444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan cataract surgery devices market represents a critical segment of the nation’s advanced healthcare infrastructure, driven by the country’s rapidly aging population and sophisticated medical technology adoption. Japan’s demographic transition has positioned it as one of the world’s most mature markets for ophthalmic surgical equipment, with cataract surgery being the most frequently performed surgical procedure in the country. The market encompasses a comprehensive range of devices including phacoemulsification systems, intraocular lenses, viscoelastics, and femtosecond laser systems.

Market dynamics in Japan are characterized by high adoption rates of premium technology solutions, with approximately 78% of facilities utilizing advanced phacoemulsification systems. The integration of artificial intelligence and robotics into surgical procedures has gained significant traction, reflecting Japan’s position as a global technology leader. Healthcare expenditure on ophthalmic procedures continues to grow at a steady 4.2% annually, supported by comprehensive insurance coverage and government healthcare initiatives.

Regional distribution shows concentrated market activity in major metropolitan areas, with Tokyo, Osaka, and Nagoya accounting for approximately 65% of market activity. The market benefits from Japan’s well-established healthcare infrastructure, advanced surgical training programs, and strong regulatory framework that ensures high-quality medical device standards.

The Japan cataract surgery devices market refers to the comprehensive ecosystem of medical equipment, instruments, and technologies specifically designed for the diagnosis, treatment, and surgical management of cataracts within Japan’s healthcare system. This market encompasses all devices used in the complete cataract treatment pathway, from initial diagnosis through post-operative care.

Cataract surgery devices include sophisticated phacoemulsification machines that use ultrasonic energy to break up clouded natural lenses, premium intraocular lenses that replace the removed cataracts, femtosecond laser systems for precision incisions, and various surgical instruments and consumables required for successful procedures. The market also includes diagnostic equipment for pre-operative assessment and post-operative monitoring systems.

Market scope extends beyond traditional surgical equipment to include advanced technologies such as optical coherence tomography systems, corneal topographers, and computer-assisted surgical planning software. The integration of these technologies reflects Japan’s commitment to precision medicine and minimally invasive surgical approaches that optimize patient outcomes while reducing recovery times.

Japan’s cataract surgery devices market demonstrates robust growth potential driven by demographic trends, technological advancement, and healthcare system modernization. The market benefits from Japan’s position as the world’s most rapidly aging society, with individuals over 65 representing approximately 29% of the population and expected to reach 38% by 2065. This demographic shift directly correlates with increased cataract incidence and surgical demand.

Technology adoption in Japan’s cataract surgery market reflects the country’s innovation-driven healthcare approach. Premium intraocular lenses, including multifocal and toric designs, have achieved significant market penetration with adoption rates exceeding 45% in urban centers. Femtosecond laser-assisted cataract surgery, while still emerging, shows promising growth with implementation in approximately 12% of procedures and expanding rapidly.

Market structure is characterized by the presence of leading global manufacturers alongside innovative domestic companies. The competitive landscape emphasizes technological differentiation, with companies investing heavily in research and development to meet Japan’s exacting quality standards and unique market preferences. MarkWide Research analysis indicates that the market’s evolution is closely tied to regulatory developments and reimbursement policy changes that influence technology adoption patterns.

Demographic drivers represent the most significant factor influencing market growth, with Japan’s super-aged society creating unprecedented demand for cataract surgical interventions. The following insights highlight critical market dynamics:

Population aging serves as the primary catalyst for market expansion, with Japan’s demographic profile creating sustained demand for cataract surgical interventions. The country’s life expectancy continues to increase, resulting in larger populations reaching ages where cataract development becomes prevalent. Healthcare policy supporting early intervention and preventive care further amplifies surgical volumes as patients seek treatment before vision impairment significantly impacts quality of life.

Technological advancement drives market sophistication and value creation. The introduction of premium intraocular lenses with advanced optical designs addresses presbyopia correction alongside cataract treatment, expanding the addressable patient population. Femtosecond laser technology enables precision surgical techniques that improve outcomes and reduce complications, justifying premium pricing and encouraging adoption among quality-focused healthcare providers.

