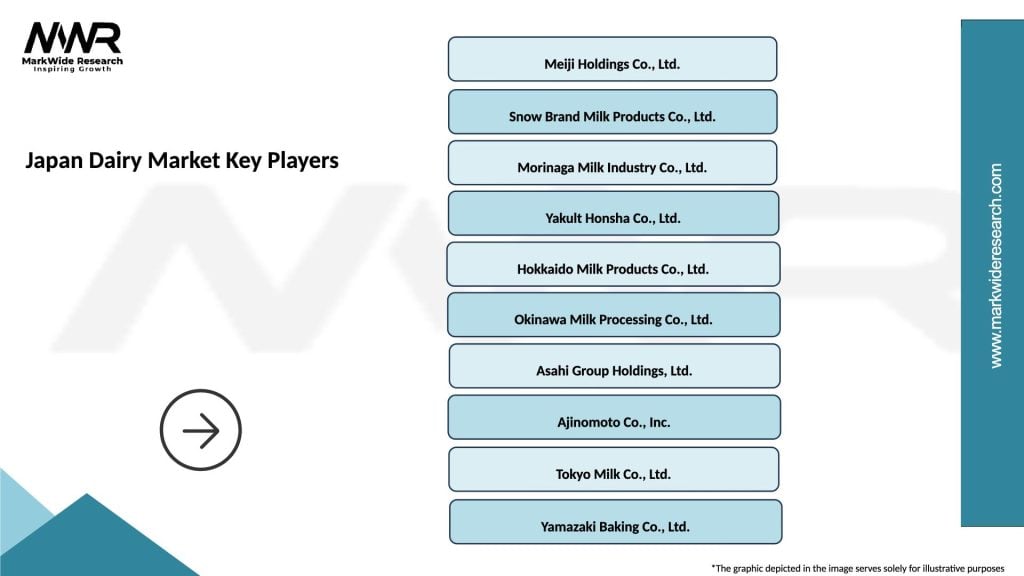

What are the key companies in the Japan Dairy Market?

Key companies in the Japan Dairy Market include Meiji Holdings Co., Ltd., Snow Brand Milk Products Co., Ltd., and Morinaga Milk Industry Co., Ltd., among others.

What are the growth factors driving the Japan Dairy Market?

The Japan Dairy Market is driven by increasing health consciousness among consumers, a growing demand for high-quality dairy products, and the rising popularity of dairy-based snacks and beverages.

What challenges does the Japan Dairy Market face?

Challenges in the Japan Dairy Market include fluctuating milk prices, competition from plant-based alternatives, and regulatory pressures regarding food safety and quality standards.

What opportunities exist in the Japan Dairy Market?

Opportunities in the Japan Dairy Market include the expansion of organic dairy products, innovation in dairy processing technologies, and the potential for export growth to other Asian markets.

What trends are shaping the Japan Dairy Market?

Trends in the Japan Dairy Market include a shift towards functional dairy products that offer health benefits, increased consumer interest in sustainable and ethically sourced dairy, and the rise of online sales channels for dairy products.

Japan Dairy Market

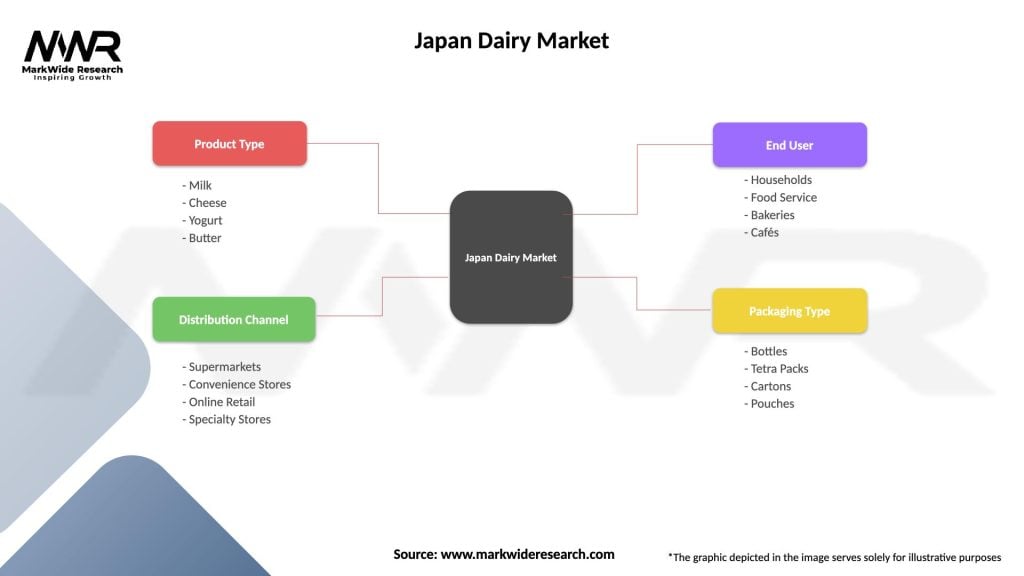

| Segmentation Details | Description |

|---|---|

| Product Type | Milk, Cheese, Yogurt, Butter |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Stores |

| End User | Households, Food Service, Bakeries, Cafés |

| Packaging Type | Bottles, Tetra Packs, Cartons, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Dairy Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at