444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan credit cards market represents one of the most sophisticated and technologically advanced payment ecosystems in Asia-Pacific. Market dynamics indicate a significant transformation driven by digital payment adoption, contactless technology integration, and evolving consumer preferences. The market demonstrates robust growth potential with increasing penetration rates across diverse demographic segments and commercial applications.

Consumer behavior patterns in Japan show accelerating acceptance of credit card payments, particularly following the COVID-19 pandemic which catalyzed contactless payment adoption. The market benefits from strong regulatory support, advanced financial infrastructure, and increasing merchant acceptance networks. Growth projections suggest the market will expand at a compound annual growth rate of 6.2% through the forecast period, driven by digital transformation initiatives and cashless society objectives.

Key market characteristics include diverse product offerings ranging from traditional credit cards to innovative digital payment solutions, premium rewards programs, and integrated financial services. The competitive landscape features both domestic financial institutions and international payment networks, creating a dynamic environment for innovation and customer acquisition.

The Japan credit cards market refers to the comprehensive ecosystem encompassing credit card issuance, processing, merchant services, and related financial products within Japan’s domestic economy. This market includes traditional plastic cards, digital payment solutions, contactless technologies, and integrated financial services offered by banks, credit card companies, and fintech organizations.

Market scope encompasses various card categories including general-purpose credit cards, co-branded cards, corporate cards, and specialized payment products. The definition extends to supporting infrastructure such as payment processing networks, merchant acquisition services, and technology platforms enabling seamless transaction experiences across retail, e-commerce, and service sectors.

Technological integration within the market includes mobile wallet compatibility, contactless payment capabilities, biometric authentication, and artificial intelligence-driven fraud prevention systems. The market also encompasses value-added services such as loyalty programs, insurance products, and financial management tools that enhance customer engagement and retention.

Strategic market analysis reveals the Japan credit cards market experiencing unprecedented growth momentum driven by digital transformation, government cashless initiatives, and changing consumer payment preferences. The market demonstrates strong fundamentals with increasing card penetration rates reaching approximately 78% of the adult population, representing significant expansion from previous years.

Key growth drivers include the government’s cashless payment promotion policies, increasing e-commerce adoption, and enhanced merchant acceptance infrastructure. The market benefits from technological innovations including contactless payment systems, mobile wallet integration, and advanced security features that address traditional consumer concerns about digital payments.

Competitive dynamics show intensifying rivalry among domestic banks, international payment networks, and emerging fintech companies. Market leaders are investing heavily in digital capabilities, customer experience enhancement, and strategic partnerships to maintain competitive advantages. Innovation focus areas include artificial intelligence applications, blockchain technology integration, and personalized financial services.

Future market trajectory indicates sustained growth supported by demographic trends, urbanization patterns, and increasing acceptance of cashless payment methods. The market is positioned for continued expansion with opportunities in underserved segments, premium product categories, and integrated financial service offerings.

Primary market insights reveal several critical trends shaping the Japan credit cards landscape:

Government policy initiatives serve as primary catalysts for market expansion, particularly the national cashless payment promotion strategy aimed at reducing cash dependency and improving economic efficiency. These policies include tax incentives for cashless transactions, infrastructure development support, and regulatory frameworks encouraging innovation in payment technologies.

Technological advancement drives market growth through enhanced security features, improved user experiences, and expanded functionality. Innovations in contactless payment technology, mobile wallet integration, and artificial intelligence applications create compelling value propositions for both consumers and merchants, accelerating adoption rates across demographic segments.

Consumer behavior evolution reflects changing preferences toward convenience, security, and integrated financial services. Younger generations demonstrate strong affinity for digital payment methods, while older demographics increasingly embrace contactless solutions for safety and efficiency reasons. This demographic shift creates sustained demand for innovative credit card products and services.

E-commerce expansion significantly impacts credit card market growth as online shopping becomes integral to consumer purchasing patterns. The proliferation of digital marketplaces, subscription services, and mobile commerce platforms requires robust payment infrastructure, driving demand for sophisticated credit card solutions with enhanced online security features.

