444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy textile industry market stands as one of Europe’s most prestigious and influential textile manufacturing sectors, renowned for its exceptional quality, innovative designs, and rich heritage spanning centuries. Italy’s textile sector encompasses a comprehensive range of activities including fiber production, fabric manufacturing, garment assembly, and luxury fashion creation, positioning the country as a global leader in high-end textile products. The industry demonstrates remarkable resilience and adaptability, with sustainable manufacturing practices gaining significant traction and driving modernization efforts across traditional production facilities.

Market dynamics indicate robust growth potential driven by increasing demand for premium textiles, sustainable fashion initiatives, and technological innovations in manufacturing processes. The sector benefits from Italy’s strategic location, skilled workforce, and established supply chain networks that connect European markets with global distribution channels. Digital transformation initiatives are reshaping traditional manufacturing approaches, with companies investing heavily in automation, artificial intelligence, and eco-friendly production technologies to maintain competitive advantages in international markets.

Regional concentration remains particularly strong in northern Italian regions, where textile clusters have evolved into sophisticated industrial ecosystems supporting both large-scale manufacturers and specialized artisanal producers. The industry’s commitment to circular economy principles has accelerated adoption of recycling technologies and sustainable material sourcing, attracting environmentally conscious consumers and international brands seeking responsible manufacturing partners.

The Italy textile industry market refers to the comprehensive ecosystem of companies, organizations, and stakeholders involved in the production, processing, and distribution of textile materials, fabrics, and finished products within Italy’s manufacturing sector. This market encompasses traditional textile manufacturing, luxury fashion production, technical textiles, and innovative sustainable materials development, representing one of Italy’s most significant industrial sectors with deep cultural and economic importance.

Industry scope extends beyond basic textile production to include sophisticated value-added services such as design consulting, pattern development, quality assurance, and logistics management. The market integrates traditional craftsmanship with modern manufacturing technologies, creating unique competitive advantages that distinguish Italian textile products in global markets. Vertical integration characterizes many Italian textile companies, allowing comprehensive control over production processes from raw material sourcing through final product delivery.

Market participants include multinational corporations, family-owned enterprises, specialized manufacturers, design houses, and technology providers working collaboratively to maintain Italy’s reputation for textile excellence. The industry’s definition encompasses both business-to-business operations serving international fashion brands and direct-to-consumer activities targeting luxury market segments worldwide.

Italy’s textile industry continues demonstrating exceptional performance across multiple market segments, driven by increasing global demand for premium quality textiles and sustainable manufacturing solutions. The sector’s strategic focus on innovation, sustainability, and digital transformation positions Italian manufacturers advantageously for long-term growth in competitive international markets. Export performance remains particularly strong, with Italian textile products commanding premium prices in luxury fashion, home textiles, and technical applications worldwide.

Key growth drivers include rising consumer awareness of sustainable fashion, increasing demand for high-quality textiles in emerging markets, and technological advancements enabling more efficient production processes. The industry benefits from Italy’s established reputation for design excellence, manufacturing quality, and innovation capabilities that attract international partnerships and investment opportunities. Digital integration initiatives are transforming traditional business models, enabling greater customization, improved supply chain efficiency, and enhanced customer engagement strategies.

Market challenges include increasing competition from low-cost manufacturing regions, rising raw material costs, and regulatory pressures related to environmental compliance. However, Italian textile companies are successfully addressing these challenges through strategic positioning in premium market segments, investment in sustainable technologies, and development of innovative products that justify higher price points through superior quality and performance characteristics.

Strategic positioning analysis reveals several critical insights driving Italy’s textile industry market development and competitive advantages in global markets:

Sustainability imperatives represent the most significant driver transforming Italy’s textile industry market, as consumers and brands increasingly prioritize environmental responsibility in purchasing decisions. Italian manufacturers are leveraging this trend by investing heavily in eco-friendly production technologies, sustainable material sourcing, and circular economy initiatives that reduce waste and environmental impact. Regulatory support from European Union policies promoting sustainable manufacturing practices provides additional momentum for companies adopting green technologies and processes.

