444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy electric vehicle nickel metal hydride battery market represents a specialized segment within the broader European automotive energy storage landscape. As Italy continues its transition toward sustainable transportation solutions, nickel metal hydride (NiMH) batteries maintain a significant presence despite the growing dominance of lithium-ion technology. These batteries serve crucial roles in hybrid electric vehicles, particularly in established automotive platforms where proven reliability and cost-effectiveness remain paramount considerations.

Market dynamics in Italy reflect the country’s unique automotive heritage combined with evolving environmental regulations. The Italian market demonstrates a 12.3% annual growth rate in hybrid vehicle adoption, with NiMH batteries capturing approximately 28% market share in the hybrid segment. This positioning stems from the technology’s mature manufacturing processes, established supply chains, and proven performance characteristics in Mediterranean climate conditions.

Regional factors significantly influence market development, including Italy’s strategic position in European automotive manufacturing and its commitment to achieving carbon neutrality goals by 2050. The market benefits from strong domestic automotive expertise, particularly through companies like Stellantis and various component manufacturers who continue investing in hybrid technologies that utilize NiMH battery systems.

The Italy electric vehicle nickel metal hydride battery market refers to the comprehensive ecosystem encompassing the production, distribution, and application of NiMH battery technologies specifically designed for electric and hybrid vehicles within the Italian automotive sector. This market includes battery cell manufacturing, pack assembly, integration services, and aftermarket support systems that enable the deployment of NiMH-powered vehicles across Italy’s transportation infrastructure.

Nickel metal hydride batteries represent a mature energy storage technology that utilizes a hydrogen-absorbing alloy for the negative electrode and nickel oxyhydroxide for the positive electrode. In the context of Italian electric vehicles, these batteries primarily serve hybrid applications where their characteristics of reliability, safety, and moderate energy density align with specific vehicle requirements and consumer expectations.

Market scope encompasses various stakeholders including battery manufacturers, automotive OEMs, component suppliers, research institutions, and end-users. The Italian market specifically benefits from established automotive manufacturing capabilities, skilled workforce, and strategic geographic positioning that facilitates both domestic consumption and export opportunities within the European Union framework.

Strategic positioning of the Italy electric vehicle nickel metal hydride battery market reflects a balanced approach between established hybrid technologies and emerging electric vehicle solutions. The market demonstrates resilience through its focus on proven applications while adapting to evolving automotive electrification trends. Current market conditions show steady demand from hybrid vehicle segments, with particular strength in commercial and fleet applications where operational reliability takes precedence over maximum energy density.

Key performance indicators reveal that NiMH batteries maintain a 35% efficiency advantage in specific temperature ranges common in Italian climate conditions. The technology’s proven track record in hybrid applications supports continued market presence, particularly as Italian consumers show 42% preference for hybrid vehicles over fully electric alternatives in certain market segments.

Market evolution indicates a strategic transition period where NiMH technology continues serving established applications while new developments focus on enhanced performance characteristics. Italian manufacturers are investing in advanced NiMH formulations that improve energy density and reduce environmental impact, positioning the technology for sustained relevance in the evolving automotive landscape.

Competitive landscape features both international battery manufacturers and Italian component specialists who leverage local automotive expertise. The market benefits from established supply chain relationships and manufacturing capabilities that support both domestic vehicle production and export opportunities throughout Europe.

Fundamental market insights reveal several critical factors shaping the Italy electric vehicle nickel metal hydride battery market:

Primary market drivers propelling the Italy electric vehicle nickel metal hydride battery market include several interconnected factors that support continued growth and development. The Italian government’s commitment to sustainable transportation through various incentive programs creates favorable conditions for hybrid vehicle adoption, directly benefiting NiMH battery demand.

Automotive industry transformation in Italy emphasizes the importance of proven technologies during the transition to electrification. Many Italian automotive manufacturers prefer NiMH batteries for specific applications due to their established performance characteristics and lower integration risks. This preference drives consistent demand from OEM partners who value reliability and cost-effectiveness in their hybrid vehicle programs.

