444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy rigid plastic packaging market represents a dynamic and rapidly evolving sector within the European packaging landscape. This market encompasses a comprehensive range of packaging solutions including bottles, containers, trays, caps, closures, and specialized packaging formats designed for various industries. Market dynamics indicate significant growth potential driven by increasing consumer demand for durable, lightweight, and sustainable packaging solutions across multiple sectors including food and beverage, pharmaceuticals, personal care, and industrial applications.

Italy’s strategic position as a manufacturing hub in Southern Europe has positioned the country as a key player in the rigid plastic packaging industry. The market demonstrates robust growth patterns with an estimated CAGR of 4.2% projected over the forecast period, reflecting strong domestic demand and export opportunities. Technological advancements in polymer science, injection molding, and blow molding technologies continue to drive innovation within the sector, enabling manufacturers to develop more efficient and environmentally conscious packaging solutions.

Regional manufacturing capabilities are concentrated primarily in Northern Italy, particularly in Lombardy, Veneto, and Emilia-Romagna regions, where established industrial infrastructure supports large-scale production operations. The market benefits from approximately 65% market penetration in food packaging applications, while pharmaceutical and personal care segments represent emerging growth opportunities with increasing adoption rates of specialized rigid plastic packaging solutions.

The Italy rigid plastic packaging market refers to the comprehensive ecosystem of manufacturing, distribution, and consumption of non-flexible plastic packaging solutions within the Italian territory. This market encompasses all forms of rigid plastic containers, bottles, jars, trays, and specialized packaging formats that maintain their structural integrity under normal handling and storage conditions.

Rigid plastic packaging distinguishes itself from flexible packaging through its ability to maintain shape and provide superior protection for contents while offering excellent barrier properties against moisture, oxygen, and contaminants. The market includes various polymer types such as polyethylene terephthalate (PET), high-density polyethylene (HDPE), polypropylene (PP), polystyrene (PS), and specialized engineering plastics designed for specific applications.

Market scope extends beyond simple container manufacturing to include value-added services such as custom design, labeling, decoration, and integrated packaging solutions. The Italian market particularly emphasizes quality, design aesthetics, and functionality, reflecting the country’s strong tradition in manufacturing excellence and design innovation across multiple industries.

Italy’s rigid plastic packaging market demonstrates remarkable resilience and growth potential within the broader European packaging landscape. The market is characterized by strong domestic demand, innovative manufacturing capabilities, and increasing focus on sustainability initiatives that align with European Union environmental regulations and consumer preferences.

Key market drivers include expanding food and beverage industry, growing pharmaceutical sector, increasing consumer preference for convenient packaging solutions, and rising demand for premium packaging in personal care and cosmetics segments. The market benefits from approximately 78% recycling rate for rigid plastic packaging, positioning Italy as a leader in circular economy initiatives within the packaging sector.

Competitive landscape features a mix of large multinational corporations and specialized regional manufacturers, creating a dynamic environment that fosters innovation and technological advancement. Market participants are increasingly investing in sustainable packaging solutions, advanced manufacturing technologies, and digital integration to meet evolving customer demands and regulatory requirements.

Growth projections indicate continued expansion across all major application segments, with particular strength in food packaging, pharmaceutical containers, and industrial packaging solutions. The market’s strategic position within Europe provides significant export opportunities, contributing to overall market growth and economic impact.

Market analysis reveals several critical insights that define the current state and future trajectory of Italy’s rigid plastic packaging sector. These insights provide valuable understanding of market dynamics, competitive positioning, and growth opportunities across various application segments.

Primary market drivers propelling growth in Italy’s rigid plastic packaging sector stem from multiple interconnected factors that create sustained demand across various application segments. These drivers reflect broader economic trends, consumer behavior changes, and technological advancements that support market expansion.

Food and beverage industry growth represents the most significant driver, with increasing consumer demand for packaged foods, ready-to-eat meals, and premium beverage products requiring sophisticated packaging solutions. The sector benefits from Italy’s strong culinary tradition and growing export market for Italian food products, creating substantial demand for high-quality rigid plastic packaging solutions.

