444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy artificial organs and bionic implants market represents a rapidly evolving healthcare sector that combines advanced medical technology with innovative bioengineering solutions. This dynamic market encompasses a comprehensive range of medical devices designed to replace, support, or enhance the function of damaged or failing human organs and body parts. Italy’s healthcare system has embraced these revolutionary technologies, positioning the country as a significant player in the European medical device landscape.

Market growth in Italy is driven by an aging population, increasing prevalence of chronic diseases, and substantial investments in healthcare infrastructure. The sector includes artificial hearts, cochlear implants, prosthetic limbs, artificial kidneys, and various bionic devices that restore functionality to patients with organ failure or physical disabilities. Italian medical institutions have demonstrated remarkable adoption rates, with approximately 78% of major hospitals now incorporating advanced artificial organ technologies into their treatment protocols.

Technological advancement continues to reshape the market landscape, with Italian research centers and medical device manufacturers collaborating to develop next-generation solutions. The integration of artificial intelligence, advanced materials science, and precision engineering has resulted in more sophisticated and reliable artificial organs and bionic implants. Patient outcomes have improved significantly, with success rates for certain artificial organ procedures reaching 92% effectiveness in specialized Italian medical centers.

The Italy artificial organs and bionic implants market refers to the comprehensive ecosystem of medical devices, technologies, and services designed to replace or augment human organ function through artificial means. This market encompasses both temporary and permanent solutions that address organ failure, physical disabilities, and functional impairments through advanced biomedical engineering.

Artificial organs are sophisticated medical devices that replicate the essential functions of natural human organs, including artificial hearts, kidneys, lungs, and pancreases. These devices utilize cutting-edge materials and engineering principles to maintain vital physiological processes when natural organs fail or become compromised. Bionic implants represent a subset of this technology that integrates electronic components with biological systems to restore sensory or motor functions.

Market scope extends beyond device manufacturing to include surgical procedures, post-operative care, device maintenance, and ongoing patient monitoring services. The Italian market specifically focuses on solutions that meet European regulatory standards while addressing the unique healthcare needs of the Italian population, including considerations for genetic predispositions and lifestyle-related health challenges.

Italy’s artificial organs and bionic implants market demonstrates robust growth potential driven by demographic shifts, technological innovation, and healthcare system modernization. The market encompasses diverse product categories ranging from life-sustaining artificial organs to quality-of-life enhancing bionic devices, serving a broad spectrum of medical conditions and patient needs.

Key market drivers include Italy’s rapidly aging population, with individuals over 65 representing approximately 23% of the total population, creating increased demand for organ replacement and augmentation technologies. The prevalence of cardiovascular diseases, diabetes, and other chronic conditions requiring artificial organ intervention continues to rise, establishing a substantial patient base for these advanced medical solutions.

Technological innovation remains a cornerstone of market development, with Italian research institutions and international medical device companies investing heavily in next-generation artificial organs and bionic systems. Recent advances in biocompatible materials, miniaturization technologies, and wireless connectivity have significantly improved device performance and patient acceptance rates.

Regulatory environment in Italy aligns with European Union medical device regulations, ensuring high safety and efficacy standards while facilitating market access for innovative technologies. The Italian healthcare system’s commitment to adopting advanced medical technologies, combined with favorable reimbursement policies for essential artificial organ procedures, supports sustained market growth and accessibility for patients across different socioeconomic backgrounds.

Market dynamics in Italy reveal several critical insights that shape the artificial organs and bionic implants landscape. The sector demonstrates strong correlation between technological advancement and clinical adoption, with newer devices achieving faster market penetration due to improved patient outcomes and reduced complications.

Demographic transformation serves as the primary catalyst for Italy’s artificial organs and bionic implants market expansion. The country’s aging population creates unprecedented demand for organ replacement and augmentation technologies, as age-related organ failure and functional decline become increasingly prevalent. Life expectancy increases paradoxically drive demand for artificial organs, as people live longer with chronic conditions that eventually require technological intervention.

