444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy data center cooling market represents a critical segment of the country’s rapidly expanding digital infrastructure ecosystem. As Italy continues its digital transformation journey, the demand for efficient and sustainable cooling solutions has reached unprecedented levels. Data center cooling systems are essential for maintaining optimal operating temperatures, ensuring equipment reliability, and maximizing energy efficiency across Italy’s growing network of data facilities.

Market dynamics in Italy are being shaped by several key factors, including the increasing adoption of cloud computing services, the proliferation of edge computing infrastructure, and stringent environmental regulations. The Italian market is experiencing robust growth, with cooling solutions evolving from traditional air-based systems to advanced liquid cooling and hybrid technologies. Energy efficiency has become a paramount concern, driving innovation in cooling technologies that can deliver superior performance while reducing environmental impact.

Regional distribution shows significant concentration in major metropolitan areas, with Milan, Rome, and Naples leading the deployment of advanced data center facilities. The market is characterized by a growing emphasis on sustainable cooling solutions, with operators increasingly adopting technologies that align with Italy’s commitment to carbon neutrality. Growth projections indicate the market will expand at a compound annual growth rate of 8.2% through the forecast period, driven by increasing digitalization and data processing requirements.

The Italy data center cooling market refers to the comprehensive ecosystem of technologies, systems, and services designed to maintain optimal thermal conditions within data center facilities across Italy. This market encompasses various cooling methodologies, including traditional air conditioning systems, liquid cooling solutions, free cooling technologies, and innovative hybrid approaches that combine multiple cooling techniques for enhanced efficiency.

Data center cooling involves the systematic removal of heat generated by IT equipment, power distribution units, and other infrastructure components to prevent overheating and ensure continuous operation. The market includes both hardware components such as chillers, cooling towers, computer room air handlers, and precision air conditioning units, as well as associated services including installation, maintenance, and optimization.

Technological scope extends beyond basic temperature control to encompass humidity management, air quality control, and energy optimization systems. Modern cooling solutions integrate advanced monitoring and control systems that enable real-time optimization of cooling performance while minimizing energy consumption and operational costs.

Strategic analysis reveals that Italy’s data center cooling market is undergoing a fundamental transformation driven by evolving technological requirements and environmental considerations. The market landscape is characterized by increasing adoption of energy-efficient cooling technologies, with liquid cooling solutions gaining significant traction among hyperscale data center operators.

Key market drivers include the rapid expansion of cloud services, growing demand for edge computing infrastructure, and stringent energy efficiency regulations imposed by Italian and European authorities. The market is witnessing a shift toward sustainable cooling practices, with operators prioritizing solutions that reduce power usage effectiveness and carbon footprint.

Competitive dynamics show a mix of international technology providers and local system integrators competing for market share. Innovation focus areas include artificial intelligence-driven cooling optimization, modular cooling systems, and integration with renewable energy sources. Market participants are increasingly offering comprehensive cooling-as-a-service solutions to address the complex requirements of modern data center operations.

Investment trends indicate substantial capital allocation toward next-generation cooling infrastructure, with particular emphasis on solutions that can support high-density computing environments and emerging technologies such as artificial intelligence and machine learning workloads.

Market intelligence reveals several critical insights that define the current state and future trajectory of Italy’s data center cooling sector:

Digital transformation initiatives across Italian enterprises and government organizations are creating unprecedented demand for data center capacity, directly driving the need for advanced cooling solutions. The acceleration of cloud adoption, particularly following the global shift toward remote work and digital services, has resulted in substantial expansion of data center infrastructure requiring sophisticated thermal management systems.

Regulatory pressures from both Italian and European Union authorities are compelling data center operators to adopt more energy-efficient cooling technologies. The European Green Deal and Italy’s National Recovery and Resilience Plan emphasize sustainable digital infrastructure, creating strong incentives for operators to invest in advanced cooling solutions that reduce environmental impact.

Technological advancement in computing hardware is generating higher heat densities that traditional cooling systems cannot adequately address. The deployment of high-performance processors, graphics processing units for artificial intelligence workloads, and dense server configurations requires innovative cooling approaches that can handle increased thermal loads while maintaining energy efficiency.

Cost optimization pressures are driving adoption of intelligent cooling systems that can dynamically adjust performance based on real-time conditions. Operators are seeking solutions that reduce total cost of ownership through improved energy efficiency, predictive maintenance capabilities, and automated optimization features.

