444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy electric vehicle battery separator market represents a critical component of the nation’s rapidly evolving automotive electrification landscape. As Italy accelerates its transition toward sustainable transportation solutions, the demand for high-performance battery separators has experienced unprecedented growth. These essential components serve as the backbone of lithium-ion batteries, ensuring safe and efficient energy storage in electric vehicles across the Italian automotive sector.

Market dynamics indicate that Italy’s strategic position within the European Union’s Green Deal framework has catalyzed significant investments in electric vehicle infrastructure and manufacturing capabilities. The battery separator segment has emerged as a focal point for technological advancement, with Italian manufacturers and international players establishing production facilities to meet the growing demand from automotive OEMs and battery manufacturers.

Growth trajectory analysis reveals that the market is expanding at a compound annual growth rate of 12.8%, driven by increasing electric vehicle adoption rates and supportive government policies. The Italian government’s commitment to phasing out internal combustion engines by 2035 has created a robust foundation for sustained market expansion, positioning battery separators as indispensable components in the country’s automotive transformation.

Regional concentration shows that Northern Italy, particularly the Lombardy and Piedmont regions, accounts for approximately 68% of the market activity, leveraging existing automotive manufacturing expertise and proximity to major European markets. This geographic advantage has attracted significant foreign direct investment from Asian and European battery separator manufacturers seeking to establish European production bases.

The Italy electric vehicle battery separator market refers to the comprehensive ecosystem encompassing the production, distribution, and application of specialized membrane materials used in lithium-ion batteries for electric vehicles within the Italian automotive industry. These separators function as critical safety barriers between battery electrodes while allowing ionic conductivity necessary for battery operation.

Technical definition encompasses various separator technologies including polyethylene (PE), polypropylene (PP), and ceramic-coated separators that provide thermal stability, mechanical strength, and electrochemical performance. The market includes both domestic production capabilities and import activities to satisfy the growing demand from Italian electric vehicle manufacturers and battery assembly facilities.

Market scope extends beyond traditional automotive applications to include energy storage systems, hybrid vehicles, and emerging mobility solutions such as electric motorcycles and commercial vehicles. This broader definition reflects Italy’s comprehensive approach to electrification across multiple transportation segments and stationary energy storage applications.

Strategic positioning of Italy’s electric vehicle battery separator market demonstrates remarkable resilience and growth potential within the European automotive landscape. The market has evolved from a nascent segment to a strategic priority, supported by substantial investments in research and development, manufacturing infrastructure, and supply chain optimization.

Key performance indicators reveal that domestic production capacity has increased by 45% over the past three years, while import dependency has decreased correspondingly. This shift toward self-sufficiency aligns with European Union objectives for strategic autonomy in critical battery materials and components.

Market segmentation analysis shows that automotive applications dominate with 78% market share, followed by energy storage systems and hybrid vehicle applications. The premium separator segment, characterized by advanced ceramic coatings and enhanced safety features, represents the fastest-growing category with superior profit margins for manufacturers.

Competitive landscape features a balanced mix of international players and emerging Italian companies, with technology transfer agreements and joint ventures facilitating knowledge exchange and production localization. This collaborative approach has accelerated innovation cycles and reduced time-to-market for advanced separator technologies.

Primary market drivers encompass several interconnected factors that collectively propel market expansion and technological advancement:

Market maturation indicators suggest that Italy is transitioning from an import-dependent market to a regional production hub, with several world-class manufacturing facilities under construction or recently commissioned.

Regulatory framework serves as the primary catalyst for market expansion, with Italy’s implementation of the European Green Deal creating mandatory targets for electric vehicle adoption and carbon neutrality. The government’s commitment to banning internal combustion engine sales by 2035 has established a clear timeline for automotive electrification, generating predictable demand for battery separators.

Automotive industry commitment represents another significant driver, with major manufacturers investing heavily in electric vehicle platforms and battery technologies. Stellantis, Italy’s largest automaker, has announced plans to achieve 100% electric vehicle sales in Europe by 2030, creating substantial demand for high-quality battery separators across multiple vehicle segments.

Technological advancement in separator materials and manufacturing processes has improved performance characteristics while reducing production costs. Innovations in ceramic-coated separators, nanofiber technologies, and multilayer designs have enhanced safety profiles and energy density capabilities, making electric vehicles more attractive to consumers.

