444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy oil and gas upstream market represents a critical component of the country’s energy infrastructure, encompassing exploration, drilling, and production activities across both onshore and offshore territories. Italy’s upstream sector has experienced significant transformation in recent years, driven by technological advancements, regulatory changes, and evolving energy policies. The market demonstrates moderate growth potential with a projected compound annual growth rate of 3.2% through 2030, reflecting the nation’s strategic approach to balancing domestic energy production with renewable energy transition goals.

Domestic production activities in Italy focus primarily on natural gas extraction, which accounts for approximately 78% of total upstream output, while crude oil production represents the remaining portion. The country’s upstream operations span across multiple regions, including the Po Valley, Southern Italy, and various offshore fields in the Adriatic and Mediterranean seas. Technological innovation continues to drive operational efficiency improvements, with enhanced recovery techniques and digital transformation initiatives contributing to 15% productivity gains across major production facilities.

Market dynamics are influenced by Italy’s position as a significant energy consumer in Europe, importing substantial quantities of oil and gas to meet domestic demand. The upstream sector plays a crucial role in reducing import dependency while supporting the country’s energy security objectives. Environmental considerations and sustainability initiatives are increasingly shaping investment decisions and operational strategies within the Italian upstream market.

The Italy oil and gas upstream market refers to the comprehensive ecosystem of activities involved in the exploration, development, and production of hydrocarbon resources within Italian territorial boundaries, including both onshore and offshore areas. This market encompasses all phases of upstream operations, from initial geological surveys and seismic studies to drilling, completion, and production activities that extract crude oil and natural gas from subsurface reservoirs.

Upstream operations in Italy involve multiple stakeholders, including international oil companies, national energy firms, service providers, and regulatory bodies that collectively manage the complex process of hydrocarbon extraction. The market includes traditional conventional resources as well as unconventional opportunities, though the latter remain limited due to geological constraints and regulatory considerations specific to the Italian context.

Italy’s upstream oil and gas market demonstrates resilient performance despite global energy market volatility, with domestic production activities maintaining steady output levels while adapting to evolving regulatory frameworks and environmental standards. The market benefits from established infrastructure, experienced workforce, and strategic geographic positioning that facilitates both domestic production and import operations.

Key market characteristics include a mature production base with several long-established fields, ongoing exploration activities in promising geological formations, and increasing focus on enhanced recovery techniques to maximize resource extraction from existing assets. The sector contributes significantly to Italy’s energy supply chain while supporting thousands of direct and indirect employment opportunities across various regions.

Investment patterns reflect a balanced approach between maintaining current production levels and exploring new opportunities, with companies allocating approximately 65% of capital expenditure toward sustaining existing operations and 35% toward exploration and new development projects. This strategic allocation ensures operational continuity while positioning the market for future growth opportunities.

Strategic market insights reveal several critical trends shaping Italy’s upstream oil and gas sector:

Energy security considerations serve as a primary driver for Italy’s upstream oil and gas market development, with domestic production contributing to reduced import dependency and enhanced supply chain resilience. The country’s strategic position in the Mediterranean region creates opportunities for both domestic resource development and regional energy hub activities.

Technological advancement continues to unlock previously inaccessible resources and improve recovery rates from existing fields. Enhanced oil recovery techniques, horizontal drilling capabilities, and advanced seismic imaging technologies are expanding the economic viability of Italian hydrocarbon resources. These innovations enable operators to maximize resource extraction while minimizing environmental impact.

Economic factors including favorable fiscal regimes and government support for domestic energy production create attractive investment conditions for upstream operators. Italy’s regulatory framework provides clear guidelines for exploration and production activities while offering competitive terms for resource development projects.

Infrastructure advantages including established pipeline networks, processing facilities, and port infrastructure support efficient upstream operations and product transportation. The existing energy infrastructure reduces development costs and accelerates project timelines for new upstream initiatives.

Environmental regulations and permitting complexities present significant challenges for upstream operators, requiring extensive environmental impact assessments and compliance procedures that can extend project development timelines. Stringent environmental standards, while necessary for ecosystem protection, increase operational costs and regulatory compliance requirements.

Geological limitations constrain the scope of upstream opportunities in Italy, with many easily accessible resources already developed and remaining prospects requiring advanced extraction techniques or located in challenging environments. The mature nature of many Italian oil and gas fields presents declining production profiles that require continuous investment to maintain output levels.