Healthcare infrastructure modernization supports market growth through facility upgrades and equipment replacement cycles. Japan’s commitment to maintaining world-class healthcare standards drives continuous investment in advanced surgical equipment. Insurance coverage for cataract surgery procedures ensures broad patient access while creating stable revenue streams for healthcare providers and device manufacturers.

Economic factors including Japan’s stable healthcare expenditure and strong currency position facilitate technology adoption and market development. The country’s focus on healthcare innovation as an economic growth driver encourages domestic and international investment in advanced medical device development and commercialization.

Cost pressures within Japan’s healthcare system create challenges for premium device adoption and market expansion. Healthcare cost containment initiatives and budget constraints at institutional levels can limit adoption of advanced technologies despite clinical benefits. Reimbursement limitations for premium intraocular lenses and advanced surgical techniques may restrict patient access to cutting-edge treatment options.

Regulatory complexity and lengthy approval processes can delay market entry for innovative devices and technologies. Japan’s rigorous regulatory framework, while ensuring safety and efficacy, may slow the introduction of breakthrough innovations compared to other markets. Clinical trial requirements specific to Japanese populations can extend development timelines and increase commercialization costs.

Market saturation in certain segments poses growth challenges as adoption rates for established technologies approach maturity. The high penetration of basic phacoemulsification systems and standard intraocular lenses limits opportunities for volume-based growth in these categories. Competition intensity among established manufacturers can pressure pricing and profit margins.

Skilled surgeon availability may constrain market growth as the healthcare workforce ages alongside the general population. Training new ophthalmic surgeons requires significant time investment, potentially creating capacity constraints. Facility limitations in rural areas may restrict access to advanced surgical options and limit market penetration in certain geographic regions.

Premium lens adoption presents significant growth opportunities as patient awareness and acceptance of advanced intraocular lens technologies continue expanding. Multifocal and extended depth of focus lenses address presbyopia correction alongside cataract treatment, creating value-added surgical solutions that command premium pricing. The growing emphasis on lifestyle maintenance among Japan’s aging population drives demand for vision correction solutions that reduce dependence on reading glasses.

Artificial intelligence integration offers transformative opportunities for surgical planning, outcome prediction, and procedural optimization. AI-powered diagnostic systems can enhance pre-operative assessment accuracy while machine learning algorithms improve surgical technique recommendations. Digital health platforms connecting diagnostic, surgical, and post-operative care create comprehensive patient management solutions.

Minimally invasive techniques continue evolving with opportunities for micro-incision cataract surgery and advanced phacoemulsification technologies. These approaches reduce surgical trauma, accelerate recovery, and improve patient satisfaction. Combination procedures addressing multiple vision correction needs simultaneously create efficiency gains and enhanced patient outcomes.

Rural market penetration represents an underserved opportunity as mobile surgical units and telemedicine solutions can extend advanced cataract care to underserved regions. Training technology including virtual reality surgical simulators can enhance surgeon education and competency development, supporting market expansion through improved surgical capacity.

Supply chain dynamics in Japan’s cataract surgery devices market reflect the country’s emphasis on quality, reliability, and technological sophistication. Manufacturer relationships with healthcare providers are characterized by long-term partnerships focused on clinical outcomes and operational efficiency. The market demonstrates strong preference for established brands with proven track records and comprehensive support services.

Innovation cycles in the market are driven by continuous technological advancement and clinical research. Japanese healthcare providers actively participate in clinical trials and technology evaluation programs, contributing to global device development while gaining early access to breakthrough innovations. Regulatory harmonization efforts facilitate faster market access for approved technologies while maintaining safety standards.

Competitive dynamics emphasize differentiation through clinical outcomes, technological innovation, and comprehensive service offerings. Market consolidation trends among device manufacturers create opportunities for enhanced research and development investment while potentially reducing competitive pricing pressure. Strategic partnerships between international manufacturers and domestic distributors optimize market penetration and customer service delivery.

Economic influences including healthcare budget allocation, insurance policy changes, and demographic shifts continuously shape market conditions. MWR analysis indicates that market resilience stems from the essential nature of cataract surgery and Japan’s commitment to maintaining high healthcare standards despite economic challenges.

