444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy cloud computing market represents one of Europe’s most dynamic and rapidly evolving technology sectors, experiencing unprecedented growth as organizations across the peninsula embrace digital transformation initiatives. Italian enterprises are increasingly migrating from traditional on-premises infrastructure to cloud-based solutions, driven by the need for enhanced operational efficiency, cost optimization, and scalability. The market encompasses a comprehensive range of cloud services including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), with hybrid cloud deployments gaining particular traction among Italian businesses.

Market dynamics indicate that Italy’s cloud adoption is accelerating at a compound annual growth rate (CAGR) of 12.8%, significantly outpacing traditional IT infrastructure investments. The Italian government’s digitalization initiatives, including the National Recovery and Resilience Plan (PNRR), have allocated substantial resources toward cloud infrastructure development, creating a favorable environment for market expansion. Small and medium enterprises (SMEs), which form the backbone of Italy’s economy, are particularly driving demand for cloud solutions as they seek to compete with larger organizations through technology-enabled business models.

Regional distribution shows that Northern Italy, particularly the Lombardy and Veneto regions, accounts for approximately 45% of cloud adoption, followed by Central Italy at 28% and Southern Italy at 27%. The concentration of manufacturing, financial services, and technology companies in the north has created a robust ecosystem for cloud service providers and system integrators.

The Italy cloud computing market refers to the comprehensive ecosystem of cloud-based services, infrastructure, and solutions deployed across Italian organizations to enable digital transformation, enhance operational efficiency, and support business continuity through scalable, on-demand computing resources delivered over the internet.

Cloud computing in the Italian context encompasses three primary service models that organizations utilize to modernize their IT infrastructure. Infrastructure as a Service (IaaS) provides virtualized computing resources including servers, storage, and networking capabilities, allowing Italian businesses to scale their operations without significant capital expenditure on physical hardware. Platform as a Service (PaaS) offers development environments and tools that enable Italian software developers and enterprises to build, deploy, and manage applications more efficiently. Software as a Service (SaaS) delivers ready-to-use applications accessible through web browsers, eliminating the need for local installation and maintenance.

Deployment models within the Italian market include public clouds, where resources are shared among multiple organizations; private clouds, dedicated to single organizations for enhanced security and control; hybrid clouds, combining both public and private elements; and multi-cloud strategies, utilizing services from multiple cloud providers to avoid vendor lock-in and optimize performance.

Italy’s cloud computing landscape is undergoing a transformational shift as organizations across all sectors recognize the strategic importance of cloud technologies in maintaining competitive advantage and operational resilience. The market has reached a critical inflection point where cloud adoption is no longer considered optional but essential for business survival and growth in the digital economy.

Key market drivers include the Italian government’s ambitious digitalization agenda, which mandates public sector cloud adoption and provides incentives for private sector transformation. The COVID-19 pandemic accelerated cloud adoption by approximately 18 months, as organizations required immediate remote work capabilities and business continuity solutions. Financial services, manufacturing, healthcare, and retail sectors are leading cloud adoption initiatives, with each sector demonstrating unique requirements and implementation approaches.

Market segmentation reveals that SaaS solutions dominate the Italian cloud market with approximately 52% market share, driven by widespread adoption of productivity suites, customer relationship management systems, and enterprise resource planning applications. IaaS follows with 31% market share, while PaaS accounts for 17% market share, though PaaS is experiencing the fastest growth rate as Italian companies increasingly focus on application development and modernization.

Competitive dynamics show a mix of global cloud giants and local service providers competing for market share. International players leverage their global scale and comprehensive service portfolios, while Italian providers offer localized support, regulatory compliance expertise, and industry-specific solutions tailored to the unique needs of Italian businesses.

Strategic insights from comprehensive market analysis reveal several critical factors shaping Italy’s cloud computing trajectory:

Digital transformation imperatives serve as the primary catalyst driving cloud adoption across Italian organizations. The need to modernize legacy systems, improve operational efficiency, and enhance customer experiences compels businesses to embrace cloud technologies as foundational elements of their digital strategies. Italian companies recognize that cloud computing enables rapid innovation, faster time-to-market for new products and services, and the agility required to respond to changing market conditions.