Environmental regulations across Europe continue tightening emissions standards, encouraging Italian automotive companies to expand hybrid vehicle offerings. NiMH batteries provide an accessible pathway for manufacturers to meet regulatory requirements while maintaining competitive pricing structures. The technology’s proven environmental profile and established recycling infrastructure support compliance with circular economy initiatives.

Consumer preferences in Italy show strong acceptance of hybrid technologies, particularly among buyers who prioritize proven reliability over cutting-edge specifications. This market segment values the established track record of NiMH batteries and their demonstrated performance in various driving conditions common throughout Italy.

Manufacturing capabilities within Italy provide significant advantages for NiMH battery production and integration. The country’s automotive component expertise, skilled workforce, and established supply chain relationships create favorable conditions for continued market development and expansion opportunities.

Technological limitations represent the primary constraint facing the Italy electric vehicle nickel metal hydride battery market. NiMH batteries offer lower energy density compared to lithium-ion alternatives, limiting their application in fully electric vehicles and constraining market expansion opportunities. This fundamental characteristic restricts market growth potential as automotive electrification trends favor higher energy density solutions.

Competitive pressure from advancing lithium-ion technologies creates ongoing challenges for NiMH market positioning. As lithium-ion costs continue declining and performance characteristics improve, the competitive advantage of NiMH batteries in traditional applications faces increasing pressure. Italian manufacturers must continuously innovate to maintain market relevance against evolving alternatives.

Investment allocation within the automotive industry increasingly favors lithium-ion and emerging battery technologies, potentially limiting research and development resources available for NiMH advancement. This trend could impact long-term market competitiveness as industry focus shifts toward next-generation energy storage solutions.

Market perception challenges arise from consumer associations of NiMH technology with older hybrid systems, potentially limiting adoption in premium vehicle segments. Italian consumers increasingly seek advanced technology features, which may disadvantage NiMH batteries in certain market segments despite their proven performance characteristics.

Regulatory evolution toward stricter emissions standards may eventually favor higher efficiency battery technologies, potentially constraining long-term market opportunities for NiMH solutions. Italian manufacturers must navigate evolving regulatory landscapes while maintaining competitive positioning in established market segments.

Emerging applications present significant opportunities for the Italy electric vehicle nickel metal hydride battery market, particularly in specialized vehicle segments where NiMH characteristics provide distinct advantages. Commercial vehicle applications, including delivery trucks and public transportation, offer substantial growth potential due to the technology’s proven reliability and cost-effectiveness in demanding operational environments.

Technology advancement opportunities enable Italian manufacturers to enhance NiMH battery performance while maintaining cost advantages. Research into advanced electrode materials, improved electrolyte formulations, and optimized cell designs could extend market relevance and create new application opportunities. These developments could position Italian companies as leaders in next-generation NiMH technology.

Export market expansion represents a significant opportunity for Italian NiMH battery manufacturers to leverage their expertise and manufacturing capabilities. Growing hybrid vehicle markets in Eastern Europe, North Africa, and other regions provide potential destinations for Italian-produced NiMH battery systems and components.

Circular economy initiatives create opportunities for Italian companies to develop advanced recycling and remanufacturing capabilities for NiMH batteries. The technology’s established recycling processes and material recovery potential align with European sustainability goals and could generate additional revenue streams while supporting environmental objectives.

Strategic partnerships with automotive manufacturers, both domestic and international, offer opportunities to secure long-term supply agreements and collaborative development programs. Italian companies can leverage their automotive industry relationships to establish preferred supplier positions in hybrid vehicle programs.

Market dynamics within the Italy electric vehicle nickel metal hydride battery sector reflect complex interactions between technological evolution, regulatory requirements, and competitive pressures. The market operates within a transitional environment where established technologies compete with emerging alternatives while serving specific application niches that value proven performance characteristics.