Public opposition to certain upstream activities, particularly hydraulic fracturing and offshore drilling in sensitive areas, creates social and political challenges that can impact project approval processes and operational activities. Community concerns about environmental impact and safety considerations influence regulatory decisions and project feasibility.

Economic volatility in global energy markets affects investment decisions and project economics, with commodity price fluctuations impacting the financial viability of upstream projects. Currency exchange rate variations and international market dynamics create additional financial risks for upstream operators.

Enhanced recovery technologies present substantial opportunities for increasing production from existing Italian oil and gas fields, with advanced techniques potentially extending field life and improving ultimate recovery factors. Carbon dioxide injection, steam flooding, and other enhanced recovery methods could unlock significant additional reserves from mature assets.

Offshore exploration in deeper Mediterranean waters offers potential for discovering new hydrocarbon accumulations, with improved seismic technologies and drilling capabilities enabling access to previously unexplored areas. The Italian continental shelf contains numerous unexplored geological structures that could host significant oil and gas resources.

Digital transformation initiatives create opportunities for operational optimization, predictive maintenance, and improved decision-making across upstream operations. Implementation of Internet of Things sensors, artificial intelligence analytics, and automated systems can significantly enhance operational efficiency and reduce costs.

Strategic partnerships with international operators and technology providers offer opportunities for knowledge transfer, risk sharing, and access to advanced technologies and expertise. Joint ventures and collaboration agreements can accelerate project development and improve technical capabilities.

Supply and demand dynamics in Italy’s upstream market reflect the country’s position as a net energy importer with significant domestic consumption requirements. Natural gas demand remains robust across residential, commercial, and industrial sectors, while oil consumption patterns align with transportation and petrochemical industry needs. Domestic production currently meets approximately 22% of natural gas demand and 8% of oil consumption, highlighting the importance of continued upstream development.

Competitive dynamics involve both international oil companies and domestic operators competing for exploration licenses, development opportunities, and market share. The market structure includes major integrated oil companies, independent producers, and specialized service providers that collectively support upstream operations across Italy.

Regulatory dynamics continue evolving in response to environmental concerns, energy security objectives, and European Union policy directives. Recent regulatory changes have streamlined certain approval processes while strengthening environmental protection requirements, creating a more balanced framework for upstream development.

Technological dynamics drive continuous improvement in exploration success rates, drilling efficiency, and production optimization. Advanced data analytics, machine learning applications, and automated systems are transforming traditional upstream operations and enabling more precise resource management.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Italy’s upstream oil and gas market. Primary research activities include extensive interviews with industry executives, government officials, and technical experts across the upstream value chain. These discussions provide firsthand insights into market trends, challenges, and opportunities from key stakeholders.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and regulatory filings to establish quantitative baselines and identify market patterns. Historical production data, licensing information, and investment statistics form the foundation for trend analysis and market projections.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings and assumptions. Statistical analysis techniques ensure data accuracy and reliability while identifying potential outliers or inconsistencies in the research findings.

Market modeling utilizes advanced analytical frameworks to project future market scenarios based on current trends, regulatory changes, and economic factors. Sensitivity analysis examines how various factors might impact market development under different conditions and assumptions.

Northern Italy dominates upstream production activities, particularly in the Po Valley region where mature gas fields continue generating significant output. The region benefits from established infrastructure, skilled workforce, and proximity to major consumption centers. Northern production accounts for approximately 68% of total domestic natural gas output, with several long-established fields maintaining steady production profiles through enhanced recovery techniques.

Southern Italy presents emerging opportunities for both onshore and offshore development, with several exploration projects currently underway in promising geological formations. The region’s offshore areas in the Ionian Sea show particular potential for new discoveries, while onshore prospects in Basilicata and other southern regions continue attracting exploration investment.

Adriatic Sea operations represent a significant portion of Italy’s offshore upstream activities, with multiple platforms producing natural gas from various fields. The shallow water environment facilitates cost-effective development while established pipeline infrastructure enables efficient product transportation to onshore processing facilities.

Mediterranean offshore areas offer long-term exploration potential, though development challenges include deeper water depths and more complex geological conditions. Recent technological advances in deepwater drilling and production systems are making previously uneconomic prospects more attractive for future development.

