444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan bunker fuel market represents a critical component of the nation’s maritime infrastructure, serving as the backbone for international shipping operations and domestic maritime activities. Japan’s strategic position as a major maritime hub in the Asia-Pacific region has established it as one of the world’s most significant bunker fuel supply centers, with major ports including Tokyo, Yokohama, Osaka, and Kobe facilitating substantial fuel bunkering operations.

Market dynamics in Japan’s bunker fuel sector are experiencing significant transformation driven by evolving international maritime regulations, environmental sustainability initiatives, and technological advancements in fuel composition. The market is witnessing a steady growth rate of 4.2% CAGR as shipping volumes continue to expand and port infrastructure modernization accelerates across the country.

Regulatory compliance has become increasingly important following the International Maritime Organization’s sulfur regulations, with Japanese suppliers adapting their fuel offerings to meet stringent environmental standards. The market encompasses various fuel grades including marine gas oil, intermediate fuel oil, and heavy fuel oil, with low-sulfur variants gaining substantial market traction representing approximately 68% of total bunker fuel demand.

Port infrastructure development and strategic geographical advantages continue to strengthen Japan’s position as a preferred bunkering destination for vessels traversing major shipping routes between Asia, North America, and other global regions.

The Japan bunker fuel market refers to the comprehensive ecosystem of marine fuel supply, distribution, and services provided to commercial vessels, cargo ships, and other maritime vessels operating in Japanese waters or utilizing Japanese ports for refueling operations. Bunker fuel encompasses various petroleum-based products specifically formulated for marine engines, including heavy fuel oil, marine diesel oil, and specialized low-sulfur alternatives designed to meet international environmental regulations.

This market encompasses the entire value chain from fuel procurement and refining to storage, blending, distribution, and delivery services at major Japanese ports. The sector includes both domestic fuel production capabilities and imported fuel products, with sophisticated supply chain management ensuring consistent availability for the thousands of vessels that transit through Japanese waters annually.

Market participants include major oil companies, independent fuel suppliers, port authorities, logistics providers, and specialized marine fuel service companies that collectively ensure efficient fuel supply operations across Japan’s extensive coastline and numerous commercial ports.

Japan’s bunker fuel market demonstrates robust growth prospects driven by increasing maritime trade volumes, port infrastructure investments, and evolving fuel quality requirements. The market benefits from Japan’s strategic location along major international shipping routes, with Tokyo Bay and Osaka Bay serving as primary bunkering hubs that collectively handle significant portions of regional marine fuel demand.

Key market drivers include expanding containerized cargo movements, growing demand for cleaner marine fuels, and continuous port modernization initiatives that enhance fuel handling capabilities. The market is experiencing a notable shift toward environmentally compliant fuel grades, with low-sulfur fuel oil variants capturing approximately 72% market adoption rate among major shipping lines operating in Japanese waters.

Competitive dynamics feature established petroleum companies, international marine fuel suppliers, and specialized bunkering service providers competing through service quality, fuel availability, and competitive pricing strategies. Market consolidation trends are evident as companies seek to enhance operational efficiency and expand service capabilities across multiple port locations.

Future market trajectory indicates sustained growth supported by Japan’s commitment to maintaining its position as a leading maritime logistics hub while adapting to evolving environmental regulations and technological innovations in marine fuel formulations.

Strategic market insights reveal several critical factors shaping the Japan bunker fuel market landscape:

Primary market drivers propelling growth in Japan’s bunker fuel market encompass multiple interconnected factors that collectively strengthen demand and operational expansion.

Maritime trade growth represents the fundamental driver, with Japan’s position as a major trading nation generating consistent demand for marine fuel services. The country’s extensive manufacturing base and import-dependent economy ensure steady vessel traffic requiring reliable fuel supply services. Container shipping volumes continue expanding as global trade patterns evolve and supply chain diversification strategies increase Japan’s role as a logistics hub.

Port infrastructure development significantly enhances the market’s capacity and efficiency. Major port authorities are investing in advanced fuel handling facilities, automated systems, and expanded storage capabilities that improve service delivery and accommodate larger vessels. These infrastructure improvements enable ports to handle increased fuel throughput while maintaining high safety and environmental standards.

