444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan beauty and personal care products market represents one of the most sophisticated and innovative consumer segments in the global beauty industry. Japanese consumers demonstrate exceptional brand loyalty and quality consciousness, driving continuous innovation in skincare, cosmetics, and personal care formulations. The market encompasses traditional J-beauty principles alongside cutting-edge technology integration, creating a unique ecosystem that influences global beauty trends.

Market dynamics in Japan reflect the country’s aging population, urbanization patterns, and evolving lifestyle preferences. The sector experiences robust growth driven by premium product demand, with consumers increasingly willing to invest in high-quality beauty solutions. Digital transformation has accelerated market evolution, with e-commerce platforms and social media significantly impacting purchasing behaviors and brand engagement strategies.

Innovation leadership characterizes the Japanese beauty market, with companies investing heavily in research and development to create advanced formulations. The market demonstrates strong growth potential, with industry analysts projecting a compound annual growth rate of 4.2% through the forecast period. Sustainability initiatives and clean beauty trends are reshaping product development, while traditional beauty rituals continue to influence modern consumer preferences.

The Japan beauty and personal care products market refers to the comprehensive ecosystem of cosmetics, skincare, haircare, fragrance, and personal hygiene products specifically designed for and consumed within the Japanese domestic market. This market encompasses both traditional Japanese beauty philosophies and modern international beauty trends, creating a distinctive segment characterized by meticulous attention to product quality, innovative formulations, and sophisticated consumer expectations.

J-beauty concepts emphasize minimalist approaches, natural ingredients, and gentle formulations that align with Japanese cultural values of harmony and balance. The market includes established domestic brands alongside international luxury and mass-market players, all competing to meet the discerning preferences of Japanese consumers who prioritize efficacy, safety, and aesthetic appeal in their beauty routines.

Strategic positioning within the Japan beauty and personal care products market requires deep understanding of local consumer behavior, regulatory requirements, and cultural nuances. The market demonstrates remarkable resilience and growth potential, supported by strong domestic consumption patterns and increasing international interest in Japanese beauty innovations.

Key market drivers include the aging population’s focus on anti-aging solutions, urbanization trends driving convenience-oriented products, and growing male grooming awareness. Digital integration has transformed retail landscapes, with online sales representing approximately 28% of total market transactions. The market benefits from Japan’s reputation for quality manufacturing and innovative product development capabilities.

Competitive dynamics feature intense rivalry between domestic heritage brands and international beauty conglomerates. Premium positioning remains crucial for market success, with consumers demonstrating willingness to pay premium prices for superior quality and innovative features. The market’s future growth trajectory appears positive, supported by continuous innovation and expanding consumer awareness of beauty and wellness benefits.

Consumer behavior analysis reveals several critical insights shaping the Japan beauty and personal care products market:

Demographic transformation serves as a primary catalyst for market growth, with Japan’s aging population creating substantial demand for anti-aging and age-defying beauty solutions. Women over 50 represent the fastest-growing consumer segment, driving innovation in mature skin care formulations and age-appropriate cosmetic products. This demographic shift influences product development priorities and marketing strategies across the industry.

Urbanization trends continue shaping consumer preferences, with city dwellers seeking convenient, time-efficient beauty solutions that fit busy lifestyles. Commuter-friendly packaging and quick-application products gain popularity among working professionals. The rise of male grooming awareness expands market opportunities, with men’s beauty and personal care segments experiencing accelerated growth rates of approximately 6.8% annually.

Technology adoption drives innovation in product formulations and application methods. Smart beauty devices integrated with mobile applications enable personalized skincare routines and real-time skin analysis. Artificial intelligence and machine learning technologies enhance product recommendations and customization capabilities, creating more engaging consumer experiences that drive brand loyalty and repeat purchases.

Cultural wellness integration promotes holistic approaches to beauty and personal care, aligning with traditional Japanese concepts of inner and outer harmony. Wellness-focused products that combine beauty benefits with health and relaxation properties gain significant market traction, particularly among health-conscious consumers seeking comprehensive lifestyle solutions.

Economic pressures impact consumer spending patterns, particularly affecting discretionary beauty purchases during periods of economic uncertainty. Price sensitivity increases among certain consumer segments, creating challenges for premium-positioned brands and limiting market expansion opportunities for luxury beauty products.

Regulatory complexity presents significant barriers for new market entrants and product innovations. Stringent safety requirements and lengthy approval processes for new ingredients or formulations increase development costs and time-to-market delays. Import regulations and compliance requirements create additional challenges for international brands seeking market entry or expansion.

