444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy marketing automation market represents a dynamic and rapidly evolving sector within the country’s broader digital transformation landscape. As Italian businesses increasingly recognize the critical importance of streamlined marketing processes and data-driven customer engagement strategies, the adoption of marketing automation solutions has accelerated significantly across various industries. Marketing automation platforms are becoming essential tools for organizations seeking to enhance their competitive positioning while optimizing resource allocation and improving customer relationship management.

Italian enterprises are experiencing a fundamental shift in their approach to marketing operations, driven by the need to manage increasingly complex customer journeys and multi-channel communication strategies. The market demonstrates robust growth potential, with adoption rates showing impressive acceleration particularly among small and medium-sized enterprises that previously relied on manual marketing processes. Digital transformation initiatives across Italy have created favorable conditions for marketing automation deployment, supported by government incentives and European Union digitalization programs.

Technology infrastructure improvements throughout Italy have facilitated the widespread implementation of sophisticated marketing automation solutions, enabling businesses to leverage advanced analytics, artificial intelligence, and machine learning capabilities. The market encompasses various solution categories, including email marketing automation, lead nurturing platforms, customer relationship management integration, and comprehensive marketing orchestration systems that support omnichannel customer engagement strategies.

The Italy marketing automation market refers to the comprehensive ecosystem of software solutions, platforms, and services designed to automate, streamline, and optimize marketing processes for businesses operating within the Italian market. Marketing automation technology enables organizations to efficiently manage repetitive marketing tasks, nurture leads through personalized communication sequences, and deliver targeted content to specific customer segments based on behavioral data and demographic characteristics.

Core functionalities within this market include automated email campaigns, lead scoring and qualification systems, customer segmentation tools, social media management platforms, and integrated analytics dashboards that provide comprehensive insights into marketing performance metrics. Italian businesses utilize these solutions to enhance customer acquisition, improve retention rates, and maximize return on marketing investments through data-driven decision-making processes.

Market participants include software vendors offering cloud-based and on-premise solutions, system integrators providing implementation and customization services, and consulting firms specializing in marketing automation strategy development. The market serves diverse industry verticals including retail, financial services, healthcare, manufacturing, and professional services, each with specific requirements for marketing automation functionality and compliance considerations.

Italy’s marketing automation market demonstrates exceptional growth momentum, driven by accelerating digital transformation initiatives and increasing recognition of automation’s strategic value in modern marketing operations. Business adoption rates have increased substantially, with organizations across various sectors implementing comprehensive marketing automation strategies to enhance customer engagement and operational efficiency.

Key market drivers include the growing complexity of customer acquisition processes, increasing demand for personalized marketing experiences, and the need for improved marketing ROI measurement and optimization. Italian companies are particularly focused on solutions that integrate seamlessly with existing business systems while providing scalable functionality to support future growth requirements.

Technological advancements in artificial intelligence and machine learning have significantly enhanced the sophistication of marketing automation platforms available in the Italian market. These developments enable more precise customer segmentation, predictive analytics capabilities, and automated content optimization that delivers superior marketing performance outcomes.

Market challenges include data privacy compliance requirements under European regulations, integration complexity with legacy systems, and the need for skilled personnel capable of managing advanced marketing automation implementations. Despite these challenges, the market outlook remains highly positive, with continued expansion expected across all major industry segments.

Strategic market insights reveal several critical trends shaping the Italy marketing automation landscape. Cloud-based solutions dominate the market, offering Italian businesses greater flexibility, scalability, and cost-effectiveness compared to traditional on-premise implementations. The shift toward cloud adoption has accelerated significantly, particularly among small and medium enterprises seeking to leverage enterprise-grade marketing automation capabilities without substantial infrastructure investments.

Digital transformation acceleration serves as the primary catalyst driving marketing automation adoption throughout Italy. Italian businesses recognize that traditional marketing approaches are insufficient to meet modern customer expectations and competitive requirements. The increasing complexity of customer touchpoints and the need for consistent, personalized experiences across all channels have made marketing automation essential for maintaining competitive advantage.

Cost optimization pressures continue to drive organizations toward automation solutions that reduce manual labor requirements while improving marketing effectiveness. Marketing teams can allocate human resources to strategic activities rather than repetitive tasks, resulting in improved productivity and better campaign outcomes. The ability to scale marketing operations without proportional increases in personnel costs represents a significant value proposition for Italian businesses.