Corporate digitization trends contribute to market expansion as businesses modernize expense management, procurement processes, and financial operations. Companies increasingly adopt corporate credit card programs for improved cash flow management, expense tracking, and employee convenience, creating substantial growth opportunities in the business segment.

Cultural payment preferences present significant challenges as Japan maintains strong cash-based transaction traditions, particularly among older demographics and in rural areas. This cultural attachment to cash payments creates resistance to credit card adoption and limits market penetration in certain segments and geographic regions.

Regulatory complexity poses operational challenges for market participants, particularly regarding consumer protection requirements, data privacy regulations, and financial service licensing. Compliance costs and regulatory uncertainty can limit innovation and market entry, particularly for smaller fintech companies and international players.

Security concerns continue to influence consumer adoption decisions, despite technological improvements in fraud prevention and transaction security. High-profile data breaches and cybersecurity incidents create consumer hesitancy, particularly among security-conscious demographics who prefer traditional payment methods.

Economic uncertainty affects consumer spending patterns and credit utilization behaviors, potentially limiting market growth during periods of economic volatility. Concerns about debt accumulation and financial stability can reduce consumer willingness to obtain or actively use credit cards, impacting transaction volumes and revenue generation.

Competitive intensity creates margin pressure and customer acquisition challenges as numerous players compete for market share. Price competition, promotional spending, and customer retention costs can impact profitability and limit resources available for innovation and market development initiatives.

Digital transformation acceleration creates substantial opportunities for innovative payment solutions, integrated financial services, and enhanced customer experiences. The growing acceptance of digital technologies among traditionally conservative consumer segments opens new market possibilities for creative product development and service delivery models.

Underserved demographic segments represent significant expansion opportunities, particularly among senior citizens, rural populations, and small business owners who have historically relied on cash transactions. Targeted product development and education initiatives can unlock substantial market potential in these segments.

Partnership opportunities with retailers, e-commerce platforms, and service providers enable market expansion through co-branded cards, loyalty program integration, and embedded payment solutions. Strategic alliances can accelerate customer acquisition and enhance value propositions for both consumers and merchants.

Premium service development offers opportunities for revenue enhancement through high-value customer segments seeking exclusive benefits, personalized services, and integrated lifestyle offerings. Luxury travel rewards, concierge services, and exclusive access programs can command premium pricing and improve customer loyalty.

Technology integration possibilities include blockchain applications, artificial intelligence enhancements, and Internet of Things connectivity that can create differentiated products and services. These technological capabilities enable new business models and revenue streams while improving operational efficiency and customer satisfaction.

Supply-side dynamics reflect intense competition among established financial institutions, international payment networks, and emerging fintech companies. Traditional banks leverage existing customer relationships and regulatory expertise, while fintech innovators introduce disruptive technologies and customer-centric service models. This competitive tension drives continuous innovation and service improvement across the market.

Demand-side factors show evolving consumer expectations for seamless, secure, and rewarding payment experiences. Customers increasingly demand integrated financial services, personalized rewards programs, and omnichannel accessibility. MarkWide Research analysis indicates consumer satisfaction directly correlates with feature richness and service quality, influencing brand loyalty and usage patterns.

Regulatory environment continues evolving to balance innovation encouragement with consumer protection and financial stability objectives. Recent policy changes promote open banking initiatives, enhance data protection requirements, and establish frameworks for emerging payment technologies. These regulatory developments create both opportunities and compliance challenges for market participants.

Technological disruption accelerates market transformation through artificial intelligence applications, blockchain technology integration, and enhanced security protocols. These innovations enable new product categories, improve operational efficiency, and create competitive advantages for early adopters while potentially obsoleting traditional approaches.

Economic factors influence market dynamics through interest rate changes, consumer spending patterns, and business investment levels. Economic growth supports increased transaction volumes and credit utilization, while economic uncertainty can reduce consumer confidence and limit market expansion opportunities.

