444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan 5G small cell market represents a pivotal component of the nation’s telecommunications infrastructure transformation, driving unprecedented connectivity solutions across urban and rural landscapes. Small cell technology has emerged as a cornerstone for Japan’s ambitious 5G deployment strategy, enabling enhanced network capacity, reduced latency, and improved coverage in high-density areas. The market demonstrates remarkable momentum with a projected CAGR of 18.5% through the forecast period, reflecting the country’s commitment to technological advancement and digital innovation.

Japan’s telecommunications sector continues to prioritize small cell deployment as a strategic response to increasing data consumption and the proliferation of IoT devices. The market encompasses various small cell types including femtocells, picocells, and microcells, each serving distinct coverage requirements and deployment scenarios. Major telecommunications operators such as NTT DoCoMo, KDDI, and SoftBank are aggressively investing in small cell infrastructure to support their 5G network rollouts and maintain competitive positioning.

Government initiatives and regulatory support have significantly accelerated market growth, with policies promoting spectrum allocation and infrastructure sharing among operators. The market benefits from Japan’s dense urban population centers, which create ideal conditions for small cell deployment and optimization. Technological convergence between 5G networks and emerging applications like autonomous vehicles, smart cities, and Industry 4.0 solutions continues to drive demand for robust small cell infrastructure.

The Japan 5G small cell market refers to the comprehensive ecosystem of low-power wireless access points designed to enhance 5G network coverage and capacity within Japan’s telecommunications infrastructure. Small cells are compact base stations that operate at lower power levels compared to traditional macro cells, providing targeted coverage for specific areas with high user density or challenging propagation conditions.

These cellular solutions encompass various deployment models including indoor and outdoor installations, serving residential, commercial, and industrial environments. The market includes hardware components such as base stations, antennas, and backhaul equipment, alongside software solutions for network management and optimization. Integration capabilities with existing macro cell networks ensure seamless connectivity and enhanced user experience across diverse deployment scenarios.

Small cell technology addresses critical 5G network requirements including ultra-low latency, massive machine-type communications, and enhanced mobile broadband services. The market encompasses both standalone small cell deployments and integrated solutions that combine multiple technologies for comprehensive coverage optimization. Deployment flexibility allows operators to customize solutions based on specific coverage requirements, traffic patterns, and environmental constraints.

Japan’s 5G small cell market demonstrates exceptional growth potential driven by accelerating 5G adoption and increasing demand for high-capacity wireless connectivity. The market benefits from strong government support, advanced technological infrastructure, and aggressive operator investment strategies. Key market drivers include the proliferation of connected devices, emergence of bandwidth-intensive applications, and the need for enhanced network performance in dense urban environments.

Market segmentation reveals diverse opportunities across indoor and outdoor deployment scenarios, with indoor small cells capturing approximately 62% market share due to enterprise digitization initiatives and smart building implementations. The competitive landscape features both international technology leaders and domestic innovation companies, creating a dynamic ecosystem for technological advancement and market expansion.

Regional deployment patterns show concentrated activity in major metropolitan areas including Tokyo, Osaka, and Nagoya, with expanding coverage to secondary cities and rural regions. The market faces challenges related to deployment costs, regulatory compliance, and integration complexity, while opportunities emerge from IoT proliferation, smart city initiatives, and industrial automation requirements. Future market trajectory indicates sustained growth supported by continuous technological innovation and expanding 5G use cases.

Strategic market analysis reveals several critical insights shaping Japan’s 5G small cell landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Multiple interconnected factors are propelling the Japan 5G small cell market forward, creating a robust foundation for sustained growth and technological advancement. The primary market drivers reflect both technological evolution and changing consumer behavior patterns.

Data traffic explosion represents the most significant driver, with mobile data consumption growing at unprecedented rates due to video streaming, cloud applications, and IoT device proliferation. Japanese consumers demonstrate particularly high data usage patterns, necessitating enhanced network capacity and coverage optimization through small cell deployment. Network densification requirements continue to intensify as operators strive to meet quality of service expectations and maintain competitive positioning.