Government initiatives significantly accelerate market growth through comprehensive digitalization programs and regulatory frameworks that mandate cloud adoption in public sector organizations. The Italian government’s Cloud First policy requires public administrations to prioritize cloud solutions for new IT investments, creating substantial demand and establishing best practices that influence private sector adoption. Financial incentives and tax benefits for digital transformation projects further encourage cloud migration across all sectors.

Cost optimization pressures drive organizations to seek alternatives to expensive on-premises infrastructure investments. Cloud computing offers predictable operational expenses, eliminates the need for large capital expenditures on hardware and software licenses, and provides automatic scaling capabilities that align costs with actual usage. Italian SMEs particularly benefit from cloud economics, gaining access to enterprise-grade technologies without prohibitive upfront investments.

Remote work requirements have permanently altered workplace dynamics, necessitating cloud-based collaboration tools, virtual desktop infrastructure, and secure remote access solutions. The pandemic demonstrated the critical importance of cloud technologies in maintaining business continuity, leading to sustained investment in cloud capabilities even as traditional work patterns resume.

Data sovereignty concerns represent the most significant barrier to cloud adoption among Italian organizations, particularly those handling sensitive customer information or operating in regulated industries. Many companies express reluctance to store critical data outside Italian borders, preferring local cloud providers or private cloud deployments that ensure complete control over data location and access. Regulatory compliance requirements in sectors such as banking, healthcare, and government create additional complexity that can slow cloud adoption decisions.

Security apprehensions continue to influence cloud adoption strategies, despite evidence that major cloud providers often offer superior security capabilities compared to on-premises alternatives. Italian organizations frequently cite concerns about data breaches, unauthorized access, and loss of direct security control as factors limiting their cloud migration pace. Legacy system integration challenges compound security concerns, as organizations struggle to maintain security standards while connecting cloud services with existing on-premises infrastructure.

Skills shortage in cloud technologies creates implementation and management challenges that can delay or complicate cloud adoption initiatives. The rapid evolution of cloud platforms and services requires continuous learning and certification, straining IT departments already managing complex hybrid environments. Italian companies often struggle to find qualified cloud architects, security specialists, and DevOps engineers with the expertise needed to design and implement sophisticated cloud solutions.

Vendor lock-in fears influence procurement decisions as organizations worry about becoming overly dependent on specific cloud providers’ proprietary technologies and services. The complexity and cost of migrating applications and data between cloud platforms can create long-term dependencies that limit flexibility and negotiating power in future contract renewals.

Industry 4.0 transformation presents unprecedented opportunities for cloud service providers to support Italian manufacturing companies in their digitalization journeys. The integration of IoT sensors, artificial intelligence, and machine learning capabilities requires scalable cloud infrastructure that can process vast amounts of industrial data in real-time. Manufacturing enterprises seek cloud solutions that enable predictive maintenance, quality optimization, and supply chain visibility, creating demand for specialized industrial cloud platforms.

Healthcare digitalization offers substantial growth potential as Italian healthcare providers modernize patient care delivery through telemedicine, electronic health records, and AI-powered diagnostic tools. The COVID-19 pandemic accelerated healthcare cloud adoption, and sustained investment in digital health initiatives creates ongoing opportunities for cloud providers offering HIPAA-compliant, secure healthcare solutions. Medical research institutions require high-performance computing capabilities for genomics research and drug discovery, driving demand for specialized cloud services.

Smart city initiatives across Italian municipalities create opportunities for cloud providers to support urban digitalization projects including traffic management, environmental monitoring, and citizen services platforms. The integration of IoT devices, data analytics, and mobile applications requires robust cloud infrastructure capable of handling diverse data types and providing real-time insights. Municipal governments increasingly recognize cloud technologies as essential enablers of efficient public service delivery.

Financial services innovation drives demand for cloud platforms supporting digital banking, fintech applications, and regulatory compliance solutions. Italian banks and financial institutions require cloud infrastructure that meets stringent security requirements while enabling rapid deployment of new digital services. Open banking initiatives and payment system modernization create additional opportunities for specialized financial cloud services.