Primary research methodologies employed in analyzing Japan’s cataract surgery devices market include comprehensive surveys of ophthalmic surgeons, healthcare administrators, and medical device distributors. In-depth interviews with key opinion leaders provide qualitative insights into market trends, technology adoption patterns, and future growth drivers. Clinical outcome studies and patient satisfaction surveys contribute valuable data on device performance and market acceptance.

Secondary research encompasses analysis of government healthcare statistics, medical device registration databases, and clinical literature reviews. Market intelligence gathering includes monitoring of regulatory approvals, reimbursement policy changes, and competitive landscape developments. Industry conference proceedings and medical journal publications provide insights into emerging technologies and clinical best practices.

Data validation processes ensure research accuracy through triangulation of multiple information sources and expert review panels. Statistical analysis employs advanced modeling techniques to project market trends and quantify growth opportunities. Regional market assessment includes geographic analysis of healthcare facility distribution, surgeon demographics, and patient population characteristics.

Quantitative analysis incorporates surgical volume data, device utilization rates, and market share calculations across different product categories. Qualitative assessment evaluates market dynamics, competitive positioning, and technology adoption barriers through structured analytical frameworks.

Tokyo metropolitan area dominates Japan’s cataract surgery devices market, accounting for approximately 35% of national surgical volume and serving as the primary hub for advanced technology adoption. The region’s concentration of leading medical institutions, research facilities, and specialist surgeons creates a dynamic market environment that drives innovation and sets national trends. Premium device penetration in Tokyo exceeds national averages, with femtosecond laser adoption rates reaching 18% of procedures.

Osaka-Kansai region represents the second-largest market segment, contributing approximately 22% of national market activity. The region’s strong healthcare infrastructure and industrial base support robust demand for advanced surgical equipment. Kansai’s medical device manufacturing presence creates synergies between local production capabilities and clinical demand, fostering innovation and market development.

Nagoya-Chubu region demonstrates steady market growth driven by industrial prosperity and aging demographics. The region’s 15% market share reflects balanced development between urban centers and surrounding prefectures. Technology adoption patterns in Chubu closely follow national trends while maintaining strong focus on cost-effectiveness and clinical outcomes.

Rural regions collectively represent significant market potential despite lower population density and facility concentration. Telemedicine initiatives and mobile surgical programs are expanding access to advanced cataract care in underserved areas. Government healthcare policies supporting rural medical infrastructure development create opportunities for market expansion beyond traditional urban centers.

Market leadership in Japan’s cataract surgery devices sector is characterized by intense competition among global manufacturers and specialized technology companies. The competitive environment emphasizes clinical excellence, technological innovation, and comprehensive customer support services.

Competitive strategies focus on technological differentiation, clinical outcome improvement, and comprehensive service delivery. Research and development investment levels remain high as companies compete to introduce breakthrough innovations that address evolving clinical needs and patient expectations.

By Product Type:

By End User:

By Technology:

Phacoemulsification systems represent the largest market segment, with modern platforms offering enhanced fluidics control, improved energy delivery, and integrated surgical guidance systems. Technology evolution focuses on reducing surgical trauma while improving efficiency and safety. Advanced systems incorporate real-time monitoring capabilities and automated parameter adjustment to optimize surgical outcomes.

Intraocular lens segment demonstrates the highest growth potential, driven by expanding premium lens adoption and technological innovation. Multifocal lenses addressing presbyopia correction alongside cataract treatment show particularly strong growth, with adoption rates increasing 12% annually. Toric lenses for astigmatism correction and extended depth of focus designs represent emerging growth categories.

Femtosecond laser systems constitute the fastest-growing segment despite relatively small current market share. These systems offer precision capsulotomy, lens fragmentation, and corneal incision capabilities that enhance surgical predictability. Clinical adoption is accelerating as surgeons recognize benefits in complex cases and premium lens implantation procedures.

Viscoelastics market remains stable with steady growth driven by surgical volume increases. Product innovation focuses on improved tissue protection, enhanced surgical visualization, and simplified handling characteristics. Cohesive and dispersive formulations serve different surgical requirements and technique preferences.

Healthcare providers benefit from advanced cataract surgery devices through improved patient outcomes, enhanced surgical efficiency, and reduced complication rates. Modern equipment enables shorter procedure times, faster patient recovery, and higher patient satisfaction scores. Premium technologies create opportunities for differentiated service offerings and enhanced revenue generation through value-based care models.

