444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy electric vehicle battery electrolyte market represents a crucial component of the nation’s rapidly evolving automotive electrification landscape. As Italy accelerates its transition toward sustainable transportation solutions, the demand for high-performance battery electrolytes has experienced unprecedented growth, driven by increasing electric vehicle adoption rates and stringent environmental regulations. The market encompasses various electrolyte technologies, including liquid electrolytes, solid-state electrolytes, and gel polymer electrolytes, each serving specific applications across passenger vehicles, commercial vehicles, and two-wheelers.

Market dynamics indicate that Italy’s electric vehicle battery electrolyte sector is experiencing robust expansion, with growth rates reaching 12.5% CAGR over the forecast period. This growth trajectory reflects the country’s commitment to achieving carbon neutrality by 2050 and the European Union’s ambitious electrification targets. The Italian automotive industry, traditionally dominated by internal combustion engines, is undergoing a fundamental transformation as major manufacturers invest heavily in electric vehicle production capabilities and battery technology development.

Regional positioning within the European electric vehicle ecosystem has positioned Italy as a strategic hub for battery electrolyte innovation and manufacturing. The country’s established chemical industry infrastructure, combined with government incentives for clean energy technologies, creates favorable conditions for market expansion. Italian manufacturers are increasingly focusing on developing advanced electrolyte formulations that enhance battery performance, safety, and longevity while reducing environmental impact.

The Italy electric vehicle battery electrolyte market refers to the comprehensive ecosystem of ionic conducting solutions and materials that facilitate electrochemical reactions within electric vehicle batteries across the Italian automotive sector. These electrolytes serve as the critical medium through which ions move between the cathode and anode during charging and discharging cycles, directly impacting battery performance, efficiency, and safety characteristics.

Electrolyte technologies encompass various chemical compositions and physical states, including organic liquid electrolytes based on lithium salts, aqueous electrolytes for specific applications, solid-state ceramic and polymer electrolytes, and hybrid gel polymer systems. Each technology offers distinct advantages in terms of energy density, thermal stability, safety profiles, and manufacturing scalability, addressing different segments of the Italian electric vehicle market.

Market scope extends beyond traditional passenger vehicles to include commercial electric vehicles, electric buses for public transportation, electric motorcycles and scooters popular in Italian urban environments, and emerging applications in electric aviation and marine transportation. The electrolyte market also encompasses aftermarket services, recycling solutions, and research and development activities focused on next-generation battery technologies.

Italy’s electric vehicle battery electrolyte market stands at the forefront of the country’s automotive electrification revolution, characterized by accelerating demand, technological innovation, and strategic investments in sustainable transportation infrastructure. The market benefits from Italy’s position as a major automotive manufacturing hub within Europe, with established supply chains and manufacturing expertise that facilitate rapid adoption of advanced battery technologies.

Key market drivers include government mandates for emission reduction, with 35% of new vehicle sales targeted to be electric by 2030, substantial investments in charging infrastructure, and consumer preference shifts toward environmentally sustainable transportation options. The Italian government’s National Recovery and Resilience Plan allocates significant funding for electric vehicle adoption and battery technology development, creating a supportive regulatory environment for market growth.

Technological advancement remains a critical success factor, with Italian research institutions and companies collaborating on breakthrough electrolyte formulations that address key challenges including energy density limitations, safety concerns, and cost optimization. The market is witnessing increased focus on solid-state electrolyte technologies, which promise enhanced safety and performance characteristics compared to conventional liquid electrolytes.

Competitive landscape features a mix of established chemical companies, specialized battery material suppliers, and emerging technology startups, all competing to capture market share in this rapidly expanding sector. Strategic partnerships between Italian automotive manufacturers and international battery technology companies are accelerating innovation and market development.