Regulatory compliance requirements drive demand for specialized fuel products and services. International Maritime Organization regulations, particularly sulfur content limitations, have created substantial demand for compliant fuel grades and related services. Japanese suppliers have responded by developing comprehensive fuel blending capabilities and quality assurance programs that ensure regulatory adherence.

Technological advancement in fuel formulations and delivery systems creates opportunities for market expansion and service differentiation. Advanced fuel management systems, real-time quality monitoring, and digital transaction platforms enhance operational efficiency and customer satisfaction.

Market restraints present challenges that influence growth patterns and operational strategies within Japan’s bunker fuel market.

Environmental regulations impose significant compliance costs and operational complexity. Stricter sulfur content limitations, emission control requirements, and waste management regulations require substantial investments in fuel processing capabilities and environmental monitoring systems. These regulatory requirements can limit market entry for smaller operators and increase operational costs across the industry.

Price volatility in crude oil markets creates uncertainty for both suppliers and customers. Fluctuating petroleum prices affect fuel procurement costs, inventory management strategies, and pricing mechanisms throughout the supply chain. This volatility can impact profit margins and complicate long-term contract negotiations between fuel suppliers and shipping companies.

Infrastructure limitations at some secondary ports restrict market expansion opportunities. While major ports have substantial fuel handling capabilities, smaller ports may lack adequate storage facilities, fuel quality testing equipment, or specialized handling systems necessary for comprehensive bunker fuel services. These limitations can constrain market growth in certain geographical areas.

Competition from alternative fuels and propulsion technologies presents long-term challenges. Growing interest in liquefied natural gas, hydrogen fuel cells, and electric propulsion systems may gradually reduce demand for traditional marine fuels, requiring market participants to adapt their service offerings and investment strategies.

Significant opportunities exist within Japan’s bunker fuel market for companies positioned to capitalize on emerging trends and evolving customer requirements.

Clean fuel development represents a substantial growth opportunity as environmental regulations become increasingly stringent. Companies investing in low-sulfur fuel production, biofuel blending capabilities, and alternative marine fuel technologies can capture market share from traditional fuel suppliers. The transition toward sustainable marine fuels creates opportunities for innovation and premium service offerings.

Digital transformation initiatives offer opportunities to enhance operational efficiency and customer service capabilities. Implementation of advanced fuel management systems, automated inventory tracking, real-time quality monitoring, and digital transaction platforms can differentiate service providers and improve operational margins. Data analytics and predictive maintenance technologies enable optimized fuel supply chain management.

Port expansion projects create opportunities for new fuel supply infrastructure and service capabilities. As Japanese ports invest in capacity expansion and modernization, fuel suppliers can establish strategic partnerships and develop specialized facilities that serve growing vessel traffic. These expansion projects often include dedicated fuel handling areas and advanced storage systems.

Regional market expansion opportunities exist as Japan strengthens its position as a maritime logistics hub for the Asia-Pacific region. Companies can leverage Japan’s strategic location to serve vessels operating on major shipping routes while developing complementary services that enhance customer value propositions.

Market dynamics in Japan’s bunker fuel sector reflect complex interactions between supply chain factors, regulatory requirements, competitive pressures, and technological developments that collectively shape industry evolution.

Supply chain optimization has become increasingly important as market participants seek to enhance efficiency and reduce operational costs. Companies are implementing integrated supply chain management systems that coordinate fuel procurement, storage, blending, and delivery operations across multiple port locations. These optimization efforts have resulted in operational efficiency improvements of approximately 23% for leading market participants.

Quality assurance programs have evolved significantly in response to regulatory requirements and customer expectations. Comprehensive fuel testing protocols, quality certification processes, and traceability systems ensure consistent fuel quality and regulatory compliance. Advanced laboratory facilities and real-time monitoring systems enable rapid quality verification and problem resolution.

Customer relationship management strategies focus on developing long-term partnerships with shipping companies, logistics providers, and vessel operators. Service differentiation through value-added offerings such as fuel optimization consulting, emission monitoring services, and flexible delivery scheduling creates competitive advantages and customer loyalty.

Market consolidation trends continue as companies seek to achieve economies of scale and expand geographical coverage. Strategic acquisitions, joint ventures, and partnership agreements enable market participants to enhance service capabilities while optimizing operational costs and improving market positioning.