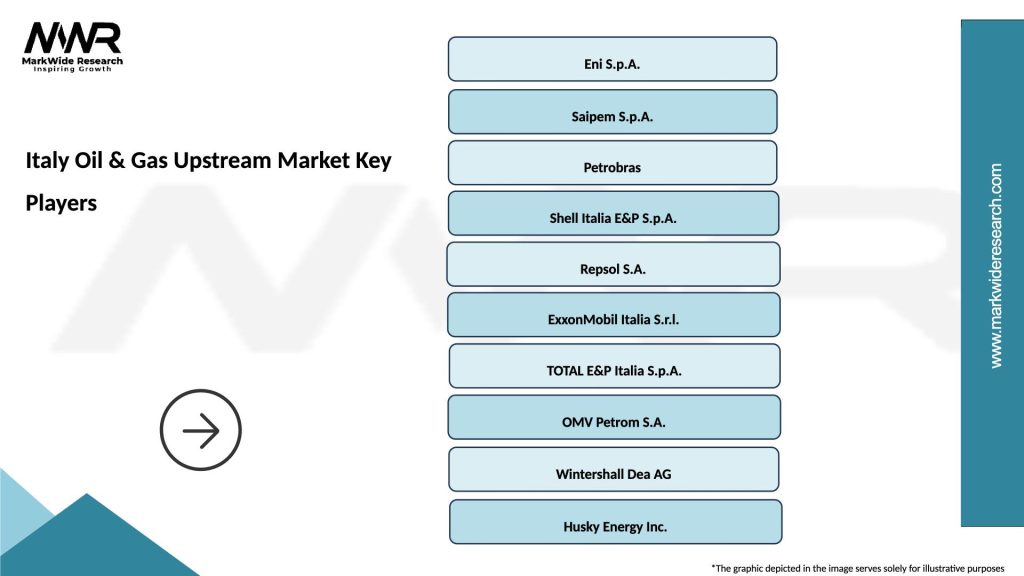

Market leadership in Italy’s upstream oil and gas sector involves several key players with diverse operational focuses and geographic concentrations:

Competitive strategies emphasize operational excellence, technology innovation, and strategic partnerships to optimize resource development and maintain market position. Companies are increasingly focusing on digital transformation initiatives and environmental sustainability to differentiate their operations and meet evolving stakeholder expectations.

Market consolidation trends reflect the industry’s response to economic pressures and the need for scale advantages in upstream operations. Strategic acquisitions and joint ventures enable companies to optimize portfolios, share risks, and access complementary capabilities.

By Resource Type:

By Location:

By Development Stage:

Natural gas production demonstrates the strongest performance within Italy’s upstream market, benefiting from robust domestic demand and established distribution infrastructure. Gas field operations achieve higher profitability margins compared to oil production due to lower transportation costs and stable pricing mechanisms. Enhanced recovery techniques are extending the productive life of mature gas fields while maintaining economic viability.

Crude oil operations face greater market volatility but offer opportunities for value optimization through advanced refining integration and product differentiation. Oil production activities increasingly focus on high-quality crude grades that command premium pricing in regional markets.

Offshore operations provide access to larger resource accumulations but require higher capital investment and specialized technical expertise. Platform operations benefit from economies of scale and centralized processing capabilities that optimize overall field economics.

Enhanced recovery projects represent a growing category within the upstream market, utilizing advanced techniques to increase ultimate recovery factors from existing fields. These projects typically achieve internal rates of return exceeding 20% while extending asset productive life by several years.

Upstream operators benefit from Italy’s stable regulatory environment, established infrastructure, and skilled workforce that collectively reduce operational risks and development costs. The country’s strategic location provides access to European markets while domestic demand ensures reliable revenue streams for production activities.

Service providers gain opportunities to deploy advanced technologies and specialized expertise across diverse upstream projects, from mature field optimization to frontier exploration activities. The market’s technical complexity creates demand for high-value services and innovative solutions.

Government stakeholders receive significant economic benefits through taxation, royalties, and employment generation from upstream activities. Fiscal contributions from the upstream sector represent approximately 2.1% of total government revenue, while direct and indirect employment supports thousands of jobs across multiple regions.

