444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy data center construction market represents a rapidly expanding sector within the European digital infrastructure landscape. Market dynamics indicate substantial growth driven by increasing digitalization, cloud adoption, and the rising demand for edge computing solutions across Italian enterprises. The market demonstrates robust expansion with a projected compound annual growth rate (CAGR) of 8.2% through the forecast period, reflecting the country’s commitment to digital transformation initiatives.

Regional positioning places Italy as a strategic hub for data center development in Southern Europe, benefiting from favorable geographical location, improving regulatory frameworks, and substantial investments in renewable energy infrastructure. The market encompasses various construction segments including hyperscale facilities, colocation centers, and edge computing installations, each contributing to the overall market momentum.

Infrastructure development across major Italian cities including Milan, Rome, and Naples drives significant construction activity. The market benefits from increasing foreign direct investment, with international data center operators recognizing Italy’s potential as a gateway to European and Mediterranean markets. Sustainability initiatives play a crucial role, with approximately 65% of new construction projects incorporating green building standards and renewable energy integration.

The Italy data center construction market refers to the comprehensive sector encompassing the planning, design, and construction of specialized facilities designed to house computer systems, data storage equipment, and networking infrastructure across Italian territories. This market includes both new construction projects and major renovation or expansion initiatives of existing facilities.

Construction activities within this market span multiple categories including hyperscale data centers, enterprise facilities, colocation centers, and edge computing installations. The market encompasses all aspects of construction from site preparation and foundation work to specialized electrical, mechanical, and cooling system installations required for optimal data center operations.

Market scope extends beyond basic construction to include integrated services such as project management, engineering design, technology integration, and compliance with Italian and European Union regulatory standards. The sector addresses the growing demand for digital infrastructure supporting cloud computing, artificial intelligence, Internet of Things applications, and digital transformation initiatives across Italian industries.

Market performance in Italy’s data center construction sector demonstrates exceptional growth trajectory, driven by accelerating digital transformation across public and private sectors. The market benefits from strategic government initiatives promoting digitalization, substantial investments in fiber optic infrastructure, and increasing adoption of cloud-based services among Italian enterprises.

Key growth drivers include the expansion of hyperscale cloud providers, rising demand for edge computing solutions, and increasing focus on data sovereignty requirements. The market experiences significant momentum from the implementation of Italy’s National Recovery and Resilience Plan, which allocates substantial resources toward digital infrastructure development. Construction activity shows particular strength in the Lombardy and Lazio regions, accounting for approximately 42% of total market activity.

Competitive landscape features a mix of international construction firms, local contractors, and specialized data center developers. The market demonstrates increasing consolidation as larger players acquire regional capabilities to serve growing demand. Technology integration remains a critical differentiator, with contractors investing heavily in modular construction techniques, advanced cooling systems, and sustainable building practices to meet evolving client requirements.

Market intelligence reveals several critical insights shaping the Italy data center construction landscape. The sector demonstrates strong correlation between regional economic development and data center investment, with northern industrial regions leading construction activity.

Digital transformation initiatives across Italian enterprises serve as the primary catalyst for data center construction demand. Organizations increasingly require robust digital infrastructure to support cloud migration, artificial intelligence implementation, and advanced analytics capabilities. The acceleration of remote work practices and digital service delivery models further amplifies infrastructure requirements.

Government support through the National Recovery and Resilience Plan provides substantial funding for digital infrastructure development. These initiatives specifically target data center construction as a strategic priority for enhancing Italy’s digital competitiveness within the European Union. Regulatory frameworks increasingly favor domestic data processing capabilities, driving demand for locally constructed facilities.

Cloud adoption among Italian businesses continues expanding rapidly, with enterprise cloud utilization growing at approximately 15.3% annually. This trend necessitates expanded data center capacity to support increased workload processing and storage requirements. Edge computing deployment creates additional demand for distributed infrastructure construction across multiple geographic locations.

International investment from global technology companies and data center operators provides substantial capital for construction projects. These investments recognize Italy’s strategic position for serving European and Mediterranean markets, driving large-scale facility development across key metropolitan areas.