Luxury market expansion continues driving demand for high-quality Italian textiles, particularly in emerging markets where growing affluent populations seek premium fashion and home textile products. The association between Italian manufacturing and superior quality creates significant competitive advantages in luxury segments, enabling premium pricing strategies and strong profit margins. Brand partnerships with international fashion houses and luxury goods manufacturers provide stable demand and opportunities for collaborative innovation projects.

Technological advancement adoption is accelerating across the industry, with manufacturers implementing automation, artificial intelligence, and digital design tools to improve efficiency while maintaining quality standards. These technologies enable greater customization capabilities, faster production cycles, and improved resource utilization, addressing customer demands for personalized products and sustainable manufacturing practices. Digital integration initiatives are creating new business models and revenue streams through direct-to-consumer channels and value-added services.

Export market opportunities in Asia-Pacific regions are driving significant growth, with Italian textile products gaining popularity among consumers seeking authentic luxury experiences and superior quality. Government trade promotion initiatives and industry associations are facilitating market entry and expansion efforts, providing support for companies seeking to establish international presence and distribution networks.

Cost competitiveness challenges pose significant constraints for Italian textile manufacturers competing against low-cost production regions, particularly in price-sensitive market segments. Rising labor costs, energy expenses, and raw material prices are pressuring profit margins and forcing companies to justify premium pricing through superior quality, innovation, and service offerings. Manufacturing efficiency improvements through technology adoption help mitigate cost pressures but require substantial capital investments that may strain smaller companies’ financial resources.

Regulatory compliance requirements related to environmental protection, worker safety, and product quality standards are increasing operational complexity and costs for textile manufacturers. While these regulations support sustainability objectives and worker protection, they create additional administrative burdens and require ongoing investment in compliance systems and processes. International trade regulations and tariff policies can impact export competitiveness and market access, particularly in key markets outside the European Union.

Raw material availability and price volatility present ongoing challenges for textile manufacturers, particularly those dependent on natural fibers and specialized synthetic materials. Supply chain disruptions, weather-related impacts on natural fiber production, and geopolitical tensions affecting material sourcing can significantly impact production costs and delivery schedules. Inventory management becomes increasingly complex as companies balance cost optimization with supply security requirements.

Skilled workforce shortages in specialized manufacturing roles and technical positions constrain growth potential and innovation capabilities for many textile companies. The industry’s traditional image and competition from other sectors for qualified personnel create recruitment challenges, particularly for positions requiring advanced technical skills and experience with modern manufacturing technologies.

Sustainable textile innovation presents exceptional opportunities for Italian manufacturers to develop and commercialize eco-friendly materials, production processes, and circular economy solutions. Growing consumer awareness of environmental issues and regulatory support for sustainable manufacturing create favorable market conditions for companies investing in green technologies and sustainable product development. Bio-based materials and recycling technologies offer potential for significant competitive advantages and premium market positioning.

Smart textile development represents an emerging opportunity segment where Italian manufacturers can leverage their technical expertise and innovation capabilities to create high-value products for healthcare, sports, automotive, and industrial applications. The integration of electronic components, sensors, and connectivity features into textile products opens new market segments and revenue streams. Research partnerships with technology companies and academic institutions can accelerate development and commercialization of smart textile solutions.

Digital marketplace expansion offers opportunities for direct customer engagement, customization services, and premium pricing strategies through e-commerce platforms and digital marketing initiatives. Italian textile companies can leverage their brand heritage and quality reputation to build strong online presence and reach global customers directly. Omnichannel strategies combining traditional distribution with digital channels can enhance market reach and customer experience.

