444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy construction equipment market represents a dynamic and evolving sector within the European construction machinery landscape. Market dynamics indicate robust growth driven by infrastructure modernization, urban development projects, and increasing adoption of advanced construction technologies. The Italian construction equipment industry has demonstrated remarkable resilience, with growth rates consistently outpacing many European counterparts at approximately 6.2% CAGR over recent years.

Infrastructure investments across Italy have significantly boosted demand for construction equipment, particularly in the northern industrial regions and southern development zones. The market encompasses various equipment categories including excavators, bulldozers, cranes, concrete mixers, and specialized machinery for road construction and building projects. Technological advancement has become a key differentiator, with manufacturers increasingly focusing on fuel-efficient, environmentally compliant equipment that meets stringent European emission standards.

Regional distribution shows concentrated activity in Lombardy, Veneto, and Emilia-Romagna, accounting for approximately 45% of total equipment deployment. The market benefits from Italy’s strategic position as a gateway to Mediterranean and North African markets, creating additional export opportunities for construction equipment manufacturers and dealers.

The Italy construction equipment market refers to the comprehensive ecosystem of heavy machinery, tools, and specialized equipment used in construction, infrastructure development, and related industrial activities throughout the Italian peninsula. This market encompasses the manufacturing, distribution, rental, and servicing of construction machinery ranging from compact utility equipment to large-scale industrial machinery used in major infrastructure projects.

Market scope includes both new equipment sales and the thriving used equipment segment, along with rental services that have gained significant traction among small to medium-sized construction companies. The definition extends to encompass aftermarket services, spare parts distribution, and equipment financing solutions that support the broader construction industry ecosystem.

Equipment categories span earthmoving machinery, material handling equipment, concrete and road construction machinery, and specialized tools for building construction. The market also includes emerging technologies such as autonomous construction equipment, telematics systems, and IoT-enabled machinery that enhance operational efficiency and project management capabilities.

Italy’s construction equipment market has emerged as a significant contributor to the European construction machinery sector, driven by substantial infrastructure investments and modernization initiatives. The market demonstrates strong fundamentals with consistent growth patterns supported by both domestic demand and export opportunities to neighboring regions.

Key growth drivers include the Italian government’s infrastructure spending programs, European Union funding for sustainable development projects, and increasing private sector investment in commercial and residential construction. The market has shown particular strength in the rental segment, which now represents approximately 35% of total equipment utilization, reflecting changing business models and cost optimization strategies among construction companies.

Technological innovation has become increasingly important, with manufacturers focusing on electric and hybrid equipment solutions to meet environmental regulations. The integration of digital technologies, including GPS tracking, predictive maintenance systems, and automated operation features, has enhanced equipment value propositions and operational efficiency.

Market challenges include regulatory compliance costs, skilled operator shortages, and economic uncertainties affecting construction project timelines. However, the overall outlook remains positive, supported by long-term infrastructure development plans and increasing emphasis on sustainable construction practices.

Strategic insights reveal several critical trends shaping the Italy construction equipment market landscape:

Infrastructure modernization serves as the primary catalyst for Italy’s construction equipment market growth. The government’s comprehensive infrastructure renewal programs, including highway upgrades, bridge reconstruction, and urban transit system expansions, have created sustained demand for heavy construction machinery. European Union funding for sustainable infrastructure projects has further amplified this demand, particularly for environmentally compliant equipment.

Urban development initiatives across major Italian cities have generated substantial equipment requirements. Smart city projects, residential development programs, and commercial construction activities have driven demand for diverse equipment types, from compact excavators for urban environments to tower cranes for high-rise construction projects.

Technological advancement has emerged as a significant market driver, with construction companies increasingly recognizing the value of modern, efficient equipment. Features such as GPS guidance systems, automated operation capabilities, and predictive maintenance technologies have improved project outcomes and reduced operational costs, encouraging equipment upgrades and replacements.