High capital investment requirements for advanced cooling infrastructure present significant barriers for smaller data center operators and enterprises considering facility upgrades. The substantial upfront costs associated with implementing liquid cooling systems, upgrading power infrastructure, and integrating monitoring systems can delay adoption decisions and limit market growth.

Technical complexity associated with modern cooling systems requires specialized expertise that may not be readily available in the Italian market. The integration of advanced cooling technologies with existing infrastructure often presents challenges related to compatibility, system integration, and ongoing maintenance requirements.

Space constraints in urban areas where many data centers are located limit the deployment of certain cooling technologies, particularly those requiring additional equipment footprint or external cooling infrastructure. Dense urban environments may also restrict access to natural cooling resources or impose limitations on cooling tower installations.

Regulatory uncertainty regarding future environmental standards and energy efficiency requirements can create hesitation among operators when making long-term cooling infrastructure investments. Changing regulations may require costly modifications or upgrades to newly installed systems, creating financial risk for market participants.

Edge computing expansion presents substantial opportunities for cooling solution providers as telecommunications companies and enterprises deploy distributed computing infrastructure across Italy. Edge data centers require compact, efficient cooling solutions that can operate reliably in diverse environmental conditions while maintaining low operational costs.

Artificial intelligence workloads are creating demand for specialized cooling solutions capable of handling extreme heat densities generated by GPU clusters and high-performance computing systems. This trend opens opportunities for liquid cooling specialists and providers of hybrid cooling solutions designed for AI infrastructure.

Sustainability mandates are driving opportunities for providers of renewable energy-integrated cooling systems, waste heat recovery solutions, and ultra-efficient cooling technologies. The growing emphasis on circular economy principles creates market potential for innovative cooling approaches that minimize environmental impact.

Service-based business models offer opportunities for cooling solution providers to develop recurring revenue streams through managed services, performance optimization, and cooling-as-a-service offerings. These models can reduce customer capital expenditure requirements while providing predictable revenue for solution providers.

Supply chain dynamics in the Italy data center cooling market are influenced by global component availability, local manufacturing capabilities, and logistics considerations. The market has experienced some supply chain disruptions, leading to increased focus on local sourcing and strategic inventory management among cooling solution providers.

Competitive intensity is increasing as both established cooling technology vendors and emerging solution providers compete for market share. This competition is driving innovation in product development, pricing strategies, and service offerings, ultimately benefiting end customers through improved solutions and competitive pricing.

Technology convergence is creating new market dynamics as cooling systems increasingly integrate with broader data center infrastructure management platforms. The convergence of cooling, power management, and monitoring systems is enabling more holistic approaches to data center optimization.

Customer behavior is evolving toward preference for comprehensive solutions that address multiple aspects of data center operations. Customers increasingly value vendors that can provide integrated cooling solutions with strong service support and long-term partnership capabilities.

Comprehensive market analysis was conducted through a multi-faceted research approach combining primary and secondary research methodologies. The research framework incorporated extensive interviews with key market participants, including data center operators, cooling solution providers, system integrators, and industry consultants across Italy’s major metropolitan areas.

Primary research activities included structured interviews with senior executives from leading data center facilities, cooling technology vendors, and end-user organizations. Survey methodologies were employed to gather quantitative data on market trends, technology adoption patterns, and investment priorities from a representative sample of market participants.

Secondary research encompassed analysis of industry publications, regulatory documents, company financial reports, and technical specifications from major cooling solution providers. Market intelligence was gathered from trade associations, government databases, and industry conferences to ensure comprehensive coverage of market dynamics.

Data validation processes included cross-referencing information from multiple sources, conducting follow-up interviews to verify key findings, and employing statistical analysis techniques to ensure data accuracy and reliability. The research methodology adhered to established market research standards and best practices.

Northern Italy dominates the data center cooling market, accounting for approximately 65% of total cooling infrastructure investments. The region benefits from favorable climate conditions for free cooling technologies, robust industrial infrastructure, and proximity to major European data center markets. Milan serves as the primary hub for hyperscale data center development, driving demand for advanced cooling solutions.

Central Italy, anchored by Rome and surrounding areas, represents a significant market segment focused on government and enterprise data centers. The region’s cooling market is characterized by emphasis on reliability and compliance with stringent security requirements. Colocation facilities in central Italy are increasingly adopting modular cooling solutions to accommodate diverse customer requirements.

Southern Italy presents emerging opportunities as digital infrastructure development accelerates in regions such as Naples, Bari, and Palermo. The warmer climate in southern regions creates unique cooling challenges but also opportunities for innovative solutions such as seawater cooling and advanced evaporative cooling technologies.