Emerging market penetration in Asia-Pacific, Latin America, and Africa regions presents significant growth opportunities as rising income levels and urbanization drive demand for quality textile products. Italian manufacturers can establish strategic partnerships, joint ventures, or direct investment to capture market share in these growing regions. Cultural appreciation for Italian design and manufacturing excellence provides natural competitive advantages in luxury and premium market segments.

Competitive landscape evolution is reshaping Italy’s textile industry market as companies adapt to changing consumer preferences, technological advances, and global market conditions. Traditional manufacturers are transforming business models to emphasize sustainability, innovation, and customer-centric approaches while maintaining core competencies in quality and design. Consolidation trends are creating larger, more diversified companies capable of investing in advanced technologies and international expansion initiatives.

Supply chain transformation initiatives are optimizing efficiency, reducing costs, and improving responsiveness to market demands through digital technologies, strategic partnerships, and vertical integration strategies. Companies are implementing advanced planning systems, real-time monitoring capabilities, and flexible manufacturing approaches to enhance competitiveness. Nearshoring trends are benefiting Italian manufacturers as international brands seek to reduce supply chain risks and improve sustainability profiles.

Innovation ecosystem development is fostering collaboration between textile manufacturers, technology providers, research institutions, and design organizations to accelerate product development and market introduction of advanced textile solutions. Industry clusters in northern Italy are evolving into comprehensive innovation hubs supporting both established companies and emerging startups. Knowledge sharing initiatives and collaborative research projects are enhancing overall industry competitiveness and innovation capabilities.

Customer relationship evolution is driving changes in business models as manufacturers develop direct connections with end consumers through digital channels, customization services, and brand experiences. This shift enables better understanding of market trends, customer preferences, and emerging opportunities while reducing dependence on traditional intermediaries. Value-added services including design consulting, sustainability certification, and supply chain transparency are becoming important competitive differentiators.

Comprehensive market analysis methodology combines quantitative data collection with qualitative insights to provide thorough understanding of Italy’s textile industry market dynamics, trends, and opportunities. Primary research activities include structured interviews with industry executives, manufacturers, suppliers, and customers to gather firsthand perspectives on market conditions, challenges, and strategic priorities. Survey instruments are designed to capture both operational metrics and strategic insights from diverse market participants across different industry segments and geographic regions.

Secondary research integration incorporates analysis of industry reports, government statistics, trade association data, and academic studies to validate primary findings and provide broader market context. Financial analysis of publicly traded companies, patent research, and regulatory document review contribute additional insights into market trends and competitive dynamics. Data triangulation methods ensure accuracy and reliability of research findings through cross-validation of multiple information sources.

Market segmentation analysis employs statistical techniques to identify distinct customer groups, product categories, and geographic markets with unique characteristics and growth patterns. Cluster analysis, regression modeling, and trend analysis provide quantitative foundation for market insights and forecasting. Competitive intelligence gathering includes analysis of company strategies, product portfolios, market positioning, and performance metrics to understand competitive landscape dynamics.

Expert validation processes involve review of research findings by industry specialists, academic researchers, and market analysts to ensure accuracy, relevance, and practical applicability of insights and recommendations. Focus group discussions and stakeholder workshops provide additional validation and refinement of research conclusions.

Northern Italy dominance continues characterizing the textile industry landscape, with Lombardy, Veneto, and Piedmont regions accounting for approximately 75% of national textile production. These regions benefit from established industrial infrastructure, skilled workforce availability, and proximity to major European markets. Textile clusters in cities like Milan, Bergamo, and Biella have evolved into sophisticated ecosystems supporting both large manufacturers and specialized suppliers, creating competitive advantages through knowledge sharing and collaborative innovation.

Lombardy region maintains leadership position with diverse textile manufacturing capabilities spanning luxury fashion, technical textiles, and industrial applications. The region’s strategic location, transportation infrastructure, and financial services availability support both domestic operations and international expansion initiatives. Innovation centers and research facilities in Lombardy drive technological advancement and sustainable manufacturing development across the broader industry.