Supply chain resilience initiatives have gained prominence following global disruptions, with Italian companies and government agencies prioritizing domestic production capabilities for critical battery components. This strategic focus has attracted international investment and technology transfer agreements, strengthening the local separator manufacturing ecosystem.

Infrastructure development across Italy’s charging network has addressed range anxiety concerns, accelerating electric vehicle adoption rates and creating sustained demand for battery separators. The government’s investment in fast-charging corridors and urban charging infrastructure has improved the practical viability of electric vehicle ownership.

Capital intensity of separator manufacturing presents significant barriers to entry, with advanced production facilities requiring substantial upfront investments in specialized equipment and clean room environments. These high capital requirements limit the number of potential market participants and create challenges for smaller companies seeking to enter the market.

Technical complexity associated with separator manufacturing demands sophisticated quality control systems and specialized expertise that may not be readily available in the Italian market. The precision required for consistent separator performance across automotive applications necessitates extensive training and technology transfer programs.

Raw material dependency remains a concern, as key separator materials and precursors are primarily sourced from Asian suppliers. This dependency creates potential supply chain vulnerabilities and cost fluctuations that can impact market stability and profitability for Italian manufacturers.

Competition from established markets poses ongoing challenges, as Asian manufacturers benefit from economies of scale and established supply relationships with major battery producers. Italian companies must differentiate through innovation, quality, and service to compete effectively against lower-cost alternatives.

Regulatory compliance requirements for automotive applications involve extensive testing and certification processes that can delay product introductions and increase development costs. These regulatory hurdles, while necessary for safety, can slow market entry for new separator technologies and manufacturers.

European market integration presents substantial opportunities for Italian separator manufacturers to serve the broader European electric vehicle market through strategic partnerships and cross-border supply agreements. Italy’s central location and established automotive relationships provide competitive advantages for regional expansion.

Advanced separator technologies offer significant growth potential, particularly in premium applications requiring enhanced safety, thermal management, and energy density characteristics. Italian companies can leverage their materials science expertise and automotive industry relationships to develop next-generation separator solutions.

Circular economy initiatives create opportunities for separator recycling and remanufacturing services, aligning with European Union sustainability objectives and creating additional revenue streams for market participants. This emerging segment could provide competitive differentiation for forward-thinking companies.

Energy storage applications beyond automotive markets represent expanding opportunities, including grid-scale storage systems, residential energy storage, and industrial applications. These diverse end markets can provide revenue diversification and reduced dependence on automotive cycles.

Research and development partnerships with Italian universities and research institutions offer opportunities to develop proprietary technologies and intellectual property that can provide long-term competitive advantages in the global separator market.

Supply and demand equilibrium in the Italian electric vehicle battery separator market reflects the complex interplay between rapidly growing demand from automotive manufacturers and the gradual expansion of domestic production capacity. Current market conditions indicate that demand growth is outpacing supply expansion, creating opportunities for new market entrants and capacity investments.

Price dynamics demonstrate a trend toward stabilization as production volumes increase and manufacturing processes mature. While premium separator technologies command higher prices, commodity-grade separators face pricing pressure from international competition, encouraging Italian manufacturers to focus on value-added applications and technical differentiation.

Technology evolution continues to reshape market dynamics, with next-generation separator materials offering improved performance characteristics that justify premium pricing. The transition from traditional polyolefin separators to ceramic-coated and nanofiber technologies represents a significant market shift that favors innovative manufacturers.

Competitive intensity has increased as international players establish Italian operations while domestic companies expand their capabilities. This competition drives innovation and efficiency improvements but also pressures profit margins, particularly in commodity separator segments.

Customer relationships play an increasingly important role in market dynamics, with long-term supply agreements and technical partnerships becoming critical success factors. Italian separator manufacturers are developing closer relationships with automotive OEMs and battery producers to secure market position and influence product development directions.

Comprehensive market analysis employed multiple research methodologies to ensure accuracy and completeness of market insights. Primary research activities included extensive interviews with industry executives, technical experts, and government officials involved in Italy’s electric vehicle and battery separator sectors.

Data collection encompassed both quantitative and qualitative research approaches, utilizing industry databases, government statistics, company financial reports, and trade association publications. This multi-source approach enabled cross-validation of key market metrics and trend analysis.

Industry expert consultations provided valuable insights into technical developments, competitive dynamics, and future market directions. These discussions with separator manufacturers, automotive engineers, and battery technology specialists enhanced understanding of market nuances and emerging opportunities.