Market segmentation analysis reveals distinct growth patterns across different electrolyte technologies and application segments within the Italian market. The following key insights highlight critical market dynamics:

Regulatory mandates serve as the primary catalyst for Italy’s electric vehicle battery electrolyte market expansion. The European Union’s stringent emission standards and Italy’s commitment to phasing out internal combustion engines by 2035 create compelling demand for advanced battery technologies. Italian cities are implementing low-emission zones and congestion charges that favor electric vehicles, directly driving electrolyte demand across urban transportation segments.

Government incentives and financial support mechanisms significantly accelerate market adoption. Italy’s Ecobonus program provides substantial purchase incentives for electric vehicles, while the National Recovery and Resilience Plan allocates billions of euros for sustainable mobility infrastructure. These initiatives create favorable market conditions for battery electrolyte suppliers and encourage investment in local manufacturing capabilities.

Automotive industry transformation represents another crucial driver, as traditional Italian automotive manufacturers pivot toward electric vehicle production. Companies like Stellantis and Ferrari are investing heavily in electric vehicle platforms, creating sustained demand for high-performance battery electrolytes. The industry’s shift toward electrification requires reliable supply chains for critical battery components, including advanced electrolyte materials.

Technological advancement in battery chemistry and electrolyte formulations continues to expand market opportunities. Italian research institutions collaborate with industry partners to develop next-generation electrolyte technologies that offer improved performance, safety, and cost-effectiveness. These innovations enable broader electric vehicle adoption across different market segments and applications.

Consumer awareness and environmental consciousness drive increasing demand for sustainable transportation solutions. Italian consumers demonstrate growing preference for electric vehicles, supported by expanding charging infrastructure and improving vehicle performance characteristics enabled by advanced electrolyte technologies.

High manufacturing costs present significant challenges for Italy’s electric vehicle battery electrolyte market development. Advanced electrolyte materials, particularly solid-state technologies, require sophisticated production processes and expensive raw materials that increase overall battery costs. These cost factors can limit market penetration, especially in price-sensitive segments of the Italian automotive market.

Supply chain dependencies create vulnerabilities for Italian electrolyte manufacturers and automotive companies. Critical raw materials for electrolyte production, including lithium salts and specialized solvents, often originate from limited global sources, creating potential supply disruptions and price volatility. The concentration of key materials in specific geographic regions poses strategic risks for Italian market participants.

Technical challenges in electrolyte performance and safety continue to constrain market growth. Issues such as electrolyte degradation over time, thermal stability limitations, and compatibility with different battery chemistries require ongoing research and development investments. These technical constraints can delay product commercialization and increase development costs for Italian companies.

Regulatory complexity and evolving safety standards create compliance challenges for electrolyte manufacturers. The need to meet stringent European Union regulations for chemical safety, transportation, and environmental impact requires significant investment in testing, certification, and quality assurance processes. Regulatory changes can also necessitate reformulation of existing electrolyte products.

Competition from established markets in Asia and other European countries poses challenges for Italian electrolyte manufacturers seeking to establish market presence. Established players with economies of scale and advanced manufacturing capabilities can offer competitive pricing and proven performance, making market entry difficult for new Italian participants.

Solid-state electrolyte development presents exceptional opportunities for Italian companies to establish leadership in next-generation battery technologies. The superior safety characteristics and energy density potential of solid-state electrolytes align with Italian automotive manufacturers’ requirements for high-performance electric vehicles. Early investment in solid-state technology could position Italian companies as preferred suppliers for premium electric vehicle applications.

Circular economy initiatives create new market segments focused on electrolyte recycling and sustainable material recovery. Italy’s commitment to circular economy principles opens opportunities for companies developing innovative recycling processes that recover valuable materials from spent batteries. These initiatives can reduce raw material dependencies while creating new revenue streams for Italian market participants.

Commercial vehicle electrification represents a substantial growth opportunity as Italian logistics and transportation companies transition to electric fleets. The unique requirements of commercial applications, including fast charging capabilities and extended operational life, create demand for specialized electrolyte formulations. Italian companies can develop tailored solutions for this growing market segment.

Export potential to other European markets offers significant expansion opportunities for Italian electrolyte manufacturers. Italy’s strategic location and established chemical industry infrastructure provide advantages for serving broader European markets. Companies that develop competitive electrolyte technologies can leverage Italy as a manufacturing base for European distribution.