Chronic disease prevalence continues to escalate across Italy, with cardiovascular disease, diabetes, and kidney disorders affecting millions of citizens. These conditions often progress to organ failure, creating a substantial patient population requiring artificial organ solutions. Lifestyle factors including dietary habits, sedentary behavior, and environmental exposures contribute to organ damage, expanding the potential market for artificial replacement technologies.

Technological advancement drives market growth by making artificial organs more effective, durable, and accessible. Innovations in materials science, miniaturization, and biocompatibility have transformed artificial organs from experimental devices to reliable medical solutions. Digital integration enables remote monitoring and predictive maintenance, improving patient outcomes and reducing healthcare system burden.

Healthcare system investment in Italy supports market expansion through infrastructure development, specialist training, and technology adoption programs. Government initiatives promoting medical innovation and patient access to advanced treatments create favorable conditions for artificial organ market growth. Insurance coverage expansion for artificial organ procedures reduces financial barriers and increases patient accessibility to these life-changing technologies.

High implementation costs represent a significant barrier to widespread adoption of artificial organs and bionic implants in Italy. The substantial financial investment required for device procurement, surgical procedures, and ongoing maintenance creates accessibility challenges for both healthcare institutions and patients. Economic constraints within the Italian healthcare system limit the number of procedures that can be performed annually, creating waiting lists and delayed treatments.

Technical complexity associated with artificial organ implantation and maintenance requires specialized expertise that may not be readily available across all Italian medical centers. The learning curve for surgical teams and the need for ongoing technical support create operational challenges that can limit market penetration. Device compatibility issues and the risk of technical failures contribute to physician hesitancy in adopting newer technologies.

Regulatory compliance requirements, while ensuring safety and efficacy, can slow the introduction of innovative artificial organ technologies to the Italian market. The extensive testing and approval processes required for new devices create delays between technological development and clinical availability. Liability concerns related to device failures or complications may discourage some healthcare providers from offering artificial organ procedures.

Patient acceptance challenges persist despite technological advances, as some individuals remain hesitant about artificial organ implantation due to cultural, religious, or personal beliefs. Psychological barriers and concerns about device dependence can limit patient willingness to pursue artificial organ solutions, even when medically indicated.

Emerging technologies present substantial opportunities for market expansion in Italy’s artificial organs and bionic implants sector. The development of bioengineered organs using stem cell technology and 3D printing offers potential for personalized organ replacement solutions that could revolutionize patient care. Nanotechnology integration enables the creation of more sophisticated and responsive artificial organs that can adapt to individual patient physiology.

Telemedicine integration creates opportunities for remote monitoring and management of artificial organ patients, improving outcomes while reducing healthcare costs. The ability to continuously monitor device performance and patient health status enables proactive interventions and preventive care strategies. Artificial intelligence applications in device optimization and predictive analytics offer opportunities to enhance artificial organ performance and longevity.

Market expansion opportunities exist in underserved regions of Italy where access to artificial organ technologies remains limited. Developing mobile surgical units and satellite treatment centers could extend the reach of these life-saving technologies to rural and remote areas. International collaboration with other European countries could create economies of scale and shared expertise that benefit Italian patients and healthcare providers.

Preventive applications represent an emerging opportunity as artificial organs evolve from reactive treatments to proactive health management tools. Early intervention with artificial organ technologies could prevent complete organ failure and improve long-term patient outcomes. Regenerative medicine integration offers opportunities to combine artificial organs with biological healing processes for enhanced therapeutic effectiveness.

Supply chain dynamics in Italy’s artificial organs market reflect the complex interplay between international device manufacturers, local distributors, and healthcare institutions. The market relies heavily on imported technologies from leading global manufacturers, while Italian companies contribute specialized components and services. Manufacturing partnerships between Italian firms and international leaders create opportunities for technology transfer and local production capabilities.

Competitive dynamics intensify as established medical device companies compete with emerging technology startups and research institutions. Innovation cycles accelerate as companies race to develop next-generation artificial organs with improved performance and reduced complications. Market consolidation trends emerge as larger companies acquire specialized artificial organ developers to expand their product portfolios.