5G application emergence is creating new demands for ultra-reliable low-latency communications, massive machine-type communications, and enhanced mobile broadband services. Applications including autonomous vehicles, augmented reality, virtual reality, and industrial automation require robust network infrastructure that small cells uniquely provide. Enterprise digitization initiatives are driving demand for private 5G networks and dedicated small cell deployments in manufacturing, logistics, and healthcare sectors.

Government digital transformation policies continue to support market growth through favorable regulations, spectrum allocation, and infrastructure development incentives. The Society 5.0 initiative and smart city programs create additional demand for advanced telecommunications infrastructure. Technological advancement in small cell hardware and software solutions is reducing deployment barriers while improving performance capabilities and cost-effectiveness.

Several challenging factors present obstacles to Japan’s 5G small cell market expansion, requiring strategic solutions and industry collaboration to address effectively. These restraints impact deployment timelines, cost structures, and overall market development pace.

High deployment costs remain a primary concern for operators, particularly regarding site acquisition, installation, and ongoing maintenance expenses. Small cell networks require dense deployment patterns to achieve optimal coverage, multiplying infrastructure investment requirements. Backhaul connectivity challenges in certain areas create additional complexity and cost considerations, especially for fiber-based backhaul solutions in dense urban environments.

Regulatory complexity surrounding site permits, zoning approvals, and environmental compliance can delay deployment schedules and increase project costs. Local government approval processes vary significantly across municipalities, creating inconsistent deployment experiences. Interference management becomes increasingly complex as small cell density increases, requiring sophisticated coordination and optimization solutions.

Technical integration challenges between different vendor solutions and legacy infrastructure can complicate deployment and optimization processes. Ensuring seamless handover between macro cells and small cells requires careful planning and ongoing network optimization. Power infrastructure limitations in certain deployment locations may require additional investment in electrical infrastructure upgrades.

Emerging opportunities within Japan’s 5G small cell market present significant potential for growth, innovation, and market expansion across diverse sectors and applications. These opportunities align with broader technological trends and societal transformation initiatives.

Private network deployment represents a substantial opportunity as enterprises seek dedicated 5G connectivity for mission-critical applications. Manufacturing facilities, ports, airports, and healthcare institutions are increasingly investing in private 5G networks utilizing small cell technology. Smart city initiatives across Japanese municipalities create demand for comprehensive small cell infrastructure supporting IoT sensors, traffic management systems, and public safety applications.

Rural connectivity expansion offers significant growth potential as government programs promote digital inclusion and economic development in underserved areas. Small cells provide cost-effective solutions for extending 5G coverage to rural communities and industrial facilities. Indoor coverage enhancement in commercial buildings, shopping centers, and transportation hubs presents ongoing opportunities for specialized deployment solutions.

Technology convergence opportunities emerge from integration with edge computing, artificial intelligence, and IoT platforms, creating comprehensive connectivity solutions. The development of neutral host networks and infrastructure sharing models opens new business opportunities for specialized deployment companies. International expansion potential exists for Japanese technology companies to leverage domestic expertise in global markets.

Complex market dynamics shape the Japan 5G small cell landscape, reflecting the interplay between technological advancement, competitive pressures, regulatory evolution, and customer demands. Understanding these dynamics is essential for strategic planning and market positioning.

Competitive intensity continues to escalate as operators race to establish 5G network leadership and capture market share in key segments. This competition drives innovation, accelerates deployment timelines, and influences pricing strategies across the value chain. Technology evolution cycles create both opportunities and challenges as vendors continuously enhance product capabilities while managing backward compatibility requirements.

Supply chain dynamics significantly impact market development, with semiconductor availability, component costs, and manufacturing capacity affecting deployment schedules and project economics. Global supply chain disruptions have highlighted the importance of diversified sourcing strategies and local manufacturing capabilities. Partnership ecosystems are evolving as operators, vendors, and system integrators develop collaborative relationships to address complex deployment requirements.

Customer behavior patterns continue to evolve with increasing expectations for seamless connectivity, high-quality service, and innovative applications. Enterprise customers demonstrate growing sophistication in evaluating small cell solutions and demanding customized deployment approaches. Regulatory dynamics remain fluid as government agencies adapt policies to support 5G deployment while addressing security, privacy, and competition concerns.

