444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy data center power market represents a critical infrastructure segment experiencing unprecedented growth as digital transformation accelerates across the nation. Italy’s strategic position in the Mediterranean region, combined with its robust industrial base and increasing cloud adoption, has positioned the country as a key hub for data center development in Southern Europe. The market encompasses power distribution units, uninterruptible power supplies, backup generators, and advanced power management systems that ensure continuous operations for mission-critical applications.

Market dynamics indicate substantial expansion driven by the proliferation of hyperscale data centers, edge computing deployments, and the growing demand for colocation services. Italian enterprises are increasingly migrating to cloud-based solutions, creating significant demand for reliable power infrastructure. The market is experiencing a compound annual growth rate of 8.2%, reflecting the country’s commitment to digital infrastructure modernization and the European Union’s digitalization initiatives.

Regional concentration remains highest in Northern Italy, particularly around Milan and Turin, where approximately 45% of data center capacity is located. However, emerging markets in Rome and Naples are gaining traction as organizations seek geographic diversification and improved latency for southern European operations. The integration of renewable energy sources and sustainability initiatives are reshaping power infrastructure requirements, with renewable energy adoption reaching 35% across major data center facilities.

The Italy data center power market refers to the comprehensive ecosystem of electrical infrastructure, power management systems, and energy solutions specifically designed to support data center operations throughout Italy. This market encompasses all power-related components from primary electrical feeds and distribution systems to backup power solutions and advanced monitoring technologies that ensure uninterrupted service delivery for digital infrastructure.

Power infrastructure components include uninterruptible power supply systems, diesel generators, power distribution units, electrical switchgear, and sophisticated energy management platforms. The market also covers emerging technologies such as lithium-ion battery systems, fuel cells, and smart grid integration solutions that enhance efficiency and reliability while reducing environmental impact.

Italy’s data center power market is experiencing robust expansion fueled by digital transformation initiatives, cloud migration trends, and increasing demand for edge computing solutions. The market demonstrates strong fundamentals with consistent growth across multiple segments, driven by both domestic demand and Italy’s role as a regional connectivity hub for Mediterranean and North African markets.

Key growth drivers include the expansion of hyperscale cloud providers, increasing adoption of artificial intelligence and machine learning applications, and the proliferation of Internet of Things devices requiring edge processing capabilities. The market benefits from supportive government policies promoting digital infrastructure development and substantial investments in renewable energy integration.

Technological advancement remains a critical factor, with operators increasingly adopting advanced power management systems, modular UPS solutions, and intelligent monitoring platforms. The shift toward sustainable operations has accelerated the adoption of energy-efficient technologies, with power usage effectiveness improvements of 15% reported across major facilities over the past two years.

Strategic market insights reveal several critical trends shaping the Italy data center power landscape:

Digital transformation acceleration serves as the primary catalyst for Italy’s data center power market expansion. Organizations across industries are rapidly adopting cloud-first strategies, creating unprecedented demand for reliable data center infrastructure. The COVID-19 pandemic has further accelerated this trend, with remote work and digital service delivery becoming permanent fixtures of the Italian business landscape.

Government initiatives supporting digital infrastructure development provide substantial market momentum. Italy’s National Recovery and Resilience Plan allocates significant resources to digital transformation projects, including data center infrastructure modernization. These investments are complemented by European Union digitalization programs that prioritize sustainable and efficient data center operations.

Cloud service provider expansion represents another significant driver, with major international players establishing regional presence in Italy. This expansion creates demand for hyperscale power infrastructure capable of supporting massive computing workloads while maintaining high efficiency standards. The trend toward data sovereignty and local data processing requirements further amplifies this demand.

Edge computing proliferation is driving distributed power infrastructure requirements across Italy. As applications require lower latency and real-time processing capabilities, organizations are deploying edge data centers in strategic locations, each requiring robust power solutions tailored to smaller-scale operations.

High capital investment requirements present significant barriers to market entry and expansion. Advanced power infrastructure systems require substantial upfront investments, particularly for backup power systems and redundant configurations necessary for mission-critical operations. These costs can be prohibitive for smaller organizations and emerging market participants.

Regulatory complexity creates challenges for market participants navigating Italy’s evolving energy and environmental regulations. Compliance requirements for energy efficiency, emissions standards, and grid integration add complexity and cost to power infrastructure deployments. The regulatory landscape continues to evolve, creating uncertainty for long-term planning and investment decisions.

