444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan contraceptive device market represents a sophisticated and evolving healthcare sector characterized by technological innovation, changing demographics, and shifting consumer preferences. Japan’s unique demographic challenges, including an aging population and declining birth rates, have created a complex landscape for contraceptive device manufacturers and healthcare providers. The market encompasses a diverse range of products including intrauterine devices (IUDs), barrier methods, hormonal implants, and emergency contraceptives, each serving distinct consumer needs and preferences.

Market dynamics in Japan are influenced by cultural factors, regulatory frameworks, and evolving attitudes toward family planning. The country’s healthcare system supports comprehensive reproductive health services, while technological advancements continue to drive product innovation. Recent trends indicate growing acceptance of long-acting reversible contraceptives (LARCs) and increased awareness of modern contraceptive options among Japanese women. The market demonstrates steady growth with a projected CAGR of 4.2% over the forecast period, driven by urbanization, women’s workforce participation, and changing lifestyle patterns.

Regional distribution shows concentrated demand in major metropolitan areas including Tokyo, Osaka, and Nagoya, where healthcare infrastructure is most developed. The market benefits from Japan’s advanced medical technology sector and strong regulatory oversight, ensuring high-quality products and safety standards. Consumer preferences increasingly favor convenient, long-term solutions that align with busy urban lifestyles and career-focused demographics.

The Japan contraceptive device market refers to the comprehensive ecosystem of medical devices, pharmaceutical products, and healthcare services designed to prevent unwanted pregnancies within the Japanese healthcare framework. This market encompasses both prescription and over-the-counter contraceptive solutions, ranging from traditional barrier methods to advanced hormonal delivery systems and emergency contraception options.

Contraceptive devices in the Japanese context include intrauterine devices (IUDs), contraceptive implants, diaphragms, cervical caps, contraceptive rings, patches, and various barrier methods. The market also incorporates digital health solutions, fertility tracking applications, and telemedicine platforms that support reproductive health management. These products serve diverse demographic segments with varying needs, preferences, and healthcare access patterns across Japan’s urban and rural regions.

Market significance extends beyond commercial considerations to encompass public health outcomes, demographic trends, and social policy implications. The contraceptive device market plays a crucial role in supporting women’s reproductive autonomy, family planning decisions, and overall healthcare system efficiency in Japan’s evolving demographic landscape.

Japan’s contraceptive device market demonstrates resilient growth amid demographic transitions and evolving healthcare needs. The market is characterized by high-quality products, stringent regulatory standards, and increasing consumer sophistication regarding reproductive health options. Key growth drivers include urbanization trends, delayed marriage patterns, and growing awareness of modern contraceptive technologies among Japanese women.

Market segmentation reveals diverse product categories with varying adoption rates and growth trajectories. Long-acting reversible contraceptives show particularly strong growth potential, with IUD adoption rates increasing by 15% annually among urban demographics. The market benefits from Japan’s advanced healthcare infrastructure, comprehensive insurance coverage, and strong pharmaceutical manufacturing capabilities.

Competitive dynamics feature both international pharmaceutical companies and domestic manufacturers, creating a balanced ecosystem of innovation and local market expertise. Digital health integration represents an emerging opportunity, with fertility tracking applications gaining 23% market penetration among women aged 20-35. The market outlook remains positive, supported by favorable regulatory developments and increasing healthcare investment in reproductive health services.

Strategic market insights reveal several critical trends shaping Japan’s contraceptive device landscape:

Primary market drivers propelling Japan’s contraceptive device market include demographic transitions, lifestyle changes, and healthcare system evolution. The country’s unique demographic challenges create sustained demand for effective family planning solutions, while urbanization trends drive preference for convenient, long-acting contraceptive options.

Women’s workforce participation continues expanding, with female employment rates reaching historic highs and driving demand for reliable contraceptive solutions that support career planning. Educational attainment improvements among Japanese women correlate with increased contraceptive awareness and adoption of modern methods. Healthcare accessibility improvements, particularly in rural areas, expand market reach and product adoption opportunities.

Technological advancement serves as a crucial driver, with innovations in drug delivery systems, biocompatible materials, and digital health integration creating new product categories and enhanced user experiences. Regulatory support for innovative contraceptive technologies accelerates market development, while healthcare provider training programs improve product recommendation and patient counseling quality.

Economic factors including rising healthcare spending, insurance coverage expansion, and disposable income growth support market expansion. Cultural shifts toward individualized healthcare decisions and reproductive autonomy create favorable conditions for diverse contraceptive options and personalized family planning approaches.

