444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan auto loan market represents a critical component of the nation’s automotive financing ecosystem, facilitating vehicle purchases for millions of consumers across the archipelago. Market dynamics in Japan’s automotive lending sector reflect the country’s unique economic landscape, characterized by conservative lending practices, technological innovation, and evolving consumer preferences. The market encompasses various financing solutions including traditional bank loans, dealer financing, leasing arrangements, and emerging digital lending platforms.

Growth trajectories in the Japanese auto loan market demonstrate resilience despite economic challenges, with the sector experiencing a steady growth rate of 3.2% annually over recent years. Consumer behavior patterns indicate increasing acceptance of financing options, particularly among younger demographics who view auto loans as accessible pathways to vehicle ownership. The market’s evolution reflects broader shifts in Japan’s financial services landscape, where traditional banking institutions compete alongside innovative fintech companies.

Regional variations across Japan’s prefectures show distinct lending patterns, with urban areas like Tokyo and Osaka demonstrating higher loan volumes compared to rural regions. Technological integration has become increasingly prominent, with digital application processes and AI-driven credit assessment tools transforming the traditional lending experience. The market’s maturity is evidenced by sophisticated risk management practices and comprehensive regulatory frameworks that protect both lenders and borrowers.

The Japan auto loan market refers to the comprehensive ecosystem of financial products and services designed to facilitate vehicle purchases through various lending mechanisms. This market encompasses traditional installment loans, lease-to-own arrangements, balloon payment structures, and innovative financing solutions tailored to Japanese consumer preferences and regulatory requirements.

Market participants include commercial banks, credit unions, automotive manufacturers’ financial arms, independent finance companies, and emerging digital lending platforms. The sector operates within Japan’s stringent financial regulatory framework, ensuring consumer protection while promoting healthy competition among lending institutions. Product diversity ranges from new vehicle financing to used car loans, with specialized offerings for commercial vehicles, motorcycles, and electric vehicles.

Consumer segments served by this market include individual buyers, small businesses, fleet operators, and commercial enterprises requiring transportation solutions. The market’s significance extends beyond mere financing, influencing automotive sales patterns, consumer spending behavior, and broader economic activity throughout Japan’s automotive value chain.

Strategic positioning of Japan’s auto loan market reveals a mature, well-regulated sector experiencing gradual transformation driven by technological innovation and changing consumer expectations. The market demonstrates remarkable stability with consistent growth patterns, supported by Japan’s robust automotive industry and evolving financing preferences among consumers.

Key performance indicators highlight the market’s health, with loan approval rates maintaining approximately 78% across all lending categories. Digital transformation initiatives have accelerated significantly, with online loan applications increasing by 45% over the past two years. Traditional banks continue to dominate market share, though fintech companies are gaining traction through innovative service delivery models and competitive interest rates.

Market segmentation reveals distinct preferences across different consumer demographics, with younger buyers increasingly favoring flexible payment terms and digital-first experiences. Electric vehicle financing has emerged as a growth catalyst, supported by government incentives and environmental consciousness among Japanese consumers. The sector’s resilience during economic uncertainties demonstrates its fundamental importance to Japan’s automotive ecosystem and consumer mobility needs.

Consumer preferences in Japan’s auto loan market reflect the nation’s unique cultural and economic characteristics, with borrowers demonstrating strong preference for predictable payment structures and comprehensive service support. Market research indicates several critical insights shaping the sector’s evolution:

Economic stability in Japan continues to support consistent demand for automotive financing, with low interest rate environments creating favorable conditions for both lenders and borrowers. Government initiatives promoting vehicle modernization and environmental sustainability drive specific segments of the auto loan market, particularly financing for hybrid and electric vehicles.

Technological advancement serves as a primary market driver, enabling streamlined application processes, faster approval times, and enhanced customer experiences. Digital transformation initiatives across the financial services sector have reduced operational costs while improving service accessibility, making auto loans more attractive to tech-savvy consumers.

Demographic shifts in Japan’s population structure influence market dynamics, with aging populations in rural areas creating demand for reliable transportation financing, while urban millennials seek flexible, technology-enabled lending solutions. Automotive industry innovation continues to drive market expansion, with new vehicle technologies requiring specialized financing approaches that traditional lenders are adapting to accommodate.