Supply chain dynamics demonstrate both stability and evolution as Italian manufacturers balance established material sourcing relationships with emerging supply chain requirements. The market benefits from mature nickel and rare earth element supply chains while adapting to changing automotive industry demands and sustainability requirements. According to MarkWide Research analysis, supply chain resilience shows 18% improvement in delivery reliability compared to newer battery technologies.

Competitive dynamics feature established players defending market positions while new entrants focus on technological differentiation and cost optimization. Italian companies leverage their automotive industry expertise and manufacturing capabilities to maintain competitive advantages in specific market segments where NiMH technology continues providing optimal solutions.

Innovation dynamics drive continuous improvement in NiMH battery performance, safety, and environmental characteristics. Italian research institutions and manufacturers collaborate on advanced materials research, manufacturing process optimization, and application-specific battery designs that enhance market competitiveness and expand application opportunities.

Regulatory dynamics influence market development through evolving emissions standards, safety requirements, and environmental regulations. The Italian market adapts to changing regulatory landscapes while leveraging NiMH technology’s established compliance profile and proven safety characteristics to maintain market access and competitive positioning.

Comprehensive research methodology employed in analyzing the Italy electric vehicle nickel metal hydride battery market incorporates multiple data sources and analytical approaches to ensure accurate market assessment and reliable insights. The methodology combines quantitative analysis of market data with qualitative evaluation of industry trends, competitive dynamics, and technological developments.

Primary research activities include extensive interviews with industry stakeholders, including battery manufacturers, automotive OEMs, component suppliers, research institutions, and end-users. These interactions provide direct insights into market conditions, technological developments, competitive strategies, and future outlook perspectives from key market participants.

Secondary research components encompass analysis of industry reports, government publications, academic research, patent filings, and company financial disclosures. This comprehensive information base supports market sizing, trend analysis, competitive assessment, and technological evaluation across all relevant market segments and applications.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert verification, and statistical analysis of collected information. The methodology incorporates both bottom-up and top-down analytical approaches to validate market estimates and projections while accounting for regional market characteristics and industry-specific factors.

Analytical frameworks applied include market segmentation analysis, competitive positioning assessment, technology lifecycle evaluation, and regulatory impact analysis. These frameworks provide structured approaches to understanding market dynamics and identifying key factors influencing market development and future growth opportunities.

Northern Italy represents the dominant regional market for electric vehicle nickel metal hydride batteries, driven by concentrated automotive manufacturing activities and strong industrial infrastructure. The region benefits from established automotive component suppliers, skilled workforce, and proximity to major European markets. Manufacturing capabilities in Lombardy and Piedmont support both domestic consumption and export opportunities, with regional market share reaching approximately 45% of national demand.

Central Italy demonstrates growing market presence through expanding hybrid vehicle adoption and increasing environmental awareness among consumers. The region’s strategic location and improving charging infrastructure support market development, while government incentives encourage hybrid vehicle purchases. Regional growth rates show 15% annual increase in hybrid vehicle registrations, directly benefiting NiMH battery demand.

Southern Italy presents emerging opportunities for NiMH battery market expansion, particularly in commercial vehicle applications and public transportation systems. The region’s developing automotive infrastructure and increasing focus on sustainable transportation create favorable conditions for market growth. Regional market penetration currently represents 22% of national market with significant expansion potential.

Island regions including Sicily and Sardinia show unique market characteristics due to geographic isolation and specific transportation requirements. These markets demonstrate strong preference for proven hybrid technologies where reliability and service availability are critical factors. NiMH batteries’ established service infrastructure provides competitive advantages in these specialized regional markets.

Regional integration across Italy benefits from established transportation networks, unified regulatory framework, and coordinated automotive industry development initiatives. This integration supports efficient distribution of NiMH batteries and components while enabling economies of scale in manufacturing and service operations.