Significant market restraints challenge growth in Japan’s contraceptive device sector, primarily stemming from cultural, regulatory, and economic factors. Traditional cultural attitudes toward contraception and family planning continue influencing consumer behavior, particularly among older demographics and rural populations where conservative views may limit adoption of modern contraceptive methods.

Regulatory complexity presents ongoing challenges, with stringent approval processes for new contraceptive technologies potentially delaying market entry and increasing development costs. The Japanese regulatory framework, while ensuring safety and efficacy, may create barriers for innovative products seeking rapid market penetration. Healthcare provider training requirements and certification processes can limit product accessibility in certain regions.

Economic constraints include high development costs for advanced contraceptive technologies and limited reimbursement coverage for certain product categories. Rural healthcare infrastructure limitations restrict market reach and product availability, while demographic concentration in urban areas creates uneven market development patterns.

Competition from alternative family planning methods and natural fertility awareness approaches may limit market expansion for certain product segments. Consumer preference variations and individual health considerations create complex market dynamics requiring tailored product offerings and marketing strategies.

Substantial market opportunities emerge from Japan’s evolving demographic landscape and advancing healthcare technologies. The aging population paradoxically creates opportunities for reproductive health services targeting older women seeking family planning solutions, while younger demographics drive demand for innovative, technology-integrated contraceptive options.

Digital health integration presents significant expansion potential, with opportunities for smart contraceptive devices, mobile health applications, and telemedicine platforms. The growing acceptance of digital healthcare solutions, accelerated by recent global health events, creates favorable conditions for technology-enabled contraceptive management systems.

Rural market expansion offers untapped potential through improved healthcare infrastructure development and telemedicine service deployment. Government initiatives supporting rural healthcare access create opportunities for contraceptive device manufacturers to expand geographic reach and serve underserved populations.

International collaboration opportunities exist through partnerships with global pharmaceutical companies and medical device manufacturers, enabling technology transfer and market development acceleration. Export potential for Japanese-developed contraceptive technologies to other Asian markets represents additional growth avenues.

Personalized healthcare trends create opportunities for customized contraceptive solutions based on individual health profiles, genetic factors, and lifestyle preferences. Advanced manufacturing capabilities in Japan support development of specialized products for niche market segments.

Complex market dynamics shape Japan’s contraceptive device sector through interconnected demographic, technological, and regulatory forces. The interplay between Japan’s declining birth rates and increasing women’s workforce participation creates unique demand patterns for contraceptive products, with emphasis on long-term effectiveness and convenience.

Supply chain dynamics reflect Japan’s advanced manufacturing capabilities and strong pharmaceutical industry foundation. Domestic production capacity for certain contraceptive devices reduces import dependence while ensuring quality control and regulatory compliance. International partnerships facilitate technology transfer and market access for innovative products.

Healthcare system integration influences market dynamics through insurance coverage policies, provider training programs, and patient education initiatives. The comprehensive nature of Japan’s healthcare system supports contraceptive device adoption while ensuring safety monitoring and adverse event reporting.

Consumer behavior patterns demonstrate increasing sophistication in contraceptive decision-making, with 72% of urban women consulting multiple information sources before selecting contraceptive methods. Digital health platform usage grows steadily, with fertility tracking applications showing 35% annual user growth among reproductive-age women.

Competitive dynamics feature both established pharmaceutical companies and emerging digital health startups, creating diverse innovation pathways and market development strategies. Collaboration between traditional manufacturers and technology companies drives product innovation and market expansion opportunities.

Comprehensive research methodology employed for analyzing Japan’s contraceptive device market incorporates multiple data collection approaches and analytical frameworks. Primary research includes surveys of healthcare providers, contraceptive device users, and industry stakeholders across Japan’s major metropolitan and rural regions.

Secondary research encompasses analysis of government health statistics, pharmaceutical industry reports, demographic studies, and healthcare utilization data. Regulatory filing analysis provides insights into product approval trends and market entry patterns, while patent research reveals innovation trajectories and competitive positioning.

Quantitative analysis utilizes statistical modeling to project market trends, segment growth rates, and regional distribution patterns. Demographic modeling incorporates population projections, age structure changes, and urbanization trends to forecast long-term market evolution.

Qualitative research methods include in-depth interviews with key opinion leaders, focus groups with target demographics, and expert consultations with reproductive health specialists. Cultural analysis examines social attitudes toward contraception and family planning across different demographic segments.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical verification methods. Market sizing methodologies account for both prescription and over-the-counter segments while considering regional variations and access patterns.

Regional market distribution across Japan reveals significant geographic variations in contraceptive device adoption and healthcare access patterns. The Kanto region, including Tokyo and surrounding prefectures, dominates market demand with approximately 42% market share, driven by high population density, advanced healthcare infrastructure, and progressive social attitudes toward reproductive health.