Data-driven decision making requirements have intensified as businesses seek to maximize return on marketing investments through precise measurement and optimization. Marketing automation platforms provide comprehensive analytics and reporting capabilities that enable organizations to track customer behavior, measure campaign performance, and optimize marketing strategies based on empirical evidence rather than assumptions.

Customer experience expectations have evolved significantly, with consumers demanding personalized, relevant communications delivered at optimal timing. Automation technology enables businesses to deliver sophisticated personalization at scale, creating more engaging customer experiences that drive higher conversion rates and improved customer loyalty. The ability to nurture leads through automated sequences while maintaining personal relevance has become crucial for business success.

Implementation complexity represents a significant barrier to marketing automation adoption among Italian businesses, particularly smaller organizations with limited technical resources. System integration challenges often require specialized expertise and substantial time investments, creating hesitation among potential adopters who lack internal technical capabilities or budget for external consulting services.

Data privacy regulations under GDPR and Italian data protection laws create compliance complexities that require careful consideration during marketing automation implementation. Organizations must ensure that their automation practices align with strict consent requirements, data processing limitations, and individual privacy rights, which can limit certain automation capabilities and require additional compliance monitoring processes.

Skills shortage in marketing automation expertise poses ongoing challenges for Italian businesses seeking to maximize their technology investments. Qualified professionals with comprehensive understanding of marketing automation strategy, implementation, and optimization remain scarce, creating competition for talent and potentially limiting the effectiveness of automation initiatives.

Budget constraints particularly affect small and medium enterprises that recognize the value of marketing automation but struggle with the initial investment requirements and ongoing subscription costs. Total cost of ownership considerations, including software licensing, implementation services, training, and ongoing maintenance, can present significant financial barriers for resource-constrained organizations.

Artificial intelligence integration presents substantial opportunities for marketing automation vendors to differentiate their offerings and provide enhanced value to Italian businesses. AI-powered capabilities such as predictive lead scoring, automated content generation, and intelligent campaign optimization can significantly improve marketing effectiveness while reducing manual management requirements.

Small business market penetration offers considerable growth potential as marketing automation solutions become more accessible and affordable for smaller organizations. Simplified platforms designed specifically for small business requirements, combined with flexible pricing models and reduced implementation complexity, can expand the addressable market significantly.

Industry-specific solutions represent opportunities for vendors to develop specialized offerings tailored to unique requirements of specific sectors such as healthcare, financial services, and manufacturing. Vertical market focus enables deeper functionality alignment with industry workflows and regulatory requirements, creating competitive advantages and customer loyalty.

Mobile marketing automation capabilities continue to evolve as consumer mobile usage patterns drive demand for sophisticated mobile-first marketing strategies. Location-based marketing, push notification automation, and mobile app engagement tools present opportunities for platform enhancement and market expansion.

Competitive dynamics within the Italy marketing automation market reflect a diverse ecosystem of international software vendors, local solution providers, and specialized service organizations. Market competition drives continuous innovation in platform capabilities, pricing strategies, and customer service offerings, benefiting Italian businesses through improved solution quality and value propositions.

Technology evolution continues to reshape market dynamics as emerging technologies such as artificial intelligence, machine learning, and advanced analytics become standard platform features. Vendor differentiation increasingly focuses on ease of use, integration capabilities, and specialized functionality rather than basic automation features, pushing the market toward more sophisticated and user-friendly solutions.

Customer expectations are evolving rapidly as businesses become more sophisticated in their marketing automation requirements and demand greater functionality, flexibility, and performance from their technology investments. According to MarkWide Research, user expectations for seamless integration and intuitive interfaces are driving platform development priorities across the market.

Partnership ecosystems play increasingly important roles in market dynamics as vendors collaborate with system integrators, consulting firms, and technology partners to deliver comprehensive solutions. Strategic alliances enable vendors to expand their market reach while providing customers with more complete implementation and support services.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Italy marketing automation market landscape. Primary research activities include structured interviews with marketing automation vendors, system integrators, and end-user organizations across various industry sectors to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass analysis of vendor financial reports, product documentation, industry publications, and regulatory filings to develop comprehensive understanding of market structure and competitive dynamics. Data triangulation techniques validate findings across multiple sources to ensure accuracy and reliability of market insights and projections.

Industry expert consultations provide specialized knowledge and validation of market trends, technological developments, and competitive positioning within the Italian marketing automation ecosystem. Expert interviews include marketing automation consultants, technology analysts, and senior marketing executives from organizations actively using automation solutions.