Regulatory complexity presents significant challenges for data center construction projects in Italy. Multiple approval processes, environmental impact assessments, and compliance requirements can extend project timelines and increase development costs. Permitting delays often impact construction schedules, particularly for large-scale facilities requiring extensive infrastructure modifications.

Energy infrastructure limitations in certain regions constrain data center construction opportunities. Adequate power supply and grid stability requirements necessitate substantial utility infrastructure investments, which may not be readily available in all desired locations. Cooling requirements in Mediterranean climate conditions increase operational complexity and construction costs.

Skilled workforce shortages affect construction project execution, particularly for specialized data center construction techniques. The market requires workers with expertise in advanced electrical systems, cooling technologies, and precision construction methods. Training programs struggle to keep pace with rapidly evolving technology requirements and construction methodologies.

Land availability and high real estate costs in prime metropolitan locations limit construction opportunities. Suitable sites require specific characteristics including proximity to fiber networks, adequate power infrastructure, and appropriate zoning classifications. Competition for prime locations drives up development costs and may force projects to less optimal locations.

Sustainability initiatives create substantial opportunities for innovative construction approaches and technologies. The growing emphasis on carbon neutrality and renewable energy integration opens markets for specialized green building techniques and advanced cooling systems. Government incentives for sustainable construction practices provide additional revenue opportunities for qualified contractors.

Edge computing expansion generates demand for distributed data center construction across secondary cities and industrial regions. This trend creates opportunities for smaller-scale, specialized facilities serving local and regional markets. 5G network deployment necessitates extensive edge infrastructure construction to support low-latency applications and services.

Modular construction techniques offer opportunities for faster project delivery and improved cost efficiency. Prefabricated solutions enable standardized construction processes while maintaining flexibility for customization. Technology integration opportunities include advanced building management systems, artificial intelligence-powered optimization, and predictive maintenance capabilities.

International expansion by Italian construction firms presents opportunities in neighboring European markets and Mediterranean regions. Expertise gained in domestic projects positions Italian companies for export opportunities in similar climate and regulatory environments. Partnership opportunities with global technology providers create potential for joint venture projects and technology transfer initiatives.

Supply and demand dynamics in the Italy data center construction market reflect the interplay between rapidly growing infrastructure requirements and construction industry capacity. Demand acceleration outpaces traditional construction capabilities, creating opportunities for innovative delivery methods and specialized contractors.

Pricing dynamics demonstrate upward pressure due to increased material costs, specialized equipment requirements, and skilled labor premiums. However, efficiency improvements through modular construction and standardized designs help offset some cost increases. The market shows price elasticity varying by project scale and complexity, with hyperscale facilities achieving better cost efficiency than smaller installations.

Technology evolution continuously reshapes construction requirements and methodologies. Advanced cooling systems, high-density power distribution, and integrated monitoring systems become standard specifications. Construction timelines face pressure for acceleration, with clients demanding faster project delivery to meet competitive requirements.

Competitive dynamics intensify as more players enter the specialized data center construction market. Differentiation strategies focus on sustainability credentials, technology integration capabilities, and project delivery speed. Market consolidation trends create larger, more capable construction organizations while maintaining opportunities for specialized niche players.

Research approach for analyzing the Italy data center construction market employs comprehensive primary and secondary research methodologies. Primary research includes structured interviews with key market participants including construction contractors, data center operators, technology providers, and regulatory officials across major Italian metropolitan areas.

Secondary research encompasses analysis of industry reports, government publications, construction permits, and project announcements. Data validation processes ensure accuracy through cross-referencing multiple sources and verification with industry experts. Market sizing and forecasting utilize established econometric models adapted for the Italian construction market context.

Qualitative analysis incorporates expert opinions, industry trends assessment, and regulatory impact evaluation. Quantitative analysis includes statistical modeling of market drivers, construction activity correlation analysis, and growth projection calculations. Regional analysis methodology accounts for varying economic conditions, infrastructure availability, and regulatory environments across Italian regions.

Market segmentation analysis employs multiple classification criteria including facility type, construction value, geographic location, and end-user categories. Competitive analysis methodology includes market share estimation, capability assessment, and strategic positioning evaluation for key market participants.