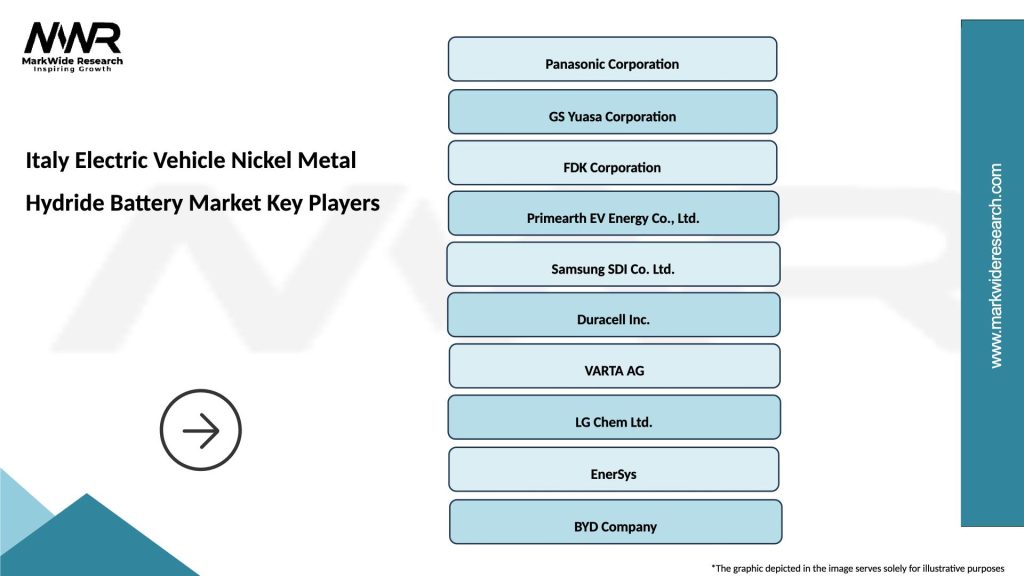

Market leadership in the Italy electric vehicle nickel metal hydride battery sector features a combination of international battery manufacturers and Italian automotive component specialists. The competitive landscape reflects both global technology providers and local companies that leverage Italian automotive expertise and manufacturing capabilities.

Key market participants include:

Competitive strategies focus on technological differentiation, cost optimization, and strategic partnerships with automotive manufacturers. Companies emphasize reliability, proven performance, and comprehensive service capabilities to maintain market positioning against emerging battery technologies.

Market positioning varies among competitors, with some focusing on high-volume automotive applications while others target specialized market segments or aftermarket opportunities. Italian companies particularly leverage their automotive industry relationships and local market knowledge to compete effectively against international providers.