Consumer confidence in Japan’s economic outlook supports sustained demand for vehicle purchases and associated financing. Employment stability and predictable income patterns among Japanese workers create favorable conditions for long-term loan commitments, supporting market growth across various consumer segments.

Regulatory complexity in Japan’s financial services sector creates significant barriers for new market entrants, requiring substantial compliance investments and ongoing regulatory monitoring. Traditional banking dominance limits competitive dynamics, with established institutions leveraging their market positions to maintain customer relationships and pricing power.

Economic uncertainties related to global market conditions and domestic policy changes create cautious lending environments, potentially restricting credit availability for certain consumer segments. Demographic challenges including population decline in rural areas reduce market potential in specific geographic regions, forcing lenders to concentrate on urban markets.

Interest rate volatility affects both lender profitability and consumer demand, with sudden rate changes potentially disrupting established market dynamics. Competition from alternative transportation models, including ride-sharing services and improved public transportation, may reduce overall vehicle ownership demand and associated financing needs.

Credit risk management requirements impose strict lending criteria that may exclude certain consumer segments, particularly younger borrowers with limited credit histories or irregular income patterns. Technology implementation costs for smaller lending institutions create competitive disadvantages compared to larger banks with greater resources for digital transformation initiatives.

Digital innovation presents substantial opportunities for market expansion, with artificial intelligence, machine learning, and blockchain technologies offering potential for enhanced risk assessment, streamlined operations, and improved customer experiences. Fintech collaboration between traditional banks and technology companies creates pathways for innovative product development and market reach expansion.

Electric vehicle financing represents a significant growth opportunity, supported by government incentives and increasing environmental awareness among Japanese consumers. Specialized lending products for autonomous vehicles, connected cars, and mobility-as-a-service platforms offer potential for market differentiation and premium pricing strategies.

Cross-border expansion opportunities exist for Japanese auto loan providers to leverage their expertise in other Asian markets, particularly those with similar regulatory frameworks and consumer preferences. Partnership strategies with automotive manufacturers, technology companies, and insurance providers can create comprehensive mobility financing ecosystems.

Data analytics capabilities enable more sophisticated risk assessment models and personalized lending products, potentially expanding market reach to previously underserved consumer segments. Sustainability-focused financing products align with global environmental trends and Japanese government policies, creating opportunities for market leadership in green automotive financing.

Competitive intensity in Japan’s auto loan market reflects the balance between established banking institutions and emerging fintech companies, with each segment leveraging distinct advantages to capture market share. Traditional banks maintain strong relationships with automotive dealers and established customer bases, while digital lenders offer streamlined processes and competitive rates to attract tech-savvy consumers.

Pricing dynamics demonstrate the market’s maturity, with interest rates remaining relatively stable despite competitive pressures. Product innovation focuses on service delivery improvements rather than fundamental lending structure changes, reflecting the conservative nature of Japanese financial markets and regulatory requirements.

Customer acquisition strategies vary significantly across market participants, with some focusing on digital marketing and online customer journeys, while others emphasize traditional relationship-building and dealer partnerships. Market consolidation trends show gradual concentration among larger players, though regulatory frameworks prevent excessive market concentration.

Technology adoption rates continue accelerating, with mobile application usage increasing by 35% annually among auto loan customers. Risk management practices have evolved to incorporate advanced analytics and real-time monitoring systems, improving loan performance while maintaining competitive approval rates.

Comprehensive analysis of Japan’s auto loan market employs multiple research methodologies to ensure accuracy and depth of insights. Primary research includes extensive surveys of market participants, including lenders, automotive dealers, and consumers, providing firsthand perspectives on market trends and preferences.

Secondary research encompasses analysis of regulatory filings, industry reports, and economic data from authoritative sources including the Bank of Japan, Ministry of Finance, and Japan Automobile Dealers Association. Quantitative analysis utilizes statistical modeling to identify market patterns, growth trends, and correlation factors affecting market performance.

Qualitative research methods include in-depth interviews with industry executives, regulatory officials, and market experts to understand strategic perspectives and future market directions. Market segmentation analysis employs demographic, geographic, and behavioral criteria to identify distinct consumer groups and their financing preferences.