Veneto textile sector demonstrates particular strength in home textiles, outdoor fabrics, and specialized industrial applications, with companies leveraging regional expertise in synthetic fiber processing and advanced weaving technologies. The region’s export orientation and established international relationships provide strong foundation for continued growth in global markets. Sustainability initiatives in Veneto are setting industry standards for environmental responsibility and circular economy implementation.

Central and Southern Italy regions are developing complementary textile capabilities focusing on specific market niches, traditional craftsmanship, and emerging sustainable materials. These regions benefit from lower operational costs, government incentives for industrial development, and growing recognition for quality and innovation. Regional specialization strategies are creating unique competitive advantages and supporting overall industry diversification efforts.

Market leadership in Italy’s textile industry is distributed among several categories of companies, each contributing unique strengths and capabilities to the overall competitive landscape:

Competitive strategies emphasize differentiation through quality, innovation, sustainability, and customer service rather than price competition. Companies are investing heavily in research and development, sustainable technologies, and digital transformation initiatives to maintain competitive advantages. Strategic partnerships with international brands, technology providers, and research institutions are becoming increasingly important for market success and growth.

Product category segmentation reveals distinct market dynamics and growth patterns across different textile applications and end-use markets:

By Product Type:

By Application Sector:

By Manufacturing Process:

Luxury fashion textiles continue demonstrating exceptional performance with sustained demand growth driven by international brand partnerships and expanding affluent consumer markets. This category benefits from Italy’s established reputation for quality and design excellence, enabling premium pricing strategies and strong profit margins. Innovation focus in luxury textiles emphasizes sustainable materials, advanced finishing techniques, and customization capabilities that differentiate Italian products from competitors.

Technical textiles segment shows robust growth potential as manufacturers leverage advanced materials science and engineering capabilities to develop specialized solutions for automotive, aerospace, and industrial applications. Italian companies are successfully competing in this segment through innovation, quality, and technical expertise rather than cost leadership. Research partnerships with technology companies and academic institutions are accelerating development of advanced technical textile solutions.

Sustainable textiles category represents the fastest-growing segment as environmental consciousness drives demand for eco-friendly materials and production processes. Italian manufacturers are investing heavily in sustainable technologies, circular economy initiatives, and environmental certification programs to capture market opportunities. Regulatory support and consumer preference trends favor companies with strong sustainability credentials and transparent environmental practices.

Home textiles market demonstrates steady growth supported by renovation activities, interior design trends, and increasing consumer spending on home improvement. Italian manufacturers compete successfully in premium home textile segments through design innovation, quality materials, and brand reputation. Digital marketing and e-commerce initiatives are expanding market reach and enabling direct consumer relationships.

Manufacturers benefit from Italy’s textile industry market through access to skilled workforce, established supply chains, and reputation for quality that enables premium pricing strategies. The industry’s focus on innovation and sustainability creates opportunities for differentiation and competitive advantage in global markets. Technology adoption support and research collaboration opportunities help manufacturers improve efficiency, reduce costs, and develop new products for emerging market segments.

Suppliers and vendors gain from stable demand, long-term partnerships, and opportunities to participate in innovation projects with leading textile manufacturers. The industry’s vertical integration trends create opportunities for specialized suppliers to provide value-added services and develop strategic relationships. Quality standards and certification requirements in Italian textile industry help suppliers improve capabilities and access international markets.

Investors and financial institutions benefit from the textile industry’s resilience, export performance, and growth potential in sustainable and technical textile segments. The sector’s transformation toward higher-value applications and digital integration creates attractive investment opportunities. Government support for industry modernization and export promotion provides additional confidence for investment decisions.

End customers receive superior quality products, innovative designs, and sustainable options that meet evolving preferences and requirements. Italian textile products offer durability, performance, and aesthetic appeal that justify premium pricing and provide long-term value. Customization capabilities and direct-to-consumer channels enhance customer experience and satisfaction.