Economic recovery following recent challenges has restored confidence in the construction sector, leading to increased capital investments and project initiations. The availability of favorable financing terms and government incentives for construction activities has further supported equipment procurement decisions.

Regulatory compliance presents ongoing challenges for the Italy construction equipment market. Stringent emission standards, safety regulations, and environmental requirements increase equipment costs and complexity, particularly affecting smaller construction companies with limited capital resources. The need for frequent regulatory updates and compliance monitoring adds operational overhead for equipment owners and operators.

Skilled operator shortage has become a significant constraint on market growth. The construction industry faces difficulties in recruiting and retaining qualified equipment operators, limiting the effective utilization of advanced machinery. This skills gap has led to increased labor costs and project delays, affecting overall market dynamics.

Economic uncertainties continue to influence construction equipment investment decisions. Fluctuating construction activity levels, project postponements, and budget constraints affect equipment demand patterns. Construction companies often delay equipment purchases during uncertain economic periods, impacting market growth momentum.

High capital requirements for modern construction equipment pose barriers for smaller market participants. The substantial initial investment needed for advanced machinery, combined with ongoing maintenance and operational costs, limits market accessibility for emerging construction companies and specialized contractors.

Sustainable construction initiatives present significant opportunities for the Italy construction equipment market. The growing emphasis on green building practices and environmental sustainability has created demand for electric and hybrid construction equipment. Manufacturers and dealers who can provide environmentally friendly solutions are well-positioned to capture expanding market segments.

Digital transformation offers substantial growth potential through equipment connectivity and data analytics solutions. Construction companies are increasingly interested in telematics systems, IoT integration, and predictive maintenance capabilities that enhance operational efficiency and reduce downtime. This trend creates opportunities for technology-focused equipment providers and service companies.

Export market expansion represents a valuable opportunity for Italian construction equipment companies. Italy’s strategic location and established trade relationships with Mediterranean, North African, and Middle Eastern markets provide platforms for international growth. The reputation of Italian engineering and manufacturing excellence supports export initiatives.

Equipment-as-a-Service models are gaining traction, offering new revenue streams and business model innovations. Rental companies and equipment manufacturers can develop comprehensive service packages that include equipment provision, maintenance, operator training, and project support services, creating differentiated value propositions.

Supply chain dynamics significantly influence the Italy construction equipment market, with manufacturers and distributors adapting to changing demand patterns and global supply considerations. The market has experienced shifts toward local sourcing and regional supply chain optimization to reduce dependencies and improve responsiveness to customer needs.

Competitive intensity has increased as both domestic and international players compete for market share. This competition has driven innovation, improved customer service standards, and enhanced product offerings. Companies are differentiating through technology integration, service quality, and specialized equipment solutions tailored to specific construction applications.

Customer behavior has evolved significantly, with construction companies increasingly prioritizing total cost of ownership over initial purchase price. This shift has emphasized the importance of equipment reliability, fuel efficiency, maintenance costs, and resale value in purchasing decisions. MarkWide Research analysis indicates that approximately 68% of equipment buyers now consider lifecycle costs as the primary decision factor.

Market consolidation trends have emerged as larger players acquire smaller distributors and service providers to expand geographic coverage and service capabilities. This consolidation has created more comprehensive service networks while potentially reducing competition in certain regional markets.

Primary research methodologies employed in analyzing the Italy construction equipment market include comprehensive surveys of equipment manufacturers, distributors, rental companies, and end-user construction firms. Direct interviews with industry executives, procurement managers, and equipment operators provide valuable insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and regulatory documentation. This approach ensures comprehensive coverage of market dynamics, regulatory impacts, and economic factors affecting the construction equipment sector in Italy.

Data validation processes involve cross-referencing multiple information sources, conducting expert interviews, and utilizing statistical analysis techniques to ensure accuracy and reliability of market insights. The methodology includes both quantitative analysis of market metrics and qualitative assessment of industry trends and competitive dynamics.