Market sizing methodologies utilize bottom-up and top-down approaches to validate market scope and growth projections. Statistical analysis of adoption rates, pricing trends, and market penetration levels across different business segments provides foundation for accurate market characterization and future outlook development.

Northern Italy dominates the marketing automation market, accounting for approximately 60% of total adoption due to the concentration of large enterprises and advanced technology infrastructure in cities like Milan, Turin, and Venice. Industrial centers in this region demonstrate higher marketing automation penetration rates, driven by manufacturing companies seeking to optimize B2B marketing processes and customer relationship management.

Central Italy, including Rome and Florence, represents approximately 25% of market activity, with strong adoption among service sector organizations, government agencies, and tourism-related businesses. Public sector initiatives promoting digital transformation have accelerated marketing automation adoption among organizations serving government and institutional markets.

Southern Italy shows emerging growth potential with approximately 15% market share, as improving technology infrastructure and increasing business digitalization create opportunities for marketing automation expansion. Small business adoption is accelerating in this region as affordable cloud-based solutions become more accessible to resource-constrained organizations.

Regional variations in adoption patterns reflect differences in industry composition, technology infrastructure maturity, and business digitalization levels. Urban centers consistently demonstrate higher adoption rates compared to rural areas, though cloud-based solutions are helping bridge this gap by reducing infrastructure requirements for marketing automation implementation.

Market leadership within the Italy marketing automation sector includes both international technology vendors and specialized local providers offering tailored solutions for Italian business requirements. Competitive positioning varies significantly based on target market segments, with different vendors focusing on enterprise, mid-market, or small business customer categories.

Technology-based segmentation reveals distinct categories of marketing automation solutions serving different organizational requirements and technical capabilities. Cloud-based platforms dominate the market due to their scalability, cost-effectiveness, and reduced infrastructure requirements, while on-premise solutions maintain relevance for organizations with specific security or compliance requirements.

By Deployment Model:

By Organization Size:

By Industry Vertical:

Email marketing automation represents the most mature and widely adopted category within the Italian market, with penetration rates exceeding 75% among businesses using marketing automation solutions. Email platforms continue to evolve beyond basic newsletter functionality to include sophisticated behavioral triggers, personalization engines, and advanced analytics capabilities that support comprehensive customer engagement strategies.

Lead management and nurturing solutions demonstrate strong growth as Italian businesses recognize the importance of systematic lead qualification and development processes. Lead scoring algorithms powered by machine learning enable more accurate prospect prioritization, while automated nurturing sequences ensure consistent follow-up and engagement throughout extended sales cycles common in B2B markets.

Social media automation tools are gaining traction as organizations seek to maintain consistent social presence while managing resource constraints. Social platforms enable scheduled posting, automated response management, and social listening capabilities that support comprehensive social media marketing strategies without requiring constant manual oversight.

Customer relationship management integration has become essential functionality as businesses demand seamless data flow between marketing automation and sales systems. CRM connectivity enables closed-loop reporting, sales and marketing alignment, and comprehensive customer lifecycle management that maximizes the value of both marketing and sales technology investments.

Marketing efficiency improvements represent primary benefits for organizations implementing marketing automation solutions, with typical efficiency gains of 30-50% in marketing operations. Automated workflows eliminate repetitive manual tasks, enabling marketing teams to focus on strategic activities such as campaign development, content creation, and performance analysis that drive superior business outcomes.

Enhanced customer experiences result from personalized, timely communications delivered through automated systems that respond to customer behavior and preferences. Personalization capabilities enable businesses to deliver relevant content and offers that resonate with individual customers, improving engagement rates and conversion performance while building stronger customer relationships.

Improved lead quality and conversion outcomes emerge from systematic lead scoring, qualification, and nurturing processes that ensure sales teams receive higher-quality prospects. Lead management systems enable better alignment between marketing and sales activities, resulting in shorter sales cycles and improved conversion rates throughout the customer acquisition process.

Data-driven insights and optimization capabilities provide organizations with comprehensive visibility into marketing performance and customer behavior patterns. Analytics platforms enable continuous optimization of marketing strategies based on empirical evidence, resulting in improved return on marketing investments and more effective resource allocation decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend reshaping the Italy marketing automation landscape, with AI-powered features becoming standard expectations rather than premium offerings. Machine learning algorithms enable predictive analytics, automated content optimization, and intelligent customer segmentation that significantly enhance marketing effectiveness while reducing manual management requirements.