Grid infrastructure limitations in certain regions constrain data center development and power system design options. While Northern Italy benefits from robust electrical infrastructure, some areas lack the grid capacity necessary to support large-scale data center operations, requiring significant infrastructure investments or limiting deployment options.

Skilled workforce shortages impact the market’s ability to support rapid expansion. The specialized nature of data center power systems requires experienced technicians and engineers, but the available talent pool remains limited. This constraint affects both deployment timelines and ongoing operational efficiency.

Renewable energy integration presents substantial opportunities for market participants developing sustainable power solutions. Italy’s commitment to carbon neutrality and abundant renewable energy resources create favorable conditions for innovative power infrastructure that combines traditional reliability with environmental responsibility. Solar and wind integration projects offer significant growth potential.

Edge computing expansion creates opportunities for specialized power solutions tailored to distributed infrastructure requirements. As 5G networks deploy across Italy and IoT applications proliferate, demand for edge data centers will drive need for compact, efficient power systems designed for unmanned operations and remote monitoring.

Modernization of existing facilities offers substantial market opportunities as operators upgrade aging power infrastructure to meet current efficiency and reliability standards. Many existing data centers require power system upgrades to support higher density computing and improved energy efficiency, creating a robust retrofit market.

International connectivity projects position Italy as a strategic hub for submarine cable landings and international data exchange, creating demand for specialized power infrastructure supporting these critical connectivity assets. The Mediterranean’s role in connecting Europe, Africa, and Asia presents unique opportunities for power infrastructure providers.

Supply chain evolution is reshaping the Italy data center power market as manufacturers adapt to changing technology requirements and sustainability mandates. Traditional power equipment suppliers are expanding their portfolios to include energy-efficient solutions, smart monitoring systems, and renewable energy integration capabilities. This evolution creates both opportunities and challenges as market participants navigate technological transitions.

Competitive intensity continues to increase as both established players and new entrants vie for market share in Italy’s expanding data center sector. Competition is driving innovation in power efficiency, reliability, and cost-effectiveness while pushing participants to develop differentiated service offerings and specialized solutions for specific market segments.

Technology convergence is creating new market dynamics as power systems integrate with broader data center infrastructure management platforms. The convergence of power, cooling, and IT infrastructure management is enabling more sophisticated optimization strategies and creating demand for integrated solutions that can manage entire facility operations.

Customer expectations are evolving toward comprehensive service offerings that extend beyond equipment supply to include ongoing monitoring, maintenance, and optimization services. This shift is driving power infrastructure providers to develop service capabilities and long-term partnership models that ensure optimal performance throughout system lifecycles.

Comprehensive market analysis for the Italy data center power market employs multiple research methodologies to ensure accuracy and completeness. Primary research includes extensive interviews with industry executives, technology providers, data center operators, and end-users across various sectors. These interviews provide insights into market trends, technology adoption patterns, and future requirements that shape market development.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market baselines and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and provides historical context for trend analysis and future projections.

Market modeling utilizes advanced analytical techniques to project market growth, segment performance, and regional development patterns. The methodology incorporates economic indicators, technology adoption curves, and regulatory impact assessments to develop robust market forecasts and scenario analyses.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical verification methods. This rigorous approach provides confidence in market insights and recommendations while identifying potential risks and opportunities that may impact market development.

Northern Italy dominates the data center power market, accounting for approximately 60% of total market activity. The region benefits from robust electrical infrastructure, proximity to major European markets, and concentration of multinational corporations requiring data center services. Milan serves as the primary hub, with significant activity in Turin and Genoa supporting both domestic and international connectivity requirements.

Central Italy represents a growing market segment, with Rome emerging as a key data center location driven by government digitalization initiatives and increasing enterprise demand. The region accounts for approximately 25% of market share and is experiencing accelerated growth as organizations seek geographic diversification and improved disaster recovery capabilities.

Southern Italy presents significant growth opportunities despite currently representing a smaller market share of approximately 15%. Naples and other southern cities are attracting investment as connectivity to North Africa and the Eastern Mediterranean improves. Government incentives for southern development and improving infrastructure are supporting market expansion in this region.

