444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy plastic packaging films market represents a dynamic and rapidly evolving sector within the European packaging industry, characterized by innovative technologies and sustainable solutions. Market dynamics indicate significant growth potential driven by increasing demand from food and beverage, pharmaceutical, and consumer goods industries. The Italian market demonstrates remarkable resilience and adaptability, with manufacturers increasingly focusing on biodegradable films and recyclable packaging solutions to meet stringent environmental regulations.

Industry transformation is evident as traditional packaging methods give way to advanced film technologies offering superior barrier properties, enhanced shelf life, and improved product protection. The market experiences robust demand from e-commerce packaging, agricultural applications, and industrial sectors, with growth rates reaching 6.2% CAGR in key segments. Technological advancement continues to drive innovation in multilayer films, smart packaging solutions, and sustainable alternatives that align with Italy’s commitment to circular economy principles.

Regional distribution shows concentrated activity in Northern Italy’s industrial regions, particularly Lombardy and Emilia-Romagna, where major packaging manufacturers maintain production facilities. The market benefits from Italy’s strategic position as a gateway to European and Mediterranean markets, facilitating export opportunities and international partnerships. Consumer preferences increasingly favor environmentally conscious packaging solutions, driving demand for compostable films and bio-based materials across various application segments.

The Italy plastic packaging films market refers to the comprehensive ecosystem of flexible plastic film manufacturing, distribution, and application within Italian territory, encompassing various polymer-based materials used for protecting, preserving, and presenting products across multiple industries. This market includes polyethylene films, polypropylene films, polyester films, and specialized barrier films designed for specific packaging applications.

Market scope extends beyond traditional packaging to include agricultural films, industrial wrapping materials, and innovative smart packaging solutions incorporating advanced technologies. The sector encompasses both conventional plastic films derived from fossil fuels and emerging bio-based alternatives manufactured from renewable resources, reflecting Italy’s commitment to sustainable packaging practices and environmental stewardship.

Industry definition includes manufacturers, converters, distributors, and end-users participating in the value chain, from raw material suppliers to final product applications. The market serves diverse sectors including food processing, pharmaceuticals, cosmetics, electronics, and agriculture, each requiring specific film properties such as barrier protection, transparency, printability, and mechanical strength tailored to unique application requirements.

Market performance in Italy’s plastic packaging films sector demonstrates consistent growth trajectory supported by robust demand from key end-use industries and increasing adoption of sustainable packaging solutions. The market benefits from Italy’s strong manufacturing base, advanced processing technologies, and strategic geographic position facilitating access to European and global markets. Innovation drivers include development of biodegradable films, smart packaging technologies, and enhanced barrier properties meeting evolving consumer and regulatory requirements.

Key growth factors encompass expanding e-commerce activities requiring protective packaging, increasing food safety regulations demanding superior barrier films, and rising consumer awareness driving demand for sustainable packaging alternatives. The market experiences significant momentum in flexible packaging applications, with adoption rates reaching 78% in food packaging segments. Technological advancement focuses on developing high-performance films with reduced environmental impact while maintaining functional properties essential for product protection and shelf life extension.

Market challenges include regulatory pressures for plastic reduction, volatile raw material costs, and increasing competition from alternative packaging materials. However, opportunities emerge from growing demand for recyclable films, expansion into emerging applications, and development of circular economy solutions. The sector demonstrates resilience through continuous innovation, strategic partnerships, and investment in sustainable technologies addressing environmental concerns while meeting performance requirements.

Strategic insights reveal the Italy plastic packaging films market’s evolution toward sustainability-focused solutions while maintaining performance standards required by demanding applications. MarkWide Research analysis indicates significant transformation in product development priorities, with manufacturers investing heavily in bio-based materials and recyclable film technologies to address environmental regulations and consumer preferences.

Primary growth drivers propelling the Italy plastic packaging films market include expanding food and beverage industry requiring advanced packaging solutions for product preservation and shelf life extension. Consumer demand for convenient, portable packaging formats drives innovation in flexible film technologies offering superior functionality while reducing material usage. The rise of e-commerce activities creates substantial demand for protective packaging films ensuring product integrity during transportation and storage.