Comprehensive research methodology employed in analyzing Japan’s bunker fuel market incorporates multiple data collection and analysis techniques to ensure accurate market assessment and reliable insights.

Primary research activities include extensive interviews with industry executives, port authorities, fuel suppliers, shipping companies, and regulatory officials to gather firsthand insights into market conditions, operational challenges, and growth prospects. These interviews provide qualitative insights that complement quantitative data analysis and help identify emerging trends and market dynamics.

Secondary research encompasses analysis of industry reports, government publications, trade association data, regulatory documents, and company financial statements to establish comprehensive market understanding. This research includes examination of historical market trends, competitive positioning, and regulatory developments that influence market evolution.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market projections and identify key growth drivers. These analytical approaches consider multiple variables including economic indicators, trade volumes, regulatory changes, and technological developments that impact market performance.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and consistency checks across different data collection methods. This validation approach enhances the reliability of market insights and projections presented in the analysis.

Regional analysis of Japan’s bunker fuel market reveals distinct geographical patterns and concentration areas that reflect the country’s maritime infrastructure and trade patterns.

Tokyo Bay region dominates the market with approximately 35% of total bunker fuel demand, driven by the concentration of major ports including Tokyo, Yokohama, and Chiba. This region benefits from extensive port infrastructure, strategic location for trans-Pacific shipping routes, and proximity to major industrial centers. The area features sophisticated fuel handling facilities and comprehensive service capabilities that attract international shipping lines.

Osaka Bay area represents the second-largest regional market, accounting for roughly 28% of national bunker fuel activity. The ports of Osaka and Kobe serve as critical gateways for trade with Asia and provide comprehensive bunkering services for container ships, bulk carriers, and specialized vessels. This region’s strong manufacturing base generates consistent demand for maritime logistics services.

Nagoya region captures approximately 18% market share through its role as a major automotive and manufacturing hub. The Port of Nagoya’s strategic importance for industrial cargo movements creates steady demand for marine fuel services, particularly for vessels engaged in raw material imports and finished goods exports.

Other regional markets including Kitakyushu, Yokkaichi, and smaller coastal ports collectively represent the remaining market share, serving specialized shipping routes and regional trade patterns. These markets often focus on specific vessel types or cargo categories while maintaining essential fuel supply capabilities.

Competitive landscape in Japan’s bunker fuel market features a diverse mix of established petroleum companies, international marine fuel suppliers, and specialized bunkering service providers competing across multiple dimensions.

Market competition focuses on service quality, fuel availability, competitive pricing, and value-added services that enhance customer operational efficiency. Leading companies differentiate through comprehensive port coverage, advanced fuel quality assurance, and integrated supply chain capabilities.

Market segmentation analysis reveals distinct categories based on fuel type, vessel application, and service delivery models that characterize Japan’s bunker fuel market structure.

By Fuel Type:

By Vessel Type:

Category-wise analysis provides detailed insights into specific market segments and their unique characteristics within Japan’s bunker fuel market.

Heavy Fuel Oil segment continues to represent substantial market volume despite regulatory pressures favoring cleaner alternatives. This category serves large commercial vessels operating on international routes where cost considerations remain paramount. However, the segment is experiencing gradual decline as environmental regulations become more stringent and shipping companies adopt cleaner fuel alternatives.

Low-Sulfur Fuel Oil category has emerged as the fastest-growing segment, driven by IMO 2020 compliance requirements and increasing environmental awareness among shipping companies. This segment demonstrates annual growth rates exceeding 15% as vessel operators transition from traditional high-sulfur fuels to compliant alternatives. Japanese suppliers have invested significantly in blending capabilities and quality assurance systems to serve this growing market segment.

Marine Gas Oil segment maintains steady demand from vessels operating in emission control areas and those requiring premium fuel quality for operational efficiency. This category commands premium pricing but offers superior performance characteristics and environmental compliance benefits that justify higher costs for many operators.

Container ship category represents the largest customer segment by volume, with major shipping lines requiring consistent fuel supply across multiple Japanese ports. These customers typically negotiate long-term supply contracts and value reliability, quality assurance, and competitive pricing in their supplier relationships.

Industry participants and stakeholders realize numerous benefits from Japan’s well-developed bunker fuel market ecosystem.