Pharmaceutical sector expansion drives demand for specialized packaging solutions that meet stringent regulatory requirements for drug safety, stability, and traceability. The aging population and increasing healthcare awareness contribute to sustained growth in pharmaceutical packaging applications, requiring advanced barrier properties and tamper-evident features.

E-commerce growth significantly impacts packaging requirements, with online retail driving demand for protective, lightweight, and cost-effective packaging solutions. The shift toward direct-to-consumer sales models requires packaging that can withstand shipping stresses while maintaining product integrity and brand presentation.

Sustainability initiatives create opportunities for innovative packaging solutions that incorporate recycled content, reduce material usage, and support circular economy principles. Consumer awareness of environmental issues drives demand for eco-friendly packaging alternatives that maintain performance characteristics while reducing environmental impact.

Market restraints present significant challenges that may limit growth potential and profitability within Italy’s rigid plastic packaging sector. Understanding these constraints is essential for market participants to develop effective strategies and mitigate potential negative impacts on business operations.

Raw material price volatility represents a major constraint, with petroleum-based polymer prices subject to global oil market fluctuations that directly impact manufacturing costs. This volatility creates challenges in pricing strategies, profit margin management, and long-term contract negotiations with customers across various industries.

Environmental regulations impose increasing compliance costs and operational constraints on manufacturers, requiring significant investments in sustainable technologies, recycling infrastructure, and alternative materials development. While driving innovation, these regulations also create short-term cost pressures and operational complexities.

Competition from alternative packaging materials including glass, metal, and flexible packaging solutions challenges market share in certain applications. Each alternative offers specific advantages that may be preferred by customers based on product requirements, cost considerations, or sustainability objectives.

Economic uncertainty and market volatility can impact customer demand, investment decisions, and overall market growth. Economic downturns typically result in reduced packaging demand as consumer spending decreases and industrial production levels decline.

Labor shortages and skill gaps in specialized manufacturing roles create operational challenges and limit production capacity expansion. The industry requires skilled technicians, engineers, and operators familiar with advanced manufacturing technologies and quality control processes.

Emerging opportunities within Italy’s rigid plastic packaging market present significant potential for growth, innovation, and market expansion. These opportunities arise from technological advancements, changing consumer preferences, regulatory developments, and evolving industry requirements across multiple sectors.

Sustainable packaging solutions represent the most promising opportunity, with increasing demand for packaging that incorporates recycled content, bio-based materials, and design for recyclability principles. Companies investing in sustainable technologies and circular economy initiatives are positioned to capture growing market segments focused on environmental responsibility.

Smart packaging technologies offer substantial growth potential through integration of sensors, RFID tags, and digital connectivity features that enhance product traceability, consumer engagement, and supply chain visibility. These technologies create value-added solutions that command premium pricing and differentiate products in competitive markets.

Export market expansion provides opportunities for Italian manufacturers to leverage their reputation for quality and design excellence in international markets. Growing demand for premium packaging solutions in emerging markets creates export opportunities that can drive revenue growth and market diversification.

Pharmaceutical packaging specialization offers high-margin opportunities in specialized applications requiring advanced barrier properties, tamper-evidence, and regulatory compliance. The growing pharmaceutical industry and increasing focus on drug safety create sustained demand for innovative packaging solutions.

Customization and personalization trends create opportunities for manufacturers to develop flexible production capabilities that can accommodate small batch sizes, custom designs, and personalized packaging solutions for niche market segments and premium brands.

Market dynamics in Italy’s rigid plastic packaging sector reflect complex interactions between supply and demand factors, competitive pressures, technological developments, and regulatory influences that shape market behavior and growth patterns. Understanding these dynamics is crucial for strategic planning and market positioning.

Supply chain integration has become increasingly important as manufacturers seek to optimize costs, improve quality control, and enhance customer service through vertical integration and strategic partnerships. This trend toward integration creates more resilient supply chains while enabling better coordination between raw material suppliers, manufacturers, and end customers.