Research collaboration between Italian universities, research institutions, and industry partners creates opportunities for breakthrough innovations in electrolyte technology. These collaborations can accelerate technology development while reducing individual company risks and costs. Government funding for research initiatives further enhances these opportunities.

Supply and demand equilibrium in Italy’s electric vehicle battery electrolyte market reflects the complex interplay between rapidly growing electric vehicle adoption and evolving manufacturing capabilities. Current market dynamics indicate strong demand growth outpacing immediate supply capacity, creating opportunities for new market entrants and capacity expansion by existing players. The market experiences seasonal variations aligned with automotive production cycles and consumer purchasing patterns.

Price dynamics demonstrate significant volatility influenced by raw material costs, manufacturing scale economies, and competitive pressures. Italian electrolyte prices generally follow European market trends while reflecting local supply chain costs and regulatory compliance expenses. Manufacturing efficiency improvements of 15-20% annually help offset raw material cost increases and maintain competitive pricing structures.

Innovation cycles drive continuous market evolution as companies invest in research and development to maintain competitive advantages. The typical product development cycle for new electrolyte formulations spans 2-3 years from concept to commercialization, requiring sustained investment and technical expertise. Italian companies increasingly focus on application-specific electrolyte solutions that address unique market requirements.

Competitive intensity continues to increase as more companies recognize the strategic importance of the electric vehicle battery electrolyte market. Competition occurs across multiple dimensions including performance characteristics, cost-effectiveness, supply chain reliability, and technical support capabilities. Strategic partnerships and vertical integration strategies are becoming more common as companies seek to secure competitive positions.

Market maturation progresses through distinct phases, with Italy currently transitioning from early adoption to mainstream market development. This transition involves standardization of key technologies, establishment of reliable supply chains, and development of comprehensive service and support ecosystems. MarkWide Research analysis indicates that market maturation accelerates as electric vehicle adoption reaches critical mass in Italian urban markets.

Primary research methodology for analyzing Italy’s electric vehicle battery electrolyte market encompasses comprehensive interviews with industry executives, technical specialists, and market participants across the value chain. Research activities include structured interviews with electrolyte manufacturers, automotive companies, battery producers, and technology suppliers operating in the Italian market. Primary research also incorporates insights from government officials, regulatory bodies, and research institutions involved in electric vehicle and battery technology development.

Secondary research sources provide comprehensive market intelligence through analysis of industry reports, company financial statements, patent filings, and regulatory documentation. Research methodology includes systematic review of Italian automotive industry publications, European Union regulatory frameworks, and international battery technology developments that impact the Italian market. Academic research from Italian universities and technical institutions contributes valuable insights into emerging electrolyte technologies and market trends.

Data validation processes ensure research accuracy through triangulation of multiple information sources and expert verification of key findings. Market data undergoes rigorous validation through comparison with industry benchmarks, historical trend analysis, and expert panel reviews. Quantitative data receives statistical validation while qualitative insights undergo peer review by industry specialists.

Market modeling techniques employ sophisticated analytical frameworks to project market development scenarios and assess competitive dynamics. Research methodology incorporates econometric modeling, scenario planning, and sensitivity analysis to evaluate different market development pathways. Technology adoption curves and market penetration models provide insights into future market evolution patterns.

Continuous monitoring systems track market developments and validate research findings through ongoing data collection and analysis. Research methodology includes establishment of key performance indicators and market monitoring protocols that enable real-time assessment of market changes and emerging trends affecting Italy’s electric vehicle battery electrolyte sector.

Northern Italy dominates the electric vehicle battery electrolyte market, accounting for approximately 55% of national demand, driven by the concentration of automotive manufacturing facilities and advanced chemical industry infrastructure. The Lombardy and Piedmont regions host major automotive production centers and research facilities that drive electrolyte demand. Cities like Milan and Turin serve as innovation hubs where automotive companies collaborate with chemical suppliers to develop advanced electrolyte technologies.