Comprehensive research methodology employed for analyzing Japan’s 5G small cell market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights. The methodology combines quantitative analysis with qualitative assessment to provide holistic market understanding.

Primary research activities include extensive interviews with key industry stakeholders including telecommunications operators, equipment vendors, system integrators, and regulatory officials. Survey data collection from enterprise customers and technology users provides insights into adoption patterns, satisfaction levels, and future requirements. Expert consultations with industry analysts, academic researchers, and technology specialists enhance understanding of market trends and technological developments.

Secondary research encompasses comprehensive analysis of industry reports, government publications, financial statements, and technical documentation from leading market participants. Patent analysis and technology roadmap evaluation provide insights into innovation trends and competitive positioning. Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and growth forecasts.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews, and applying consistency checks to ensure information accuracy. Market sizing methodologies incorporate bottom-up and top-down approaches to validate market estimates and growth projections. Quality assurance protocols ensure research findings meet professional standards and provide actionable insights for market participants.

Regional market distribution across Japan reveals distinct patterns of 5G small cell adoption, deployment density, and growth potential, reflecting demographic concentrations, economic activity levels, and infrastructure development priorities. MarkWide Research analysis indicates significant regional variations in market maturity and expansion opportunities.

Greater Tokyo Area dominates market activity with approximately 45% market share, driven by high population density, extensive commercial activity, and aggressive operator competition. The region benefits from advanced infrastructure, early 5G deployment, and strong enterprise demand for private network solutions. Kansai Region including Osaka and Kyoto represents the second-largest market segment with 22% market share, supported by manufacturing concentration and smart city initiatives.

Chubu Region centered around Nagoya captures 15% market share, benefiting from automotive industry concentration and industrial automation requirements. The region demonstrates strong growth potential as manufacturers implement Industry 4.0 solutions requiring robust 5G connectivity. Northern regions including Tohoku and Hokkaido show emerging opportunities with 8% combined market share, supported by government rural connectivity programs and tourism industry digitization.

Southern regions including Kyushu and Chugoku represent 10% market share with growth driven by port automation, logistics optimization, and renewable energy integration projects. Regional deployment strategies vary based on local requirements, with urban areas focusing on capacity enhancement while rural regions prioritize coverage extension and connectivity improvement.

The competitive landscape of Japan’s 5G small cell market features a diverse ecosystem of international technology leaders, domestic innovation companies, and specialized solution providers. Market participants compete across multiple dimensions including technology performance, cost effectiveness, deployment expertise, and customer relationships.

Competitive strategies emphasize technology differentiation, cost optimization, and comprehensive service offerings. Market leaders invest heavily in research and development to maintain technological advantages while expanding partnership networks to enhance market reach and deployment capabilities.

Market segmentation analysis reveals diverse opportunities across multiple dimensions including technology type, deployment location, application sector, and customer segment. Understanding segmentation patterns enables targeted strategies and optimized resource allocation for market participants.

By Technology Type:

By Deployment Location:

By Application Sector:

Detailed category analysis provides comprehensive understanding of market dynamics, growth patterns, and opportunity distribution across different small cell deployment categories and application segments.

Indoor Small Cell Category demonstrates the strongest growth momentum with deployment rates increasing 28% annually driven by enterprise digitization and smart building initiatives. This category benefits from controlled deployment environments, predictable coverage requirements, and strong ROI potential for enterprise customers. Technology integration with building management systems and IoT platforms creates additional value propositions and differentiation opportunities.

Outdoor Small Cell Category shows steady expansion supported by urban densification requirements and coverage enhancement needs. Deployment challenges related to site acquisition and environmental factors are offset by technological improvements and streamlined installation processes. Smart city applications including traffic management, environmental monitoring, and public safety systems drive demand for outdoor small cell infrastructure.

Private Network Category emerges as a high-growth segment with enterprises increasingly investing in dedicated 5G infrastructure for mission-critical applications. Manufacturing, healthcare, and logistics sectors demonstrate particularly strong adoption patterns. Customization requirements and specialized deployment approaches create opportunities for specialized service providers and system integrators.