Patients experience significant benefits including improved visual outcomes, reduced dependence on corrective eyewear, and faster recovery times. Advanced lens technologies provide comprehensive vision correction addressing cataracts, presbyopia, and astigmatism simultaneously. Minimally invasive techniques reduce surgical discomfort and accelerate return to normal activities.

Device manufacturers gain access to a sophisticated market with high technology adoption rates and strong quality standards. Japan’s regulatory environment provides clear pathways for device approval while ensuring market credibility. Clinical collaboration opportunities with leading medical institutions support product development and validation.

Healthcare system benefits include improved resource utilization, enhanced quality of care, and better population health outcomes. Advanced technologies support Japan’s aging society by maintaining visual function and independence among elderly populations. Economic benefits include reduced long-term healthcare costs through improved surgical outcomes and reduced revision procedures.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend reshaping cataract surgery planning and execution. AI-powered diagnostic systems enhance pre-operative assessment accuracy while machine learning algorithms optimize surgical parameter selection. Predictive analytics improve outcome forecasting and complication prevention, supporting evidence-based treatment decisions.

Minimally invasive surgery continues evolving with micro-incision techniques and advanced phacoemulsification technologies. Surgical trauma reduction improves patient comfort and accelerates recovery while maintaining excellent visual outcomes. Energy optimization in ultrasonic systems reduces tissue damage and enhances surgical safety.

Premium lens adoption accelerates as patient awareness and acceptance of advanced vision correction options increase. Multifocal and extended depth of focus lenses address presbyopia alongside cataract treatment, creating comprehensive vision solutions. Customization trends include patient-specific lens selection based on lifestyle requirements and visual demands.

Digital health integration connects pre-operative assessment, surgical planning, and post-operative monitoring through comprehensive platforms. Electronic health records integration streamlines clinical workflows while telemedicine capabilities extend specialist consultation access. Patient engagement tools improve treatment compliance and satisfaction through enhanced communication and education.

Regulatory approvals for next-generation femtosecond laser systems have expanded treatment options and improved surgical precision. Advanced imaging integration enables real-time surgical guidance and outcome optimization. Laser technology refinements reduce treatment times while enhancing safety profiles and expanding clinical applications.

Intraocular lens innovations include new optical designs addressing presbyopia correction and visual quality enhancement. Extended depth of focus lenses provide improved intermediate vision while maintaining distance and near visual acuity. Light-adjustable lenses offer post-operative vision customization through controlled UV light exposure.

Phacoemulsification system advances incorporate improved fluidics control, enhanced energy delivery, and integrated surgical guidance capabilities. Intelligent systems automatically adjust parameters based on real-time tissue response and surgical conditions. Ergonomic improvements reduce surgeon fatigue and enhance procedural efficiency.

Market consolidation activities among device manufacturers create opportunities for enhanced research and development investment while optimizing global supply chains. Strategic partnerships between technology companies and healthcare providers accelerate innovation adoption and clinical validation. MarkWide Research indicates that these developments position Japan as a key market for breakthrough technology introduction and clinical evaluation.

Technology investment strategies should prioritize artificial intelligence integration and digital health platform development to address evolving clinical needs and operational efficiency requirements. Manufacturers should focus on comprehensive solution offerings that integrate diagnostic, surgical, and post-operative care components. Clinical validation programs demonstrating improved outcomes and cost-effectiveness will support premium technology adoption.

Market expansion opportunities exist in rural regions through telemedicine initiatives and mobile surgical programs. Healthcare providers should consider partnerships with technology companies to develop innovative service delivery models. Training programs utilizing virtual reality and simulation technologies can enhance surgeon competency while supporting market growth.

Regulatory strategy should emphasize early engagement with Japanese authorities to expedite approval processes for innovative devices. Clinical trial design should incorporate Japanese population characteristics and healthcare system requirements. Post-market surveillance programs demonstrating long-term safety and efficacy support continued market access and expansion.

Competitive positioning requires differentiation through clinical outcomes, technological innovation, and comprehensive service offerings. Value-based care models aligning device costs with patient outcomes create sustainable competitive advantages. Customer relationship management focusing on long-term partnerships and clinical support enhances market position and customer loyalty.