Competitive intensity in the Italian cloud market continues to escalate as global hyperscale providers expand their local presence while domestic providers enhance their service portfolios to compete effectively. The market exhibits characteristics of both consolidation, as smaller providers partner with or are acquired by larger entities, and fragmentation, as specialized niche providers emerge to serve specific industry verticals or technical requirements. Price competition remains fierce, particularly in commodity IaaS services, driving providers to differentiate through value-added services, industry expertise, and superior customer support.

Technology evolution accelerates market dynamics as emerging technologies such as artificial intelligence, machine learning, and edge computing become integral components of cloud service offerings. Italian organizations increasingly expect cloud providers to offer pre-built AI/ML services, automated management capabilities, and seamless integration with emerging technologies. Container technologies and serverless computing models gain traction as organizations seek greater application portability and operational efficiency.

Customer expectations continue to evolve toward more sophisticated service level agreements, enhanced security guarantees, and comprehensive support services. Italian businesses demand cloud providers that understand local business practices, regulatory requirements, and cultural nuances while delivering global-scale capabilities. Service customization becomes increasingly important as organizations seek cloud solutions tailored to their specific industry requirements and operational constraints.

Partnership ecosystems play crucial roles in market dynamics as cloud providers collaborate with system integrators, software vendors, and consulting firms to deliver comprehensive solutions. The complexity of cloud migrations and hybrid deployments necessitates partnerships that combine cloud infrastructure expertise with industry knowledge and implementation capabilities. Channel partner programs enable cloud providers to extend their reach into underserved market segments and geographic regions.

Comprehensive market analysis employs a multi-faceted research approach combining primary research, secondary data analysis, and expert insights to provide accurate and actionable market intelligence. The methodology incorporates both quantitative and qualitative research techniques to capture market dynamics, competitive positioning, and future growth trajectories across all segments of the Italian cloud computing market.

Primary research activities include structured interviews with cloud service providers, enterprise customers, system integrators, and industry experts across Italy’s major economic regions. Survey methodologies capture quantitative data on adoption rates, spending patterns, technology preferences, and implementation challenges from representative samples of Italian organizations across various size categories and industry verticals. Focus group discussions provide deeper insights into decision-making processes, vendor selection criteria, and future technology requirements.

Secondary research encompasses analysis of financial reports, industry publications, government statistics, and regulatory documents to establish market context and validate primary research findings. Comprehensive review of cloud provider announcements, partnership agreements, and service launches provides insights into competitive strategies and market evolution trends. MarkWide Research leverages proprietary databases and analytical frameworks to ensure data accuracy and consistency across all research components.

Data validation processes include triangulation of findings across multiple sources, expert review panels, and statistical analysis to ensure research reliability and accuracy. Market sizing and forecasting models incorporate multiple scenarios and sensitivity analyses to account for potential market variations and external factors that could influence growth trajectories.

Northern Italy dominates the cloud computing landscape, accounting for approximately 45% of total market activity, driven by the concentration of multinational corporations, financial institutions, and technology companies in the Lombardy, Piedmont, and Veneto regions. Milan serves as the primary cloud hub, hosting major data centers and cloud provider operations that support both local and international customers. Manufacturing companies in the industrial triangle of Milan-Turin-Genoa lead Industry 4.0 cloud adoption initiatives, implementing IoT platforms, predictive analytics, and supply chain optimization solutions.

Central Italy represents approximately 28% of market share, with Rome serving as the government and public sector cloud adoption center. The presence of national government agencies, regulatory bodies, and public sector organizations drives demand for secure, compliant cloud solutions that meet stringent data sovereignty requirements. Healthcare institutions and universities in the region contribute to growing demand for specialized cloud services supporting research, education, and patient care delivery.

Southern Italy accounts for 27% of market activity, with Naples and Bari emerging as important cloud adoption centers. The region benefits from government digitalization initiatives aimed at reducing the digital divide and promoting economic development through technology adoption. Tourism and agriculture sectors increasingly leverage cloud technologies for digital marketing, e-commerce platforms, and supply chain management, creating unique opportunities for cloud service providers.

Island regions including Sicily and Sardinia show growing cloud adoption rates, particularly in public sector organizations and SMEs seeking to overcome geographic isolation through digital connectivity. The development of submarine cable infrastructure and edge computing capabilities enhances cloud service availability and performance in these regions, supporting local economic development initiatives.