Island territories including Sicily and Sardinia represent emerging markets with specialized requirements for power infrastructure. These locations offer strategic advantages for submarine cable landings and serve growing local demand for data center services, though infrastructure limitations require innovative power solutions tailored to island operations.

Market leadership in Italy’s data center power sector is characterized by a mix of international technology providers and specialized regional players. The competitive landscape reflects the market’s evolution from traditional electrical infrastructure toward sophisticated, integrated power management solutions.

By Component: The Italy data center power market segments into several key component categories, each addressing specific infrastructure requirements and operational needs.

By Data Center Type: Market segmentation reflects diverse operational requirements across different data center categories.

Hyperscale segment demonstrates the strongest growth trajectory, driven by major cloud service providers establishing Italian operations. These facilities require sophisticated power infrastructure capable of supporting massive computing workloads while maintaining exceptional efficiency standards. Power usage effectiveness improvements of 12% have been achieved through advanced power management and cooling integration.

Colocation facilities represent a mature but evolving segment, with operators upgrading power infrastructure to support higher density computing and diverse customer requirements. The segment benefits from increasing enterprise adoption of colocation services as organizations seek to reduce capital expenditure while maintaining control over their IT infrastructure.

Enterprise data centers continue to modernize power infrastructure to support digital transformation initiatives and improved operational efficiency. Many organizations are implementing modular power solutions that can scale with changing requirements while providing enhanced monitoring and management capabilities.

Edge computing facilities represent the fastest-growing segment, requiring specialized power solutions designed for unmanned operations and remote monitoring. These facilities typically require compact, highly reliable power systems that can operate in diverse environmental conditions while maintaining connectivity to central management platforms.

Technology providers benefit from expanding market opportunities driven by Italy’s digital transformation and infrastructure modernization initiatives. The market offers potential for long-term partnerships with data center operators and opportunities to showcase innovative power solutions that address evolving efficiency and sustainability requirements.

Data center operators gain access to advanced power infrastructure solutions that improve operational efficiency, reduce energy costs, and enhance service reliability. Modern power systems provide sophisticated monitoring and management capabilities that enable proactive maintenance and optimization strategies.

End-user organizations benefit from improved service reliability and performance as data center operators deploy advanced power infrastructure. Enhanced power management translates to better application performance, reduced downtime, and improved user experiences across digital services.

Government and regulatory bodies benefit from improved national digital infrastructure that supports economic development and competitiveness. Advanced power systems contribute to energy efficiency goals and environmental sustainability objectives while enabling the digital services essential for modern governance and public service delivery.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping Italy’s data center power market. Operators are increasingly adopting renewable energy sources, implementing advanced energy management systems, and pursuing carbon neutrality goals. This trend is driving demand for innovative power solutions that combine traditional reliability with environmental responsibility.

Modular power systems are gaining traction as organizations seek flexible infrastructure that can adapt to changing requirements. These solutions enable rapid deployment, easy scaling, and improved maintenance efficiency while reducing initial capital investments. The modular approach is particularly attractive for edge computing applications and phased data center expansions.

Artificial intelligence integration is transforming power management through predictive analytics, automated optimization, and intelligent monitoring systems. AI-powered solutions can anticipate power requirements, optimize energy usage, and predict maintenance needs, resulting in improved efficiency and reduced operational costs.

Lithium-ion battery adoption is accelerating as organizations seek alternatives to traditional lead-acid battery systems. Lithium-ion solutions offer improved energy density, longer lifespan, and reduced maintenance requirements, making them attractive for modern data center applications despite higher initial costs.

Major infrastructure investments are reshaping Italy’s data center landscape, with several hyperscale facilities under development or recently completed. These projects require sophisticated power infrastructure capable of supporting massive computing workloads while meeting strict efficiency and reliability standards.

Regulatory developments continue to influence market dynamics, with new energy efficiency standards and environmental regulations affecting power system design and implementation. MarkWide Research analysis indicates that regulatory compliance is becoming increasingly important for market participants seeking long-term success.

Technology partnerships between power infrastructure providers and data center operators are creating integrated solutions that optimize performance across entire facilities. These collaborations are driving innovation in power management, monitoring, and maintenance while improving overall operational efficiency.

Renewable energy projects specifically designed to support data center operations are gaining momentum, with several large-scale solar and wind installations planned or under construction. These projects represent significant opportunities for power infrastructure providers specializing in renewable energy integration.