Carrier Network Category remains the largest market segment by deployment volume, with operators prioritizing network densification and capacity enhancement. Competition intensity drives continuous innovation and cost optimization efforts. Network sharing initiatives and neutral host deployments create new business models and market opportunities.

Multiple stakeholder groups realize significant benefits from Japan’s expanding 5G small cell market, creating value across the telecommunications ecosystem and supporting broader economic development objectives.

Telecommunications Operators benefit from enhanced network capacity, improved coverage quality, and reduced per-bit transmission costs. Small cell deployment enables operators to address capacity constraints in high-traffic areas while maintaining service quality standards. Revenue diversification opportunities emerge through private network services, enterprise solutions, and specialized connectivity offerings. Operational efficiency improvements result from automated network management and optimization capabilities.

Enterprise Customers gain access to reliable, high-performance connectivity supporting digital transformation initiatives and operational optimization. Private 5G networks enable innovative applications including autonomous systems, real-time monitoring, and advanced analytics. Competitive advantages result from enhanced operational efficiency, improved customer experiences, and new business model opportunities.

Technology Vendors benefit from expanding market opportunities, recurring revenue streams, and technology innovation drivers. Small cell market growth supports research and development investment while creating economies of scale for manufacturing operations. Partnership opportunities with operators, system integrators, and enterprise customers enhance market reach and solution capabilities.

Government and Society realize benefits including improved digital infrastructure, enhanced economic competitiveness, and support for smart city initiatives. Small cell deployment contributes to digital inclusion objectives and rural connectivity improvement. Innovation ecosystem development supports technology leadership and export potential for Japanese companies.

Comprehensive SWOT analysis provides strategic insights into Japan’s 5G small cell market position, highlighting internal capabilities and external factors influencing market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends shape the evolution of Japan’s 5G small cell landscape, reflecting technological advancement, changing customer requirements, and industry transformation patterns. These trends provide insights into future market direction and strategic opportunities.

Network Densification Acceleration represents a fundamental trend as operators deploy increasingly dense small cell networks to meet capacity and coverage requirements. This trend drives demand for advanced interference management, network optimization, and automated deployment solutions. Deployment efficiency becomes critical as operators seek to minimize installation time and operational complexity while maximizing network performance.

Private Network Proliferation continues gaining momentum as enterprises recognize the strategic value of dedicated 5G connectivity for mission-critical applications. This trend creates opportunities for specialized deployment services, customized solutions, and vertical-specific applications. Industry-specific requirements drive development of tailored small cell solutions for manufacturing, healthcare, transportation, and other sectors.

Edge Computing Integration emerges as a key trend combining small cell connectivity with distributed computing capabilities. This convergence enables ultra-low latency applications, local data processing, and enhanced security for enterprise deployments. Multi-access edge computing platforms integrated with small cells create new service opportunities and revenue streams for operators and technology providers.

Artificial Intelligence Adoption in network management and optimization is transforming small cell deployment and operation. AI-powered solutions enable predictive maintenance, automated optimization, and intelligent resource allocation. Machine learning algorithms improve network performance while reducing operational costs and complexity.

Recent industry developments demonstrate the dynamic nature of Japan’s 5G small cell market, highlighting technological breakthroughs, strategic partnerships, and regulatory changes that influence market trajectory and competitive positioning.

Major operator announcements regarding accelerated 5G deployment timelines and expanded small cell investment commitments signal strong market confidence and growth potential. NTT DoCoMo’s partnership expansion with international vendors enhances technology access and deployment capabilities. KDDI’s enterprise-focused initiatives demonstrate growing recognition of private network opportunities and vertical market potential.

Technology vendor innovations including advanced antenna systems, software-defined networking capabilities, and integrated edge computing platforms enhance small cell value propositions. MWR analysis indicates that vendor consolidation activities and strategic acquisitions are reshaping competitive dynamics and market structure. Open RAN initiatives promote interoperability and vendor diversity while reducing deployment costs.

Government policy developments including spectrum allocation decisions, infrastructure sharing regulations, and digital transformation funding programs continue to support market growth. Local government smart city initiatives create additional demand for small cell infrastructure and innovative applications. International cooperation agreements facilitate technology transfer and market access for Japanese companies in global markets.