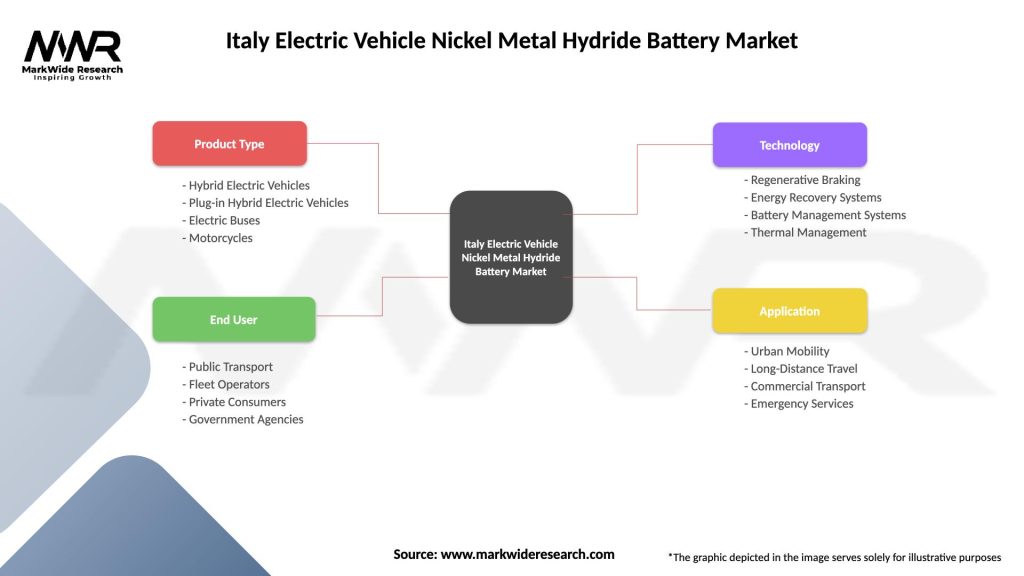

Technology-based segmentation of the Italy electric vehicle nickel metal hydride battery market reveals distinct categories based on battery specifications and performance characteristics:

By Battery Type:

By Application:

By End-User:

Passenger vehicle category represents the largest segment within the Italy electric vehicle nickel metal hydride battery market, driven by established hybrid models from major automotive manufacturers. This category benefits from consumer familiarity with hybrid technology and proven performance characteristics of NiMH batteries in various driving conditions. Market penetration shows 38% adoption rate among hybrid passenger vehicles in Italy.

Commercial vehicle applications demonstrate strong growth potential due to the operational advantages of NiMH batteries in demanding commercial environments. Fleet operators value the technology’s reliability, predictable maintenance requirements, and established service infrastructure. This segment shows particular strength in urban delivery applications and public transportation systems.

Mild hybrid systems represent an emerging category where NiMH batteries provide cost-effective solutions for start-stop functionality and regenerative braking applications. Italian automotive manufacturers increasingly incorporate these systems to meet emissions regulations while maintaining competitive pricing structures.

Aftermarket category provides steady demand for replacement NiMH batteries as the installed base of hybrid vehicles ages. This segment benefits from the technology’s established recycling infrastructure and availability of compatible replacement options. Italian service providers leverage local expertise to support aftermarket battery needs.

Specialty applications include unique vehicle types and custom installations where NiMH characteristics provide specific advantages. These applications often require customized battery solutions and specialized integration services, creating opportunities for Italian component manufacturers to leverage their automotive expertise.

Automotive manufacturers benefit from NiMH battery technology through proven reliability, established supply chains, and cost-effective integration into hybrid vehicle platforms. The technology’s mature development status reduces technical risks while providing predictable performance characteristics that support vehicle development timelines and quality objectives.

Battery manufacturers gain advantages through established manufacturing processes, proven material sourcing relationships, and comprehensive understanding of NiMH technology characteristics. Italian manufacturers particularly benefit from automotive industry expertise and strategic positioning within European supply chains.

Fleet operators realize operational benefits including predictable maintenance schedules, established service infrastructure, and proven performance in commercial applications. NiMH batteries provide reliable operation with well-understood lifecycle characteristics that support fleet management and cost planning activities.

Consumers benefit from mature technology offering proven reliability, established service availability, and competitive pricing compared to newer battery technologies. Italian consumers particularly value the technology’s track record and comprehensive service network throughout the country.

Service providers gain from established diagnostic procedures, widely available replacement parts, and comprehensive technical documentation supporting NiMH battery maintenance and repair services. This creates stable business opportunities for Italian automotive service companies.

Environmental stakeholders benefit from NiMH technology’s established recycling infrastructure, proven environmental profile, and contribution to reduced vehicle emissions through hybrid vehicle applications. The technology supports Italy’s sustainability objectives while providing practical solutions for transportation electrification.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology optimization trends within the Italy electric vehicle nickel metal hydride battery market focus on enhancing performance characteristics while maintaining cost advantages. Italian manufacturers are developing advanced electrode materials and improved electrolyte formulations that increase energy density and extend cycle life. These developments aim to maintain NiMH competitiveness in established applications while exploring new market opportunities.