Kansai region represents the second-largest market segment, accounting for 23% of national demand, with Osaka and Kyoto serving as major distribution and healthcare centers. The region benefits from established pharmaceutical manufacturing presence and comprehensive medical facilities supporting contraceptive device access and patient education.

Rural regions present unique challenges and opportunities, with lower population density but growing healthcare infrastructure development. Government initiatives supporting rural healthcare access create expansion opportunities, while telemedicine platforms help bridge geographic barriers to contraceptive counseling and product access.

Northern prefectures including Hokkaido show distinct demographic patterns with aging populations and specific healthcare needs. These regions demonstrate growing demand for long-acting contraceptive solutions that reduce frequent healthcare visits and provide reliable family planning options.

Southern regions including Kyushu and Okinawa exhibit different cultural attitudes and healthcare utilization patterns, requiring tailored market approaches and culturally sensitive product positioning strategies.

Japan’s contraceptive device market features a diverse competitive landscape combining international pharmaceutical giants, domestic manufacturers, and emerging digital health companies. The market structure promotes innovation while ensuring high safety and efficacy standards through rigorous regulatory oversight.

Leading market participants include:

Competitive strategies emphasize product differentiation, healthcare provider relationships, and patient education programs. Companies invest heavily in clinical research, regulatory compliance, and market access initiatives to maintain competitive positioning.

Innovation focus areas include digital health integration, personalized contraceptive solutions, and improved delivery systems. Strategic partnerships between pharmaceutical companies and technology firms drive product development and market expansion efforts.

Market segmentation analysis reveals diverse product categories and consumer demographics driving Japan’s contraceptive device market. Segmentation by product type, distribution channel, and target demographics provides insights into growth opportunities and market development strategies.

By Product Type:

By Distribution Channel:

By Age Demographics:

Intrauterine devices (IUDs) represent the fastest-growing category in Japan’s contraceptive device market, with adoption rates increasing significantly among urban women seeking long-term contraceptive solutions. The category benefits from improved product designs, reduced side effects, and comprehensive healthcare provider training programs. Copper IUDs maintain steady demand for non-hormonal contraception, while hormonal IUDs gain popularity for their additional health benefits beyond contraception.

Hormonal contraceptives including pills, patches, and rings continue dominating market volume, though growth rates moderate as consumers explore alternative options. Innovation in this category focuses on reduced side effects, improved dosing regimens, and personalized hormone delivery systems. Low-dose formulations gain preference among health-conscious consumers, while extended-cycle options appeal to women seeking reduced menstrual frequency.

Barrier methods experience renewed interest driven by growing preference for non-hormonal contraception and increased awareness of natural family planning approaches. Modern barrier devices incorporate improved materials and designs for enhanced comfort and effectiveness. Female condoms show growing acceptance, while diaphragms and cervical caps maintain niche market positions.

Emergency contraceptives benefit from improved accessibility through over-the-counter availability and reduced stigma surrounding their use. The category serves as an important safety net for contraceptive failure situations and unprotected intercourse incidents. Ulipristal acetate products gain market share due to extended effectiveness windows compared to traditional options.

Digital contraceptive solutions emerge as a complementary category, with fertility tracking applications and smart devices supporting traditional contraceptive methods. This category shows 40% annual growth among tech-savvy demographics seeking comprehensive reproductive health management tools.

Healthcare providers benefit from expanded contraceptive device options that enable personalized patient care and improved reproductive health outcomes. Comprehensive product portfolios allow providers to match contraceptive methods with individual patient needs, health conditions, and lifestyle preferences. Enhanced training programs and clinical support resources improve provider confidence and patient counseling quality.

Pharmaceutical manufacturers gain access to a stable, growing market with opportunities for innovation and product differentiation. Japan’s advanced healthcare system and regulatory framework support product development while ensuring market access for approved devices. Strong intellectual property protection encourages research and development investment in novel contraceptive technologies.

Patients and consumers benefit from increased contraceptive choices, improved product safety, and enhanced healthcare access. Modern contraceptive devices offer better efficacy, reduced side effects, and greater convenience compared to traditional methods. Comprehensive insurance coverage and healthcare system support improve affordability and accessibility for diverse demographic segments.

Healthcare systems realize benefits through improved family planning outcomes, reduced unintended pregnancies, and optimized resource allocation. Effective contraceptive access supports public health goals while reducing healthcare costs associated with unplanned pregnancies and related complications.