Market leadership in Italy’s cloud computing sector reflects a dynamic competitive environment where global hyperscale providers compete alongside established local players and emerging specialized service providers. The competitive landscape continues to evolve as providers adapt their strategies to address unique Italian market requirements while leveraging global scale and capabilities.

Competitive strategies increasingly focus on industry specialization, regulatory compliance expertise, and hybrid cloud capabilities that address specific Italian market requirements. Providers invest heavily in local partnerships, customer support capabilities, and data center infrastructure to differentiate their offerings in an increasingly crowded marketplace.

Service model segmentation reveals distinct adoption patterns and growth trajectories across different cloud computing categories within the Italian market:

By Service Type:

By Deployment Model:

By Organization Size:

Manufacturing sector demonstrates sophisticated cloud adoption patterns focused on Industry 4.0 transformation initiatives. Italian manufacturers leverage cloud platforms to implement IoT sensor networks, predictive maintenance systems, and supply chain optimization solutions. Automotive companies in the Turin region particularly drive demand for high-performance computing capabilities supporting design simulation and autonomous vehicle development. The sector shows preference for hybrid cloud deployments that maintain sensitive intellectual property on-premises while utilizing public cloud resources for scalable analytics and collaboration.

Financial services exhibit conservative but accelerating cloud adoption patterns, driven by digital banking initiatives and fintech competition. Italian banks prioritize cloud providers offering comprehensive security certifications, regulatory compliance expertise, and low-latency performance for trading applications. Insurance companies increasingly adopt cloud-based analytics platforms for risk assessment, fraud detection, and customer engagement optimization. The sector demonstrates growing acceptance of public cloud services for non-core applications while maintaining private cloud infrastructure for critical financial systems.

Healthcare organizations show rapid cloud adoption acceleration following COVID-19 pandemic experiences with telemedicine and remote patient monitoring. Italian hospitals and clinics seek cloud solutions supporting electronic health records, medical imaging, and AI-powered diagnostic tools. Pharmaceutical companies require specialized cloud platforms for drug discovery research, clinical trial management, and regulatory compliance documentation. The sector emphasizes data sovereignty and security requirements that influence cloud provider selection decisions.

Retail and e-commerce sectors drive demand for cloud platforms supporting omnichannel customer experiences, inventory management, and digital marketing campaigns. Italian retailers leverage cloud technologies to compete with international e-commerce giants while maintaining local market advantages. Fashion companies particularly benefit from cloud-based design collaboration tools and global supply chain management platforms that support their international operations.

Enterprise customers realize substantial operational and strategic benefits through cloud adoption, including significant cost reductions compared to traditional on-premises infrastructure investments. Cloud computing enables Italian organizations to achieve operational efficiency improvements of 25-40% through automated resource management, predictive scaling, and reduced maintenance overhead. Innovation acceleration represents another critical benefit as cloud platforms provide immediate access to cutting-edge technologies such as artificial intelligence, machine learning, and advanced analytics without requiring specialized expertise or infrastructure investments.

Small and medium enterprises gain access to enterprise-grade technologies and capabilities previously available only to large corporations with substantial IT budgets. Cloud computing democratizes access to sophisticated business applications, data analytics tools, and global infrastructure that enable SMEs to compete effectively in digital markets. Scalability benefits allow growing businesses to expand their IT capabilities seamlessly without the constraints and risks associated with traditional infrastructure investments.

Cloud service providers benefit from the expanding Italian market through revenue growth opportunities and the ability to leverage global scale advantages while serving local market requirements. The growing demand for specialized industry solutions creates opportunities for providers to develop high-value, differentiated service offerings. Partnership opportunities with local system integrators and consulting firms enable cloud providers to extend their market reach and enhance customer success rates.

System integrators and consultants find expanding opportunities to provide cloud migration services, hybrid infrastructure design, and ongoing managed services that help organizations optimize their cloud investments. The complexity of cloud adoption creates sustained demand for professional services that bridge the gap between cloud capabilities and business requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Edge computing integration emerges as a dominant trend as Italian organizations seek to process data closer to its source for improved performance and reduced latency. Manufacturing companies implement edge computing solutions to support real-time quality control and predictive maintenance applications, while telecommunications providers deploy edge infrastructure to support 5G services and IoT applications. Distributed cloud architectures become increasingly important as organizations balance the benefits of centralized cloud services with the performance requirements of edge computing applications.