Market modeling techniques incorporated historical data analysis, trend extrapolation, and scenario planning to develop robust market projections and identify key growth drivers. Statistical analysis methods ensured reliability and accuracy of quantitative findings.

Validation processes included peer review by industry experts and cross-referencing with multiple data sources to ensure consistency and accuracy of research findings. This rigorous approach supports the credibility and reliability of market insights and recommendations.

Northern Italy dominates the electric vehicle battery separator market, accounting for approximately 68% of total market activity. The Lombardy region, centered around Milan, serves as the primary hub for separator manufacturing and distribution, benefiting from proximity to major automotive manufacturers and established industrial infrastructure.

Piedmont region represents the second-largest market concentration with 22% market share, leveraging its automotive heritage and the presence of Stellantis manufacturing facilities. The region’s expertise in automotive components and materials science provides a strong foundation for separator technology development and production.

Emilia-Romagna contributes approximately 15% of market activity, with particular strength in high-performance separator applications for luxury and sports car manufacturers. The region’s concentration of premium automotive brands creates demand for advanced separator technologies with superior performance characteristics.

Central and Southern Italy represent emerging markets with growing potential, particularly as electric vehicle adoption expands beyond traditional automotive centers. Government incentives and infrastructure development programs are driving market expansion in these regions, creating opportunities for separator suppliers and distributors.

Regional specialization patterns show Northern Italy focusing on high-volume automotive applications, while Central Italy emphasizes energy storage and specialty applications. This geographic diversification provides market stability and reduces dependence on single application segments or customer concentrations.

Market leadership in Italy’s electric vehicle battery separator sector features a diverse mix of international corporations and emerging domestic players, each contributing unique capabilities and market positioning strategies.

Competitive strategies emphasize technological differentiation, supply chain localization, and customer relationship development. Leading companies are establishing Italian production facilities and technical centers to better serve local automotive manufacturers and reduce supply chain risks.

Market consolidation trends indicate potential merger and acquisition activity as companies seek to achieve economies of scale and expand their technological capabilities. Strategic partnerships and joint ventures are becoming increasingly common as market participants collaborate to address complex technical and commercial challenges.

By Material Type: The Italian electric vehicle battery separator market demonstrates clear segmentation preferences based on application requirements and performance characteristics.

By Application Segment: Market distribution reflects Italy’s diverse electric vehicle ecosystem and expanding electrification scope.

By End-User Category: Customer segmentation reveals diverse market dynamics and relationship structures.

Premium Separator Category represents the most dynamic market segment, characterized by advanced materials, superior performance characteristics, and higher profit margins. This category includes ceramic-coated separators, nanofiber technologies, and specialized multilayer designs that offer enhanced safety, thermal management, and energy density benefits for high-end electric vehicle applications.

Standard Separator Category encompasses traditional polyolefin separators that serve mainstream automotive applications with proven reliability and cost-effectiveness. While facing pricing pressure from international competition, this category maintains strong demand due to volume production requirements and established supply relationships with major automotive manufacturers.

Specialty Separator Category addresses niche applications including energy storage systems, hybrid vehicles, and specialized automotive applications requiring unique performance characteristics. This category offers opportunities for technical differentiation and premium pricing while serving diverse end markets beyond traditional automotive applications.

Innovation Category encompasses emerging separator technologies including solid-state interfaces, advanced polymer compositions, and next-generation manufacturing processes. While representing a small current market share, this category attracts significant research and development investment and offers potential for future market disruption.

Service Category includes technical support, customization services, and value-added offerings that enhance customer relationships and provide additional revenue opportunities. Italian separator suppliers are increasingly emphasizing service capabilities to differentiate from commodity competitors and strengthen market position.

Automotive Manufacturers benefit from reliable separator supply chains that ensure consistent battery performance, safety compliance, and cost optimization. Local separator production reduces supply chain risks and enables closer technical collaboration for product development and customization.

Battery Producers gain access to advanced separator technologies that enhance battery performance, safety characteristics, and competitive positioning. Italian separator suppliers offer technical expertise and customization capabilities that support battery innovation and market differentiation.

Separator Manufacturers capitalize on growing market demand, favorable investment climate, and government support for domestic production capabilities. The Italian market offers opportunities for technology development, customer relationship building, and regional expansion within the European Union.