Technology adoption rates vary significantly across different market segments and company sizes, with larger manufacturers leading in advanced automation, digital technologies, and sustainable production methods. This technology gap creates both competitive advantages for early adopters and opportunities for technology providers to support industry modernization.

Customer consolidation in key end-use industries creates both challenges and opportunities for packaging manufacturers. While larger customers may have greater negotiating power, they also offer opportunities for long-term partnerships, volume commitments, and collaborative innovation programs that can drive mutual growth.

Regulatory evolution continues to shape market dynamics through new requirements for recycling, material composition, and environmental impact reporting. Companies that proactively address regulatory changes often gain competitive advantages through early compliance and innovative solutions that exceed minimum requirements.

Comprehensive research methodology employed in analyzing Italy’s rigid plastic packaging market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy, reliability, and actionable insights for market participants and stakeholders.

Primary research involves direct engagement with industry participants including manufacturers, suppliers, distributors, and end-users through structured interviews, surveys, and focus groups. This approach provides firsthand insights into market trends, challenges, opportunities, and competitive dynamics from various perspectives across the value chain.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, company financial statements, and regulatory documents to establish market context, historical trends, and quantitative foundations for market analysis. This research provides comprehensive background information and validates primary research findings.

Market modeling utilizes advanced analytical techniques including regression analysis, scenario planning, and forecasting models to project market trends, growth rates, and potential outcomes under various market conditions. These models incorporate multiple variables and assumptions to provide robust projections for strategic planning purposes.

Expert validation involves consultation with industry experts, academic researchers, and market specialists to verify findings, validate assumptions, and ensure research conclusions align with market realities and industry best practices.

Regional distribution of Italy’s rigid plastic packaging market reveals significant geographic concentration in Northern Italy, where established industrial infrastructure, skilled workforce, and proximity to major European markets create competitive advantages for manufacturing operations.

Northern Italy dominates market activity with approximately 72% market share, concentrated primarily in Lombardy, Veneto, and Emilia-Romagna regions. These areas benefit from well-developed transportation networks, established supplier relationships, and clusters of packaging manufacturers that create synergies and operational efficiencies.

Lombardy region serves as the primary manufacturing hub, hosting numerous large-scale production facilities and corporate headquarters of major packaging companies. The region’s strategic location, skilled workforce, and advanced infrastructure support both domestic market service and export operations to European and international markets.

Central Italy represents approximately 18% market share with growing activity in specialized applications and niche market segments. The region benefits from proximity to Rome’s administrative center and developing industrial capabilities that support regional market growth and customer service requirements.

Southern Italy accounts for remaining 10% market share but demonstrates significant growth potential driven by government incentives, developing infrastructure, and increasing industrial investment. The region offers cost advantages and growth opportunities for companies seeking to expand manufacturing capacity and serve emerging markets.

Export activities are primarily coordinated from Northern Italian facilities, leveraging established logistics networks and proximity to major European markets. Italian manufacturers maintain strong export performance with annual export growth of 5.4% to European Union countries and expanding presence in international markets.

Competitive environment in Italy’s rigid plastic packaging market features a diverse mix of international corporations, regional specialists, and local manufacturers that create a dynamic and innovation-driven marketplace. Competition is based on factors including quality, innovation, sustainability, customer service, and cost competitiveness.

Market competition drives continuous innovation in product development, manufacturing processes, and customer service capabilities. Leading companies invest significantly in research and development, sustainable technologies, and digital transformation to maintain competitive advantages and market leadership positions.

Market segmentation analysis reveals distinct categories within Italy’s rigid plastic packaging market, each characterized by specific requirements, growth patterns, and competitive dynamics that influence strategic positioning and market opportunities.

By Material Type:

By Application:

By End-Use Industry:

Food packaging category represents the largest segment within Italy’s rigid plastic packaging market, driven by the country’s strong food processing industry and growing demand for convenient, safe, and attractive packaging solutions. This category benefits from steady growth rates of 3.8% annually supported by increasing consumer preference for packaged foods and export market expansion.