Artificial intelligence and machine learning integration accelerates across cloud platforms as Italian businesses seek to leverage data analytics for competitive advantage. Cloud providers increasingly offer pre-built AI/ML services that enable organizations to implement sophisticated analytics without requiring specialized expertise. Industry-specific AI solutions gain traction in sectors such as manufacturing, healthcare, and financial services, where domain expertise combined with cloud-scale computing power creates significant value.

Sustainability and green computing influence cloud adoption decisions as Italian organizations prioritize environmental responsibility and carbon footprint reduction. Cloud providers invest heavily in renewable energy sources and energy-efficient data center technologies to meet growing customer demands for sustainable computing solutions. Carbon accounting and environmental reporting capabilities become standard features of cloud platforms as organizations seek to measure and reduce their environmental impact.

Multi-cloud and hybrid strategies become standard practice as Italian organizations seek to optimize performance, avoid vendor lock-in, and maintain flexibility in their cloud deployments. The trend toward cloud-native application development accelerates as organizations modernize their software portfolios to take full advantage of cloud capabilities including automatic scaling, microservices architectures, and containerized deployments.

Infrastructure investments by major cloud providers continue to expand throughout Italy, with significant data center construction and network enhancement projects improving service availability and performance. These investments demonstrate long-term commitment to the Italian market and provide the foundation for sustained growth in cloud adoption across all sectors. Submarine cable projects enhance international connectivity and reduce latency for cloud services, particularly benefiting organizations with global operations.

Strategic partnerships between international cloud providers and Italian system integrators create comprehensive service delivery capabilities that combine global cloud expertise with local market knowledge. These partnerships enable more effective cloud adoption support for Italian organizations while expanding market reach for cloud providers. Industry-specific alliances develop specialized solutions for key sectors such as manufacturing, healthcare, and financial services.

Regulatory developments including updated data protection guidelines and cloud security frameworks provide clearer guidance for organizations considering cloud adoption. The Italian government’s cloud qualification program establishes standards for cloud providers serving public sector organizations, creating a framework that influences private sector procurement decisions. Digital identity initiatives and interoperability standards facilitate cloud service integration and data portability.

Acquisition activity accelerates as cloud providers seek to expand their capabilities and market presence through strategic acquisitions of local providers, specialized technology companies, and professional services firms. These transactions consolidate market expertise while providing acquired companies with resources to scale their operations and service offerings.

Cloud providers should prioritize local data center investments and partnerships with Italian system integrators to address data sovereignty concerns and provide comprehensive support for complex cloud migrations. MarkWide Research analysis indicates that providers offering local data residency options and Italian-language support achieve significantly higher customer satisfaction and retention rates. Developing industry-specific solutions and compliance expertise for key sectors such as manufacturing, healthcare, and financial services creates competitive differentiation and premium pricing opportunities.

Enterprise customers should develop comprehensive cloud strategies that balance cost optimization with security requirements and regulatory compliance needs. Organizations benefit from adopting hybrid cloud approaches that enable gradual migration while maintaining control over sensitive data and critical applications. Investment in cloud skills development through training programs and strategic hiring initiatives proves essential for successful cloud adoption and ongoing optimization.

System integrators should expand their cloud expertise and certification programs to capture growing demand for cloud migration and managed services. Developing specialized capabilities in emerging areas such as edge computing, AI/ML integration, and multi-cloud management creates opportunities for high-value service offerings. Partnership strategies with multiple cloud providers enable system integrators to provide vendor-neutral advice and optimal solutions for diverse customer requirements.

Government agencies should continue promoting cloud adoption through policy initiatives, incentive programs, and public sector modernization projects that demonstrate cloud benefits and best practices. Establishing clear regulatory frameworks and security standards provides confidence for private sector cloud adoption while ensuring appropriate protection of sensitive data and critical infrastructure.

Market trajectory indicates sustained growth momentum as Italian organizations accelerate their digital transformation initiatives and cloud-first strategies become standard practice across all sectors. The convergence of emerging technologies including artificial intelligence, Internet of Things, and 5G communications creates expanding opportunities for cloud platforms that can support these integrated technology solutions. Cloud adoption rates are projected to reach 85% among large enterprises and 65% among SMEs within the next five years, driven by competitive pressures and operational efficiency requirements.