Central Italy represents a growing market segment with 25% market share, characterized by increasing electric vehicle adoption in urban areas and expanding charging infrastructure. The region benefits from government initiatives promoting sustainable transportation and significant investments in electric vehicle manufacturing capabilities. Rome and surrounding areas demonstrate strong growth in electric vehicle registrations, driving demand for battery electrolytes across passenger and commercial vehicle segments.

Southern Italy shows emerging market potential with 20% current market share but the highest growth rates as electric vehicle adoption accelerates in major cities. The region’s strategic location for Mediterranean trade and growing logistics sector create opportunities for commercial electric vehicle applications. Government incentives specifically targeting southern Italian development contribute to accelerating market growth in this region.

Island regions including Sicily and Sardinia present unique market dynamics with specialized requirements for electric vehicle applications. These markets demonstrate particular interest in solid-state electrolyte technologies due to challenging operating conditions and limited service infrastructure. The island markets serve as testing grounds for advanced electrolyte technologies before broader mainland deployment.

Cross-regional collaboration facilitates knowledge transfer and supply chain optimization across Italian regions. Northern Italian chemical companies increasingly establish partnerships with southern Italian automotive facilities to optimize logistics and reduce transportation costs. This regional integration strengthens Italy’s overall competitiveness in the European electric vehicle battery electrolyte market.

Market leadership in Italy’s electric vehicle battery electrolyte sector features a diverse mix of international chemical companies, specialized battery material suppliers, and emerging Italian technology firms. The competitive landscape reflects the market’s evolution from traditional chemical applications to specialized electric vehicle requirements.

Competitive strategies emphasize technological differentiation, supply chain optimization, and strategic partnerships with Italian automotive manufacturers. Companies invest heavily in research and development to create proprietary electrolyte formulations that offer superior performance characteristics. Strategic alliances between chemical suppliers and automotive companies accelerate product development and market penetration.

Market positioning varies across different competitive segments, with some companies focusing on cost-effective solutions for mass market applications while others target premium performance segments. Italian companies leverage local market knowledge and established relationships to compete effectively against international suppliers.

By Electrolyte Type: The Italian market demonstrates clear segmentation across different electrolyte technologies, each serving specific application requirements and performance criteria. Liquid electrolytes currently dominate with 70% market share due to established manufacturing processes and cost-effectiveness. Solid-state electrolytes represent the fastest-growing segment with 25% annual growth driven by superior safety characteristics and energy density potential.

By Vehicle Type: Market segmentation reflects Italy’s diverse transportation landscape and varying electrification rates across different vehicle categories.

By Application: Different applications require specific electrolyte characteristics optimized for particular operating conditions and performance requirements.

Liquid Electrolyte Category maintains market dominance through established manufacturing infrastructure and proven performance in diverse operating conditions. Italian manufacturers focus on optimizing liquid electrolyte formulations to enhance energy density and extend operating temperature ranges. The category benefits from continuous innovation in additive technologies that improve safety characteristics while maintaining cost-effectiveness for mass market applications.

Solid-State Electrolyte Category represents the most dynamic growth segment with significant investment in research and development activities. Italian companies collaborate with international partners to develop commercially viable solid-state electrolyte technologies that address key challenges including manufacturing scalability and cost optimization. The category shows particular promise for premium vehicle applications where superior performance justifies higher costs.

Gel Polymer Electrolyte Category serves specialized applications requiring unique performance characteristics such as flexibility and enhanced safety. This category demonstrates growing importance in applications where traditional liquid electrolytes face limitations, including extreme temperature conditions and specialized form factors. Italian manufacturers develop customized gel polymer solutions for specific customer requirements.

Performance Optimization across all categories focuses on key metrics including energy density, cycle life, safety characteristics, and environmental impact. MWR analysis indicates that Italian companies prioritize balanced performance profiles that address multiple requirements simultaneously rather than optimizing single performance parameters.