Government Stakeholders achieve strategic objectives including industrial development, employment creation, and reduced dependency on foreign suppliers for critical battery components. The separator industry contributes to Italy’s automotive competitiveness and sustainable transportation goals.

Research Institutions benefit from industry collaboration opportunities, funding for advanced materials research, and technology transfer partnerships that advance separator science and engineering capabilities. These relationships support academic research while addressing practical industry challenges.

Investment Community gains exposure to a growing market with strong fundamentals, government support, and long-term growth prospects aligned with global electrification trends. The separator market offers opportunities for both financial returns and environmental impact through sustainable transportation advancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology Integration represents a fundamental trend reshaping the Italian electric vehicle battery separator market, with manufacturers increasingly adopting advanced materials and manufacturing processes. The integration of ceramic coatings, nanofiber technologies, and multilayer designs reflects industry movement toward higher-performance separator solutions that enhance battery safety and energy density.

Supply Chain Localization has emerged as a critical trend driven by supply chain resilience concerns and government policy initiatives. Italian companies and international partners are establishing domestic production facilities and regional supply networks to reduce dependency on Asian suppliers and improve supply chain security for critical battery components.

Sustainability Focus influences separator development and manufacturing processes, with companies investing in recyclable materials, reduced environmental impact manufacturing, and circular economy initiatives. This trend aligns with European Union sustainability objectives and automotive industry commitments to environmental responsibility.

Customer Collaboration intensifies as separator manufacturers develop closer relationships with automotive OEMs and battery producers. These partnerships involve joint technology development, customized product solutions, and integrated supply chain management that enhance competitiveness and market positioning.

Performance Enhancement drives continuous innovation in separator characteristics including thermal stability, mechanical strength, ionic conductivity, and safety features. MarkWide Research analysis indicates that performance improvements are becoming increasingly important as electric vehicle requirements become more demanding and sophisticated.

Market Consolidation trends suggest potential industry restructuring through mergers, acquisitions, and strategic partnerships as companies seek to achieve economies of scale and expand technological capabilities. This consolidation may reshape competitive dynamics and market leadership positions.

Manufacturing Investments have accelerated significantly, with several international separator manufacturers announcing major production facilities in Italy. These investments represent hundreds of millions of euros in capital commitments and demonstrate confidence in the Italian market’s growth potential and strategic importance.

Technology Partnerships between Italian companies and international separator specialists have facilitated knowledge transfer and capability development. These collaborations enable Italian participants to access advanced technologies while contributing local market expertise and automotive industry relationships.

Research Initiatives involving Italian universities, research institutions, and industry partners have advanced separator science and engineering capabilities. Government funding for battery technology research has supported these initiatives and strengthened Italy’s position in separator innovation.

Regulatory Developments including updated safety standards, environmental regulations, and quality requirements have influenced separator design and manufacturing processes. These regulatory changes ensure market development aligns with safety and sustainability objectives while maintaining competitive dynamics.

Market Entry activities by new participants including both domestic startups and international corporations have increased competitive intensity and innovation pace. These new entrants bring fresh perspectives and technologies that benefit overall market development and customer choice.

Infrastructure Expansion in testing facilities, quality control systems, and technical support capabilities has strengthened Italy’s separator market foundation. These infrastructure investments support market growth and enhance the country’s attractiveness for separator manufacturing and development activities.

Strategic Focus recommendations emphasize the importance of technology differentiation and customer relationship development for separator manufacturers operating in the Italian market. Companies should prioritize advanced separator technologies that offer superior performance characteristics and justify premium pricing in competitive market conditions.

Investment Priorities should emphasize manufacturing capacity expansion, quality control systems, and research and development capabilities that support long-term competitiveness. MarkWide Research analysis suggests that companies investing in advanced manufacturing technologies and automation will achieve sustainable competitive advantages.

Partnership Development represents a critical success factor, with companies encouraged to establish strategic relationships with automotive OEMs, battery manufacturers, and technology partners. These collaborations provide market access, technical expertise, and risk sharing opportunities that enhance business sustainability.

Market Positioning strategies should emphasize technical expertise, quality assurance, and customer service capabilities that differentiate from commodity competitors. Italian separator suppliers should leverage their proximity to automotive customers and ability to provide customized solutions and technical support.