Pricing dynamics reflect the balance between device sophistication, manufacturing costs, and healthcare budget constraints. Value-based pricing models gain traction as healthcare systems focus on long-term outcomes rather than initial device costs. Reimbursement policies significantly influence market dynamics by determining patient access and healthcare provider adoption rates.

Technology adoption patterns vary across different artificial organ categories, with some devices achieving rapid acceptance while others face longer adoption cycles. Clinical evidence generation and physician education programs play crucial roles in shaping adoption dynamics. Patient advocacy groups increasingly influence market dynamics by promoting awareness and access to artificial organ technologies.

Comprehensive market analysis for Italy’s artificial organs and bionic implants market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves direct engagement with key stakeholders including healthcare professionals, device manufacturers, patients, and regulatory authorities to gather firsthand insights into market conditions and trends.

Data collection methods include structured interviews with cardiac surgeons, nephrologists, and other specialists who regularly work with artificial organs. Survey instruments capture quantitative data on device usage patterns, patient outcomes, and adoption barriers across different Italian regions. Clinical data analysis examines patient registries and hospital databases to identify trends in artificial organ procedures and success rates.

Secondary research incorporates analysis of medical literature, regulatory filings, patent databases, and industry reports to understand technological developments and competitive landscapes. Market intelligence gathering includes monitoring of conference proceedings, research publications, and clinical trial results to identify emerging trends and opportunities.

Analytical frameworks employ statistical modeling and trend analysis to project market growth and identify key success factors. Cross-validation of findings through multiple data sources ensures research reliability and reduces potential bias in market assessments. Expert validation processes involve review of findings by industry specialists and academic researchers to confirm accuracy and relevance of conclusions.

Northern Italy dominates the artificial organs and bionic implants market, accounting for approximately 52% of total market activity due to concentrated healthcare infrastructure and research institutions. Major cities including Milan, Turin, and Bologna host leading medical centers specializing in artificial organ procedures. Lombardy region particularly excels in cardiac artificial organ procedures, with several hospitals achieving international recognition for their expertise and outcomes.

Central Italy represents a growing market segment, with Rome serving as a major hub for artificial organ research and clinical applications. The region benefits from proximity to regulatory authorities and academic institutions that drive innovation in artificial organ technologies. Tuscany and Lazio regions demonstrate increasing adoption rates for bionic implants, particularly cochlear implants and advanced prosthetics.

Southern Italy presents significant growth opportunities despite currently representing a smaller market share. Infrastructure development initiatives and healthcare system investments are improving access to artificial organ technologies in regions including Campania, Sicily, and Puglia. Regional disparities in healthcare access create challenges but also represent opportunities for market expansion through targeted programs and mobile treatment units.

Island regions including Sicily and Sardinia face unique challenges in accessing artificial organ technologies due to geographic isolation and limited specialized healthcare facilities. However, telemedicine initiatives and partnerships with mainland medical centers are improving patient access to these critical technologies. Regional cooperation programs facilitate knowledge sharing and resource optimization across different Italian regions.

Market leadership in Italy’s artificial organs and bionic implants sector involves a combination of international medical device giants and specialized Italian companies. The competitive environment reflects the complex nature of artificial organ technologies, requiring extensive research and development capabilities, regulatory expertise, and clinical support infrastructure.

Competitive strategies focus on clinical evidence generation, physician education, and patient support programs to differentiate products and services. Companies invest heavily in Italian clinical trials and research partnerships to demonstrate device effectiveness and build market credibility. Local partnerships with Italian medical institutions and distributors provide market access and cultural understanding necessary for successful market penetration.

Product-based segmentation reveals distinct market categories within Italy’s artificial organs and bionic implants sector, each with unique characteristics, growth patterns, and competitive dynamics. The segmentation approach considers device functionality, target organ systems, and technological sophistication to provide comprehensive market understanding.