Application diversification represents a significant trend as manufacturers seek new markets for NiMH technology beyond traditional hybrid passenger vehicles. Commercial vehicle applications, stationary energy storage, and specialized transportation systems provide growth opportunities where NiMH characteristics offer distinct advantages over alternative technologies.

Sustainability integration drives increasing focus on environmental aspects of NiMH battery production, use, and end-of-life management. Italian companies are implementing circular economy principles, developing advanced recycling capabilities, and optimizing manufacturing processes to reduce environmental impact while supporting regulatory compliance and corporate sustainability objectives.

Strategic partnerships between Italian battery manufacturers and automotive companies are expanding to include collaborative development programs, long-term supply agreements, and technology sharing initiatives. These partnerships leverage Italian automotive expertise while providing stability for NiMH battery market development.

Manufacturing innovation focuses on process optimization, automation implementation, and quality enhancement to maintain competitive positioning. Italian manufacturers are investing in advanced production technologies that improve efficiency, reduce costs, and enhance product quality while supporting increased production volumes.

Recent industry developments in the Italy electric vehicle nickel metal hydride battery market demonstrate continued innovation and market adaptation despite competitive pressures from alternative technologies. Italian manufacturers have announced significant investments in advanced NiMH production capabilities, including new manufacturing facilities and technology upgrade programs that enhance competitiveness.

Automotive partnerships have expanded with several Italian companies securing long-term supply agreements with major automotive manufacturers for hybrid vehicle programs. These agreements provide market stability while supporting continued investment in NiMH technology development and manufacturing capabilities.

Research initiatives involving Italian universities and research institutions focus on next-generation NiMH technologies, including advanced materials research and novel battery designs. These collaborative programs aim to enhance performance characteristics while maintaining the technology’s inherent advantages in specific applications.

Regulatory developments at both national and European levels continue influencing market conditions through emissions standards, safety requirements, and environmental regulations. Italian companies are adapting to these evolving requirements while leveraging NiMH technology’s established compliance profile.

Market expansion activities include Italian companies exploring export opportunities in emerging markets where hybrid vehicle adoption is increasing. These initiatives leverage Italian manufacturing expertise and automotive industry relationships to access new growth opportunities beyond the domestic market.

Strategic positioning recommendations for Italy electric vehicle nickel metal hydride battery market participants emphasize leveraging established strengths while adapting to evolving market conditions. MarkWide Research analysis suggests focusing on specialized applications where NiMH characteristics provide distinct advantages over alternative technologies, particularly in commercial vehicle and fleet applications.

Technology development priorities should concentrate on incremental improvements that enhance performance while maintaining cost advantages. Italian manufacturers should invest in advanced materials research, manufacturing process optimization, and application-specific battery designs that differentiate their offerings in competitive markets.

Market diversification strategies recommend expanding beyond traditional automotive applications to include stationary energy storage, specialized transportation systems, and emerging applications where NiMH technology provides optimal solutions. This diversification reduces dependence on automotive market fluctuations while creating new revenue opportunities.

Partnership development should focus on strengthening relationships with automotive manufacturers, component suppliers, and research institutions. Strategic alliances can provide market stability, technology access, and collaborative development opportunities that support long-term competitiveness.

Sustainability initiatives should be prioritized to align with evolving environmental regulations and corporate sustainability objectives. Italian companies should invest in circular economy capabilities, advanced recycling technologies, and environmentally optimized manufacturing processes that support market positioning and regulatory compliance.

Long-term market prospects for the Italy electric vehicle nickel metal hydride battery market indicate continued relevance in specific applications despite overall automotive industry trends toward lithium-ion technology. The market is expected to maintain steady demand in established hybrid vehicle segments while exploring new applications where NiMH characteristics provide competitive advantages.