Digital health companies find opportunities to integrate contraceptive management with broader health monitoring platforms, creating comprehensive women’s health ecosystems. Technology integration enhances user experience while providing valuable health data for personalized care optimization.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trends reshape Japan’s contraceptive device market through integration of smart technologies, mobile health applications, and telemedicine platforms. Fertility tracking applications gain widespread adoption, with user bases growing 32% annually among women aged 20-40. Smart contraceptive devices incorporating sensors and connectivity features provide enhanced monitoring and user experience capabilities.

Personalization trends drive demand for customized contraceptive solutions based on individual health profiles, genetic factors, and lifestyle preferences. MarkWide Research indicates growing consumer interest in personalized hormone dosing and delivery systems tailored to individual metabolic patterns and health conditions.

Sustainability trends influence product development and packaging decisions, with manufacturers focusing on environmentally friendly materials and reduced waste generation. Reusable contraceptive devices and biodegradable packaging options gain consumer preference, particularly among environmentally conscious demographics.

Accessibility trends expand contraceptive device availability through online platforms, extended pharmacy hours, and telemedicine consultations. Rural healthcare access improvements through mobile clinics and digital health services reduce geographic barriers to contraceptive access.

Education and awareness trends promote comprehensive reproductive health knowledge through digital platforms, healthcare provider training, and public health campaigns. Social media and online resources play increasing roles in contraceptive education and decision-making support.

Recent industry developments demonstrate significant innovation and market evolution in Japan’s contraceptive device sector. Regulatory approvals for next-generation IUD technologies expand long-acting contraceptive options, while digital health platform launches integrate contraceptive management with comprehensive women’s health monitoring.

Partnership developments between pharmaceutical companies and technology firms accelerate digital contraceptive solution development. Major manufacturers establish research collaborations with Japanese universities and medical institutions to advance contraceptive device technologies and clinical research capabilities.

Manufacturing investments in Japan support domestic production capacity expansion and supply chain resilience. Several international companies establish local manufacturing facilities to serve the Japanese market and broader Asia-Pacific region, creating employment opportunities and technology transfer benefits.

Regulatory developments include streamlined approval processes for innovative contraceptive technologies and expanded insurance coverage for certain device categories. The Japanese regulatory authority implements digital health guidelines that support telemedicine-based contraceptive consultations and remote monitoring capabilities.

Market access improvements through pharmacy network expansion and online platform development increase contraceptive device availability across Japan’s diverse geographic regions. Healthcare system integration initiatives improve contraceptive counseling and patient education resources.

Strategic recommendations for market participants emphasize innovation, accessibility, and consumer education as key success factors. Companies should invest in digital health integration capabilities while maintaining focus on product safety and efficacy standards that meet Japan’s stringent regulatory requirements.

Product development strategies should prioritize personalized contraceptive solutions that address individual health needs and lifestyle preferences. Long-acting reversible contraceptives represent particularly attractive growth opportunities, given demographic trends and consumer preference for convenient, effective solutions.

Market expansion approaches should focus on rural healthcare access improvement through telemedicine platforms and mobile health services. Strategic partnerships with local healthcare providers and digital health companies can accelerate market penetration and consumer adoption rates.

Consumer engagement strategies must emphasize education, accessibility, and cultural sensitivity to address traditional barriers and promote informed decision-making. Digital marketing approaches and social media engagement can effectively reach younger demographics while respecting cultural considerations.

Regulatory compliance strategies should anticipate evolving safety requirements and approval processes while maintaining innovation momentum. Early engagement with regulatory authorities and comprehensive clinical research programs support successful product launches and market access.

Future market prospects for Japan’s contraceptive device sector remain positive despite demographic challenges, with innovation and technology integration driving continued growth opportunities. The market is expected to maintain steady expansion with projected growth rates of 4.5% CAGR over the next five years, supported by digital health adoption and improved healthcare access.

Technology evolution will continue reshaping the market through smart contraceptive devices, artificial intelligence-powered fertility tracking, and personalized hormone delivery systems. MWR analysis suggests that digital health integration will account for 25% of market growth by 2030, driven by consumer demand for comprehensive reproductive health management solutions.

Demographic trends will create new market dynamics, with aging populations requiring specialized contraceptive solutions while younger generations drive demand for technology-enabled products. Urban concentration will intensify, requiring targeted strategies for rural market development and healthcare access improvement.

Regulatory evolution will likely support innovation while maintaining safety standards, with potential for accelerated approval processes for breakthrough technologies. International harmonization efforts may facilitate market access for global contraceptive device innovations.

Market consolidation may occur as companies seek scale advantages and technology capabilities, while new entrants from digital health sectors bring innovative approaches to contraceptive management and patient engagement.