Local communities benefit from economic development, infrastructure improvements, and employment opportunities associated with upstream operations. Many projects include community investment programs that support local development initiatives and environmental conservation efforts.

Environmental stakeholders benefit from increasingly stringent environmental standards and monitoring programs that ensure responsible resource development. Modern upstream operations incorporate advanced environmental management systems and restoration programs that minimize ecological impact.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping Italy’s upstream oil and gas market, with operators implementing advanced analytics, artificial intelligence, and automated systems to optimize operations. Smart field technologies are enabling real-time monitoring and control of production facilities, resulting in operational efficiency improvements of 18-25% across major installations.

Environmental sustainability initiatives are becoming increasingly important, with companies investing in emissions reduction technologies, waste minimization programs, and ecosystem restoration projects. Carbon footprint reduction efforts include methane leak detection systems, flare reduction programs, and renewable energy integration at production facilities.

Enhanced recovery techniques are gaining prominence as operators seek to maximize resource extraction from mature fields. Advanced reservoir management, chemical flooding, and gas injection programs are extending field productive life while improving ultimate recovery factors.

Collaborative partnerships between operators, technology providers, and research institutions are accelerating innovation and knowledge transfer. These partnerships facilitate development of customized solutions for specific geological and operational challenges within the Italian upstream market.

Recent regulatory updates have streamlined certain permitting processes while strengthening environmental protection requirements, creating a more balanced framework for upstream development. The Italian government has introduced new guidelines for offshore exploration that clarify approval procedures and environmental assessment requirements.

Technology deployments include implementation of advanced seismic imaging systems that improve exploration success rates and reduce drilling risks. Several operators have deployed machine learning algorithms for predictive maintenance and production optimization, achieving significant cost reductions and operational improvements.

Infrastructure investments focus on modernizing existing facilities and expanding capacity to accommodate future production growth. Recent projects include pipeline upgrades, processing facility expansions, and digital control system installations that enhance overall system reliability and efficiency.

Strategic acquisitions and joint ventures have reshaped the competitive landscape, with companies optimizing portfolios and accessing complementary capabilities. These transactions enable better resource allocation and risk sharing across upstream projects while facilitating technology transfer and operational synergies.

MarkWide Research analysis indicates that upstream operators should prioritize technology integration and operational optimization to maintain competitiveness in Italy’s evolving energy market. Investment strategies should balance production maintenance with exploration activities, ensuring sustainable long-term growth while maximizing returns from existing assets.

Regulatory compliance requires proactive engagement with government agencies and stakeholder groups to ensure project approval and social acceptance. Companies should invest in comprehensive environmental management systems and community engagement programs that demonstrate commitment to responsible resource development.

Technology adoption should focus on solutions that deliver measurable operational improvements and cost reductions. Priority areas include predictive maintenance systems, automated production optimization, and advanced reservoir management techniques that enhance recovery factors and extend field productive life.

Partnership strategies should emphasize collaboration with technology providers, research institutions, and other operators to share risks, access expertise, and accelerate innovation. Joint ventures and strategic alliances can provide access to new opportunities while optimizing resource allocation across upstream portfolios.

Long-term prospects for Italy’s upstream oil and gas market remain positive despite global energy transition trends, with continued demand for natural gas supporting domestic production activities. Market projections indicate sustained investment in enhanced recovery projects and selective exploration activities, with annual capital expenditure expected to grow at 4.2% CAGR through 2030.

Technology evolution will continue driving operational improvements and cost reductions, with artificial intelligence, automation, and advanced materials enabling more efficient resource extraction. MWR forecasts suggest that digital transformation initiatives could improve overall upstream productivity by 30-40% over the next decade.

Regulatory developments are expected to maintain the balance between energy security objectives and environmental protection requirements, with continued support for responsible upstream development. Future regulations may introduce additional incentives for low-carbon production techniques and environmental restoration programs.

Market integration with broader European energy systems will create opportunities for cross-border projects and regional cooperation initiatives. Italy’s strategic position as a Mediterranean energy hub could facilitate development of new infrastructure and trading relationships that benefit domestic upstream operations.

Italy’s upstream oil and gas market demonstrates resilient fundamentals and promising growth prospects despite global energy market challenges and environmental considerations. The sector’s established infrastructure, technical expertise, and strategic geographic position provide competitive advantages that support continued development and investment activities.