Market saturation in certain product categories limits growth potential, particularly in mature segments like basic skincare and traditional cosmetics. Intense competition among established players creates pricing pressures and requires substantial marketing investments to maintain market share and brand visibility.

Changing consumer preferences toward minimalist beauty routines and natural products challenge traditional product categories and formulations. Sustainability concerns regarding packaging waste and ingredient sourcing create pressure for costly reformulations and supply chain modifications that impact profitability margins.

Digital transformation creates unprecedented opportunities for direct-to-consumer engagement and personalized beauty experiences. E-commerce expansion enables brands to reach previously underserved geographic markets and demographic segments while reducing traditional retail overhead costs. Social commerce integration through platforms like Instagram and TikTok opens new revenue streams and customer acquisition channels.

Customization trends present significant growth opportunities for brands capable of delivering personalized beauty solutions. Made-to-order cosmetics and bespoke skincare formulations command premium pricing while building stronger customer relationships. Subscription-based models create recurring revenue streams and improve customer lifetime value metrics.

International expansion of J-beauty concepts offers substantial growth potential as global consumers increasingly appreciate Japanese beauty philosophies and product quality. Export opportunities for successful domestic brands continue expanding, particularly in Asian markets where Japanese beauty products enjoy premium positioning and strong brand recognition.

Sustainability innovation enables brands to differentiate through eco-friendly initiatives while meeting growing consumer demand for responsible beauty choices. Refillable packaging systems and zero-waste product lines create competitive advantages while addressing environmental concerns that influence purchasing decisions among environmentally conscious consumers.

Supply chain evolution reflects changing consumer expectations and technological capabilities within the Japan beauty and personal care products market. Local sourcing initiatives gain prominence as brands seek to reduce environmental impact while supporting domestic ingredient suppliers. Vertical integration strategies enable greater quality control and cost management throughout the production process.

Retail transformation continues reshaping distribution channels, with traditional department stores adapting to compete with specialized beauty retailers and online platforms. Omnichannel strategies become essential for brands seeking comprehensive market coverage and consistent customer experiences across touchpoints. Pop-up retail concepts and experiential marketing initiatives create engaging brand interactions that drive consumer awareness and trial.

Innovation cycles accelerate as brands compete to introduce breakthrough products and technologies. Research and development investments focus on advanced ingredient technologies, sustainable formulations, and enhanced product efficacy. Collaborative partnerships between beauty brands and technology companies drive innovation in smart beauty devices and digital beauty solutions.

Consumer education becomes increasingly important as product complexity and ingredient sophistication advance. Educational marketing content helps consumers understand product benefits and proper usage techniques, building brand trust and customer loyalty. Professional consultation services integrated into retail experiences enhance customer satisfaction and purchase confidence.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Japan beauty and personal care products market. Primary research activities include extensive consumer surveys, in-depth interviews with industry executives, and focus group discussions with target demographic segments across major Japanese metropolitan areas.

Secondary research integration incorporates analysis of industry reports, government statistics, trade association data, and company financial disclosures. Market intelligence gathering utilizes retail tracking data, e-commerce analytics, and social media sentiment analysis to understand consumer behavior patterns and emerging trends.

Quantitative analysis employs statistical modeling techniques to project market growth trajectories and segment performance. Qualitative insights from expert interviews and consumer feedback provide contextual understanding of market dynamics and competitive positioning strategies.

Data validation processes ensure research accuracy through cross-referencing multiple sources and expert review panels. Continuous monitoring of market developments enables real-time updates to research findings and maintains relevance throughout rapidly evolving market conditions.

Tokyo metropolitan area dominates the Japan beauty and personal care products market, representing approximately 35% of total market consumption. Urban consumers in Tokyo demonstrate the highest spending levels on premium beauty products and show greatest receptivity to innovative formulations and international brands. Retail density in Tokyo supports diverse distribution channels from luxury department stores to specialized beauty retailers.

Osaka region serves as the second-largest market, accounting for roughly 18% of national consumption. Consumer preferences in Osaka tend toward practical, value-oriented products while maintaining quality expectations. Regional brands often achieve strong market penetration in Osaka before expanding to other metropolitan areas.

Nagoya and surrounding areas represent emerging growth opportunities, with increasing urbanization driving demand for sophisticated beauty solutions. Regional distribution networks continue expanding to serve growing consumer bases in secondary cities throughout Japan.

Rural market segments demonstrate unique characteristics, with consumers often preferring traditional beauty approaches and locally-sourced ingredients. E-commerce penetration in rural areas reaches approximately 42%, higher than urban areas due to limited physical retail access. Aging demographics in rural regions create specific market opportunities for age-appropriate beauty and personal care solutions.