Market participants should focus on developing comprehensive service offerings that extend beyond equipment supply to include ongoing monitoring, maintenance, and optimization services. The market is evolving toward long-term partnerships that ensure optimal performance throughout system lifecycles while providing predictable revenue streams for providers.

Technology innovation remains critical for competitive success, particularly in areas such as energy efficiency, renewable energy integration, and intelligent monitoring systems. Organizations should invest in research and development capabilities that address evolving customer requirements and regulatory standards.

Geographic expansion strategies should consider the growing opportunities in Central and Southern Italy, where infrastructure development is accelerating. However, expansion efforts must account for regional differences in infrastructure, regulations, and market dynamics.

Sustainability positioning is becoming increasingly important as customers prioritize environmental responsibility. Power infrastructure providers should develop comprehensive sustainability strategies that address both product design and operational practices while supporting customer environmental objectives.

Long-term market prospects for Italy’s data center power sector remain highly positive, driven by continued digital transformation, cloud adoption, and edge computing proliferation. MWR projections indicate sustained growth across all market segments, with particularly strong performance expected in edge computing and sustainable power solutions.

Technology evolution will continue to reshape market requirements, with emerging technologies such as quantum computing, advanced AI applications, and next-generation networking creating new power infrastructure demands. Market participants must remain agile and innovative to address these evolving requirements.

Regulatory landscape evolution will likely emphasize sustainability and energy efficiency, creating both challenges and opportunities for market participants. Organizations that proactively address environmental requirements and develop sustainable solutions will be best positioned for long-term success.

Market consolidation may accelerate as smaller players seek partnerships or acquisition opportunities to compete effectively in an increasingly sophisticated market. This consolidation could create opportunities for specialized providers while challenging traditional market structures.

Italy’s data center power market represents a dynamic and rapidly evolving sector with substantial growth potential driven by digital transformation, cloud adoption, and emerging technology requirements. The market benefits from Italy’s strategic geographic position, supportive government policies, and robust industrial base, while facing challenges related to regional disparities, regulatory complexity, and skills shortages.

Market participants who focus on innovation, sustainability, and comprehensive service offerings will be best positioned to capitalize on emerging opportunities in hyperscale, edge computing, and renewable energy integration. The shift toward modular, intelligent power solutions creates significant potential for organizations that can deliver integrated platforms addressing evolving customer requirements.

Future success in Italy’s data center power market will depend on the ability to navigate regulatory requirements, develop sustainable solutions, and build long-term partnerships with data center operators. Organizations that can combine technological innovation with local market expertise and comprehensive service capabilities will achieve competitive advantage in this expanding market.

What is Data Center Power?

Data Center Power refers to the electrical power supply and management systems that support the operation of data centers, including servers, storage, and networking equipment. It encompasses various aspects such as power distribution, backup systems, and energy efficiency measures.

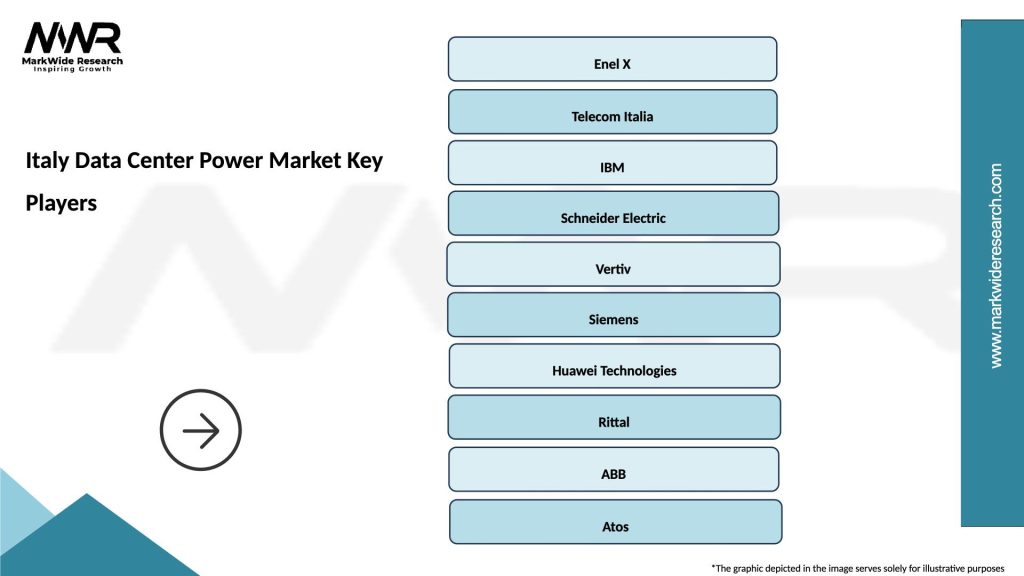

What are the key players in the Italy Data Center Power Market?