Regulatory frameworks promoting food safety and product quality standards necessitate high-performance barrier films protecting against moisture, oxygen, and contaminants. Sustainability initiatives drive development of eco-friendly alternatives, with bio-based films gaining 23% market acceptance in environmentally conscious applications. Technological advancement enables production of thinner films with enhanced properties, reducing material consumption while maintaining performance standards.

Industrial growth in pharmaceutical and healthcare sectors demands specialized packaging films meeting stringent regulatory requirements for product safety and sterility. Agricultural modernization increases demand for protective films in greenhouse applications and crop protection, supporting Italy’s significant agricultural sector. Export opportunities to European and Mediterranean markets provide additional growth momentum, leveraging Italy’s strategic geographic position and manufacturing expertise in flexible packaging solutions.

Significant challenges facing the Italy plastic packaging films market include increasing regulatory pressure for plastic waste reduction and implementation of extended producer responsibility schemes requiring manufacturers to manage end-of-life packaging materials. Environmental concerns regarding plastic pollution drive consumer preference toward alternative packaging materials, potentially limiting market growth in traditional plastic film segments.

Raw material volatility creates cost pressures for manufacturers, with petroleum-based polymer prices fluctuating based on global oil markets and supply chain disruptions. Competition from alternatives such as paper-based packaging, glass containers, and metal packaging presents ongoing challenges, particularly in applications where environmental considerations outweigh functional benefits of plastic films.

Technical limitations in recycling infrastructure for multilayer films and specialized barrier materials create disposal challenges, potentially limiting adoption in environmentally sensitive applications. Investment requirements for developing sustainable alternatives and upgrading production facilities to meet new regulatory standards impose financial burdens on manufacturers, particularly smaller companies with limited resources for research and development activities.

Emerging opportunities in the Italy plastic packaging films market center on development of innovative sustainable solutions addressing environmental concerns while maintaining superior performance characteristics. Bio-based films derived from renewable resources present significant growth potential, with market penetration expected to reach 35% by 2028 in specific application segments. Smart packaging integration offers opportunities for value-added solutions incorporating sensors, indicators, and digital connectivity features.

Circular economy initiatives create demand for recyclable and compostable films, driving innovation in material science and processing technologies. Agricultural applications present substantial growth opportunities, particularly in greenhouse films, mulch films, and crop protection materials supporting Italy’s extensive agricultural sector. Export expansion to emerging markets in Africa and Asia leverages Italian manufacturing expertise and quality reputation in flexible packaging solutions.

Technological advancement enables development of ultra-thin films with enhanced barrier properties, reducing material usage while improving performance. Pharmaceutical packaging growth driven by aging population and healthcare expansion creates demand for specialized films meeting stringent regulatory requirements. E-commerce packaging evolution requires innovative solutions balancing protection, sustainability, and cost-effectiveness, presenting opportunities for customized film development addressing specific shipping and handling requirements.

Complex market dynamics shape the Italy plastic packaging films landscape through interplay of technological innovation, regulatory requirements, and evolving consumer preferences. Supply chain integration becomes increasingly important as manufacturers seek to optimize costs and ensure consistent quality while meeting sustainability targets. Digital transformation influences production processes, quality control, and customer engagement, with automation adoption reaching 67% in major facilities.

Competitive pressures drive continuous innovation in product development, with companies investing in research and development to create differentiated solutions addressing specific market needs. Sustainability mandates reshape product portfolios, requiring significant investment in alternative materials and processing technologies. Market consolidation trends emerge as companies seek economies of scale and enhanced technological capabilities through strategic partnerships and acquisitions.

Consumer behavior evolution influences packaging design and material selection, with increasing emphasis on convenience, sustainability, and product information transparency. Regulatory landscape continues evolving with new directives addressing plastic waste, recycling targets, and extended producer responsibility, requiring adaptive strategies from market participants. Global supply chain considerations affect raw material sourcing, production planning, and market expansion strategies, particularly in light of recent disruptions and geopolitical tensions.

Comprehensive research approach employed in analyzing the Italy plastic packaging films market combines primary and secondary research methodologies to ensure accurate and reliable market intelligence. Primary research includes extensive interviews with industry executives, manufacturers, distributors, and end-users across various application segments to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to validate primary findings and establish market baselines. Data triangulation methods ensure accuracy by cross-referencing multiple sources and identifying consistent patterns and trends across different information channels.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing production capacity, consumption patterns, and trade statistics to establish market parameters. Forecasting models incorporate historical trends, economic indicators, and industry-specific factors to project future market development. Quality assurance processes include peer review, expert validation, and continuous monitoring of market developments to maintain research accuracy and relevance throughout the analysis period.