Northern Italy dominates data center construction activity, with the Lombardy region accounting for approximately 35% of total market activity. Milan metropolitan area serves as the primary hub for hyperscale facility development, benefiting from excellent connectivity infrastructure, proximity to financial centers, and robust power grid infrastructure. The region attracts significant international investment and hosts major cloud service provider facilities.

Central Italy demonstrates strong growth momentum, particularly in the Lazio region surrounding Rome. The capital city’s status as a government and business center drives demand for data center infrastructure supporting public sector digitalization and enterprise cloud adoption. Construction activity in central regions accounts for approximately 28% of national market share, with emphasis on colocation facilities and enterprise data centers.

Southern Italy represents an emerging opportunity area with increasing construction activity driven by government development initiatives and improving infrastructure. The region benefits from lower construction costs and available land, attracting projects focused on disaster recovery and distributed computing applications. Naples and Bari emerge as key development centers with growing technology sector presence.

Island regions including Sicily and Sardinia show nascent data center construction activity, primarily focused on serving local market requirements and supporting tourism industry digitalization. These regions present opportunities for edge computing facilities and specialized applications requiring geographic isolation for security or regulatory compliance purposes.

Market leadership in Italy’s data center construction sector features a diverse mix of international construction giants, specialized data center contractors, and regional building firms. The competitive environment demonstrates increasing specialization as traditional construction companies develop data center expertise to capture market opportunities.

Competitive strategies focus on developing specialized capabilities, forming strategic partnerships with technology providers, and investing in sustainable construction practices. Market differentiation increasingly depends on project delivery speed, sustainability credentials, and integrated technology solutions rather than traditional cost-based competition.

By Facility Type: The market segments into hyperscale data centers, colocation facilities, enterprise data centers, and edge computing installations. Hyperscale facilities represent the largest construction value segment, driven by cloud service provider expansion and increasing data processing requirements.

By Construction Value: Projects categorize into large-scale developments exceeding major investment thresholds, medium-scale facilities serving regional requirements, and smaller edge computing installations. Large-scale projects account for approximately 58% of total construction value despite representing fewer individual projects.

By End User: Market segmentation includes cloud service providers, telecommunications companies, financial services, government agencies, and enterprise clients. Cloud providers drive the majority of large-scale construction activity, while enterprise clients focus on smaller, specialized facilities.

By Geographic Region: Regional segmentation reflects varying market maturity, infrastructure availability, and economic development levels across Italian territories. Northern regions maintain market leadership while southern areas show increasing growth potential.

Hyperscale Data Centers: This category dominates construction activity with facilities designed for massive computing capacity and scalability. Construction requirements emphasize high-density power distribution, advanced cooling systems, and modular expansion capabilities. Projects typically require substantial site preparation and specialized infrastructure development.

Colocation Facilities: Multi-tenant data centers represent a growing construction category serving diverse client requirements. Design flexibility becomes crucial for accommodating varying client specifications while maintaining operational efficiency. Construction focuses on compartmentalized security, redundant systems, and scalable infrastructure.

Edge Computing Centers: Distributed computing infrastructure drives demand for smaller, strategically located facilities across urban and industrial areas. Construction characteristics emphasize rapid deployment, standardized designs, and integration with existing infrastructure. These facilities often require specialized site selection and utility coordination.

Enterprise Data Centers: Private facilities serving specific organizational requirements represent a stable construction category. Customization needs drive unique design requirements while maintaining cost efficiency. Construction projects often involve renovation or expansion of existing facilities rather than greenfield development.

Construction Companies benefit from access to a rapidly growing, high-value market segment with strong profit margins and long-term project relationships. Specialization opportunities allow firms to develop competitive advantages through expertise in advanced building systems, sustainability practices, and technology integration.

Technology Providers gain opportunities for integrated solution delivery, combining construction services with advanced building management systems, cooling technologies, and monitoring solutions. Partnership potential with construction firms creates comprehensive service offerings addressing complete client requirements.

Real Estate Developers access new revenue streams through specialized data center development projects and land optimization strategies. Investment opportunities include build-to-suit arrangements and long-term lease agreements with stable, credit-worthy tenants.

Local Communities benefit from job creation, infrastructure investment, and economic development associated with data center construction projects. Skill development programs create employment opportunities in high-technology construction specialties with strong career advancement potential.