Risk Management approaches should address supply chain vulnerabilities, technology disruption potential, and competitive pressures through diversification strategies and contingency planning. Companies should develop multiple supplier relationships and maintain flexibility in production and technology capabilities.

Sustainability Integration should become a core business strategy, with companies investing in environmentally responsible manufacturing processes, recyclable materials, and circular economy initiatives that align with customer and regulatory expectations for environmental stewardship.

Market trajectory projections indicate continued robust growth for Italy’s electric vehicle battery separator market, with expansion expected to accelerate as automotive electrification reaches mainstream adoption levels. The market is positioned to benefit from favorable regulatory environment, increasing consumer acceptance, and expanding charging infrastructure that supports electric vehicle viability.

Technology evolution will likely focus on next-generation separator materials offering enhanced safety, performance, and sustainability characteristics. Solid-state battery interfaces, advanced polymer compositions, and innovative manufacturing processes represent areas of significant development potential that could reshape market dynamics and competitive positioning.

Production capacity expansion is expected to continue as domestic and international manufacturers establish Italian operations to serve growing market demand. These capacity additions will improve supply chain resilience while creating employment opportunities and strengthening Italy’s position in the European battery value chain.

Market maturation processes will likely result in industry consolidation, standardization of quality requirements, and development of established supply chain relationships. This maturation will benefit customers through improved product reliability and supply security while creating opportunities for market leaders to strengthen their positions.

Regional integration with broader European markets will enhance Italy’s role as a separator supply hub, leveraging strategic location and automotive industry relationships to serve continental demand. This integration supports economies of scale and market diversification that strengthen business sustainability for Italian separator manufacturers.

Innovation acceleration driven by competitive pressures and customer requirements will continue advancing separator technologies and manufacturing capabilities. Companies investing in research and development will be best positioned to capitalize on emerging opportunities and maintain competitive advantages in evolving market conditions.

Italy’s electric vehicle battery separator market represents a dynamic and rapidly evolving sector with substantial growth potential and strategic importance for the country’s automotive industry transformation. The market benefits from strong government support, established automotive relationships, and favorable investment climate that attracts both domestic and international participation.

Market fundamentals remain robust, with growing electric vehicle adoption, expanding production capacity, and advancing separator technologies creating sustained demand and innovation opportunities. The combination of regulatory support, customer demand, and technological advancement provides a solid foundation for continued market expansion and development.

Competitive dynamics favor companies that emphasize technology differentiation, customer relationships, and operational excellence while managing supply chain risks and competitive pressures. Success in this market requires strategic focus, substantial investment, and commitment to continuous innovation and improvement.

Future prospects indicate that Italy’s separator market will continue growing and maturing, potentially becoming a significant regional supply hub within the European automotive ecosystem. Companies positioned to capitalize on these opportunities through strategic investments and partnerships will benefit from the ongoing transformation of Italy’s transportation sector toward sustainable electrification solutions.

What is Electric Vehicle Battery Separator?

Electric Vehicle Battery Separator refers to a critical component in lithium-ion batteries that prevents short circuits by separating the anode and cathode while allowing the flow of ions. This technology is essential for the performance and safety of electric vehicle batteries.