Market leadership within the Japan beauty and personal care products market features intense competition between established domestic brands and international beauty conglomerates. Strategic positioning varies significantly across companies, with some focusing on premium luxury segments while others target mass-market accessibility.

Competitive strategies emphasize innovation, quality differentiation, and customer experience enhancement. Brand portfolio management enables companies to target multiple consumer segments while maintaining distinct brand identities and positioning strategies.

Product category segmentation reveals diverse market dynamics across the Japan beauty and personal care products market:

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Skincare dominance reflects Japanese consumers’ fundamental commitment to comprehensive skin health and protection. Multi-step skincare routines remain popular, driving demand for specialized products including essences, serums, and targeted treatments. Anti-aging formulations command premium pricing, with consumers willing to invest significantly in products promising visible results and long-term skin health benefits.

Haircare innovation focuses on damage repair, scalp health, and styling convenience. Salon-quality formulations for home use gain popularity among consumers seeking professional results without salon visits. Natural ingredient integration appeals to health-conscious consumers, while technology-enhanced products attract younger demographics interested in advanced hair care solutions.

Color cosmetics trends emphasize natural-looking enhancement and long-wearing formulations suitable for Japan’s humid climate. Seasonal collections drive repeat purchases, with brands launching limited-edition products aligned with cultural events and fashion trends. Customizable makeup solutions enable personalized color matching and individual expression preferences.

Men’s grooming expansion represents the fastest-growing category, with male consumers increasingly adopting comprehensive grooming routines. Skincare adoption among men reaches approximately 58%, while grooming device usage continues expanding. Subtle enhancement products designed specifically for male preferences gain market acceptance and drive category growth.

Brand manufacturers benefit from Japan’s reputation for quality and innovation, enabling premium positioning in global markets. Research and development capabilities in Japan provide competitive advantages through advanced formulation technologies and ingredient innovations. Consumer loyalty in Japanese markets creates stable revenue streams and predictable growth patterns for established brands.

Retail partners gain access to sophisticated consumers willing to invest in high-quality beauty products. Educational marketing opportunities enable retailers to build customer relationships through product knowledge and consultation services. Premium pricing structures support healthy profit margins and sustainable business models.

Ingredient suppliers benefit from demand for innovative, high-quality raw materials that meet stringent safety and efficacy standards. Sustainable sourcing initiatives create opportunities for suppliers focused on environmental responsibility and ethical practices. Technology integration enables suppliers to develop advanced ingredients that command premium pricing.

Consumers access world-class beauty products with proven efficacy and safety profiles. Innovation leadership ensures continuous improvement in product performance and user experience. Cultural alignment between products and consumer values creates satisfying beauty routines that enhance daily life quality and personal confidence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean beauty movement gains significant momentum as consumers prioritize ingredient transparency and environmental responsibility. Natural formulations using traditional Japanese ingredients like rice bran, green tea, and seaweed appeal to health-conscious consumers seeking gentle yet effective solutions. Sustainable packaging initiatives reduce environmental impact while meeting consumer expectations for responsible brand behavior.

Personalization technology enables customized beauty solutions tailored to individual skin types, concerns, and preferences. AI-powered skin analysis tools provide professional-grade assessments accessible through mobile applications and retail locations. Bespoke formulations create unique products that address specific consumer needs while commanding premium pricing structures.

Wellness integration expands beauty concepts beyond appearance enhancement to include holistic health and well-being benefits. Stress-relief formulations incorporate aromatherapy and relaxation properties into traditional beauty products. Sleep beauty products designed for overnight skin repair and rejuvenation gain popularity among busy consumers seeking efficient beauty solutions.

Social media influence continues reshaping marketing strategies and consumer discovery processes. Influencer partnerships drive brand awareness and product trial among younger demographics. User-generated content provides authentic product reviews and application tutorials that influence purchasing decisions. Live streaming commerce creates interactive shopping experiences that combine entertainment with product demonstration.

Strategic partnerships between beauty brands and technology companies accelerate innovation in smart beauty devices and digital solutions. MarkWide Research analysis indicates that collaborative innovation drives approximately 23% of new product launches in the Japanese beauty market. Cross-industry alliances enable brands to access new technologies and expand their capabilities beyond traditional beauty expertise.

Sustainability initiatives reshape supply chains and product development processes across the industry. Refillable packaging systems reduce waste while maintaining product integrity and brand aesthetics. Carbon-neutral manufacturing commitments drive operational improvements and appeal to environmentally conscious consumers who consider sustainability in purchasing decisions.