Industry collaboration initiatives between operators, vendors, and research institutions accelerate technology development and standardization efforts. Testing and validation programs ensure interoperability and performance optimization across different vendor solutions. Ecosystem partnerships create comprehensive solution offerings combining connectivity, computing, and application capabilities.

Strategic recommendations for market participants focus on optimizing market positioning, enhancing competitive advantages, and capitalizing on emerging opportunities within Japan’s evolving 5G small cell landscape.

For Telecommunications Operators: Prioritize strategic small cell deployment in high-value locations while developing comprehensive private network service offerings. Invest in automation and AI-powered network management to reduce operational costs and improve service quality. Partnership strategies with enterprise customers and vertical industry specialists can accelerate market penetration and revenue diversification. Focus on differentiated service offerings that leverage small cell capabilities for competitive advantage.

For Technology Vendors: Emphasize solution integration and comprehensive service offerings rather than standalone product sales. Develop specialized solutions for key vertical markets including manufacturing, healthcare, and transportation. Local partnership development with Japanese system integrators and service providers enhances market access and customer relationships. Invest in research and development to maintain technology leadership while optimizing cost structures for competitive pricing.

For Enterprise Customers: Evaluate private 5G network opportunities as part of comprehensive digital transformation strategies. Consider phased deployment approaches that demonstrate value while managing investment risk. Pilot project implementation can validate use cases and build internal expertise before large-scale deployment. Engage with multiple vendors and service providers to ensure optimal solution selection and competitive pricing.

For Government and Regulators: Continue supporting market development through favorable policies, streamlined approval processes, and infrastructure sharing initiatives. Promote innovation through research funding and public-private partnerships. Digital inclusion programs should leverage small cell technology to extend 5G benefits to underserved communities and rural areas.

The future trajectory of Japan’s 5G small cell market indicates sustained growth driven by technological advancement, expanding applications, and evolving customer requirements. Market evolution will be shaped by continued innovation, regulatory development, and competitive dynamics across the telecommunications ecosystem.

Technology advancement will continue driving market expansion with next-generation small cell solutions offering enhanced performance, reduced costs, and simplified deployment. Integration with emerging technologies including 6G research, quantum communications, and advanced AI will create new opportunities and applications. Deployment automation and self-optimizing networks will reduce operational complexity while improving network performance and reliability.

Market expansion patterns indicate growing adoption across diverse sectors and applications, with private networks representing the fastest-growing segment. Enterprise digitization initiatives will drive demand for specialized small cell solutions supporting Industry 4.0, smart buildings, and connected logistics. Rural connectivity expansion will create new market opportunities as government programs promote digital inclusion and economic development.

Competitive landscape evolution will feature continued consolidation, strategic partnerships, and ecosystem development. Market leaders will focus on comprehensive solution offerings combining hardware, software, and services. Innovation acceleration through research and development investment will maintain Japan’s technology leadership position while supporting export opportunities in global markets.

Regulatory environment development will continue supporting market growth through spectrum optimization, infrastructure sharing promotion, and innovation-friendly policies. International cooperation and standardization efforts will facilitate technology interoperability and global market access. Sustainability initiatives will influence technology development and deployment practices, promoting energy efficiency and environmental responsibility.

Japan’s 5G small cell market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, regulatory support, and expanding application opportunities. The market benefits from strong fundamentals including advanced infrastructure, competitive operator environment, and government commitment to digital transformation initiatives.

Key success factors for market participants include strategic positioning, technology innovation, and comprehensive service offerings that address diverse customer requirements. The convergence of 5G connectivity with edge computing, artificial intelligence, and IoT platforms creates unprecedented opportunities for value creation and market differentiation. Collaboration and partnership strategies will be essential for navigating market complexity and capitalizing on emerging opportunities.

Market challenges related to deployment costs, technical complexity, and regulatory compliance require strategic solutions and industry cooperation. However, the long-term outlook remains highly positive with sustained growth expected across multiple market segments and applications. MarkWide Research projections indicate continued market expansion supported by technological advancement, increasing demand for high-performance connectivity, and evolving customer requirements across enterprise and consumer segments.