Island regions including Sicily and Sardinia are experiencing growing demand for edge computing infrastructure, creating niche opportunities for compact, efficient cooling solutions designed for distributed deployment scenarios.

Market leadership is distributed among several key categories of participants, each bringing distinct capabilities and market positioning strategies:

By Technology:

By Application:

By Component:

Air-Based Cooling Systems continue to dominate the Italian market due to their proven reliability, lower initial investment requirements, and extensive service infrastructure. However, the segment is evolving toward more efficient designs incorporating variable speed drives, advanced controls, and integration with building management systems. Precision air conditioning units are experiencing steady demand from enterprise data centers prioritizing reliability and precise environmental control.

Liquid Cooling Technologies are gaining momentum, particularly in high-performance computing and artificial intelligence applications where traditional air cooling proves insufficient. Direct-to-chip cooling solutions are being adopted by organizations deploying high-density server configurations, while immersion cooling is attracting interest from cryptocurrency mining operations and research institutions.

Free Cooling Solutions are experiencing strong adoption across Italy, leveraging the country’s favorable climate conditions for natural cooling. Economizer systems are being integrated into new data center designs, while existing facilities are retrofitting cooling systems to incorporate free cooling capabilities during cooler months.

Hybrid Cooling Approaches are emerging as optimal solutions for facilities with diverse workload requirements. These systems combine multiple cooling technologies to optimize efficiency across varying operating conditions and equipment types, providing flexibility for future expansion and technology evolution.

Data Center Operators benefit from advanced cooling solutions through reduced energy consumption, improved equipment reliability, and enhanced operational efficiency. Modern cooling systems enable operators to achieve better power usage effectiveness ratios, reduce maintenance requirements, and extend equipment lifespan through optimal thermal management.

Technology Vendors gain opportunities to differentiate their offerings through innovative cooling solutions that address specific customer requirements. The growing market provides revenue growth potential through both equipment sales and recurring service revenues from maintenance and optimization services.

End Users experience improved service reliability, reduced operational costs, and enhanced sustainability through efficient cooling infrastructure. Organizations benefit from reduced total cost of ownership and improved environmental performance of their digital infrastructure investments.

System Integrators can expand their service portfolios by incorporating cooling expertise, creating additional revenue streams and strengthening customer relationships through comprehensive infrastructure solutions. The complexity of modern cooling systems creates opportunities for specialized integration and optimization services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming cooling system management through predictive analytics, automated optimization, and intelligent fault detection. AI-powered cooling systems can anticipate thermal loads, optimize energy consumption, and predict maintenance requirements, resulting in improved efficiency and reduced operational costs.

Liquid Cooling Adoption is accelerating as data centers deploy higher-density computing equipment that generates heat levels beyond the capacity of traditional air cooling systems. Direct liquid cooling and immersion cooling technologies are becoming mainstream solutions for high-performance computing and AI workloads.

Sustainability Focus is driving adoption of environmentally responsible cooling technologies, including integration with renewable energy sources, waste heat recovery systems, and ultra-efficient cooling designs. Carbon neutrality goals are influencing cooling technology selection and operational strategies.

Modular Cooling Solutions are gaining popularity due to their scalability, faster deployment, and reduced capital investment requirements. Modular systems enable data center operators to match cooling capacity with actual demand while maintaining flexibility for future expansion.

Edge Computing Requirements are creating demand for compact, efficient cooling solutions that can operate reliably in diverse environmental conditions with minimal maintenance requirements. Distributed cooling strategies are being developed to support edge infrastructure deployment.

Technology Innovation continues to drive significant developments in the Italian data center cooling market. Recent advancements include the introduction of next-generation liquid cooling systems capable of handling extreme heat densities, development of AI-powered cooling optimization platforms, and integration of renewable energy sources with cooling infrastructure.

Strategic Partnerships between cooling technology vendors and data center operators are becoming more common, focusing on long-term service agreements and collaborative development of customized cooling solutions. These partnerships enable vendors to better understand customer requirements while providing operators with access to cutting-edge cooling technologies.

Regulatory Developments include updated energy efficiency standards for data center cooling systems and incentives for adoption of sustainable cooling technologies. MarkWide Research analysis indicates that regulatory changes are driving approximately 30% of cooling system upgrade decisions in the Italian market.