Market Evolution within each category reflects broader technology trends and changing customer requirements. The transition toward higher performance electrolyte solutions drives innovation across all categories while maintaining focus on manufacturing scalability and cost-effectiveness for widespread adoption.

Automotive Manufacturers benefit from access to advanced electrolyte technologies that enable superior battery performance and competitive electric vehicle offerings. Italian automotive companies gain strategic advantages through partnerships with local electrolyte suppliers, including reduced supply chain risks, faster product development cycles, and customized solutions for specific vehicle platforms. The proximity of suppliers facilitates collaborative innovation and rapid response to changing market requirements.

Chemical Companies participating in the electrolyte market access high-growth opportunities with substantial revenue potential and technological advancement possibilities. The transition from traditional chemical applications to specialized battery materials offers significant value creation opportunities while leveraging existing manufacturing capabilities and technical expertise. Italian chemical companies benefit from established infrastructure and skilled workforce capabilities.

Technology Suppliers gain access to expanding market opportunities through partnerships with Italian automotive and chemical companies. The collaborative ecosystem facilitates technology transfer and joint development programs that accelerate innovation while sharing development risks and costs. Suppliers benefit from Italy’s strategic position within the European automotive market.

Government and Regulatory Bodies achieve environmental and economic objectives through supporting domestic electrolyte industry development. The growth of Italian electrolyte manufacturing capabilities contributes to job creation, technology leadership, and reduced dependence on imports for critical battery materials. Government initiatives create positive feedback loops that accelerate market development.

Research Institutions benefit from increased funding opportunities and industry collaboration that advance scientific knowledge while contributing to commercial applications. Italian universities and research centers gain access to real-world testing opportunities and industry expertise that enhance research capabilities and student training programs.

End Consumers ultimately benefit from improved electric vehicle performance, safety, and affordability enabled by advanced electrolyte technologies. The development of domestic electrolyte supply chains contributes to market stability and competitive pricing for Italian electric vehicle buyers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Solid-State Technology Acceleration represents the most significant trend shaping Italy’s electric vehicle battery electrolyte market. Italian companies increasingly invest in solid-state electrolyte development, recognizing the technology’s potential to address key limitations of conventional liquid systems. This trend involves substantial research and development investments, strategic partnerships with international technology leaders, and pilot manufacturing programs to demonstrate commercial viability.

Sustainability Integration drives comprehensive changes in electrolyte development and manufacturing processes. Italian companies prioritize environmentally sustainable production methods, renewable energy utilization, and circular economy principles in electrolyte lifecycle management. This trend includes development of bio-based electrolyte materials, implementation of closed-loop recycling systems, and reduction of environmental impact throughout the supply chain.

Localization Strategies gain momentum as companies seek to reduce supply chain dependencies and improve responsiveness to customer requirements. Italian automotive manufacturers increasingly prefer local electrolyte suppliers to minimize logistics costs, reduce delivery times, and enhance supply chain security. This trend drives investment in domestic manufacturing capabilities and technology transfer agreements.

Performance Optimization Focus emphasizes development of electrolyte formulations that simultaneously address multiple performance criteria including energy density, safety, cycle life, and cost-effectiveness. Italian companies develop balanced solutions rather than optimizing single performance parameters, reflecting market demands for comprehensive performance improvements.

Digital Integration transforms electrolyte development and manufacturing processes through implementation of advanced analytics, artificial intelligence, and digital twin technologies. These digital tools accelerate product development, optimize manufacturing processes, and enable predictive maintenance capabilities that improve operational efficiency.

Collaborative Innovation increases as companies recognize the benefits of shared research and development efforts in addressing complex technical challenges. Italian companies participate in consortium research programs, university partnerships, and international collaboration initiatives that pool resources and expertise for breakthrough innovations.

Manufacturing Capacity Expansion represents a major development trend as Italian companies invest in new production facilities and upgrade existing infrastructure to meet growing electrolyte demand. Recent announcements include significant capacity additions by major chemical companies and establishment of new manufacturing facilities specifically designed for battery electrolyte production. These investments demonstrate industry confidence in long-term market growth prospects.

