444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Italy POS Terminals Market has experienced significant growth over the past few years, driven by advancements in technology and the rising demand for cashless payment solutions. Point of Sale (POS) terminals are electronic devices used by businesses to process payments from customers. These terminals facilitate secure transactions, offer real-time sales data, and streamline the payment process for both merchants and consumers.

Meaning

POS terminals are essential tools in modern retail and service industries. They enable businesses to accept various payment methods, including credit cards, debit cards, mobile payments, and contactless transactions. This technology has revolutionized the way transactions are conducted, providing convenience and efficiency to both businesses and consumers.

Executive Summary

The Italy POS Terminals Market has experienced substantial growth due to the increasing adoption of cashless payment methods and the growing e-commerce sector. The market is expected to witness further expansion in the coming years as businesses continue to upgrade their payment systems and as consumers increasingly prefer digital payment options.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Dynamics

The Italy POS Terminals Market is dynamic and influenced by various factors, including consumer preferences, technological advancements, and regulatory changes. The market players must adapt to these dynamics to stay competitive and meet the evolving needs of merchants and consumers.

Regional Analysis

Italy’s POS terminals market is segmented into different regions, such as North, South, Central, and the Islands. The Northern region, including major cities like Milan and Turin, is a key hub for economic activities and digital payment adoption. The Southern region, on the other hand, is catching up with the rest of the country in terms of payment technology.

Competitive Landscape

Leading Companies in Italy POS Terminals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Italy POS Terminals Market can be segmented based on the type of POS terminals, deployment mode, end-users, and technology used. Common types of POS terminals include countertop, mobile, and wireless terminals. Deployment modes can be either cloud-based or on-premises, catering to different business needs.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic accelerated the adoption of cashless payments in Italy as consumers and businesses sought safer and contactless transaction methods. This trend further boosted the demand for POS terminals equipped with contactless technology and contributed to the overall growth of the market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Italy POS Terminals Market is projected to maintain steady growth in the foreseeable future. The ongoing digitization of payment systems, advancements in technology, and the rising adoption of contactless payments are expected to be the key drivers of market expansion.

Conclusion

The Italy POS Terminals Market is witnessing significant growth driven by the increasing demand for cashless payment options, government initiatives, and the thriving e-commerce sector. Although security concerns and high initial investments pose challenges, the market is poised for growth with opportunities arising from the integration of contactless technology and enhanced data analytics. Businesses that prioritize security, adapt to consumer trends, and embrace technological advancements are likely to thrive in this competitive landscape. The industry’s future outlook remains promising, with POS terminals continuing to play a pivotal role in shaping the country’s payment landscape.

What is POS Terminals?

POS Terminals are electronic devices used to process card payments at retail locations. They facilitate transactions by reading credit and debit cards, enabling businesses to accept payments efficiently and securely.

What are the key players in the Italy POS Terminals Market?

Key players in the Italy POS Terminals Market include Ingenico, Verifone, and NCR Corporation, which provide a range of payment solutions and technologies for various retail environments, among others.

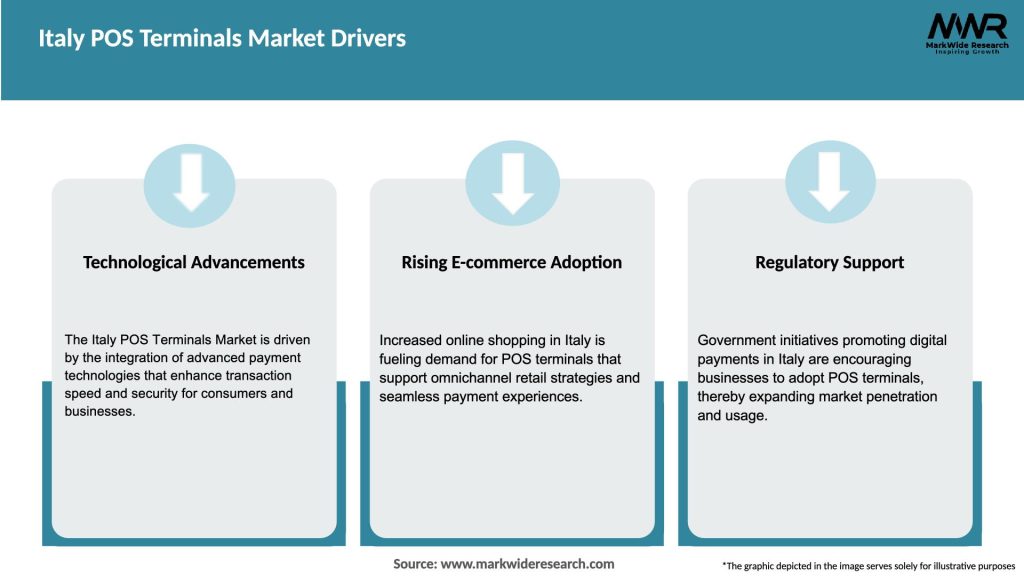

What are the growth factors driving the Italy POS Terminals Market?

The growth of the Italy POS Terminals Market is driven by the increasing adoption of cashless payments, the rise of e-commerce, and advancements in payment technologies such as contactless and mobile payments.

What challenges does the Italy POS Terminals Market face?

Challenges in the Italy POS Terminals Market include the high cost of advanced POS systems, cybersecurity threats, and the need for continuous updates to comply with evolving payment regulations.

What opportunities exist in the Italy POS Terminals Market?

Opportunities in the Italy POS Terminals Market include the expansion of digital payment solutions, the integration of AI and machine learning for enhanced customer experiences, and the growth of small and medium-sized enterprises adopting POS systems.

What trends are shaping the Italy POS Terminals Market?

Trends in the Italy POS Terminals Market include the increasing use of mobile POS systems, the shift towards omnichannel retailing, and the growing demand for integrated payment solutions that enhance customer engagement.

Italy POS Terminals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed Terminals, Mobile Terminals, Self-Service Kiosks, Smart Terminals |

| End User | Retail, Hospitality, Transportation, Healthcare |

| Technology | Contactless, Chip & Pin, Magnetic Stripe, NFC |

| Deployment | On-Premise, Cloud-Based, Hybrid, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Italy POS Terminals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at