Market Consolidation activities include acquisitions of specialized cooling technology companies by larger infrastructure vendors, creating more comprehensive solution portfolios and expanded service capabilities. These developments are reshaping competitive dynamics and creating new opportunities for market participants.

Investment Prioritization should focus on cooling technologies that offer the best combination of energy efficiency, scalability, and future-proofing capabilities. Organizations should evaluate cooling solutions based on total cost of ownership rather than initial capital investment, considering long-term operational costs and environmental impact.

Technology Selection requires careful consideration of specific application requirements, facility constraints, and growth projections. Hybrid cooling approaches may provide optimal solutions for facilities with diverse workload requirements, while specialized applications may benefit from dedicated liquid cooling systems.

Service Strategy development should emphasize comprehensive support capabilities, including installation, maintenance, optimization, and emergency response services. Organizations should consider managed service agreements that provide predictable costs and access to specialized expertise.

Sustainability Integration should be incorporated into cooling strategy development from the initial planning stages. Organizations should evaluate cooling solutions based on their environmental impact, energy efficiency, and alignment with corporate sustainability goals and regulatory requirements.

Market evolution in Italy’s data center cooling sector will be characterized by continued technological advancement, increasing emphasis on sustainability, and growing adoption of intelligent cooling systems. MarkWide Research projections indicate the market will experience sustained growth driven by digital transformation initiatives and expanding data center infrastructure requirements.

Technology trends will favor solutions that combine high efficiency with environmental responsibility. Liquid cooling adoption is expected to accelerate, with market penetration reaching 25% by the end of the forecast period. Integration of artificial intelligence and machine learning capabilities will become standard features in advanced cooling systems.

Market dynamics will be influenced by evolving customer requirements, regulatory developments, and competitive pressures. The shift toward service-based business models will continue, with managed cooling services expected to represent 40% of market revenue within the next five years.

Innovation focus will center on development of ultra-efficient cooling technologies, integration with renewable energy systems, and creation of intelligent cooling platforms that can autonomously optimize performance across diverse operating conditions. The market will also see increased emphasis on circular economy principles and waste heat recovery applications.

The Italy data center cooling market represents a dynamic and rapidly evolving sector that plays a crucial role in supporting the country’s digital infrastructure development. Market growth is being driven by increasing data center capacity requirements, technological advancement, and growing emphasis on energy efficiency and environmental sustainability.

Key success factors for market participants include technological innovation, comprehensive service capabilities, and alignment with sustainability requirements. The market offers substantial opportunities for organizations that can deliver advanced cooling solutions while addressing the complex requirements of modern data center operations.

Future market development will be characterized by continued adoption of liquid cooling technologies, integration of artificial intelligence capabilities, and growing emphasis on service-based business models. Organizations that invest in advanced cooling technologies and develop comprehensive service capabilities will be well-positioned to capitalize on market opportunities and drive sustainable growth in Italy’s expanding data center ecosystem.

What is Data Center Cooling?

Data Center Cooling refers to the methods and technologies used to maintain optimal temperature and humidity levels in data centers, ensuring the efficient operation of servers and IT equipment. Effective cooling is crucial for preventing overheating and ensuring reliability in data processing environments.

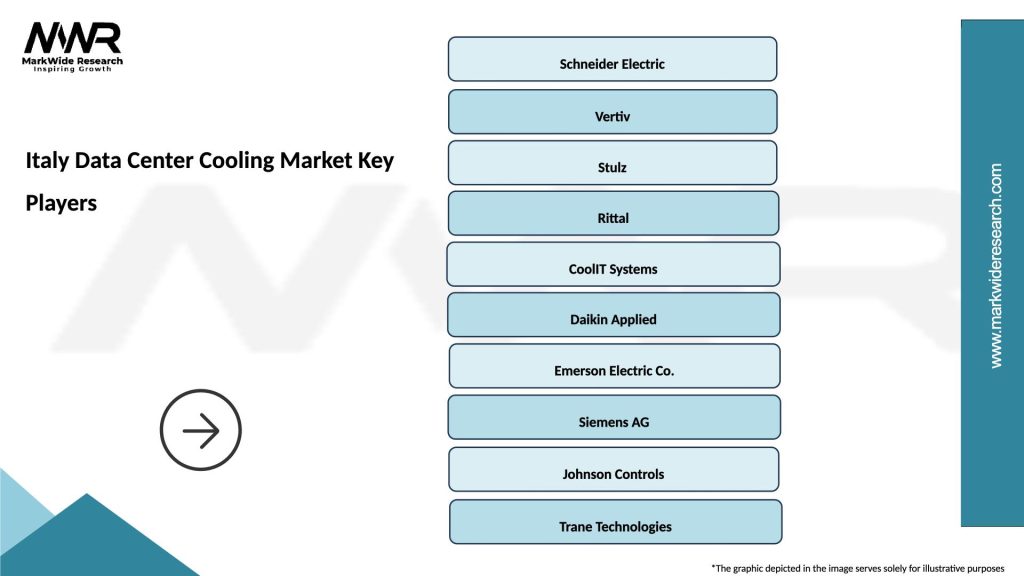

What are the key players in the Italy Data Center Cooling Market?