Beverage packaging demonstrates robust performance with particular strength in water bottles, soft drinks, and premium beverage applications. The segment leverages Italy’s position as a major beverage producer and benefits from growing health consciousness driving demand for bottled water and functional beverages.

Pharmaceutical packaging represents a high-growth, high-margin segment with annual growth rates exceeding 6.2% driven by aging population, increasing healthcare spending, and stringent regulatory requirements. This category requires specialized expertise in barrier properties, tamper-evidence, and regulatory compliance.

Personal care packaging focuses on premium applications where aesthetics, functionality, and brand differentiation are critical success factors. Italian manufacturers leverage their design expertise and quality reputation to compete effectively in this demanding segment.

Industrial packaging serves diverse applications including chemicals, automotive fluids, and specialty products requiring specific performance characteristics such as chemical resistance, durability, and specialized dispensing features.

Industry participants in Italy’s rigid plastic packaging market enjoy numerous strategic advantages and benefits that support business growth, profitability, and competitive positioning within domestic and international markets.

Manufacturing Excellence: Italian manufacturers benefit from established reputation for quality, design innovation, and technical expertise that creates competitive advantages in premium market segments. This reputation supports premium pricing strategies and customer loyalty across various applications.

Strategic Location: Italy’s position within Europe provides excellent access to major European markets while serving as a gateway to Mediterranean, Middle Eastern, and North African regions. This geographic advantage supports both domestic market service and export growth opportunities.

Technology Access: Proximity to leading packaging machinery manufacturers and technology providers enables rapid adoption of advanced manufacturing technologies, automation systems, and innovative production processes that enhance efficiency and product quality.

Skilled Workforce: Access to experienced technical personnel, engineers, and manufacturing specialists supports high-quality production operations and continuous improvement initiatives that maintain competitive advantages.

Supply Chain Integration: Well-developed supplier networks and logistics infrastructure enable efficient raw material sourcing, production planning, and customer service that support operational excellence and cost competitiveness.

Innovation Ecosystem: Collaboration opportunities with research institutions, technology providers, and industry associations support innovation initiatives and technology development that drive market differentiation and growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping Italy’s rigid plastic packaging market, with manufacturers increasingly adopting circular economy principles, recycled content integration, and bio-based materials development. This trend is driven by regulatory requirements, consumer preferences, and corporate sustainability commitments that prioritize environmental responsibility.

Digital integration is revolutionizing manufacturing operations through Industry 4.0 technologies, smart sensors, and data analytics that optimize production efficiency, quality control, and predictive maintenance. MarkWide Research indicates that companies implementing digital technologies achieve productivity improvements of 25-30% while reducing operational costs and enhancing customer service capabilities.

Customization and personalization trends are driving demand for flexible manufacturing capabilities that can accommodate small batch sizes, custom designs, and personalized packaging solutions. This trend creates opportunities for premium pricing and customer differentiation while requiring investments in flexible production technologies.

Smart packaging integration incorporates sensors, RFID tags, and connectivity features that enhance product traceability, consumer engagement, and supply chain visibility. These technologies create value-added solutions that command premium pricing while providing enhanced functionality for end users.

Lightweighting initiatives focus on reducing material usage while maintaining packaging performance through advanced design techniques, material optimization, and innovative manufacturing processes. This trend supports sustainability objectives while reducing costs and improving transportation efficiency.

Recent industry developments highlight significant changes and innovations that are shaping the future direction of Italy’s rigid plastic packaging market. These developments reflect broader industry trends toward sustainability, technology integration, and market consolidation.

Sustainability investments have accelerated significantly with major manufacturers announcing substantial commitments to recycled content integration, renewable energy adoption, and circular economy initiatives. These investments demonstrate industry commitment to environmental responsibility while positioning companies for future regulatory requirements and market opportunities.

Technology partnerships between packaging manufacturers and technology providers are driving innovation in smart packaging, automation, and digital integration. These collaborations enable rapid technology adoption and development of innovative solutions that enhance market competitiveness and customer value.

Merger and acquisition activity continues to reshape the competitive landscape as companies seek to achieve scale advantages, expand geographic reach, and enhance technological capabilities through strategic combinations and partnerships.