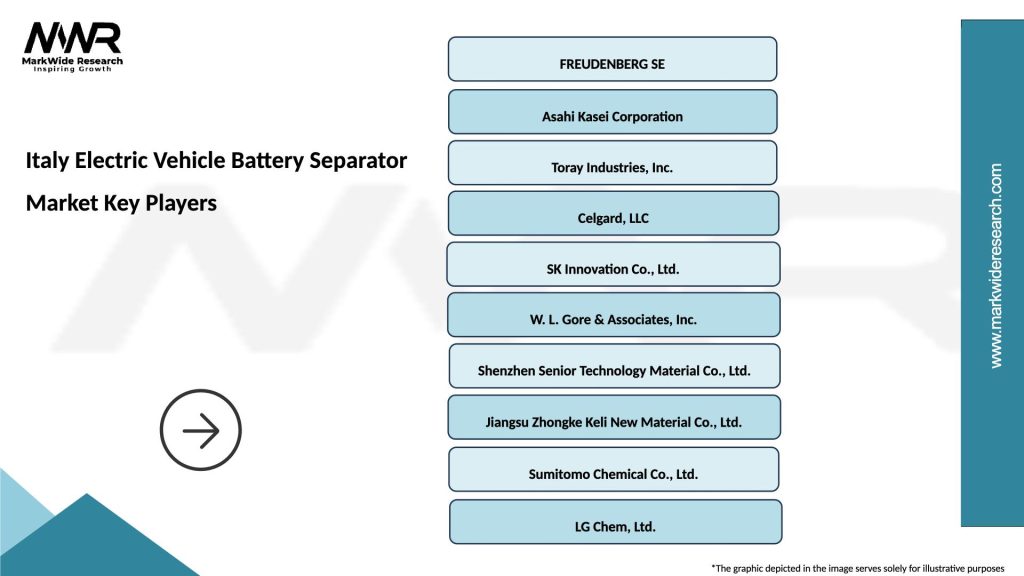

What are the key players in the Italy Electric Vehicle Battery Separator Market?

Key players in the Italy Electric Vehicle Battery Separator Market include companies like Asahi Kasei, Toray Industries, and Celgard, which are known for their advanced separator technologies and contributions to the electric vehicle industry, among others.

What are the growth factors driving the Italy Electric Vehicle Battery Separator Market?

The growth of the Italy Electric Vehicle Battery Separator Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation solutions. These factors are leading to a surge in battery production and innovation.

What challenges does the Italy Electric Vehicle Battery Separator Market face?

The Italy Electric Vehicle Battery Separator Market faces challenges such as high production costs, the need for continuous innovation, and competition from alternative battery technologies. These factors can impact the market’s growth and development.

What opportunities exist in the Italy Electric Vehicle Battery Separator Market?

Opportunities in the Italy Electric Vehicle Battery Separator Market include the rising adoption of electric vehicles, the development of new materials for separators, and potential collaborations between automotive manufacturers and battery producers. These trends can enhance market growth.

What trends are shaping the Italy Electric Vehicle Battery Separator Market?

Trends shaping the Italy Electric Vehicle Battery Separator Market include the shift towards solid-state batteries, increased focus on recycling and sustainability, and innovations in separator materials that improve battery efficiency and safety. These trends are crucial for the future of electric vehicle technology.

Italy Electric Vehicle Battery Separator Market

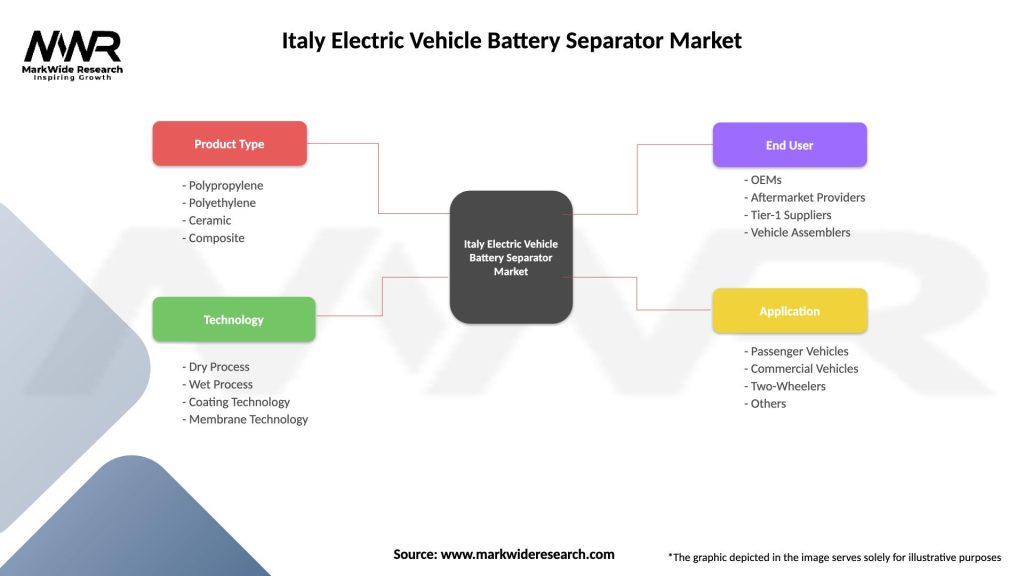

| Segmentation Details | Description |

|---|---|

| Product Type | Polypropylene, Polyethylene, Ceramic, Composite |

| Technology | Dry Process, Wet Process, Coating Technology, Membrane Technology |

| End User | OEMs, Aftermarket Providers, Tier-1 Suppliers, Vehicle Assemblers |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Electric Vehicle Battery Separator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at