Shipping Companies benefit from reliable fuel supply availability, competitive pricing through market competition, and comprehensive service offerings that enhance operational efficiency. The market’s mature infrastructure ensures consistent fuel quality and delivery reliability that supports predictable voyage planning and cost management. Advanced fuel management services help optimize consumption patterns and reduce environmental impact.

Fuel Suppliers gain access to substantial market opportunities through Japan’s position as a major maritime hub. The market’s size and stability provide revenue predictability while regulatory compliance requirements create opportunities for premium service offerings. Strategic port locations enable suppliers to serve multiple shipping routes and develop long-term customer relationships.

Port Authorities benefit from increased port utilization and revenue generation through fuel-related services. Bunker fuel operations enhance port competitiveness and attract vessel traffic that supports broader maritime logistics activities. Infrastructure investments in fuel handling capabilities create long-term competitive advantages.

Economic Stakeholders realize benefits through job creation, tax revenue generation, and support for Japan’s broader maritime industry. The bunker fuel market contributes to the country’s position as a regional logistics hub while supporting international trade facilitation and economic growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Japan’s bunker fuel market reflect broader industry evolution and technological advancement.

Environmental compliance acceleration represents the most significant trend, with fuel suppliers investing heavily in low-sulfur fuel production and alternative fuel development. This trend has resulted in environmental compliance rates exceeding 95% among major Japanese ports, positioning the market as a leader in sustainable marine fuel supply.

Digital transformation initiatives are revolutionizing fuel supply chain management through automated inventory systems, real-time quality monitoring, and digital transaction platforms. These technologies enhance operational efficiency while providing customers with improved transparency and service reliability.

Supply chain integration trends involve vertical integration strategies where fuel suppliers acquire storage facilities, transportation assets, and service capabilities to control quality and reduce costs. This integration approach enables better customer service and improved profit margins.

Customer service enhancement focuses on developing comprehensive service offerings that go beyond basic fuel supply to include fuel optimization consulting, emission monitoring, and technical support services. These value-added services create competitive differentiation and strengthen customer relationships.

Regional cooperation initiatives involve collaboration between Japanese ports and international partners to develop standardized fuel quality protocols and shared infrastructure investments that enhance overall market efficiency.

Recent industry developments highlight significant changes and investments shaping Japan’s bunker fuel market evolution.

Infrastructure modernization projects at major ports have enhanced fuel handling capabilities and storage capacity. Tokyo Port’s recent completion of advanced fuel terminal facilities increased handling capacity while implementing state-of-the-art environmental protection systems. Similar projects at Osaka and Yokohama ports demonstrate ongoing commitment to infrastructure excellence.

Regulatory framework updates have strengthened fuel quality standards and environmental protection requirements. New regulations governing sulfur content, emission monitoring, and waste management have prompted industry-wide compliance investments and operational improvements.

Technology partnerships between fuel suppliers and technology companies have resulted in advanced fuel management systems and quality assurance platforms. These partnerships enable real-time monitoring, predictive maintenance, and optimized supply chain operations that enhance service delivery.

Market consolidation activities include strategic acquisitions and joint ventures that strengthen market positioning and expand service capabilities. Recent partnerships between domestic and international companies have created integrated service offerings and enhanced geographical coverage.

Sustainability initiatives encompass investments in biofuel blending capabilities, carbon footprint reduction programs, and alternative fuel research and development activities that position Japanese suppliers for future market evolution.

Strategic recommendations for market participants focus on positioning for long-term success in Japan’s evolving bunker fuel market environment.

Investment in clean fuel capabilities represents the highest priority for market participants seeking sustainable competitive advantages. Companies should develop comprehensive low-sulfur fuel production, biofuel blending, and alternative fuel supply capabilities that meet evolving environmental requirements. According to MarkWide Research analysis, companies investing in clean fuel technologies demonstrate superior growth rates of 8-12% annually compared to traditional fuel suppliers.

Digital transformation acceleration should encompass comprehensive technology adoption across fuel supply chain operations. Implementation of automated inventory management, real-time quality monitoring, and customer relationship management systems can enhance operational efficiency while improving customer satisfaction and retention rates.

Strategic partnership development with port authorities, shipping companies, and technology providers can create competitive advantages and market expansion opportunities. These partnerships enable shared infrastructure investments, risk mitigation, and access to new customer segments while optimizing operational costs.