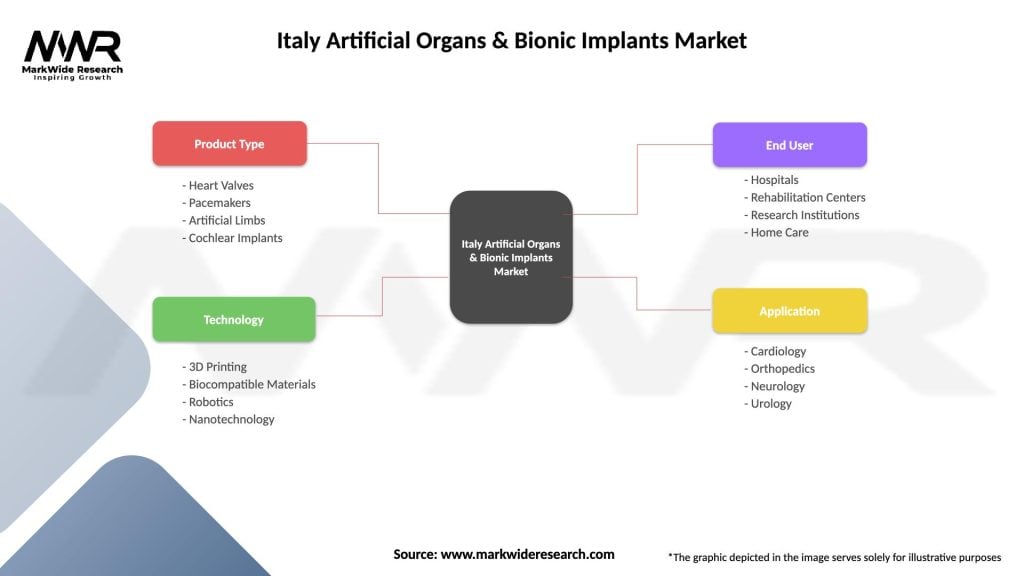

By Product Type:

By Technology:

By End User:

Cardiovascular artificial organs dominate the Italian market due to high prevalence of heart disease and well-established clinical protocols. Artificial hearts and ventricular assist devices demonstrate strong growth driven by aging population and improved surgical techniques. Patient outcomes continue to improve with newer generation devices showing enhanced durability and reduced complications.

Renal replacement technologies represent a rapidly growing category as chronic kidney disease prevalence increases across Italy. Portable dialysis systems and bioartificial kidney devices offer patients greater mobility and quality of life compared to traditional treatments. Innovation focus centers on miniaturization and automation to reduce treatment burden on patients and healthcare systems.

Sensory restoration devices including cochlear implants and retinal implants show exceptional growth potential as technology advances and awareness increases. These devices significantly improve quality of life for patients with sensory impairments, leading to high patient satisfaction and strong clinical adoption. Pediatric applications drive particular growth as early intervention improves long-term outcomes.

Bionic prosthetics represent an emerging high-growth category with advanced neural interfaces and sensory feedback capabilities. Italian research institutions contribute significantly to prosthetic innovation, creating opportunities for local technology development and commercialization. Military and civilian applications expand the market beyond traditional medical indications to include enhancement and performance improvement applications.

Healthcare providers benefit from artificial organs and bionic implants through improved patient outcomes, reduced long-term care costs, and enhanced treatment capabilities. These technologies enable hospitals and clinics to offer advanced treatment options that attract patients and establish clinical excellence reputations. Operational efficiency improves as artificial organs reduce the need for repeated interventions and long-term management of organ failure.

Patients and families experience life-changing benefits including restored organ function, improved quality of life, and extended life expectancy. Artificial organs provide hope for individuals facing organ failure and offer alternatives to organ transplantation when donor organs are unavailable. Independence and mobility improvements through bionic implants enable patients to return to productive lives and maintain social connections.

Medical device manufacturers access growing market opportunities driven by demographic trends and technological advancement. The Italian market provides a sophisticated healthcare environment for testing and refining artificial organ technologies before broader European expansion. Innovation partnerships with Italian research institutions offer opportunities for collaborative development and clinical validation of new technologies.