Omnichannel orchestration capabilities are evolving to support increasingly complex customer journey management across multiple touchpoints and communication channels. Unified customer profiles enable consistent messaging and experiences regardless of interaction channel, while advanced attribution modeling provides insights into the effectiveness of different touchpoints throughout the customer acquisition process.

Privacy-first marketing approaches are becoming essential as organizations adapt to evolving data protection regulations and changing consumer privacy expectations. Consent management systems and privacy-compliant automation workflows ensure that marketing activities align with regulatory requirements while maintaining effectiveness and customer trust.

Real-time personalization capabilities are advancing through improved data processing and decision-making technologies that enable instant content and offer optimization based on current customer behavior and context. Dynamic content systems deliver personalized experiences at scale while maintaining relevance and engagement throughout customer interactions.

Platform consolidation trends are reshaping the competitive landscape as marketing automation vendors expand their capabilities through acquisitions and strategic partnerships. Integrated marketing suites that combine automation, analytics, and customer relationship management functionality are becoming preferred solutions for organizations seeking comprehensive marketing technology stacks.

API-first architecture development enables greater flexibility and integration capabilities, allowing organizations to create customized marketing technology ecosystems that align with specific business requirements. Microservices approaches provide scalability and modularity that support evolving marketing automation needs without requiring complete platform replacements.

Industry-specific solution development continues to accelerate as vendors recognize the value of tailored functionality for specific market segments. Vertical solutions address unique regulatory requirements, workflow patterns, and customer engagement strategies that generic platforms cannot adequately support.

Mobile-first platform design reflects changing user expectations and mobile marketing requirements, with vendors prioritizing responsive interfaces and mobile-optimized automation capabilities. Mobile marketing automation features include location-based triggers, push notification management, and mobile app engagement tools that support comprehensive mobile marketing strategies.

Strategic implementation planning should prioritize clear objective definition and success metrics before technology selection to ensure marketing automation investments align with business goals. Organizations should focus on identifying specific marketing challenges and opportunities that automation can address, rather than implementing technology for its own sake without clear strategic direction.

Phased deployment approaches enable organizations to minimize risk while building internal expertise and demonstrating value before expanding automation scope. MWR analysis suggests starting with high-impact, low-complexity use cases such as email marketing automation before progressing to more sophisticated lead nurturing and customer lifecycle management implementations.

Data quality and integration foundations must be established before marketing automation implementation to ensure accurate customer insights and effective campaign execution. Clean, consolidated customer data serves as the foundation for successful automation, requiring investment in data management processes and systems integration capabilities.

Skills development and training programs should accompany technology implementations to maximize platform utilization and return on investment. Internal capability building through training, certification programs, and strategic hiring ensures organizations can effectively manage and optimize their marketing automation investments over time.

Market expansion is expected to continue at a robust pace, with growth rates projected to maintain strong momentum driven by increasing digital transformation initiatives and evolving customer engagement requirements. Small business adoption will likely accelerate as solutions become more accessible and affordable, while enterprise implementations will focus on advanced AI capabilities and sophisticated integration requirements.

Technology evolution will emphasize artificial intelligence, machine learning, and predictive analytics capabilities that enable more sophisticated automation and personalization. Next-generation platforms will likely incorporate advanced AI features as standard functionality rather than premium add-ons, democratizing access to sophisticated marketing automation capabilities across all business segments.

Regulatory compliance will remain a critical consideration as data protection laws continue to evolve and enforcement intensifies. Privacy-compliant automation solutions will become competitive differentiators, with vendors investing heavily in consent management, data protection, and transparency features that enable effective marketing while respecting customer privacy rights.

Integration ecosystem development will expand as marketing automation platforms become central components of comprehensive marketing technology stacks. API connectivity and partnership ecosystems will enable more flexible and customizable solutions that adapt to specific organizational requirements and existing technology investments.

Italy’s marketing automation market demonstrates exceptional growth potential driven by digital transformation initiatives, evolving customer expectations, and increasing recognition of automation’s strategic value in modern marketing operations. Market dynamics favor continued expansion across all business segments, with particular opportunities in small business adoption and industry-specific solution development.

Technology advancement continues to enhance platform capabilities while improving accessibility and ease of use, making marketing automation viable for organizations of all sizes and technical capabilities. Artificial intelligence integration and omnichannel orchestration capabilities represent key differentiators that will shape competitive positioning and customer value propositions in the evolving market landscape.