Northern Italy dominates the plastic packaging films market, accounting for approximately 58% of national production capacity, with major manufacturing centers in Lombardy, Emilia-Romagna, and Veneto regions. Industrial concentration in these areas benefits from established supply chains, skilled workforce, and proximity to major consumer markets. Lombardy region leads in advanced film technologies and sustainable packaging solutions, hosting several multinational packaging companies and research facilities.

Central Italy contributes significantly to the market through specialized applications in pharmaceutical and food packaging, with Tuscany and Lazio regions showing strong growth in bio-based film production. Regional specialization emerges in high-value applications requiring advanced barrier properties and regulatory compliance. Infrastructure development supports market expansion through improved transportation networks and logistics capabilities.

Southern Italy presents emerging opportunities in agricultural films and basic packaging applications, with growing investment in production facilities and technology transfer from northern regions. Agricultural demand drives market development in regions like Campania, Puglia, and Sicily, where greenhouse cultivation and crop protection create substantial film consumption. Export potential from southern ports facilitates access to Mediterranean and African markets, supporting regional economic development and market expansion initiatives.

Market leadership in Italy’s plastic packaging films sector features a mix of international corporations and domestic specialists, each contributing unique strengths and capabilities to the competitive landscape. Innovation focus drives competitive differentiation through development of sustainable materials, advanced barrier technologies, and specialized applications meeting specific industry requirements.

Market segmentation analysis reveals diverse application areas and material types driving the Italy plastic packaging films market, with each segment demonstrating unique growth patterns and requirements. Material-based segmentation shows polyethylene films maintaining largest market share due to versatility and cost-effectiveness, while specialty films gain traction in high-value applications.

By Material Type:

By Application:

Food packaging films represent the largest category, driven by Italy’s significant food processing industry and stringent food safety regulations requiring advanced barrier properties. Innovation trends focus on extending shelf life, reducing food waste, and incorporating sustainable materials without compromising product protection. Market penetration of active and intelligent packaging films reaches 42% in premium food segments, offering enhanced functionality through oxygen scavengers, moisture control, and freshness indicators.

Pharmaceutical packaging films demonstrate robust growth supported by Italy’s expanding healthcare sector and aging population driving medication consumption. Regulatory compliance requirements necessitate specialized films meeting FDA and EMA standards for drug packaging applications. Technology advancement enables development of child-resistant packaging, tamper-evident features, and moisture barrier properties essential for pharmaceutical product integrity.

Agricultural films category benefits from Italy’s extensive agricultural sector, with greenhouse cultivation and crop protection driving demand for specialized films. Sustainability focus promotes development of biodegradable mulch films and recyclable greenhouse covers addressing environmental concerns. Performance enhancement includes UV stabilization, thermal properties, and optical characteristics optimized for specific crop requirements and growing conditions across different Italian agricultural regions.

Manufacturers benefit from expanding market opportunities driven by diverse application requirements and growing demand for sustainable packaging solutions. Technology investment in advanced production equipment enables development of high-performance films with enhanced properties while reducing production costs through improved efficiency. Market diversification across multiple end-use industries provides risk mitigation and stable revenue streams despite cyclical fluctuations in individual sectors.

End-users gain access to innovative packaging solutions offering superior product protection, extended shelf life, and enhanced consumer appeal through advanced printing and finishing capabilities. Sustainability benefits include reduced environmental impact through lightweight films, recyclable materials, and bio-based alternatives supporting corporate environmental commitments. Cost optimization opportunities emerge through material reduction, improved logistics efficiency, and enhanced product preservation reducing waste and losses.

Supply chain participants benefit from integrated solutions combining material supply, converting services, and logistics support optimizing overall packaging costs and performance. Innovation partnerships between film manufacturers, converters, and end-users drive development of customized solutions addressing specific application requirements. Market expansion opportunities include export potential leveraging Italy’s quality reputation and strategic geographic position accessing European and Mediterranean markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the Italy plastic packaging films market, with manufacturers investing heavily in bio-based materials, recyclable films, and circular economy solutions. MWR analysis indicates 89% of major manufacturers have initiated sustainability programs incorporating renewable materials and waste reduction strategies. Consumer pressure drives demand for environmentally responsible packaging solutions across all application segments.