End Users gain access to state-of-the-art digital infrastructure supporting business growth, operational efficiency, and competitive positioning. Customization capabilities ensure facilities meet specific operational requirements while maintaining cost effectiveness and scalability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend shaping data center construction practices across Italy. Green building standards become mandatory for many projects, with approximately 72% of new facilities incorporating renewable energy systems and advanced cooling technologies. Construction companies invest heavily in sustainable building expertise and certification programs.

Modular Construction Adoption accelerates as clients demand faster project delivery and improved cost predictability. Prefabricated solutions enable standardized construction processes while maintaining customization flexibility. This trend particularly benefits edge computing projects requiring rapid deployment across multiple locations.

Technology Convergence drives integration of artificial intelligence, Internet of Things, and advanced automation systems into construction projects. Smart building capabilities become standard requirements rather than optional features. Construction firms develop partnerships with technology providers to deliver integrated solutions.

Regional Diversification spreads construction activity beyond traditional northern Italian centers toward southern regions and secondary cities. Distributed infrastructure requirements create opportunities in previously underserved markets while reducing concentration risks for construction companies.

Major Investment Announcements from international cloud service providers signal substantial construction opportunities across multiple Italian regions. These commitments provide long-term visibility for construction companies and drive infrastructure development in selected markets.

Regulatory Framework Updates streamline approval processes for data center construction while maintaining environmental and safety standards. Government initiatives specifically target reducing permitting timelines and improving coordination between regulatory agencies.

Technology Partnership Formation between construction companies and advanced building system providers creates integrated solution capabilities. These partnerships enable comprehensive project delivery including construction, technology integration, and ongoing facility management services.

Workforce Development Programs launch across major construction markets to address skilled labor shortages in specialized data center construction techniques. Training initiatives focus on advanced electrical systems, precision cooling technologies, and integrated building management systems.

Sustainability Certification Programs gain adoption as clients increasingly require environmental performance verification. Construction companies invest in green building expertise and pursue relevant certifications to maintain competitive positioning.

MarkWide Research analysis indicates that construction companies should prioritize developing specialized data center expertise to capitalize on market growth opportunities. Investment recommendations include workforce training programs, technology partnerships, and sustainability certification initiatives to maintain competitive positioning.

Strategic positioning should emphasize rapid project delivery capabilities, integrated technology solutions, and proven sustainability credentials. Companies lacking these capabilities should consider strategic partnerships or acquisitions to develop necessary expertise quickly.

Geographic expansion strategies should target emerging markets in southern Italy while maintaining strong positions in established northern regions. Market entry approaches should consider local partnerships and gradual capability building rather than immediate large-scale investments.

Technology integration capabilities become increasingly critical for long-term success. Construction firms should develop relationships with building automation providers, advanced cooling system manufacturers, and renewable energy solution providers.

Risk management strategies should address potential regulatory changes, economic uncertainty, and technology evolution impacts. Diversified project portfolios and flexible construction methodologies help mitigate market volatility risks.

Market trajectory indicates continued strong growth through the forecast period, with construction activity expanding across all major facility categories. Growth acceleration is expected to continue at approximately 8.2% CAGR, driven by sustained digital transformation initiatives and increasing cloud adoption across Italian enterprises.

Technology evolution will continue reshaping construction requirements, with emphasis on sustainability, automation, and edge computing capabilities. Construction methodologies will increasingly favor modular approaches and integrated technology solutions to meet client demands for faster delivery and improved performance.

Regional development patterns suggest expanding construction activity beyond traditional centers toward secondary cities and southern regions. Infrastructure investments in these areas will create new opportunities while reducing market concentration risks.

Competitive landscape evolution will likely feature increased specialization, strategic partnerships, and potential market consolidation as companies seek to develop comprehensive capabilities. MWR projections indicate that successful firms will combine construction expertise with technology integration and sustainability credentials.

Long-term sustainability requirements will become increasingly stringent, driving innovation in construction materials, energy systems, and operational efficiency. Companies investing early in these capabilities will maintain competitive advantages as market requirements evolve.

The Italy data center construction market presents exceptional growth opportunities driven by accelerating digitalization, government support initiatives, and increasing international investment. Market dynamics favor companies with specialized expertise, sustainability credentials, and integrated technology capabilities.