Regional communities benefit from employment opportunities, economic development, and preservation of traditional craftsmanship skills that contribute to cultural heritage. The industry’s commitment to sustainability and environmental responsibility supports community well-being and quality of life improvements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Circular economy adoption is transforming textile manufacturing practices as companies implement comprehensive recycling programs, waste reduction initiatives, and sustainable material sourcing strategies. Italian manufacturers are leading this transition through investment in advanced recycling technologies and development of closed-loop production systems. Consumer awareness of environmental issues is driving demand for products with transparent sustainability credentials and verified environmental performance.

Digital integration acceleration is reshaping business models through implementation of Industry 4.0 technologies, artificial intelligence, and data analytics for production optimization and customer engagement. Manufacturers are adopting digital design tools, automated production systems, and predictive maintenance technologies to improve efficiency and quality. E-commerce expansion is enabling direct customer relationships and customization services that enhance value propositions and profit margins.

Smart textile development is creating new market opportunities as manufacturers integrate electronic components, sensors, and connectivity features into traditional textile products. Applications in healthcare monitoring, sports performance, and industrial safety are driving innovation and investment in this emerging segment. Research collaboration between textile companies and technology providers is accelerating development and commercialization of smart textile solutions.

Customization and personalization trends are driving demand for flexible manufacturing capabilities and direct-to-consumer services that enable tailored products and premium pricing. Italian manufacturers are leveraging their craftsmanship heritage and quality reputation to develop bespoke services and limited-edition products. Digital platforms are facilitating customer engagement and enabling mass customization approaches that combine efficiency with personalization.

Supply chain localization initiatives are benefiting Italian manufacturers as international brands seek to reduce risks, improve sustainability profiles, and enhance supply chain transparency. Nearshoring trends are creating opportunities for Italian companies to capture production that previously moved to distant low-cost regions.

Sustainability certification programs are becoming increasingly important as manufacturers seek to verify environmental performance and meet customer requirements for responsible sourcing. Italian textile companies are investing in comprehensive certification systems covering energy use, water consumption, waste management, and social responsibility practices. Blockchain technology implementation is enabling supply chain transparency and traceability that support sustainability claims and brand authenticity.

Advanced manufacturing technology adoption is accelerating across the industry with companies implementing robotics, artificial intelligence, and digital production systems to improve efficiency while maintaining quality standards. These investments are enabling Italian manufacturers to compete more effectively with low-cost producers while preserving employment and craftsmanship traditions. Government incentives for technology modernization are supporting industry transformation initiatives.

International partnership expansion is creating new opportunities for Italian textile companies to access global markets, share technology, and develop innovative products. Strategic alliances with fashion brands, technology companies, and research institutions are facilitating knowledge transfer and market development. Export promotion initiatives by government and industry associations are supporting international expansion efforts.

Workforce development programs are addressing skills gaps and preparing workers for advanced manufacturing technologies through collaboration between companies, educational institutions, and government agencies. These initiatives focus on technical training, digital skills, and sustainability practices that support industry competitiveness. Apprenticeship programs are preserving traditional craftsmanship while incorporating modern manufacturing techniques.

Research and innovation investment is increasing significantly as companies and government agencies recognize the importance of technological advancement for long-term competitiveness. Focus areas include sustainable materials, smart textiles, advanced manufacturing processes, and digital technologies that enhance customer experience and operational efficiency.

Strategic positioning recommendations emphasize the importance of continued focus on premium market segments where Italian textile manufacturers can leverage quality, design, and innovation advantages to justify higher pricing and maintain profit margins. Companies should avoid direct competition in commodity segments and instead concentrate on value-added applications that utilize core competencies. Brand development initiatives should emphasize heritage, craftsmanship, and sustainability to differentiate from competitors and build customer loyalty.