Data validation processes ensure research accuracy through cross-referencing multiple sources and employing statistical significance testing. Trend analysis incorporates historical data spanning multiple economic cycles to identify sustainable market patterns versus temporary fluctuations.

Geographic distribution of Japan’s auto loan market reveals significant variations across the country’s diverse regions, with urban centers demonstrating higher loan volumes and more competitive lending environments. Tokyo metropolitan area accounts for approximately 28% of total market activity, reflecting the region’s population density and economic concentration.

Osaka and surrounding Kansai region represents another major market hub, contributing 18% of national auto loan volume with strong automotive manufacturing presence supporting both consumer and commercial lending segments. Regional banks play crucial roles in smaller prefectures, often maintaining dominant market positions through established community relationships.

Rural market characteristics differ substantially from urban areas, with longer loan terms, different risk profiles, and greater reliance on traditional banking relationships. Northern prefectures including Hokkaido show distinct seasonal patterns in auto loan demand, influenced by weather conditions and agricultural economic cycles.

Southern regions including Kyushu demonstrate growing market potential, supported by automotive manufacturing investments and improving economic conditions. Digital penetration rates vary significantly across regions, with urban areas showing 65% higher adoption of online lending platforms compared to rural markets.

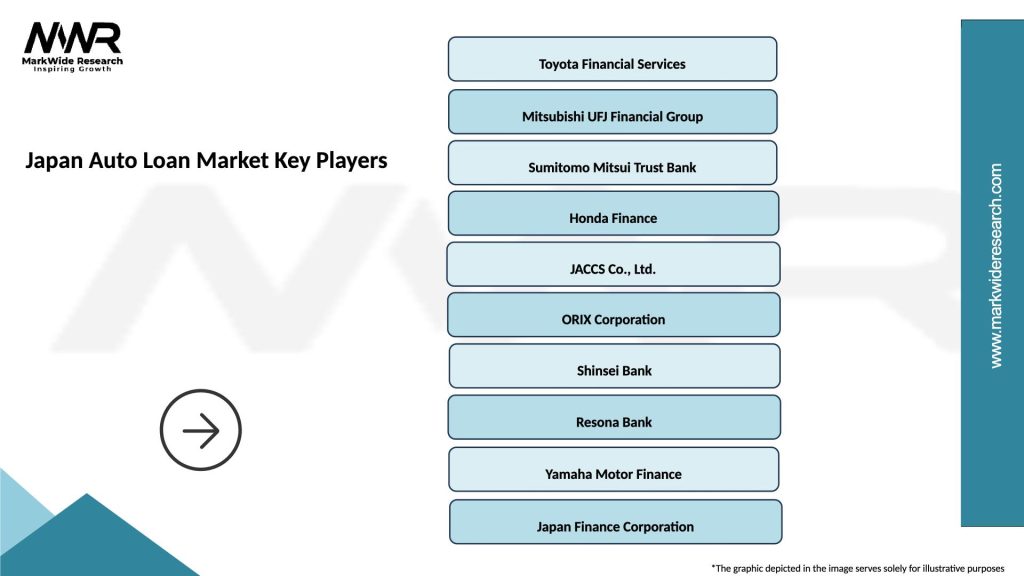

Market leadership in Japan’s auto loan sector is distributed among several key player categories, each leveraging distinct competitive advantages to maintain market position. Major commercial banks continue to dominate through extensive branch networks and established customer relationships:

Competitive strategies vary significantly across market participants, with traditional banks emphasizing relationship-based lending and comprehensive service offerings, while fintech companies focus on streamlined processes and competitive pricing. Market share distribution remains relatively stable, though digital transformation initiatives are creating opportunities for market position changes.

Market segmentation in Japan’s auto loan sector reveals distinct categories based on various criteria including loan purpose, customer demographics, vehicle types, and lending institutions. By loan purpose, the market divides into new vehicle financing, used car loans, refinancing products, and commercial vehicle lending.

By customer demographics:

By vehicle categories:

New vehicle financing represents the largest and most competitive segment of Japan’s auto loan market, characterized by manufacturer partnerships, promotional interest rates, and comprehensive warranty integration. Loan terms typically range from three to seven years, with most consumers preferring five-year repayment schedules that balance monthly payment affordability with total interest costs.