Strategic success factors include developing rapid project delivery capabilities, forming technology partnerships, and maintaining strong sustainability practices. The market rewards innovation in construction methodologies, particularly modular approaches and advanced building systems integration.

Future market leadership will depend on adaptability to evolving technology requirements, geographic diversification strategies, and comprehensive service offerings. Companies positioning themselves as integrated solution providers rather than traditional contractors will capture the greatest market opportunities in Italy’s dynamic data center construction landscape.

What is Data Center Construction?

Data Center Construction refers to the process of building facilities that house computer systems and associated components, such as telecommunications and storage systems. These facilities are designed to support the growing demand for data processing and storage in various industries.

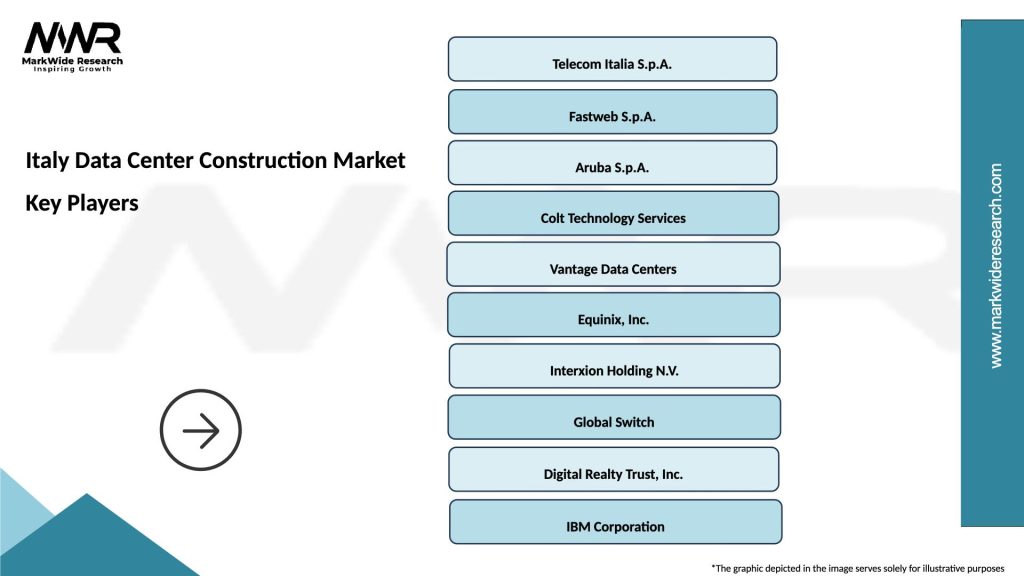

What are the key players in the Italy Data Center Construction Market?

Key players in the Italy Data Center Construction Market include companies like Engie, Schneider Electric, and IBM, which provide various services and technologies for data center development and management, among others.

What are the main drivers of the Italy Data Center Construction Market?

The main drivers of the Italy Data Center Construction Market include the increasing demand for cloud services, the rise of big data analytics, and the growing need for enhanced data security. These factors are pushing companies to invest in new data center facilities.

What challenges does the Italy Data Center Construction Market face?

The Italy Data Center Construction Market faces challenges such as high construction costs, regulatory compliance issues, and the need for sustainable energy solutions. These factors can hinder the timely development of new data centers.

What opportunities exist in the Italy Data Center Construction Market?

Opportunities in the Italy Data Center Construction Market include the expansion of edge computing facilities, the integration of renewable energy sources, and the increasing demand for colocation services. These trends are likely to shape the future of data center development.

What trends are shaping the Italy Data Center Construction Market?

Trends shaping the Italy Data Center Construction Market include the adoption of modular data center designs, advancements in cooling technologies, and the focus on energy efficiency. These innovations are crucial for meeting the demands of modern data processing.

Italy Data Center Construction Market

| Segmentation Details | Description |

|---|---|

| Type | Colocation, Hyperscale, Edge, Modular |

| Technology | Cooling Systems, Power Distribution, Fire Suppression, Security Solutions |

| End User | Telecommunications, Cloud Service Providers, Enterprises, Government |

| Capacity | Small Scale, Medium Scale, Large Scale, Enterprise Level |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Data Center Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at