Technology investment priorities should focus on digital transformation initiatives that improve operational efficiency, enable customization capabilities, and enhance customer engagement. Automation and artificial intelligence adoption can help address labor cost challenges while maintaining quality standards and production flexibility. Sustainability technologies deserve particular attention as environmental responsibility becomes increasingly important for market success and regulatory compliance.

Market expansion strategies should prioritize emerging markets in Asia-Pacific regions where growing affluent populations seek premium textile products and appreciate Italian quality and design. Strategic partnerships with local distributors, fashion brands, and retail channels can facilitate market entry and reduce investment risks. Digital marketing and e-commerce capabilities are essential for reaching international customers and building brand awareness.

Innovation collaboration with technology companies, research institutions, and international partners can accelerate product development and market introduction of advanced textile solutions. Focus areas should include smart textiles, sustainable materials, and technical applications that offer higher margins and growth potential. Intellectual property protection becomes increasingly important as companies develop proprietary technologies and processes.

Supply chain optimization efforts should emphasize flexibility, sustainability, and risk management while maintaining quality standards and cost competitiveness. Vertical integration strategies and strategic supplier partnerships can improve control over production processes and ensure consistent quality delivery. Nearshoring opportunities should be evaluated as international brands seek to reduce supply chain risks and improve sustainability profiles.

Long-term growth prospects for Italy’s textile industry market remain positive, driven by increasing global demand for premium textiles, sustainable manufacturing solutions, and innovative products that combine traditional craftsmanship with modern technology. MarkWide Research analysis indicates continued expansion opportunities in luxury fashion, technical textiles, and sustainable materials segments where Italian manufacturers maintain competitive advantages through quality, innovation, and brand reputation.

Sustainability transformation will continue driving industry evolution as environmental responsibility becomes a primary competitive factor and regulatory requirement. Companies investing in circular economy practices, renewable energy, and sustainable materials development are positioned for long-term success in evolving market conditions. Consumer preferences increasingly favor products with verified sustainability credentials and transparent environmental performance.

Digital integration acceleration will reshape business models, customer relationships, and operational processes as manufacturers adopt Industry 4.0 technologies and develop direct-to-consumer capabilities. E-commerce growth, customization services, and data-driven decision making will become essential capabilities for market success. Artificial intelligence and automation adoption will help address labor cost challenges while improving efficiency and quality consistency.

International market expansion opportunities in Asia-Pacific, Latin America, and Africa regions will drive export growth as rising income levels and urbanization increase demand for quality textile products. Italian manufacturers with strong brand positioning and sustainable practices are well-positioned to capture market share in these growing regions. Trade relationships and government support for export promotion will facilitate international expansion efforts.

Innovation investment in smart textiles, advanced materials, and technical applications will create new revenue streams and market opportunities for companies with research and development capabilities. Collaboration with technology partners and academic institutions will accelerate innovation and commercialization of breakthrough products. Intellectual property development will become increasingly important for maintaining competitive advantages and justifying premium pricing strategies.

Italy’s textile industry market demonstrates remarkable resilience and adaptability in navigating global competitive challenges while maintaining leadership in quality, innovation, and sustainability. The sector’s strategic focus on premium market segments, sustainable manufacturing practices, and digital transformation positions Italian manufacturers advantageously for continued growth and market expansion. Competitive advantages rooted in centuries of textile heritage, skilled craftsmanship, and design excellence provide strong foundation for long-term success in evolving market conditions.

Market dynamics favor companies that can successfully balance traditional strengths with modern capabilities, emphasizing sustainability, innovation, and customer-centric approaches. The industry’s commitment to environmental responsibility, technological advancement, and international expansion creates multiple pathways for growth and value creation. Strategic partnerships and collaboration initiatives will continue playing crucial roles in accessing new markets, developing innovative products, and maintaining competitive positioning.

Future success will depend on continued investment in sustainability technologies, digital transformation, and innovation capabilities that differentiate Italian textile products in global markets. Companies that can effectively leverage brand heritage while embracing modern manufacturing technologies and business models are positioned for exceptional performance in the evolving Italy textile industry market landscape.