Healthcare systems achieve cost savings through reduced hospitalization, decreased complications, and improved patient management efficiency. Artificial organs help address organ shortage challenges and reduce waiting lists for transplant procedures. Resource optimization enables healthcare systems to treat more patients effectively while managing budget constraints and improving population health outcomes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization and portability represent dominant trends in Italy’s artificial organs market, with devices becoming smaller, lighter, and more suitable for ambulatory use. This trend enables patients to maintain active lifestyles while receiving artificial organ support, significantly improving quality of life outcomes. Wearable artificial organs eliminate the need for permanent hospitalization and reduce healthcare system burden.

Smart technology integration transforms artificial organs into connected medical devices capable of real-time monitoring, data collection, and remote management. Italian healthcare providers increasingly adopt artificial organs with wireless connectivity and smartphone integration for enhanced patient monitoring. Predictive analytics enable proactive maintenance and early intervention to prevent device failures and complications.

Personalization and customization emerge as key trends with 3D printing and advanced manufacturing enabling patient-specific artificial organ design. Italian medical centers explore personalized artificial organs tailored to individual anatomy and physiology for improved compatibility and performance. Biocompatibility optimization reduces rejection risks and improves long-term device integration.

Regenerative medicine integration creates hybrid solutions combining artificial organs with biological components and stem cell therapy. This trend represents the convergence of artificial organ technology with regenerative medicine to create more natural and adaptive solutions. Tissue engineering applications enhance artificial organ functionality and longevity through biological integration.

Recent technological breakthroughs in Italy’s artificial organs sector include the development of bioartificial kidneys with living cell components and advanced cardiac assist devices with magnetic levitation technology. Italian research institutions collaborate with international partners to advance artificial organ science and clinical applications. Clinical trial results demonstrate improved patient outcomes and device reliability for next-generation artificial organs.

Regulatory approvals for innovative artificial organ technologies expand treatment options available to Italian patients. Recent approvals include advanced cochlear implants with enhanced signal processing and bionic limbs with neural control interfaces. Reimbursement expansions improve patient access to newer artificial organ technologies through updated coverage policies.

Strategic partnerships between Italian healthcare institutions and international medical device companies accelerate technology transfer and clinical adoption. These collaborations facilitate clinical trials, physician training, and patient access programs for advanced artificial organ technologies. Investment increases in artificial organ research and development reflect growing market confidence and innovation potential.

Infrastructure developments include establishment of specialized artificial organ centers and expansion of existing facilities to accommodate growing patient demand. Italian hospitals invest in advanced surgical suites and support equipment necessary for complex artificial organ procedures. Training programs expand to develop specialized expertise in artificial organ implantation and management across different medical specialties.

Market participants should focus on developing comprehensive patient support programs that extend beyond device implantation to include ongoing monitoring, maintenance, and lifestyle adaptation services. MarkWide Research analysis indicates that companies providing holistic patient care achieve higher market penetration and customer loyalty in the Italian market.

Technology developers should prioritize biocompatibility improvements and device miniaturization to address key patient concerns and expand market accessibility. Investment in artificial intelligence and machine learning capabilities will differentiate products and improve patient outcomes. Clinical evidence generation remains crucial for market acceptance and reimbursement approval in Italy’s evidence-based healthcare system.

Healthcare providers should invest in specialist training and infrastructure development to capture growing market opportunities in artificial organs and bionic implants. Establishing centers of excellence and developing multidisciplinary teams will enhance patient outcomes and institutional reputation. Regional expansion strategies should address underserved areas through mobile services and telemedicine integration.

Policy makers should consider updating reimbursement frameworks to reflect the long-term cost benefits of artificial organ technologies and ensure equitable access across different Italian regions. Investment in research infrastructure and international collaboration will strengthen Italy’s position in the global artificial organs market. Regulatory streamlining could accelerate innovation adoption while maintaining safety standards.