Geographic expansion strategies should focus on secondary ports and emerging market opportunities that complement existing operations. Selective expansion into underserved markets can provide growth opportunities while diversifying revenue sources and reducing dependence on major port locations.

Service differentiation initiatives through value-added offerings such as fuel optimization consulting, technical support services, and comprehensive supply chain management can create premium pricing opportunities and strengthen customer loyalty in competitive market conditions.

Future market outlook for Japan’s bunker fuel market indicates continued growth supported by evolving industry dynamics and strategic positioning initiatives.

Market expansion prospects remain positive driven by Japan’s strengthening role as a regional maritime logistics hub and increasing vessel traffic through major shipping routes. The market is projected to maintain steady growth rates of 4-6% annually over the next five years, supported by infrastructure investments and service capability enhancements.

Environmental compliance evolution will continue driving market transformation as regulations become increasingly stringent and shipping companies adopt cleaner fuel alternatives. This transition creates opportunities for suppliers investing in advanced fuel technologies while potentially challenging traditional fuel providers.

Technology integration advancement will enhance operational efficiency and customer service capabilities through continued adoption of digital platforms, automated systems, and data analytics solutions. These technological improvements are expected to reduce operational costs by 15-20% while improving service quality and reliability.

Regional competition intensification may impact market dynamics as other Asian ports invest in bunkering capabilities and compete for international shipping business. Japanese market participants must continue enhancing service quality and competitive positioning to maintain market leadership.

Alternative fuel development represents both opportunity and challenge as the maritime industry explores hydrogen, ammonia, and other clean fuel alternatives. Market participants should monitor these developments and consider strategic investments in emerging fuel technologies to ensure long-term market relevance.

Japan’s bunker fuel market demonstrates strong fundamentals and positive growth prospects supported by strategic geographic advantages, advanced infrastructure, and comprehensive service capabilities. The market’s evolution toward environmental compliance and technological advancement creates opportunities for forward-thinking participants while presenting challenges for traditional operators.

Key success factors include investment in clean fuel technologies, digital transformation initiatives, strategic partnerships, and comprehensive service offerings that meet evolving customer requirements. Market participants positioned to capitalize on these trends while maintaining operational excellence are likely to achieve sustainable competitive advantages.

Market outlook remains optimistic with continued growth expected through infrastructure development, regulatory compliance opportunities, and Japan’s strengthening position as a regional maritime hub. The transition toward sustainable marine fuels and advanced operational technologies will continue shaping market dynamics and creating new business opportunities for innovative market participants.

What is Bunker Fuel?

Bunker fuel refers to the fuel used in ships and vessels for propulsion and power generation. It is a crucial component in the maritime industry, particularly for commercial shipping and fishing operations.

What are the key players in the Japan Bunker Fuel Market?

Key players in the Japan Bunker Fuel Market include companies like Nippon Oil Corporation, Idemitsu Kosan Co., Ltd., and Cosmo Oil Co., Ltd., among others.

What are the main drivers of the Japan Bunker Fuel Market?

The main drivers of the Japan Bunker Fuel Market include the growth of international trade, increasing shipping activities, and the demand for energy-efficient marine fuels. Additionally, regulatory changes aimed at reducing emissions are influencing market dynamics.

What challenges does the Japan Bunker Fuel Market face?

The Japan Bunker Fuel Market faces challenges such as fluctuating crude oil prices, stringent environmental regulations, and competition from alternative fuels. These factors can impact supply stability and pricing strategies.

What opportunities exist in the Japan Bunker Fuel Market?

Opportunities in the Japan Bunker Fuel Market include the development of low-sulfur fuels and the adoption of cleaner technologies. The shift towards sustainable shipping practices is also creating avenues for innovation and investment.

What trends are shaping the Japan Bunker Fuel Market?

Trends shaping the Japan Bunker Fuel Market include the increasing focus on sustainability, the rise of digitalization in fuel management, and the growing adoption of alternative fuels such as LNG. These trends are driving changes in operational practices within the maritime sector.