What is Italy Textile?

Italy Textile refers to the production and trade of fabrics, garments, and other textile products within Italy. This sector is known for its high-quality materials and craftsmanship, playing a significant role in the country’s economy and cultural heritage.

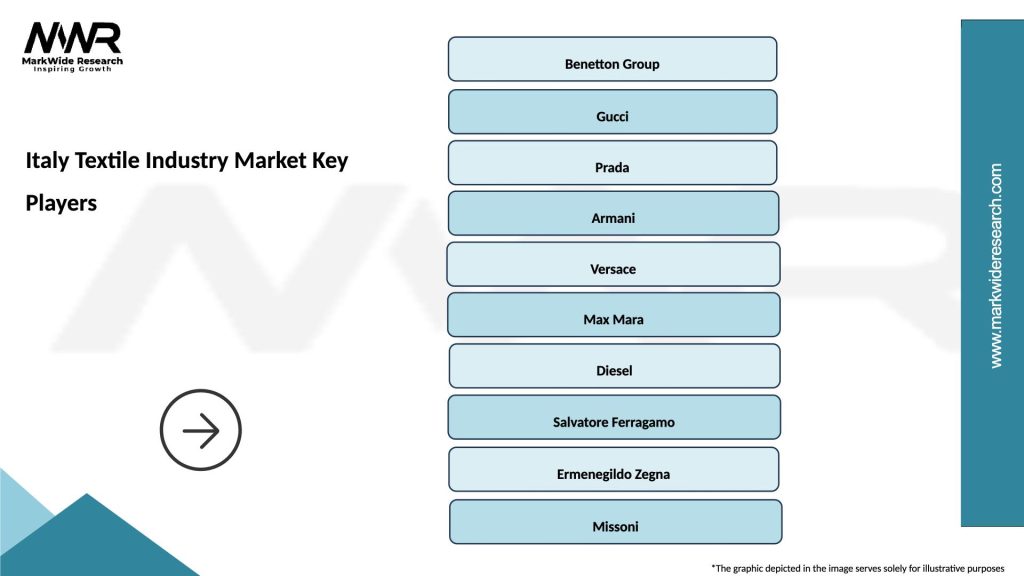

What are the key players in the Italy Textile Industry Market?

Key players in the Italy Textile Industry Market include companies like Gucci, Prada, and Benetton, which are renowned for their luxury fashion and textile products. Other notable companies include Calzedonia and OVS, among others.

What are the growth factors driving the Italy Textile Industry Market?

The growth of the Italy Textile Industry Market is driven by factors such as increasing demand for sustainable and high-quality fabrics, the rise of e-commerce in fashion retail, and the global trend towards luxury and designer clothing.

What challenges does the Italy Textile Industry Market face?

The Italy Textile Industry Market faces challenges such as competition from low-cost manufacturing countries, fluctuating raw material prices, and the need to adapt to changing consumer preferences towards sustainability and ethical production.

What opportunities exist in the Italy Textile Industry Market?

Opportunities in the Italy Textile Industry Market include the growing interest in eco-friendly textiles, the potential for innovation in smart fabrics, and the expansion of online retail channels that cater to a global audience.

What trends are shaping the Italy Textile Industry Market?

Trends shaping the Italy Textile Industry Market include a shift towards sustainable practices, the integration of technology in textile production, and a focus on customization and personalization in fashion, reflecting changing consumer demands.

Italy Textile Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Woven Fabrics, Knitted Fabrics, Non-woven Fabrics, Technical Textiles |

| End User | Apparel, Home Textiles, Automotive Interiors, Industrial Applications |

| Material | Cotton, Polyester, Wool, Linen |

| Distribution Channel | Online Retail, Specialty Stores, Wholesale Distributors, Supermarkets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Textile Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at