Market growth prospects remain robust driven by Japan’s demographic trends and continued healthcare system modernization. Surgical volume expansion is projected to continue at approximately 3.5% annually through the next decade, supported by aging population dynamics and improved access to care. Premium technology adoption will accelerate as clinical evidence demonstrates superior outcomes and patient satisfaction.

Technology evolution will focus on artificial intelligence integration, robotics-assisted surgery, and personalized treatment approaches. Next-generation devices will incorporate advanced imaging, real-time surgical guidance, and automated parameter optimization. Combination therapies addressing multiple vision correction needs simultaneously will create new market opportunities and treatment paradigms.

Market structure evolution will likely include continued consolidation among device manufacturers and increased collaboration between technology companies and healthcare providers. Innovation partnerships will accelerate product development while reducing commercialization risks. Regulatory harmonization efforts may facilitate faster market access for approved technologies.

Healthcare delivery models will incorporate telemedicine, mobile surgery programs, and integrated care platforms to expand access and improve efficiency. Digital health integration will create comprehensive patient management solutions spanning the entire treatment continuum. Value-based care models will increasingly influence technology adoption decisions and market dynamics.

Japan’s cataract surgery devices market represents a dynamic and sophisticated healthcare segment positioned for sustained growth driven by demographic trends, technological innovation, and healthcare system evolution. The market’s foundation rests on Japan’s rapidly aging population, advanced healthcare infrastructure, and commitment to clinical excellence that creates favorable conditions for continued expansion and development.

Market opportunities are particularly pronounced in premium technology segments including advanced intraocular lenses, femtosecond laser systems, and artificial intelligence-integrated surgical platforms. The growing emphasis on minimally invasive techniques and comprehensive vision correction solutions aligns with patient preferences and clinical best practices, supporting premium technology adoption and market value creation.

Competitive dynamics emphasize technological differentiation, clinical outcomes, and comprehensive service delivery as key success factors. Companies that successfully navigate Japan’s regulatory environment while delivering innovative solutions that address specific clinical needs will capture significant market opportunities. The integration of digital health platforms and artificial intelligence capabilities will become increasingly important for competitive positioning and market leadership.

Future market evolution will be characterized by continued innovation, expanded access through telemedicine and mobile surgery programs, and enhanced integration across the care continuum. Japan’s position as a global technology leader and its commitment to healthcare excellence ensure that the cataract surgery devices market will remain at the forefront of medical device innovation and clinical advancement, creating value for patients, healthcare providers, and industry participants alike.

What is Cataract Surgery Devices?

Cataract Surgery Devices refer to the medical instruments and equipment used in the surgical treatment of cataracts, which include phacoemulsification machines, intraocular lenses, and surgical instruments designed for cataract removal.

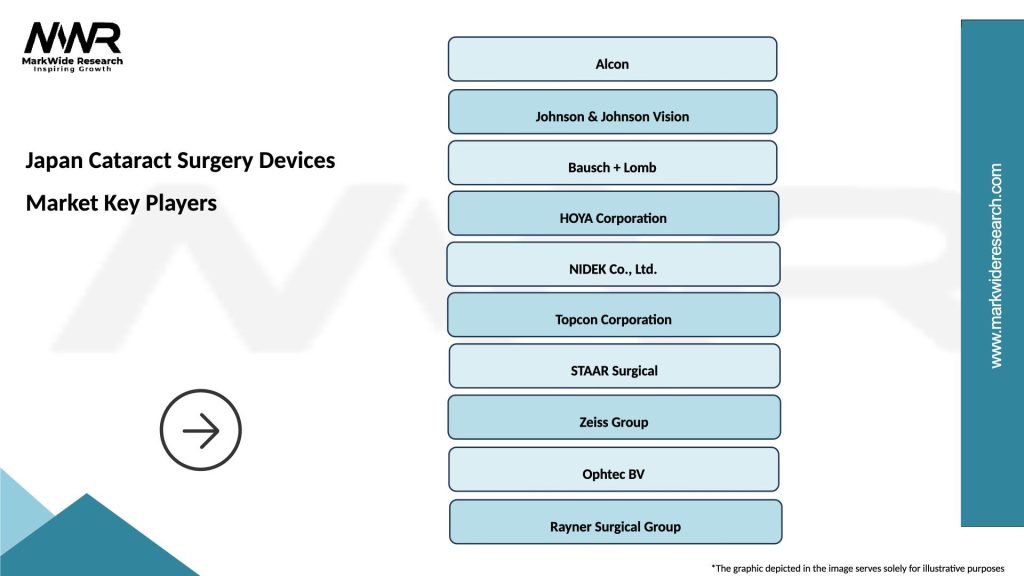

What are the key players in the Japan Cataract Surgery Devices Market?