Strategic Partnership Formation accelerates as companies seek to combine complementary capabilities and share development risks. Notable partnerships include collaborations between Italian chemical companies and international battery manufacturers, joint ventures for solid-state electrolyte development, and supply agreements that secure long-term market access. These partnerships facilitate technology transfer and market expansion.

Research and Development Initiatives receive substantial investment as companies and government agencies recognize the strategic importance of electrolyte technology leadership. Major developments include establishment of new research centers, university collaboration programs, and international research partnerships focused on next-generation electrolyte technologies. Government funding programs support these initiatives through grants and tax incentives.

Regulatory Framework Evolution shapes industry development through updated safety standards, environmental regulations, and quality requirements for battery materials. Recent regulatory developments include enhanced testing requirements for electrolyte safety, updated transportation regulations for hazardous materials, and new environmental standards for manufacturing processes.

Technology Commercialization progresses as research developments transition from laboratory to commercial applications. Key developments include pilot production programs for solid-state electrolytes, commercial launch of advanced liquid electrolyte formulations, and demonstration projects for recycling technologies. These commercialization efforts validate technical feasibility and market readiness.

Market Consolidation Activities emerge as the industry matures and companies seek to achieve greater scale and market presence. Recent activities include acquisitions of specialized electrolyte companies, merger discussions among mid-size players, and strategic investments by major chemical companies in electrolyte technology firms.

Technology Investment Priorities should focus on solid-state electrolyte development as the most promising long-term opportunity for Italian companies. MarkWide Research recommends prioritizing ceramic and polymer solid-state technologies that offer the best balance of performance improvement and manufacturing feasibility. Companies should establish dedicated research teams and pilot manufacturing capabilities to accelerate technology development and commercial readiness.

Strategic Partnership Development represents a critical success factor for Italian companies seeking to compete effectively in the global electrolyte market. Recommended partnership strategies include collaborations with international battery manufacturers for technology validation, joint ventures with Asian companies for manufacturing expertise, and alliances with automotive companies for application-specific development programs.

Supply Chain Optimization requires comprehensive strategies to address raw material dependencies and ensure reliable supply security. Italian companies should diversify supplier bases, invest in strategic inventory management, and explore backward integration opportunities for critical materials. Long-term supply agreements and strategic partnerships with raw material suppliers can provide supply security and cost stability.

Market Positioning Strategies should emphasize differentiation through superior performance, reliability, and customer service rather than competing primarily on cost. Italian companies can leverage their proximity to European automotive markets, technical expertise, and quality reputation to command premium pricing for high-performance electrolyte solutions.

Sustainability Integration should become a core component of business strategy as environmental considerations increasingly influence customer decisions and regulatory requirements. Companies should invest in sustainable manufacturing processes, develop bio-based electrolyte materials, and implement comprehensive recycling programs that create competitive advantages.

Talent Development requires sustained investment in workforce capabilities to support technology advancement and market expansion. Recommended initiatives include university partnership programs, technical training for existing workforce, and recruitment of international expertise in advanced electrolyte technologies.

Market expansion trajectory for Italy’s electric vehicle battery electrolyte sector indicates sustained growth driven by accelerating electric vehicle adoption and advancing battery technologies. The market is projected to experience robust growth with compound annual growth rates exceeding 15% through the forecast period, supported by government policies, automotive industry transformation, and technological advancement. This growth trajectory positions Italy as an increasingly important player in the European electrolyte market.

Technology evolution will fundamentally reshape the electrolyte landscape as solid-state technologies mature and achieve commercial viability. Italian companies that establish early leadership in solid-state electrolyte development are positioned to capture significant market share as automotive manufacturers transition to next-generation battery systems. The timeline for widespread solid-state adoption suggests commercial deployment beginning in premium vehicle segments within the next 3-5 years.