Market segmentation analysis employs detailed categorization by equipment type, application, end-user industry, and geographic region. This segmentation approach enables precise identification of growth opportunities and market dynamics within specific market niches and customer segments.

Northern Italy dominates the construction equipment market, accounting for approximately 52% of total equipment demand. The Lombardy region leads with significant industrial construction activity, infrastructure projects, and high equipment utilization rates. Milan and surrounding areas generate substantial demand for urban construction equipment, while the broader northern industrial corridor requires heavy machinery for manufacturing facility construction and expansion.

Central Italy represents a growing market segment, driven by infrastructure modernization projects and urban development initiatives in Rome and surrounding regions. The area shows increasing demand for specialized equipment for historical building restoration and urban renewal projects, requiring equipment with specific capabilities for working in constrained urban environments.

Southern Italy presents significant growth potential, supported by European Union development funding and government infrastructure investment programs. The region shows increasing construction activity in transportation infrastructure, renewable energy projects, and industrial development initiatives. Equipment demand patterns reflect the need for both heavy construction machinery and specialized equipment for diverse project types.

Island regions including Sicily and Sardinia demonstrate unique market characteristics, with equipment demand influenced by tourism infrastructure development, port facility construction, and renewable energy projects. These markets require specialized logistics solutions for equipment transportation and service support.

Market leadership in Italy’s construction equipment sector is characterized by a mix of international manufacturers and strong domestic distributors. The competitive environment emphasizes service quality, local market knowledge, and comprehensive equipment portfolios.

By Equipment Type: The Italy construction equipment market demonstrates diverse segmentation patterns across multiple equipment categories. Excavators represent the largest segment, accounting for significant market share due to their versatility in construction, demolition, and earthmoving applications. Bulldozers and graders serve essential roles in site preparation and road construction projects, while cranes and lifting equipment support building construction and infrastructure development activities.

By Application: Infrastructure construction dominates market applications, including highway construction, bridge building, and public facility development. Residential construction represents a growing segment, driven by urban development and housing demand. Commercial construction includes office buildings, retail facilities, and industrial structures, while specialty applications encompass mining, quarrying, and environmental construction projects.

By End User: Construction contractors form the primary customer base, ranging from large general contractors to specialized subcontractors. Rental companies have become increasingly important, serving smaller contractors and project-specific equipment needs. Government agencies and public works departments represent significant customers for infrastructure equipment, while industrial companies require equipment for facility construction and maintenance.

By Technology: Conventional equipment maintains the largest market share, while hybrid and electric equipment segments are experiencing rapid growth. Autonomous and semi-autonomous equipment represents an emerging segment with significant future potential, particularly for large-scale infrastructure projects.

Earthmoving Equipment: This category demonstrates the strongest growth dynamics within the Italy construction equipment market. Excavators lead demand due to their versatility across multiple construction applications, from foundation work to demolition projects. The segment benefits from technological advances including improved fuel efficiency, enhanced operator comfort, and integrated GPS systems. Mini excavators show particularly strong growth in urban construction environments where space constraints require compact, maneuverable equipment.

Material Handling Equipment: Cranes and lifting equipment represent a critical market segment, driven by high-rise construction projects and infrastructure development. Tower cranes dominate urban construction sites, while mobile cranes serve diverse applications across different project types. The segment emphasizes safety features, lifting capacity optimization, and advanced control systems that enhance operational precision and efficiency.

Road Construction Equipment: Asphalt pavers, compactors, and road maintenance equipment form an essential market category, supported by extensive highway infrastructure projects and urban road development initiatives. This segment benefits from government infrastructure spending and the need for ongoing road maintenance and improvement projects throughout Italy.

Concrete Equipment: Concrete mixers, pumps, and finishing equipment serve the substantial concrete construction market in Italy. The segment shows steady growth driven by both residential and commercial construction activities, with increasing demand for high-capacity, efficient equipment that can handle diverse concrete applications and project requirements.