Primary research approach encompasses comprehensive surveys of credit card users, in-depth interviews with industry executives, and focus group discussions with target demographic segments. This methodology provides direct insights into consumer preferences, usage patterns, and satisfaction levels while capturing emerging trends and unmet needs within the market.

Secondary research analysis includes examination of industry reports, regulatory filings, company financial statements, and academic studies related to payment systems and consumer behavior. This approach ensures comprehensive market understanding through multiple data sources and analytical perspectives, validating primary research findings and identifying broader market trends.

Quantitative analysis techniques employ statistical modeling, trend analysis, and comparative assessments to identify market patterns and growth projections. Data collection includes transaction volume analysis, market share calculations, and demographic segmentation studies that provide measurable insights into market performance and future potential.

Qualitative research methods capture nuanced consumer attitudes, cultural factors, and behavioral motivations that influence credit card adoption and usage decisions. This methodology includes ethnographic studies, behavioral observation, and expert opinion analysis that complement quantitative findings with contextual understanding.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical verification techniques. Quality assurance measures include bias detection, sample representativeness assessment, and methodology peer review to maintain research integrity and reliability.

Tokyo metropolitan area dominates the Japan credit cards market, representing approximately 35% of total transaction volume due to high population density, advanced merchant infrastructure, and tech-savvy consumer demographics. The region demonstrates the highest adoption rates for innovative payment technologies and premium credit card products, serving as a testing ground for new market initiatives.

Osaka and surrounding Kansai region accounts for approximately 18% of market activity, characterized by strong commercial activity and growing acceptance of cashless payment methods. The region shows particular strength in retail and hospitality sectors, with increasing merchant adoption of contactless payment systems and integrated loyalty programs.

Nagoya and central Japan represent roughly 12% of the market, driven by manufacturing industry presence and corporate credit card adoption. The region demonstrates steady growth in business-to-business payment applications and expense management solutions, reflecting the industrial economy’s digitization trends.

Northern regions including Sendai and Sapporo collectively account for approximately 15% of market share, showing accelerating growth in credit card adoption as infrastructure development and demographic changes support cashless payment acceptance. These areas present significant expansion opportunities for market participants.

Southern regions and rural areas represent the remaining 20% of market activity, characterized by traditional payment preferences but showing increasing openness to credit card adoption. Government initiatives promoting cashless payments in rural areas create growth opportunities, though cultural and infrastructure challenges remain significant factors.

Market leadership remains concentrated among established financial institutions and international payment networks, each leveraging distinct competitive advantages:

Competitive strategies focus on digital transformation, customer experience enhancement, and strategic partnerships. Market leaders invest heavily in technology infrastructure, mobile applications, and data analytics capabilities to maintain competitive advantages and capture emerging market opportunities.

By Card Type:

By Technology:

By Customer Segment:

General purpose credit cards maintain the largest market share due to broad utility and merchant acceptance, though growth rates moderate as the market matures. These products focus on competitive interest rates, reward programs, and digital service enhancements to maintain customer engagement and transaction volumes.

Co-branded credit cards demonstrate strong growth potential through strategic partnerships with popular retailers, airlines, and service providers. These products leverage partner brand loyalty and offer targeted rewards that resonate with specific consumer segments, creating differentiated value propositions in competitive markets.

Corporate credit cards represent a high-growth segment driven by business digitization trends and expense management automation. Companies increasingly adopt these solutions for improved financial control, employee convenience, and integrated accounting system compatibility, creating substantial revenue opportunities for issuers.

Premium credit cards show robust growth among affluent consumers seeking exclusive benefits, personalized services, and lifestyle enhancements. These products command higher fees and generate superior profitability while building strong customer loyalty through differentiated experiences and exclusive access privileges.

Contactless payment cards experience rapid adoption acceleration, particularly following pandemic-related hygiene concerns and convenience preferences. This technology category drives market innovation and customer satisfaction while enabling new use cases in transportation, retail, and service industries.