Industry consolidation is expected to accelerate as the market matures and companies seek to achieve greater scale and technological capabilities. This consolidation will likely favor companies with strong research and development capabilities, established customer relationships, and manufacturing scalability. Italian companies with unique technological advantages or strategic market positions are well-positioned to participate in this consolidation trend.

Regulatory environment will continue evolving to support electric vehicle adoption while ensuring safety and environmental protection. Future regulations are likely to establish more stringent performance standards for battery materials, enhanced recycling requirements, and updated safety protocols for electrolyte handling and transportation. Companies that proactively address these regulatory trends will maintain competitive advantages.

Global market integration will increase as Italian companies expand beyond domestic markets to serve broader European and international customers. The development of competitive electrolyte technologies and manufacturing capabilities positions Italian companies to capture export opportunities and participate in global supply chains for electric vehicle batteries.

Innovation acceleration will continue as companies invest in breakthrough technologies that address current limitations and enable new applications. Future innovations may include revolutionary electrolyte chemistries, advanced manufacturing processes, and integrated recycling systems that create sustainable competitive advantages for Italian market participants.

The Italy electric vehicle battery electrolyte market represents a dynamic and rapidly evolving sector that plays a crucial role in the country’s transition toward sustainable transportation. The market demonstrates strong growth potential driven by government policies supporting electric vehicle adoption, automotive industry transformation, and advancing electrolyte technologies that enable superior battery performance. Italian companies are well-positioned to capitalize on these opportunities through strategic investments in technology development, manufacturing capabilities, and market partnerships.

Key success factors for market participants include technology leadership in emerging areas such as solid-state electrolytes, strategic partnerships that combine complementary capabilities, and comprehensive sustainability strategies that address environmental and regulatory requirements. The market’s evolution toward higher performance and more sustainable solutions creates opportunities for companies that can deliver innovative electrolyte technologies while maintaining cost-effectiveness and manufacturing scalability.

Future market development will be characterized by continued technology advancement, industry consolidation, and expanding international market opportunities. Italian companies that establish strong competitive positions through technology differentiation and strategic partnerships are positioned to achieve sustained growth and market leadership. The market’s trajectory toward solid-state technologies and sustainable manufacturing practices aligns with Italy’s broader objectives for technology leadership and environmental responsibility in the automotive sector.

What is Electric Vehicle Battery Electrolyte?

Electric Vehicle Battery Electrolyte refers to the medium that allows the flow of electric charge between the anode and cathode in a battery. It plays a crucial role in the performance, safety, and longevity of electric vehicle batteries.

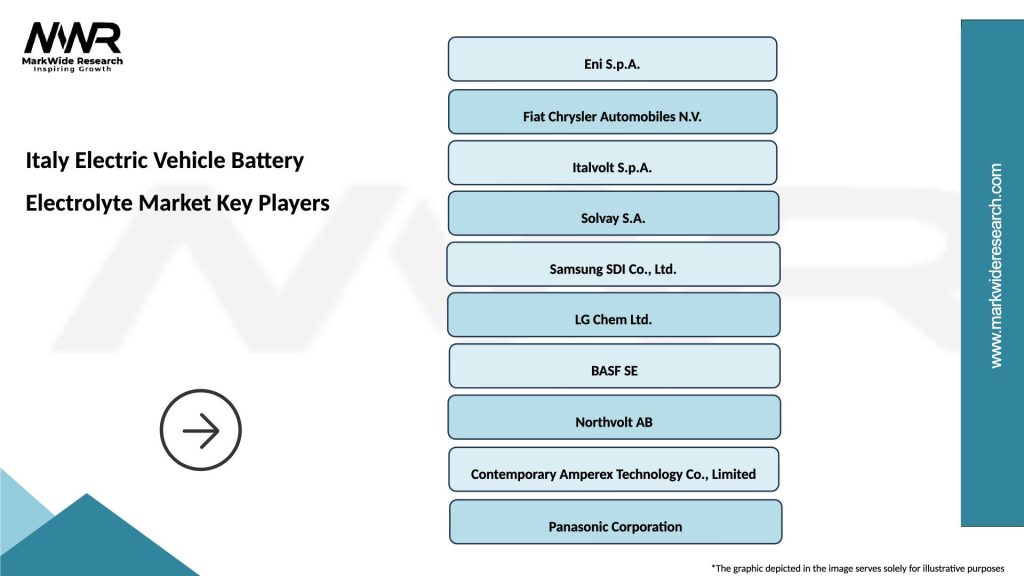

What are the key players in the Italy Electric Vehicle Battery Electrolyte Market?