Used car lending demonstrates different risk profiles and pricing structures, with shorter loan terms and higher interest rates reflecting increased credit risk. Market growth in this segment is driven by economic consciousness among consumers and improved used vehicle quality standards. Digital assessment tools have enhanced used car loan processing efficiency and accuracy.

Commercial vehicle financing serves business customers with specialized needs including fleet management, seasonal payment adjustments, and equipment financing integration. Risk assessment for commercial loans incorporates business financial analysis and industry-specific considerations. Relationship banking remains particularly important in this segment, with long-term partnerships between lenders and business customers.

Electric vehicle financing has emerged as a high-growth category, supported by government incentives and environmental awareness. Specialized products in this segment include battery lease arrangements, charging infrastructure financing, and extended warranty programs. Market penetration of EV financing is expected to reach 15% of total auto loans within the next three years.

Financial institutions participating in Japan’s auto loan market benefit from stable, predictable revenue streams with relatively low default rates compared to other consumer lending categories. Risk diversification advantages include secured lending positions with tangible collateral and established resale markets for repossessed vehicles.

Automotive dealers gain significant advantages through financing partnerships, including increased sales conversion rates, higher average transaction values, and additional revenue streams from financing commissions. Customer relationship benefits extend beyond initial sales, creating opportunities for long-term service relationships and repeat business.

Consumers benefit from competitive interest rates, flexible payment terms, and streamlined application processes that make vehicle ownership more accessible. Digital innovation in the sector provides enhanced convenience, faster approval times, and transparent pricing structures that improve the overall borrowing experience.

Automotive manufacturers leverage captive finance companies to support sales objectives, manage inventory levels, and create customer loyalty through integrated financing and service offerings. Market intelligence gathered through financing operations provides valuable insights for product development and marketing strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping Japan’s auto loan market, with artificial intelligence and machine learning technologies enabling more sophisticated risk assessment and personalized lending products. Mobile-first approaches are becoming standard, with consumers increasingly expecting seamless digital experiences throughout the loan application and management process.

Sustainability focus is driving significant changes in product offerings, with green vehicle financing gaining prominence through government incentives and consumer environmental consciousness. Electric vehicle loans now feature specialized terms including battery warranties, charging infrastructure access, and environmental impact reporting.

Partnership ecosystems are evolving beyond traditional bank-dealer relationships to include technology companies, insurance providers, and mobility service platforms. Integrated solutions combining financing, insurance, maintenance, and digital services create comprehensive customer value propositions.

Data analytics advancement enables more precise risk assessment and personalized pricing strategies, with real-time monitoring systems improving portfolio management and customer service delivery. Predictive modeling helps lenders anticipate market trends and customer needs, supporting proactive product development initiatives.

Regulatory evolution in Japan’s financial services sector continues influencing auto loan market dynamics, with recent policy changes emphasizing consumer protection and digital innovation support. Open banking initiatives are creating opportunities for enhanced data sharing and improved customer experiences across financial service providers.

Technology partnerships between traditional banks and fintech companies are accelerating, with several major institutions launching collaborative platforms that combine banking expertise with innovative technology solutions. Blockchain implementation pilots are exploring applications in loan documentation, identity verification, and cross-border transactions.

Automotive industry transformation toward electric and autonomous vehicles is driving specialized financing product development, with manufacturers and lenders collaborating on integrated mobility solutions. Subscription-based models are emerging as alternatives to traditional ownership financing, particularly among urban consumers.

Market consolidation activities include strategic acquisitions and partnerships aimed at expanding market reach and technological capabilities. International expansion efforts by Japanese auto loan providers are targeting other Asian markets with similar regulatory and cultural characteristics.

Strategic recommendations for market participants emphasize the importance of digital transformation investments and customer experience enhancement initiatives. MarkWide Research analysis suggests that institutions prioritizing mobile-first strategies and AI-driven risk assessment will achieve competitive advantages in the evolving market landscape.

Product development focus should concentrate on electric vehicle financing specialization and integrated mobility solutions that address changing consumer preferences. Partnership strategies with automotive manufacturers, technology companies, and service providers can create differentiated value propositions and expanded market reach.

Risk management enhancement through advanced analytics and real-time monitoring systems will become increasingly critical as market competition intensifies. Regulatory compliance investments should anticipate future policy changes while maintaining operational efficiency and customer service quality.