Financial institutions benefit from diversified revenue streams through interchange fees, interest income, and ancillary service offerings. Credit card portfolios provide stable recurring revenue, customer relationship deepening opportunities, and cross-selling platforms for additional financial products and services.

Merchants and retailers gain access to expanded customer bases, improved transaction security, and enhanced customer experience capabilities. Credit card acceptance enables higher transaction values, reduced cash handling costs, and integration with digital marketing and loyalty programs that drive customer engagement.

Consumers enjoy enhanced purchasing power, fraud protection, rewards and benefits programs, and convenient payment experiences. Credit cards provide financial flexibility, emergency funding access, and integrated financial management tools that simplify personal finance administration.

Technology providers benefit from growing demand for payment processing infrastructure, security solutions, and innovative financial technology applications. The market expansion creates opportunities for software developers, hardware manufacturers, and service providers supporting the payment ecosystem.

Government and regulatory bodies achieve policy objectives including cashless society promotion, economic efficiency improvement, and enhanced transaction transparency for tax collection and economic monitoring purposes. Digital payment adoption supports broader economic modernization initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Contactless payment acceleration represents the most significant trend reshaping the Japan credit cards market, with adoption rates increasing dramatically across all demographic segments. This trend reflects changing consumer preferences for hygiene, convenience, and speed in payment transactions, driving infrastructure investment and product development initiatives.

Mobile wallet integration continues expanding as smartphone penetration reaches saturation levels and consumers embrace digital payment methods. Credit card issuers increasingly partner with mobile platform providers to ensure compatibility and capture the growing mobile commerce market segment.

Artificial intelligence applications transform fraud detection, customer service, and personalized marketing capabilities within credit card operations. MWR research indicates AI-driven solutions improve operational efficiency while enhancing customer experiences through predictive analytics and automated decision-making processes.

Sustainability focus emerges as consumers and businesses prioritize environmental responsibility, leading to eco-friendly card materials, carbon offset programs, and sustainable business practice integration. This trend creates differentiation opportunities and appeals to environmentally conscious consumer segments.

Embedded finance solutions enable credit card functionality integration within e-commerce platforms, mobile applications, and digital services, creating seamless payment experiences and expanding market reach beyond traditional card products.

Regulatory modernization initiatives include updated consumer protection frameworks, enhanced data privacy requirements, and open banking regulations that promote innovation while maintaining security standards. These developments create new business opportunities while requiring operational adjustments from market participants.

Strategic partnership formations between traditional financial institutions and technology companies accelerate digital transformation and expand service capabilities. Recent collaborations focus on mobile payment integration, artificial intelligence applications, and customer experience enhancement initiatives.

Infrastructure investments in contactless payment acceptance networks expand merchant coverage and improve transaction processing capabilities. Major retailers and service providers upgrade point-of-sale systems to support advanced payment technologies and enhanced security features.

Product innovation launches include biometric authentication cards, blockchain-based loyalty programs, and integrated financial management platforms that differentiate offerings and create competitive advantages. These developments reflect industry commitment to technological advancement and customer value creation.

International expansion activities by domestic players and foreign market entry by international companies increase competitive intensity while expanding consumer choice and service quality. These developments contribute to market dynamism and innovation acceleration.

Digital transformation acceleration should remain the primary strategic focus for market participants seeking sustainable competitive advantages. Companies must invest in mobile applications, contactless payment capabilities, and integrated financial services that meet evolving consumer expectations and usage patterns.

Customer experience optimization requires comprehensive service design improvements, personalized product offerings, and omnichannel accessibility that creates seamless interactions across all touchpoints. Superior customer experience becomes increasingly critical for differentiation in competitive markets.

Strategic partnership development with retailers, technology companies, and service providers can accelerate market expansion and enhance value propositions. Collaborative approaches enable resource sharing, risk mitigation, and access to new customer segments and distribution channels.