Key players in the Italy Electric Vehicle Battery Electrolyte Market include companies like Solvay, BASF, and Mitsubishi Chemical, which are involved in the development and supply of advanced electrolytes for electric vehicle batteries, among others.

What are the growth factors driving the Italy Electric Vehicle Battery Electrolyte Market?

The growth of the Italy Electric Vehicle Battery Electrolyte Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation solutions.

What challenges does the Italy Electric Vehicle Battery Electrolyte Market face?

Challenges in the Italy Electric Vehicle Battery Electrolyte Market include the high cost of raw materials, safety concerns related to electrolyte stability, and the need for continuous innovation to meet evolving performance standards.

What opportunities exist in the Italy Electric Vehicle Battery Electrolyte Market?

Opportunities in the Italy Electric Vehicle Battery Electrolyte Market include the development of solid-state electrolytes, which promise enhanced safety and efficiency, and the growing trend of recycling battery materials to create sustainable supply chains.

What trends are shaping the Italy Electric Vehicle Battery Electrolyte Market?

Trends in the Italy Electric Vehicle Battery Electrolyte Market include the shift towards eco-friendly and high-performance electrolytes, increased investment in research and development, and the integration of digital technologies to optimize battery management systems.

Italy Electric Vehicle Battery Electrolyte Market

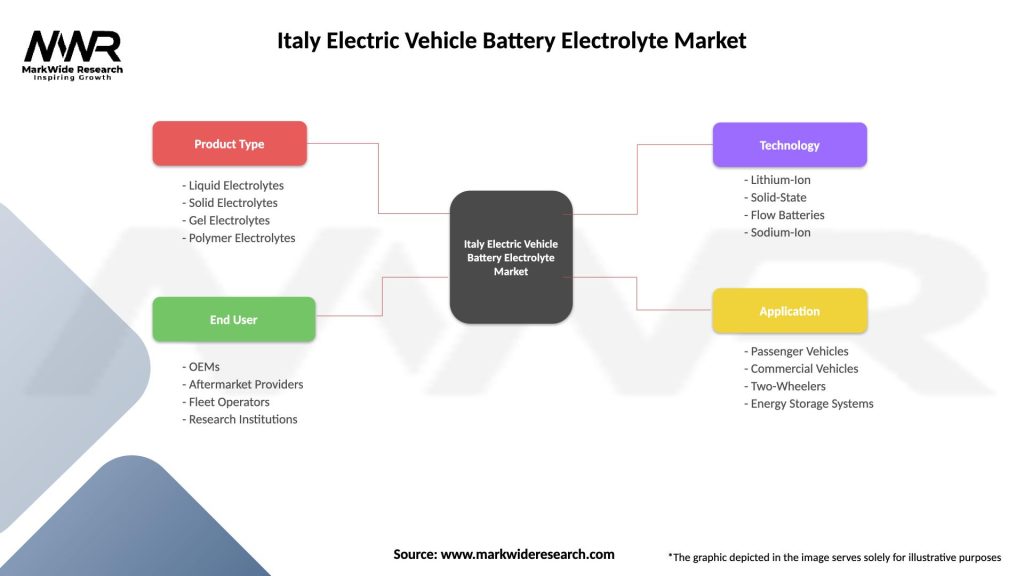

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Electrolytes, Solid Electrolytes, Gel Electrolytes, Polymer Electrolytes |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Research Institutions |

| Technology | Lithium-Ion, Solid-State, Flow Batteries, Sodium-Ion |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Energy Storage Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Electric Vehicle Battery Electrolyte Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at