Technology evolution will continue reshaping the cloud landscape as edge computing, quantum computing, and advanced AI capabilities become integrated components of cloud platforms. Italian organizations will increasingly demand cloud solutions that can seamlessly integrate these emerging technologies while maintaining security, compliance, and performance standards. Serverless computing and container technologies will gain broader adoption as organizations seek greater application portability and operational efficiency.

Industry transformation will accelerate across key sectors as cloud technologies enable new business models and service delivery approaches. Manufacturing companies will achieve deeper Industry 4.0 integration through cloud-enabled IoT platforms and AI-powered optimization systems. Healthcare organizations will expand telemedicine and digital health services supported by cloud infrastructure and analytics capabilities. Financial services will continue evolving toward digital-first customer experiences and AI-powered risk management systems.

Competitive dynamics will intensify as the market matures and customer requirements become more sophisticated. Cloud providers will differentiate through specialized industry solutions, superior customer experience, and innovative technology capabilities rather than competing primarily on price. MWR projections indicate that successful providers will be those that can combine global scale with local expertise and industry-specific knowledge to deliver comprehensive solutions that address unique Italian market requirements.

Italy’s cloud computing market stands at a pivotal moment of transformation as organizations across all sectors recognize cloud technologies as essential enablers of digital competitiveness and operational excellence. The market demonstrates robust growth momentum driven by government digitalization initiatives, competitive pressures, and the proven benefits of cloud adoption in improving efficiency, reducing costs, and enabling innovation. Strategic investments by major cloud providers in local infrastructure and partnerships demonstrate long-term commitment to the Italian market and provide the foundation for sustained growth.

Market maturation creates opportunities for specialized providers and service integrators to develop industry-specific solutions that address unique Italian business requirements while leveraging global cloud capabilities. The evolution toward hybrid and multi-cloud strategies reflects the sophistication of Italian organizations in optimizing their cloud investments for maximum business value. Emerging technologies including artificial intelligence, edge computing, and IoT integration will continue driving demand for advanced cloud platforms that can support complex, integrated digital transformation initiatives.

Future success in the Italian cloud market will depend on providers’ ability to balance global scale and capabilities with local expertise, regulatory compliance, and industry specialization. Organizations that embrace cloud technologies strategically while addressing security, compliance, and skills development requirements will achieve significant competitive advantages in Italy’s evolving digital economy. The cloud computing market in Italy represents not just a technology shift but a fundamental transformation in how businesses operate, compete, and deliver value to their customers in an increasingly digital world.

What is Cloud Computing?

Cloud computing refers to the delivery of computing services over the internet, including storage, processing, and software applications. It allows businesses and individuals to access and manage data remotely, enhancing flexibility and scalability.