Key players in the Japan Cataract Surgery Devices Market include Alcon, Johnson & Johnson Vision, Bausch + Lomb, and Carl Zeiss AG, among others.

What are the growth factors driving the Japan Cataract Surgery Devices Market?

The Japan Cataract Surgery Devices Market is driven by an aging population, increasing prevalence of cataracts, and advancements in surgical technology that enhance patient outcomes.

What challenges does the Japan Cataract Surgery Devices Market face?

Challenges in the Japan Cataract Surgery Devices Market include high costs of advanced surgical equipment, regulatory hurdles, and competition from alternative vision correction methods.

What future opportunities exist in the Japan Cataract Surgery Devices Market?

Opportunities in the Japan Cataract Surgery Devices Market include the development of innovative surgical techniques, increasing awareness about eye health, and potential growth in outpatient surgical centers.

What trends are shaping the Japan Cataract Surgery Devices Market?

Trends in the Japan Cataract Surgery Devices Market include the rise of minimally invasive surgical techniques, the integration of digital technologies in surgery, and the growing demand for premium intraocular lenses.

Japan Cataract Surgery Devices Market

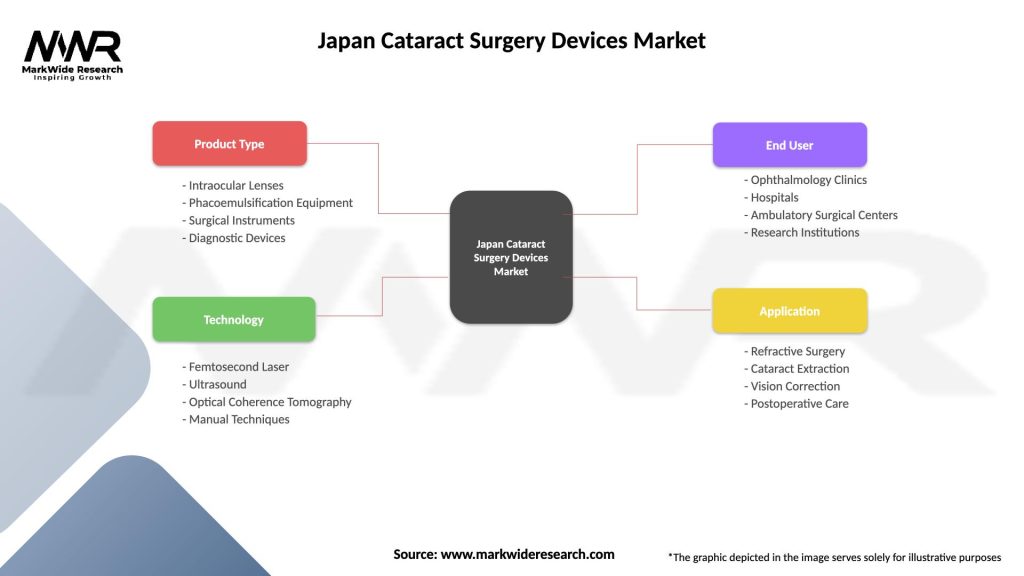

| Segmentation Details | Description |

|---|---|

| Product Type | Intraocular Lenses, Phacoemulsification Equipment, Surgical Instruments, Diagnostic Devices |

| Technology | Femtosecond Laser, Ultrasound, Optical Coherence Tomography, Manual Techniques |

| End User | Ophthalmology Clinics, Hospitals, Ambulatory Surgical Centers, Research Institutions |

| Application | Refractive Surgery, Cataract Extraction, Vision Correction, Postoperative Care |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Cataract Surgery Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at