Equipment Manufacturers benefit from Italy’s strategic position as a gateway to European and Mediterranean markets, providing opportunities for regional expansion and export growth. The market offers access to sophisticated customers who value quality, reliability, and advanced technology features. Manufacturing partnerships with Italian companies can provide local market insights and distribution advantages.

Distributors and Dealers gain from the market’s emphasis on service quality and local support capabilities. The Italian market rewards companies that provide comprehensive service networks, rapid parts availability, and skilled technical support. Long-term customer relationships are particularly valuable in this market, creating stable revenue streams and competitive advantages.

Construction Companies benefit from access to advanced equipment technologies that enhance project efficiency and reduce operational costs. The competitive equipment market provides multiple options for different project requirements and budget considerations. Flexible financing and rental options improve equipment accessibility and cash flow management for construction firms of all sizes.

Rental Companies capitalize on the growing trend toward equipment rental rather than ownership, particularly among smaller construction companies. The market provides opportunities for specialized rental services, including short-term project support and equipment packages tailored to specific construction applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification and Sustainability have emerged as dominant trends in the Italy construction equipment market. Manufacturers are increasingly developing electric and hybrid equipment solutions to meet environmental regulations and customer sustainability goals. This trend is particularly pronounced in urban construction applications where noise and emission restrictions are stringent. Battery technology improvements and charging infrastructure development are accelerating the adoption of electric construction equipment.

Digital Transformation continues to reshape the construction equipment landscape through IoT integration, telematics systems, and data analytics platforms. Construction companies are leveraging these technologies to optimize equipment utilization, reduce maintenance costs, and improve project management capabilities. Predictive maintenance systems are becoming standard features, helping prevent equipment failures and minimize downtime.

Autonomous and Semi-Autonomous Equipment represents an emerging trend with significant long-term potential. While full autonomy remains limited to specific applications, semi-autonomous features such as grade control, automated digging, and operator assistance systems are gaining widespread adoption. These technologies enhance productivity while reducing operator skill requirements.

Equipment-as-a-Service models are transforming traditional ownership patterns, with construction companies increasingly preferring comprehensive service packages that include equipment provision, maintenance, and support services. This trend is driven by the desire to reduce capital requirements and transfer operational risks to equipment providers.

Regulatory Evolution has significantly impacted the Italy construction equipment market through updated emission standards and safety requirements. The implementation of Stage V emission regulations has driven equipment manufacturers to develop cleaner, more efficient engines and exhaust systems. These regulatory changes have accelerated the replacement cycle for older equipment and increased demand for compliant machinery.

Technology Partnerships between equipment manufacturers and technology companies have accelerated innovation in construction equipment capabilities. Collaborations focusing on artificial intelligence, machine learning, and advanced sensors are creating smarter, more capable equipment that can adapt to changing job site conditions and optimize performance automatically.

Market Consolidation activities have reshaped the competitive landscape, with larger companies acquiring smaller distributors and service providers to expand geographic coverage and service capabilities. These consolidation trends have created more comprehensive service networks while potentially affecting competition in certain regional markets.

Infrastructure Investment Programs announced by the Italian government and European Union have provided long-term visibility for equipment demand. Major projects including highway modernization, high-speed rail development, and urban transit system expansion have created sustained demand for construction equipment across multiple categories and regions.

MarkWide Research recommends that equipment manufacturers prioritize sustainability initiatives and electric equipment development to align with evolving market demands and regulatory requirements. Companies should invest in research and development for battery technology, charging infrastructure, and hybrid systems that can provide competitive advantages in the growing sustainable construction segment.

Service Enhancement strategies should focus on developing comprehensive support networks that provide rapid response times, skilled technical support, and proactive maintenance services. Companies that can differentiate through service quality and customer support will be better positioned to build long-term customer relationships and command premium pricing.

Digital Integration initiatives should emphasize user-friendly technology solutions that provide clear value to construction companies. Equipment manufacturers and dealers should focus on technologies that demonstrably improve productivity, reduce costs, or enhance safety rather than pursuing technology for its own sake.