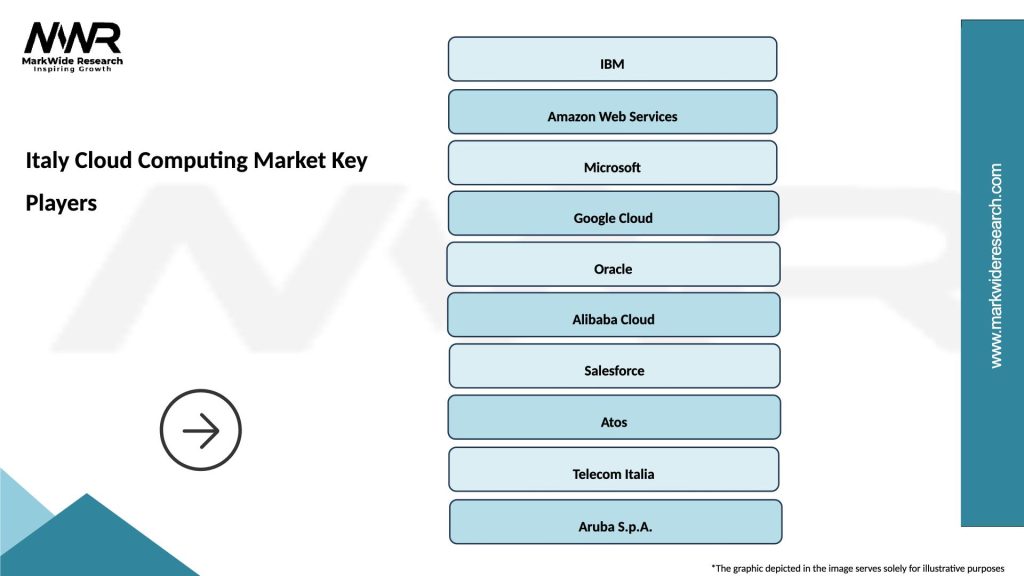

What are the key players in the Italy Cloud Computing Market?

Key players in the Italy Cloud Computing Market include Telecom Italia, Aruba, and Microsoft Azure. These companies provide a range of cloud services, including infrastructure as a service (IaaS) and software as a service (SaaS), among others.

What are the main drivers of growth in the Italy Cloud Computing Market?

The main drivers of growth in the Italy Cloud Computing Market include the increasing demand for digital transformation, the rise of remote work, and the need for scalable IT solutions. Additionally, businesses are adopting cloud services to enhance operational efficiency and reduce costs.

What challenges does the Italy Cloud Computing Market face?

The Italy Cloud Computing Market faces challenges such as data security concerns, regulatory compliance issues, and the complexity of migrating existing systems to the cloud. These factors can hinder the adoption of cloud solutions among businesses.

What opportunities exist in the Italy Cloud Computing Market?

Opportunities in the Italy Cloud Computing Market include the growing demand for cloud-based solutions in sectors like healthcare, finance, and e-commerce. Additionally, advancements in artificial intelligence and machine learning are creating new avenues for cloud service providers.

What trends are shaping the Italy Cloud Computing Market?

Trends shaping the Italy Cloud Computing Market include the increasing adoption of hybrid cloud solutions, the rise of edge computing, and a focus on sustainability in cloud operations. These trends are influencing how businesses leverage cloud technologies for innovation and efficiency.

Italy Cloud Computing Market

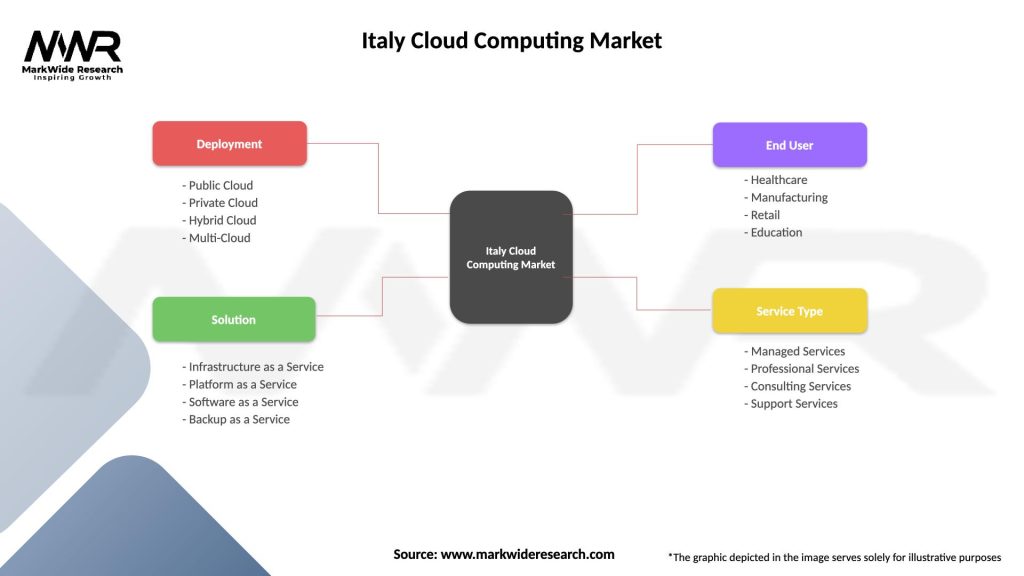

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Solution | Infrastructure as a Service, Platform as a Service, Software as a Service, Backup as a Service |

| End User | Healthcare, Manufacturing, Retail, Education |

| Service Type | Managed Services, Professional Services, Consulting Services, Support Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Cloud Computing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at