Long-term market prospects for Italy’s artificial organs and bionic implants sector remain highly positive, driven by demographic trends, technological advancement, and healthcare system evolution. The market is projected to experience sustained growth over the next decade as artificial organ technologies become more sophisticated, accessible, and integrated into standard medical practice.

Technological evolution will continue transforming artificial organs from mechanical devices to intelligent, adaptive systems capable of learning and responding to individual patient needs. MWR projections indicate that smart artificial organs with AI capabilities will represent approximately 40% of new implantations by 2030, revolutionizing patient care and outcomes.

Market expansion will extend beyond traditional organ replacement applications to include enhancement and prevention applications for healthy individuals seeking improved performance or early intervention. The convergence of artificial organs with regenerative medicine will create hybrid solutions that combine the reliability of artificial devices with the adaptability of biological systems.

Healthcare integration will deepen as artificial organs become seamlessly connected to electronic health records, telemedicine platforms, and population health management systems. This integration will enable predictive healthcare delivery and personalized treatment optimization based on real-time device data and patient monitoring. Global collaboration will accelerate innovation and reduce costs through shared research, standardized protocols, and economies of scale in manufacturing and distribution.

Italy’s artificial organs and bionic implants market represents a dynamic and rapidly evolving healthcare sector with substantial growth potential driven by demographic trends, technological innovation, and healthcare system modernization. The market demonstrates strong fundamentals including advanced healthcare infrastructure, clinical expertise, and supportive regulatory environment that position Italy as a significant player in the European artificial organs landscape.

Market opportunities abound across multiple product categories and applications, from life-sustaining cardiac devices to quality-of-life enhancing bionic prosthetics. The convergence of artificial intelligence, miniaturization, and biocompatibility improvements creates unprecedented possibilities for patient care and market expansion. Regional development initiatives and technology accessibility improvements will ensure broader population access to these transformative medical technologies.

Success factors for market participants include comprehensive patient support, clinical evidence generation, and strategic partnerships with Italian healthcare institutions. The market rewards innovation, quality, and long-term commitment to patient outcomes over short-term profit maximization. Future growth will be driven by continued technological advancement, expanding applications, and integration with broader healthcare digitization trends that position artificial organs as central components of modern medical practice in Italy.

What is Artificial Organs & Bionic Implants?

Artificial organs and bionic implants are medical devices designed to replace or enhance the function of biological organs. They are used in various applications, including cardiac support, limb replacement, and sensory restoration.

What are the key players in the Italy Artificial Organs & Bionic Implants Market?

Key players in the Italy Artificial Organs & Bionic Implants Market include Medtronic, Abbott Laboratories, and Boston Scientific, among others. These companies are involved in the development and distribution of advanced medical devices and technologies.

What are the drivers of growth in the Italy Artificial Organs & Bionic Implants Market?

The growth of the Italy Artificial Organs & Bionic Implants Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in medical technology, and a growing aging population requiring organ replacements.

What challenges does the Italy Artificial Organs & Bionic Implants Market face?

The Italy Artificial Organs & Bionic Implants Market faces challenges such as high costs of development and production, regulatory hurdles, and the need for extensive clinical trials to ensure safety and efficacy.

What opportunities exist in the Italy Artificial Organs & Bionic Implants Market?

Opportunities in the Italy Artificial Organs & Bionic Implants Market include the potential for innovation in biocompatible materials, the rise of personalized medicine, and the expansion of telemedicine solutions for remote monitoring.

What trends are shaping the Italy Artificial Organs & Bionic Implants Market?

Trends in the Italy Artificial Organs & Bionic Implants Market include the integration of artificial intelligence in device functionality, the development of 3D-printed implants, and a focus on minimally invasive surgical techniques.

Italy Artificial Organs & Bionic Implants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Heart Valves, Pacemakers, Artificial Limbs, Cochlear Implants |

| Technology | 3D Printing, Biocompatible Materials, Robotics, Nanotechnology |

| End User | Hospitals, Rehabilitation Centers, Research Institutions, Home Care |

| Application | Cardiology, Orthopedics, Neurology, Urology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Artificial Organs & Bionic Implants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at