Market Expansion opportunities in Mediterranean and North African markets should be carefully evaluated, with emphasis on understanding local market conditions, regulatory requirements, and customer preferences. Companies should consider partnerships with local distributors or service providers to facilitate market entry and ongoing support.

Long-term growth prospects for the Italy construction equipment market remain positive, supported by continued infrastructure investment, urban development initiatives, and technological advancement. The market is expected to maintain steady growth rates of approximately 5.8% annually over the next five years, driven by both replacement demand and new project requirements.

Technology adoption will accelerate, with electric and hybrid equipment gaining significant market share as battery technology improves and charging infrastructure expands. Autonomous and semi-autonomous equipment features will become increasingly common, particularly in large-scale infrastructure projects where productivity gains and safety improvements justify the additional investment.

Market structure evolution will continue toward service-oriented business models, with equipment-as-a-service offerings becoming more prevalent. This shift will require equipment manufacturers and dealers to develop new capabilities in service delivery, customer support, and risk management while potentially providing more stable revenue streams.

Regional development patterns suggest continued concentration in northern Italy, with growing opportunities in southern regions supported by EU development funding and government infrastructure programs. MWR analysis indicates that southern Italy could account for 28% of market growth over the next decade, representing a significant shift in regional demand patterns.

The Italy construction equipment market presents a dynamic and evolving landscape characterized by steady growth, technological innovation, and changing customer preferences. The market benefits from substantial infrastructure investment, strategic geographic positioning, and a sophisticated customer base that values quality and advanced technology features.

Key success factors for market participants include embracing sustainability initiatives, investing in digital technologies, and developing comprehensive service capabilities that differentiate from competitors. The shift toward equipment rental and service-oriented business models creates both challenges and opportunities for traditional equipment manufacturers and distributors.

Future growth will be driven by continued infrastructure modernization, urban development projects, and the adoption of advanced construction technologies. Companies that can successfully navigate regulatory requirements, address skilled labor shortages, and provide innovative solutions for evolving customer needs will be best positioned to capitalize on market opportunities and achieve sustainable growth in Italy’s construction equipment sector.

What is Construction Equipment?

Construction equipment refers to heavy machinery and vehicles used for construction activities, including excavation, lifting, and transportation. This includes bulldozers, cranes, and excavators, which are essential for various construction projects.

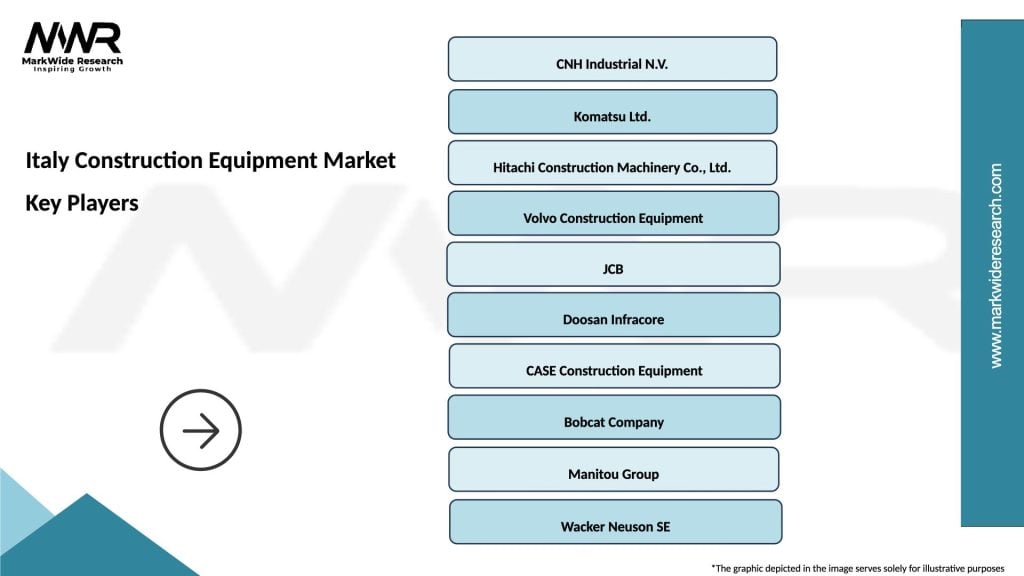

What are the key players in the Italy Construction Equipment Market?