The Japan 5G small cell market will continue serving as a critical enabler of digital transformation, economic competitiveness, and technological innovation, positioning Japan as a global leader in next-generation telecommunications infrastructure and applications.

What is 5G Small Cell?

5G Small Cell refers to low-powered cellular radio access nodes that operate in a range of a few hundred meters. They are essential for enhancing network capacity and coverage, particularly in urban areas where high data traffic is prevalent.

What are the key players in the Japan 5G Small Cell Market?

Key players in the Japan 5G Small Cell Market include NTT Docomo, SoftBank, and NEC Corporation, which are actively involved in deploying small cell technology to improve network performance and user experience, among others.

What are the growth factors driving the Japan 5G Small Cell Market?

The growth of the Japan 5G Small Cell Market is driven by the increasing demand for high-speed internet, the proliferation of IoT devices, and the need for enhanced mobile broadband services in densely populated areas.

What challenges does the Japan 5G Small Cell Market face?

Challenges in the Japan 5G Small Cell Market include regulatory hurdles related to site acquisition, the high costs of deployment, and the need for extensive infrastructure upgrades to support small cell networks.

What opportunities exist in the Japan 5G Small Cell Market?

Opportunities in the Japan 5G Small Cell Market include the expansion of smart city initiatives, the growth of augmented and virtual reality applications, and the increasing adoption of autonomous vehicles that require robust connectivity.

What trends are shaping the Japan 5G Small Cell Market?

Trends in the Japan 5G Small Cell Market include the integration of artificial intelligence for network management, the deployment of Open RAN technology, and the collaboration between telecom operators and technology providers to enhance service delivery.

Japan 5G Small Cell Market

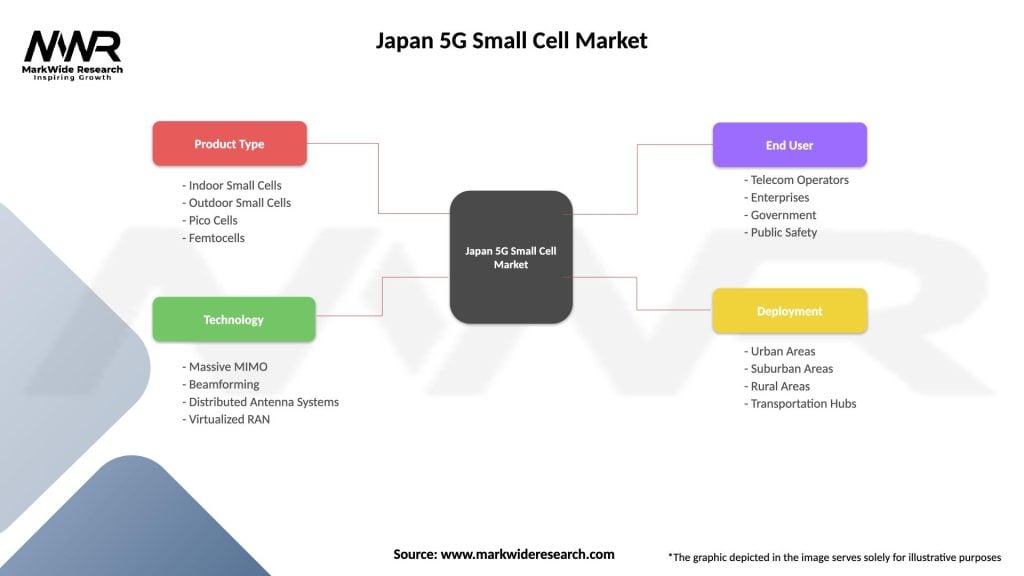

| Segmentation Details | Description |

|---|---|

| Product Type | Indoor Small Cells, Outdoor Small Cells, Pico Cells, Femtocells |

| Technology | Massive MIMO, Beamforming, Distributed Antenna Systems, Virtualized RAN |

| End User | Telecom Operators, Enterprises, Government, Public Safety |

| Deployment | Urban Areas, Suburban Areas, Rural Areas, Transportation Hubs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan 5G Small Cell Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at