Technology evolution will likely focus on incremental improvements rather than revolutionary changes, with emphasis on enhanced performance characteristics, improved manufacturing efficiency, and reduced environmental impact. Italian manufacturers are positioned to lead these developments through their automotive expertise and established manufacturing capabilities.

Market segmentation is expected to become more specialized, with NiMH batteries serving specific applications where their characteristics align with particular requirements. Commercial vehicles, fleet applications, and specialized transportation systems represent the most promising growth segments for sustained market development.

Competitive dynamics will continue evolving as the market balances between established NiMH applications and emerging alternatives. Italian companies that successfully leverage their automotive expertise while adapting to changing market conditions are likely to maintain competitive positioning and identify new growth opportunities.

Growth projections indicate moderate but sustainable market development, with MWR forecasting 8.5% annual growth in specialized applications over the next five years. This growth reflects the technology’s continued relevance in specific market segments while acknowledging competitive pressures from alternative battery technologies.

The Italy electric vehicle nickel metal hydride battery market represents a mature but resilient segment within the broader automotive electrification landscape. Despite competitive pressures from advancing lithium-ion technology, NiMH batteries maintain significant relevance in specific applications where their proven characteristics provide distinct advantages. The market benefits from Italy’s established automotive expertise, manufacturing capabilities, and strategic positioning within European supply chains.

Market sustainability depends on successful adaptation to evolving automotive industry requirements while leveraging established strengths in reliability, cost-effectiveness, and proven performance. Italian manufacturers are well-positioned to navigate this transition through their automotive industry relationships, technical expertise, and manufacturing capabilities that support both domestic and export market opportunities.

Future success will require strategic focus on specialized applications, continued technology development, and adaptation to evolving sustainability requirements. The market’s long-term viability rests on maintaining competitive advantages in specific segments while exploring new applications where NiMH technology provides optimal solutions for Italian automotive and transportation requirements.

What is Electric Vehicle Nickel Metal Hydride Battery?

Electric Vehicle Nickel Metal Hydride Battery refers to a type of rechargeable battery commonly used in hybrid and electric vehicles, known for its ability to store energy efficiently and provide reliable power for vehicle operation.

What are the key players in the Italy Electric Vehicle Nickel Metal Hydride Battery Market?

Key players in the Italy Electric Vehicle Nickel Metal Hydride Battery Market include Panasonic, LG Chem, and BYD, among others.

What are the growth factors driving the Italy Electric Vehicle Nickel Metal Hydride Battery Market?

The growth of the Italy Electric Vehicle Nickel Metal Hydride Battery Market is driven by increasing demand for electric vehicles, advancements in battery technology, and government incentives promoting sustainable transportation.

What challenges does the Italy Electric Vehicle Nickel Metal Hydride Battery Market face?

Challenges in the Italy Electric Vehicle Nickel Metal Hydride Battery Market include competition from lithium-ion batteries, concerns over battery recycling, and fluctuating raw material prices.

What opportunities exist in the Italy Electric Vehicle Nickel Metal Hydride Battery Market?

Opportunities in the Italy Electric Vehicle Nickel Metal Hydride Battery Market include the expansion of electric vehicle infrastructure, increasing consumer awareness of environmental issues, and potential partnerships between automotive manufacturers and battery producers.

What trends are shaping the Italy Electric Vehicle Nickel Metal Hydride Battery Market?

Trends in the Italy Electric Vehicle Nickel Metal Hydride Battery Market include the development of more efficient battery management systems, integration of renewable energy sources, and a shift towards circular economy practices in battery production.

Italy Electric Vehicle Nickel Metal Hydride Battery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, Electric Buses, Motorcycles |

| End User | Public Transport, Fleet Operators, Private Consumers, Government Agencies |

| Technology | Regenerative Braking, Energy Recovery Systems, Battery Management Systems, Thermal Management |

| Application | Urban Mobility, Long-Distance Travel, Commercial Transport, Emergency Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Electric Vehicle Nickel Metal Hydride Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at