Key players in the Italy Data Center Cooling Market include companies like Schneider Electric, Vertiv, and Stulz, which provide innovative cooling solutions tailored for data centers. These companies focus on energy efficiency and advanced cooling technologies, among others.

What are the main drivers of the Italy Data Center Cooling Market?

The main drivers of the Italy Data Center Cooling Market include the increasing demand for data storage and processing, the growth of cloud computing, and the need for energy-efficient cooling solutions. Additionally, the rise in digital transformation initiatives across various industries contributes to market growth.

What challenges does the Italy Data Center Cooling Market face?

The Italy Data Center Cooling Market faces challenges such as high operational costs associated with advanced cooling technologies and the complexity of integrating new systems into existing infrastructures. Additionally, regulatory pressures regarding energy consumption can pose challenges for data center operators.

What opportunities exist in the Italy Data Center Cooling Market?

Opportunities in the Italy Data Center Cooling Market include the adoption of innovative cooling technologies like liquid cooling and the increasing focus on sustainability and energy efficiency. Furthermore, the expansion of edge computing facilities presents new avenues for growth in cooling solutions.

What trends are shaping the Italy Data Center Cooling Market?

Trends shaping the Italy Data Center Cooling Market include the shift towards modular cooling solutions and the integration of artificial intelligence for predictive maintenance. Additionally, there is a growing emphasis on sustainable practices and the use of renewable energy sources in cooling operations.

Italy Data Center Cooling Market

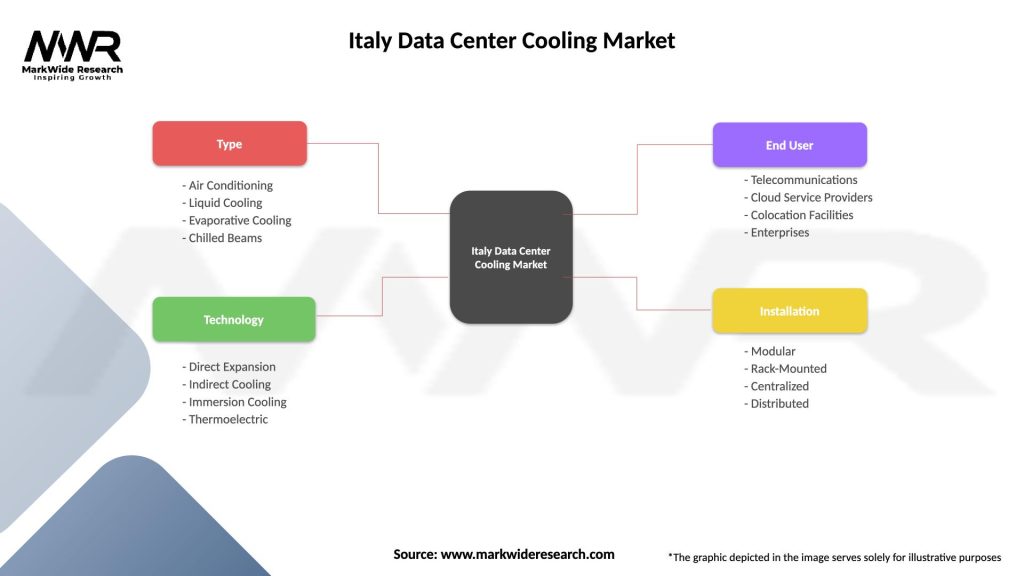

| Segmentation Details | Description |

|---|---|

| Type | Air Conditioning, Liquid Cooling, Evaporative Cooling, Chilled Beams |

| Technology | Direct Expansion, Indirect Cooling, Immersion Cooling, Thermoelectric |

| End User | Telecommunications, Cloud Service Providers, Colocation Facilities, Enterprises |

| Installation | Modular, Rack-Mounted, Centralized, Distributed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Data Center Cooling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at