Smart packaging integration emerges as a key differentiator, with films incorporating QR codes, NFC tags, and sensor technologies providing enhanced functionality and consumer engagement. Digital connectivity enables supply chain traceability, product authentication, and interactive consumer experiences. Technology adoption accelerates in premium food and pharmaceutical applications where added functionality justifies higher costs.

Lightweighting initiatives focus on reducing material usage while maintaining performance standards, driven by cost optimization and environmental considerations. Advanced processing technologies enable production of thinner films with enhanced barrier properties and mechanical strength. Multilayer film development provides superior functionality through optimized layer combinations addressing specific application requirements while minimizing overall material consumption.

Recent industry developments highlight significant investment in sustainable packaging technologies and production capacity expansion across Italy’s plastic packaging films sector. Manufacturing upgrades focus on implementing advanced extrusion technologies, improving energy efficiency, and enhancing quality control systems to meet evolving market requirements and regulatory standards.

Strategic partnerships between film manufacturers and technology providers accelerate development of innovative solutions, particularly in bio-based materials and smart packaging applications. Acquisition activities consolidate market position and expand technological capabilities, with international companies investing in Italian facilities to access European markets and manufacturing expertise.

Regulatory compliance initiatives drive significant changes in product development and manufacturing processes, with companies adapting to new EU packaging directives and extended producer responsibility requirements. Sustainability certifications become increasingly important for market access, with manufacturers pursuing various environmental standards and third-party validations to demonstrate commitment to sustainable practices and meet customer requirements.

Strategic recommendations for Italy plastic packaging films market participants emphasize the critical importance of sustainability integration and technological innovation to maintain competitive advantage in an evolving regulatory and consumer landscape. Investment priorities should focus on developing bio-based alternatives, enhancing recycling capabilities, and implementing circular economy principles throughout operations.

Market positioning strategies should leverage Italy’s reputation for quality and innovation while addressing environmental concerns through transparent sustainability communications and certified eco-friendly products. Partnership development with technology providers, research institutions, and downstream customers enables access to advanced technologies and market intelligence essential for successful product development and market expansion.

Operational excellence initiatives should prioritize energy efficiency, waste reduction, and supply chain optimization to improve cost competitiveness while meeting sustainability targets. Export expansion opportunities require careful market analysis and local partnership development, particularly in emerging markets where Italian quality reputation provides competitive advantages. Digital transformation investments in production automation, quality control, and customer engagement platforms support long-term competitiveness and operational efficiency.

Long-term prospects for the Italy plastic packaging films market remain positive despite regulatory challenges, with growth driven by innovation in sustainable materials and expanding applications in emerging sectors. Market evolution toward bio-based and recyclable films accelerates, with penetration rates projected to reach 45% by 2030 in environmentally sensitive applications. Technology advancement continues enabling development of high-performance sustainable alternatives matching traditional film properties.

Industry transformation emphasizes circular economy principles, with manufacturers developing closed-loop systems and take-back programs addressing end-of-life packaging management. Smart packaging integration expands beyond premium applications to mainstream markets as technology costs decrease and consumer acceptance increases. Export opportunities grow as Italian manufacturers leverage quality reputation and sustainable innovation to access international markets seeking environmentally responsible packaging solutions.

Investment trends focus on production technology upgrades, sustainable material development, and digital transformation initiatives supporting operational efficiency and market responsiveness. Regulatory landscape continues evolving with potential additional restrictions on conventional plastics balanced by support for sustainable alternatives and recycling infrastructure development. Market consolidation may accelerate as companies seek economies of scale and technological capabilities necessary for sustainable innovation and global competitiveness.

Italy’s plastic packaging films market stands at a critical juncture where traditional industry practices must evolve to meet sustainability imperatives while maintaining the performance standards essential for product protection and consumer satisfaction. The market demonstrates remarkable adaptability through continuous innovation in bio-based materials, advanced barrier technologies, and smart packaging solutions addressing evolving regulatory requirements and consumer preferences.