Market expansion opportunities exist in underserved segments including small businesses, rural consumers, and specialized vehicle categories. Cross-border growth strategies should leverage Japanese market expertise while adapting to local regulatory and cultural requirements in target markets.

Long-term projections for Japan’s auto loan market indicate continued steady growth driven by technological innovation, electric vehicle adoption, and evolving consumer preferences. Market evolution will likely favor institutions that successfully balance traditional banking strengths with digital innovation capabilities.

Electric vehicle financing is projected to represent 25% of total auto loan volume by 2030, supported by government policies and automotive industry transformation. Digital lending platforms will continue gaining market share, particularly among younger demographics who prioritize convenience and speed in financial services.

Competitive dynamics will intensify as fintech companies mature and traditional banks enhance their digital capabilities. Market consolidation may accelerate, with smaller players seeking partnerships or acquisition opportunities to remain competitive in the evolving landscape.

Regulatory framework evolution will likely support innovation while maintaining consumer protection standards, creating opportunities for new product development and service delivery models. MWR projections suggest that successful market participants will be those that effectively integrate technology, maintain strong risk management practices, and adapt to changing consumer expectations while preserving the relationship-based service quality that characterizes Japanese financial markets.

Japan’s auto loan market represents a mature, well-regulated sector experiencing gradual transformation driven by technological innovation, changing consumer preferences, and evolving automotive industry dynamics. The market’s stability and growth potential reflect Japan’s robust economic foundation and sophisticated financial services infrastructure.

Key success factors for market participants include digital transformation capabilities, strong risk management practices, strategic partnerships, and adaptability to regulatory changes. Electric vehicle financing emergence as a growth catalyst, combined with continued innovation in digital lending platforms, creates opportunities for market differentiation and expansion.

Future market evolution will likely favor institutions that successfully balance traditional banking strengths with innovative technology solutions while maintaining the high service standards expected by Japanese consumers. The sector’s continued growth and adaptation to changing mobility patterns position it as a critical component of Japan’s automotive and financial services ecosystems, supporting both economic growth and consumer mobility needs throughout the nation.

What is Auto Loan?

An auto loan is a type of financing that allows individuals to borrow money to purchase a vehicle, which is then secured by the vehicle itself. In Japan, auto loans are commonly offered by banks, credit unions, and specialized auto finance companies.

What are the key players in the Japan Auto Loan Market?

Key players in the Japan Auto Loan Market include major banks like Mitsubishi UFJ Financial Group, Sumitomo Mitsui Banking Corporation, and auto finance companies such as Toyota Financial Services and Honda Finance, among others.

What are the growth factors driving the Japan Auto Loan Market?

The Japan Auto Loan Market is driven by factors such as increasing vehicle ownership, favorable interest rates, and the growing trend of financing options among consumers. Additionally, the rise of electric and hybrid vehicles is also influencing loan offerings.

What challenges does the Japan Auto Loan Market face?

Challenges in the Japan Auto Loan Market include stringent regulatory requirements, fluctuating interest rates, and the potential for economic downturns that may affect consumer borrowing capacity. Additionally, competition from alternative financing options poses a challenge.

What opportunities exist in the Japan Auto Loan Market?

Opportunities in the Japan Auto Loan Market include the increasing demand for eco-friendly vehicles, which may lead to specialized loan products, and the potential for digital transformation in loan processing and customer service. The rise of online lending platforms also presents new avenues for growth.

What trends are shaping the Japan Auto Loan Market?

Trends in the Japan Auto Loan Market include the growing popularity of online loan applications, the integration of technology in loan management, and a shift towards more flexible repayment options. Additionally, there is an increasing focus on customer experience and personalized loan offerings.

Japan Auto Loan Market

| Segmentation Details | Description |

|---|---|

| Product Type | New Cars, Used Cars, Electric Vehicles, Hybrid Vehicles |

| Customer Type | Individual Borrowers, Corporates, Small Businesses, Government Agencies |

| Loan Type | Secured Loans, Unsecured Loans, Fixed Rate Loans, Variable Rate Loans |

| Distribution Channel | Direct Lenders, Banks, Credit Unions, Online Platforms |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Auto Loan Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at