Data analytics capabilities must be enhanced to support personalized marketing, fraud prevention, and customer insight generation. Advanced analytics enable better decision-making, risk management, and customer relationship optimization that drive profitability and growth.

Regulatory compliance preparation for evolving requirements ensures operational continuity and competitive positioning. Proactive compliance strategies reduce implementation costs and enable faster response to regulatory changes while maintaining customer trust and market access.

Market expansion trajectory indicates sustained growth driven by digital payment adoption, demographic changes, and technological innovation. The market is projected to maintain a compound annual growth rate of 6.2% through the forecast period, supported by government policy initiatives and evolving consumer preferences toward cashless payment methods.

Technology integration advancement will accelerate with artificial intelligence, blockchain, and biometric authentication becoming standard features in credit card products. These technological capabilities will enable new business models, improve security, and create differentiated customer experiences that drive market expansion.

Demographic transformation as younger generations reach peak earning years will fundamentally reshape market dynamics, with digital-native consumers demanding innovative features, seamless integration, and personalized services. This generational shift creates opportunities for market participants who successfully adapt their offerings.

Competitive landscape evolution will intensify as fintech companies, technology giants, and traditional financial institutions compete for market share. Success will depend on innovation capabilities, customer experience quality, and strategic partnership development rather than traditional competitive advantages.

MarkWide Research projections suggest the market will experience continued consolidation among smaller players while market leaders invest heavily in technology and customer acquisition. Long-term success will require sustained innovation, operational excellence, and adaptive strategies that respond to rapidly changing market conditions and consumer expectations.

The Japan credit cards market stands at a transformative juncture, characterized by accelerating digital adoption, evolving consumer preferences, and intensifying competition. Market fundamentals remain strong with government support for cashless payments, advanced technological infrastructure, and growing acceptance across demographic segments creating sustainable growth opportunities.

Strategic success factors include digital transformation capabilities, customer experience excellence, and innovative product development that addresses emerging consumer needs. Market participants must balance traditional strengths with technological innovation while maintaining security, compliance, and customer trust in increasingly competitive environments.

Future market development will be shaped by technological advancement, demographic changes, and regulatory evolution that create both opportunities and challenges for industry participants. Companies that successfully navigate these dynamics while delivering superior customer value will capture disproportionate market share and profitability in the expanding Japan credit cards market.

What is Japan Credit Cards?

Japan Credit Cards refer to the various credit card products and services offered to consumers and businesses in Japan, facilitating transactions, credit access, and financial management.