Retail innovation transforms customer experiences through technology integration and service enhancement. Virtual try-on technologies enable consumers to test products digitally before purchase, reducing returns and increasing customer satisfaction. Augmented reality applications provide interactive product education and personalized recommendations that enhance the shopping experience.

International expansion strategies focus on exporting Japanese beauty concepts and products to global markets. J-beauty positioning leverages Japan’s reputation for quality and innovation to command premium pricing in international markets. Cultural adaptation ensures products meet local preferences while maintaining authentic Japanese brand identity and values.

Innovation investment remains critical for maintaining competitive advantage in the rapidly evolving Japan beauty and personal care products market. Research and development priorities should focus on sustainable formulations, personalization technologies, and wellness integration that align with emerging consumer preferences and regulatory requirements.

Digital transformation acceleration enables brands to reach new customer segments and create more engaging shopping experiences. Omnichannel strategies that seamlessly integrate online and offline touchpoints provide competitive advantages in customer acquisition and retention. Data analytics capabilities support personalized marketing and product development decisions.

Sustainability leadership creates differentiation opportunities while meeting growing consumer demand for responsible beauty choices. Circular economy principles should guide packaging design and supply chain optimization. Transparency initiatives regarding ingredient sourcing and manufacturing processes build consumer trust and brand loyalty.

Market expansion strategies should consider both demographic diversification within Japan and international growth opportunities. Male grooming segments offer significant growth potential with targeted product development and marketing approaches. Export opportunities for successful domestic brands continue expanding, particularly in markets where Japanese quality reputation provides competitive advantages.

Long-term growth prospects for the Japan beauty and personal care products market remain positive despite demographic challenges and market maturity. Innovation leadership continues driving market evolution, with brands investing heavily in advanced formulations and technology integration. MWR projections indicate sustained growth momentum supported by premium positioning and international expansion opportunities.

Technology integration will accelerate across all market segments, from smart beauty devices to AI-powered personalization platforms. Digital-native consumers increasingly influence market trends and purchasing patterns, requiring brands to adapt marketing strategies and product development approaches. Virtual beauty experiences become standard offerings that enhance customer engagement and brand differentiation.

Sustainability transformation will reshape industry practices and consumer expectations over the next decade. Circular economy adoption creates opportunities for innovative business models and supply chain optimization. Environmental consciousness among consumers reaches approximately 71%, driving demand for eco-friendly products and responsible brand practices.

Global influence expansion positions Japanese beauty concepts and products as international trend leaders. J-beauty philosophy gains recognition worldwide, creating export opportunities and brand licensing possibilities. Cultural exchange through beauty products strengthens Japan’s soft power influence while generating economic benefits for domestic companies and stakeholders.

The Japan beauty and personal care products market represents a sophisticated and dynamic ecosystem that continues evolving through innovation, consumer education, and technological advancement. Market resilience demonstrates the strength of Japanese consumer commitment to quality beauty solutions and the industry’s ability to adapt to changing preferences and demographic trends.

Strategic opportunities abound for companies capable of balancing traditional Japanese beauty values with modern innovation and sustainability requirements. Digital transformation and personalization technologies create new avenues for customer engagement and market expansion, while international growth potential offers significant revenue diversification opportunities.

Future success in this market will depend on continuous innovation, authentic brand positioning, and deep understanding of evolving consumer needs. Sustainability leadership and technology integration will become increasingly important differentiators, while maintaining the quality standards and cultural authenticity that define Japanese beauty excellence. The market’s trajectory suggests continued growth and global influence, positioning Japan as a lasting leader in beauty innovation and consumer satisfaction.

What is Japan Beauty & Personal Care Products?

Japan Beauty & Personal Care Products refer to a wide range of items designed for personal hygiene, skincare, haircare, and cosmetics, catering to the unique preferences and needs of Japanese consumers.