Key players in the Italy Data Center Power Market include Enel X, Schneider Electric, and ABB, which provide innovative power solutions and infrastructure for data centers. These companies focus on energy efficiency and reliability to meet the growing demands of data processing and storage, among others.

What are the main drivers of the Italy Data Center Power Market?

The main drivers of the Italy Data Center Power Market include the increasing demand for cloud computing services, the rise in data generation, and the need for energy-efficient solutions. Additionally, the growth of IoT applications and digital transformation initiatives are contributing to the market’s expansion.

What challenges does the Italy Data Center Power Market face?

The Italy Data Center Power Market faces challenges such as high energy costs, regulatory compliance issues, and the need for sustainable energy solutions. Additionally, the rapid pace of technological change can make it difficult for companies to keep up with the latest power management innovations.

What opportunities exist in the Italy Data Center Power Market?

Opportunities in the Italy Data Center Power Market include the development of renewable energy sources, advancements in energy storage technologies, and the implementation of smart grid solutions. These factors can enhance energy efficiency and reduce operational costs for data center operators.

What trends are shaping the Italy Data Center Power Market?

Trends shaping the Italy Data Center Power Market include the increasing adoption of modular data centers, the focus on sustainability and carbon neutrality, and the integration of AI for power management. These trends reflect the industry’s shift towards more efficient and environmentally friendly operations.

Italy Data Center Power Market

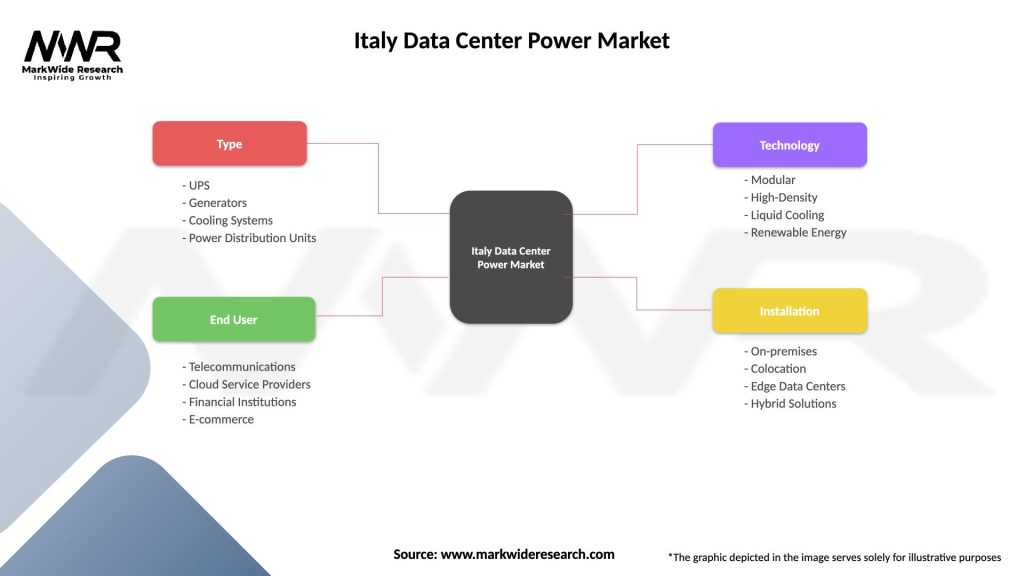

| Segmentation Details | Description |

|---|---|

| Type | UPS, Generators, Cooling Systems, Power Distribution Units |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, E-commerce |

| Technology | Modular, High-Density, Liquid Cooling, Renewable Energy |

| Installation | On-premises, Colocation, Edge Data Centers, Hybrid Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Data Center Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at