Japan’s contraceptive device market represents a dynamic and evolving healthcare sector characterized by innovation, demographic complexity, and significant growth potential. The market successfully balances traditional healthcare excellence with emerging technology integration, creating opportunities for diverse stakeholders including manufacturers, healthcare providers, and consumers.

Key success factors include technological innovation, cultural sensitivity, regulatory compliance, and comprehensive consumer education. The market benefits from Japan’s advanced healthcare infrastructure, strong regulatory framework, and growing acceptance of modern contraceptive technologies among diverse demographic segments.

Future growth prospects remain favorable despite demographic challenges, with digital health integration, personalized medicine approaches, and improved healthcare access driving market expansion. Strategic investments in innovation, market access, and consumer engagement will determine competitive success in this evolving landscape.

The Japan contraceptive device market continues demonstrating resilience and adaptability, positioning itself for sustained growth through technological advancement, regulatory support, and evolving consumer needs. Market participants who embrace innovation while respecting cultural considerations and maintaining safety standards will find significant opportunities in this sophisticated healthcare market.

What is Contraceptive Device?

Contraceptive devices are medical products designed to prevent pregnancy. They include various types such as intrauterine devices (IUDs), implants, and barrier methods like condoms.

What are the key players in the Japan Contraceptive Device Market?

Key players in the Japan Contraceptive Device Market include Bayer AG, Merck & Co., and CooperSurgical, among others.

What are the main drivers of the Japan Contraceptive Device Market?

The main drivers of the Japan Contraceptive Device Market include increasing awareness of family planning, rising demand for effective contraceptive methods, and government initiatives promoting reproductive health.

What challenges does the Japan Contraceptive Device Market face?

Challenges in the Japan Contraceptive Device Market include cultural stigma surrounding contraceptive use, regulatory hurdles, and competition from alternative contraceptive methods.

What opportunities exist in the Japan Contraceptive Device Market?

Opportunities in the Japan Contraceptive Device Market include the development of innovative contraceptive technologies, increasing acceptance of long-term contraceptive methods, and potential growth in online sales channels.

What trends are shaping the Japan Contraceptive Device Market?

Trends in the Japan Contraceptive Device Market include a shift towards personalized contraceptive solutions, increased focus on sustainability in product development, and the integration of digital health technologies.

Japan Contraceptive Device Market

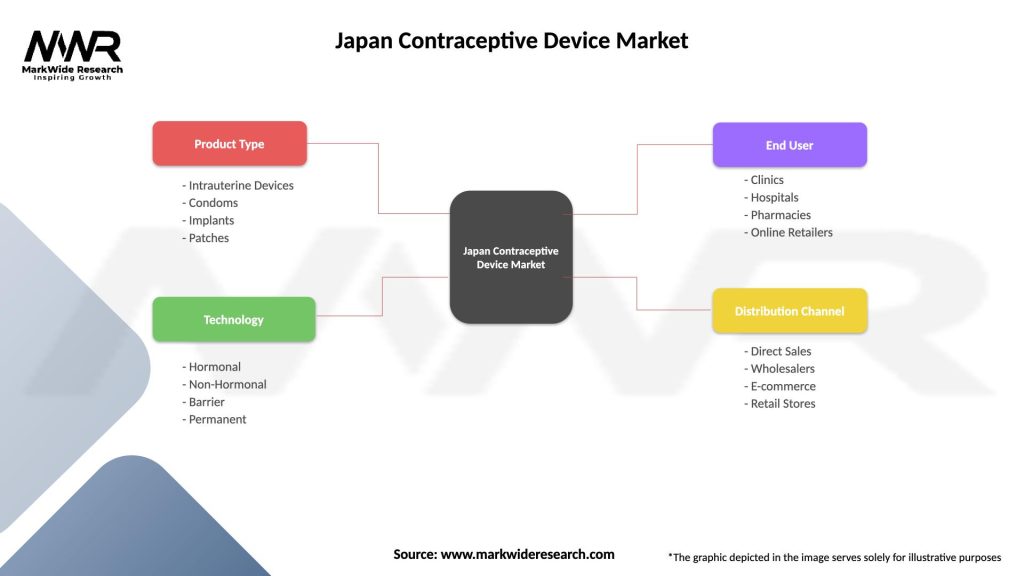

| Segmentation Details | Description |

|---|---|

| Product Type | Intrauterine Devices, Condoms, Implants, Patches |

| Technology | Hormonal, Non-Hormonal, Barrier, Permanent |

| End User | Clinics, Hospitals, Pharmacies, Online Retailers |

| Distribution Channel | Direct Sales, Wholesalers, E-commerce, Retail Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Contraceptive Device Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at