Regulatory compliance initiatives focus on meeting evolving European Union requirements for packaging materials, recycling targets, and environmental impact reporting. Companies are investing in compliance systems and sustainable technologies to ensure regulatory adherence while maintaining operational efficiency.

Export market expansion efforts are intensifying as Italian manufacturers leverage their quality reputation and design expertise to penetrate international markets and diversify revenue sources beyond domestic demand.

Strategic recommendations for market participants in Italy’s rigid plastic packaging sector focus on leveraging competitive advantages while addressing market challenges and capitalizing on emerging opportunities for sustainable growth and profitability.

Sustainability leadership should be prioritized through investments in recycled content integration, bio-based materials development, and circular economy initiatives that align with regulatory requirements and customer preferences. Companies that establish sustainability leadership positions will benefit from competitive advantages and premium market positioning.

Technology adoption in manufacturing operations, supply chain management, and customer engagement should be accelerated to maintain competitiveness and operational efficiency. Digital transformation initiatives can drive significant productivity improvements while enhancing customer service capabilities and market responsiveness.

Market diversification strategies should focus on expanding into high-growth segments such as pharmaceuticals, personal care, and specialty applications where Italian manufacturers can leverage quality reputation and design expertise for premium positioning and higher margins.

Export market development represents significant growth opportunities for companies with established domestic market positions. International expansion should focus on markets where quality, design, and technical expertise are valued and can command premium pricing.

Strategic partnerships with technology providers, raw material suppliers, and customers can enhance innovation capabilities, improve supply chain efficiency, and create competitive advantages through collaborative development programs and long-term relationships.

Future prospects for Italy’s rigid plastic packaging market appear highly favorable, with multiple growth drivers supporting sustained expansion across key application segments and geographic markets. MWR analysis projects continued market growth driven by innovation, sustainability initiatives, and expanding application opportunities.

Market growth is expected to maintain steady momentum with projected annual growth rates of 4.5% over the next five years, supported by strong domestic demand, export market expansion, and increasing adoption of advanced packaging solutions across various industries. This growth trajectory reflects both organic market expansion and value-added innovation that enhances market positioning.

Sustainability transformation will continue to drive market evolution through increased adoption of recycled content, bio-based materials, and circular economy principles. Companies that successfully navigate this transformation will benefit from competitive advantages and access to growing market segments focused on environmental responsibility.

Technology integration will accelerate across all aspects of the value chain, from manufacturing operations to customer engagement, creating opportunities for efficiency improvements, cost reduction, and enhanced customer value. Smart packaging solutions and digital technologies will become increasingly important for market differentiation.

Export opportunities will expand as Italian manufacturers leverage their reputation for quality and design excellence to penetrate international markets. Growing global demand for premium packaging solutions creates significant opportunities for revenue growth and market diversification.

Innovation focus will intensify in areas including sustainable materials, smart packaging technologies, and customized solutions that meet evolving customer requirements and regulatory standards. Companies that maintain strong innovation capabilities will be best positioned for long-term success and market leadership.

Italy’s rigid plastic packaging market represents a dynamic and growing sector with significant opportunities for sustainable growth, innovation, and market expansion. The market benefits from strong domestic demand, established manufacturing capabilities, strategic geographic positioning, and reputation for quality and design excellence that create competitive advantages in both domestic and international markets.

Market fundamentals remain strong with diverse application segments, growing end-use industries, and increasing focus on sustainability initiatives that align with broader market trends and regulatory requirements. The combination of traditional manufacturing excellence and modern technology integration positions Italian manufacturers for continued success in evolving market conditions.

Strategic opportunities in sustainability leadership, technology adoption, export market development, and premium segment positioning provide multiple pathways for growth and profitability. Companies that successfully execute strategies in these areas will be best positioned to capitalize on market opportunities and maintain competitive advantages.

Future success in Italy’s rigid plastic packaging market will depend on the ability to balance traditional strengths in quality and design with modern requirements for sustainability, technology integration, and operational efficiency. Market participants that achieve this balance while maintaining focus on customer value and innovation will drive continued market growth and industry leadership in the years ahead.