Market dynamics reflect the successful integration of traditional upstream operations with modern technology solutions and environmental stewardship practices. Companies operating in this market benefit from stable regulatory frameworks, skilled workforce availability, and access to European energy markets that ensure reliable demand for domestic production.

Future success in Italy’s upstream market will depend on continued innovation, strategic partnerships, and adaptive management approaches that respond to evolving market conditions and stakeholder expectations. The sector’s contribution to energy security, economic development, and technological advancement positions it as a vital component of Italy’s energy infrastructure for the foreseeable future.

What is Oil & Gas Upstream?

Oil & Gas Upstream refers to the exploration and production segment of the oil and gas industry, focusing on the extraction of crude oil and natural gas from underground reservoirs.

What are the key players in the Italy Oil & Gas Upstream Market?

Key players in the Italy Oil & Gas Upstream Market include Eni S.p.A., Saipem S.p.A., and Edison S.p.A., among others.

What are the main drivers of the Italy Oil & Gas Upstream Market?

The main drivers of the Italy Oil & Gas Upstream Market include the increasing demand for energy, advancements in extraction technologies, and the need for energy security.

What challenges does the Italy Oil & Gas Upstream Market face?

The Italy Oil & Gas Upstream Market faces challenges such as regulatory hurdles, environmental concerns, and fluctuating oil prices that can impact profitability.

What opportunities exist in the Italy Oil & Gas Upstream Market?

Opportunities in the Italy Oil & Gas Upstream Market include the potential for offshore exploration, investment in renewable energy integration, and technological innovations in drilling techniques.

What trends are shaping the Italy Oil & Gas Upstream Market?

Trends shaping the Italy Oil & Gas Upstream Market include a shift towards digitalization, increased focus on sustainability, and the adoption of advanced data analytics for exploration and production.

Italy Oil & Gas Upstream Market

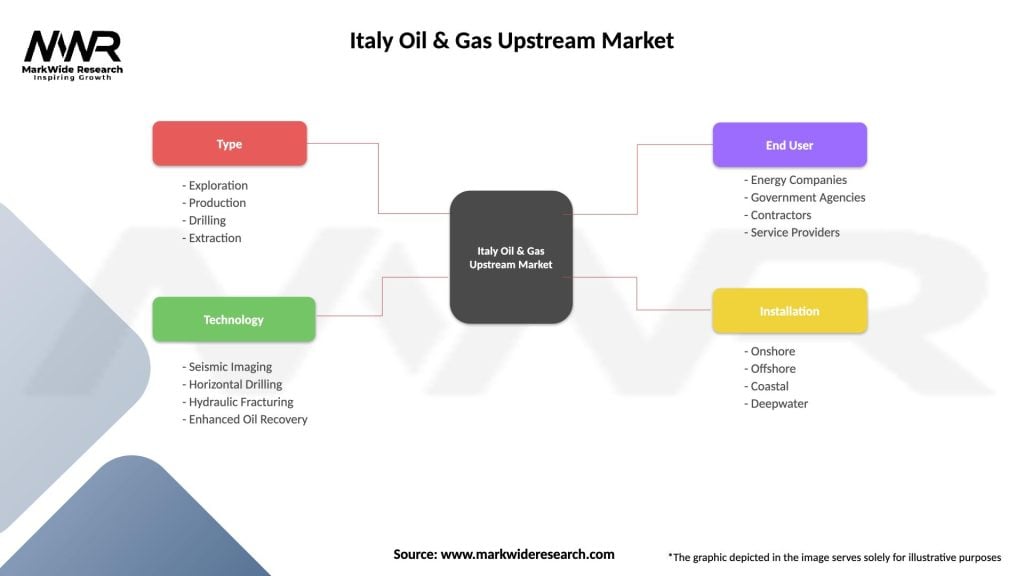

| Segmentation Details | Description |

|---|---|

| Type | Exploration, Production, Drilling, Extraction |

| Technology | Seismic Imaging, Horizontal Drilling, Hydraulic Fracturing, Enhanced Oil Recovery |

| End User | Energy Companies, Government Agencies, Contractors, Service Providers |

| Installation | Onshore, Offshore, Coastal, Deepwater |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Oil & Gas Upstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at