Strategic positioning for long-term success requires balanced investment in sustainable technologies, operational excellence, and market expansion initiatives leveraging Italy’s manufacturing expertise and quality reputation. The sector’s future depends on successful navigation of environmental challenges while capitalizing on growth opportunities in emerging applications and international markets. Collaborative approaches between manufacturers, technology providers, and regulatory bodies will be essential for developing practical solutions that balance environmental responsibility with economic viability and functional performance requirements across diverse packaging applications.

What is Plastic Packaging Films?

Plastic packaging films are thin layers of plastic used to wrap, protect, and preserve products. They are commonly used in various applications, including food packaging, medical supplies, and consumer goods.

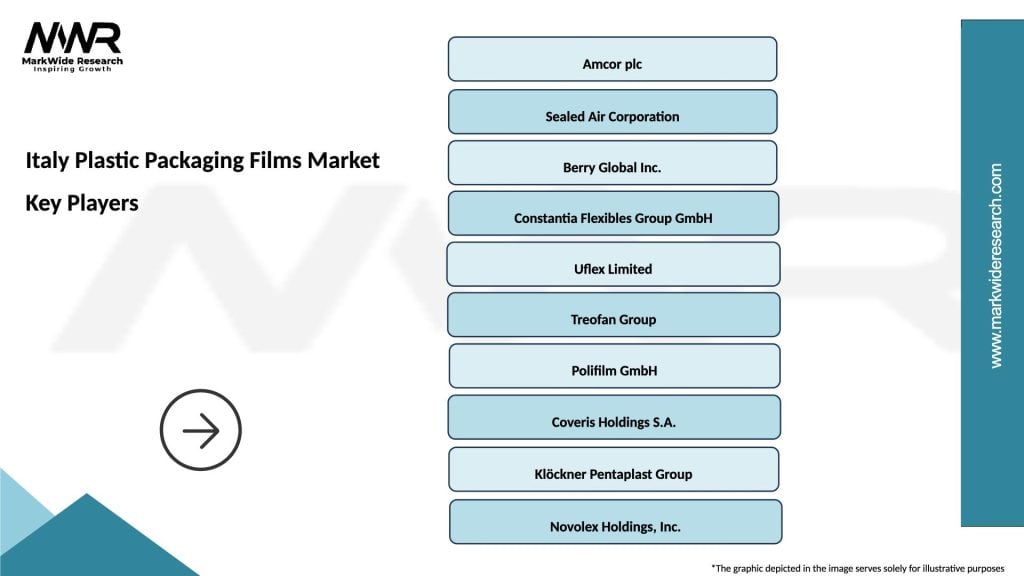

What are the key players in the Italy Plastic Packaging Films Market?

Key players in the Italy Plastic Packaging Films Market include companies like Amcor, Sealed Air Corporation, and Berry Global. These companies are known for their innovative packaging solutions and extensive product offerings, among others.

What are the main drivers of the Italy Plastic Packaging Films Market?

The main drivers of the Italy Plastic Packaging Films Market include the growing demand for convenient packaging solutions, the rise in e-commerce, and the increasing focus on food safety and preservation. Additionally, sustainability trends are pushing for more eco-friendly packaging options.

What challenges does the Italy Plastic Packaging Films Market face?

The Italy Plastic Packaging Films Market faces challenges such as regulatory pressures regarding plastic waste, competition from alternative packaging materials, and fluctuating raw material prices. These factors can impact production costs and market dynamics.

What opportunities exist in the Italy Plastic Packaging Films Market?

Opportunities in the Italy Plastic Packaging Films Market include the development of biodegradable films, advancements in recycling technologies, and the increasing demand for customized packaging solutions. These trends can lead to innovative product offerings and market expansion.

What trends are shaping the Italy Plastic Packaging Films Market?

Trends shaping the Italy Plastic Packaging Films Market include the shift towards sustainable packaging, the integration of smart packaging technologies, and the growing preference for lightweight materials. These trends are influencing consumer choices and industry practices.

Italy Plastic Packaging Films Market

| Segmentation Details | Description |

|---|---|

| Product Type | Stretch Films, Shrink Films, Barrier Films, Rigid Films |

| Application | Food Packaging, Medical Packaging, Industrial Packaging, Consumer Goods Packaging |

| End User | Food & Beverage, Pharmaceuticals, Electronics, Personal Care |

| Material | Polyethylene, Polypropylene, Polyvinyl Chloride, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Plastic Packaging Films Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at