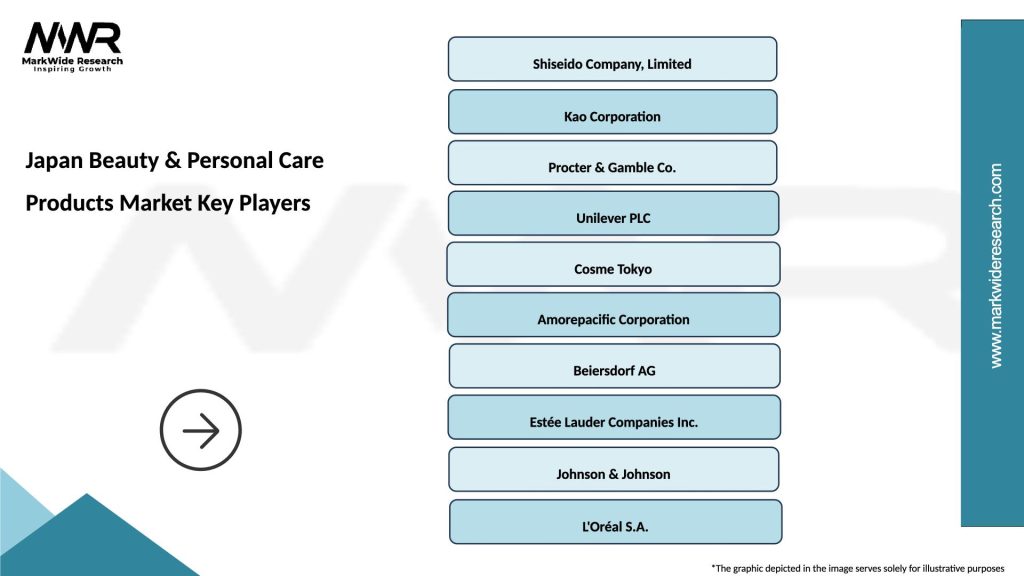

What are the key companies in the Japan Beauty & Personal Care Products Market?

Key companies in the Japan Beauty & Personal Care Products Market include Shiseido, Kao Corporation, and Fancl, among others.

What are the main drivers of growth in the Japan Beauty & Personal Care Products Market?

The main drivers of growth in the Japan Beauty & Personal Care Products Market include increasing consumer awareness of skincare, the rise of e-commerce platforms, and a growing demand for natural and organic products.

What challenges does the Japan Beauty & Personal Care Products Market face?

Challenges in the Japan Beauty & Personal Care Products Market include intense competition among brands, changing consumer preferences, and regulatory compliance regarding product safety and ingredients.

What opportunities exist in the Japan Beauty & Personal Care Products Market?

Opportunities in the Japan Beauty & Personal Care Products Market include the expansion of men’s grooming products, the growth of anti-aging solutions, and the increasing popularity of K-beauty and J-beauty trends.

What trends are shaping the Japan Beauty & Personal Care Products Market?

Trends shaping the Japan Beauty & Personal Care Products Market include the rise of clean beauty, the integration of technology in skincare routines, and the focus on sustainability and eco-friendly packaging.

Japan Beauty & Personal Care Products Market

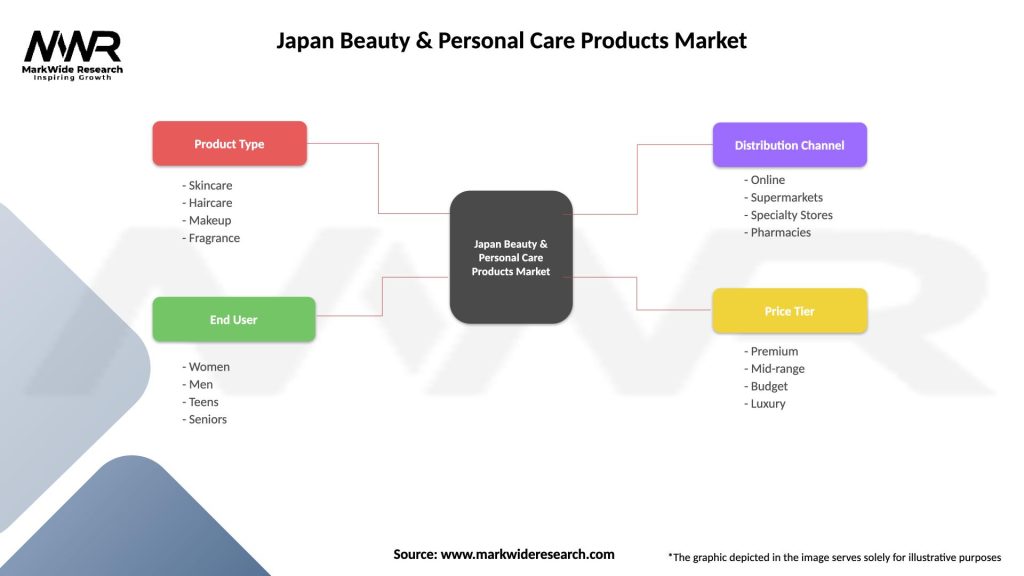

| Segmentation Details | Description |

|---|---|

| Product Type | Skincare, Haircare, Makeup, Fragrance |

| End User | Women, Men, Teens, Seniors |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Pharmacies |

| Price Tier | Premium, Mid-range, Budget, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Beauty & Personal Care Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at