Key players in the Italy Construction Equipment Market include companies like CNH Industrial, Komatsu, and Caterpillar, which provide a range of construction machinery and equipment. These companies are known for their innovative solutions and extensive product lines, among others.

What are the growth factors driving the Italy Construction Equipment Market?

The Italy Construction Equipment Market is driven by factors such as increasing infrastructure development, urbanization, and the demand for advanced machinery. Additionally, government investments in public works projects contribute to market growth.

What challenges does the Italy Construction Equipment Market face?

Challenges in the Italy Construction Equipment Market include fluctuating raw material prices, regulatory compliance, and competition from alternative construction methods. These factors can impact profitability and operational efficiency.

What opportunities exist in the Italy Construction Equipment Market?

Opportunities in the Italy Construction Equipment Market include the adoption of smart technologies and automation in construction equipment. The growing emphasis on sustainability and eco-friendly machinery also presents new avenues for growth.

What trends are shaping the Italy Construction Equipment Market?

Trends in the Italy Construction Equipment Market include the increasing use of electric and hybrid machinery, advancements in telematics, and a focus on safety features. These innovations are transforming how construction projects are managed and executed.

Italy Construction Equipment Market

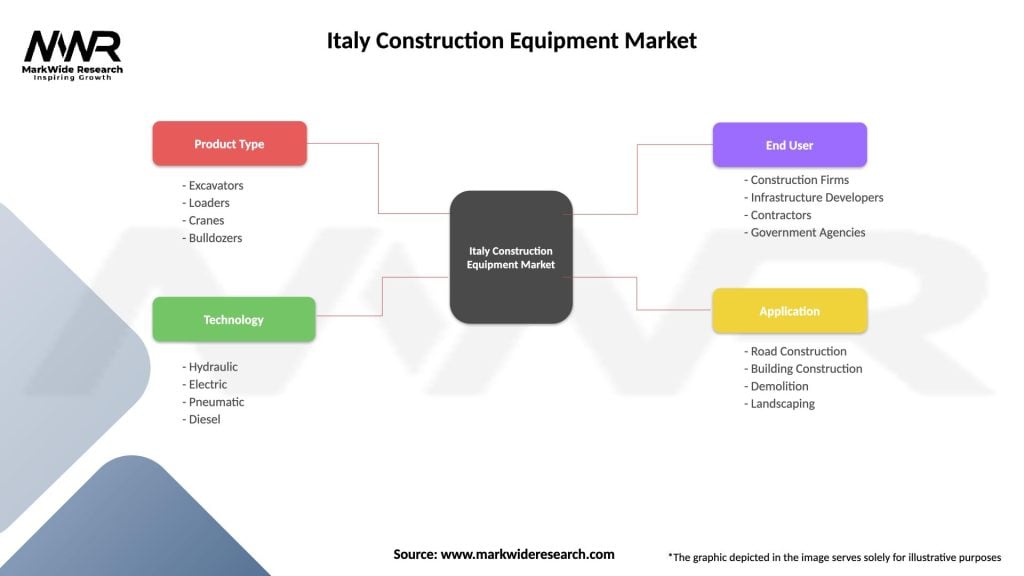

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Loaders, Cranes, Bulldozers |

| Technology | Hydraulic, Electric, Pneumatic, Diesel |

| End User | Construction Firms, Infrastructure Developers, Contractors, Government Agencies |

| Application | Road Construction, Building Construction, Demolition, Landscaping |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Construction Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at