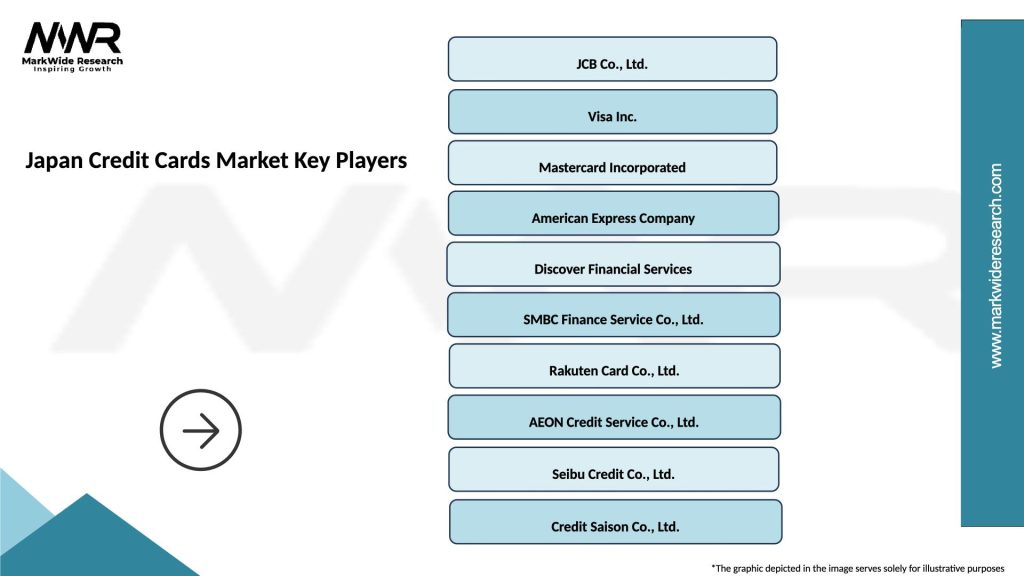

What are the major players in the Japan Credit Cards Market?

The major players in the Japan Credit Cards Market include companies like JCB, Mitsubishi UFJ NICOS, and Sumitomo Mitsui Trust Card, among others.

What are the key drivers of growth in the Japan Credit Cards Market?

Key drivers of growth in the Japan Credit Cards Market include the increasing adoption of cashless payments, the rise of e-commerce, and consumer demand for rewards and loyalty programs.

What challenges does the Japan Credit Cards Market face?

The Japan Credit Cards Market faces challenges such as high competition among issuers, regulatory compliance issues, and the need to address cybersecurity threats.

What opportunities exist in the Japan Credit Cards Market?

Opportunities in the Japan Credit Cards Market include the expansion of digital payment solutions, the integration of advanced technologies like AI for fraud detection, and the potential for growth in contactless payment options.

What trends are shaping the Japan Credit Cards Market?

Trends shaping the Japan Credit Cards Market include the increasing popularity of mobile wallets, the shift towards sustainable card options, and the growing emphasis on personalized customer experiences.

Japan Credit Cards Market

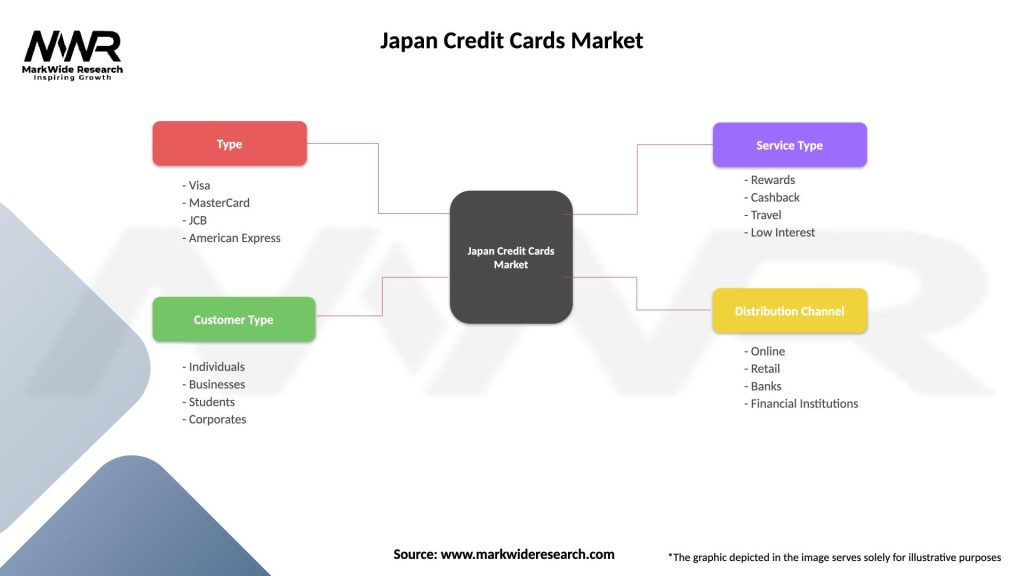

| Segmentation Details | Description |

|---|---|

| Type | Visa, MasterCard, JCB, American Express |

| Customer Type | Individuals, Businesses, Students, Corporates |

| Service Type | Rewards, Cashback, Travel, Low Interest |

| Distribution Channel | Online, Retail, Banks, Financial Institutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Credit Cards Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at