Success factors for organizations implementing marketing automation include strategic planning, phased deployment approaches, data quality management, and comprehensive skills development programs. MarkWide Research indicates that organizations following structured implementation methodologies achieve significantly better outcomes and return on investment compared to ad-hoc technology deployments.

Future market development will be characterized by continued innovation in AI capabilities, enhanced privacy compliance features, and expanded integration ecosystems that support comprehensive marketing technology strategies. The Italy marketing automation market is well-positioned for sustained growth as businesses increasingly recognize automation as essential for competitive success in the digital economy.

What is Marketing Automation?

Marketing automation refers to the use of software and technology to automate marketing tasks and workflows, enabling businesses to streamline their marketing efforts, improve efficiency, and enhance customer engagement. It encompasses various tools and strategies, including email marketing, social media management, and lead generation.

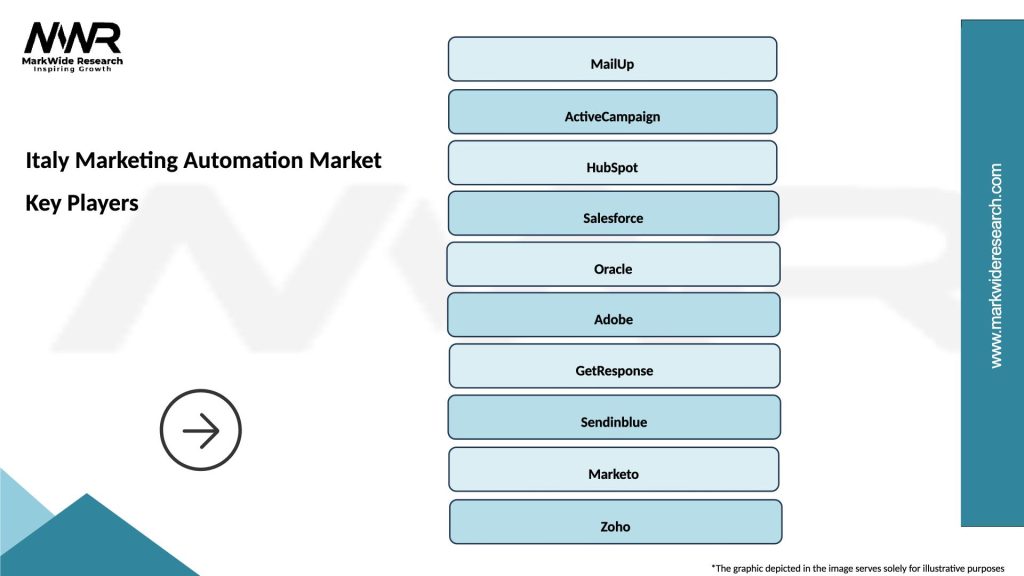

What are the key players in the Italy Marketing Automation Market?

Key players in the Italy Marketing Automation Market include HubSpot, Salesforce, and Mailchimp, which provide a range of solutions for businesses to manage their marketing campaigns effectively. These companies offer tools for email marketing, customer relationship management, and analytics, among others.

What are the growth factors driving the Italy Marketing Automation Market?

The growth of the Italy Marketing Automation Market is driven by the increasing adoption of digital marketing strategies, the need for personalized customer experiences, and the rising demand for data-driven decision-making. Businesses are leveraging automation to enhance their marketing efficiency and reach targeted audiences more effectively.

What challenges does the Italy Marketing Automation Market face?

The Italy Marketing Automation Market faces challenges such as data privacy concerns, the complexity of integrating automation tools with existing systems, and the need for skilled personnel to manage these technologies. Additionally, businesses may struggle with measuring the effectiveness of their automated campaigns.

What opportunities exist in the Italy Marketing Automation Market?

Opportunities in the Italy Marketing Automation Market include the growing trend of artificial intelligence in marketing, the expansion of e-commerce, and the increasing focus on customer relationship management. Companies can leverage these trends to enhance their marketing strategies and improve customer engagement.

What trends are shaping the Italy Marketing Automation Market?

Trends shaping the Italy Marketing Automation Market include the rise of omnichannel marketing, the integration of AI and machine learning for predictive analytics, and the emphasis on customer journey mapping. These trends are helping businesses create more personalized and effective marketing campaigns.

Italy Marketing Automation Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| End User | Retail, Healthcare, Education, Manufacturing |

| Solution | Email Marketing, Social Media Automation, Lead Management, Analytics |

| Customer Type | Small Businesses, Enterprises, Startups, Nonprofits |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Marketing Automation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at