What is Rigid Plastic Packaging?

Rigid plastic packaging refers to containers made from plastic that maintain their shape and do not deform under normal handling. This type of packaging is commonly used for products such as food, beverages, and consumer goods due to its durability and versatility.

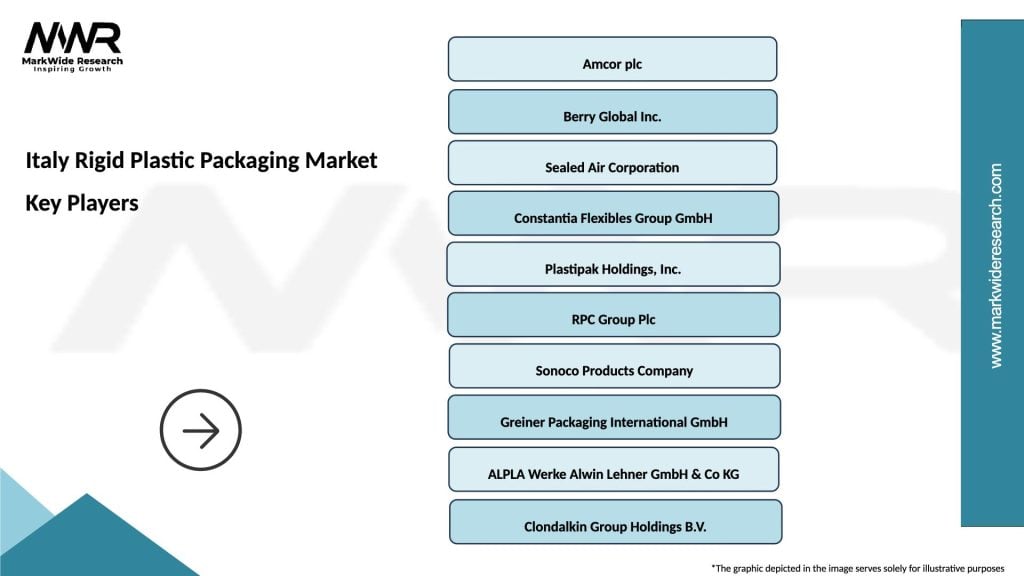

What are the key companies in the Italy Rigid Plastic Packaging Market?

Key companies in the Italy Rigid Plastic Packaging Market include Amcor, Berry Global, and Sealed Air, among others. These companies are known for their innovative packaging solutions and extensive product offerings in various sectors.

What are the growth factors driving the Italy Rigid Plastic Packaging Market?

The growth of the Italy Rigid Plastic Packaging Market is driven by increasing demand for sustainable packaging solutions, the rise in e-commerce, and the need for efficient supply chain management. Additionally, consumer preferences for convenience and product safety are influencing market expansion.

What challenges does the Italy Rigid Plastic Packaging Market face?

The Italy Rigid Plastic Packaging Market faces challenges such as regulatory pressures regarding plastic waste and recycling, competition from alternative packaging materials, and fluctuating raw material prices. These factors can impact production costs and market dynamics.

What opportunities exist in the Italy Rigid Plastic Packaging Market?

Opportunities in the Italy Rigid Plastic Packaging Market include the development of biodegradable plastics, innovations in design for enhanced user experience, and the expansion of packaging solutions for the healthcare sector. These trends can lead to new product offerings and market growth.

What trends are shaping the Italy Rigid Plastic Packaging Market?

Trends shaping the Italy Rigid Plastic Packaging Market include the increasing focus on sustainability, the adoption of smart packaging technologies, and the growth of online retail. These trends are influencing how products are packaged and delivered to consumers.

Italy Rigid Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Containers, Trays, Tubs |

| Material | Polyethylene, Polypropylene, Polystyrene, PET |

| End User | Food & Beverage, Personal Care, Household, Pharmaceuticals |

| Packaging Type | Flexible, Rigid, Blister, Clamshell |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Rigid Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at