Japan Bunker Fuel Market

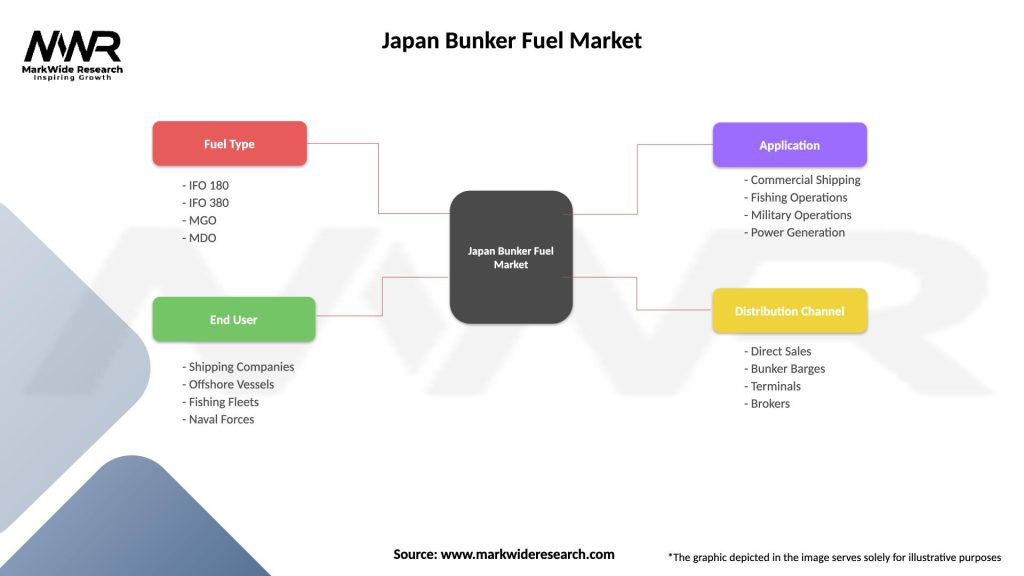

| Segmentation Details | Description |

|---|---|

| Fuel Type | IFO 180, IFO 380, MGO, MDO |

| End User | Shipping Companies, Offshore Vessels, Fishing Fleets, Naval Forces |

| Application | Commercial Shipping, Fishing Operations, Military Operations, Power Generation |

| Distribution Channel | Direct Sales, Bunker Barges, Terminals, Brokers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

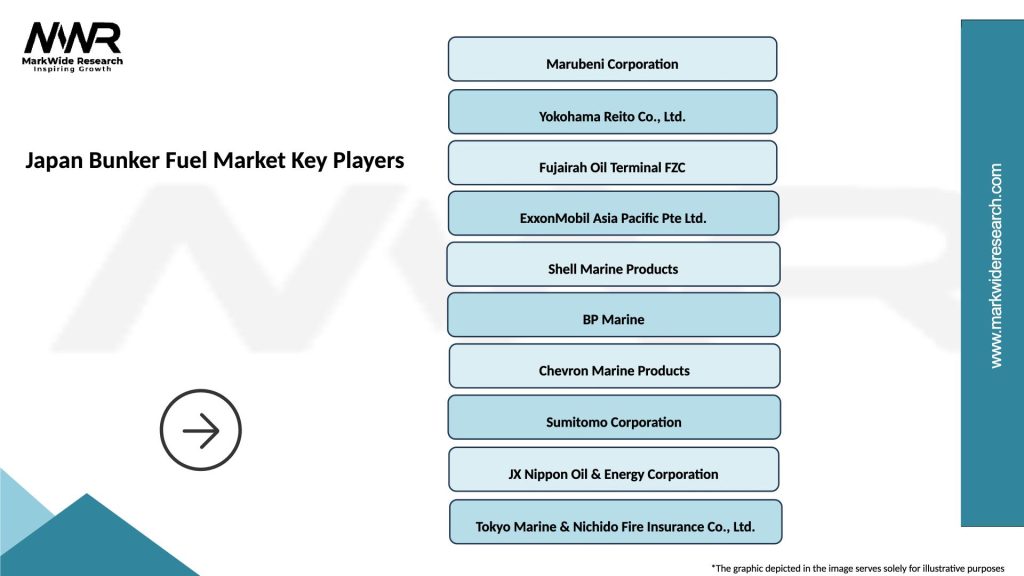

Leading companies in the Japan Bunker Fuel Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at